Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

May 30 2024 - 11:13AM

Edgar (US Regulatory)

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

—

94

.8

%

Aerospace

—

1

.5

%

7,370

Allient

Inc.

......................

$

262,962

1,950

BAE

Systems

plc

,

ADR

.............

135,232

200

General

Dynamics

Corp.

............

56,498

12,000

HEICO

Corp.

.....................

2,292,000

75,000

Howmet

Aerospace

Inc.

.............

5,132,250

63,300

L3Harris

Technologies

Inc.

...........

13,489,230

2,325

Mercury

Systems

Inc.

†

.............

68,587

213

Northrop

Grumman

Corp.

...........

101,955

1,200,000

Rolls-Royce

Holdings

plc

†

...........

6,462,713

24,440

RTX

Corp.

......................

2,383,633

400

Thales

SA

......................

68,205

53,700

The

Boeing

Co.

†

..................

10,363,563

40,816,828

Agriculture

—

0.0

%

5,000

Corteva

Inc.

.....................

288,350

Automotive

—

0

.8

%

15,000

Daimler

Truck

Holding

AG

...........

759,942

50,000

Ford

Motor

Co.

...................

664,000

77,500

General

Motors

Co.

................

3,514,625

308,000

Iveco

Group

NV

†

.................

4,585,544

100,000

PACCAR

Inc.

....................

12,389,000

15,000

Piaggio

&

C

SpA

..................

47,448

46,000

Traton

SE

.......................

1,654,567

23,615,126

Automotive:

Parts

and

Accessories

—

2

.8

%

48,676

Aptiv

plc

†

......................

3,877,043

165,932

Dana

Inc.

.......................

2,107,337

350,000

Dowlais

Group

plc

.................

344,567

288,915

Garrett

Motion

Inc.

†

...............

2,871,815

270,400

Genuine

Parts

Co.

.................

41,893,072

6,000

Lear

Corp.

......................

869,280

30,000

Modine

Manufacturing

Co.

†

..........

2,855,700

26,000

Monro

Inc.

......................

820,040

18,900

O'Reilly

Automotive

Inc.

†

............

21,335,832

14,000

Visteon

Corp.

†

...................

1,646,540

78,621,226

Broadcasting

—

0

.3

%

585,000

Grupo

Televisa

SAB

,

ADR

............

1,872,000

37,121

Liberty

Broadband

Corp.

,

Cl. C

†

.......

2,124,435

50,000

Liberty

Media

Corp.-Liberty

SiriusXM

†

..

1,485,500

135,000

Sinclair

Inc.

.....................

1,818,450

30,000

TEGNA

Inc.

.....................

448,200

7,748,585

Building

and

Construction

—

1

.8

%

102,000

Carrier

Global

Corp.

...............

5,929,260

78,200

Fortune

Brands

Innovations

Inc.

.......

6,621,194

4,500

H&E

Equipment

Services

Inc.

.........

288,810

Shares

Market

Value

121,693

Herc

Holdings

Inc.

................

$

20,480,932

161,900

Johnson

Controls

International

plc

.....

10,575,308

18,000

Masterbrand

Inc.

†

.................

337,320

11,000

Sika

AG

........................

3,276,154

5,625

United

Rentals

Inc.

................

4,056,244

51,565,222

Business

Services

—

3

.1

%

4,500

ITOCHU

Corp.

....................

192,152

15,000

Jardine

Matheson

Holdings

Ltd.

.......

559,500

70,000

JCDecaux

SE

†

...................

1,359,351

8,000

Loomis

AB

......................

223,318

11,000

Marubeni

Corp.

...................

189,692

141,620

Mastercard

Inc.

,

Cl. A

..............

68,199,944

8,500

Mitsubishi

Corp.

..................

195,571

4,000

Mitsui

&

Co.

Ltd.

.................

186,101

50,000

Rentokil

Initial

plc

,

ADR

.............

1,507,500

30,503

Steel

Partners

Holdings

LP

†

..........

1,209,444

25,000

Stericycle

Inc.

†

...................

1,318,750

8,000

Sumitomo

Corp.

..................

191,835

60,000

Vestis

Corp.

.....................

1,156,200

41,600

Visa

Inc.

,

Cl. A

...................

11,609,728

88,099,086

Cable

and

Satellite

—

0

.9

%

18,000

AMC

Networks

Inc.

,

Cl. A

†

...........

218,340

7,445

Charter

Communications

Inc.

,

Cl. A

†

....

2,163,740

15,000

Cogeco

Inc.

.....................

630,099

388,000

Comcast

Corp.

,

Cl. A

...............

16,819,800

25,000

EchoStar

Corp.

,

Cl. A

†

..............

356,250

10,000

Liberty

Latin

America

Ltd.

,

Cl. A

†

......

69,700

130,000

Liberty

Latin

America

Ltd.

,

Cl. C

†

......

908,700

95,000

Rogers

Communications

Inc.

,

Cl. B

.....

3,895,000

25,061,629

Communications

Equipment

—

0

.4

%

24,000

Arista

Networks

Inc.

†

..............

6,959,520

106,000

Corning

Inc.

.....................

3,493,760

7,500

QUALCOMM

Inc.

.................

