Evergreen Reports Fourth Quarter 2003 Results; Record Year in

Production, Reserves and Earnings DENVER, Feb. 18

/PRNewswire-FirstCall/ -- EVERGREEN RESOURCES, INC. today reported

fourth quarter 2003 earnings of $17.6 million or 40 cents per

diluted share, which includes an after-tax charge to earnings of

$2.0 million or 5 cents per diluted share, as compared to earnings

of $1.0 million or 3 cents per diluted share in the fourth quarter

of 2002. 2003 was a record year for Evergreen with production of

46.3 billion cubic feet equivalent (Bcfe), proven reserves of 1.495

trillion cubic feet equivalent (Tcfe), oil and gas revenues of

$215.5 million, and net income of $72.6 million or $1.77 per

diluted share. As previously reported, Evergreen completed the

acquisition of Carbon Energy Corporation on October 29, 2003.

Carbon is an independent oil and gas company engaged in the

exploration, development and production of natural gas and crude

oil in the U.S. and Canada. Carbon's areas of operationsin the U.S.

are the Piceance Basin in Colorado and the Uintah Basin in Utah.

Carbon's areas of operations in Canada are primarily in

south-central Alberta. Under the terms of the merger agreement,

Carbon's shareholders received 0.55 shares of Evergreen common

stock for each common share of Carbon. This required Evergreen to

issue approximately 3.5 million new shares of Evergreen common

stock to Carbon's shareholders. The aggregate value of the

transaction was $88.4 million plus the assumption of Carbon's debt

of approximately $20 million. Fourth Quarter Operating Results Oil

and gas sales in 2003's fourth quarter totaled $60.0 million, which

compared to $38.6 million in the fourth quarter of 2002. The

increase in revenues helped generate fourth quarter 2003 earnings

of $17.6 million or 40 cents per diluted share, which compared to

earnings of $1.0 million or 3 cents per diluted share in the fourth

quarter of 2002. Fourth quarter 2002 earnings were affected by a

non-cash, after-tax charge to earnings of $11.2 million, resulting

from the impairment of the company's remaining assets in the United

Kingdom, Northern Ireland and the Republic of Ireland. Average net

sales increased to a record 130.5 million cubic feet equivalent

(MMcfe) per day in the Raton Basin and 13.5 MMcfe per day (in

November and December) from the acquired properties for a total of

12.8 Bcfe in 2003's fourth quarter, up 22% from an average of 113.8

MMcfe per day or a total of 10.5 Bcfe in the corresponding 2002

period. The fourth quarter 2003 production total was comprised of

approximately 12.0 Bcfe from the Raton Basin and about 0.8 Bcfe

from properties acquired during 2003 in the Piceance/Uintah Basins

and in Canada. Evergreen had 973 net wells producing gas from the

Raton Basin at year-end 2003 compared to 837 net gas wells as of

December 31, 2002. Evergreen drilled 24 coal bed methane wells in

the Raton Basin during the fourth quarter, bringing to 160 the

number of wells the company drilled in 2003. With the addition of

185 net producing wells in the Piceance/Uintah Basins and Canada,

Evergreen had a total of 1,158 net producing wells as of December

31, 2003. The company's average price realization of $4.68 per

thousand cubic feet equivalent (Mcfe) in the fourth quarter of 2003

represented a 27% increase from the $3.68-per-Mcfe average in

2002's fourth quarter. Lease operating expenses in the fourth

quarter of 2003 totaled $6.3 million compared to $4.2 million in

2002's fourth quarter. On a per-unit-of-production basis, fourth

quarter 2003 lease operating expenses increased 23% from the

prior-year period to 49 cents per Mcfe from 40 cents per Mcfe. The

increase was due primarily to several scheduled compressor

overhauls in the Raton Basin and higher lease operating expenses

associated with the recently acquired Piceance/Uintah and Canadian

properties. Transportation costs in the fourth quarter of 2003

totaled $3.9 million or 30 cents per Mcfe as compared to $3.2

million or 31 cents per Mcfe inthe fourth quarter of 2002. General

and administrative expenses were $5.0 million in the fourth quarter

as compared to $2.5 million in 2002's fourth quarter. General and

administrative expenses on a per-unit-of-production basis increased

to 39 cents per Mcfe from 24 cents per Mcfe in the fourth quarter

of 2002. The increase was primarily due to year-end bonuses and

profit-sharing contributions, salaries and related benefits,

professional fees, additional office space and additional general

and administrative costs associated with Carbon. Interest expense

was $2.0 million in the fourth quarter of 2003 as compared to $2.2

million in the same period of 2002. The decrease in interest

expense was primarily the result of lower average interest rates.

