GAAP subscription revenue of $131.4 million within Q1 FY25

guidance range

Strong cash flow generation in Q1 FY25

E2open Parent Holdings, Inc. (NYSE: ETWO) (“e2open” or the

“Company”), the connected supply chain SaaS platform with the

largest multi-enterprise network, today announced financial results

for its fiscal first quarter ended May 31, 2024.

“During the fiscal first quarter, e2open continued to make

progress on our multi-quarter plan to return to strong, sustainable

organic growth,” said Andrew Appel, e2open chief executive officer.

“We have successfully put in place a disciplined operational

cadence and a client-centric mindset designed to restore retention

to our normal historical levels. Due to our proactive approach, we

are on track for material improvements in retention metrics through

the end of FY25. We are prioritizing and investing in e2open’s most

important asset – our client relationships – and in Q1, this

enabled us to improve client satisfaction and secure long-term

contract extensions to support future growth. We closed important

new subscription business in Q1, and although we experienced some

temporary deal closure delays, we have already closed a number of

those delayed deals in June. We remain confident in our strong

market position and are moving forward aggressively with our

client-focused growth re-acceleration plan.”

“In Q1 FY25, e2open delivered subscription revenue at the

mid-point of our guidance,” said Marje Armstrong, chief financial

officer of e2open. “Adjusted EBITDA margins remained strong and our

Q1 cash generation was very robust. Our sound underlying business

fundamentals provide important support for the changes we are

making to improve client retention, sales execution, and

implementation excellence. Gaining traction with these changes, we

remain well positioned to build booking and revenue momentum as we

move through the fiscal year.”

Armstrong also noted continued engagement in the strategic

review that e2open announced in March, anticipating its completion

in the near future. “We look forward to being able to share the

outcome of the review with our customers, employees, and

shareholders as soon as appropriate.”

Fiscal First Quarter 2025 Financial

Highlights

- Revenue

- GAAP subscription revenue for the first quarter of 2025

was $131.4 million, a decrease of 2.6% from the year-ago comparable

period and 86.9% of total revenue.

- Total GAAP revenue for the first quarter of 2025 was

$151.2 million, a decrease of 5.6% from the year-ago comparable

period.

- GAAP gross profit for the first quarter of 2025 was

$72.7 million, a decrease of 8.5% from the year-ago comparable

period. Non-GAAP gross profit was $102.6 million, down 7.1%.

- GAAP gross margin for the first quarter of 2025 was

48.1% compared to 49.6% from the year-ago comparable period.

Non-GAAP gross margin was 67.8% compared to 69.0% from the

comparable year-ago period.

- GAAP Net loss for the first quarter of 2025 was $42.8

million compared to $360.9 million from the year-ago comparable

period. Adjusted EBITDA for the first quarter of 2025 was

$50.7 million, a decrease of 5.7% from the year-ago comparable

period. Adjusted EBITDA margin was 33.6% consistent with the

comparable year-ago period.

- GAAP EPS for the first quarter of 2025 was a loss of

$0.13. Adjusted EPS for the first quarter of 2025 was

$0.04.

Recent Business

Highlights

- Selected by one of the world’s largest retailers in a new logo

win for e2open, to provide a global trade program with customs

filing and trade automation solutions in multiple countries to

support their business priorities.

- Expanded business with several major clients including a large,

multi-year renewal with a global technology manufacturer, and a top

multinational manufacturer in the automotive industry that selected

e2open’s Supplier Network Discovery solution to address regulatory

compliance and supply assurance risk.

- Launched Supply Network Discovery, a new solution that helps

clients meet regulatory compliance requirements and strengthen

their supply assurance with capabilities to discover, map, trace,

and assess multiple tiers of suppliers. The e2open Supply Network

Discovery application and its supply collaboration platform help

brand owners and their supply partners share the strategic

information necessary to get components, raw materials, and

products where they are needed most and avoid risk of

disruptions.