1,269,750

94,000

Telesat

Corp.

†

...................

808,400

12,531,430

Computer

Hardware

—

0

.8

%

110,550

Apple

Inc.

......................

18,957,114

10,000

Dell

Technologies

Inc.

,

Cl. C

..........

1,141,100

5,000

HP

Inc.

........................

151,100

17,500

Micron

Technology

Inc.

.............

2,063,075

22,312,389

Computer

Software

and

Services

—

7

.2

%

30,000

3D

Systems

Corp.

†

................

133,200

8,300

Adobe

Inc.

†

.....................

4,188,180

1,000

Akamai

Technologies

Inc.

†

...........

108,760

1,000

Alibaba

Group

Holding

Ltd.

,

ADR

......

72,360

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Computer

Software

and

Services

(Continued)

37,000

Alphabet

Inc.

,

Cl. A

†

...............

$

5,584,410

224,900

Alphabet

Inc.

,

Cl. C

†

...............

34,243,274

163,900

Amazon.com

Inc.

†

................

29,564,282

8,520

Backblaze

Inc.

,

Cl. A

†

..............

87,160

4,000

Check

Point

Software

Technologies

Ltd.

†

.

656,040

23,000

Cisco

Systems

Inc.

................

1,147,930

17,800

CrowdStrike

Holdings

Inc.

,

Cl. A

†

......

5,706,502

7,530

Edgio

Inc.

†

......................

72,664

5,000

Fastly

Inc.

,

Cl. A

†

.................

64,850

6,200

Fiserv

Inc.

†

.....................

990,884

1,000

Fortinet

Inc.

†

....................

68,310

2,500

Gen

Digital

Inc.

...................

56,000

500,000

Hewlett

Packard

Enterprise

Co.

........

8,865,000

4,790

Intuit

Inc.

.......................

3,113,500

59,000

Kyndryl

Holdings

Inc.

†

.............

1,283,840

38,750

Meta

Platforms

Inc.

,

Cl. A

...........

18,816,225

140,950

Microsoft

Corp.

..................

59,300,484

8,886

MKS

Instruments

Inc.

..............

1,181,838

75,000

N-able

Inc.

†

.....................

980,250

2,500

Oracle

Corp.

.....................

314,025

50,000

Oxford

Metrics

plc

................

65,632

68,500

Rockwell

Automation

Inc.

...........

19,956,105

4,500

SAP

SE

,

ADR

....................

877,635

7,400

ServiceNow

Inc.

†

.................

5,641,760

42,973

SolarWinds

Corp.

†

................

542,319

12,000

Stratasys

Ltd.

†

...................

139,440

19,757

Vimeo

Inc.

†

.....................

80,806

203,903,665

Consumer

Products

—

1

.9

%

30,000

Church

&

Dwight

Co.

Inc.

...........

3,129,300

318,000

Edgewell

Personal

Care

Co.

..........

12,287,520

47,000

Energizer

Holdings

Inc.

.............

1,383,680

95,000

Hanesbrands

Inc.

†

................

551,000

700

Johnson

Outdoors

Inc.

,

Cl. A

.........

32,277

150

Kering

SA

......................

59,286

3,995

Nintendo

Co.

Ltd.

,

ADR

.............

54,292

212,000

Philip

Morris

International

Inc.

........

19,423,440

48,870

Spectrum

Brands

Holdings

Inc.

.......

4,349,919

250

The

Estee

Lauder

Companies

Inc.

,

Cl. A

..

38,537

73,000

The

Procter

&

Gamble

Co.

...........

11,844,250

7,000

The

Scotts

Miracle-Gro

Co.

..........

522,130

53,675,631

Consumer

Services

—

0

.4

%

86,530

Arlo

Technologies

Inc.

†

.............

1,094,604

13,100

Ashtead

Group

plc

................

932,527

9,000

Avis

Budget

Group

Inc.

.............

1,102,140

750

Booking

Holdings

Inc.

..............

2,720,910

7,000

Travel

+

Leisure

Co.

................

342,720

Shares

Market

Value

54,000

Uber

Technologies

Inc.

†

............

$

4,157,460

10,350,361

Diversified

Industrial

—

4

.2

%

500

Agilent

Technologies

Inc.

............

72,755

10,555

American

Outdoor

Brands

Inc.

†

.......

92,884

237,000

Ampco-Pittsburgh

Corp.

†

...........

514,290

10,845

AZZ

Inc.

........................

838,427

95,000

Bouygues

SA

....................

3,877,225

4,800

Crane

Co.

.......................

648,624

3,000

Crane

NXT

Co.

...................

185,700

48,700

Eaton

Corp.

plc

...................

15,227,516

47,600

General

Electric

Co.

................

8,355,228

3,500

Graham

Corp.

†

...................

95,480

123,000

Griffon

Corp.

....................

9,020,820

173,000

Honeywell

International

Inc.

..........

35,508,250

11,000

Hyster-Yale

Materials

Handling

Inc.

.....

705,870

43,199

Intevac

Inc.

†

....................

165,884

37,500

ITT

Inc.

........................

5,101,125

10,000

nVent

Electric

plc

.................

754,000

15,000

Pentair

plc

......................

