Current Report Filing (8-k)

July 31 2020 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

July 29, 2020

Date of Report (Date of earliest event reported)

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

001-13270

|

90-0023731

|

|

(State or Other Jurisdiction of

|

(Commission

|

(IRS Employer

|

|

Incorporation)

|

File Number)

|

Identification No.)

|

8846 N. Sam Houston Pkwy W.,

Houston, Texas 77064

(Address of principal executive office and zip code)

(713) 849-9911

(Registrant’s telephone number, including area code)

(Not applicable)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

|

FTK

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On July 29, 2020, Flotek Industries, Inc. (the "Company") entered into an employment agreement (the "Employment Agreement") with Michael E. Borton, pursuant to which he will serve as Chief Financial Officer, principal financial officer and principal accounting officer. Mr. Borton, age 60, has most recently served as the Chief Financial Officer at Dynasty Sports and Entertainment, a data and analytics company serving the sports and entertainment sector, from April 2019 to July 2020. Prior to his time at Dynasty Sports, Mr. Borton was the Chief Financial Officer of Wombat Security Technologies, an international SaaS provider of computer-based security awareness, from February 2015 to August 2018, including through its acquisition by Proofpoint, Inc. in 2018. From 2009 through 2014, Mr. Borton was the Chief Financial Officer of Harmony Information Systems, Inc., a SaaS organization serving health and human services organizations. Mr. Borton has served in various financial and operational leadership roles at Consul risk Management BV (acquired by IBM), iSKY Corporation and Invensys. Prior to these roles, Mr. Borton spent more than a decade in financial leadership roles for oil and gas services companies, including Schlumberger and Halliburton, where he served as Group Controller for Landmark Graphics. Mr. Borton received a Master of Business Administration in Finance from Indiana University in Bloomington, Indiana, and a Bachelor of Science from Valparaiso University. Mr. Borton is a certified management accountant, earning a Certificate of Distinguished Performance from the Institute of Management Accounting.

Pursuant to the Employment Agreement, Mr. Borton will receive an annual base salary of $340,000. Mr. Borton will also be eligible to earn an annual bonus with a target amount equal to his annual base salary multiplied by 80%, based on achievement of performance goals established by the compensation committee of the Board. In addition, Mr. Borton will receive grants of restricted stock of the Company and options to purchase shares of the Company's common stock in connection with the Employment Agreement. Mr. Borton will receive 240,000 restricted stock awards that will vest over three years. Mr. Borton will also receive performance-based options representing 360,000 shares of the Company's common stock that vest 50% based on performance of the company relative to its peers, and 50% based on the closing price of the Company's common stock, with full vesting at $7.00 per share for a 20 consecutive trading-day period. The exercise price of the options will be the closing price of the Company's stock on the date of grant. Mr. Borton will be eligible to participate in the Company's long-term incentive plans after January 1, 2021. In the event that Mr. Borton's employment is terminated by the Company without cause, or by Mr. Borton for good reason, Mr. Borton will receive severance equal to twelve months base salary, paid out in installments, and an amount equal to the target annual bonus, with the amount determined on actual performance over the entire performance period and paid at the Company's normally scheduled time. Mr. Borton will also receive reimbursement for COBRA premiums for up to eighteen months.

The summary of the Employment Agreement is qualified in its entirety by reference to the Employment Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

|

|

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

On July 30, 2020, the Company issued a press release announcing Mr. Borton's hiring by the Company. The press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

10.1

|

|

|

|

99.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

FLOTEK INDUSTRIES, INC.

|

|

|

|

|

|

|

|

|

Date: July 30, 2020

|

|

/s/ Nicholas J. Bigney

|

|

|

|

|

Name:

|

Nicholas J. Bigney

|

|

|

|

|

Title:

|

Senior Vice President, General Counsel & Corporate Secretary

|

|

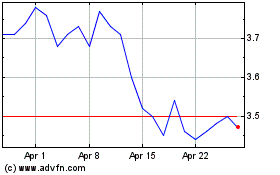

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

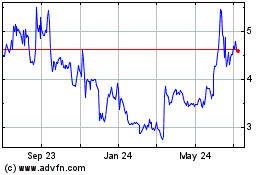

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2023 to Apr 2024