- Record first quarter sales and margin performance

- EBX expected to drive improved full year margins

- Strengthened balance sheet with successful bond offering

- Completed acquisition of Sager S. A. and announced agreement to

acquire SUMIG Ltda

ESAB Corporation (“ESAB” or the “Company”) (NYSE: ESAB), a

focused premier industrial compounder, today announced financial

results for the first quarter of 2024.

ESAB reported first quarter sales of $690 million, an increase

of 1% on a reported basis or 2% higher core organic growth before

acquisitions and currency translation impacts, as compared to the

prior year. ESAB also reported first quarter net income from

continuing operations attributable to ESAB of $61 million or $1.00

diluted earnings per share and core adjusted net income of $74

million or $1.20 diluted earnings per share. Core adjusted EBITDA

of $123 million rose 9% and margins expanded 140 basis points to

18.8%, both as compared to the prior year quarter.

“ESAB is off to a great start to 2024, with our results

reflecting the power of ESAB Business Excellence to drive growth

and margin expansion,” stated Shyam P. Kambeyanda, President and

CEO of ESAB. “We also strengthened our balance sheet by

successfully completing a bond offering, positioning us well to

execute our compounder strategy. During the quarter, we completed

the acquisition of Sager and announced an agreement to acquire

SUMIG. These acquisitions are faster growing, less cyclical and

higher margin businesses that expand our light automation,

equipment and repairs and maintenance portfolio in the Americas. We

are confident in our outlook for the remainder of the year and

continue to make great strides towards achieving our 2028

goals.”

ESAB Full Year 2024

Outlook

ESAB expects total core sales growth of 1.5% to 3.5%, core

organic sales growth of 2.5% to 4.5%, M&A of ~0.5% and FX of

~(1.5)%. ESAB raised its estimated core adjusted EBITDA to $500 to

$520 million and core adjusted EPS to $4.75 to $4.95, up from our

prior guidance of core adjusted EBITDA of $495 to $515 million and

core adjusted EPS of $4.65 to $4.85.

About Sager S.A. and SUMIG

Ltda

On February 26, 2024, the Company completed the acquisition of

Sager S.A., a welding repair and maintenance product and service

provider in South America, which is expected to generate

approximately $10 million of sales in 2024. On April 30, 2024, the

Company reached an agreement to acquire SUMIG Ltda, a South

American light automation and equipment business, with

approximately $30 million of sales in the last twelve months. This

acquisition is expected to be completed during the second half of

2024.

About ESAB Corporation

Founded in 1904, ESAB Corporation is a focused premier

industrial compounder. The Company’s rich history of innovative

products, workflow solutions and its business system ESAB Business

Excellence (“EBX”), enables the Company’s purpose of Shaping the

world we imagine™. ESAB Corporation is based in North Bethesda,

Maryland and employs approximately 9,000 associates and serves

customers in approximately 150 countries. To learn more, visit

www.ESABcorporation.com.

Conference Call and

Webcast

The Company will hold a conference call to discuss its first

quarter 2024 results beginning at 8:00 a.m. Eastern on Wednesday,

May 1, 2024, which will be open to the public by calling

+1-888-550-5302 (U.S. callers) and +1-646-960-0685 (International

callers) and referencing the conference ID number 4669992 and

through webcast via ESAB’s website www.ESABcorporation.com under

the “Investors” section. Access to a supplemental slide

presentation can also be found on ESAB's website under the same

heading. Both the audio of this call and the slide presentation

will be archived on the website later today and will be available

until the next quarterly call. The Company’s quarterly report on

Form 10-Q for the fiscal quarter ended March 29, 2024, filed May 1,

2024, is also available on ESAB’s website under the “Investors”

section.

Non-GAAP Financial Measures and Other

Adjustments

ESAB has provided in this press release financial information

that has not been prepared in accordance with accounting principles

generally accepted in the United States of America (“non-GAAP”).