1,281,600

10,678

Proto

Labs

Inc.

†

..................

381,738

1,250

Siemens

AG

.....................

238,642

6,500

Sulzer

AG

.......................

790,653

287,000

Textron

Inc.

.....................

27,531,910

15,225

The

Sherwin-Williams

Co.

...........

5,288,099

300,000

Toray

Industries

Inc.

...............

1,437,971

36,000

Trinity

Industries

Inc.

...............

1,002,600

119,117,291

Electronics

—

2

.3

%

5,000

Flex

Ltd.

†

.......................

143,050

58,000

Intel

Corp.

......................

2,561,860

8,597

Kimball

Electronics

Inc.

†

............

186,125

148,000

Resideo

Technologies

Inc.

†

..........

3,318,160

1,650

Signify

NV

......................

50,875

371,000

Sony

Group

Corp.

,

ADR

.............

31,809,540

38,000

TE

Connectivity

Ltd.

...............

5,519,120

79,200

Texas

Instruments

Inc.

.............

13,797,432

13,000

Thermo

Fisher

Scientific

Inc.

.........

7,555,730

3,500

Universal

Display

Corp.

.............

589,575

65,531,467

Energy

and

Utilities:

Electric

—

0

.4

%

2,000

ALLETE

Inc.

.....................

119,280

5,000

American

Electric

Power

Co.

Inc.

......

430,500

29,000

Electric

Power

Development

Co.

Ltd.

....

475,000

112,000

Evergy

Inc.

......................

5,978,560

12,000

Pinnacle

West

Capital

Corp.

..........

896,760

10,000

Portland

General

Electric

Co.

.........

420,000

3,000

PPL

Corp.

......................

82,590

61,600

The

AES

Corp.

...................

1,104,488

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Energy

and

Utilities:

Electric

(Continued)

6,500

WEC

Energy

Group

Inc.

.............

$

533,780

10,040,958

Energy

and

Utilities:

Integrated

—

1

.2

%

20,000

Chubu

Electric

Power

Co.

Inc.

........

260,867

20,000

Endesa

SA

......................

370,369

228,000

Enel

SpA

.......................

1,505,138

12,500

Eversource

Energy

................

747,125

23,000

Hawaiian

Electric

Industries

Inc.

.......

259,210

410,000

Hera

SpA

.......................

1,444,645

16,000

Hokkaido

Electric

Power

Co.

Inc.

......

87,124

45,000

Iberdrola

SA

,

ADR

.................

2,243,250

115,000

Korea

Electric

Power

Corp.

,

ADR

†

......

957,950

23,000

Kyushu

Electric

Power

Co.

Inc.

........

205,873

23,000

MGE

Energy

Inc.

..................

1,810,560

152,000

NextEra

Energy

Inc.

................

9,714,320

5,650

NextEra

Energy

Partners

LP

..........

169,952

49,000

NiSource

Inc.

....................

1,355,340

10,000

Northwestern

Energy

Group

Inc.

.......

509,300

57,500

OGE

Energy

Corp.

.................

1,972,250

11,000

Ormat

Technologies

Inc.

............

728,090

195,000

PG&E

Corp.

.....................

3,268,200

49,000

PNM

Resources

Inc.

...............

1,844,360

30,000

Public

Service

Enterprise

Group

Inc.

....

2,003,400

50,000

Shikoku

Electric

Power

Co.

Inc.

.......

389,582

40,000

The

Chugoku

Electric

Power

Co.

Inc.

....

300,700

18,000

The

Kansai

Electric

Power

Co.

Inc.

.....

255,529

50,000

Tohoku

Electric

Power

Co.

Inc.

........

390,739

32,793,873

Energy

and

Utilities:

Natural

Gas

—

1

.2

%

16,000

APA

Corp.

......................

550,080

200,000

Enterprise

Products

Partners

LP

.......

5,836,000

47,000

Kinder

Morgan

Inc.

................

861,980

207,500

National

Fuel

Gas

Co.

..............

11,146,900

30,000

National

Grid

plc

..................

403,636

22,000

National

Grid

plc

,

ADR

..............

1,500,840

14,300

ONEOK

Inc.

.....................

1,146,431

75,000

Sempra

........................

5,387,250

67,000

Southwest

Gas

Holdings

Inc.

.........

5,100,710

74,000

UGI

Corp.

.......................

1,815,960

33,749,787

Energy

and

Utilities:

Oil

—

4

.5

%

82,900

Chevron

Corp.

...................

13,076,646

207,300

ConocoPhillips

...................

26,385,144

65,000

Devon

Energy

Corp.

...............

3,261,700

123,000

Eni

SpA

,

ADR

....................

3,901,560

375,000

Equinor

ASA

,

ADR

................

10,136,250

107,000

Exxon

Mobil

Corp.

................

12,437,680

15,700

Hess

Corp.

......................

2,396,448

Shares

Market

Value

129,000

Marathon

Petroleum

Corp.

...........

$

25,993,500

73,000

Occidental

Petroleum

Corp.

..........

4,744,270

100,000

PetroChina

Co.

Ltd.

,

Cl. H

...........

85,475

25,000

Petroleo

Brasileiro

SA

,

ADR

..........

380,250

52,000

Phillips

66

......................

