Fluor Announces Full Mandatory Conversion of Series A 6.50% Cumulative Perpetual Convertible Preferred Stock

September 25 2023 - 6:50AM

Business Wire

Fluor Corporation (NYSE: FLR) (the “Company” or “Fluor”)

announced today that it has exercised its mandatory conversion

rights on its outstanding Series A 6.50% Cumulative Perpetual

Convertible Preferred Stock (the “Preferred Stock”). All of the

outstanding shares of Preferred Stock will automatically convert to

shares of the Company’s common stock, $0.01 par value (“Common

Stock”) plus a cash payment equal to the Mandatory Conversion

Make-Whole Amount, effective September 27, 2023 (the “Mandatory

Conversion Date”). For each share of Preferred Stock, holders of

Preferred Stock will receive 44.9585 shares of Common Stock and a

cash payment of $45.23 in respect of the Mandatory Conversion

Make-Whole Amount. Fractional shares of Common Stock will be

rounded up to the nearest whole share. All dividends on the

Preferred Stock will cease to accumulate on the Mandatory

Conversion Date, and no payment or adjustment shall be made upon

conversion of Preferred Stock for accumulated dividends since the

last record date.

“Today's announcement represents a key milestone in our journey

to restore Fluor’s solid capital structure, support future growth

and provide financial resiliency,” said Joe Brennan, Fluor’s chief

financial officer. “The mandatory conversion of the Preferred

Stock, along with our successful convertible debt offering last

month, reinforces our financial discipline and enables a path

towards returning capital to common stockholders.”

About Fluor Corporation

Fluor Corporation (NYSE: FLR) is building a better world by

applying world-class expertise to solve its clients’ greatest

challenges. Fluor’s 40,000 employees provide professional and

technical solutions that deliver safe, well-executed,

capital-efficient projects to clients around the world. Fluor had

revenue of $13.7 billion in 2022 and is ranked 303 among the

Fortune 500 companies. With headquarters in Irving, Texas, Fluor

has provided engineering, procurement and construction services for

more than 110 years.

Forward-Looking Statements: This

press release may contain forward-looking statements (including

without limitation statements to the effect that the Company or its

management “will,” “believes,” “expects,” “anticipates,” “plans” or

other similar expressions). Such forward-looking statements

include, but are not limited to, statements that are not historical

facts. Actual results may differ materially as a result of a number

of factors. Caution must be exercised in relying on forward-looking

statements. Due to known and unknown risks, the Company’s results

may differ materially from its expectations and projections.

Additional information concerning factors that could affect the

Company’s results can be found in the Company's public periodic

filings with the Securities and Exchange Commission, including the

discussion under the heading “Item 1A. Risk Factors” in the

Company’s Form 10-K filed on February 21, 2023. Such filings are

available either publicly or upon request from Fluor's Investor

Relations Department: (469) 398-7222. The Company disclaims any

intent or obligation other than as required by law to update its

forward-looking statements in light of new information or future

events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230925474099/en/

Fluor Corporation 469.398.7000 main tel Brett Turner Media

Relations 864.281.6976 tel Jason Landkamer Investor Relations

469.398.7222 tel

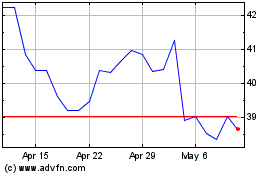

Fluor (NYSE:FLR)

Historical Stock Chart

From Apr 2024 to May 2024

Fluor (NYSE:FLR)

Historical Stock Chart

From May 2023 to May 2024