Continued Strong Performance

Equity LifeStyle Properties, Inc. (NYSE: ELS) (referred to

herein as “we,” “us,” and “our”) today announced results for the

quarter ended March 31, 2024. All per share results are reported on

a fully diluted basis unless otherwise noted.

($ in millions, except per share

data)

FINANCIAL

RESULTS

Q1 2024

Q1 2023

$ Change

Total Revenues

$

386.6

$

370.0

$

16.6

Net Income available for Common

Stockholders

$

109.9

$

82.4

$

27.5

Net Income per Common Share

$

0.59

$

0.44

$

0.15

NON-GAAP

FINANCIAL MEASURES

Q1 2024

Q1 2023

$ Change

Funds from Operations (“FFO”) per Common

Share and OP Unit

$

0.86

$

0.72

$

0.14

Normalized Funds from Operations

(“Normalized FFO”) per Common Share and

OP Unit

$

0.78

$

0.72

$

0.06

Property operating revenues

$

353.7

$

334.8

$

18.9

Income from property operations, excluding

property management

$

211.4

$

198.0

$

13.4

CORE PORTFOLIO

PERFORMANCE

Q1 2024

Q1 2023

% Change

Core property operating revenues

$

345.4

$

326.4

5.8

%

Core Income from property operations,

excluding property management

$

206.1

$

192.4

7.1

%

Operations Update

Normalized FFO for the quarter ended March 31, 2024 was $0.78

per share, representing an 8.6% increase compared to the same

period in 2023, and is in line with the midpoint of our guidance

expectation.

MH

Core MH base rental income for the quarter ended March 31, 2024

increased 6.4% compared to the same period in 2023, which reflects

6.3% growth from rate increases and 0.1% from occupancy gains. Core

MH homeowners increased by 123 since December 31, 2023. We sold 191

new homes during the quarter ended March 31, 2024, with an average

sales price of approximately $93,000.

RV and Marina

Core RV and marina base rental income for the quarter ended

March 31, 2024 increased 5.8% compared to the same period in 2023.

Core RV and marina annual base rental income increased 8.0% for the

quarter ended March 31, 2024, which included allocation of an

additional day’s revenue resulting from the leap year, compared to

the same period in 2023. Total nights camped during the quarter

ended March 31, 2024 is in line compared to the same period in

2023.

Property Operating Expenses

Core property operating expenses, excluding property management

for the quarter ended March 31, 2024 increased 3.9% compared to the

same period in 2023. See page 8 for details of the Core property

operating expenses, excluding property management.

We completed our property and casualty insurance renewal as of

April 1, 2024 with no change to program deductibles, an increase to

certain coverage limits, and a premium increase of approximately

9%.

Balance Sheet Activity

In April 2024, the Company entered into three interest rate swap

agreements (“Swaps”) with an aggregate notional value of $300.0

million allowing us to trade the variable interest rate associated

with our $300.0 million unsecured term loan for a fixed interest

rate. The Swaps have a weighted average all-in fixed interest rate

of 6.05% per annum and mature on April 17, 2026. As a result,

borrowings on our unsecured line of credit represent our only

exposure to floating rate debt.

Guidance Update (1)(2)

($ in millions, except per share

data)

2024

Second Quarter

Full Year

Net Income per Common Share

$0.34 to $0.40

$1.83 to $1.93

FFO per Common Share and OP Unit

$0.61 to $0.67

$2.91 to $3.01

Normalized FFO per Common Share and OP

Unit

$0.61 to $0.67

$2.84 to $2.94

2023 Actual

2024 Growth Rates

Core Portfolio:

Second Quarter

Full Year

Second Quarter

Full Year

MH base rental income

$

166.3

$

668.5

5.9% to 6.5%

5.6% to 6.6%

RV and marina base rental income (3)

$

98.6

$

413.5

2.8% to 3.4%

4.5% to 5.5%

Property operating revenues

$

317.7

$

1,297.7

4.8% to 5.4%

4.8% to 5.8%

Property operating expenses, excluding

property management

$

145.4

$

562.3

5.3% to 5.9%

4.2% to 5.2%

Income from property operations, excluding

property management

$

172.3

$

735.4

4.3% to 4.9%

5.3% to 6.3%

Non-Core Portfolio:

2024 Full Year

Income from property operations, excluding

property management

$15.2 to $19.2

Other Guidance Assumptions:

2024 Full Year

Property management and general

administrative

$114.7 to $120.7

Debt assumptions:

Weighted average debt outstanding

$3,400 to $3,600

Interest and related amortization

$141.2 to $147.2

______________________

- Second quarter and full year 2024 guidance represent

management’s estimate of a range of possible outcomes. The midpoint

of the ranges reflect management’s estimate of the most likely

outcome based on our current view of existing market conditions and

assumptions. Actual results could vary materially from management’s

estimates presented above if any of our assumptions, including

occupancy and rate changes, our ability to manage expenses in an

inflationary environment, our ability to integrate and operate

recent acquisitions and costs to restore property operations and

potential revenue losses following storms or other unplanned

events, are incorrect. See Forward-Looking Statements in this press

release for additional factors impacting our 2024 guidance

assumptions. See Non-GAAP Financial Measures Definitions and

Reconciliations at the end of the supplemental financial

information for definitions of FFO and Normalized FFO and a

reconciliation of Net income per Common Share - Fully Diluted to

FFO per Common Share and OP Unit - Fully Diluted and Normalized FFO

per Common Share and OP Unit - Fully Diluted.

- Guidance assumptions do not include future capital events

(financing transactions, acquisitions or dispositions).

