false

0001600438

0001600438

2023-12-07

2023-12-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): December 7, 2023

GMS INC.

(Exact name of

registrant as specified in charter)

| Delaware |

|

001-37784 |

|

46-2931287 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

100 Crescent Centre Parkway, Suite 800

Tucker, Georgia |

|

30084 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (800) 392-4619

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

GMS |

|

New York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act ¨

Item 2.02. Results of Operations and Financial Condition.

On

December 7, 2023, GMS Inc. (the “Company” or “GMS”) issued a press release, a copy of which is furnished

as Exhibit 99.1 hereto and incorporated herein by reference, announcing the Company’s financial results for the three

and six months ended October 31, 2023.

In accordance with General Instruction B.2 of Form 8-K, the information

in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of

1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference

in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

*Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GMS INC. |

| |

|

|

|

| Date: December 7, 2023 |

By: |

/s/ Scott M. Deakin |

| |

|

Name: |

Scott M. Deakin |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

GMS REPORTS SECOND QUARTER FISCAL 2024 RESULTS

Strong Multi-Family and Commercial Activity

During the Quarter

Amid An Improving Single-Family Demand Backdrop

Tucker, Georgia, December 7, 2023. GMS Inc. (NYSE: GMS),

a leading North American specialty building products distributor, today reported financial results for the fiscal second quarter ended

October 31, 2023.

Second Quarter Fiscal 2024 Highlights

(Comparisons are to the second quarter of fiscal 2023)

| · | Net sales of $1.4 billion decreased 0.7%; organic net sales decreased 3.1%. |

| · | In the U.S., Wallboard volume growth of 17.0% in multi-family and 6.5% in commercial helped to offset single-family volume declines

of 11.4%. |

| · | Net income of $81.0 million, or $1.97 per diluted share, decreased 21.5% compared to net income of $103.2 million, or $2.41 per diluted

share in the previous year; Net income margin declined 150 basis points to 5.7%; Adjusted net income of $94.6 million, or $2.30 per diluted

share, compared to $119.5 million, or $2.79 per diluted share in the previous year. |

| · | Adjusted EBITDA of $167.6 million decreased $28.0 million, or 14.3%; Adjusted EBITDA margin was 11.8%, compared to 13.7%. |

| · | Improved cash generation with cash provided by operating activities and free cash flow up 10.1% and 5.8%, respectively, as compared

to a year ago; Net debt leverage was 1.5 times, improved from 1.6 times a year ago. |

“We were pleased to deliver solid results for our fiscal second

quarter, including net sales, net income and Adjusted EBITDA that were ahead of our previously stated expectations as commercial and multi-family

Wallboard, Ceilings and Steel Framing volumes outpaced our forecast,” said John C. Turner, Jr., President and Chief Executive

Officer of GMS. “These solid levels of demand helped to offset a steeper than anticipated steel pricing decline along with single-family

demand that is comparatively reduced versus the prior year, but sequentially improving.”

“Our well-balanced product portfolio, with a revenue mix roughly

evenly split between commercial and residential construction, allows us to flex our operations to best align with demand as dynamics in

our end markets evolve,” Turner continued. “In the near term, we anticipate the backlog in multi-family construction to drive

continued growth in this end market through the end of fiscal 2024, albeit at declining year-over-year rates. Despite some potential headwinds

from tightened credit conditions, our commercial demand is expected to continue its current pace of activity over the next few quarters.

Additionally, we are optimistic about improving single-family activity, as the very recent easing of mortgage rates, limited supply of

existing homes for sale and favorable demographics seem to be setting up improved conditions, particularly as we look out to fiscal 2025.”

“While market conditions are fluid, our scale, wide breadth of

product offerings, execution and expertise across all of our varying end markets, and our commitment to outstanding service continues

to position us well for solid financial performance, growth and realization of value for our shareholders over the long term.”

Second Quarter Fiscal 2024 Results

Net sales for the second quarter of fiscal 2024 of $1.4 billion decreased

0.7% as compared with the prior year quarter. Continued solid demand in commercial and multi-family construction drove volume increases

in Ceilings, Steel Framing and Complementary Products, the benefits of which were offset by a marked price deflation in Steel Framing,

which reduced net sales by $85 million for the quarter. Despite softness in the single-family market, Wallboard experienced only a slight

volume decline, contributing to continued resilience in pricing. Recent acquisitions also contributed positively for the quarter. Organic

net sales, which exclude the first year of acquired business net sales as well as the impact of foreign currency translation, declined

3.1%.

Year-over-year quarterly sales changes by product category were as

follows:

·

Wallboard sales of $585.2 million increased 0.1% (down 0.3% on an organic basis).

·

Ceilings sales of $175.3 million increased 9.9% (up 7.2% on an organic basis).

