GAAP revenue growth of 7% both in the quarter

and year to date; GAAP EPS decreased 37% in the quarter and

increased 6% year to date; Operating cash flow increased 24% to

$4.41 billion year to date; Organic revenue growth of 15% in the

quarter and 17% year to date; Adjusted EPS increased 17% in the

quarter and 18% year to date; Free cash flow increased 23% to $3.34

billion year to date; Company raises 2024 organic revenue growth

outlook to 16% to 17% and adjusted EPS outlook to $8.73 to

$8.80

Fiserv, Inc. (NYSE: FI), a leading global provider of payments

and financial services technology solutions, today reported

financial results for the third quarter of 2024.

Third Quarter 2024 GAAP Results

GAAP revenue for the company increased 7% to $5.22 billion in

the third quarter of 2024 compared to the prior year period, with

9% growth in the Merchant Solutions segment and 5% growth in the

Financial Solutions segment. GAAP revenue for the company increased

7% to $15.21 billion in the first nine months of 2024 compared to

the prior year period, with 10% growth in the Merchant Solutions

segment and 5% growth in the Financial Solutions segment.

GAAP earnings per share decreased 37% to $0.98 in the third

quarter of 2024 and increased 6% to $3.74 in the first nine months

of 2024 compared to the prior year periods. The third quarter and

first nine months of 2024 included a $570 million non-cash

impairment charge related to one of the company’s equity method

investments. The third quarter and first nine months of 2023

included a $177 million pre-tax gain related to the sale of the

company’s financial reconciliation business.

GAAP operating margin was 30.7% and 27.7% in the third quarter

and first nine months of 2024 compared to 30.8% and 25.2% in the

third quarter and first nine months of 2023. GAAP operating margin

in the Merchant Solutions segment was 37.7% and 36.2% in the third

quarter and first nine months of 2024 compared to 34.8% and 32.9%

in the third quarter and first nine months of 2023. GAAP operating

margin in the Financial Solutions segment was 47.4% and 45.8% in

the third quarter and first nine months of 2024 compared to 46.9%

and 45.1% in the third quarter and first nine months of 2023. Net

cash provided by operating activities increased 24% to $4.41

billion in the first nine months of 2024 compared to $3.57 billion

in the prior year period.

“We are pleased with our third quarter performance, which

showcases strength across both our Merchant and Financial Solutions

segments and several significant new wins,” said Frank Bisignano,

Chairman, President and Chief Executive Officer of Fiserv. “This

performance is anchored in the privileged position we hold at the

crossroads of two ecosystems – merchants and financial institutions

– which are increasingly interconnected.”

Third Quarter 2024 Non-GAAP Results and Additional

Information

- Adjusted revenue increased 7% to $4.88 billion in the third

quarter and 7% to $14.22 billion in the first nine months of 2024

compared to the prior year periods.

- Organic revenue growth was 15% in the third quarter of 2024,

led by 24% growth in the Merchant Solutions segment and 6% growth

in the Financial Solutions segment.

- Organic revenue growth was 17% in the first nine months of

2024, led by 29% growth in the Merchant Solutions segment and 6%

growth in the Financial Solutions segment.

- Adjusted earnings per share increased 17% to $2.30 in the third

quarter and 18% to $6.29 in the first nine months of 2024 compared

to the prior year periods.

- Adjusted operating margin increased 170 basis points to 40.2%

in the third quarter and 170 basis points to 38.2% in the first

nine months of 2024 compared to the prior year periods.

- Adjusted operating margin increased 290 basis points to 37.7%

in the Merchant Solutions segment and increased 40 basis points to

47.4% in the Financial Solutions segment in the third quarter of

2024, compared to the prior year period.

- Adjusted operating margin increased 330 basis points to 36.2%

in the Merchant Solutions segment and 60 basis points to 45.8% in

the Financial Solutions segment in the first nine months of 2024,

compared to the prior year period.

- Free cash flow increased 23% to $3.34 billion in the first nine

months of 2024 compared to $2.72 billion in the prior year

period.

- The company repurchased 7.6 million shares of common stock for

$1.3 billion in the third quarter and 27.8 million shares of common

stock for $4.3 billion in the first nine months of 2024.

- Fiserv was named as the #1 global financial technology provider

on the 2024 International Data Corporation (IDC) FinTech Top 100

Rankings for the second consecutive year.