- Core RV and marina annual revenue represents approximately

73.2% and 69.3% of second quarter 2024 and full year 2024 RV and

marina base rental income, respectively. Core RV and marina annual

revenue second quarter 2024 growth rate range is 6.5% to 7.1% and

the full year 2024 growth rate range is 6.6% to 7.6%.

About Equity LifeStyle Properties

We are a self-administered, self-managed real estate investment

trust (“REIT”) with headquarters in Chicago. As of April 22, 2024,

we own or have an interest in 451 properties in 35 states and

British Columbia consisting of 172,464 sites.

For additional information, please contact our Investor

Relations Department at (800) 247-5279 or at

investor_relations@equitylifestyle.com.

Conference Call

A live audio webcast of our conference call discussing these

results will take place tomorrow, Tuesday, April 23, 2024, at 10:00

a.m. Central Time. Please visit the Investor Relations section at

www.equitylifestyleproperties.com for the link. A replay of the

webcast will be available for two weeks at this site.

Forward-Looking Statements

In addition to historical information, this press release

includes certain “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. When used,

words such as “anticipate,” “expect,” “believe,” “project,”

“estimate,” “guidance,” “intend,” “may be” and “will be” and

similar words or phrases, or the negative thereof, unless the

context requires otherwise, are intended to identify

forward-looking statements and may include, without limitation,

information regarding our expectations, goals or intentions

regarding the future, and the expected effect of our acquisitions.

Forward-looking statements, including our guidance concerning Net

Income, FFO and Normalized FFO per share data, and certain growth

rates, by their nature, involve estimates, projections, goals,

forecasts and assumptions and are subject to risks and

uncertainties that could cause actual results or outcomes to differ

materially from those expressed in a forward-looking statement due

to a number of factors, which include, but are not limited to the

following: (i) the mix of site usage within the portfolio; (ii)

yield management on our short-term resort and marina sites; (iii)

scheduled or implemented rate increases on community, resort and

marina sites; (iv) scheduled or implemented rate increases in

annual payments under membership subscriptions; (v) occupancy

changes; (vi) our ability to attract and retain membership

customers; (vii) change in customer demand regarding travel and

outdoor vacation destinations; (viii) our ability to manage

expenses in an inflationary environment; (ix) our ability to

integrate and operate recent acquisitions in accordance with our

estimates; (x) our ability to execute expansion/development

opportunities in the face of supply chain delays/shortages; (xi)

completion of pending transactions in their entirety and on assumed

schedule; (xii) our ability to attract and retain property

employees, particularly seasonal employees; (xiii) ongoing legal

matters and related fees; (xiv) costs to restore property

operations and potential revenue losses following storms or other

unplanned events; and (xv) the potential impact of, and our ability

to remediate, material weaknesses in our internal control over

financial reporting. For further information on these and other

factors that could impact us and the statements contained herein,

refer to our filings with the Securities and Exchange Commission,

including the “Risk Factors” and “Forward-Looking Statements”

sections in our most recent Annual Report on Form 10-K and any

subsequent Quarterly Reports on Form 10-Q. These forward-looking

statements are based on management's present expectations and

beliefs about future events. As with any projection or forecast,

these statements are inherently susceptible to uncertainty and

changes in circumstances. We are under no obligation to, and

expressly disclaim any obligation to, update or alter our

forward-looking statements whether as a result of such changes, new

information, subsequent events or otherwise.

Supplemental Financial Information

Financial Highlights

(In millions, except Common Shares and OP Units outstanding

and per share data, unaudited)

As of and for the Quarters

Ended

Mar 31, 2024

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Operating Information

Total revenues

$

386.6

$

360.6

$

388.8

$

370.0

$

370.0

Consolidated net income

$

115.3

$

96.4

$

80.7

$

66.0

$

86.5

Net income available for Common

Stockholders

$

109.9

$

91.9

$

77.0

$

62.9

$

82.4

Adjusted EBITDAre (1)

$

186.3

$

171.1

$

167.0

$

157.7

$

173.0

FFO available for Common Stock and OP Unit

holders (1)(2)

$

167.4

$

148.5

$

133.8

$

118.6

$

140.3

Normalized FFO available for Common Stock

and OP Unit holders (1)(2)

$

152.7

$

138.2

$

133.9

$

124.9

$

140.5

Funds Available for Distribution ("FAD")

for Common Stock and OP Unit holders (1)(2)

$

136.9

$

109.2

$

107.8

$

98.3

$

122.4

Common Shares and OP Units Outstanding

(In thousands) and Per Share Data

Common Shares and OP Units, end of the

period

195,598

195,531

195,525

195,514

195,446

Weighted average Common Shares and OP

Units outstanding - Fully Diluted

195,545

195,475

195,440

195,430

195,369

Net income per Common Share - Fully

Diluted (3)

$

0.59

$

0.49

$

0.41

$

0.34

$

0.44

FFO per Common Share and OP Unit - Fully

Diluted

$

0.86

$

0.76

$

0.68

$

0.61

$

0.72

Normalized FFO per Common Share and OP

Unit - Fully Diluted

$

0.78

$

0.71

$

0.68

$

0.64

$

0.72

Dividends per Common Share

$

0.4775

$

0.4475

$

0.4475

$

0.4475

$

0.4475

Balance Sheet

Total assets

$

5,630

$

5,614

$

5,626

$

5,586

$

5,519

Total liabilities

$

4,110

$

4,115

$

4,129

$

4,083

$

4,006

Market Capitalization

Total debt (4)

$

3,507

$

3,548

$

3,533

$

3,479

$

3,414

Total market capitalization (5)

$

16,104

$

17,341

$

15,990

$

16,557

$

16,534

Ratios

Total debt / total market

capitalization

21.8

%

20.5

%

22.1

%

21.0

%

20.6

%

Total debt / Adjusted EBITDAre (6)

5.1

5.3

5.4

5.4

5.4

Interest coverage (7)

5.2

5.2

5.3

5.4

5.5

Fixed charges(8)

5.1

5.1

5.1

5.2

5.4

______________________

- See Non-GAAP Financial Measures Definitions and Reconciliations

at the end of the supplemental financial information for

definitions of Adjusted EBITDAre, FFO, Normalized FFO and FAD and a

reconciliation of Consolidated net income to Adjusted

EBITDAre.