·

Steel Framing sales of $232.1 million decreased 16.6% (down 17.4% on an organic basis).

·

Complementary Product sales of $428.3 million increased 4.8% (down 1.4% on an organic basis).

Gross profit of $458.6 million decreased $5.9 million, or 1.3%, compared

to the second quarter of fiscal 2023 notably due to deflationary dynamics in steel pricing. Gross margin was 32.3%, compared to 32.5%

a year ago.

Selling, general and administrative (“SG&A”) expenses

were $300.9 million for the quarter, up from $279.0 million in the prior year period. Of the $21.9 million year-over-year increase, $12.6

million related to recent acquisitions and newly-opened greenfield locations. The remaining $9.3 million increase was primarily driven

by higher wages and benefits as we executed against more robust sales volumes in our commercial and multi-family end markets, which tend

to require a higher cost to serve than our single-family end market. Specifically, volume growth in Steel Framing was 13.0%, commercial

Wallboard volumes grew 6.5% and Ceilings volumes grew 5.8%.

SG&A expense as a percentage of net sales increased 170 basis points

to 21.2% for the quarter, compared to 19.5% in the second quarter of fiscal 2023 with 120 basis points of the difference due to steel

price deflation, 30 basis points related to increased labor costs, primarily associated with the higher level of commercial and multi-family

activity levels and the remaining 20 basis points due to recent acquisitions. Adjusted SG&A expense as a percentage of net sales of

20.6% also increased 170 basis points from 18.9% in the prior year quarter.

All in, inclusive of a $2.7 million, or 16.7%, increase in interest

expense, net income decreased 21.5% to $81.0 million, or $1.97 per diluted share, compared to net income of $103.2 million, or $2.41 per

diluted share, in the second quarter of fiscal 2023. Net income margin declined 150 basis points from 7.2% to 5.7%. Adjusted net income

was $94.6 million, or $2.30 per diluted share, compared to $119.5 million, or $2.79 per diluted share, in the second quarter of the prior

fiscal year.

Adjusted EBITDA decreased $28.0 million, or 14.3%, to $167.6 million

compared to the prior year quarter. Adjusted EBITDA margin was 11.8%, compared with 13.7% for the second quarter of fiscal 2023.

Balance Sheet, Liquidity and Cash Flow

As of October 31, 2023, the Company had cash on hand of $76.5

million, total debt of $1.1 billion and $823.7 million of available liquidity under its revolving credit facilities. Net debt leverage

was 1.5 times as of the end of the quarter, down from 1.6 times at the end of the second quarter of fiscal 2023.

For the second quarter of fiscal 2024, cash provided by operating activities

improved to $118.1 million, compared to cash provided by operating activities of $107.3 million in the prior year period. Free cash flow

improved to $102.1 million for the quarter ended October 31, 2023, compared to $96.5 million for the quarter ended October 31,

2022.

Expanded Share Repurchase Authorization

In October 2023, the Company’s Board of Directors approved

an expanded share repurchase program under which the Company is authorized to repurchase up to $250 million of its outstanding common

stock. This expanded program replaces the Company’s previous share repurchase authorization of $200 million, which commenced in

June 2022, and reflects the Board’s confidence in the business going forward. The repurchases will be made from time to time

on the open market at prevailing market prices or in negotiated transactions off the market.

During the quarter, the Company repurchased 688,717 shares of common

stock for $44.3 million, of which $8.7 million was purchased under the new and expanded authorization. As of October 31, 2023, the

Company had $241.3 million of share repurchase authorization remaining.

Platform Expansion Activities

During the second quarter of fiscal 2024, the Company continued the

execution of its platform expansion strategy with the acquisition of AMW Construction Supply, LLC, a highly respected tools and fasteners

and other complementary products distributor servicing the Phoenix, AZ metro area.

In addition during the quarter, the Company added two new greenfield

locations and one new AMES store location.

Conference Call and Webcast

GMS will host a conference call and webcast to discuss its results

for the second quarter of fiscal 2024 ended October 31, 2023 and other information related to its business at 8:30 a.m. Eastern

Time on Thursday, December 7, 2023. Investors who wish to participate in the call should dial 877-407-3982 (domestic) or 201-493-6780

(international) at least 5 minutes prior to the start of the call. The live webcast will be available on the Investors section of the

Company’s website at www.gms.com. There will be a slide presentation of the results available on that page of the website as

well. Replays of the call will be available through January 7, 2024 and can be accessed at 844-512-2921 (domestic) or 412-317-6671

(international) and entering the pass code 13741690.

About GMS Inc.