ESAB presents some of these non-GAAP financial measures including

and excluding Russia due to economic and political volatility

caused by the war in Ukraine, which results in enhanced investor

interest in this information. Core non-GAAP financial measures

exclude Russia for the three months ended March 29, 2024 and March

31, 2023. These non-GAAP financial measures may include one or more

of the following: adjusted net income from continuing operations,

Core adjusted net income from continuing operations, adjusted

EBITDA (earnings before interest, taxes, pension settlement losses,

Restructuring and other related charges, acquisition-amortization

and other related charges and depreciation and other amortization),

Core adjusted EBITDA, organic sales growth, Core organic sales

growth, adjusted free cash flow and ratios based on the foregoing

measures. ESAB also provides adjusted EBITDA and adjusted EBITDA

margin on a segment basis, as well as Core adjusted EBITDA and Core

adjusted EBITDA margin on a segment basis.

Adjusted net income from continuing operations represents Net

income from continuing operations attributable to ESAB Corporation,

excluding Restructuring and other related charges,

acquisition-amortization and other related charges and pension

settlement losses. Adjusted net income, includes the tax effect of

non-GAAP adjusting items at applicable tax rates and excludes the

impact of discrete tax charges or gains in each period. ESAB also

presents adjusted net income margin from continuing operations,

which is subject to the same adjustments as adjusted net income

from continuing operations. Adjusted net income per diluted share

from continuing operations is a calculation of adjusted net income

from continuing operations over the weighted-average diluted shares

outstanding. ESAB also presents Core adjusted net income from

continuing operations and Core adjusted net income per share -

diluted from continuing operations, which are subject to the same

adjustments as Adjusted net income from continuing operations and

Adjusted net income per diluted share from continuing operations,

further removing the impact of Russia for the three months ended

March 29, 2024 and the March 31, 2023.

Adjusted EBITDA, excludes from Net income from continuing

operations, the effect of Income tax expense, Interest expense

(income) and other, net, Restructuring and other related charges,

acquisition-amortization and other related charges, pension

settlement losses and depreciation and other amortization. ESAB

presents adjusted EBITDA margins, which are subject to the same

adjustments as adjusted EBITDA. Further, ESAB presents these

non-GAAP performance measures on a segment basis, which excludes

the impact of Restructuring and other related charges, separation

costs, acquisition-amortization and other related charges, pension

settlement losses and depreciation and other amortization from

operating income. ESAB also presents Core adjusted EBITDA and Core

adjusted EBITDA margins, which are subject to the same adjustments

as Adjusted EBITDA and Adjusted EBITDA margins, respectively,

further removing the impact of Russia for the three months ended

March 29, 2024 and the March 31, 2023.

ESAB presents organic sales growth, which excludes the impact of

acquisitions and foreign exchange rate fluctuations and presents

core organic sales growth, which further excludes the impact of the

Russia business for the three months ended March 29, 2024 and March

31, 2023 from core organic sales growth.

Adjusted free cash flow represents cash flows from operating

activities excluding cash outflows related to the Company’s

separation from Enovis Corporation and discontinued operations,

less Purchases of property, plant and equipment net of proceeds

from sale of certain properties. Cash conversion represents

Adjusted free cash flow divided by Adjusted net income from

continuing operations.

These non-GAAP financial measures assist ESAB management in

comparing its operating performance over time because certain items

may obscure underlying business trends and make comparisons of

long-term performance difficult, as they are of a nature and/or

size that occur with inconsistent frequency or relate to unusual

events or discrete restructuring plans and other initiatives that

are fundamentally different from the ongoing productivity and core

business of the Company.

ESAB management also believes that presenting these measures

allows investors to view its performance using the same measures

that the Company uses in evaluating its financial and business

performance and trends.

Non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

calculated in accordance with GAAP. Investors are encouraged to

review the reconciliation of these non-GAAP measures to their most

directly comparable GAAP financial measures. A reconciliation of

non-GAAP financial measures presented above to GAAP results has

been provided in the financial tables included in this press

release.

Forward Looking

Statements

This press release includes forward-looking statements,

including forward-looking statements within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements include, but are not limited to,

statements concerning the Company’s plans, goals, objectives,

outlook, expectations, and intentions, and other statements that

are not historical or current fact. Forward-looking statements are

based on the Company’s current expectations and involve risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied in such forward-looking statements,

including general risks and uncertainties such as market

conditions, economic conditions, geopolitical events, changes in

laws, regulations or accounting rules, fluctuations in interest

rates, terrorism, wars or conflicts, major health concerns, natural

disasters or other disruptions of expected business conditions.