- Released quarterly product update 24.2, including the launch of

Supply Network Discovery plus enhancements across the platform

including: updates to customs filing capabilities supporting

modernization initiatives for the US 21st Century Customs Framework

(21CCF), the United Kingdom Customs Declaration System, Germany

ATLAS, Netherlands AES, Italy NCTS and the EU’s ICS2 Import Control

System; sustainability calculation tools to support tariff due

diligence and decision-making considerations to reduce carbon

footprint; upgraded capabilities for shippers to view and take

action on electronic bills of lading via e2open’s ocean booking

platform.

- Recognized customers and partners at annual award program

during international customer conference for supply chain

innovations and transformations that accelerate their business

outcomes, including: JLR for Connected Supply Chain; Sanofi for

Supply Chain Innovator; RS Group for Supply Chain Visibility;

Goikid Consulting for Connected Supply Chain Partner; and Shippeo

for Supply Chain Alliance Partner.

- Achieved interoperability certification on Catena-X, an open

data ecosystem for the automotive industry to support multi-tier

supplier collaboration. E2open is the first supply chain software

provider to be certified outside of founding Catena-X members.

Financial Outlook for Fiscal Year

2025

As of July 10, 2024, e2open is reiterating full year 2025

guidance previously provided on April 29, 2024, and providing

second quarter 2025 guidance as follows:

Fiscal 2025 and Second Quarter GAAP Subscription

Revenue

- GAAP subscription revenue for fiscal 2025 is expected to be in

the range of $532 million to $542 million, reflecting flat growth

year over year at the mid-point.

- GAAP subscription revenue for the fiscal second quarter of 2025

is expected to be in the range of $129 million to $132 million,

reflecting a negative 3.1% organic growth rate at the

mid-point.

Fiscal 2025 Total GAAP Revenue

- Total GAAP revenue for fiscal 2025 is expected to be in the

range of $630 million to $645 million, reflecting a 0.5% organic

growth rate at the mid-point.

Fiscal 2025 Non-GAAP Gross Profit Margin

- Non-GAAP gross profit margin for fiscal 2025 is expected to be

in the range of 68% to 70%.

Fiscal 2025 Adjusted EBITDA

- Adjusted EBITDA for fiscal 2025 is expected to be in the range

of $215 million to $225 million, reflecting an implied adjusted

EBITDA margin in the range of 34% to 35%.

Quarterly Conference

Call

E2open will host a conference call today at 5:00 p.m. ET to

review fiscal first quarter 2025 financial results, in addition to

discussing the Company’s outlook for the full fiscal year 2025. To

access this call, dial 888-506-0062 (domestic) or 973-528-0011

(international). The conference ID is 721473. A live webcast of the

conference call will be accessible in the “Investor Relations”

section of e2open’s website at www.e2open.com. A replay of this

conference call can also be accessed through July 24, 2024, at

877-481-4010 (domestic) or 919-882-2331 (international). The replay

passcode is 50762. An archived webcast of this conference call will

also be available after the completion of the call in the “Investor

Relations” section of the Company’s website at www.e2open.com.

About e2open

E2open is the connected supply chain software platform that

enables the world’s largest companies to transform the way they

make, move, and sell goods and services. With the broadest

cloud-native global platform purpose-built for modern supply

chains, e2open connects more than 480,000 manufacturing, logistics,

channel, and distribution partners as one multi-enterprise network

tracking over 16 billion transactions annually. Our SaaS platform

anticipates disruptions and opportunities to help companies improve

efficiency, reduce waste, and operate sustainably. Moving as one.™

Learn More: www.e2open.com.

E2open and “Moving as one.” are the registered trademarks of

E2open, LLC. All other trademarks, registered trademarks and

service marks are the property of their respective owners.

Non-GAAP Financial

Measures

This press release includes certain financial measures not

presented in accordance with generally accepted accounting

principles (“GAAP”) including non-GAAP revenue, non-GAAP

subscription revenue, non-GAAP professional services and other

revenue, adjusted EBITDA, adjusted EBITDA margin, non-GAAP gross

profit, non-GAAP net income, non-GAAP gross margin, adjusted free

cash flow and adjusted earnings per share. These non-GAAP financial

measures are not a measure of financial performance in accordance

with GAAP and may exclude items that are significant in

understanding and assessing the Company’s financial results.

