Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

February 08 2024 - 5:16PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-272489

Relating to Preliminary Prospectus Supplement dated February 5, 2024

FORTIVE CORPORATION

PRICING TERM

SHEET

February 8, 2024

€500,000,000 3.700% Senior Notes due 2026

€700,000,000 3.700% Senior Notes due 2029

The information in this pricing term sheet supplements Fortive Corporation’s preliminary prospectus supplement, dated February 5, 2024 (the

“Preliminary Prospectus Supplement”), and supersedes the information in the Preliminary Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement. In all other respects, this term sheet

is qualified in its entirety by reference to the Preliminary Prospectus Supplement. You should rely on the information contained or incorporated by reference in the Preliminary Prospectus Supplement, as supplemented by this pricing term sheet, in

making an investment decision with respect to the Notes. Terms used herein but not defined herein shall have the respective meanings as set forth in the Preliminary Prospectus Supplement.

|

|

|

| Issuer: |

|

Fortive Corporation |

|

|

| Legal Entity Identifier (LEI) Code: |

|

549300MU9YQJYHDQEF63 |

|

|

| Expected Ratings (Moody’s/S&P)*: |

|

Baa1 (Stable) / BBB (Stable) |

|

|

| Securities: |

|

3.700% Senior Notes due 2026 (the “2026 Notes”)

3.700% Senior Notes due 2029 (the “2029 Notes” and, together with the 2026 Notes, the “Notes”) |

|

|

| Trade Date: |

|

February 8, 2024 |

|

|

| Settlement Date: |

|

February 13, 2024 (T+3) |

|

|

| Size: |

|

2026 Notes: €500,000,000 2029 Notes:

€700,000,000 |

|

|

| Maturity: |

|

2026 Notes: February 13, 2026 2029 Notes:

August 15, 2029 |

|

|

| Coupon (Interest Rate): |

|

2026 Notes: 3.700% 2029 Notes:

3.700% |

|

|

| Yield to Maturity: |

|

2026 Notes: 3.738% 2029 Notes:

3.715% |

|

|

| Mid-Swap Yield: |

|

2026 Notes: 3.088% 2029 Notes:

2.715% |

|

|

| Spread to Mid-Swap Yield: |

|

2026 Notes: +65 basis points 2029 Notes: +100

basis points |

|

|

|

| Price to Public: |

|

2026 Notes: 99.928% 2029 Notes:

99.943% |

|

|

| Spread to Benchmark Bund: |

|

2026 Notes: +105.7 basis points 2029 Notes:

+146.5 basis points |

|

|

| Benchmark Bund: |

|

2026 Notes: DBR 0.500% due February 15, 2026

2029 Notes: DBR 0.000% due August 15, 2029 |

|

|

| Benchmark Bund Price and Yield: |

|

2026 Notes: 95.790%; 2.681% 2029 Notes:

88.470%; 2.250% |

|

|

| Interest Payment Dates: |

|

2026 Notes: February 13 of each year, commencing on February 13, 2025

2029 Notes: August 15 of each year, commencing on August 15, 2024 (short first coupon) |

|

|

| Optional Redemption: |

|

The 2026 Notes will be redeemable, at the Issuer’s option, in whole or in part, at any time, at a redemption price equal to the greater

of: (i) (a) the sum of the present values of the remaining scheduled payments of principal and interest thereon discounted to the redemption date, on an annual basis (ACTUAL/ACTUAL (ICMA)), at a rate equal to the Comparable Government Bond Rate

plus 20 basis points, less (b) interest accrued to, but not including, the date of redemption; and (ii) 100% of the principal amount of the 2026 Notes to be redeemed, plus, in either case, accrued and unpaid interest on the 2026 Notes to

be redeemed to, but not including, the redemption date. The 2029 Notes will be

redeemable, at the Issuer’s option, in whole or in part, from settlement until July 15, 2029 (the date that is 1 month prior to the scheduled maturity date), at a redemption price equal to the greater of: (i) (a) the sum of the

present values of the remaining scheduled payments of principal and interest thereon discounted to the redemption date (assuming the 2029 Notes matured on July 15, 2029), on an annual basis (ACTUAL/ACTUAL (ICMA)), at a rate equal to the

Comparable Government Bond Rate plus 25 basis points, less (b) interest accrued to, but not including, the date of redemption; and (ii) 100% of the principal amount of the 2029 Notes to be redeemed, plus, in either case, accrued and

unpaid interest on the 2029 Notes to be redeemed to, but not including, the redemption date. |

|

|

| Par Call: |

|

2026 Notes: None 2029 Notes: On or after

July 15, 2029 |

|

|

| Payment of Additional Amounts: |

|

Subject to certain exceptions and limitations, the Issuer will pay additional amounts on the Notes as are necessary in order that the net payment by the Issuer or the paying agent of the principal of, and premium, if any, and

interest on, the Notes to a holder who is not a United States person, after withholding or deduction for any present or future tax, duty, assessment or governmental charge of whatever nature imposed or levied by the United States or any taxing

authority thereof or therein, will not be less than the amount provided in the Notes to be then due and payable. |

|

|

|

| Redemption for Tax Reasons: |

|

The Issuer may redeem all, but not less than all, of the Notes in the event of certain changes in the tax law of the United States (or any taxing authority thereof or therein) which would obligate the Issuer to pay additional