Factors that could cause the Company’s results to differ materially

from current expectations include, but are not limited to, risks

related to the impact of the war in Ukraine and escalating

geopolitical tensions; impact of supply chain disruptions; the

impact of creditworthiness and financial viability of customers;

other impacts on the Company’s business and ability to execute

business continuity plans; and the other factors detailed in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023 filed with the SEC on February 29, 2024, as well as other

risks discussed in the Company’s filings with the U.S. Securities

and Exchange Commission. In addition, these statements are based on

assumptions that are subject to change. This press release speaks

only as of the date hereof. The Company disclaims any duty to

update the information herein.

ESAB CORPORATION

CONSOLIDATED AND CONDENSED

STATEMENTS OF OPERATIONS

Dollars in thousands, except

per share data

(Unaudited)

Three Months Ended

March 29, 2024

March 31, 2023

Net sales

$

689,744

$

684,000

Cost of sales

434,717

436,611

Gross profit

255,027

247,389

Selling, general and administrative

expense

142,450

147,282

Restructuring and other related

charges

1,924

9,444

Operating income

110,653

90,663

Pension settlement loss

12,155

—

Interest expense and other, net

17,091

19,510

Income from continuing operations before

income taxes

81,407

71,153

Income tax expense

18,504

37,024

Net income from continuing operations

62,903

34,129

Loss from discontinued operations, net of

taxes

(1,309

)

(913

)

Net income

61,594

33,216

Income attributable to noncontrolling

interest, net of taxes

(1,643

)

(1,313

)

Net income attributable to ESAB

Corporation

$

59,951

$

31,903

Earnings (loss) per share – basic

Income from continuing operations

$

1.01

$

0.54

Loss on discontinued operations

$

(0.02

)

$

(0.02

)

Net income per share

$

0.99

$

0.52

Earnings (loss) per share – diluted

Income from continuing operations

$

1.00

$

0.54

Loss on discontinued operations

$

(0.02

)

$

(0.02

)

Net income per share – diluted

$

0.98

$

0.52

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Dollars in millions, except

per share data

(Unaudited)

Three Months Ended

March 29, 2024

March 31, 2023

Adjusted Net Income

(Dollars in millions, except

per share data)

Net income from continuing operations

(GAAP)

$

62.9

$

34.1

Less: Income attributable to

noncontrolling interest, net of taxes

1.6

1.3

Net income from continuing operations

attributable to ESAB Corporation (GAAP)

$

61.3

$

32.8

Restructuring and other related charges –

pretax(1)

1.9

9.4

Acquisition-amortization and other related

charges – pretax(2)

7.7

9.3

Pension settlement loss – pretax

12.2

—

Tax effect on above items(3)

(5.3

)

(4.2

)

Discrete tax adjustments(4)

—

19.6

Adjusted net income from continuing

operations (non-GAAP)

$

77.8

$

66.9

Adjusted net income from continuing

operations attributable to Russia (non-GAAP)(5)

4.2

3.6

Core adjusted net income from continuing

operations (non-GAAP)

$

73.6

$

63.3

Adjusted net income margin from continuing

operations

11.3

%

9.8

%

Adjusted Net Income Per Share

Net income per share – diluted from

continuing operations (GAAP)

$

1.00

$

0.54

Restructuring and other related charges –

pretax(1)

0.03

0.16

Acquisition-amortization and other related

charges – pretax(2)

0.13

0.15

Pension settlement loss – pretax

0.20

—

Tax effect on above items(3)

(0.09

)

(0.07

)

Discrete tax adjustments(4)

—

0.32

Adjusted net income per share – diluted

from continuing operations (non-GAAP)

$

1.27

$

1.10

Adjusted net income per share – diluted

from continuing operations attributable to Russia (non-GAAP)(5)

0.07

0.06

Core adjusted net income per share –

diluted from continuing operations (non-GAAP)

$

1.20

$

1.04

__________

(1)

Includes severance and other termination

benefits, including outplacement services as well as the cost of

relocating associates, relocating equipment, lease termination

expenses, impairment of long-lived assets and other costs in

connection with the closure and optimization of facilities and

product lines.