Therefore, these measures should not be considered in isolation or

as an alternative to net income, cash flows from operations or

other measures of profitability, liquidity, or performance under

GAAP. You should be aware that the Company’s presentation of these

measures may not be comparable to similarly titled measures used by

other companies.

The Company believes this non-GAAP measure of financial results

provides useful information to management and investors regarding

certain financial and business trends relating to the Company’s

financial condition and results of operations. The Company believes

that the use of these non-GAAP financial measures provides an

additional tool for investors to use in evaluating ongoing

operating results and trends in comparing the Company’s financial

measures with other similar companies, many of which present

similar non-GAAP financial measures to investors. These non-GAAP

financial measures are subject to inherent limitations as they

reflect the exercise of judgments by management about which expense

and income are excluded or included in determining these non-GAAP

financial measures.

NOTE: E2open is unable to quantify certain amounts that would be

required to be included in the most directly comparable GAAP

financial measures for non-GAAP gross profit margin or adjusted

EBITDA without unreasonable effort, and therefore no reconciliation

of certain forward-looking non-GAAP financial measures for non-GAAP

gross profit margin or adjusted EBITDA is included.

Safe Harbor Statement

Certain statements in this press release are "forward-looking

statements" within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and are subject to the safe

harbor created thereby. These statements relate to future events or

the Company's future financial performance and involve known and

unknown risks, uncertainties and other factors that may cause the

actual results, levels of activity, performance or achievements of

the Company or its industry to be materially different from those

expressed or implied by any forward-looking statements. In

particular, statements about the Company's expectations, beliefs,

plans, objectives, assumptions, future events or future performance

contained in this press release are forward-looking statements. In

some cases, forward-looking statements can be identified by

terminology such as "may," "will," "could," "would," "should,"

"expect," "plan," "anticipate," "intend," "believe," "estimate,"

"predict," "potential," "outlook," "guidance" or the negative of

those terms or other comparable terminology.

Please see the Company's documents filed or to be filed with the

Securities and Exchange Commission, including the annual report

filed on Form 10-K, and any amendments thereto for a discussion of

certain important risk factors that relate to forward-looking

statements contained in this press release. The Company has based

these forward-looking statements on its current expectations,

assumptions, estimates and projections. While the Company believes

these expectations, assumptions, estimates, and projections are

reasonable, such forward-looking statements are only predictions

and involve known and unknown risks and uncertainties, many of

which are beyond the Company's control. These and other important

factors may cause actual results, performance or achievements to

differ materially from those expressed or implied by these

forward-looking statements. Any forward-looking statements are made

only as of the date hereof, and unless otherwise required by

applicable securities laws, the Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

E2OPEN PARENT HOLDINGS,

INC

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

Three Months Ended May

31,

(In thousands, except per share

amounts)

2024

2023

Revenue

Subscriptions

$

131,404

$

134,903

Professional services and other

19,759

25,217

Total revenue

151,163

160,120

Cost of Revenue

Subscriptions

37,099

36,544

Professional services and other

16,752

19,528

Amortization of acquired intangible

assets

24,652

24,630

Total cost of revenue

78,503

80,702

Gross Profit

72,660

79,418

Operating Expenses

Research and development

24,797

25,866

Sales and marketing

20,996

19,558

General and administrative

23,343

22,125

Acquisition-related expenses

283

389

Amortization of acquired intangible

assets

20,086

20,128

Goodwill impairment

—

410,041

Intangible asset impairment

—

4,000

Total operating expenses

89,505

502,107

Loss from operations

(16,845

)

(422,689

)

Other income (expense)

Interest and other expense, net

(25,373

)

(25,726

)

Loss from change in tax receivable

agreement liability

(3,974

)

(2,460

)

Gain from change in fair value of warrant

liability

3,761

14,680

(Loss) gain from change in fair value of

contingent consideration

(2,280

)

9,000

Total other expense

(27,866

)

(4,506

)

Loss before income tax benefit

(44,711

)

(427,195

)

Income tax benefit

1,923

66,311

Net loss

(42,788

)

(360,884

)

Less: Net loss attributable to

noncontrolling interest

(3,926

)

(35,489

)

Net loss attributable to E2open Parent

Holdings, Inc.

