SCHEDULE

14A

(Rule 14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the

Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, For Use of

the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[X] Definitive Additional Materials

[ ] Soliciting Material Pursuant

to Section 240.14a-12

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

|

Eaton

Vance Floating-Rate 2022 Target Term Trust

Eaton

Vance 2021 Target Term Trust

Eaton

Vance Municipal Income 2028 Term Trust

Eaton

Vance National Municipal Opportunities Trust

Eaton

Vance Tax-Advantaged Global Dividend Income Fund

Eaton

Vance Floating-Rate Income Trust

Eaton

Vance Senior Floating-Rate Trust

Eaton

Vance New York Municipal Income Trust

(Name of

Registrant as Specified in Its Charter)

|

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(Name of

Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check

the appropriate box):

[X] No fee required.

[ ] Fee computed on table below

per Exchange Act Rules 14a-6(i) (1) and 0-11.

(1) Title of each class

of securities to which transaction applies:

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(2) Aggregate number of

securities to which transaction applies:

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(3) Per unit price or other underlying

value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and

state how it was determined):

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(4) Proposed maximum aggregate

value of transaction:

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(5) Total fee paid:

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

[ ] Fee paid previously

with preliminary materials.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

[ ] Check box if any part

of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount previously paid:

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(2) Form, Schedule or Registration

Statement no.:

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(3) Filing Party:

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(4) Date Filed:

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

February 1, 2021

Dear Valued Consultant:

I am pleased to provide this update on the status and

expected timing of the acquisition of Eaton Vance by Morgan Stanley announced on October 8, 2020. As announced, our Eaton Vance

Management, Parametric, Atlanta Capital and Calvert investment affiliates will join Morgan Stanley Investment Management. Since

the transaction announcement, we and Morgan Stanley have been actively engaged in joint business planning to seek to ensure a seamless

transition and to lay the foundation for the premier global investment organization we aspire to create. Over recent months, we

have connected with many of our clients and business partners to share our vision for the combined Eaton Vance and Morgan Stanley

Investment Management, and to request the client consents and fund shareholder approvals that we need to close the transaction.

Morgan Stanley and Eaton Vance expect the transaction

to be completed no later than early in the second quarter. Subject to the satisfaction of customary closing conditions, including

receipt of necessary regulatory approvals and client consents, the transaction could take place as soon as March 1, 2021.

In February, we will be reaching out to separate account clients and fund shareholders to secure the remaining consents and approvals

we need to close the transaction. All of us at Eaton Vance are deeply grateful for your time and attention to this important

matter.

Throughout this transition period, our investment teams

and client representatives have remained singularly focused on providing the high-quality investment management services you have

come to expect from us. Post-transaction, we look forward to continuing to serve you as part of Morgan Stanley Investment Management.

Thank you for your continued support.

Sincerely,

Thomas E. Faust Jr.

Chairman and Chief Executive Officer

Eaton Vance Corp.

©2021 Eaton Vance Corp. | Two International Place, Boston, MA

02110 | 617.482.8260 eatonvance.com 37808

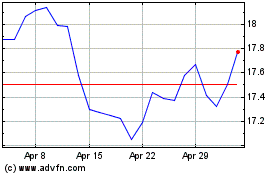

Eaton Vance Tax Advantag... (NYSE:ETG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eaton Vance Tax Advantag... (NYSE:ETG)

Historical Stock Chart

From Apr 2023 to Apr 2024