Founded in 1971, GMS operates a network of more than 300 distribution

centers with extensive product offerings of Wallboard, Ceilings, Steel Framing and Complementary Products. In addition, GMS operates more

than 100 tool sales, rental and service centers, providing a comprehensive selection of building products and solutions for its residential

and commercial contractor customer base across the United States and Canada. The Company’s unique operating model combines the benefits

of a national platform and strategy with a local go-to-market focus, enabling GMS to generate significant economies of scale while maintaining

high levels of customer service.

Use of Non-GAAP Financial Measures

GMS reports its financial results in accordance with GAAP. However,

it presents Adjusted net income, free cash flow, Adjusted SG&A, Adjusted EBITDA, and Adjusted EBITDA margin, which are not recognized

financial measures under GAAP. GMS believes that Adjusted net income, free cash flow, Adjusted SG&A, Adjusted EBITDA, and Adjusted

EBITDA margin assist investors and analysts in comparing its operating performance across reporting periods on a consistent basis by excluding

items that the Company does not believe are indicative of its core operating performance. The Company’s management believes Adjusted

net income, Adjusted SG&A, free cash flow, Adjusted EBITDA and Adjusted EBITDA margin are helpful in highlighting trends in its operating

results, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax

jurisdictions in which the Company operates and capital investments. In addition, the Company utilizes Adjusted EBITDA in certain calculations

in its debt agreements.

You are encouraged to evaluate each adjustment and the reasons GMS

considers it appropriate for supplemental analysis. In addition, in evaluating Adjusted net income, Adjusted SG&A and Adjusted EBITDA,

you should be aware that in the future, the Company may incur expenses similar to the adjustments in the presentation of Adjusted net

income, Adjusted SG&A and Adjusted EBITDA. The Company’s presentation of Adjusted net income, Adjusted SG&A, Adjusted SG&A

margin, Adjusted EBITDA, and Adjusted EBITDA margin should not be construed as an inference that its future results will be unaffected

by unusual or non-recurring items. In addition, Adjusted net income, free cash flow, Adjusted SG&A and Adjusted EBITDA may not be

comparable to similarly titled measures used by other companies in GMS’s industry or across different industries. Please see the

tables at the end of this release for a reconciliation of Adjusted EBITDA, free cash flow, Adjusted SG&A and Adjusted net income to

the most directly comparable GAAP financial measures.

When calculating organic net sales growth, the Company excludes from

the calculation (i) net sales of acquired businesses until the first anniversary of the acquisition date, and (ii) the impact

of foreign currency translation.

Forward-Looking Statements and Information

This press release includes “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act of 1995. You can generally identify forward-looking statements by the

Company’s use of forward-looking terminology such as “anticipate,” “believe,” “confident,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“potential,” “predict,” “seek,” or “should,” or the negative thereof or other variations

thereon or comparable terminology. In particular, statements about the markets in which GMS operates, including in particular residential

and commercial construction, and the economy generally, end market mix, backlog, pricing, volumes, the demand for the Company’s

products, including Complementary Products, the Company’s strategic priorities and the results thereof, stockholder value, performance,

growth, and results thereof, and future share repurchases contained in this press release may be considered forward-looking statements.

The Company has based forward-looking statements on its current expectations, assumptions, estimates and projections. While the Company

believes these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions

and involve known and unknown risks and uncertainties, many of which are beyond its control, including current and future public health

issues that may affect the Company’s business. Forward-looking statements involve risks and uncertainties, including, but not limited

to, those described in the “Risk Factors” section in the Company’s most recent Annual Report on Form 10-K, and

in its other periodic reports filed with the SEC. In addition, the statements in this release are made as of December 7, 2023. The

Company undertakes no obligation to update any of the forward-looking statements made herein, whether as a result of new information,

future events, changes in expectation or otherwise. These forward-looking statements should not be relied upon as representing the Company’s

views as of any date subsequent to December 7, 2023.

Contact Information:

Investors:

Carey Phelps

ir@gms.com

770-723-3369

GMS Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

(in thousands, except per share data)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

October 31, |

|

|

October 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net sales |

|

$ |

1,420,930 |

|

|

$ |

1,430,979 |

|

|

$ |

2,830,530 |

|

|

$ |

2,790,532 |

|

| Cost of sales (exclusive of depreciation and amortization shown separately below) |