$

(38,862

)

$

(325,395

)

Weighted-average common shares

outstanding:

Basic

306,732

302,502

Diluted

306,732

302,502

Net loss attributable to E2open Parent

Holdings, Inc. common shareholders per share:

Basic

$

(0.13

)

$

(1.08

)

Diluted

$

(0.13

)

$

(1.08

)

E2OPEN PARENT HOLDINGS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands)

May 31, 2024

February 29, 2024

Assets

Cash and cash equivalents

$

160,203

$

134,478

Restricted cash

15,737

14,560

Accounts receivable, net

111,359

161,556

Prepaid expenses and other current

assets

33,072

28,843

Total current assets

320,371

339,437

Goodwill

1,845,209

1,843,477

Intangible assets, net

796,551

841,031

Property and equipment, net

65,638

67,177

Operating lease right-of-use assets

19,629

21,299

Other noncurrent assets

29,669

29,234

Total assets

$

3,077,067

$

3,141,655

Liabilities, Redeemable Share-Based

Awards and Stockholders' Equity

Accounts payable and accrued

liabilities

$

85,112

$

90,594

Channel client deposits payable

15,737

14,560

Deferred revenue

187,197

213,138

Current portion of notes payable

11,277

11,272

Current portion of operating lease

obligations

6,996

7,378

Current portion of financing lease

obligations

1,473

1,448

Income taxes payable

5,748

584

Total current liabilities

313,540

338,974

Long-term deferred revenue

1,615

2,077

Operating lease obligations

15,799

17,372

Financing lease obligations

3,248

3,626

Notes payable

1,036,007

1,037,623

Tax receivable agreement liability

72,394

67,927

Warrant liability

10,952

14,713

Contingent consideration

20,308

18,028

Deferred taxes

49,767

55,586

Other noncurrent liabilities

1,052

602

Total liabilities

1,524,682

1,556,528

Commitments and Contingencies

Redeemable share-based awards

930

—

Stockholders' Equity

Class A common stock

31

31

Class V common stock

—

—

Series B-1 common stock

—

—

Series B-2 common stock

—

—

Additional paid-in capital

3,415,627

3,407,694

Accumulated other comprehensive loss

(44,341

)

(46,835

)

Accumulated deficit

(1,912,565

)

(1,873,703

)

Treasury stock, at cost

(2,473

)

(2,473

)

Total E2open Parent Holdings, Inc.

equity

1,456,279

1,484,714

Noncontrolling interest

95,176

100,413

Total stockholders' equity

1,551,455

1,585,127

Total liabilities, redeemable share-based

awards and stockholders' equity

$

3,077,067

$

3,141,655

E2OPEN PARENT HOLDINGS,

IN

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Three Months Ended May

31,

(In thousands)

2024

2023

Cash flows from operating

activities

Net loss

$

(42,788

)

$

(360,884

)

Adjustments to reconcile net loss to net

cash from operating activities:

Depreciation and amortization

53,605

53,319

Amortization of deferred commissions

2,109

1,344

Provision for credit losses

151

69

Amortization of debt issuance costs

1,320

1,320

Amortization of operating lease

right-of-use assets

1,722

1,946

Share-based compensation

11,787

4,445

Deferred income taxes

(5,972

)

(67,833

)

Right-of-use assets impairment charge

—

362

Goodwill impairment charge

—

410,041

Indefinite-lived intangible asset

impairment charge

—

4,000

Loss from change in tax receivable

agreement liability

3,974

2,460

Gain from change in fair value of warrant

liability

(3,761

)

