Filed by: Berry Global Group, Inc.

Commission File No.: 001-35672

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company:

Glatfelter Corporation (Commission File No.: 001-03560)

Below is a communication made by Berry Global Group, Inc. on February 7, 2024:

To All Berry Global Employees,

This morning, in connection with our first quarter financial results

earnings call, Berry announced an agreement in which we will spin-off and combine our Health, Hygiene and Specialties Global Nonwovens

and Films business (“HHNF”) with Glatfelter, a leading global supplier of specialty materials headquartered in Charlotte,

North Carolina.

This transaction represents the successful conclusion of our comprehensive

review of strategic alternatives for HH&S, which I wrote to you about in September 2023. The Board and Berry’s senior leadership

team evaluated opportunities to ensure Berry is best positioned to execute on its strategic objectives, and we are confident this announcement

is the best path forward.

We are confident this transaction will unlock greater value creation

opportunities for our customers, shareholders, and employees. Combining our HHNF business with Glatfelter positions Berry to become a

pure-play provider of sustainable global packaging solutions. With our three-segment portfolio, comprising Consumer Packaging International,

Consumer Packaging North America, and Flexibles (formerly Engineered Materials), we will be the #1 or #2 player in more than 75% of the

markets we serve globally. This focused and streamlined portfolio is expected to result in an even more predictable, stable earnings and

growth profile for Berry.

This transaction also creates meaningful opportunities for the combined

Glatfelter and HHNF (“NewCo”), which will be a global leader in the growing specialty materials industry. With fast-growing

health and hygiene end markets, scalable innovation, and sustainable solutions offerings, NewCo will be uniquely positioned to serve the

world’s largest brand owners across global end markets with favorable long-term growth dynamics. NewCo will be well positioned to

deliver enhanced value for employees, customers, and other stakeholders.

Upon completion of the transaction, which is expected to occur in the

second half of 2024, Curt Begle, Berry’s HH&S President, will become CEO of the combined business. Additional members of NewCo's

senior management team will be announced at a later date.

Looking ahead, Berry’s strategic priorities remain unchanged.

We will continue offering industry-leading products, solutions, and material sciences to help customers achieve their commercial and sustainability

goals, and we will remain laser focused on our commercial excellence approach, which includes driving more revenue through our sales and

innovation pipelines and increasing share of wallet with our customers.

Until the transaction is complete, the HHNF business will remain a

part of Berry, and we are continuing to operate as usual. There are no immediate changes to roles, responsibilities, reporting structure,

or compensation and benefits as a result of this announcement. We’re counting on everyone to stay focused on working safely while

advancing our strategy and delivering for our customers.

Today’s

announcement may generate increased interest or questions from the media and other outside parties. As always, it’s important that

the Company continues to speak with one voice. If you receive any inquiries from the media, please send them to Laci Scourfield (Laciscourfield@berryglobal.com)

and any investor inquiries to Dustin Stilwell (dustinstilwell@berryglobal.com). Thank you for your continued dedication

to Berry.

Sincerely,

Kevin Kwilinski

Cautionary Statement Concerning Forward-Looking

Statements

Statements

in this release that are not historical, including statements relating the expected timing, completion and effects of the proposed

transaction between Berry and Glatfelter, are considered “forward looking” within the meaning of the federal securities laws

and are presented pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking

statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,”

“would,” “could,” “seeks,” “approximately,” “intends,” “plans,”

“estimates,” “projects,” “outlook,” “anticipates” or “looking forward,” or

similar expressions that relate to strategy, plans, intentions, or expectations. All statements relating to estimates and statements about

the expected timing and structure of the proposed transaction, the ability of the parties to complete the proposed transaction, benefits

of the transaction, including future financial and operating results, the combined company’s plans, objectives, expectations and

intentions, and other statements that are not historical facts are forward-looking statements. In addition, senior management of Berry

and Glatfelter, from time to time make forward-looking public statements concerning expected future operations and performance and other

developments.

Actual

results may differ materially from those that are expected due to a variety of factors, including without limitation: the occurrence

of any event, change or other circumstances that could give rise to the termination of the proposed transaction; the risk that Glatfelter

shareholders may not approve the transaction proposals; the risk that the necessary regulatory approvals may not be obtained or may be

obtained subject to conditions that are not anticipated; risks that any of the other closing conditions to the proposed transaction may

not be satisfied in a timely manner; risks that the anticipated tax treatment of the proposed transaction is not obtained; risks related

to potential litigation brought in connection with the proposed transaction; uncertainties as to the timing of the consummation of the

proposed transaction; unexpected costs, charges or expenses resulting from the proposed transaction; risks and costs related to the implementation

