UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

EDWARDS LIFESCIENCES CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 1-15525 |

| (State or other jurisdiction of incorporation) | (Commission file number) |

| One Edwards Way, Irvine, California | 92614 |

| (Address of principal executive offices) | (Zip code) |

| Arnold A. Pinkston (949) 250-2500 |

| (Name and telephone number, including area code, of the person to contact in connection with this report.) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

| | | | | |

| ☒ | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

| ☐ | Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended ______. |

Section 1—Conflict Minerals Disclosure

Item 1.01—Conflict Minerals Disclosure and Report

A copy of the conflict minerals report is publicly available on Edwards’ website at www.edwards.com under “About Us—Corporate Compliance—Responsible Supply Chain—Supplier Resources” or at https://www.edwards.com/about-us/responsible-supply-chain.

Item 1.02—Exhibit

A copy of the conflict minerals report is attached hereto as Exhibit 1.01 and incorporated herein by this reference.

Section 2—Resource Extraction Issuer Disclosure

Item 2.01—Resource Extraction Issuer Disclosure and Report

Not applicable.

Section 3—Exhibits

Item 3.01—Exhibits

| | | | | |

| Exhibit No. | Description |

| 1.01 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | EDWARDS LIFESCIENCES CORPORATION

|

| | | |

| May 30, 2024 | | | By: | /s/ Arnold A. Pinkston |

| | | | Arnold A. Pinkston |

| | | | Corporate Vice President, General Counsel |

Exhibit 1.01

Edwards Lifesciences Corporation

Conflict Minerals Report

For the Year Ended December 31, 2023

OVERVIEW

Edwards Lifesciences Corporation (“Edwards,” and also referred to as “we,” “us,” or “our”) is the global leader in patient-focused medical innovations for structural heart disease and critical care monitoring.

Sustainability reflects the impact we are having on society and our stakeholders, as well as our unwavering commitment to innovating for patients with unmet needs. Ensuring a sustainable future is core to everything we do at Edwards. This conflict minerals report (this “Report”) relates to the process undertaken for Edwards’ products that were manufactured, or contracted to be manufactured, during 2023 and that contain 3TG. For purposes of this Report, “3TG” is defined as columbite-tantalite (coltan), cassiterite, gold, wolframite, or their derivatives, which are limited to tantalum, tin, and tungsten.

Driven by a passion to help patients, we partner with the world’s leading clinicians and researchers and invest in research and development to transform care for those impacted by structural heart disease or who require hemodynamic monitoring during surgery or in intensive care. A pioneer in the development of heart valve therapies, we are the world's leading manufacturer of heart valve systems and repair products used to replace or repair a patient's diseased or defective heart valve. Our innovative work in heart valves encompasses both surgical and transcatheter therapies for heart valve replacement and repair. In addition, our robust pipeline of future technologies is focused on the less invasive repair or replacement of the mitral and tricuspid valves of the heart, which are more complex and more challenging to treat than the aortic valve. We are also a global leader in hemodynamic and noninvasive brain and tissue oxygenation monitoring systems used to measure a patient's cardiovascular function in the hospital setting.

Our products and technologies are categorized into four mains areas: Transcatheter Aortic Valve Replacement, Transcatheter Mitral and Tricuspid Therapies, Surgical Structural Heart, and Critical Care. We have in-scope products under the Conflict Minerals Rule for 2023, with a large portion sourced primarily for critical care monitors.

MANAGEMENT SYSTEMS

Edwards’ Supplier Code of Conduct provides that Edwards respects the human rights of all workers and will not tolerate any form of human rights or labor abuses in its supply chain. In addition, Edwards seeks to reduce environmental and human health impacts from our use of materials in products, including in connection with the sourcing of 3TG.

Edwards has established management systems in accordance with Step 1 of the Organisation for Economic Co-operation and Development Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, including the Supplement on Tin, Tantalum and Tungsten and the Supplement on Gold (Third Edition) (the “OECD Due Diligence Guidance”).

These systems include the following:

A.Edwards maintains and communicates via our website our policy on conflicts minerals in our supply chain, our Responsible Supply Chain Policy and our Supplier Code of Conduct. Among other things, our Responsible Supply Chain Policy and Supplier Code of Conduct indicate that we are committed to conducting business only with suppliers who adhere to ethical business practices.

•As part of our smelter reasonable country of origin inquiry (“RCOI”), we provide copies of our Conflict Minerals Policy to our suppliers that provide us with components containing 3TG.