Outlook for 2024

Fiserv raises organic revenue growth outlook to 16% to 17% and

adjusted earnings per share outlook to $8.73 to $8.80, representing

growth of 16% to 17%, for 2024.

“Fiserv continues to demonstrate consistency and sustainability

in our top-line growth and margin improvement, leading us to raise

the outlook on our 2024 financial commitments,” said Bisignano.

“Our unparalleled track record remains intact as we move closer to

achieving our 39th consecutive year of double-digit adjusted

earnings per share growth.”

Segment Realignment

The company realigned its reportable segments during the first

quarter of 2024 to correspond with changes in its business designed

to further enhance operational performance in the delivery of its

integrated portfolio of products and solutions to its financial

institution clients (“Segment Realignment”). The company’s new

reportable segments are Merchant Solutions and Financial Solutions.

Segment results for the three and nine months ended September 30,

2023 have been recast to reflect the Segment Realignment.

Earnings Conference Call

The company will discuss its third quarter 2024 results in a

live webcast at 7 a.m. CT on Tuesday, October 22, 2024. The

webcast, along with supplemental financial information, can be

accessed on the investor relations section of the Fiserv website at

investors.fiserv.com. A replay will be available approximately one

hour after the conclusion of the live webcast.

About Fiserv

Fiserv, Inc. (NYSE: FI), a Fortune 500™ company, aspires to move

money and information in a way that moves the world. As a global

leader in payments and financial technology, the company helps

clients achieve best-in-class results through a commitment to

innovation and excellence in areas including account processing and

digital banking solutions; card issuer processing and network

services; payments; e-commerce; merchant acquiring and processing;

and the Clover® cloud-based point-of-sale and business management

platform. Fiserv is a member of the S&P 500® Index and has been

recognized as one of Fortune® World’s Most Admired Companies™ for 9

of the last 10 years. Visit fiserv.com and follow on social media

for more information and the latest company news.

Use of Non-GAAP Financial Measures

In this news release, the company supplements its reporting of

information determined in accordance with generally accepted

accounting principles (“GAAP”), such as revenue, operating income,

operating margin, net income attributable to Fiserv, diluted

earnings per share and net cash provided by operating activities,

with “adjusted revenue,” “adjusted revenue growth,” “organic

revenue,” “organic revenue growth,” “adjusted operating income,”

“adjusted operating margin,” “adjusted net income,” “adjusted

earnings per share,” “adjusted earnings per share growth,” and

“free cash flow.” Management believes that adjustments for certain

non-cash or other items and the exclusion of certain pass-through

revenue and expenses should enhance shareholders' ability to

evaluate the company’s performance, as such measures provide

additional insights into the factors and trends affecting its

business. Therefore, the company excludes these items from its GAAP

financial measures to calculate these unaudited non-GAAP measures.

The corresponding reconciliations of these unaudited non-GAAP

financial measures to the most comparable GAAP measures are

included in this news release, except for forward-looking measures

where a reconciliation to the corresponding GAAP measures is not

available due to the variability, complexity and limited visibility

of the non-cash and other items described below that are excluded

from the non-GAAP outlook measures. See pages 15-17 for additional

information regarding the company’s forward-looking non-GAAP

financial measures.

Examples of non-cash or other items may include, but are not

limited to, non-cash intangible asset amortization expense

associated with acquisitions; non-cash impairment charges;

severance costs; merger and integration costs; gains or losses from

the sale of businesses, certain assets or investments; and certain

discrete tax benefits and expenses. The company excludes these

items to more clearly focus on the factors management believes are

pertinent to the company’s operations, and management uses this

information to make operating decisions, including the allocation

of resources to the company’s various businesses.

The company adjusts its non-GAAP results to exclude amortization

of acquisition-related intangible assets as such amounts are

inconsistent in amount and frequency and are significantly impacted

by the timing and/or size of acquisitions. Management believes that

the adjustment of acquisition-related intangible asset amortization

supplements GAAP information with a measure that can be used to

assess the comparability of operating performance. Although the

company excludes amortization from acquisition-related intangible

assets from its non-GAAP expenses, management believes that it is

important for investors to understand that such intangible assets

were recorded as part of purchase accounting and contribute to

revenue generation.