Depreciation, depletion and amortization expense in the fourth

quarter increased to $8.7 million or 68 cents per Mcfe from $5.4

million or 52 cents per Mcfe in the corresponding 2002 period. The

increase was primarily due to the addition of the proved oil and

gas properties from the Carbon acquisition. Other expenses incurred

during the fourth quarter of 2003 included a charge of $3.1 million

($2.0 million after tax) for the preliminary settlement of a

royalty interest owner lawsuit, which included legal fees and other

related costs. Capital expenditures in the fourth quarter of 2003

were $122.5 million. These capital costs included $8.7 million for

the drilling and completion of 24 Raton Basin wells, $3.9 million

for recompletions and remedial fieldwork and $4.5 million for the

Raton Basin gas collection facilities. A total of $7.2 million was

used for property acquisitions and other items, approximately $3.5

million was used for the Forest City Basin exploration project and

$1.3 million for Alaska. The balance of fourth quarter expenditures

primarily consisted of $86.9 million for the Carbon acquisition,

which included the issuance of approximately $82.2 million in

Evergreen common stock and transaction costs, and $6.5 million for

exploration and development activities on the acquired properties.

Full-year 2003 Operating Results For the year ended December 31,

2003, Evergreen reported record earnings of $72.6 million or $1.77

per diluted share, compared to a net loss of $8.3 million or 22

cents per diluted share in 2002. Net earnings for 2002 included an

after-tax impairment charge of $33.2 million. Oil and gas revenues

in 2003 totaled $215.5 million, nearly double the $111.6 million in

2002. Net sales during 2003 averaged a record 124.5 MMcfe per day

in the Raton Basin and 13.5 MMcfe per day (in November and

December) from the acquired properties for a total of 46.3 Bcfe in

2003, representing a 19% increase over 2002's total of 39.0 Bcfe.

Evergreen's net gas price in 2003 averaged $4.66 per Mcfe, up 63%

from $2.86 per Mcfe in the previous year. Total capital

expenditures for the year ending December 31, 2003 were $247.3

million. These capital costs included: $39.3 million to drill and

complete 160 Raton Basin wells; $21.0 million for other Raton Basin

projects, including remediation work; $35.4 million for the Raton

Basin gas collection facilities; $45.6 million for exploration

projects, consisting of $38.6 million for the Forest City Basin and

$7.0 million for Alaska; and $88.4 million for the Carbon

acquisition, of which $82.2 million was from the issuance of

Evergreen common stock. Of the remaining 2003 expenditures,

approximately $6.5 million was for exploration and development

operations on the acquired Piceance/Uintah and south-central

Alberta, Canada areas and $11.1 million was primarily used for

other property acquisitions and equipment. Revised 2004 Production

Guidance Net gas production from the Raton Basin to date in 2004

has averaged approximately 130 MMcfe per day, or roughly 5% lower

than our previous forecast of between 135 MMcfe and 137 MMcfe of

gas per day. The lower-than- anticipated production is due to a

combination of weather-related and operational issues such as

delays in hooking up new wells to pipelines and gas pipeline

freeze-ups. As a result of extensive compressor maintenance in

December 2003, a number of coal bed methane wells have not yet

returned to their previous production levels. We expect the overall

situation to improve later in the first quarter. From the

Piceance/Uintah Basins and Canada, we had projected daily volumes

to average between 26 MMcfe and 30 MMcfe in the first quarter of

2004. Due to extreme cold weather, there have been delays in

getting a number ofwells connected to pipeline and installing

gathering lines. With these delays, net sales in January from the

Piceance/Uintah Basins and Canada have averaged approximately 14

MMcfe per day. Thus, companywide we are expecting our first quarter

2004 netsales to total between 13.5 Bcfe and 13.9 Bcfe as opposed

to our previous guidance of between 14.7 Bcfe and 15.2 Bcfe.