|

|

962,301 |

|

|

|

966,479 |

|

|

|

1,921,347 |

|

|

|

1,891,311 |

|

| Gross profit |

|

|

458,629 |

|

|

|

464,500 |

|

|

|

909,183 |

|

|

|

899,221 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

300,894 |

|

|

|

278,994 |

|

|

|

587,690 |

|

|

|

546,683 |

|

| Depreciation and amortization |

|

|

32,937 |

|

|

|

32,226 |

|

|

|

64,955 |

|

|

|

64,666 |

|

| Total operating expenses |

|

|

333,831 |

|

|

|

311,220 |

|

|

|

652,645 |

|

|

|

611,349 |

|

| Operating income |

|

|

124,798 |

|

|

|

153,280 |

|

|

|

256,538 |

|

|

|

287,872 |

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(18,742 |

) |

|

|

(16,055 |

) |

|

|

(37,656 |

) |

|

|

(30,716 |

) |

| Write-off of debt discount and deferred financing fees |

|

|

— |

|

|

|

— |

|

|

|

(1,401 |

) |

|

|

— |

|

| Other income, net |

|

|

2,106 |

|

|

|

1,923 |

|

|

|

4,245 |

|

|

|

3,492 |

|

| Total other expense, net |

|

|

(16,636 |

) |

|

|

(14,132 |

) |

|

|

(34,812 |

) |

|

|

(27,224 |

) |

| Income before taxes |

|

|

108,162 |

|

|

|

139,148 |

|

|

|

221,726 |

|

|

|

260,648 |

|

| Provision for income taxes |

|

|

27,205 |

|

|

|

35,995 |

|

|

|

53,939 |

|

|

|

68,025 |

|

| Net income |

|

$ |

80,957 |

|

|

$ |

103,153 |

|

|

$ |

167,787 |

|

|

$ |

192,623 |

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

40,466 |

|

|

|

42,232 |

|

|

|

40,608 |

|

|

|

42,390 |

|

| Diluted |

|

|

41,088 |

|

|

|

42,887 |

|

|

|

41,282 |

|

|

|

43,102 |

|

| Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

2.00 |

|

|

$ |

2.44 |

|

|

$ |

4.13 |

|

|

$ |

4.54 |

|

| Diluted |

|

$ |

1.97 |

|

|

$ |

2.41 |

|

|

$ |

4.06 |

|

|

$ |

4.47 |

|

GMS Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except

per share data)

| |

|

October 31,

2023 |

|

|

April 30,

2023 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

76,517 |

|

|

$ |

164,745 |

|

| Trade accounts and notes receivable, net of allowances of $16,215 and $13,636, respectively |

|

|

880,196 |

|

|

|

792,232 |

|

| Inventories, net |

|

|

559,449 |

|

|

|

575,495 |

|

| Prepaid expenses and other current assets |

|

|

31,270 |

|

|

|

17,051 |

|

| Total current assets |

|

|

1,547,432 |

|

|

|

1,549,523 |

|

| Property and equipment, net of accumulated depreciation of $281,550 and $264,650, respectively |

|

|

423,240 |

|

|

|

396,419 |

|

| Operating lease right-of-use assets |

|

|

190,141 |

|

|

|

189,351 |

|

| Goodwill |

|

|

720,273 |

|

|

|

700,813 |

|

| Intangible assets, net |

|

|

393,587 |

|

|

|

399,660 |

|

| Deferred income taxes |

|

|

21,908 |

|

|

|

19,839 |

|

| Other assets |

|

|

17,818 |

|

|

|

11,403 |

|

| Total assets |

|

$ |

3,314,399 |

|

|

$ |

3,267,008 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

367,405 |

|

|

$ |

377,003 |

|

| Accrued compensation and employee benefits |

|

|

83,483 |

|

|

|

119,887 |

|

| Other accrued expenses and current liabilities |

|

|

118,870 |

|

|

|

107,675 |

|

| Current portion of long-term debt |

|

|

47,766 |

|

|

|

54,035 |

|

| Current portion of operating lease liabilities |

|

|

48,788 |

|

|

|

47,681 |

|

| Total current liabilities |

|

|

666,312 |

|

|

|

706,281 |

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

| Long-term debt, less current portion |

|

|

1,028,284 |

|

|

|

1,044,642 |

|

| Long-term operating lease liabilities |

|

|

142,577 |

|

|

|

141,786 |

|

| Deferred income taxes, net |

|

|

55,142 |

|

|

|

51,223 |

|

| Other liabilities |

|

|

46,199 |

|

|

|

48,319 |

|

| Total liabilities |

|

|

1,938,514 |

|

|

|

1,992,251 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

| Common stock, par value $0.01 per share, 500,000 shares authorized; 40,055 and 40,971 shares issued and outstanding as of October 31, 2023 and April 30, 2023, respectively |

|

|

401 |

|

|

|

410 |

|

| Preferred stock, par value $0.01 per share, 50,000 shares authorized; 0 shares issued and outstanding as of October 31, 2023 and April 30, 2023 |