8,493,680

75,000

Repsol

SA

,

ADR

..................

1,253,355

92,800

Shell

plc

,

ADR

...................

6,221,312

3,000

Texas

Pacific

Land

Corp.

............

1,735,530

70,000

TotalEnergies

SE

,

ADR

..............

4,818,100

2,891

Woodside

Energy

Group

Ltd.

,

ADR

.....

57,733

125,378,633

Energy

and

Utilities:

Services

—

1

.5

%

2,000

Baker

Hughes

Co.

.................

67,000

89,000

Dril-Quip

Inc.

†

...................

2,005,170

556,325

Halliburton

Co.

...................

21,930,331

117,975

Oceaneering

International

Inc.

†

.......

2,760,615

267,000

Schlumberger

NV

.................

14,634,270

41,397,386

Energy

and

Utilities:

Water

—

0

.3

%

11,000

American

States

Water

Co.

...........

794,640

6,000

American

Water

Works

Co.

Inc.

.......

733,260

51,000

Essential

Utilities

Inc.

..............

1,889,550

61,000

Mueller

Water

Products

Inc.

,

Cl. A

.....

981,490

34,000

Severn

Trent

plc

..................

1,059,954

22,000

SJW

Group

.....................

1,244,980

7,500

The

York

Water

Co.

................

272,025

8,000

United

Utilities

Group

plc

,

ADR

........

208,200

7,184,099

Entertainment

—

2

.6

%

222,000

Atlanta

Braves

Holdings

Inc.

,

Cl. A

†

....

9,301,800

65,000

Atlanta

Braves

Holdings

Inc.

,

Cl. C

†

....

2,538,900

25,000

Caesars

Entertainment

Inc.

†

..........

1,093,500

61,333

Fox

Corp.

,

Cl. A

...................

1,917,883

71,000

Fox

Corp.

,

Cl. B

...................

2,032,020

3,000

International

Game

Technology

plc

.....

67,770

59,880

Madison

Square

Garden

Entertainment

Corp.

†

.......................

2,347,895

50,000

Madison

Square

Garden

Sports

Corp.

†

..

9,226,000

22,800

Netflix

Inc.

†

.....................

13,847,124

156,250

Ollamani

SAB

†

...................

282,245

91,000

Paramount

Global

,

Cl. A

.............

1,986,530

260,000

Paramount

Global

,

Cl. B

.............

3,060,200

3,000

Penn

Entertainment

Inc.

†

............

54,630

57,880

Sphere

Entertainment

Co.

†

..........

2,840,750

16,000

Take-Two

Interactive

Software

Inc.

†

....

2,375,840

25,000

The

Walt

Disney

Co.

...............

3,059,000

105,000

Universal

Music

Group

NV

...........

3,158,226

650,000

Vivendi

SE

......................

7,082,650

720,000

Warner

Bros

Discovery

Inc.

†

.........

6,285,600

72,558,563

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Environmental

Services

—

2

.7

%

181,000

Republic

Services

Inc.

..............

$

34,650,640

29,180

Veolia

Environnement

SA

............

948,518

97,222

Waste

Connections

Inc.

.............

16,723,156

108,000

Waste

Management

Inc.

............

23,020,200

75,342,514

Equipment

and

Supplies

—

1

.8

%

3,000

CTS

Corp.

......................

140,370

106,000

Flowserve

Corp.

..................

4,842,080

113,500

Graco

Inc.

......................

10,607,710

270,000

Mueller

Industries

Inc.

..............

14,561,100

456,825

RPC

Inc.

.......................

3,535,825

70,000

Sealed

Air

Corp.

..................

2,604,000

25,800

The

L.S.

Starrett

Co.

,

Cl. A

†

..........

409,962

96,000

The

Timken

Co.

...................

8,393,280

29,000

Valmont

Industries

Inc.

.............

6,620,120

51,714,447

Financial

Services

—

16

.2

%

14,000

AJ

Bell

plc

......................

53,434

283,750

American

Express

Co.

..............

64,607,038

65,000

American

International

Group

Inc.

......

5,081,050

274,600

Bank

of

America

Corp.

..............

10,412,832

60,000

Berkshire

Hathaway

Inc.

,

Cl. B

†

.......

25,231,200

15,600

BlackRock

Inc.

...................

13,005,720

75,000

Blackstone

Inc.

...................

9,852,750

7,174

Brookfield

Asset

Management

Ltd.

,

Cl. A

.

301,451

28,500

Brookfield

Corp.

..................

1,193,295

196

Brookfield

Reinsurance

Ltd.

..........

8,189

2,300

Brooks

Macdonald

Group

plc

.........

52,398

14,000

Cannae

Holdings

Inc.

†

..............

311,360

192,000

Citigroup

Inc.

....................

12,142,080

5,000

Cohen

&

Steers

Inc.

...............

384,450

18,500

Cullen/Frost

Bankers

Inc.

............

2,082,545

11,000

EXOR

NV

.......................

1,222,930

140

Farmers

&

Merchants

Bank

of

Long

Beach

672,000

37,000

Fidelity

National

Financial

Inc.

.........

1,964,700

80,000

FTAI

Aviation

Ltd.

.................