(14,680

)

Loss (gain) from change in fair value of

contingent consideration

2,280

(9,000

)

Loss (gain) on disposal of property and

equipment

79

(154

)

Changes in operating assets and

liabilities:

Accounts receivable

50,047

48,176

Prepaid expenses and other current

assets

(3,905

)

(1,304

)

Other noncurrent assets

(2,544

)

(1,772

)

Accounts payable and accrued

liabilities

(10,702

)

(12,228

)

Channel client deposits payable

1,177

2,539

Deferred revenue

(26,403

)

(23,401

)

Changes in other liabilities

3,740

(2,306

)

Net cash provided by operating

activities

35,916

36,459

Cash flows from investing

activities

Capital expenditures

(6,084

)

(6,552

)

Net cash used in investing activities

(6,084

)

(6,552

)

Cash flows from financing

activities

Repayments of indebtedness

(2,808

)

(2,741

)

Repayments of financing lease

obligations

(353

)

(223

)

Proceeds from exercise of stock

options

155

—

Net cash used in financing activities

(3,006

)

(2,964

)

Effect of exchange rate changes on cash

and cash equivalents

76

2,105

Net increase in cash, cash equivalents and

restricted cash

26,902

29,048

Cash, cash equivalents and restricted

cash at beginning of period

149,038

104,342

Cash, cash equivalents and restricted

cash at end of period

$

175,940

$

133,390

E2OPEN PARENT HOLDINGS,

INC.

RECONCILIATION OF PRO FORMA

INFORMATION

TABLE I

(in millions)

Q1

Q1

$ Var

% Var

FY2025

FY2024

PRO FORMA REVENUE

RECONCILIATION

Total GAAP Revenue

151.2

160.1

(9.0)

(5.6%)

Constant currency FX impact (1)

0.1

-

0.1

n/m

Total non-GAAP revenue (constant

currency basis) (2)

$151.2

$160.1

($8.9)

(5.6%)

GAAP Subscription Revenue

131.4

134.9

(3.5)

(2.6%)

Constant currency FX impact (1)

-

-

-

n/m

Non-GAAP subscription revenue (constant

currency basis) (2)

$131.4

$134.9

($3.5)

(2.6%)

GAAP Professional Services and other

revenue

19.8

25.2

(5.5)

(21.6%)

Constant currency FX impact (1)

-

-

-

n/m

Non-GAAP professional services and

other revenue (constant currency basis) (2)

$19.8

$25.2

($5.5)

(21.6%)

PRO FORMA GROSS PROFIT

RECONCILIATION

GAAP Gross profit

72.7

79.4

(6.8)

(8.5%)

Depreciation and amortization

28.5

28.6

(0.1)

(0.5%)

Share-based compensation (3)

1.2

0.6

0.6

92.1%

Non-recurring/non-operating costs (4)

0.2

1.7

(1.5)

(88.5%)

Non-GAAP gross profit

$102.6

$110.4

($7.9)

(7.1%)

Non-GAAP Gross Margin %

67.8%

69.0%

Constant currency FX impact (1)

(0.1)

-

(0.1)

n/m

Total non-GAAP gross profit (constant

currency basis) (2)

$102.4

$110.4

($8.0)

(7.2%)

Non-GAAP Gross Margin % (constant currency

basis) (2)

67.7%

69.0%

PRO FORMA ADJUSTED EBITDA

RECONCILIATION

Net loss

(42.8)

(360.9)

318.1

n/m

Interest expense, net

24.7

24.3

0.4

1.8%

Income tax benefit

(1.9)

(66.3)

64.4

(97.1%)

Depreciation and amortization

53.6

53.3

0.3

0.5%

EBITDA

$33.6

($349.6)

$383.2

n/m

Share-based compensation (3)

11.8

4.5

7.3

164.3%

Non-recurring/non-operating costs (4)

2.6

5.3

(2.8)

(52.0%)

Acquisition-related adjustments (5)

0.3

0.4

(0.1)

(28.2%)

