FedEx Warns of Another Hit to Profits--Update

December 17 2019 - 6:09PM

Dow Jones News

By Paul Ziobro

FedEx Corp. cut its earnings targets for the fourth time this

calendar year, as the delivery giant struggles to adapt to a world

where fewer packages are being flown around the globe and more are

being delivered from warehouses to people's homes.

The company's profit has been sapped by a global slump in air

shipments -- its core business -- and a surge in e-commerce

deliveries to residences -- a service it is expanding at

considerable cost. The challenge has become acute as Amazon.com

Inc. flips from FedEx customer to formidable competitor.

On Tuesday, FedEx executives said the company had experienced

higher-than-expected expenses in the quarter that ended on Nov. 30

and cautioned costs would be elevated during the peak shipping

season. The company plans to take new steps to rein in spending,

including grounding aircraft, eliminating some international

flights and restricting hiring.

"We continue to be in a period of challenges and changes," FedEx

Chairman and Chief Executive Fred Smith said on a conference

call.

FedEx shares, which were trading above $250 last year, fell more

than 6% in late trading to $153.34.

For its just-ended fiscal second quarter, FedEx posted a 40%

drop in profit and a 3% decline in revenue. It continues to deal

with the loss of Amazon's shipping contracts, which totaled $900

million in annual revenue. FedEx said the pricing environment is

more competitive as well.

Rival United Parcel Service Inc. has capitalized on FedEx's

cutting ties with Amazon. UPS has spent heavily in recent years to

expand and automate its network to handle more online orders. In

recent quarters, it has significantly expanded its air shipments to

carry more packages, including from Amazon. In October, UPS posted

higher quarterly profit and revenue, and backed its earnings

targets for the year.

Both FedEx and UPS are absorbing higher costs in the U.S. as

they modernize sorting centers and shift to seven-day residential

delivery, not just during the holidays, but year round. FedEx is

also beginning to keep in its network more of the packages it sent

to the U.S. Postal Service for last-mile delivery.

The goal is to shift FedEx's delivery network, designed

primarily for shipments between businesses, to one that can deliver

more individual packages to residences to capitalize on the

relentless growth of online shopping.

The latest quarter shows that the changes FedEx is making to its

Ground network "are costing them more than they had realized," said

Satish Jindel, president of the parcel research firm SJ Consulting

Group Inc.

Both FedEx and UPS have acknowledged some problems making all

their deliveries during the holiday season. They said winter storms

slowed operations in some areas during Cyber Week, the busy

shipping period after Thanksgiving. They are also facing a

truncated calendar with six fewer days between Thanksgiving and

Christmas.

For FedEx, this calendar shift pushed Cyber Week into the

company's fiscal third quarter. That added costs to the second

quarter without the revenue bump.

Amazon hasn't just stopped using FedEx's service. It is also

ramping up its own delivery capabilities, including leasing cargo

planes and buying thousands of vehicles. Analysts estimate Amazon

will handle nearly half of its own package deliveries this holiday

season.

This week, Amazon prohibited its third-party sellers from using

FedEx's Ground network for Prime shipments citing poor delivery

performance. The online retailer said it won't allow merchants to

resume using FedEx for such orders until service improves.

For its second quarter, FedEx reported a profit of $560 million,

compared with net income of $935 million a year earlier. Excluding

integration expenses and aircraft impairment charges, per share

earnings were $2.51 -- below Wall Street's expectations.

Revenue fell 3% to $17.3 billion, including a 5% decline in its

Express segment and a 3% increase in its Ground business. Analysts

polled by FactSet expected $17.6 billion in quarterly revenue.

For the current fiscal year, FedEx is now forecasting per share

earnings of between $10.25 and $11.50 before pension accounting

adjustments, compared with its forecast of between $11 and $13

issued in September.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

December 17, 2019 17:54 ET (22:54 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

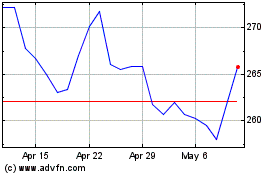

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

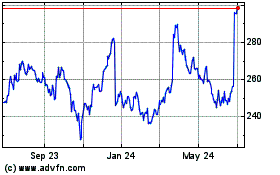

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024