GameStop Trading Restrictions Blamed on Wall Street's Clearing Firm by Online Broker

January 28 2021 - 4:21PM

Dow Jones News

By Caitlin McCabe

The chief executive of popular online brokerage Webull Financial

LLC said Thursday that the restrictions placed on trading GameStop

Corp. and other highflying stocks rested with the platform's

clearing firm that helps streamline trades.

Anthony Denier, Webull's CEO, said in an interview that he was

told Thursday morning by his clearing firm, Apex Clearing Corp.,

that Webull needed to shut off the ability to open new positions in

certain stocks, otherwise the clearing firm wouldn't be able to

settle the trade. Apex Clearing, Mr. Denier said, was told by the

Depository Trust & Clearing Corp. that it would need to put up

more collateral to help facilitate the settling of trades. That

message, he said, was then passed down to Webull, where individual

investors can trade securities such as stocks for free.

Apex couldn't immediately be reached for comment.

The decision to limit trading in a handful of popular stocks by

Webull and other brokerages such as Robinhood Markets Inc. prompted

outrage from individual investors and some members of Congress.

Many of the stocks, including GameStop and AMC Entertainment

Holdings Inc., fell sharply Thursday as some of the euphoria around

the stocks abated. GameStop dropped 25%, while AMC fell 50%. Both

stocks are still up more than 350% for the month.

Webull later said on Twitter that the firm was reopening trading

in GameStop, AMC and headphone maker Koss Corp., the three stocks

it had restricted.

The process that occurs after an individual investor places a

trade on a smartphone or computer on a platform such as Webull

typically appears to the end user to be a seamless transaction.

Usually, if an individual investor buys or sells a security, the

transaction appears to settle right away.

Behind the scenes, however, are multiple parties -- and large

sums of money -- at play.

Webull, like other online brokerages, routes its trades through

a clearing firm, which helps streamline the trading process until

settlement. Typically, Mr. Denier says, it takes two business days

for a trade to settle. He said clearing firms such as Apex are

required to put up collateral on behalf of the broker and the

customer to help facilitate the trade as an intermediary. Mr.

Denier said that Apex was told by DTCC that collateral requirements

had been raised on transactions for GameStop to near 100%.

Write to Caitlin McCabe at caitlin.mccabe@wsj.com

(END) Dow Jones Newswires

January 28, 2021 16:06 ET (21:06 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

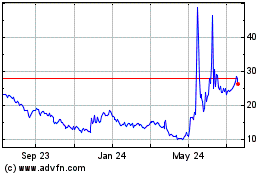

GameStop (NYSE:GME)

Historical Stock Chart

From Jun 2024 to Jul 2024

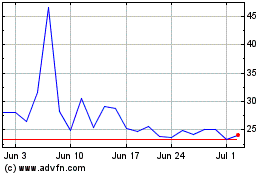

GameStop (NYSE:GME)

Historical Stock Chart

From Jul 2023 to Jul 2024