- See page 6 for a reconciliation of Net income available for

Common Stockholders to Non-GAAP financial measures FFO available

for Common Stock and OP Unit holders, Normalized FFO available for

Common Stock and OP Unit holders and FAD for Common Stock and OP

Unit holders.

- Net income per Common Share - Fully Diluted is calculated

before Income allocated to non-controlling interest - Common OP

Units.

- Excludes deferred financing costs of approximately $28.6

million as of March 31, 2024.

- See page 14 for the calculation of market capitalization as of

March 31, 2024.

- Calculated using trailing twelve months Adjusted EBITDAre.

- Calculated by dividing trailing twelve months Adjusted EBITDAre

by the interest expense incurred during the same period.

- See Non-GAAP Financial Measures Definitions and Reconciliations

at the end of the supplemental financial information for a

definition of fixed charges. This ratio is calculated by dividing

trailing twelve months Adjusted EBITDAre by the sum of fixed

charges and preferred stock dividends, if any, during the same

period.

Consolidated Balance

Sheets

(In thousands, except share and per share data)

March 31, 2024

December 31, 2023

(unaudited)

Assets

Investment in real estate:

Land

$

2,088,657

$

2,088,657

Land improvements

4,435,288

4,380,649

Buildings and other depreciable

property

1,229,374

1,236,985

7,753,319

7,706,291

Accumulated depreciation

(2,497,039

)

(2,448,876

)

Net investment in real estate

5,256,280

5,257,415

Cash and restricted cash

47,281

29,937

Notes receivable, net

49,346

49,937

Investment in unconsolidated joint

ventures

84,989

85,304

Deferred commission expense

54,024

53,641

Other assets, net

138,314

137,499

Total Assets

$

5,630,234

$

5,613,733

Liabilities and Equity

Liabilities:

Mortgage notes payable, net

$

2,974,728

$

2,989,959

Term loans, net

497,875

497,648

Unsecured line of credit

6,000

31,000

Accounts payable and other liabilities

171,061

151,567

Deferred membership revenue

223,470

218,337

Accrued interest payable

12,543

12,657

Rents and other customer payments received

in advance and security deposits

131,547

126,451

Distributions payable

93,264

87,493

Total Liabilities

4,110,488

4,115,112

Equity:

Preferred stock, $0.01 par value,

10,000,000 shares authorized as of March 31, 2024 and December 31,

2023; none issued and outstanding.

—

—

Common stock, $0.01 par value, 600,000,000

shares authorized as of March 31, 2024 and December 31, 2023;

186,493,598 and 186,426,281 shares issued and outstanding as of

March 31, 2024 and December 31, 2023, respectively.

1,917

1,917

Paid-in capital

1,644,410

1,644,319

Distributions in excess of accumulated

earnings

(202,721

)

(223,576

)

Accumulated other comprehensive income

5,280

6,061

Total Stockholders’ Equity

1,448,886

1,428,721

Non-controlling interests – Common OP

Units

70,860

69,900

Total Equity

1,519,746

1,498,621

Total Liabilities and Equity

$

5,630,234

$

5,613,733

Consolidated Statements of

Income

(In thousands, unaudited)

Quarters Ended March

31,

2024

2023

Revenues:

Rental income

$

316,599

$

296,451

Annual membership subscriptions

16,215

15,970

Membership upgrade sales (1)

3,947

3,505

Other income

15,548

17,714

Gross revenues from home sales, brokered

resales and ancillary services

30,053

32,133

Interest income

2,168

2,088

Income from other investments, net

2,038

2,091

Total revenues

386,568

369,952

Expenses:

Property operating and maintenance

114,783

112,483

Real estate taxes

20,787

18,316

Membership sales and marketing (2)

5,297

4,838

Property management

19,710

19,464

Depreciation and amortization

51,108

50,502

Cost of home sales, brokered resales and

ancillary services

21,967

23,141

Home selling expenses and ancillary

operating expenses

6,147

6,924

General and administrative

11,989

11,661

Casualty-related charges/(recoveries), net

(3)

(14,843

)

—

Other expenses

1,331

1,468

Interest and related amortization

33,543

32,588

Total expenses

271,819

281,385

Income before income taxes and other

items

114,749

88,567

Gain/(Loss) on sale of real estate and

impairment, net

—

(2,632

)

Income tax benefit

239

—

Equity in income of unconsolidated joint

ventures

283

524

Consolidated net income

115,271

86,459

Income allocated to non-controlling

interests – Common OP Units

(5,366

)

(4,088

)

Net income available for Common

Stockholders

$

109,905

$

82,371

______________________

- Membership upgrade sales revenue is net of deferrals of $3.6

million and $4.5 million for the quarters ended March 31, 2024 and

March 31, 2023, respectively. See page 13 for details of membership

sales activity.

- Membership sales and marketing expense is net of sales

commission deferrals of $0.4 million and $0.7 million for the

quarters ended March 31, 2024 and March 31, 2023, respectively. See

page 13 for details of membership sales activity.