(2)

Includes transaction expenses,

amortization of intangibles, fair value charges on acquired

inventories and integration expenses.

(3)

This line item reflects the aggregate tax

effect of all non-tax adjustments reflected in the proceeding line

items of the table. ESAB estimates the tax effect of each

adjustment item by applying ESAB’s overall estimated effective tax

rate to the pretax amount, unless the nature of the item and/or tax

jurisdiction in which the item has been recorded requires

application of a specific tax rate or tax treatment, in which case

the tax effect of such item is estimated by applying such specific

tax rate or tax treatment.

(4)

For 2023, discrete tax adjustments include

the impact of net discrete tax expenses related to dividend

withholding tax and the impact of an uncertain tax position due to

an adverse court ruling in a foreign jurisdiction.

(5)

Represents Russia contribution for the

three months ended March 29, 2024 and March 31, 2023,

respectively.

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Dollars in millions

(Unaudited)

Three Months Ended March 29,

2024

Americas

EMEA & APAC

Total

(Dollars in

millions)(1)

Net income from continuing operations

(GAAP)

$

62.9

Income tax expense

18.5

Interest expense and other, net

17.1

Pension settlement loss

12.2

Operating income (GAAP)

$

46.0

$

64.7

$

110.7

Adjusted to add

Restructuring and other related

charges(2)

0.2

1.7

1.9

Acquisition-amortization and other related

charges(3)

4.4

3.3

7.7

Depreciation and other amortization

3.5

5.3

8.8

Adjusted EBITDA (non-GAAP)

$

54.1

$

75.0

$

129.1

Adjusted EBITDA attributable to Russia

(non-GAAP)(4)

—

5.9

5.9

Core adjusted EBITDA (non-GAAP)

$

54.1

$

69.1

$

123.2

Adjusted EBITDA margin (non-GAAP)

18.3

%

19.1

%

18.7

%

Core adjusted EBITDA margin

(non-GAAP)(5)

18.3

%

19.2

%

18.8

%

__________

(1)

Numbers may not sum due to rounding.

(2)

Includes severance and other termination

benefits, including outplacement services as well as the cost of

relocating associates, relocating equipment, lease termination

expenses, impairment of long-lived assets and other costs in

connection with the closure and optimization of facilities and

product lines.

(3)

Includes transaction expenses,

amortization of intangibles, fair value charges on acquired

inventories and integration expenses.

(4)

Numbers calculated following the same

definition as Adjusted EBITDA for total Company.

(5)

Net sales were $33.6 million relating to

Russia for the three months ended March 29, 2024.

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Dollars in millions

(Unaudited)

Three Months Ended March 31,

2023

Americas

EMEA & APAC

Total

(Dollars in

millions)(1)

Net income from continuing operations

(GAAP)

$

34.1

Income tax expense

37.0

Interest expense and other, net

19.5

Operating income (GAAP)

$

39.9

$

50.8

$

90.7

Adjusted to add

Restructuring and other related

charges(2)

0.9

8.5

9.4

Acquisition-amortization and other related

charges(3)

5.3

4.0

9.3

Depreciation and other amortization

3.3

5.3

8.6

Adjusted EBITDA (non-GAAP)

$

49.4

$

68.5

$

118.0

Adjusted EBITDA attributable to Russia

(non-GAAP)(4)

—

5.3

5.3

Core adjusted EBITDA (non-GAAP)

$

49.4

$

63.2

$

112.7

Adjusted EBITDA margin (non-GAAP)

17.0

%

17.5

%

17.2

%

Core adjusted EBITDA margin

(non-GAAP)(5)

17.0

%

17.8

%

17.4

%

(1)

Numbers may not sum due to rounding.

(2)

Includes severance and other termination

benefits, including outplacement services as well as the cost of

relocating associates, relocating equipment, lease termination

expenses, impairment of long-lived assets and other costs in

connection with the closure and optimization of facilities and

product lines.

(3)

Includes transaction expenses,

amortization of intangibles, fair value charges on acquired

inventories and integration expenses.

(4)

Numbers calculated following the same

definition as Adjusted EBITDA for total Company.

(5)

Net sales were $37.1 million relating to

Russia for the three months ended March 31, 2023.