•The Conflict Minerals Policy, Responsible Supply Chain Policy, and Supplier Code of Conduct are publicly available on our website at www.edwards.com under “About Us—Corporate Compliance—Responsible Supply Chain—Supplier Resources” or at https://www.edwards.com/about-us/responsible-supply-chain. Information on our website is not part of this Report and is not incorporated by reference herein.

•We expect our suppliers to source responsibly from the Democratic Republic of the Congo and its surrounding region (the “covered countries”), and whenever possible from sources that are listed as “conformant.”

B.Edwards has structured internal management to support supply chain due diligence.

•We have dedicated personnel and funds supporting the operation and monitoring of our 3TG compliance program. Day-to-day operation and oversight of the program rests with our Global Supply Chain Product Stewardship group. In addition, Edwards maintains a cross-functional team, under the auspices of its Corporate Impact Council, which includes senior personnel from different functional areas of our Company, including Corporate Impact, Global Legal, Corporate Strategy, Global Quality, Operations, Supply Chain, and Environmental Health & Safety, to support supply chain due diligence and implementation and monitoring of our conflict minerals program. Executive leadership of our 3TG compliance program rests with our Senior Vice President of Global Supply Chain, a member of our senior management team, and our supply chain findings are reported to the Audit Committee of our Board of Directors.

•We use an external consulting firm to assist with supplier outreach, data validation and smelter analysis. Some of the activities discussed in this report were performed on our behalf by the consulting firm. We also use specialized external counsel to advise on selected aspects of our program.

C.We have established a system of transparency, information collection and control over the supply chain, including the RCOI and due diligence procedures described below. We use the industry-standard Conflict Minerals Reporting Template (“CMRT” or the “Template”) developed by the Responsible Minerals Initiative (the “RMI”) to identify smelters and refiners (which, for brevity, we generally refer to collectively as smelters in this Report) in our supply chain. The CMRT requires suppliers to provide information concerning the usage and source of 3TG in their components, parts and products, as well as information concerning their related compliance efforts. We have procedures to maintain business records relating to 3TG due diligence, including records of due diligence processes, findings and resulting decisions, on a computerized database for at least five years.

D.We periodically provide training to relevant employees on our policies and procedures relating to the sourcing of 3TG.

E.We strengthen our engagement with suppliers, by:

•Directly engaging suppliers during the RCOI process;

•Reviewing supplier responses as part of the RCOI process;

•Engaging in additional outreach to suppliers that identify high-risk smelters in their CMRTs, requesting them to provide product-level 3TG information (i.e., information specific to the 3TG contained in our in-scope products); this is intended to improve the quality of supplier responses and help us to mitigate risk; and

•Engaging with suppliers throughout the year via a part supplier survey allowing suppliers to declare 3TG in their products prior to the annual RCOI campaign.

F.Edwards maintains various grievance mechanisms for stakeholders to report concerns relating to 3TG sourcing.

•We recognize the RMI’s online grievance mechanism as a valid source of smelter- or mine-level grievances.

•A company-wide grievance mechanism is also available, through which our employees, suppliers and other third parties can confidentially report a violation of our policies without fear of retaliation. That grievance mechanism is available here: www.reportlineweb.com/edwards.

•We also maintain an e-mail address (conflict_minerals@edwards.com) for suppliers and employees to ask questions and voice concerns.

REASONABLE COUNTRY OF ORIGIN INQUIRY

For the 2023 reporting period, Edwards conducted two stages of RCOI, supplier and smelter, in accordance with the Conflict Minerals Rule and the OECD Due Diligence Guidance.

Supplier Scoping Process and RCOI

We designed our supplier RCOI process to identify the smelters in our supply chain and to determine whether 3TG in our in-scope products originated in a covered country. This process included the following steps:

•Developing a list of suppliers that provided us with components containing 3TG. As part of materials management, when a new supplier is to be added or a new part is to be purchased, we require the supplier to complete a survey that, among other things, requires it to provide information on the materials content of the parts to be purchased from that supplier. This information also is requested if there is a manufacturing process change, material composition change, supplier location change or change of an indirect or sub-tier supplier. For 2023, our outreach included 48 suppliers that we identified as potentially having provided us with components containing 3TG.

•Contacting each supplier and requesting a CMRT that included its smelter information. We follow up by email or phone with suppliers that do not respond to the request to complete a CMRT within a specified time frame. We have an escalation process under which internal personnel and external consultants that interact with suppliers reach out to non-responsive suppliers. For 2023, 100% of the suppliers responded to our inquiries, which is the same response rate as last year.

•Reviewing supplier responses and CMRTs for accuracy and completeness. We follow up by email or phone with suppliers that submit an incomplete response or a response that we believe contains errors or inaccuracies, in order to improve response quality.

