- Fourth Quarter and Full-Year Revenues of

$2.28 billion and $8.80 billion, respectively - - Fourth Quarter

Diluted EPS of $1.45, Non-GAAP Diluted EPS of $1.86 - - Full-Year

Diluted EPS of $2.40, Non-GAAP Diluted EPS of $6.40 - - Full-Year

Operating Cash Flow of $806.4 million, 126.7% Increase

Year-over-Year - - Record Remaining Performance Obligations of

$4.59 billion, 13.8% Increase Year-over-Year - - Announces 2021

Revenues and Diluted EPS Guidance -

EMCOR Group, Inc. (NYSE: EME) today reported results for the

fourth quarter and year ended December 31, 2020.

For the fourth quarter of 2020, net income was $79.8 million, or

$1.45 per diluted share, compared to $86.9 million, or $1.54 per

diluted share, for the fourth quarter of 2019. Net income for the

fourth quarter of 2020 was negatively impacted by the tax effect of

the goodwill, identifiable intangible asset, and other long-lived

asset impairment charges recorded in the second quarter of 2020,

primarily related to our U.S. Industrial Services segment.

Excluding this tax effect, non-GAAP net income for the fourth

quarter of 2020 was $102.8 million, or $1.86 per diluted share.

Revenues for the fourth quarter of 2020 totaled $2.28 billion, a

decrease of 5.1%, compared to $2.40 billion for the fourth quarter

of 2019.

Please see the attached tables for a reconciliation of non-GAAP

net income and non-GAAP diluted earnings per share to the

comparable GAAP measures.

Operating income for the fourth quarter of 2020 was $137.6

million, or 6.0% of revenues. This compared to $122.9 million, or

5.1% of revenues, for the fourth quarter of 2019.

Selling, general and administrative expenses for the fourth

quarter of 2020 totaled $244.6 million, or 10.7% of revenues,

compared to $240.9 million, or 10.0% of revenues, for the fourth

quarter of 2019.

The Company's income tax rate for the fourth quarter of 2020 was

41.8%, compared to an income tax rate of 27.8% for the fourth

quarter of 2019. The Company’s tax rate for the fourth quarter of

2020 was impacted by the previously referenced tax effect of the

impairment charges recorded in the second quarter of 2020.

Remaining performance obligations as of December 31, 2020 were

$4.59 billion compared to $4.04 billion as of December 31, 2019.

Total remaining performance obligations grew approximately $558.3

million year-over-year.

Tony Guzzi, Chairman, President and Chief Executive Officer of

EMCOR, commented, “The Company delivered another strong year in

2020 with record full year non-GAAP operating income, non-GAAP

operating margin and non-GAAP diluted earnings per share despite

the challenging operating environment. These results were driven by

exceptional execution for our customers, disciplined cost control,

and innovative solutions that drove increased productivity across

the business. Additionally, our remaining performance obligations

increased 13.8% year-over-year to a record $4.59 billion,

demonstrating the resilient demand for our services across our

geographies and end markets. Finally, our strong operating leverage

and flexibility during the pandemic allowed us to generate record

operating cash flow of $806.4 million, an increase of $450.7

million year-over-year.”

Mr. Guzzi added, “Our robust profitability in the fourth quarter

was anchored by our U.S. Construction segments, posting combined

operating income growth of 30.4% year-over-year. In particular, our

U.S. Mechanical Construction segment delivered exceptional

operating income growth of 45.7% and an operating margin of 10.4%,

up 270 basis points year-over-year, driven by strong performance

across key market sectors including commercial, healthcare, and

institutional. Our U.S. Building Services segment has rebounded

well since the onset of the pandemic and generated revenue and

operating income growth of 5.4% and 15.7%, respectively, in the

fourth quarter, as we partnered closely with our customers to

optimize their systems and improve the safety of their facilities.

While our U.S. Industrial Services segment continues to be impacted

by the effects of the pandemic, we are positioned as a leading

service provider in the industry and we expect to be ready and able

to execute when demand returns, which we anticipate in late 2021.

We are pleased by the strength in our U.K. Building Services

segment, which continues to win in the market despite restrictive

lockdowns, delivering fourth quarter revenue and operating income

growth of 8.9% and 6.7%, respectively.”