Management believes organic revenue growth is useful because it

presents adjusted revenue growth excluding the impact of foreign

currency fluctuations, acquisitions and dispositions. Management

believes free cash flow is useful to measure the funds generated in

a given period that are available for debt service requirements and

strategic capital decisions. Management believes this supplemental

information enhances shareholders’ ability to evaluate and

understand the company’s core business performance.

These unaudited non-GAAP measures may not be comparable to

similarly titled measures reported by other companies and should be

considered in addition to, and not as a substitute for, revenue,

operating income, operating margin, net income attributable to

Fiserv, diluted earnings per share and net cash provided by

operating activities or any other amount determined in accordance

with GAAP.

Forward-Looking Statements

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

including statements regarding anticipated organic revenue growth,

adjusted earnings per share, adjusted earnings per share growth and

other statements regarding our future financial performance.

Statements can generally be identified as forward-looking because

they include words such as “believes,” “anticipates,” “expects,”

“could,” “should,” “confident,” “likely,” “plan,” or words of

similar meaning. Statements that describe the company’s future

plans, outlook, objectives or goals are also forward-looking

statements.

Forward-looking statements are subject to assumptions, risks and

uncertainties that may cause actual results to differ materially

from those contemplated by such forward-looking statements. The

factors that could cause the company’s actual results to differ

materially include, among others, the following: the company’s

ability to compete effectively against new and existing competitors

and to continue to introduce competitive new products and services

on a timely, cost-effective basis; changes in customer demand for

the company’s products and services; the ability of the company’s

technology to keep pace with a rapidly evolving marketplace; the

success of the company’s merchant alliances, some of which are not

controlled by the company; the impact of a security breach or

operational failure in the company’s business, including

disruptions caused by other participants in the global financial

system; losses due to chargebacks, refunds or returns as a result

of fraud or the failure of the company’s vendors and merchants to

satisfy their obligations; changes in local, regional, national and

international economic or political conditions, including those

resulting from heightened inflation, rising interest rates, a

recession, bank failures, or intensified international hostilities,

and the impact they may have on the company and its employees,

clients, vendors, supply chain, operations and sales; the effect of

proposed and enacted legislative and regulatory actions affecting

the company or the financial services industry as a whole; the

company’s ability to comply with government regulations and

applicable card association and network rules; the protection and

validity of intellectual property rights; the outcome of pending

and future litigation and governmental proceedings; the company’s

ability to successfully identify, complete and integrate

acquisitions, and to realize the anticipated benefits associated

with the same; the impact of the company’s strategic initiatives;

the company’s ability to attract and retain key personnel;

volatility and disruptions in financial markets that may impact the

company’s ability to access preferred sources of financing and the

terms on which the company is able to obtain financing or increase

its costs of borrowing; adverse impacts from currency exchange

rates or currency controls; changes in corporate tax and interest

rates; and other factors included in “Risk Factors” in the

company’s Annual Report on Form 10-K for the year ended December

31, 2023, and in other documents that the company files with the

Securities and Exchange Commission, which are available at

http://www.sec.gov. You should consider these factors carefully in

evaluating forward-looking statements and are cautioned not to

place undue reliance on such statements. The company assumes no

obligation to update any forward-looking statements, which speak

only as of the date of this news release.

Fiserv, Inc.

Condensed Consolidated

Statements of Income

(In millions, except per share

amounts, unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

Processing and services

$

4,237

$

4,008

$

12,377

$

11,605

Product

978

865

2,828

2,571

Total revenue

5,215

4,873

15,205

14,176

Expenses

Cost of processing and services

1,346

1,311

4,043

4,067

Cost of product

661

583

1,951

1,761

Selling, general and administrative

1,606

1,652

5,000

4,952

Net gain on sale of businesses and other

assets

—

(176

)

—

(172

)

Total expenses

3,613

3,370

10,994

10,608

Operating income

1,602

1,503

4,211

3,568

Interest expense, net

(326

)

(258

)

(872

)

(692

)

Other expense, net

(5

)

(35

)

(17

)

(81

)

Income before income taxes and loss

from investments in unconsolidated affiliates

1,271

1,210

3,322

2,795

Income tax provision

(74

)

(239

)

(448

)

(544

)

Loss from investments in unconsolidated

affiliates

(626

)

(2

)

(642

)

(11

)

Net income

571

969

2,232

2,240

Less: net income attributable to

noncontrolling interests

7

17

39

42

Net income attributable to

Fiserv

$

564

$

952

$

2,193

$

2,198

GAAP earnings per share attributable to

Fiserv — diluted

$

0.98

$

1.56

$

3.74

$

3.54

Diluted shares used in computing

earnings per share attributable to Fiserv

576.9

610.3

585.7

620.3

Earnings per share is calculated using

actual, unrounded amounts.