- Casualty-related charges/(recoveries), net for the quarter

ended March 31, 2024 includes debris removal and cleanup costs

related to Hurricane Ian of $0.5 million and insurance recovery

revenue of $15.4 million including excess revenue of $14.8 million

for reimbursement of capital expenditures related to Hurricane

Ian.

Non-GAAP Financial Measures

This document contains certain Non-GAAP measures used by

management that we believe are helpful to understand our business.

We believe investors should review these Non-GAAP measures along

with GAAP net income and cash flows from operating activities,

investing activities and financing activities, when evaluating an

equity REIT’s operating performance. Our definitions and

calculations of these Non-GAAP financial and operating measures and

other terms may differ from the definitions and methodologies used

by other REITs and, accordingly, may not be comparable. These

Non-GAAP financial and operating measures do not represent cash

generated from operating activities in accordance with GAAP, nor do

they represent cash available to pay distributions and should not

be considered as an alternative to net income, determined in

accordance with GAAP, as an indication of our financial

performance, or to cash flows from operating activities, determined

in accordance with GAAP, as a measure of our liquidity, nor are

they indicative of funds available to fund our cash needs,

including our ability to make cash distributions. For definitions

and reconciliations of Non-GAAP measures to our financial

statements as prepared under GAAP, refer to both Reconciliation of

Net Income to Non-GAAP Financial Measures on page 6 and Non-GAAP

Financial Measures Definitions and Reconciliations on pages

16-19.

Selected Non-GAAP Financial

Measures

(In millions, except per share data, unaudited)

Quarter Ended

March 31, 2024

Income from property operations, excluding

property management - 2024 Core (1)

$

206.1

Income from property operations, excluding

property management - Non-Core (1)

5.3

Property management and general and

administrative

(31.3

)

Other income and expenses

6.1

Interest and related amortization

(33.5

)

Normalized FFO available for Common

Stock and OP Unit holders (2)

$

152.7

Deferred income tax benefit

0.2

Transaction/pursuit costs and other

(0.4

)

Insurance proceeds due to catastrophic

weather event (3)

14.8

FFO available for Common Stock and OP

Unit holders (2)(4)

$

167.4

FFO per Common Share and OP Unit

$

0.86

Normalized FFO per Common Share and OP

Unit

$

0.78

Normalized FFO available for Common

Stock and OP Unit holders (2)

$

152.7

Non-revenue producing improvements to real

estate

(15.8

)

FAD for Common Stock and OP Unit

holders (2)

$

136.9

Weighted average Common Shares and OP

Units - Fully Diluted

195.5

______________________

- See pages 8-9 for details of the Core Income from Property

Operations, excluding property management. See page 10 for details

of the Non-Core Income from Property Operations, excluding property

management.

- See page 6 for a reconciliation of Net income available for

Common Stockholders to FFO available for Common Stock and OP Unit

holders, Normalized FFO available for Common Stock and OP Unit

holders and FAD for Common Stock and OP Unit holders.

- Represents insurance recovery revenue for reimbursement of

capital expenditures related to Hurricane Ian.

- Amounts may not foot due to rounding.

Reconciliation of Net Income

to Non-GAAP Financial Measures

(In thousands, except per share data, unaudited)

Quarters Ended March

31,

2024

2023

Net income available for Common

Stockholders

$

109,905

$

82,371

Income allocated to non-controlling

interests – Common OP Units

5,366

4,088

Depreciation and amortization

51,108

50,502

Depreciation on unconsolidated joint

ventures

1,051

1,135

Gain on unconsolidated joint ventures

—

(416

)

(Gain)/Loss on sale of real estate and

impairment, net

—

2,632

FFO available for Common Stock and OP

Unit holders

167,430

140,312

Deferred income tax benefit

(239

)

—

Transaction/pursuit costs and other

(1)

383

206

Insurance proceeds due to catastrophic

weather event (2)

(14,843

)

—

Normalized FFO available for Common

Stock and OP Unit holders

152,731

140,518

Non-revenue producing improvements to real

estate

(15,812

)

(18,112

)

FAD for Common Stock and OP Unit

holders

$

136,919

$

122,406

Net income per Common Share -

Basic

$

0.59

$

0.44

Net income per Common Share - Fully

Diluted (3)

$

0.59

$

0.44

FFO per Common Share and OP Unit -

Basic

$

0.86

$

0.72

FFO per Common Share and OP Unit -

Fully Diluted

$

0.86

$

0.72

Normalized FFO per Common Share and OP

Unit - Basic

$

0.78

$

0.72

Normalized FFO per Common Share and OP

Unit - Fully Diluted

$

0.78

$

0.72

Weighted average Common Shares outstanding

- Basic

186,287

185,900

Weighted average Common Shares and OP

Units outstanding - Basic

195,392

195,162

Weighted average Common Shares and OP

Units outstanding - Fully Diluted

195,545

195,369

____________________

- Prior period amounts have been reclassified to conform to the

current period presentation.

- Represents insurance recovery revenue for reimbursement of

capital expenditures related to Hurricane Ian.

- Net income per Common Share - Fully Diluted is calculated

before Income allocated to non-controlling interest - Common OP

Units.