of the separation of Berry’s HH&S global nonwovens and films business into a new entity (“Spinco”), including timing

anticipated to complete the separation; any changes to the configuration of the businesses included in the separation if implemented;

the risk that the integration of the combined companies is more difficult, time consuming or costly than expected; risks related to financial

community and rating agency perceptions of each of Berry and Glatfelter and its business, operations, financial condition and the industry

in which they operate; risks related to disruption of management time from ongoing business operations due to the proposed transaction;

failure to realize the benefits expected from the proposed transaction; effects of the announcement, pendency or completion of the proposed

transaction on the ability of the parties to retain customers and retain and hire key personnel and maintain relationships with their

counterparties, and on their operating results and businesses generally; and other risk factors detailed from time to time in Glatfelter’s

and Berry’s reports filed with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K and other documents filed with the SEC. These risks, as well as other risks associated with the proposed transaction, will be

more fully discussed in the registration statements, proxy statement/prospectus and other documents that will be filed with the SEC in

connection with the proposed transaction. The foregoing list of important factors may not contain all of the material factors that are

important to you. New factors may emerge from time to time, and it is not possible to either predict new factors or assess the potential

effect of any such new factors. Accordingly, readers should not place undue reliance on those statements. All forward-looking statements

are based upon information available as of the date hereof. All forward-looking statements are made only as of the date hereof and neither

Berry nor Glatfelter undertake any obligation to update or revise any forward-looking statement as a result of new information, future

events or otherwise, except as otherwise required by law.

Additional Information and Where to Find

It

This

communication may be deemed to be solicitation material in respect of the proposed transaction between Berry and Glatfelter. In connection

with the proposed transaction, Berry and Glatfelter intend to file relevant materials with the SEC, including a registration statement

on Form S-4 by Glatfelter that will contain a proxy statement/prospectus relating to the proposed transaction. In addition, Spinco

expects to file a registration statement in connection with its separation from Berry. This communication is not a substitute for the

registration statements, proxy statement/prospectus or any other document which Berry and/or Glatfelter may file with the SEC. STOCKHOLDERS

OF BERRY AND GLATFELTER ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS,

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain

copies of the registration statements and proxy statement/prospectus (when available) as well as other filings containing information

about Berry and Glatfelter, as well as the Spinco, without charge, at the SEC’s website, http://www.sec.gov. Copies of documents

filed with the SEC by Berry or the Spinco will be made available free of charge on Berry’s investor relations website at https://ir.berryglobal.com.

Copies of documents filed with the SEC by Glatfelter will be made available free of charge on Glatfelter's investor relations website

at https://www.glatfelter.com/investors.

No Offer or Solicitation

This

communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation

of an offer to sell, subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any

sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful, prior to registration

or qualification under the securities laws of any such jurisdiction. No offer or sale of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable

law.

Participants in Solicitation

Berry

and its directors and executive officers, and Glatfelter and its directors and executive officers, may be deemed to be participants in

the solicitation of proxies from the holders of Glatfelter capital stock and/or the offering of securities in respect of the proposed

transaction. Information about the directors and executive officers of Berry, including a description of their direct or indirect

interests, by security holdings or otherwise, is set forth under the caption “Security Ownership of Beneficial Owners and Management”

in the definitive proxy statement for Berry’s 2024 Annual Meeting of Stockholders, which was filed with the SEC on January 4, 2024

(https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0001378992/000110465924001073/tm2325571d6_def14a.htm). Information about

the directors and executive officers of Glatfelter including a description of their direct or indirect interests, by security holdings

or otherwise, is set forth under the caption “Ownership of Company Stock” in the proxy statement for Glatfelter's 2023 Annual

Meeting of Shareholders, which was filed with the SEC on March 31, 2023 (https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/0000041719/000004171923000012/glt-20230331.htm).

In addition, Curt Begle, the current President of the Berry’s Health, Hygiene & Specialties Division, will be appointed as Chief

Executive Officer of the combined company. Investors may obtain additional information regarding the interest of such participants by

reading the proxy statement/prospectus regarding the proposed transaction when it becomes available.

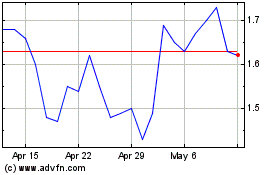

Glatfelter (NYSE:GLT)

Historical Stock Chart

From Apr 2024 to May 2024

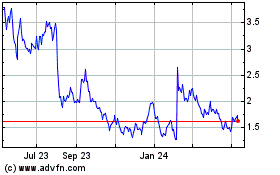

Glatfelter (NYSE:GLT)

Historical Stock Chart

From May 2023 to May 2024