Fiserv, Inc.

Reconciliation of GAAP

to

Adjusted Net Income and

Adjusted Earnings Per Share

(In millions, except per share

amounts, unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

GAAP net income attributable to

Fiserv

$

564

$

952

$

2,193

$

2,198

Adjustments:

Merger and integration costs 1

—

30

59

120

Severance costs

14

15

77

52

Amortization of acquisition-related

intangible assets 2

346

388

1,085

1,245

Non wholly-owned entity activities 3

24

31

78

102

Impairment of equity method investments

4

610

—

610

—

Net gain on sale of businesses and other

assets 5

—

(176

)

—

(172

)

Canadian tax law change 6

—

—

—

27

Tax impact of adjustments 7

(233

)

(44

)

(416

)

(261

)

Adjusted net income

$

1,325

$

1,196

$

3,686

$

3,311

GAAP earnings per share attributable to

Fiserv - diluted

$

0.98

$

1.56

$

3.74

$

3.54

Adjustments - net of income taxes:

Merger and integration costs 1

—

0.04

0.08

0.15

Severance costs

0.02

0.02

0.10

0.07

Amortization of acquisition-related

intangible assets 2

0.48

0.51

1.48

1.60

Non wholly-owned entity activities 3

0.03

0.04

0.11

0.13

Impairment of equity method investments

4

0.79

—

0.78

—

Net gain on sale of businesses and other

assets 5

—

(0.21

)

—

(0.20

)

Canadian tax law change 6

—

—

—

0.03

Adjusted earnings per share

$

2.30

$

1.96

$

6.29

$

5.34

GAAP earnings per share attributable to

Fiserv growth

(37

)%

6

%

Adjusted earnings per share growth

17

%

18

%

See pages 3-4 for disclosures related to

the use of non-GAAP financial measures.

Earnings per share is calculated using

actual, unrounded amounts.

1

Represents acquisition and related

integration costs incurred in connection with acquisitions. Merger

and integration costs associated with integration activities in the

first nine months of 2024 primarily include $13 million of

third-party professional service fees and $22 million of

share-based compensation and associated taxes. Merger and

integration costs associated with integration activities in the

third quarter and first nine months of 2023 primarily include $19

million and $52 million of third-party professional service fees,

respectively, as well as $39 million of share-based compensation in

the first nine months of 2023.

2

Represents amortization of intangible

assets acquired through acquisition, including customer

relationships, software/technology and trade names. This adjustment

does not exclude the amortization of other intangible assets such

as contract costs (sales commissions and deferred conversion

costs), capitalized and purchased software, financing costs and

debt discounts. See additional information on page 14 for an

analysis of the company's amortization expense.

3

Represents the company’s share of

amortization of acquisition-related intangible assets at its

unconsolidated affiliates, as well as the minority interest share

of amortization of acquisition-related intangible assets at its

subsidiaries in which the company holds a controlling financial

interest.

4

Represents a non-cash impairment of

certain equity method investments during the third quarter of 2024,

primarily related to the company’s Wells Fargo Merchant Services

joint venture, recorded within loss from investments in

unconsolidated affiliates in the consolidated statement of

income.

5

Represents a net gain primarily associated

with the sale of the company’s financial reconciliation business

during the third quarter of 2023.

6

Represents the impact of a multi-year

retroactive Canadian tax law change, enacted in June 2023, related

to the Goods and Services Tax / Harmonized Sales Tax (GST/HST)

treatment of payment card services.

7

The tax impact of adjustments is

calculated using a tax rate of 20% in both the first nine months of

2024 and 2023, which approximates the company’s anticipated annual

effective tax rate, exclusive of actual tax impacts of a $156

million benefit associated with the impairment of certain equity

method investments during the first nine months of 2024 and a $49

million provision associated with the net gain on sale of

businesses during the first nine months of 2023.