Consolidated Income from

Property Operations (1)

(In millions, except home site and occupancy figures,

unaudited)

Quarters Ended March

31,

2024

2023

MH base rental income (2)

$

175.1

$

164.6

Rental home income (2)

3.5

3.9

RV and marina base rental income (2)

120.2

111.6

Annual membership subscriptions

16.2

16.0

Membership upgrade sales (3)

3.9

3.5

Utility and other income (2)(4)

34.8

35.2

Property operating revenues

353.7

334.8

Property operating, maintenance and real

estate taxes (2)

137.0

132.0

Membership sales and marketing (3)

5.3

4.8

Property operating expenses, excluding

property management (1)

142.3

136.8

Income from property operations,

excluding property management (1)

$

211.4

$

198.0

Manufactured home site figures and

occupancy averages:

Total sites

73,008

72,717

Occupied sites

68,916

68,847

Occupancy %

94.4

%

94.7

%

Monthly base rent per site

$

847

$

797

RV and marina base rental

income:

Annual

$

75.6

$

69.4

Seasonal

29.5

28.0

Transient

15.1

14.2

Total RV and marina base rental income

$

120.2

$

111.6

______________________

- Excludes property management expenses.

- MH base rental income, Rental home income, RV and marina base

rental income and Utility income, net of bad debt expense, are

presented in Rental income in the Consolidated Statements of Income

on page 3. Bad debt expense is presented in Property operating,

maintenance and real estate taxes in this table.

- See page 13 for details of membership sales activity.

- Includes approximately $1.9 million and $4.0 million of

business interruption income from Hurricane Ian during the quarters

ended March 31, 2024 and March 31, 2023, respectively.

Core Income from Property

Operations (1)

(In millions, except occupancy figures, unaudited)

Quarters Ended March

31,

2024

2023

Change (2)

MH base rental income

$

174.9

$

164.4

6.4

%

Rental home income

3.5

3.9

(9.2

)%

RV and marina base rental income

115.6

109.3

5.8

%

Annual membership subscriptions

16.2

15.8

2.7

%

Membership upgrade sales

3.9

3.5

13.9

%

Utility and other income

31.3

29.5

5.6

%

Property operating revenues

345.4

326.4

5.8

%

Utility expense

38.7

38.4

0.7

%

Payroll

27.7

28.1

(1.4

)%

Repair & maintenance

20.8

21.8

(4.6

)%

Insurance and other (3)

26.4

23.0

14.6

%

Real estate taxes

20.4

17.9

14.3

%

Membership sales and marketing

5.3

4.8

9.9

%

Property operating expenses, excluding

property management (1)

139.3

134.0

3.9

%

Income from property operations,

excluding property management (1)

$

206.1

$

192.4

7.1

%

Occupied sites (4)

68,904

68,801

_____________________

- Excludes property management expenses.

- Calculations prepared using actual results without

rounding.

- Includes bad debt expense for the periods presented.

- Occupied sites are presented as of the end of the period.

Core Income from Property

Operations (continued)

(In millions, except home site and occupancy figures,

unaudited)

Quarters Ended March

31,

2024

2023

Core manufactured home site figures and

occupancy averages:

Total sites

72,593

72,456

Occupied sites

68,858

68,790

Occupancy %

94.9

%

94.9

%

Monthly base rent per site

$

847

$

797

Quarters Ended March

31,

2024

2023

Change (1)

Core RV and marina base rental

income:

Annual (2)

$

73.1

$

67.6

8.0

%

Seasonal

28.2

27.6

2.4

%

Transient

14.3

14.1

1.4

%

Total Seasonal and Transient

$

42.5

$

41.7

2.1

%

Total RV and marina base rental income

$

115.6

$

109.3

5.8

%

Quarters Ended March

31,

2024

2023

Change (1)

Core utility information:

Income

$

18.0

$

17.6

2.3

%

Expense

38.7

38.4

0.7

%

Expense, net

$

20.7

$

20.8

(0.5

)%

Utility recovery rate (3)

46.5

%

45.8

%

_____________________

- Calculations prepared using actual results without

rounding.

- Core Annual marina base rental income represents approximately

99% of the total Core marina base rental income for all periods

presented.

- Calculated by dividing the utility income by utility

expense.

Non-Core Income from Property

Operations (1)

(In millions, unaudited)

Quarter Ended

March 31, 2024

MH base rental income

$

0.2

RV and marina base rental income

4.5

Utility and other income

3.6

Property operating revenues

8.3

Property operating expenses, excluding

property management (1)(2)

3.0

Income from property operations,

excluding property management (1)

$

5.3

______________________

- Excludes property management expenses.

- Includes bad debt expense for the periods presented.

Home Sales and Rental Home

Operations

(In thousands, except home sale volumes and occupied rentals,

unaudited)

Home Sales - Select Data

Quarters Ended March

31,

2024

2023

Total new home sales volume

191

176

New home sales gross revenues

$

17,700

$

18,314

Total used home sales volume

54

102

Used home sales gross revenues

$

838

$

1,175

Brokered home resales volume

109

134

Brokered home resales gross revenues

$

572

$

675

Rental Homes - Select Data

Quarters Ended March

31,

2024

2023

Rental operations revenues (1)

$

9,058

$

10,258

Rental home operations expense (2)

1,369

959

Depreciation on rental homes (3)

2,568

2,747

Occupied rentals: (4)

New

1,922

2,389

Used

236

313

Total occupied rental sites

2,158

2,702

As of March 31, 2024

As of March 31, 2023

Cost basis in rental homes: (5)

Gross

Net of Depreciation

Gross

Net of Depreciation

New

$

238,963

$

197,641

$

252,204

$

209,673

Used

11,744

7,118

14,056

8,094

Total rental homes

$

250,707

$

204,759

$

266,260

$

217,767

______________________

- For the quarters ended March 31, 2024 and 2023, approximately

$5.6 million and $6.4 million, respectively, of the rental

operations revenue is included in the MH base rental income in the

Core Income from Property Operations on pages 8-9. The remainder of

the rental operations revenue for the quarters ended March 31, 2024

and 2023 is included in Rental home income in the Core Income from

Property Operations on pages 8-9.