5,384,000

23,000

HSBC

Holdings

plc

,

ADR

............

905,280

23,249

Interactive

Brokers

Group

Inc.

,

Cl. A

....

2,597,146

20,450

Intercontinental

Exchange

Inc.

........

2,810,444

155,000

Invesco

Ltd.

.....................

2,571,450

14,000

Janus

Henderson

Group

plc

..........

460,460

321,747

JPMorgan

Chase

&

Co.

.............

64,445,924

65,000

KeyCorp.

.......................

1,027,650

45,000

KKR

&

Co.

Inc.

...................

4,526,100

85,000

Loews

Corp.

.....................

6,654,650

42,000

M&T

Bank

Corp.

..................

6,108,480

189,726

Morgan

Stanley

..................

17,864,600

4,000

MSCI

Inc.

.......................

2,241,800

70,000

National

Australia

Bank

Ltd.

,

ADR

......

796,600

Shares

Market

Value

124,000

Navient

Corp.

....................

$

2,157,600

90,500

Northern

Trust

Corp.

...............

8,047,260

168,375

Oaktree

Specialty

Lending

Corp.

.......

3,310,253

5,000

PayPal

Holdings

Inc.

†

..............

334,950

80,000

Resona

Holdings

Inc.

..............

492,535

15,000

S&P

Global

Inc.

..................

6,381,750

90,000

SLM

Corp.

......................

1,961,100

154,000

State

Street

Corp.

.................

11,907,280

123,000

T.

Rowe

Price

Group

Inc.

............

14,996,160

621,000

The

Bank

of

New

York

Mellon

Corp.

....

35,782,020

35,000

The

Charles

Schwab

Corp.

...........

2,531,900

34,000

The

Goldman

Sachs

Group

Inc.

.......

14,201,460

90,000

The

Hartford

Financial

Services

Group

Inc.

9,274,500

137,000

The

PNC

Financial

Services

Group

Inc.

..

22,139,200

74,000

The

Travelers

Companies

Inc.

.........

17,030,360

60,000

W.

R.

Berkley

Corp.

................

5,306,400

545,000

Wells

Fargo

&

Co.

.................

31,588,200

2,300

Willis

Towers

Watson

plc

............

632,500

455,049,434

Food

and

Beverage

—

9

.0

%

12,000

Ajinomoto

Co.

Inc.

................

446,453

100,117

BellRing

Brands

Inc.

†

..............

5,909,907

12,500

Brown-Forman

Corp.

,

Cl. B

..........

645,250

344,000

Campbell

Soup

Co.

................

15,290,800

900,000

China

Mengniu

Dairy

Co.

Ltd.

.........

1,931,799

66,000

Conagra

Brands

Inc.

...............

1,956,240

156,000

Danone

SA

......................

10,079,523

1,920,000

Davide

Campari-Milano

NV

..........

19,292,945

1,500

Diageo

plc

......................

55,386

138,500

Diageo

plc

,

ADR

..................

20,600,490

70,954

Flowers

Foods

Inc.

................

1,685,157

184,200

General

Mills

Inc.

.................

12,888,474

18,000

Heineken

Holding

NV

...............

1,452,564

260,000

ITO

EN

Ltd.

.....................

6,351,433

110,000

Keurig

Dr

Pepper

Inc.

..............

3,373,700

1,650,000

Kikkoman

Corp.

..................

21,101,863

10,000

Lamb

Weston

Holdings

Inc.

..........

1,065,300

11,000

Lifecore

Biomedical

Inc.

†

............

58,410

108,000

Maple

Leaf

Foods

Inc.

..............

1,770,832

6,000

McCormick

&

Co.

Inc.

..............

464,520

35,000

Molson

Coors

Beverage

Co.

,

Cl. B

......

2,353,750

502,000

Mondelēz

International

Inc.

,

Cl. A

......

35,140,000

60,000

Morinaga

Milk

Industry

Co.

Ltd.

.......

1,225,922

10,000

Nathan's

Famous

Inc.

..............

708,000

4,400

National

Beverage

Corp.

†

............

208,824

24,000

Nestlé

SA

.......................

2,548,096

35,000

Nestlé

SA

,

ADR

...................

3,717,000

384,000

Nissin

Foods

Holdings

Co.

Ltd.

........

10,577,883

69,982

Nomad

Foods

Ltd.

................

1,368,848

69,250

PepsiCo

Inc.

.....................

12,119,442

39,000

Pernod

Ricard

SA

.................

6,309,169

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Food

and

Beverage

(Continued)

42,000

Post

Holdings

Inc.

†

................

$

4,463,760

24,500

Remy

Cointreau

SA

................

2,469,790

18,000

Suntory

Beverage

&

Food

Ltd.

........

607,848

2,500

The

Boston

Beer

Co.

Inc.

,

Cl. A

†

.......

761,050

240,000

The

Coca-Cola

Co.

................

14,683,200

51,000

The

Hain

Celestial

Group

Inc.

†

........

400,860

5,150

The

J.M.

Smucker

Co.

..............

648,230

424,000

The

Kraft

Heinz

Co.

................

15,645,600

14,000

TreeHouse

Foods

Inc.

†

.............