amounts as described above. This redemption would be at a redemption price equal to 100% of the principal amount of the Notes, plus accrued and unpaid interest, if any, on the Notes to, but not including, the redemption date. |

|

|

| Change of Control Offer to Purchase: |

|

If a change of control triggering event occurs, each holder of the notes may require the Issuer to repurchase some or all of its notes at a purchase price equal to 101% of the aggregate principal amount of the notes being

repurchased, plus accrued and unpaid interest to, but not including, the repurchase date. A change of control triggering event means the occurrence of both a change of control and a rating event. |

|

|

| Use of Proceeds |

|

The Issuer intends to use the net proceeds from the Notes to refinance outstanding indebtedness, which may include borrowings under its U.S. dollar-denominated commercial paper program and/or its Term Loan Credit Agreement, and for

general corporate purposes. The indebtedness the Issuer intends to refinance is primarily associated with the funding of the acquisition of EA Elektro-Automatik Holding GmbH. The Issuer has broad discretion in the use of such proceeds. |

|

|

| Legal Defeasance and Covenant Defeasance; Satisfaction and Discharge: |

|

For purposes of the legal defeasance and covenant defeasance and the satisfaction and discharge provisions, government obligations means (i) a direct obligation of the Federal Republic of Germany or any country that is a member

of the European Monetary Union whose long-term debt is rated “A1” or higher by Moody’s or “A+” or higher by S&P or the equivalent rating category of another internationally recognized rating agency on the issue date of

the Notes, for the payment of which the full faith and credit of the Federal Republic of Germany or such country, respectively, is pledged or (ii) an obligation of a person controlled or supervised by and acting as an agency or instrumentality

of the Federal Republic of Germany or any such country the payment of which is unconditionally guaranteed as a full faith and credit obligation by the Federal Republic of Germany or such country, respectively, which, in either case of clause

(i) or (ii), is not callable or redeemable at the option of the issuer thereof. |

|

|

| CUSIP Number: |

|

2026 Notes: 34959J AL2 2029 Notes: 34959J

AM0 |

|

|

| ISIN Number: |

|

2026 Notes: XS2764789231 2029 Notes:

XS2764790833 |

|

|

| Common Code: |

|

2026 Notes: 276478923 2029 Notes:

276479083 |

|

|

| Denominations: |

|

€100,000 and integral multiples of €1,000 in excess thereof |

|

|

| Day Count Convention: |

|

ACTUAL/ACTUAL (ICMA) |

|

|

| Listing: |

|

Application will be made to list the Notes on The New York Stock Exchange |

|

|

| Stabilization: |

|

FCA/ICMA |

|

|

|

|

|

| Target Markets/PRIIPs: |

|

MiFID II and UK MiFIR professionals/ECPs-only / No EEA PRIIPs KID or UK PRIIPs KID – Manufacturer target market (MIFID II and UK MiFIR product governance) is eligible counterparties and professional clients only (all

distribution channels). No EEA or UK PRIIPs key information document (KID) has been prepared as not available to retail in EEA or the UK. |

|

|

| Book-Running Managers: |

|

BNP Paribas

Morgan Stanley & Co. International plc

Goldman Sachs & Co. LLC

J.P. Morgan Securities plc

PNC Capital Markets LLC SMBC Nikko Capital Markets

Limited Truist Securities, Inc. |

|

|

| Senior Co-Managers: |

|

Barclays Bank PLC Merrill Lynch

International Scotiabank (Ireland) Designated Activity Company

The Toronto-Dominion Bank U.S. Bancorp Investments,

Inc. |

|

|

| Co-Manager: |

|

Loop Capital Markets LLC |

| * |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time. |

We expect that delivery of the Notes will be made against payment therefor

on or about February 13, 2024, which will be the third business day following the date of pricing of the Notes, or “T+3”. Under Rule 15c6-1 of the Exchange Act, trades in the secondary market

generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the second business day before delivery will be required, by virtue

of the fact that the Notes initially will settle in T+3, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to the second business

day before delivery should consult their advisors.

The Issuer has filed a registration statement (including a prospectus) with the

SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this

offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, BNP Paribas or Morgan Stanley & Co. International plc will arrange to send you the prospectus if you request it by calling

BNP Paribas at 1-800-854-5674 or Morgan Stanley & Co. International plc at 1-866-718-1649.

This communication should be read

in conjunction with the preliminary prospectus supplement and the accompanying base prospectus. The information in this communication supersedes the information in the preliminary prospectus supplement and the accompanying base prospectus to the

extent inconsistent with the information in the preliminary prospectus supplement and the accompanying base prospectus.

ANY

DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR

ANOTHER EMAIL SYSTEM.

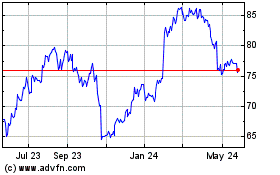

Fortive (NYSE:FTV)

Historical Stock Chart

From Apr 2024 to May 2024

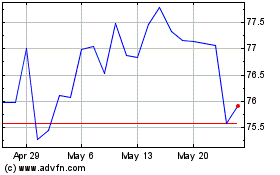

Fortive (NYSE:FTV)

Historical Stock Chart

From May 2023 to May 2024