- Rental home operations expense is included in Property

operating, maintenance and real estate taxes in the Consolidated

Income from Property Operations on page 7. Rental home operations

expense is included in Insurance and other in the Core Income from

Property Operations on pages 8-9.

- Depreciation on rental homes in our Core portfolio is presented

in Depreciation and amortization in the Consolidated Statements of

Income on page 3.

- Includes occupied rental sites in our Core portfolio.

- Includes both occupied and unoccupied rental homes in our Core

portfolio.

Total Sites

(Unaudited)

Summary of Total Sites as of March 31,

2024

Sites (1)

MH sites

73,000

RV sites:

Annual

34,900

Seasonal

11,800

Transient

16,300

Marina slips

6,900

Membership (2)

26,000

Joint Ventures (3)

3,600

Total

172,500

______________________

- MH sites are generally leased on an annual basis to residents

who own or lease factory-built homes, including manufactured homes.

Annual RV and marina sites are leased on an annual basis to

customers who generally have an RV, factory-built cottage, boat or

other unit placed on the site, including those Northern properties

that are open for the summer season. Seasonal RV and marina sites

are leased to customers generally for one to six months. Transient

RV and marina sites are leased to customers on a short-term

basis.

- Sites primarily utilized by approximately 118,900 members.

Includes approximately 6,100 sites rented on an annual basis.

- Joint ventures have approximately 2,000 annual sites and 1,600

transient sites.

Membership Campgrounds -

Select Data

(Unaudited)

Years Ended December

31,

Quarter Ended March

31,

Campground and Membership Revenue

($ in thousands, unaudited)

2020

2021

2022

2023

2024

Annual membership subscriptions

$

53,085

$

58,251

$

63,215

$

65,379

$

16,215

Annual RV base rental income

$

20,761

$

23,127

$

25,945

$

27,842

$

7,116

Seasonal/Transient RV base rental

income

$

18,126

$

25,562

$

24,316

$

20,996

$

2,823

Membership upgrade sales

$

9,677

$

11,191

$

12,958

$

14,719

$

3,947

Utility and other income

$

2,426

$

2,735

$

2,626

$

2,544

$

361

Membership Count

Total Memberships (1)

116,169

125,149

128,439

121,002

118,885

Paid Membership Origination

20,587

23,923

23,237

20,758

3,883

Promotional Membership Origination

23,542

26,600

28,178

25,232

5,485

Membership Upgrade Sales Volume (2)

3,373

4,863

4,068

3,858

806

Campground Metrics

Membership Campground Count

81

81

82

82

82

Membership Campground RV Site Count

24,800

25,100

25,800

26,000

26,000

Annual Site Count (3)

5,986

6,320

6,390

6,154

6,121

Membership Sales Activity ($ in

thousands, unaudited)

Quarters Ended March

31,

2024

2023

Membership upgrade sales current period,

gross

$

7,543

$

7,975

Membership upgrade sales upfront payments,

deferred, net

(3,596

)

(4,470

)

Membership upgrade sales

$

3,947

$

3,505

Membership sales and marketing, gross

$

(5,713

)

$

(5,517

)

Membership sales commissions, deferred,

net

416

679

Membership sales and marketing

$

(5,297

)

$

(4,838

)

______________________

- Members who have entered into annual subscriptions with us that

entitle them to use certain properties on a continuous basis for up

to 21 days.

- Existing members who have upgraded memberships are eligible for

enhanced benefits, including but not limited to longer stays, the

ability to make earlier reservations, potential discounts on rental

units, and potential access to additional properties. Upgrades

require a non-refundable upfront payment.

- Sites that have been rented by members for an entire year.

Market Capitalization

(In millions, except share and OP Unit data,

unaudited)

Capital Structure as of March 31,

2024

Total Common

Shares/Units

% of Total Common

Shares/Units

Total

% of Total

% of Total Market

Capitalization

Secured Debt

$

3,001

85.6

%

Unsecured Debt

506

14.4

%

Total Debt (1)

$

3,507

100.0

%

21.8

%

Common Shares

186,493,598

95.3

%

OP Units

9,104,654

4.7

%

Total Common Shares and OP Units

195,598,252

100.0

%

Common Stock price at March 31, 2024

$

64.40

Fair Value of Common Shares and OP

Units

$

12,597

100.0

%

Total Equity

$

12,597

100.0

%

78.2

%

Total Market Capitalization

$

16,104

100.0

%

______________________

1. Excludes deferred financing costs of approximately $28.6

million.

Debt Maturity Schedule

Debt Maturity Schedule as of March 31, 2024

(In thousands, unaudited)

Year

Outstanding Debt

Weighted Average Interest

Rate

% of Total Debt

Weighted Average Years to

Maturity

Secured Debt

2024

$

—

—

%

—

%

—

2025

89,757

3.45

%

2.56

%

1.02

2026

—

—

%

—

%

—

2027

—

—

%

—

%

—

2028

200,461

4.19

%

5.72

%

4.45

2029

272,266

4.92

%

7.76

%

5.43

2030

275,385

2.69

%

7.85

%

6.00

2031

248,749

2.46

%

7.09

%

7.14

2032

202,000

2.47

%

5.76

%

8.46

Thereafter

1,712,601

4.07

%

48.83

%

12.86

Total

$

3,001,219

3.77

%

85.57

%

9.85

Unsecured Term Loans

2024

$

—

—

%

—

%

—

2025

—

—

%

—

%

—

2026

300,000

2.20

%

8.56

%

2.08

2027

200,000

4.88

%

5.70

%

2.85

2028

—

—

%

—

%

—

Thereafter

—

—

%

—

%

—

Total

$

500,000

3.27

%

14.26

%

2.39

Total Secured and

Unsecured

$

3,501,219

3.70

%

99.83

%

8.80

Line of Credit Borrowing

(1)

6,000

6.65

%

0.17

%

—

Note Premiums and Unamortized

loan costs

(28,616

)

Total Debt, Net

$

3,478,603

3.89% (2)

100

%

_____________________

- The floating interest rate on the line of credit is daily SOFR

plus 1.25% to 1.65%. During the quarter ended March 31, 2024, the

effective interest rate on the line of credit borrowings was

6.65%.