President and CEO Mark S. Sexton commented, "With the 2004

production revisions, we expect to increase production 37% over

2003 levels. The changes in our production guidance do not affect

our previous guidance for year-end 2004 reserve objectives or our

budgeted capital expenditures. We have had a slower than normal

start in 2004, partly due to operational delays resulting from our

using non-Evergreen contractors on our exploration projects. We are

looking forward to applying our vertically integrated business

model to our new project areas, and we expect 2004 to be another

record year for Evergreen." Modeling Assumptions The following

quarterly estimates are for the year ending December 31, 2004: Q1

Q2 Q3 Q4 Total Wells Drilled Raton Basin 47 64 52 37 200 Forest

City Basin 15 10 20 16 61 Piceance/Uintah Basins 5 15 20 15 55

Canada 3 18 32 12 65 Total Wells Drilled 70 107 124 80 381 Net

sales (Bcfe) Raton Basin 11.9-12.1 12.5-12.7 13.5-13.7 14.1-14.5

52.0-53.0 Forest City Basin 0 0 0 0 0 Piceance/ Uintah Basins

0.7-0.8 0.8-0.9 0.8-1.0 0.9-1.1 3.2-3.8 Canada 0.9-1.0 1.3-1.4

2.3-2.4 2.5-2.7 7.0-7.5 Totals 13.5-13.9 14.6-15.0 16.6-17.1

17.5-18.3 62.2-64.3 Average daily sales (MMcfe) 148-153 160-165

180-186 190-199 170-176 Per Mcfe Lease operating expenses $.57-.59

$.48-.51 $.45-.48 $.45-.48 $.49-.52 Transportation costs $.29-.31

$.29-.31 $.29-.31 $.29-.31 $.29-.31 Depletion and amortization

$.73-.75 $.74-.76 $.79-.81 $.78-.80 $.76-.78 General and

administrative $.29-.31 $.23-.25 $.21-.23 $.20-.22 $.23-.25

Interest expense $.15-.18 $.14-.17 $.14-.17 $.13-.16 $.14-.17

Minority interest $.03-.04 $.02-.03 $.02-.03 $.02-.03 $.02-.03

Production and property taxes are estimated to be approximately 6%

of net gas sales.The income tax rate for 2004 is estimated to be

about 37% of income before income taxes. Q1 Q2 Q3 Q4 Total Capital

Expenditures $41 $81 $59 $39 $220 (in millions) Operations Update

Raton Basin Since the first of the year, Evergreen drilled 16 coal

bed methane wells in the Raton Basin and currently has 50 wells

awaiting completion operations or pipeline hookup. The company

plans to drill up to a total of 200 wells in the Basin during 2004.

Forest City Basin Through year-end 2003, the company had drilled 21

wells. Originally, the company planned to drill 40 wells in the

fourth quarter; however, due to weather-related setbacks and

operational delays, the completion of the 40-well program has been

moved to the first quarter of 2004. The six wells drilled to date

in 2004 bring the total number of Evergreen wells in the Forest

City Basin to 27. Aggregate coal thicknesses have ranged from five

feet to 40 feet per well, and 11 wells are currently in various

stages of production testing. Because of significant delays,

Evergreen is reducing the number of wells that it plans to drill in

2004 to 61 wells. Therefore, the original capital budget for the

Forest City Basin is being reduced by approximately $25 million, to

$33 million. Piceance/Uintah Basins The acquired properties in the

Piceance/Uintah Basins in western Colorado and eastern Utah are

estimated to contain approximately 65 Bcfe of proven reserves, 51%

of which are proved developed. There are currently 124 net wells

producing at a daily net rate of 6.0 MMcfe with another 36 net

wells shut-in and 15 net wells awaiting pipeline hookup. Evergreen

recently completed a property acquisition in the Uintah Basin

increasing the company's total acreage position in the

Piceance/Uintah Basins to approximately 194,000 gross acres. Canada

The acquired properties in south-central Alberta, Canada are

estimated to contain approximately 37 Bcfe of proven reserves, 72%

of which are proved developed. Current daily net production of 10.0

MMcfe is coming from 81 net wells. Another 14 wells are currently

shut-in while four wells are awaiting completion or pipeline

hookup. Evergreen recently completed a property acquisition

increasing its total acreage position in Alberta, Canada to

approximately 164,000 gross acres. Alaska Evergreen is in the

process of drilling five stratigraphic core holes on various parts

of this acreage to obtain additional petrophysical data, including

information on coal quality and gas content. Based on the results

of these core holes, Evergreen will determine potential locations

for additional core holes or multi-well pilots. Capital Budget for

2004 Evergreen's capital budget for 2004 is $220 million. Of this

total, approximately $110 million is expected to be directed to

Evergreen's coal bed methane operations in the Raton Basin, which

includes approximately $34 million for infrastructure, about $47

million for the drilling and completion of 200 wells, approximately

$26 million primarily for recompletions and well equipment, and $2

million for leases and well service equipment. Evergreen plans to

spend $34 million in the Piceance/Uintah Basins, primarily for the

drilling and completion of 55 wells, and $34 million in Alberta,

Canada, primarily for the drilling and completion of 65 wells and

associated infrastructure. Approximately $33 million will be

directed to the Forest City Basin exploration projectand $2 million

will be spent in Alaska. Conference Call Information Evergreen

management will comment on fourth quarter and full-year 2003

financial results tomorrow, Thursday, February 19 at 1:00 p.m.