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Change in Sales

Dollars in millions

(Unaudited)

Sales Growth(1)

Americas

EMEA & APAC

Total ESAB

$

Change %

$

Change %

$

Change %

For the three months ended March 31,

2023

$

291.6

$

392.4

$

684.0

Components of Change:

Existing businesses (organic sales

growth)(2)

8.9

3.1

%

7.7

2.0

%

16.6

2.4

%

Acquisitions(3)

0.9

0.3

%

0.1

—

%

1.0

0.1

%

Foreign Currency translation(4)

(5.3

)

(1.8

)%

(6.6

)

(1.7

)%

(11.9

)

(1.7

)%

Total sales growth

4.5

1.5

%

1.3

0.3

%

5.7

0.8

%

For the three months ended March 29,

2024

$

296.0

$

393.7

$

689.7

(1)

Numbers may not sum due to rounding.

(2)

Excludes the impact of acquisitions and

foreign exchange rate fluctuations, thus providing a measure of

change due to organic growth factors such as price, product mix and

volume.

(3)

Represents the incremental sales in

comparison to the portion of the prior period during which we did

not own the business.

(4)

Represents the difference between prior

year sales valued at the actual prior year foreign exchange rates

and prior year sales valued at current year foreign exchange

rates.

Core Sales

Growth(1)(5)

Americas

EMEA & APAC

ESAB

$

Change %

$

Change %

$

Change %

For the three months ended March 31,

2023

$

291.6

$

355.3

$

646.9

Components of Change:

Existing businesses (core organic sales

growth)(2)

8.9

3.1

%

4.1

1.2

%

13.0

2.0

%

Acquisitions(3)

0.9

0.3

%

0.1

—

%

1.0

0.2

%

Foreign Currency translation(4)

(5.3

)

(1.8

)%

0.5

0.1

%

(4.8

)

(0.7

)%

Total core sales growth

4.5

1.5

%

4.7

1.3

%

9.2

1.4

%

For the three months ended March 29,

2024

$

296.0

$

360.1

$

656.1

(1)

Numbers may not sum due to rounding.

(2)

Excludes the impact of acquisitions and

foreign exchange rate fluctuations, thus providing a measure of

change due to organic growth factors such as price, product mix and

volume.

(3)

Represents the incremental sales in

comparison to the portion of the prior period during which we did

not own the business.

(4)

Represents the difference between prior

year sales valued at the actual prior year foreign exchange rates

and prior year sales valued at current year foreign exchange

rates.

(5)

Represents sales excluding Russia for the

three months ended March 29, 2024 and March 31, 2023,

respectively.

ESAB CORPORATION

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

Adjusted Free Cash

Flow

Dollars in millions

(Unaudited)

Three Months Ended

March 29, 2024

March 31, 2023

Net cash provided by operating activities

(GAAP)

$

44.5

$

38.1

Purchases of property, plant and equipment

(GAAP)

(7.4

)

(7.7

)

Payments related to the Separation(1)

—

4.4

Payments related to discontinued

operations

3.7

5.4

Adjusted free cash flow (non-GAAP)

$

40.8

$

40.2

(1)

Separation payments relate to one-time

non-recurring professional fees and employee costs incurred in the

planning and execution of the Separation from Enovis.

ESAB CORPORATION

2024 Outlook

Dollars in millions

(Unaudited)

ESAB 2024 Outlook

Previous Guidance

New Guidance

2023 Core net sales

$

2,620.9

$

2,620.9

Organic growth

2.5%-4.5

%

2.5%-4.5

%

Acquisitions

—

%

0.5

%

Currency

(1.0

)%

(1.5

)%

2024 Core net sales growth

range

1.5%-3.5

%

1.5%-3.5

%

2023 Core adjusted EBITDA

$

482.7

$

482.7

2024 Core adjusted EBITDA range

$

495-$515

$

500-$520

2023 Core adjusted EPS

$

4.46

$

4.46

2024 Core adjusted EPS range

$

4.65-$4.85

$

4.75-$4.95

ESAB CORPORATION

CONSOLIDATED AND CONDENSED

BALANCE SHEETS

Dollars in thousands

(Unaudited)