- Reflects effective interest rate for the quarter ended March

31, 2024, including interest associated with the line of credit and

amortization of deferred financing costs.

Non-GAAP Financial Measures

Definitions and Reconciliations

The following Non-GAAP financial measures definitions have been

revised and do not include adjustments in respect to membership

upgrade sales: (i) FFO; (ii) Normalized FFO; (iii) EBITDAre; (iv)

Adjusted EBITDAre; (v) Property operating revenues; (vi) Property

operating expenses; and (vii) Income from property operations,

excluding property management. For comparability, prior periods’

non-GAAP financial measures have also been updated.

FUNDS FROM OPERATIONS (FFO). We define FFO as net income,

computed in accordance with GAAP, excluding gains or losses from

sales of properties, depreciation and amortization related to real

estate, impairment charges and adjustments to reflect our share of

FFO of unconsolidated joint ventures. Adjustments for

unconsolidated joint ventures are calculated to reflect FFO on the

same basis. We compute FFO in accordance with our interpretation of

standards established by the National Association of Real Estate

Investment Trusts (“NAREIT”), which may not be comparable to FFO

reported by other REITs that do not define the term in accordance

with the current NAREIT definition or that interpret the current

NAREIT definition differently than we do.

We believe FFO, as defined by the Board of Governors of NAREIT,

is generally a measure of performance for an equity REIT. While FFO

is a relevant and widely used measure of operating performance for

equity REITs, it does not represent cash flow from operations or

net income as defined by GAAP, and it should not be considered as

an alternative to these indicators in evaluating liquidity or

operating performance.

NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO). We

define Normalized FFO as FFO excluding non-operating income and

expense items, such as gains and losses from early debt

extinguishment, including prepayment penalties, defeasance costs,

transaction/pursuit costs and other, and other miscellaneous

non-comparable items. Normalized FFO presented herein is not

necessarily comparable to Normalized FFO presented by other real

estate companies due to the fact that not all real estate companies

use the same methodology for computing this amount.

FUNDS AVAILABLE FOR DISTRIBUTION (FAD). We define FAD as

Normalized FFO less non-revenue producing capital expenditures.

We believe that FFO, Normalized FFO and FAD are helpful to

investors as supplemental measures of the performance of an equity

REIT. We believe that by excluding the effect of gains or losses

from sales of properties, depreciation and amortization related to

real estate and impairment charges, which are based on historical

costs and may be of limited relevance in evaluating current

performance, FFO can facilitate comparisons of operating

performance between periods and among other equity REITs. We

further believe that Normalized FFO provides useful information to

investors, analysts and our management because it allows them to

compare our operating performance to the operating performance of

other real estate companies and between periods on a consistent

basis without having to account for differences not related to our

normal operations. For example, we believe that excluding the early

extinguishment of debt and other miscellaneous non-comparable items

from FFO allows investors, analysts and our management to assess

the sustainability of operating performance in future periods

because these costs do not affect the future operations of the

properties. In some cases, we provide information about identified

non-cash components of FFO and Normalized FFO because it allows

investors, analysts and our management to assess the impact of

those items.

INCOME FROM PROPERTY OPERATIONS, EXCLUDING PROPERTY

MANAGEMENT. We define Income from property operations,

excluding property management as rental income, membership

subscriptions and upgrade sales, utility and other income less

property and rental home operating and maintenance expenses, real

estate taxes, membership sales and marketing expenses, excluding

property management expenses. Property management represents the

expenses associated with indirect costs such as off-site payroll

and certain administrative and professional expenses. We believe

exclusion of property management expenses is helpful to investors

and analysts as a measure of the operating results of our

properties, excluding items that are not directly related to the

operation of the properties. For comparative purposes, we present

bad debt expense within Property operating, maintenance and real

estate taxes in the current and prior periods. We believe that this

Non-GAAP financial measure is helpful to investors and analysts as

a measure of the operating results of our properties.

The following table reconciles Net income available for Common

Stockholders to Income from property operations:

Quarters Ended March

31,

(amounts in thousands)

2024

2023

Net income available for Common

Stockholders

$

109,905

$

82,371

Income allocated to non-controlling

interests – Common OP Units

5,366

4,088

Consolidated net income

115,271

86,459

Equity in income of unconsolidated joint

ventures

(283

)

(524

)

Income tax benefit

(239

)

—

(Gain) / Loss on sale of real estate and

impairment, net

—

2,632

Gross revenues from home sales, brokered

resales and ancillary services

(30,053

)

(32,133

)

Interest income

(2,168

)

(2,088

)

Income from other investments, net

(2,038

)

(2,091

)

Property management

19,710

19,464

Depreciation and amortization

51,108

50,502

Cost of home sales, brokered resales and

ancillary services

21,967

23,141

Home selling expenses and ancillary

operating expenses

6,147

6,924

General and administrative

11,989

11,661

Casualty-related charges/(recoveries), net

(1)

(14,843

)

—

Other expenses

1,331

1,468

Interest and related amortization

33,543

32,588

Income from property operations, excluding

property management

211,442

198,003

Property management

(19,710

)

(19,464

)

Income from property operations

$

191,732

$

178,539

EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION

FOR REAL ESTATE (EBITDAre) AND ADJUSTED EBITDAre. We define

EBITDAre as net income or loss excluding interest income and

expense, income taxes, depreciation and amortization, gains or

losses from sales of properties, impairments charges, and

adjustments to reflect our share of EBITDAre of unconsolidated

joint ventures. We compute EBITDAre in accordance with our

interpretation of the standards established by NAREIT, which may

not be comparable to EBITDAre reported by other REITs that do not

define the term in accordance with the current NAREIT definition or

that interpret the current NAREIT definition differently than we

do.