Fiserv, Inc.

Financial Results by

Segment

(In millions, unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Total Company

Revenue

$

5,215

$

4,873

$

15,205

$

14,176

Adjustments:

Postage reimbursements

(331

)

(307

)

(984

)

(927

)

Deferred revenue purchase accounting

adjustments

—

5

—

16

Adjusted revenue

$

4,884

$

4,571

$

14,221

$

13,265

Operating income

$

1,602

$

1,503

$

4,211

$

3,568

Adjustments:

Merger and integration costs 1

—

30

59

120

Severance costs

14

15

77

52

Amortization of acquisition-related

intangible assets

346

388

1,085

1,245

Net gain on sale of businesses and other

assets

—

(176

)

—

(172

)

Canadian tax law change

—

—

—

27

Adjusted operating income

$

1,962

$

1,760

$

5,432

$

4,840

Operating margin

30.7

%

30.8

%

27.7

%

25.2

%

Adjusted operating margin

40.2

%

38.5

%

38.2

%

36.5

%

Merchant Solutions (“Merchant”)

2

Revenue

$

2,469

$

2,259

$

7,132

$

6,461

Operating income

$

931

$

786

$

2,582

$

2,123

Operating margin

37.7

%

34.8

%

36.2

%

32.9

%

Financial Solutions

(“Financial”)

Revenue

$

2,412

$

2,302

$

7,076

$

6,770

Adjustments:

Deferred revenue purchase accounting

adjustments

—

5

—

16

Adjusted revenue

$

2,412

$

2,307

$

7,076

$

6,786

Operating income

$

1,143

$

1,079

$

3,244

$

3,050

Adjustments:

Deferred revenue purchase accounting

adjustments

—

5

—

16

Adjusted operating income

$

1,143

$

1,084

$

3,244

$

3,066

Operating margin

47.4

%

46.9

%

45.8

%

45.1

%

Adjusted operating margin

47.4

%

47.0

%

45.8

%

45.2

%

Fiserv, Inc.

Financial Results by Segment

(cont.)

(In millions, unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Corporate and Other

Revenue

$

334

$

312

$

997

$

945

Adjustments:

Postage reimbursements

(331

)

(307

)

(984

)

(927

)

Adjusted revenue

$

3

$

5

$

13

$

18

Operating loss

$

(472

)

$

(362

)

$

(1,615

)

$

(1,605

)

Adjustments:

Merger and integration costs

—

25

59

104

Severance costs

14

15

77

52

Amortization of acquisition-related

intangible assets

346

388

1,085

1,245

Net gain on sale of businesses and other

assets

—

(176

)

—

(172

)

Canadian tax law change

—

—

—

27

Adjusted operating loss

$

(112

)

$

(110

)

$

(394

)

$

(349

)

See pages 3-4 for disclosures related to

the use of non-GAAP financial measures.

Operating margin percentages are

calculated using actual, unrounded amounts.

1

Includes deferred revenue purchase

accounting adjustments within the Financial segment related to the

2019 acquisition of First Data Corporation. Adjustments for this

residual activity concluded as of December 31, 2023.

2

For all periods presented in the Merchant

segment, there were no adjustments to GAAP measures presented and

thus the adjusted measures are equal to the GAAP measures

presented.

Fiserv, Inc.

Condensed Consolidated

Statements of Cash Flows

(In millions, unaudited)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities

Net income

$

2,232

$

2,240

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and other amortization

1,248

1,093

Amortization of acquisition-related

intangible assets

1,089

1,261

Amortization of financing costs and debt

discounts

33

30

Share-based compensation

273

275

Deferred income taxes

(539

)

(344

)

Net gain on sale of businesses and other

assets

—

(172

)

Loss from investments in unconsolidated

affiliates

642

11

Distributions from unconsolidated

affiliates

29

42

Non-cash impairment charges

14

—

Other operating activities

79

(2

)

Changes in assets and liabilities, net of

effects from acquisitions and dispositions:

Trade accounts receivable

(136

)

119

Prepaid expenses and other assets

(503

)

(506

)

Contract costs

(189

)

(180

)

Accounts payable and other liabilities

134

(303

)

Contract liabilities

4

3

Net cash provided by operating

activities

4,410

3,567

Cash flows from investing

activities

Capital expenditures, including

capitalized software and other intangibles

(1,170

)