|

|

— |

|

|

|

— |

|

| Additional paid-in capital |

|

|

362,021 |

|

|

|

428,508 |

|

| Retained earnings |

|

|

1,048,755 |

|

|

|

880,968 |

|

| Accumulated other comprehensive loss |

|

|

(35,292 |

) |

|

|

(35,129 |

) |

| Total stockholders' equity |

|

|

1,375,885 |

|

|

|

1,274,757 |

|

| Total liabilities and stockholders' equity |

|

$ |

3,314,399 |

|

|

$ |

3,267,008 |

|

GMS Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

| |

|

Six Months Ended

October 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

| Net income |

|

$ |

167,787 |

|

|

$ |

192,623 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

64,955 |

|

|

|

64,666 |

|

| Write-off and amortization of debt discount and debt issuance costs |

|

|

2,726 |

|

|

|

802 |

|

| Equity-based compensation |

|

|

10,698 |

|

|

|

13,322 |

|

| Gain on disposal and impairment of assets |

|

|

(441 |

) |

|

|

(203 |

) |

| Deferred income taxes |

|

|

(5,085 |

) |

|

|

(2,925 |

) |

| Other items, net |

|

|

3,590 |

|

|

|

4,662 |

|

| Changes in assets and liabilities net of effects of acquisitions: |

|

|

|

|

|

|

|

|

| Trade accounts and notes receivable |

|

|

(89,384 |

) |

|

|

(133,445 |

) |

| Inventories |

|

|

20,267 |

|

|

|

(32,270 |

) |

| Prepaid expenses and other assets |

|

|

(19,578 |

) |

|

|

(4,913 |

) |

| Accounts payable |

|

|

(9,849 |

) |

|

|

3,821 |

|

| Accrued compensation and employee benefits |

|

|

(36,293 |

) |

|

|

(17,859 |

) |

| Other accrued expenses and liabilities |

|

|

15,354 |

|

|

|

14,580 |

|

| Cash provided by operating activities |

|

|

124,747 |

|

|

|

102,861 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(29,546 |

) |

|

|

(21,670 |

) |

| Proceeds from sale of assets |

|

|

1,701 |

|

|

|

896 |

|

| Acquisition of businesses, net of cash acquired |

|

|

(55,964 |

) |

|

|

(2,620 |

) |

| Cash used in investing activities |

|

|

(83,809 |

) |

|

|

(23,394 |

) |

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Repayments on revolving credit facilities |

|

|

(389,409 |

) |

|

|

(251,247 |

) |

| Borrowings from revolving credit facilities |

|

|

360,173 |

|

|

|

280,113 |

|

| Payments of principal on long-term debt |

|

|

— |

|

|

|

(2,555 |

) |

| Borrowings from term loan amendment |

|

|

288,266 |

|

|

|

— |

|

| Repayments from term loan amendment |

|

|

(287,768 |

) |

|

|

— |

|

| Payments of principal on finance lease obligations |

|

|

(19,304 |

) |

|

|

(16,450 |

) |

| Repurchases of common stock |

|

|

(75,356 |

) |

|

|

(49,571 |

) |

| Payment of acquisition holdback liability |

|

|

— |

|

|

|

(13,500 |

) |

| Payment for debt issuance costs |

|

|

(5,825 |

) |

|

|

— |

|

| Proceeds from exercises of stock options |

|

|

1,756 |

|

|

|

701 |

|

| Payments for taxes related to net share settlement of equity awards |

|

|

(3,975 |

) |

|

|

(3,960 |

) |

| Proceeds from issuance of stock pursuant to employee stock purchase plan |

|

|

2,664 |

|

|

|

1,329 |

|

| Cash used in financing activities |

|

|

(128,778 |

) |

|

|

(55,140 |

) |

| Effect of exchange rates on cash and cash equivalents |

|

|

(388 |

) |

|

|

(2,042 |

) |

| (Decrease) increase in cash and cash equivalents |

|

|

(88,228 |

) |

|

|

22,285 |

|

| Cash and cash equivalents, beginning of period |

|

|

164,745 |

|

|

|

101,916 |

|

| Cash and cash equivalents, end of period |

|

$ |

76,517 |

|

|

$ |

124,201 |

|

| Supplemental cash flow disclosures: |

|

|

|

|

|

|

|

|

| Cash paid for income taxes |

|

$ |

69,224 |

|

|

$ |

60,792 |

|

| Cash paid for interest |

|

|

35,321 |

|

|

|

29,268 |

|

GMS Inc.