•Aggregating the smelters provided by our suppliers into a single list of smelters meeting the definition of a smelter under one of the industry-recognized audit protocols.

Edwards’ suppliers that provided CMRT responses that we determined were product-level responses identified 68 smelters. Information concerning these smelters is contained on Annex A to this Conflict Minerals Report.

Smelter RCOI

Due to the overlap between the smelter RCOI and smelter due diligence processes, the smelter RCOI process is summarized below in the due diligence section of this Report.

DUE DILIGENCE

Edwards’ due diligence process was designed in accordance with the OECD Due Diligence Guidance.

Smelter RCOI and Due Diligence

Edwards’ smelter RCOI and due diligence process is designed to:

•Identify the scope of the risk assessment of the mineral supply chain; and

•Assess whether the smelters have carried out due diligence for responsible supply chains of minerals from conflict-affected and high risk areas.

Our smelter RCOI and due diligence process included the following steps with respect to each smelter identified:

•We directly engaged with the smelter to determine whether or not the smelter sourced from the covered countries, to the extent this information was not publicly available.

•For smelters that declared directly or through their relevant industry association that they did not source from the covered countries, and were not recognized as conformant by RMI’s Responsible Minerals Assurance Process (the “RMAP”), Edwards reviewed publicly available information to determine if there was any contrary evidence to the smelter’s declaration. The sources reviewed included:

◦A public Internet search of the facility in combination with each of the covered countries; and

◦Specific non-governmental organization publications, including those from Global Witness, Radio Okapi and the UN Group of Experts on the Democratic Republic of the Congo.

•For smelters that did not respond to direct engagement, Edwards reviewed the same publicly available sources to determine if there was any reason to believe that the smelter may have sourced from the covered countries during the reporting period.

•For smelters that sourced from, or there is reason to believe may have sourced from, the covered countries, the smelter is encouraged to be audited and recognized as conformant by the RMAP.

•For smelters that have not been audited and recognized as conformant by the RMAP, Edwards communicated the risk to a designated member of senior management and conducted risk mitigation on the smelter as described under Risk Mitigation below.

RISK MITIGATION

For the 2023 reporting period, all 68 smelters identified by suppliers were recognized as conformant by the RMAP. We did not engage in a risk mitigation process with respect to such smelters.

To the extent that Edwards conducts risk mitigation on smelters identified by suppliers that are not recognized as conformant by the RMAP and are believed to be sourcing from covered countries, we report such risk to our Corporate Vice President, Global Supply Chain, and take the following steps:

•Engage in additional outreach to suppliers that did not respond to our inquiries within the requested time frame, pursuant to our escalation process.

•Conduct additional due diligence to determine if there was any reason to believe the smelter directly or indirectly financed or benefitted armed groups in the covered countries;

•Work with internal stakeholders and relevant suppliers to provide product level information to determine whether 3TG from the specific smelter were actually in Edwards’ supply chain in the 2023 reporting period; and

•Directly engage with smelters to verify risk and to encourage them to be audited and recognized as conformant by the RMAP.

INDEPENDENT THIRD-PARTY AUDITS OF SUPPLY CHAIN DUE DILIGENCE

In connection with our due diligence, we utilized and relied on information made available by the RMAP concerning independent third-party audits of smelters to assess smelter and refiner due diligence and to determine whether the smelter is conformant.

REPORT ON SUPPLY CHAIN DUE DILIGENCE

We file a Form SD and a Conflict Minerals Report with the Securities and Exchange Commission and make them available on our website. We also provide additional information on our 3TG compliance program in our most recent Sustainability Report, which is available on our website.

SMELTERS AND REFINERS

In connection with our RCOI and due diligence processes, our suppliers identified to us the smelters and refiners described on Annex A as having processed the necessary 3TG contained in our in-scope products for 2023, through their submission of CMRTs that we determined were completed at the product level. The 68 smelters and refiners identified by our suppliers at the product level for the 2023 reporting period included 5 gold refiners and 63 tin smelters.

All of the foregoing smelters and refiners identified by our suppliers for the 2023 reporting period have been audited and recognized as conformant by the RMAP.