545,300

29,000

Unilever

plc

,

ADR

.................

1,455,510

10,000

WK

Kellogg

Co.

..................

188,000

470,000

Yakult

Honsha

Co.

Ltd.

.............

9,599,947

254,167,075

Health

Care

—

10

.9

%

30,500

Abbott

Laboratories

...............

3,466,630

58,600

AbbVie

Inc.

.....................

10,671,060

42,486

AstraZeneca

plc

,

ADR

..............

2,878,426

185,987

Avantor

Inc.

†

....................

4,755,688

122,000

Bausch

+

Lomb

Corp.

†

.............

2,110,600

85,000

Baxter

International

Inc.

.............

3,632,900

1,000

Bayer

AG

.......................

30,672

10,000

Becton

Dickinson

&

Co.

.............

2,474,500

2,500

BioMarin

Pharmaceutical

Inc.

†

........

218,350

12,500

Bio-Rad

Laboratories

Inc.

,

Cl. A

†

......

4,323,375

69,000

Bristol-Myers

Squibb

Co.

............

3,741,870

75,000

Catalent

Inc.

†

....................

4,233,750

25,000

Cencora

Inc.

.....................

6,074,750

9,000

Charles

River

Laboratories

International

Inc.

†

........................

2,438,550

12,500

Chemed

Corp.

...................

8,024,125

23,000

DaVita

Inc.

†

.....................

3,175,150

1,000

Demant

A/S

†

....................

49,610

100,000

DENTSPLY

SIRONA

Inc.

............

3,319,000

55,000

Elanco

Animal

Health

Inc.

†

...........

895,400

15,000

Elevance

Health

Inc.

...............

7,778,100

51,400

Eli

Lilly

&

Co.

....................

39,987,144

300,000

Evolent

Health

Inc.

,

Cl. A

†

...........

9,837,000

24,500

Fortrea

Holdings

Inc.

†

..............

983,430

467

GE

HealthCare

Technologies

Inc.

.......

42,455

12,510

Gerresheimer

AG

.................

1,409,025

45,000

Halozyme

Therapeutics

Inc.

†

.........

1,830,600

25,000

HCA

Healthcare

Inc.

...............

8,338,250

45,500

Henry

Schein

Inc.

†

................

3,436,160

30,000

ICU

Medical

Inc.

†

.................

3,219,600

7,200

Incyte

Corp.

†

....................

410,184

42,371

Integer

Holdings

Corp.

†

.............

4,943,848

15,900

Intuitive

Surgical

Inc.

†

..............

6,345,531

101,535

Johnson

&

Johnson

...............

16,061,822

3,735

Kenvue

Inc.

.....................

80,153

Shares

Market

Value

24,500

Laboratory

Corp.

of

America

Holdings

...

$

5,352,270

10,000

Lantheus

Holdings

Inc.

†

............

622,400

11,000

McKesson

Corp.

..................

5,905,350

40,000

Medtronic

plc

....................

3,486,000

122,000

Merck

&

Co.

Inc.

..................

16,097,900

191,042

Option

Care

Health

Inc.

†

............

6,407,549

1,000

Organon

&

Co.

...................

18,800

70,000

Owens

&

Minor

Inc.

†

..............

1,939,700

100,000

Pacific

Biosciences

of

California

Inc.

†

...

375,000

63,000

Patterson

Cos.

Inc.

................

1,741,950

78,000

Perrigo

Co.

plc

...................

2,510,820

65,000

PetIQ

Inc.

†

......................

1,188,200

462,088

Pfizer

Inc.

......................

12,822,942

25,430

QuidelOrtho

Corp.

†

................

1,219,114

250

Roche

Holding

AG

.................

63,675

25,000

Silk

Road

Medical

Inc.

†

.............

458,000

24,400

Stryker

Corp.

....................

8,732,028

3,600

Teladoc

Health

Inc.

†

...............

54,360

133,398

Tenet

Healthcare

Corp.

†

.............

14,021,464

56,000

The

Cigna

Group

..................

20,338,640

48,000

The

Cooper

Companies

Inc.

..........

4,870,080

21,252

Treace

Medical

Concepts

Inc.

†

........

277,339

4,050

UnitedHealth

Group

Inc.

............

2,003,535

10,000

Vertex

Pharmaceuticals

Inc.

†

.........

4,180,100

25,000

Viatris

Inc.

......................

298,500

30,000

Zimmer

Biomet

Holdings

Inc.

.........

3,959,400

105,038

Zoetis

Inc.

......................

17,773,480

307,936,304

Hotels

and

Gaming

—

0

.4

%

19,000

Accor

SA

.......................

887,570

79,800

Boyd

Gaming

Corp.

................

5,372,136

43,000

Entain

plc

.......................

432,769

400

Flutter

Entertainment

plc

†

...........

79,717

4,700

Gambling.com

Group

Ltd.

†

..........

42,911

15,000

Golden

Entertainment

Inc.

...........

552,450

16,000

Las

Vegas

Sands

Corp.

.............

827,200

400,000

Mandarin

Oriental

International

Ltd.

....

622,000

20,400

MGM

Resorts

International

†

.........

963,084

15,000

Ryman

Hospitality

Properties

Inc.

,

REIT

.