Net Sales by Product Group (Unaudited)

(dollars in thousands)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

October 31,

2023 |

|

|

% of

Total |

|

|

October 31,

2022 |

|

|

% of

Total |

|

|

October 31,

2023 |

|

|

% of

Total |

|

|

October 31,

2022 |

|

|

% of

Total |

|

| Wallboard |

|

$ |

585,174 |

|

|

|

41.2 |

% |

|

$ |

584,557 |

|

|

|

40.9 |

% |

|

$ |

1,156,599 |

|

|

|

40.9 |

% |

|

$ |

1,106,111 |

|

|

|

39.6 |

% |

| Ceilings |

|

|

175,329 |

|

|

|

12.3 |

% |

|

|

159,601 |

|

|

|

11.2 |

% |

|

|

350,534 |

|

|

|

12.4 |

% |

|

|

326,876 |

|

|

|

11.7 |

% |

| Steel framing |

|

|

232,108 |

|

|

|

16.3 |

% |

|

|

278,152 |

|

|

|

19.4 |

% |

|

|

468,868 |

|

|

|

16.6 |

% |

|

|

553,048 |

|

|

|

19.8 |

% |

| Complementary products |

|

|

428,319 |

|

|

|

30.1 |

% |

|

|

408,669 |

|

|

|

28.6 |

% |

|

|

854,529 |

|

|

|

30.2 |

% |

|

|

804,497 |

|

|

|

28.8 |

% |

| Total net sales |

|

$ |

1,420,930 |

|

|

|

|

|

|

$ |

1,430,979 |

|

|

|

|

|

|

$ |

2,830,530 |

|

|

|

|

|

|

$ |

2,790,532 |

|

|

|

|

|

GMS Inc.

Net Sales and Organic Sales by Product Group

(Unaudited)

(dollars in millions)

| |

|

Net Sales |

|

|

|

|

|

Organic Sales |

|

|

|

|

| |

|

Three Months Ended October 31, |

|

|

|

|

|

Three Months Ended October 31, |

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

|

Change |

|

|

2023 |

|

|

2022 |

|

|

Change |

|

| Wallboard |

|

$ |

585.2 |

|

|

$ |

584.5 |

|

|

|

0.1 |

% |

|

$ |

582.7 |

|

|

$ |

584.5 |

|

|

|

(0.3 |

)% |

| Ceilings |

|

|

175.3 |

|

|

|

159.6 |

|

|

|

9.9 |

% |

|

|

171.0 |

|

|

|

159.6 |

|

|

|

7.2 |

% |

| Steel framing |

|

|

232.1 |

|

|

|

278.2 |

|

|

|

(16.6 |

)% |

|

|

229.8 |

|

|

|

278.2 |

|

|

|

(17.4 |

)% |

| Complementary products |

|

|

428.3 |

|

|

|

408.7 |

|

|

|

4.8 |

% |

|

|

403.0 |

|

|

|

408.7 |

|

|

|

(1.4 |

)% |

| Total net sales |

|

$ |

1,420.9 |

|

|

$ |

1,431.0 |

|

|

|

(0.7 |

)% |

|

$ |

1,386.5 |

|

|

$ |

1,431.0 |

|

|

|

(3.1 |

)% |

GMS Inc.

Per Day Net Sales and Per Day Organic Sales

by Product Group (Unaudited)

(dollars in millions)

| |

|

Per Day Net Sales |

|

|

|

|

|

Per Day Organic Sales |

|

|

|

|

| |

|

Three Months Ended October 31, |

|

|

|

|

|

Three Months Ended October 31, |

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

|

Change |

|

|

2023 |

|

|

2022 |

|

|

Change |

|

| Wallboard |

|

$ |

9.0 |

|

|

$ |

9.0 |

|

|

|

0.1 |

% |

|

$ |

9.0 |

|

|

$ |

9.0 |

|

|

|

(0.3 |

)% |

| Ceilings |

|

|

2.7 |

|

|

|

2.5 |

|

|

|

9.9 |

% |

|

|

2.6 |

|

|

|

2.5 |

|

|

|

7.2 |

% |

| Steel framing |

|

|

3.6 |

|

|

|

4.3 |

|

|

|

(16.6 |

)% |

|

|

3.5 |

|

|

|

4.3 |

|

|

|

(17.4 |

)% |

| Complementary products |

|

|

6.6 |

|

|

|

6.3 |

|

|

|

4.8 |

% |

|

|

6.2 |

|

|

|

6.3 |

|

|

|

(1.4 |

)% |

| Total net sales |

|

$ |

21.9 |

|

|

$ |

22.1 |

|

|

|

(0.7 |

)% |

|

$ |

21.3 |

|

|

$ |

22.1 |

|

|

|

(3.1 |

)% |

| |

|

Per Day Organic Growth |

|

| |

|

Three Months Ended October 31, 2023 |

|

| |

|

Volume |

|

|

Price/Mix/Fx |

|

| Wallboard |

|

|

(1.0 |

)% |

|

|

0.7 |

% |

| Ceilings |

|

|

5.8 |

% |

|

|

1.4 |

% |

| Steel framing |

|

|

13.1 |

% |

|

|

(30.5 |

)% |

GMS Inc.