We define Adjusted EBITDAre as EBITDAre excluding non-operating

income and expense items, such as gains and losses from early debt

extinguishment, including prepayment penalties and defeasance

costs, transaction/pursuit costs and other, and other miscellaneous

non-comparable items.

We believe that EBITDAre and Adjusted EBITDAre may be useful to

an investor in evaluating our operating performance and liquidity

because the measures are widely used to measure the operating

performance of an equity REIT.

____________________

- Represents insurance recovery revenue for reimbursement of

capital expenditures related to Hurricane Ian.

The following table reconciles Consolidated net income to

EBITDAre and Adjusted EBITDAre:

Quarters Ended March

31,

(amounts in thousands)

2024

2023

Consolidated net income

$

115,271

$

86,459

Interest income

(2,168

)

(2,088

)

Real estate depreciation and

amortization

51,108

50,502

Other depreciation and amortization

1,318

1,351

Interest and related amortization

33,543

32,588

Income tax benefit

(239

)

—

(Gain)/Loss on sale of real estate and

impairment, net

—

2,632

Adjustments to our share of EBITDAre of

unconsolidated joint ventures

1,880

1,307

EBITDAre

200,713

172,751

Transaction/pursuit costs and other

(1)

383

206

Insurance proceeds due to catastrophic

weather event (2)

(14,843

)

—

Adjusted EBITDAre

$

186,253

$

172,957

CORE. The Core properties include properties we owned and

operated during all of 2023 and 2024. We believe Core is a measure

that is useful to investors for annual comparison as it removes the

fluctuations associated with acquisitions, dispositions and

significant transactions or unique situations.

NON-CORE. The Non-Core properties in 2024 include

properties that were not owned and operated during all of 2023 and

2024, including six properties in Florida impacted by Hurricane Ian

and two properties in California that were impacted by storm and

flooding events. The 2024 guidance reflects Non-Core properties in

2024, which includes properties not owned and operated during all

of 2023 and 2024.

NON-REVENUE PRODUCING IMPROVEMENTS. Represents capital

expenditures that do not directly result in increased revenue or

expense savings and are primarily comprised of common area

improvements, furniture and mechanical improvements.

FIXED CHARGES. Fixed charges consist of interest expense,

amortization of note premiums and debt issuance costs.

______________________

- Prior period amounts have been reclassified to

conform to the current period presentation.

- Represents insurance recovery revenue for reimbursement of

capital expenditures related to Hurricane Ian.

FORWARD-LOOKING NON-GAAP MEASURES. The

following table reconciles Net Income per Common Share - Fully

Diluted guidance to FFO per Common Share and OP Unit - Fully

Diluted guidance and Normalized FFO per Common Share and OP Unit -

Fully diluted guidance:

(Unaudited)

Second Quarter

2024

Full Year

2024

Net income per Common Share

$0.34 to $0.40

$1.83 to $1.93

Depreciation and amortization

0.27

1.08

FFO per Common Share and OP Unit -

Fully Diluted

$0.61 to $0.67

$2.91 to $3.01

Other

$—

$(0.07)

Normalized FFO per Common Share and OP

Unit - Fully Diluted

$0.61 to $0.67

$2.84 to $2.94

This press release includes certain forward-looking information,

including Core and Non-Core Income from property operations,

excluding property management, that is not presented in accordance

with GAAP. In reliance on the exception in Item 10(e)(1)(i)(B) of

Regulation S-K, we do not provide a quantitative reconciliation of

such forward-looking information to the most directly comparable

financial measure calculated and presented in accordance with GAAP,

where we are unable to provide a meaningful or accurate calculation

or estimation of reconciling items and the information is not

available without unreasonable effort. This includes, for example,

(i) scheduled or implemented rate increases on community, resort

and marina sites; (ii) scheduled or implemented rate increases in

annual payments under membership subscriptions; (iii) occupancy

changes; (iv) costs to restore property operations and potential

revenue losses following storms or other unplanned events; and (v)

other nonrecurring/unplanned income or expense items, which may not

be within our control, may vary between periods and cannot be

reasonably predicted. These unavailable reconciling items could

significantly impact our future financial results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240421483510/en/

Paul Seavey (800) 247-5279

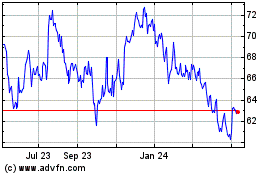

Equity Lifestyle Propert... (NYSE:ELS)

Historical Stock Chart

From Nov 2024 to Nov 2024

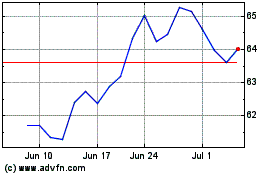

Equity Lifestyle Propert... (NYSE:ELS)

Historical Stock Chart

From Nov 2023 to Nov 2024