1,734,150

5,000

Wyndham

Hotels

&

Resorts

Inc.

.......

383,750

500

Wynn

Resorts

Ltd.

................

51,115

11,948,852

Machinery

—

2

.6

%

57,000

Astec

Industries

Inc.

...............

2,491,470

1,751,700

CNH

Industrial

NV

.................

22,702,032

55,500

Deere

&

Co.

.....................

22,796,070

7,500

Generac

Holdings

Inc.

†

.............

946,050

3,500

Otis

Worldwide

Corp.

..............

347,445

1,500

Tennant

Co.

.....................

182,415

40,000

Twin

Disc

Inc.

....................

661,200

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Machinery

(Continued)

172,480

Xylem

Inc.

......................

$

22,291,315

72,417,997

Metals

and

Mining

—

1

.0

%

59,585

Agnico

Eagle

Mines

Ltd.

............

3,554,245

18,000

Alliance

Resource

Partners

LP

........

360,900

124,190

Barrick

Gold

Corp.

................

2,066,521

8,000

BHP

Group

Ltd.

,

ADR

..............

461,520

10,000

Endeavour

Mining

plc

..............

203,167

10,000

Franco-Nevada

Corp.

...............

1,191,540

860

Franco-Nevada

Corp.,

New

York

.......

102,478

200,000

Freeport-McMoRan

Inc.

.............

9,404,000

270,620

Newmont

Corp.

..................

9,699,021

9,615

Osisko

Gold

Royalties

Ltd.,

New

York

...

157,878

27,201,270

Paper

and

Forest

Products

—

0.0

%

2,200

Keweenaw

Land

Association

Ltd.

†

.....

50,710

Publishing

—

0.0

%

1,200

Graham

Holdings

Co.

,

Cl. B

..........

921,216

Real

Estate

Investment

Trust

—

0

.5

%

46,000

American

Tower

Corp.

..............

9,089,140

16,000

Crown

Castle

Inc.

.................

1,693,280

1,700

Equinix

Inc.

.....................

1,403,061

1,800

VICI

Properties

Inc.

................

53,622

85,000

Weyerhaeuser

Co.

.................

3,052,350

15,291,453

Retail

—

3

.4

%

101,808

AutoNation

Inc.

†

..................

16,857,369

1,000

AutoZone

Inc.

†

...................

3,151,650

19,000

Bassett

Furniture

Industries

Inc.

.......

280,440

40,000

CarMax

Inc.

†

....................

3,484,400

1,790

Chipotle

Mexican

Grill

Inc.

†

..........

5,203,118

200,000

Conn's

Inc.

†

.....................

670,000

10,900

Costco

Wholesale

Corp.

.............

7,985,667

193,000

CVS

Health

Corp.

.................

15,393,680

65,000

Hertz

Global

Holdings

Inc.

†

..........

508,950

98,500

Ingles

Markets

Inc.

,

Cl. A

............

7,552,980

29,530

Lowe's

Companies

Inc.

.............

7,522,177

6,000

Macy's

Inc.

.....................

119,940

7,500

MSC

Industrial

Direct

Co.

Inc.

,

Cl. A

....

727,800

15,000

Penske

Automotive

Group

Inc.

........

2,429,850

56,250

Rush

Enterprises

Inc.

,

Cl. B

..........

2,997,563

236,000

Sally

Beauty

Holdings

Inc.

†

..........

2,931,120

348,000

Seven

&

i

Holdings

Co.

Ltd.

..........

5,057,471

40,000

Starbucks

Corp.

..................

3,655,600

12,000

The

Home

Depot

Inc.

...............

4,603,200

70,000

Walgreens

Boots

Alliance

Inc.

........

1,518,300

Shares

Market

Value

60,000

Walmart

Inc.

....................

$

3,610,200

96,261,475

Semiconductors

—

1

.8

%

31,000

Advanced

Micro

Devices

Inc.

†

........

5,595,190

21,000

Applied

Materials

Inc.

..............

4,330,830

6,100

ASML

Holding

NV

.................

5,919,867

1,050

Broadcom

Inc.

...................

1,391,680

3,000

Entegris

Inc.

.....................

421,620

34,500

NVIDIA

Corp.

....................

31,172,820

1,500

NXP

Semiconductors

NV

............

371,655

34,804

SkyWater

Technology

Inc.

†

..........

353,957

11,000

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

,

ADR

.....................

1,496,550

51,054,169

Specialty

Chemicals

—

1

.3

%

11,000

Air

Products

and

Chemicals

Inc.

.......

2,664,970

30,000

Ashland

Inc.

.....................

2,921,100

10,000

Axalta

Coating

Systems

Ltd.

†

.........

343,900

400

DSM-Firmenich

AG

................

45,484

203,000

DuPont

de

Nemours

Inc.

............

15,564,010

27,000

FMC

Corp.

......................

1,719,900

15,000

International

Flavors

&

Fragrances

Inc.

..

1,289,850

22,260

Novonesis

(Novozymes)

B

...........

1,304,592

83,000

Olin

Corp.

......................

4,880,400

15,400

Rogers

Corp.

†

...................

1,827,826

5,000

Sensient

Technologies

Corp.

.........