(1,034

)

Net proceeds from sale of businesses and

other assets

—

232

Merchant cash advances, net

(645

)

—

Distributions from unconsolidated

affiliates

59

110

Purchases of investments

(37

)

(15

)

Proceeds from sale of investments

53

—

Other investing activities

—

(3

)

Net cash used in investing

activities

(1,740

)

(710

)

Cash flows from financing

activities

Debt proceeds

6,141

5,188

Debt repayments

(4,665

)

(1,652

)

Net borrowings from (repayments of)

commercial paper and short-term borrowings

345

(2,032

)

Payments of debt financing costs

(28

)

(38

)

Proceeds from issuance of treasury

stock

79

68

Purchases of treasury stock, including

employee shares withheld for tax obligations

(4,491

)

(3,790

)

Settlement activity, net

487

(630

)

Distributions paid to noncontrolling

interests and redeemable noncontrolling interest

(48

)

(22

)

Payment to acquire noncontrolling interest

of consolidated subsidiary

—

(56

)

Payments of acquisition-related contingent

consideration

(3

)

(33

)

Other financing activities

(2

)

(39

)

Net cash used in financing

activities

(2,185

)

(3,036

)

Effect of exchange rate changes on cash

and cash equivalents

25

(8

)

Net change in cash and cash

equivalents

510

(187

)

Cash and cash equivalents, beginning

balance

2,963

3,192

Cash and cash equivalents, ending

balance

$

3,473

$

3,005

Fiserv, Inc.

Condensed Consolidated Balance

Sheets

(In millions, unaudited)

September 30,

December 31,

2024

2023

Assets

Cash and cash equivalents

$

1,228

$

1,204

Trade accounts receivable – net

3,714

3,582

Prepaid expenses and other current

assets

2,749

2,344

Settlement assets

17,434

27,681

Total current assets

25,125

34,811

Property and equipment – net

2,377

2,161

Customer relationships – net

6,218

7,075

Other intangible assets – net

4,104

4,135

Goodwill

37,133

37,205

Contract costs – net

985

968

Investments in unconsolidated

affiliates

1,585

2,262

Other long-term assets

2,265

2,273

Total assets

$

79,792

$

90,890

Liabilities and Equity

Accounts payable and other current

liabilities

$

4,161

$

4,355

Short-term and current maturities of

long-term debt

1,200

755

Contract liabilities

770

761

Settlement obligations

17,434

27,681

Total current liabilities

23,565

33,552

Long-term debt

24,085

22,363

Deferred income taxes

2,526

3,078

Long-term contract liabilities

255

250

Other long-term liabilities

958

978

Total liabilities

51,389

60,221

Redeemable noncontrolling interest

—

161

Fiserv shareholders' equity

27,751

29,857

Noncontrolling interests

652

651

Total equity

28,403

30,508

Total liabilities and equity

$

79,792

$

90,890

Fiserv, Inc.

Selected Non-GAAP Financial

Measures and Additional Information

(In millions, unaudited)

Organic Revenue Growth 1

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

Growth

2024

2023

Growth

Total Company

Adjusted revenue

$

4,884

$

4,571

$

14,221

$

13,265

Currency impact 2

371

—

1,327

—

Acquisition adjustments

(3

)

—

(9

)

—

Divestiture adjustments

(3

)

(7

)

(13

)

(41

)

Organic revenue

$

5,249

$

4,564

15%

$

15,526

$

13,224

17%

Merchant

Adjusted revenue

$

2,469

$

2,259

$

7,132

$

6,461

Currency impact 2

344

—

1,225

—

Acquisition adjustments

(3

)

—

(9

)

—

Organic revenue

$

2,810

$

2,259

24%

$

8,348

$

6,461

29%

Financial

Adjusted revenue

$

2,412

$

2,307

$

7,076

$

6,786

Currency impact 2

27

—

102

—

Divestiture adjustments

—

(2

)

—

(23

)

Organic revenue

$

2,439

$

2,305

6%

$

7,178

$

6,763

6%

Corporate and Other

Adjusted revenue

$

3

$

5

$

13

$

18

Divestiture adjustments

(3

)

(5

)

(13

)

(18

)

Organic revenue

$

—

$

—

$

—

$

—

See pages 3-4 for disclosures related to

the use of non-GAAP financial measures.