Revenues for the 2020 full-year period totaled $8.80 billion, a

decrease of 4.1%, compared to $9.17 billion for the 2019 full-year

period. Net income for the 2020 full-year period was $132.9

million, or $2.40 per diluted share, compared to $325.1 million, or

$5.75 per diluted share, for the 2019 full-year period. Excluding

the previously referenced impairment charges recorded in the second

quarter of 2020 and the related tax effect, non-GAAP net income for

the 2020 full-year period was $354.6 million, or $6.40 per diluted

share.

Operating income for the 2020 full-year period was $256.8

million, or 2.9% of revenues, compared to $460.9 million, or 5.0%

of revenues, for the 2019 full-year period. Excluding the $232.8

million of non-cash impairment charges recorded in the second

quarter of 2020, non-GAAP operating income for the 2020 full-year

period was $489.6 million, or 5.6% of revenues. SG&A totaled

$903.6 million, or 10.3% of revenues, for the 2020 full-year

period, compared to $893.5 million, or 9.7% of revenues, for the

2019 full-year period.

Please see the attached tables for a reconciliation of non-GAAP

operating income, non-GAAP operating margin, non-GAAP net income,

and non-GAAP diluted earnings per share to the comparable GAAP

measures.

Based on project mix, visibility into the coming year, and

assuming a gradual improvement of current market conditions as the

year progresses, EMCOR expects full-year 2021 revenues to be

between $9.2 billion and $9.4 billion, and full-year 2021 diluted

earnings per share in the range of $6.20 to $6.70.

Mr. Guzzi concluded, “Coming off a year where we successfully

navigated unprecedented operating conditions and delivered

outstanding service for our customers, our performance is a

testament to the incredible team we have at EMCOR. I’d like to

extend a sincere thank you to all of our employees and leaders. We

have demonstrated that we can execute for our customers under

difficult circumstances, and the momentum we’re seeing in some key

market sectors, underscored by our robust remaining performance

obligations, makes us optimistic for our prospects in 2021 and

beyond. Moving forward, with our strong balance sheet and

substantial cash on hand, we will continue to execute on our

balanced capital allocation strategy, pursuing both organic growth

investments and strategic acquisition opportunities, while also

returning capital to shareholders through share repurchases and

dividends.”

EMCOR Group, Inc. is a Fortune 500 leader in mechanical and

electrical construction services, industrial and energy

infrastructure and building services. This press release and other

press releases may be viewed at the Company’s website at

www.emcorgroup.com. EMCOR routinely

posts information that may be important to investors in the

“Investor Relations” section of our website at www.emcorgroup.com. Investors and potential

investors are encouraged to consult the EMCOR website regularly for

important information about EMCOR.

EMCOR Group's fourth quarter conference call will be available

live via internet broadcast today, Thursday, February 25, at 10:30

AM Eastern Standard Time. The live call may be accessed through the

Company's website at www.emcorgroup.com.

Forward Looking Statements:

This release contains certain forward-looking statements. Any

such comments speak only as of February 25, 2021 and EMCOR assumes

no obligation to update any such forward-looking statements, unless

required by law. These forward-looking statements may include

statements regarding anticipated future operating and financial

performance, the nature and impact of our remaining performance

obligations, our ability to pursue acquisitions, our ability to

return capital to shareholders, market opportunities, market growth

and customer trends. These forward-looking statements involve risks

and uncertainties that could cause actual results to differ

materially from those anticipated (whether expressly or implied) by

the forward-looking statements. Accordingly, these statements are

no guarantee of future performance. Such risks and uncertainties

include, but are not limited to, adverse effects of general

economic conditions, changes in the political environment, changes

in the specific markets for EMCOR’s services, adverse business

conditions, availability of adequate levels of surety bonding,

increased competition, unfavorable labor productivity, mix of

business, and the impact of the COVID-19 pandemic on our revenue

and operations, including employees, construction activity, and

facilities utilization, and certain of the risk factors associated

with EMCOR’s business discussed in Part I, Item 1A “Risk Factors,”

of the Company’s 2020 Form 10-K, and in other reports filed from

time to time with the Securities and Exchange Commission and

available at www.sec.gov and

www.emcorgroup.com. Such risk factors should be taken into account

in evaluating any forward-looking statements.