Reconciliation of Net Income to Adjusted EBITDA

(Unaudited)

(in thousands)

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

October 31, |

|

|

October 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net income |

|

$ |

80,957 |

|

|

$ |

103,153 |

|

|

$ |

167,787 |

|

|

$ |

192,623 |

|

| Interest expense |

|

|

18,742 |

|

|

|

16,055 |

|

|

|

37,656 |

|

|

|

30,716 |

|

| Write-off of debt discount and deferred financing fees |

|

|

— |

|

|

|

— |

|

|

|

1,401 |

|

|

|

— |

|

| Interest income |

|

|

(292 |

) |

|

|

(154 |

) |

|

|

(766 |

) |

|

|

(210 |

) |

| Provision for income taxes |

|

|

27,205 |

|

|

|

35,995 |

|

|

|

53,939 |

|

|

|

68,025 |

|

| Depreciation expense |

|

|

16,963 |

|

|

|

15,058 |

|

|

|

33,290 |

|

|

|

30,051 |

|

| Amortization expense |

|

|

15,974 |

|

|

|

17,168 |

|

|

|

31,665 |

|

|

|

34,615 |

|

| EBITDA |

|

$ |

159,549 |

|

|

$ |

187,275 |

|

|

$ |

324,972 |

|

|

$ |

355,820 |

|

| Stock appreciation expense(a) |

|

|

401 |

|

|

|

3,230 |

|

|

|

1,619 |

|

|

|

5,574 |

|

| Redeemable noncontrolling interests and deferred compensation(b) |

|

|

184 |

|

|

|

340 |

|

|

|

664 |

|

|

|

835 |

|

| Equity-based compensation(c) |

|

|

5,111 |

|

|

|

3,781 |

|

|

|

8,415 |

|

|

|

6,913 |

|

| Severance and other permitted costs(d) |

|

|

882 |

|

|

|

379 |

|

|

|

1,288 |

|

|

|

731 |

|

| Transaction costs (acquisitions and other)(e) |

|

|

1,223 |

|

|

|

292 |

|

|

|

2,608 |

|

|

|

678 |

|

| (Gain) loss on disposal of assets(f) |

|

|

(310 |

) |

|

|

81 |

|

|

|

(441 |

) |

|

|

(203 |

) |

| Effects of fair value adjustments to inventory(g) |

|

|

140 |

|

|

|

135 |

|

|

|

442 |

|

|

|

179 |

|

| Debt transaction costs(h) |

|

|

378 |

|

|

|

— |

|

|

|

1,289 |

|

|

|

— |

|

| EBITDA adjustments |

|

|

8,009 |

|

|

|

8,238 |

|

|

|

15,884 |

|

|

|

14,707 |

|

| Adjusted EBITDA |

|

$ |

167,558 |

|

|

$ |

195,513 |

|

|

$ |

340,856 |

|

|

$ |

370,527 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

1,420,930 |

|

|

$ |

1,430,979 |

|

|

$ |

2,830,530 |

|

|

$ |

2,790,532 |

|

| Adjusted EBITDA Margin |

|

|

11.8 |

% |

|

|

13.7 |

% |

|

|

12.0 |

% |

|

|

13.3 |

% |

| (a) | Represents changes in the fair value of stock appreciation rights. |

| (b) | Represents changes in the fair values of noncontrolling interests and deferred compensation agreements. |

| (c) | Represents non-cash equity-based compensation expense related to the issuance of share-based awards. |

| (d) | Represents severance expenses and certain other cost adjustments as permitted under the ABL Facility and the Term Loan Facility. |

| (e) | Represents costs related to acquisitions paid to third parties. |

| (f) | Includes gains and losses from the sale and disposal of assets. |

| (g) | Represents the non-cash cost of sales impact of acquisition accounting adjustments to increase inventory to its estimated fair value. |

| (h) | Represents costs paid to third-party advisors related to debt refinancing activities. |

GMS Inc.

Reconciliation of Cash Provided By Operating

Activities to Free Cash Flow (Unaudited)

(in thousands)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

October 31, | | |

October 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Cash provided by operating activities | |

$ | 118,100 | | |

$ | 107,264 | | |

$ | 124,747 | | |

$ | 102,861 | |

| Purchases of property and equipment | |

| (16,008 | ) | |

| (10,727 | ) | |

| (29,546 | ) | |

| (21,670 | ) |

| Free cash flow (a) | |

$ | 102,092 | | |

$ | 96,537 | | |

$ | 95,201 | | |

$ | 81,191 | |

(a) Free cash flow is a non-GAAP financial measure that we define

as net cash provided by (used in) operations less capital expenditures.

GMS Inc.