345,950

65,000

Valvoline

Inc.

†

...................

2,897,050

35,805,032

Telecommunications

—

2

.1

%

29,000

AT&T

Inc.

.......................

510,400

148,000

BCE

Inc.

........................

5,029,040

415,000

Deutsche

Telekom

AG

,

ADR

..........

10,047,150

73,750

Eurotelesites

AG

†

.................

293,993

62,279

GCI

Liberty

Inc.,

Escrow

†

(a)

.........

0

195,000

Hellenic

Telecommunications

Organization

SA

,

ADR

......................

1,400,100

392,000

Liberty

Global

Ltd.

,

Cl. C

†

...........

6,914,880

46,000

Orange

SA

,

ADR

..................

541,420

50,000

Pharol

SGPS

SA

†

.................

2,632

40,000

Proximus

SA

....................

323,569

100,000

Telefonica

SA

,

ADR

................

441,000

295,000

Telekom

Austria

AG

................

2,466,521

100,000

Telephone

and

Data

Systems

Inc.

......

1,602,000

105,000

Telstra

Group

Ltd.

,

ADR

.............

1,316,910

245,000

TELUS

Corp.

....................

3,922,450

71,200

T-Mobile

US

Inc.

..................

11,621,264

12,000

VEON

Ltd.

,

ADR

†

.................

288,120

285,586

Verizon

Communications

Inc.

.........

11,983,189

127,100

Vodafone

Group

plc

,

ADR

...........

1,131,190

59,835,828

The

Gabelli

Dividend

&

Income

Trust

Schedule

of

Investments

(Continued)

—

March

31,

2024

(Unaudited)

Shares

Market

Value

COMMON

STOCKS

(Continued)

Transportation

—

0

.9

%

28,840

Canadian

Pacific

Kansas

City

Ltd.

......

$

2,542,823

170,000

GATX

Corp.

.....................

22,785,100

25,327,923

Wireless

Communications

—

0

.1

%

60,400

United

States

Cellular

Corp.

†

.........

2,204,600

TOTAL

COMMON

STOCKS

...........

2,668,871,884

CLOSED-END

FUNDS

—

0.0

%

40,000

Altaba

Inc.,

Escrow

†

...............

96,000

PREFERRED

STOCKS

—

0

.1

%

Consumer

Services

—

0

.1

%

33,000

Qurate

Retail

Inc.

,

8.000

%

,

03/15/31

....

1,640,760

Health

Care

—

0.0

%

2,296

XOMA

Corp.

,

Ser.

A

,

8.625

%

.........

57,836

TOTAL

PREFERRED

STOCKS

.........

1,698,596

MANDATORY

CONVERTIBLE

SECURITIES

(b)

—

0

.2

%

Energy

and

Utilities

—

0

.2

%

123,000

El

Paso

Energy

Capital

Trust

I

,

4.750

%

,

03/31/28

...............

5,899,080

WARRANTS

—

0.0

%

Diversified

Industrial

—

0.0

%

32,000

Ampco-Pittsburgh

Corp.

,

expire

08/01/25

†

3,200

Energy

and

Utilities:

Oil

—

0.0

%

12,257

Occidental

Petroleum

Corp.

,

expire

08/03/27

†

.....................

528,277

TOTAL

WARRANTS

................

531,477

Principal

Amount

U.S.

GOVERNMENT

OBLIGATIONS

—

4

.9

%

$

137,819,000

U.S.

Treasury

Bills,

5.151

%

to

5.472

%

††

,

04/11/24

to

09/12/24

......................

136,723,044

TOTAL

INVESTMENTS

—

100

.0

%

.....

(Cost

$

1,624,668,623

)

............

$

2,813,820,081

(a)

Security

is

valued

using

significant

unobservable

inputs

and

is

classified

as

Level

3

in

the

fair

value

hierarchy.

(b)

Mandatory

convertible

securities

are

required

to

be

converted

on

the

dates

listed;

they

generally

may

be

converted

prior

to

these

dates

at

the

option

of

the

holder.

†

Non-income

producing

security.

††

Represents

annualized

yields

at

dates

of

purchase.

ADR

American

Depositary

Receipt

REIT

Real

Estate

Investment

Trust

Geographic

Diversification

%

of

Total

Investments

Market

Value

North

America

......................

88

.1

%

$

2,478,309,550

Europe

..............................

8

.2

232,533,716

Japan

...............................

3

.3

92,083,923

Asia/Pacific

.........................

0

.3

8,358,397

Latin

America

.......................

0

.1

2,534,495

Total

Investments

...................

100.0%

$

2,813,820,081

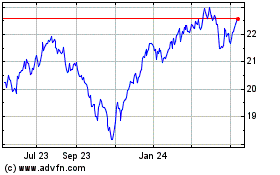

Gabelli Dividend and Inc... (NYSE:GDV)

Historical Stock Chart

From Dec 2024 to Jan 2025

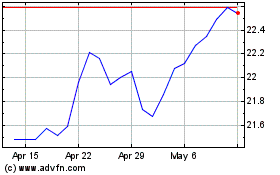

Gabelli Dividend and Inc... (NYSE:GDV)

Historical Stock Chart

From Jan 2024 to Jan 2025