Equus II Incorporated Announces First Quarter Net Asset Value

May 13 2005 - 5:57PM

PR Newswire (US)

Equus II Incorporated Announces First Quarter Net Asset Value

HOUSTON, May 13 /PRNewswire-FirstCall/ -- Equus II Incorporated

(NYSE:EQS) reports net assets as of March 31, 2005 of $75.5

million, or $11.61 per share. Comparative data is summarized below:

3/31/05 12/31/04 3/31/04 ----------- ----------- ----------- Net

assets $75,515,326 $68,599,657 $69,717,748 Shares Outstanding

6,506,692 6,506,692 6,615,173 Net assets per share $11.61 $10.54

$10.54 Net assets per share increased approximately 10% from

year-end and approximately 16% from the comparable period a year

ago, after considering the 2004 dividend. The increase in net

assets from year-end is primarily due to increases in valuation for

Champion Window Holdings, Inc. ("Champion") and Spectrum

Management, LLC ("Spectrum"). The value of Champion increased by

$6.6 million from year-end as a result of increased earnings at the

company and valuation multiples attributable to comparable

companies in the home building products industry. The value of the

Fund's interest in Spectrum was increased by $1.2 million from

year-end, due to better earnings performance. Several third party

indications of acquisition interest exist for both Champion and

Spectrum companies. The increase in net assets from the same period

a year earlier is primarily due to increases in valuations for

Champion and Spectrum. Champion increased approximately $6 million

and Spectrum increased approximately $3.2 million from a year ago.

These increases were partially offset by the Fund dividend paid for

2004 and decreases in valuation of $.9 million at Turf Grass

Holdings, Inc. and $.5 million at Doane PetCare Enterprises, Inc.

The operating performances at these entities declined from a year

ago, and the decreases were recorded prior to December 31, 2004.

"We are pleased with the significant increases in NAV per share

from year- end and last year," stated Sam P. Douglass, Chairman and

Chief Executive Officer of Equus. "As previously announced, we look

forward to the ratification by shareholders of Moore, Clayton

Capital Advisors, Inc. as the Fund's new adviser. The combination

of twenty plus years of experience for Equus in the business

development arena and MCC's expertise in personal wealth accretion

should provide an attractive vehicle for investors in the future."

Equus II is a business development company which seeks to generate

current distributions of net investment income and long-term

capital gains by making equity-oriented investments in small to

medium-sized, privately owned companies. The current portfolio

consists of investments in 12 businesses in various industries, 2

venture capital funds and 2 entities which have disposed of

substantially all of their assets and are awaiting liquidation.

"Safe Harbor" Statement Under the Private Securities Litigation

Reform Act of 1995: This press release contains certain

forward-looking statements which involve known and unknown risks,

uncertainties or other factors not under the Company's control

which may cause the actual results, performance or achievement of

the Company to be materially different from the results,

performance or other expectations implied by these forward-looking

statements. These factors include, but are not limited to, those

disclosed in the Company's periodic filings with the Securities and

Exchange Commission. CONTACT: Hank Nicodemus (713) 529-0900

DATASOURCE: Equus II Incorporated CONTACT: Hank Nicodemus of Equus

II Incorporated, +1-713-529-0900 Web site: http://www.equuscap.com/

Copyright

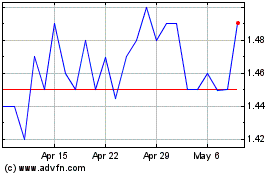

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

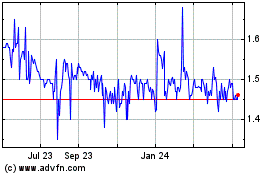

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Jul 2023 to Jul 2024