Non-GAAP Measures:

This release also includes certain financial measures that were

not prepared in accordance with U.S. generally accepted accounting

principles (GAAP). Reconciliations of those non-GAAP financial

measures to the most directly comparable GAAP financial measures

are included in this release. The Company uses these non-GAAP

measures as key performance indicators for the purpose of

evaluating performance internally. We also believe that these

non-GAAP measures provide investors with useful information with

respect to our ongoing operations. Any non-GAAP financial measures

presented are not, and should not be viewed as, substitutes for

financial measures required by GAAP, have no standardized meaning

prescribed by GAAP and may not be comparable to the calculation of

similar measures of other companies.

EMCOR GROUP, INC.

FINANCIAL HIGHLIGHTS

(In thousands, except share and

per share information)

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

For the three months ended

December 31,

For the twelve months ended

December 31,

2020

2019

2020

2019

Revenues

$

2,281,494

$

2,403,940

$

8,797,061

$

9,174,611

Cost of sales

1,897,643

2,039,193

7,401,679

7,818,743

Gross profit

383,851

364,747

1,395,382

1,355,868

Selling, general and administrative

expenses

244,620

240,917

903,584

893,453

Restructuring expenses

1,609

956

2,214

1,523

Impairment loss on goodwill, identifiable

intangible assets, and other long-lived assets

—

—

232,750

—

Operating income

137,622

122,874

256,834

460,892

Net periodic pension (cost) income

769

366

2,980

1,553

Interest expense, net

(1,406)

(2,824)

(7,488)

(11,556)

Income before income taxes

136,985

120,416

252,326

450,889

Income tax provision

57,204

33,492

119,383

125,749

Net income

$

79,781

$

86,924

$

132,943

$

325,140

Basic earnings per common share:

$

1.45

$

1.54

$

2.41

$

5.78

Diluted earnings per common share:

$

1.45

$

1.54

$

2.40

$

5.75

Weighted average shares of common stock

outstanding:

Basic

54,882,514

56,263,774

55,196,173

56,208,280

Diluted

55,160,893

56,592,654

55,421,271

56,519,281

Dividends declared per common share

$

0.08

$

0.08

$

0.32

$

0.32

EMCOR GROUP, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

December 31,

2020

December 31,

2019

ASSETS

Current assets:

Cash and cash equivalents

$

902,867

$

358,818

Accounts receivable, net

1,922,096

2,030,813

Contract assets

171,956

177,830

Inventories

53,338

40,446

Prepaid expenses and other

70,679

51,976

Total current assets

3,120,936

2,659,883

Property, plant & equipment, net

158,427

156,187

Operating lease right-of-use assets

242,155

245,471

Goodwill

851,783

1,063,911

Identifiable intangible assets, net

582,893

611,444

Other assets

107,646

93,462

Total assets

$

5,063,840

$

4,830,358

LIABILITIES AND EQUITY

Current liabilities:

Current maturities of long-term debt and

finance lease liabilities

$

16,910

$

18,092

Accounts payable

671,886

665,402

Contract liabilities

722,252

623,642

Accrued payroll and benefits

450,955

382,573

Other accrued expenses and liabilities

247,597

195,757

Operating lease liabilities, current

53,632

53,144

Total current liabilities

2,163,232

1,938,610

Borrowings under revolving credit

facility

—

50,000

Long-term debt and finance lease

liabilities

259,619

244,139

Operating lease liabilities, long-term

205,362

204,950

Other long-term obligations

382,383

334,879

Total liabilities

3,010,596

2,772,578

Equity:

Total EMCOR Group, Inc. stockholders’

equity

2,052,668

2,057,134

Noncontrolling interests

576

646

Total equity

2,053,244

2,057,780

Total liabilities and equity

$

5,063,840

$

4,830,358

EMCOR GROUP, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

For the Twelve Months Ended

December 31, 2020 and 2019

(In thousands)

2020

2019

Cash flows - operating activities:

Net income

$

132,943

$

325,140

Depreciation and amortization

46,721

43,945

Amortization of identifiable intangible

assets

59,950

48,142

Deferred income taxes

(36,354)