Organic revenue growth is calculated using

actual, unrounded amounts.

1

Organic revenue growth is measured as the

change in adjusted revenue (see pages 9-10) for the current period

excluding the impact of foreign currency fluctuations and revenue

attributable to acquisitions and dispositions, divided by adjusted

revenue from the prior period excluding revenue attributable to

dispositions.

2

Currency impact is measured as the

increase or decrease in adjusted revenue for the current period by

applying prior period foreign currency exchange rates to present a

constant currency comparison to prior periods.

Fiserv, Inc.

Selected Non-GAAP Financial

Measures and Additional Information (cont.)

(In millions, unaudited)

Free Cash Flow

Nine Months Ended September

30,

2024

2023

Net cash provided by operating

activities

$

4,410

$

3,567

Capital expenditures

(1,170

)

(1,034

)

Adjustments:

Distributions paid to noncontrolling

interests and redeemable noncontrolling interest

(48

)

(22

)

Distributions from unconsolidated

affiliates included in cash flows from investing activities

59

110

Severance, merger and integration

payments

116

121

Tax payments on adjustments

(23

)

(24

)

Other

—

5

Free cash flow

$

3,344

$

2,723

Total Amortization 1

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Acquisition-related intangible assets

$

345

$

393

$

1,089

$

1,261

Capitalized software and other

intangibles

164

133

464

360

Purchased software

57

53

175

167

Financing costs and debt discounts

11

10

33

30

Sales commissions

29

28

84

83

Deferred conversion costs

33

21

82

61

Total amortization

$

639

$

638

$

1,927

$

1,962

See pages 3-4 for disclosures related to

the use of non-GAAP financial measures.

1

The company adjusts its non-GAAP results

to exclude amortization of acquisition-related intangible assets as

such amounts are inconsistent in amount and frequency and are

significantly impacted by the timing and/or size of acquisitions.

Management believes that the adjustment of acquisition-related

intangible asset amortization supplements the GAAP information with

a measure that can be used to assess the comparability of operating

performance. Although the company excludes amortization from

acquisition-related intangible assets from its non-GAAP expenses,

management believes that it is important for investors to

understand that such intangible assets were recorded as part of

purchase accounting and contribute to revenue generation.

Amortization of intangible assets that relate to past acquisitions

will recur in future periods until such intangible assets have been

fully amortized. Any future acquisitions may result in the

amortization of additional intangible assets.

Fiserv, Inc.

Full Year Forward-Looking

Non-GAAP Financial Measures

Reconciliations of unaudited non-GAAP

financial measures to the most comparable GAAP measures are

included in this news release, except for forward-looking measures

where a reconciliation to the corresponding GAAP measures is not

available due to the variability, complexity and limited visibility

of these items that are excluded from the non-GAAP outlook

measures. The company’s forward-looking non-GAAP financial measures

for 2024, including organic revenue growth, adjusted earnings per

share and adjusted earnings per share growth, are designed to

enhance shareholders’ ability to evaluate the company’s performance

by excluding certain items to focus on factors and trends affecting

its business.

Organic Revenue Growth - The company's

organic revenue growth outlook for 2024 excludes the impact of

foreign currency fluctuations, acquisitions, dispositions and the

impact of the company's postage reimbursements. The currency impact

is measured as the increase or decrease in the expected adjusted

revenue for the period by applying prior period foreign currency

exchange rates to present a constant currency comparison to prior

periods.

Growth

2024 Revenue

7.5% - 8.5%

Postage reimbursements

(0.5)%

2024 Adjusted revenue

7% - 8%

Currency impact

8.5%

Acquisition adjustments

0.0%

Divestiture adjustments

0.5%

2024 Organic revenue

16% - 17%

Adjusted Earnings Per Share - The

company's adjusted earnings per share outlook for 2024 excludes

certain non-cash or other items such as non-cash intangible asset

amortization expense associated with acquisitions; non-cash

impairment charges; non-cash pension plan termination charges;

merger and integration costs; severance costs; gains or losses from

the sale of businesses, certain assets and investments; and certain

discrete tax benefits and expenses. The company estimates that

amortization expense in 2024 with respect to acquired intangible

assets will decrease approximately 15% compared to the amount

incurred in 2023.