IMPROVEMENT PLAN

Edwards has taken and will continue to take the following steps to improve the due diligence conducted to further mitigate risk that the necessary 3TG in Edwards’ products could directly or indirectly benefit or finance armed groups in the covered countries:

•Consider whether to further enhance our Conflict Minerals Policy to support responsible sourcing of 3TG by our suppliers and otherwise advance the goals of our 3TG compliance program;

•Include a conflict minerals compliance clause in new and renewing supplier quality agreements;

•Incorporate a conflict minerals compliance clause into the terms and conditions of standard purchase orders;

•Continue to drive our suppliers to obtain current, accurate, and complete information about the smelters in their supply chains;

•Communicate to new potentially in-scope suppliers our sourcing expectations, including through the dissemination of our Conflict Minerals Policy to them;

•Continue to communicate to suppliers that we are committed to responsible sourcing from the covered countries, and that we expect our suppliers to not embargo responsibly sourced 3TG originating from the covered countries;

•Monitor suppliers’ progress toward transitioning to exclusively sourcing from conformant smelters and refiners; and

•Follow up in 2024 through our suppliers on smelters requiring risk mitigation.

ADDITIONAL RISK FACTORS

The statements above are based on the RCOI and due diligence processes performed in good faith by Edwards. These statements are based on the infrastructure and information available at the time. A number of factors could introduce errors or otherwise affect these statements.

These factors include, but are not limited to, gaps in supplier data, gaps in smelter data, errors or omissions by suppliers, errors or omissions by smelters, confusion by suppliers over requirements of the Conflict Minerals Rule, gaps in supplier education and knowledge, timeliness of data, information not discovered during a reasonable search, errors in public data, language barriers and translation, oversights or errors in conformant smelter audits, materials sourced from the covered countries being declared secondary materials, incorrectly tagged conflict minerals from the covered countries being introduced into the supply chain, and smuggling of conflict minerals from the covered countries to other countries.

Annex A

Capitalized terms used and not otherwise defined in this Annex have the meanings set forth in the Conflict Minerals Report of which this Annex is a part.

In connection with our RCOI and due diligence processes, our suppliers identified to us 68 smelters as having processed the necessary 3TG contained in our in-scope products for 2023. The table indicates each of the number of identified and conformant smelters by metal. Please see the notes that accompany the table for additional information concerning the data in the table.

| | | | | | | | | | | |

| Metal | Known Smelters | Conformant Smelters |

| Total | Total | % of Known Smelters |

| Gold | 5 | 5 | 100% |

| Tin | 63 | 63 | 100% |

| Total | 68 | 68 | 100% |

We note the following in connection with the information contained in the foregoing table:

a.The smelters identified by our suppliers as being part of our 2023 supply chain were provided through our suppliers’ submission of product-level CMRTs. Some of our suppliers may have reported to us smelters that were not in our supply chain due to over-inclusiveness in the information received from their suppliers or for other reasons. See “Additional Risk Factors” in the Conflict Minerals Report. In addition, the smelters provided may not be all of the smelters in our 2023 supply chain because: (i) we have not included smelter information that our suppliers reported to us at a “company-level,” meaning that they reported to us the 3TG contained in all of their products, not just the products that they sold to us, or that our suppliers reported to us at a “user-defined” level that was broader than the products that we purchased from the supplier; and (ii) many of our suppliers were unable to identify all of the smelters used to process the necessary 3TG content contained in our in-scope products.

b.Smelter status information in the table is as of March 21, 2024.

c.A smelter is a “Known Smelter” if it is listed on the Smelter Look-up tab list of the CMRT.

d.“Conformant” means that a smelter was listed as RMAP Conformant by the RMI and successfully completed an assessment against the applicable RMAP standard or an equivalent cross-recognized assessment. Included smelters were not necessarily Conformant for all or part of 2023 and may not continue to be Conformant for any future period.

e.Smelter status reflected in the table is based solely on information made publicly available by the RMI, without independent verification by us.

Country of Origin Information

The table below provides information on the smelters included in the table above that are believed to source in whole or in part from a covered country. We are unable to determine specifically the countries of origin of the 3TG in our products. Accordingly, the 3TG in our products may not have originated in a covered country or a particular covered country.

| | | | | | | | | | | |

| Metal | Believed to Source From a Covered Country |

| Total Smelters Sourcing from the Covered Countries | % of Known Smelters | % Conformant |

| Gold | 0 | - | - |

| Tin | 8 | 100% | 100% |

| Total | 8 | 100% | 100% |

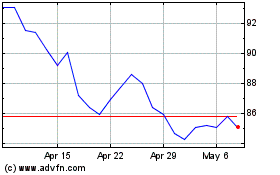

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From May 2024 to Jun 2024

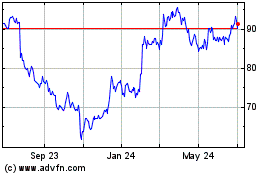

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Jun 2023 to Jun 2024