Equus II Incorporated Announces Investment in Real Estate Sector

December 06 2005 - 5:19PM

PR Newswire (US)

HOUSTON, Dec. 6 /PRNewswire-FirstCall/ -- Equus II Incorporated

(NYSE:EQS) (the "Fund") announces the completion of $4.25 million

in mezzanine debt to Creekstone Florida Holdings, L.L.C. to develop

Creekstone's Island Reserve condominium project. The Florida

development consists of 299 condominium homes and townhomes in

Panama City. The investment represents the fund's first in the real

estate market. Creekstone is one of the nation's most prominent,

vertically integrated, full service real estate development

companies. With over $600 million in total investments, Creekstone

is a well-established name in the real estate development and

management marketplace. Creekstone concentrates on institutional

quality assets, each generally less than $75 million in total cost,

within geographic regions that maintain long-term employment and

strong population growth trends. "Creekstone's past performance and

development strategy satisfy the fund's established criteria of

investing in areas that we believe will enhance shareholder value,"

commented Sam P. Douglass, Co-Chairman of Equus. "We believe the

current real estate market provides excellent opportunities for

growth. We are also excited about this investment because it

provides the fund's first entry into real estate, which is

representative of our strategy to invest in attractive millennium

growth trends," said Anthony Moore, Co-Chairman, CEO and President

of Equus. "Creekstone is delighted to have Equus as our partner in

the Island Reserve development project. We hope our relationship

develops into an ongoing investment partnership that will be

beneficial to all parties and shareholders," stated Everett

Jackson, Principal and Co-founder of Creekstone. Equus II

Incorporated is a business development company that trades as a

closed-end fund on the New York Stock Exchange, under the symbol

"EQS". Additional information on Equus II Incorporated may be

obtained from Equus' website at http://www.equuscap.com/ This press

release may contain certain forward-looking statements regarding

future circumstances. These forward-looking statements are based

upon the Company's current expectations and assumptions and are

subject to various risks and uncertainties that could cause actual

results to differ materially from those contemplated in such

forward-looking statements including, in particular, the risks and

uncertainties described in the Company's filings with the

Securities and Exchange Commission. Actual results, events, and

performance may differ. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

to the date hereof. The Company undertakes no obligation to release

publicly any revisions to these forward-looking statements that may

be made to reflect events or circumstances after the date hereof or

to reflect the occurrence of unanticipated events. The inclusion of

any statement in this release does not constitute an admission by

the Company or any other person that the events or circumstances

described in such statements are material. CONTACT: BRETT CHILES

(713-529-0900) DATASOURCE: Equus II Incorporated CONTACT: Brett

Chiles of Equus II Incorporated, +1-713-529-0900 Web site:

http://www.equuscap.com/

Copyright

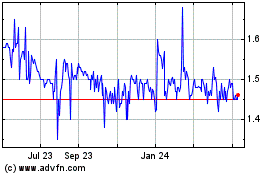

Equus Total Return (NYSE:EQS)

Historical Stock Chart

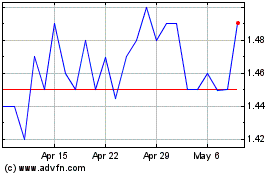

From Jun 2024 to Jul 2024

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024