Other adjustments to the company’s

financial measures that were incurred in 2023 and for the three and

nine months ended September 30, 2024 are presented in this news

release; however, they are not necessarily indicative of

adjustments that may be incurred throughout the remainder of 2024

or beyond. Estimates of these impacts and adjustments on a

forward-looking basis are not available due to the variability,

complexity and limited visibility of these items.

Fiserv, Inc.

Full Year Forward-Looking

Non-GAAP Financial Measures (cont.)

The company's adjusted earnings per share

growth outlook for 2024 is based on 2023 adjusted earnings per

share performance.

2023 GAAP net income attributable to

Fiserv

$

3,068

Adjustments:

Merger and integration costs 1

158

Severance costs

74

Amortization of acquisition-related

intangible assets 2

1,623

Non wholly-owned entity activities 3

133

Net gain on sale of businesses and other

assets 4

(167

)

Canadian tax law change 5

27

Tax impact of adjustments 6

(355

)

Argentine Peso devaluation 7

71

2023 adjusted net income

$

4,632

Weighted average common shares outstanding

- diluted

615.9

2023 GAAP earnings per share attributable

to Fiserv - diluted

$

4.98

Adjustments - net of income taxes:

Merger and integration costs 1

0.21

Severance costs

0.10

Amortization of acquisition-related

intangible assets 2

2.11

Non wholly-owned entity activities 3

0.17

Net gain on sale of businesses and other

assets 4

(0.19

)

Canadian tax law change 5

0.04

Argentine Peso devaluation 7

0.12

2023 adjusted earnings per share

$

7.52

2024 adjusted earnings per share

outlook

$8.73 - $8.80

2024 adjusted earnings per share growth

outlook

16% - 17%

In millions, except per share amounts,

unaudited. Earnings per share is calculated using actual, unrounded

amounts.

See pages 3-4 for disclosures related to

the use of non-GAAP financial measures.

Fiserv, Inc.

Full Year Forward-Looking

Non-GAAP Financial Measures (cont.)

1

Represents acquisition and related

integration costs incurred in connection with acquisitions. Merger

and integration costs associated with integration activities

primarily include $35 million of share-based compensation and $70

million of third-party professional service fees.

2

Represents amortization of intangible

assets acquired through acquisition, including customer

relationships, software/technology and trade names. This adjustment

does not exclude the amortization of other intangible assets such

as contract costs (sales commissions and deferred conversion

costs), capitalized and purchased software, financing costs and

debt discounts.

3

Represents the company’s share of

amortization of acquisition-related intangible assets at its

unconsolidated affiliates, as well as the minority interest share

of amortization of acquisition-related intangible assets at its

subsidiaries in which the company holds a controlling financial

interest.

4

Represents a net gain primarily associated

with the sale of the company’s financial reconciliation

business.

5

Represents the impact of a multi-year

retroactive Canadian tax law change, enacted in June 2023, related

to the Goods and Services Tax / Harmonized Sales Tax (GST/HST)

treatment of payment card services.

6

The tax impact of adjustments is

calculated using a tax rate of 20%, which approximates the

company's annual effective tax rate, exclusive of actual tax

impacts of $48 million associated with the net gain on sale of

businesses.

7

On December 12, 2023, the Argentina

government announced economic reforms, including a significant

devaluation of the Argentine Peso. This adjustment represents the

corresponding one-day foreign currency exchange loss from the

remeasurement of the company’s Argentina subsidiary’s monetary

assets and liabilities in Argentina’s highly inflationary

economy.

FI-G

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022343630/en/

Media Relations: Sophia Marshall Head of Communications

Fiserv, Inc. 470-351-9908 sophia.marshall@fiserv.com

Investor Relations: Julie Chariell Head of Investor

Relations Fiserv, Inc. 212-515-0278 julie.chariell@fiserv.com

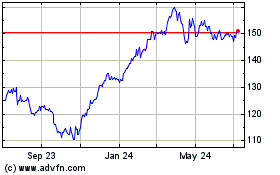

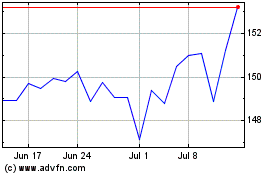

Fiserv (NYSE:FI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Fiserv (NYSE:FI)

Historical Stock Chart

From Nov 2023 to Nov 2024