1,701

Non-cash expense for impairment of

goodwill, identifiable intangible assets, and other long-lived

assets

232,750

—

Non-cash share-based compensation

expense

11,151

11,386

Other reconciling items

4,589

4,286

Changes in operating assets and

liabilities, excluding the effect of businesses acquired

354,616

(78,900)

Net cash provided by operating

activities

806,366

355,700

Cash flows - investing activities:

Payments for acquisitions of businesses,

net of cash acquired

(50,357)

(300,980)

Proceeds from sale or disposal of

property, plant and equipment

3,463

5,487

Purchases of property, plant and

equipment

(47,969)

(48,432)

Investments in and advances to

unconsolidated entities

—

(2,252)

Distributions from unconsolidated

entities

—

838

Net cash used in investing

activities

(94,863)

(345,339)

Cash flows - financing activities:

Proceeds from revolving credit

facility

200,000

50,000

Repayments of revolving credit

facility

(250,000)

(25,000)

Proceeds from long-term debt

300,000

—

Repayments of long-term debt and debt

issuance costs

(286,987)

(15,198)

Repayments of finance lease

liabilities

(4,470)

(4,571)

Dividends paid to stockholders

(17,674)

(17,950)

Repurchases of common stock

(112,553)

—

Taxes paid related to net share

settlements of equity awards

(2,640)

(6,451)

Issuances of common stock under employee

stock purchase plan

6,557

6,090

Payments for contingent consideration

arrangements

(4,070)

(5,917)

Distributions to noncontrolling

interests

(70)

(250)

Net cash used in financing

activities

(171,907)

(19,247)

Effect of exchange rate changes on

cash, cash equivalents, and restricted cash

4,046

2,592

Increase (decrease) in cash, cash

equivalents, and restricted cash

543,642

(6,294)

Cash, cash equivalents, and restricted

cash at beginning of year (1)

359,920

366,214

Cash, cash equivalents, and restricted

cash at end of period (1)

$

903,562

$

359,920

(1)

Includes $0.7 million, $1.1 million, and $2.3 million of

restricted cash classified as “Prepaid expenses and other” in the

Consolidated Balance Sheets as of December 31, 2020, 2019, and

2018, respectively.

EMCOR GROUP, INC.

SEGMENT INFORMATION

(In thousands)

(Unaudited)

For the three months ended

December 31,

2020

2019

Revenues from unrelated

entities:

United States electrical construction and

facilities services

$

493,454

$

564,491

United States mechanical construction and

facilities services

969,433

895,654

United States building services

568,075

538,973

United States industrial services

135,538

299,272

Total United States operations

2,166,500

2,298,390

United Kingdom building services

114,994

105,550

Total operations

$

2,281,494

$

2,403,940

For the twelve months ended

December 31,

2020

2019

Revenues from unrelated

entities:

United States electrical construction and

facilities services

$

1,973,427

$

2,216,600

United States mechanical construction and

facilities services

3,485,495

3,340,337

United States building services

2,110,129

2,106,872

United States industrial services

797,447

1,087,543

Total United States operations

8,366,498

8,751,352

United Kingdom building services

430,563

423,259

Total operations

$

8,797,061

$

9,174,611

EMCOR GROUP, INC.

SEGMENT INFORMATION

(In thousands)

(Unaudited)

For the three months ended

December 31,

2020

2019

Operating income (loss):

United States electrical construction and

facilities services

$

43,355

$

41,304

United States mechanical construction and

facilities services

100,380

68,888

United States building services

28,010

24,219

United States industrial services

(8,212)

13,131

Total United States operations

163,533

147,542

United Kingdom building services

4,218

3,952

Corporate administration

(28,520)

(27,664)

Restructuring expenses

(1,609)

(956)

Total operations

137,622

122,874

Other corporate items:

Net periodic pension (cost) income

769

366

Interest expense, net

(1,406)

(2,824)

Income before income taxes

$

136,985

$

120,416

For the twelve months ended

December 31,

2020

2019

Operating income (loss):

United States electrical construction and

facilities services

$

166,501

$

161,684

United States mechanical construction and

facilities services

292,536

225,040

United States building services

113,431

114,754

United States industrial services

(2,788)

44,340

Total United States operations

569,680

545,818

United Kingdom building services

20,660

18,323

Corporate administration

(98,542)