(Eastern Standard Time). The dial-in number is (888) 452-7103 for

domestic callers and (706) 643-3753 for international callers. The

conference call will also be broadcast live on the Internet at

http://www.evergreengas.com/. A replay of the call will be

available until February 27, 2004 at (800) 642-1687 or (706)

645-9291 for international callers. Please enter the conference ID

5336303. Evergreen Resources is an independent energy company

engaged primarily in the exploration, development, production,

operation and acquisition of unconventional natural gas properties.

Evergreen is one of the leading developers of coal bed methane

reserves in the United States. Evergreen's current operations are

principally focused on developing and expanding its coal bed

methane project located in the Raton Basin in southern Colorado.

Evergreen has also begun coal bed methane projects in Alaska and

eastern Kansas and holds conventional oil and gas producing

property interests in the Piceance Basin of western Colorado, the

Uintah Basin of eastern Utah, and in the Western Sedimentary Basin

of south-central Alberta, Canada. This press release contains

forward-looking statements within the meaning of federal securities

laws, including statements regarding, among other things, the

company's growth strategies; anticipated trends in the company's

business and its future results of operations; market conditions in

the oil and gas industry; the ability of the company to make and

integrate acquisitions; and the impact of government regulations.

These forward-looking statements are based largely on the company's

expectations and are subject to a number of risks and

uncertainties, many of which are beyond the company's control.

Actual results could differ materially from those implied by these

forward-looking statements as a result of, among other things, a

decline in natural gas production, a decline in natural gas prices,

incorrect estimations of required capital expenditures, increases

in the cost of drilling, completion and gas collection, an increase

in the cost of production and operations, an inability to meet

projections, and/or changes in general economic conditions. In

light of these and other risks and uncertainties of which the

company may be unaware or which the company currently deems

immaterial, there can be no assurance that actual results will be

as projected in the forward-looking statements. These and other

risks and uncertainties are described in more detail in the

company's most recent Annual Report on Form 10-K filed with the

Securities and Exchange Commission. Evergreen Resources, Inc. -

Financial Highlights Consolidated Statements of Operations (in

000's except per-share and per Mcfe amounts) Three Months Ended

Year Ended December 31, December 31, 2003 2002 2003 2002

(unaudited) (unaudited) Revenues: Oil and gas revenues $59,976

$38,576 $215,460 $111,550 Interest and other 86 119 980 576 Total

revenues 60,062 38,695 216,440 112,126 Expenses: Lease operating

expenses 6,256 4,205 20,970 16,161 Transportation costs 3,863 3,207

14,486 12,233 Production and property taxes 2,812 2,033 11,096

5,960 Depreciation, depletion and amortization 8,703 5,446 26,913

20,916 General and administrative expenses 4,977 2,502 14,619 9,226

Interest expense 1,989 2,239 8,251 8,345 Minority interest in

subsidiaries 384 16 1,346 4 Impairment of international properties

212 17,376 2,708 51,546 Other expense 3,052 124 532 641 Total

expenses 32,248 37,148 100,921 125,032 Income (loss) before income

taxes and cumulative effect of change in accounting principle

27,814 1,547 115,519 (12,906) Income tax provision: Current 221 --

221 -- Deferred 9,945 549 41,957 (4,582) 10,166 549 42,178 (4,582)

Income (loss) before cumulative effect of change in accounting

principle 17,648 998 73,341 (8,324) Cumulative effect of change in

accounting principle, net of tax -- -- 713 -- Net income (loss)

$17,648 $998 $72,628 $(8,324) Basic income (loss) per common share:

Earnings before cumulative effect of change in accounting principle

$0.42 $0.03 $1.86 $(0.22) Cumulative effect of change in accounting

principle -- -- 0.02 -- $0.42 $0.03 $1.84 $(0.22) Diluted income

(loss) per common share: Earnings before cumulative effect of

change in accounting principle $0.40 $0.03 $1.79 $(0.22) Cumulative

effect of change in accounting principle -- -- 0.02 -- $0.40 $0.03

$1.77 $(0.22) Weighted average shares outstanding: Basic 41,749

38,030 39,446 37,912 Diluted 45,227 39,366 41,312 39,224 Net sales

volume (MMcfe) 12,829 10,470 46,268 38,988 Average daily sales

(MMcfe/d) 139.4 113.8 126.8 106.8 Rate per Mcfe: Average sales

price $4.68 $3.68 $4.66 $2.86 Lease operating expenses $0.49 $0.40

$0.45 $0.41 Transportation costs $0.30 $0.31 $0.31 $0.31 Production

and property taxes $0.22 $0.19 $0.24 $0.15 Depreciation, depletion

and amortization $0.68 $0.52 $0.58 $0.54 General and administrative

expenses $0.39 $0.24 $0.32 $0.24 Interest expense $0.16 $0.21 $0.18

$0.21 Other expenses (includes impairment) $0.25 $1.67 $0.07 $1.34

Minority interest in subsidiaries $0.03 $-- $0.03 $-- Evergreen

Resources, Inc. - Financial Highlights - Continued Condensed

Consolidated Balance Sheets (in 000's) Year Ended December 31, 2003

2002 ASSETS Current: Cash and cash equivalents $3,820 $871 Accounts

receivable 25,708 17,684 Other current assets 2,817 1,384 Total

current assets 32,345 19,939 Property and equipment, at cost, based

on full-cost accounting for oil and gas properties 965,757 654,847

Less accumulated depreciation, depletion and amortization103,119

74,431 Net property and equipment 862,638 580,416 Other assets

10,103 6,406 $905,086 $606,761 LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Accounts payable $4,697 $4,109 Amounts payable

to oil and gas property owners 10,557 5,871 Production and property

taxes payable 9,407 5,731 Derivative instruments 17,821 1,454

Accrued expenses and other 14,214 7,912 Total current liabilities

56,696 25,077 Notes payable 149,373 136,000 Senior convertible

notes 100,000 100,000 Deferred income tax liabilities 92,355 27,666

Production taxes payable and other 6,221 4,328 Asset retirement

obligations 12,876 -- Total liabilities 417,521 293,071 Minority

interest in subsidiaries 4,637 1,262 Stockholders' equity: Common

stock, $0.005 stated value; shares authorized, 100,000; shares

issued and outstanding 42,937 and 38,105 215 190 Additional paid-in

capital 370,352 262,083 Retained earnings 123,099 50,471

Accumulated other comprehensive loss (10,738) (316) Total

stockholders' equity 482,928 312,428 $905,086 $606,761 Evergreen

Resources, Inc. - Financial Highlights - Continued Condensed

Consolidated Statements of Cash Flows (in 000's) Year Ended

December 31, 2003 2002 Operating activities: Net income (loss)

$72,628 $(8,324) Adjustments to reconcile net income (loss) to net

cash provided by operating activities: Deferred income taxes 41,957

(4,582) Depreciation, depletion and amortization 26,913 20,916

Impairment of international properties 2,708 51,546 Other 256 964

Changes in operating assets and liabilities 5,489 (5,126) Netcash

provided by operating activities 149,951 55,394 Investing

activities: Investment in property and equipment (143,981)

(126,617) Proceeds from the sale of investments in affiliated

company 4,877 2,000 Proceeds from the sale of equipment 1,181

10,003 Carbon Energy acquisition transaction costs (6,152) --

Exercise of stock purchase warrants in affiliated company (2,250)

-- Proceeds from sale of investment in common stock 2,780 --

Deposits on property and equipment (5,904) -- Change in other

assets (1,122) (152) Net cash used in investing activities

(150,571) (114,766) Financing activities: Net (payments on)

proceeds from notes payable (6,384) 55,000 Proceeds from issuance

of common stock, net 7,371 2,936 Debt issue costs -- (738) Net

proceeds from minority interest owners 2,582 -- Net cash provided

by financing activities 3,569 57,198 Effect of exchange rate

changes on cash -- 21 Increase (decrease) in cash and cash

equivalents 2,949 (2,153) Cash and cash equivalents,beginning of

year 871 3,024 Cash and cash equivalents, end of year $3,820 $871

DATASOURCE: Evergreen Resources, Inc. CONTACT: John B. Kelso,

Director of Investor Relations of Evergreen Resources, Inc.,

+1-303-298-8100 Web site: http://www.evergreengas.com/

Copyright

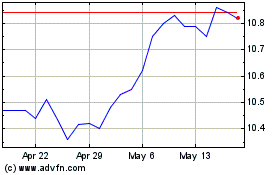

Eaton Vance Short Durati... (NYSE:EVG)

Historical Stock Chart

From Jun 2024 to Jul 2024

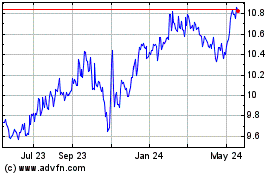

Eaton Vance Short Durati... (NYSE:EVG)

Historical Stock Chart

From Jul 2023 to Jul 2024