March 29, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

76,495

$

102,003

Trade receivables, less allowance for

credit losses of $25,424 and $25,477

430,149

385,198

Inventories, net

405,601

392,858

Prepaid expenses

60,415

61,771

Other current assets

70,088

55,890

Total current assets

1,042,748

997,720

Property, plant and equipment, net

290,431

294,305

Goodwill

1,586,943

1,588,331

Intangible assets, net

484,219

499,535

Lease assets - right of use

94,162

95,607

Other assets

328,986

353,131

Total assets

$

3,827,489

$

3,828,629

LIABILITIES AND EQUITY

CURRENT LIABILITIES:

Accounts payable

$

338,399

$

306,593

Accrued liabilities

292,903

313,489

Total current liabilities

631,302

620,082

Long-term debt

992,798

1,018,057

Other liabilities

521,011

542,833

Total liabilities

2,145,111

2,180,972

Equity:

Common stock - $0.001 par value -

Authorized 600,000,000, 60,424,421 and 60,295,634 shares

outstanding as of March 29, 2024 and December 31, 2023,

respectively

60

60

Additional paid-in capital

1,881,534

1,881,054

Retained earnings

406,867

350,557

Accumulated other comprehensive loss

(647,661

)

(624,272

)

Total ESAB Corporation equity

1,640,800

1,607,399

Noncontrolling interest

41,578

40,258

Total equity

1,682,378

1,647,657

Total liabilities and equity

$

3,827,489

$

3,828,629

ESAB CORPORATION

CONSOLIDATED AND CONDENSED

STATEMENTS OF CASH FLOWS

Dollars in thousands

(Unaudited)

Three Months Ended

March 29, 2024

March 31, 2023

Cash flows from operating

activities:

Net income

$

61,594

$

33,216

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, amortization, and other

impairment charges

16,387

21,871

Stock-based compensation expense

4,133

2,994

Deferred income tax

(638

)

2,290

Non-cash interest expense

1,062

299

Pension settlement loss

12,155

—

Changes in operating assets and

liabilities:

Trade receivables, net

(48,946

)

(21,048

)

Inventories, net

(16,078

)

(21,611

)

Accounts payable

36,196

28,480

Other operating assets and liabilities

(21,398

)

(8,424

)

Net cash provided by operating

activities

44,467

38,067

Cash flows from investing

activities:

Purchases of property, plant and

equipment

(7,414

)

(7,709

)

Proceeds from sale of property, plant and

equipment

368

681

Acquisition, net of cash received

(18,067

)

(18,721

)

Other

(1,501

)

—

Net cash used in investing

activities

(26,614

)

(25,749

)

Cash flows from financing

activities:

Proceeds from borrowings on revolving

credit facility

115,000

187,000

Repayments of borrowings on term credit

facility

(6,250

)

—

Repayments of borrowings on revolving

credit facility and other

(139,035

)

(189,765

)

Payment of dividends

(3,635

)

(3,033

)

Distributions to noncontrolling interest

holders

—

(1,249

)

Net cash used in financing

activities

(33,920

)

(7,047

)

Effect of foreign exchange rates on Cash

and cash equivalents

(9,441

)

4,769

(Decrease) increase in Cash and cash

equivalents

(25,508

)

10,040

Cash and cash equivalents, beginning of

period

102,003

72,024

Cash and cash equivalents, end of

period

$

76,495

$

82,064

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501141161/en/

Investor Relations Contact:

Mark Barbalato Vice President, Investor Relations E-mail:

investorrelations@esab.com Phone: 1-301-323-9098 Media Contact: Tilea Coleman Vice President,

Corporate Communications E-mail: mediarelations@esab.com Phone:

1-301-323-9092

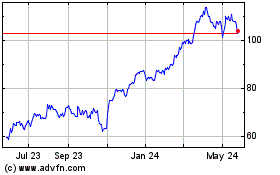

ESAB (NYSE:ESAB)

Historical Stock Chart

From Dec 2024 to Jan 2025

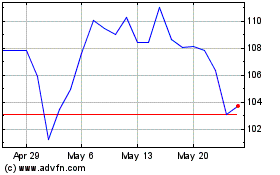

ESAB (NYSE:ESAB)

Historical Stock Chart

From Jan 2024 to Jan 2025