Reconciliation of Selling, General and Administrative

Expense to Adjusted SG&A (Unaudited)

(in thousands)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

October 31, | | |

October 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Selling, general and administrative expense | |

$ | 300,894 | | |

$ | 278,994 | | |

$ | 587,690 | | |

$ | 546,683 | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjustments | |

| | | |

| | | |

| | | |

| | |

| Stock appreciation expense(a) | |

| (401 | ) | |

| (3,230 | ) | |

| (1,619 | ) | |

| (5,574 | ) |

| Redeemable noncontrolling interests and deferred compensation(b) | |

| (184 | ) | |

| (340 | ) | |

| (664 | ) | |

| (835 | ) |

| Equity-based compensation(c) | |

| (5,111 | ) | |

| (3,781 | ) | |

| (8,415 | ) | |

| (6,913 | ) |

| Severance and other permitted costs(d) | |

| (882 | ) | |

| (411 | ) | |

| (1,288 | ) | |

| (748 | ) |

| Transaction costs (acquisitions and other)(e) | |

| (1,223 | ) | |

| (292 | ) | |

| (2,608 | ) | |

| (678 | ) |

| Gain (loss) on disposal of assets(f) | |

| 310 | | |

| (81 | ) | |

| 441 | | |

| 203 | |

| Debt transaction costs(g) | |

| (378 | ) | |

| — | | |

| (1,289 | ) | |

| — | |

| Adjusted SG&A | |

$ | 293,025 | | |

$ | 270,859 | | |

$ | 572,248 | | |

$ | 532,138 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net sales | |

$ | 1,420,930 | | |

$ | 1,430,979 | | |

$ | 2,830,530 | | |

$ | 2,790,532 | |

| Adjusted SG&A margin | |

| 20.6 | % | |

| 18.9 | % | |

| 20.2 | % | |

| 19.1 | % |

| (a) | Represents changes in the fair value of stock appreciation rights. |

| (b) | Represents changes in the fair values of noncontrolling interests and deferred compensation agreements. |

| (c) | Represents non-cash equity-based compensation expense related to the issuance of share-based awards. |

| (d) | Represents severance expenses and certain other cost adjustments as permitted under the ABL Facility and the Term Loan Facility. |

| (e) | Represents costs related to acquisitions paid to third parties. |

| (f) | Includes gains and losses from the sale and disposal of assets. |

| (g) | Represents costs paid to third-party advisors related to debt refinancing activities. |

GMS Inc.

Reconciliation of Income

Before Taxes to Adjusted Net Income (Unaudited)

(in thousands, except

per share data)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

October 31, | | |

October 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Income before taxes | |

$ | 108,162 | | |

$ | 139,148 | | |

$ | 221,726 | | |

$ | 260,648 | |

| EBITDA adjustments | |

| 8,009 | | |

| 8,238 | | |

| 15,884 | | |

| 14,707 | |

| Write-off of debt discount and deferred financing fees | |

| — | | |

| — | | |

| 1,401 | | |

| — | |

| Acquisition accounting depreciation and amortization (1) | |

| 10,823 | | |

| 13,057 | | |

| 21,738 | | |

| 26,335 | |

| Adjusted pre-tax income | |

| 126,994 | | |

| 160,443 | | |

| 260,749 | | |

| 301,690 | |

| Adjusted income tax expense | |

| 32,383 | | |

| 40,913 | | |

| 66,491 | | |

| 76,931 | |

| Adjusted net income | |

$ | 94,611 | | |

$ | 119,530 | | |

$ | 194,258 | | |

$ | 224,759 | |

| Effective tax rate (2) | |

| 25.5 | % | |

| 25.5 | % | |

| 25.5 | % | |

| 25.5 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 40,466 | | |

| 42,232 | | |

| 40,608 | | |

| 42,390 | |

| Diluted | |

| 41,088 | | |

| 42,887 | | |

| 41,282 | | |

| 43,102 | |

| Adjusted net income per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 2.34 | | |

$ | 2.83 | | |

$ | 4.78 | | |

$ | 5.30 | |

| Diluted | |

$ | 2.30 | | |

$ | 2.79 | | |

$ | 4.71 | | |

$ | 5.21 | |

| (1) | Depreciation and amortization from the increase in value of

certain long-term assets associated with the April 1, 2014 acquisition of the predecessor company and amortization of intangible

assets from the acquisitions of Titan, Westside Building Material and Ames Taping Tools. |

| (2) | Normalized cash tax rate excluding the impact of acquisition

accounting and certain other deferred tax amounts. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

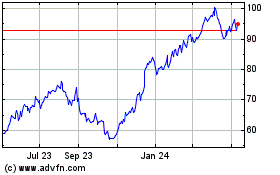

GMS (NYSE:GMS)

Historical Stock Chart

From Dec 2024 to Jan 2025

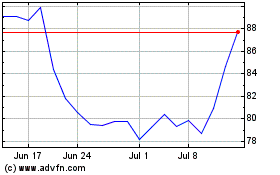

GMS (NYSE:GMS)

Historical Stock Chart

From Jan 2024 to Jan 2025