(101,726)

Restructuring expenses

(2,214)

(1,523)

Impairment loss on goodwill, identifiable

intangible assets, and other long-lived assets

(232,750)

—

Total operations

256,834

460,892

Other corporate items:

Net periodic pension (cost) income

2,980

1,553

Interest expense, net

(7,488)

(11,556)

Income before income taxes

$

252,326

$

450,889

EMCOR GROUP, INC. RECONCILIATION OF

2020 AND 2019 NON-GAAP OPERATING INCOME AND NON-GAAP OPERATING

MARGIN (In thousands) (Unaudited)

In our press release, we provide non-GAAP operating income and

non-GAAP operating margin for the three and twelve months ended

December 31, 2020 and 2019. The following tables provide a

reconciliation between operating income and operating margin

determined on a non-GAAP basis to the most directly comparable GAAP

measures for such periods.

For the three months ended

December 31,

For the twelve months ended

December 31,

2020

2019

2020

2019

GAAP operating income

$

137,622

$

122,874

$

256,834

$

460,892

Impairment loss on goodwill, identifiable

intangible assets, and other long-lived assets

—

—

232,750

—

Non-GAAP operating income

$

137,622

$

122,874

$

489,584

$

460,892

For the three months ended

December 31,

For the twelve months ended

December 31,

2020

2019

2020

2019

GAAP operating margin

6.0

%

5.1

%

2.9

%

5.0

%

Impairment loss on goodwill, identifiable

intangible assets, and other long-lived assets

—

%

—

%

2.6

%

—

%

Non-GAAP operating margin

6.0

%

5.1

%

5.6

%

5.0

%

EMCOR GROUP, INC. RECONCILIATION OF

2020 AND 2019 NON-GAAP NET INCOME (In thousands)

(Unaudited)

In our press release, we provide non-GAAP net income for the

three and twelve months ended December 31, 2020 and 2019. The

following table provides a reconciliation between net income

determined on a non-GAAP basis to the most directly comparable GAAP

measure for such periods.

For the three months ended

December 31,

For the twelve months ended

December 31,

2020

2019

2020

2019

GAAP net income

$

79,781

$

86,924

$

132,943

$

325,140

Impairment loss on goodwill, identifiable

intangible assets, and other long-lived assets

—

—

232,750

—

Tax effect of impairment loss on goodwill,

identifiable intangible assets, and other long-lived assets

22,984

—

(11,105)

—

Non-GAAP net income

$

102,765

$

86,924

$

354,588

$

325,140

EMCOR GROUP, INC. RECONCILIATION OF

2020 AND 2019 NON-GAAP DILUTED EARNINGS PER SHARE

(Unaudited)

In our press release, we provide non-GAAP diluted earnings per

common share for the three and twelve months ended December 31,

2020 and 2019. The following table provides a reconciliation

between diluted earnings per common share determined on a non-GAAP

basis to the most directly comparable GAAP measure for such

periods.

For the three months ended

December 31,

For the twelve months ended

December 31,

2020

2019

2020

2019

GAAP diluted earnings per common share

$

1.45

$

1.54

$

2.40

$

5.75

Impairment loss on goodwill, identifiable

intangible assets, and other long-lived assets

—

—

4.20

—

Tax effect of impairment loss on goodwill,

identifiable intangible assets, and other long-lived assets

0.42

—

(0.20)

—

Non-GAAP diluted earnings per common

share

$

1.86

$

1.54

$

6.40

$

5.75

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210225005206/en/

R. Kevin Matz Executive Vice President Shared Services (203)

849-7938 FTI Consulting, Inc. Investors: Jamie Baird (212)

850-5659

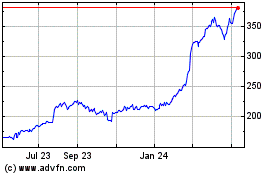

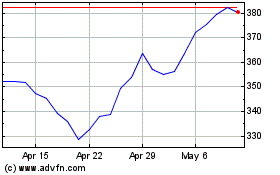

EMCOR (NYSE:EME)

Historical Stock Chart

From Mar 2024 to Apr 2024

EMCOR (NYSE:EME)

Historical Stock Chart

From Apr 2023 to Apr 2024