Investors Shelter from GameStop Mania in Bonds

January 28 2021 - 7:11AM

Dow Jones News

By Anna Hirtenstein

The benchmark 10-year U.S. Treasury bond yield fell below 1% in

intraday trading on Thursday, as investors spooked by the

volatility in markets sought safety.

The clash over retail-drive stocks such as GameStop is making

asset managers nervous, said Andrew Mulliner, a portfolio manager

at Janus Henderson.

"It makes people go 'I don't understand what this means' and get

ready to duck and cover."

The yield on the 10 year Treasury dropped as low as 0.998% in

European morning trading, down from 1.014% on Wednesday, according

to Tradeweb.

"Some investors will have bought Treasurys to hedge their

portfolios, given the moves seen in risk assets," said Seamus

MacGorin, head of global rates at J.P. Morgan Asset Management.

"This move in Treasurys might go further if equity markets remain

weak."

U.S. government bonds are considered to be the safest assets in

financial markets. Yields fall when prices rise, signaling an

increase in demand.

This item is part of a Wall Street Journal live coverage event.

The full stream can be found by searching P/WSJL (WSJ Live

Coverage).

(END) Dow Jones Newswires

January 28, 2021 06:56 ET (11:56 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

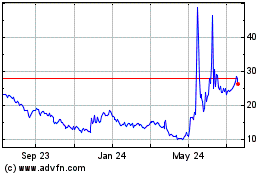

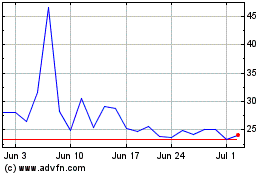

GameStop (NYSE:GME)

Historical Stock Chart

From Jun 2024 to Jul 2024

GameStop (NYSE:GME)

Historical Stock Chart

From Jul 2023 to Jul 2024