Change in tax receivable agreement

liability (6)

4.0

2.5

1.5

61.4%

Change in fair value of warrant liability

(7)

(3.8)

(14.7)

10.9

(74.4%)

Change in fair value of contingent

consideration (8)

2.3

(9.0)

11.3

n/m

Goodwill impairment (9)

-

410.0

(410.0)

n/m

Intangible asset impairment charge

(10)

-

4.0

(4.0)

n/m

Right-of-use assets impairment charge

(11)

-

0.4

(0.4)

n/m

Adjusted EBITDA

$50.7

$53.8

($3.0)

(5.7%)

Adjusted EBITDA Margin %

33.6%

33.6%

Constant currency FX impact (1)

(0.3)

-

(0.3)

n/m

Total adjusted EBITDA (constant

currency basis) (2)

$50.4

$53.8

($3.3)

(6.2%)

Adjusted EBITDA Margin % (constant

currency basis) (2)

33.4%

33.6%

(1) Constant Currency refers to pro-forma

amounts excluding the impact of translating foreign currencies into

U.S. dollars. To calculate foreign currency translation on a

constant currency basis, operating results for the current year

period for entities reporting in currencies other than the U.S.

dollar are translated into U.S. dollars at the exchange rates in

effect during the comparable period of the prior year (rather than

the actual exchange rates in effect during the current year

period).

(2) Constant Currency refers to pro forma

amounts excluding translation and transactional impacts from

foreign currency exchange rates.

(3) Reflects non-cash, long-term

share-based compensation expense.

(4) Primarily includes other non-recurring

expenses such as non-acquisition related severance, foreign

currency transaction gains and losses, systems integrations, legal

entity rationalization, expenses related to retention of key

employees from acquisitions and non-recurring consulting and

advisory fees.

(5) Primarily includes advisory,

consulting, accounting and legal expenses and severance incurred in

connection with mergers and acquisitions activities, including

related valuation, negotiation and integration costs and

capital-raising activities, related to the Business Combination,

acquisitions of BluJay and Logistyx and the strategic review.

(6) Represents the fair value adjustment

at each balance sheet date for the Tax Receivable Agreement along

with the associated interest.

(7) Represents the fair value adjustment

at each balance sheet date of the warrant liability related to our

warrants.

(8) Represents the fair value adjustment

at each balance sheet date of the contingent consideration

liability related to the restricted Series B-1 and B-2 common stock

and Sponsor Side Letter and Series 1 and 2 RCUs. The Series B-1

common stock, Sponsor Side Letter and Series 1 RCUs were

automatically converted into our Class A Common Stock on a

one-to-one basis as of June 8, 2021.

(9) Represents the goodwill impairment

taken in the first quarter of fiscal 2024.

(10) Represents the indefinite-lived

trademark/trade name impairment taken in the first quarter of

fiscal 2024.

(11) Represents the impairment on our

operating lease ROU assets and leasehold improvements due to

vacating certain facilities.

E2OPEN PARENT HOLDINGS,

INC.

RECONCILIATION OF NON-GAAP

EXPENSES

TABLE II

Fiscal First Quarter 2025

(in millions)

GAAP

Non- Recurring(1)

Depreciation &

Amortization

Share-Based

Compensation

Non- GAAP (Adjusted)

% of Revenue

Subscriptions

37.1

(0.0)

(3.6)

(0.7)

32.7

24.9%

Professional services and other

16.8

(0.2)

(0.2)

(0.5)

15.9

80.5%

Amortization of intangibles

24.7

-

(24.7)

0.0

-

Total cost of revenue

$78.5

($0.2)

($28.5)

(1.2)

$48.6

32.2%

Gross Profit

$72.7

$0.2

$28.5

$1.20

$102.5

67.8%

OPERATING COSTS

Research & development

24.8

(0.1)

(4.5)

(1.9)

18.2

12.0%

Sales & marketing

21.0

(0.8)

(0.3)

(1.6)

18.3

12.1%

General & administrative

23.3

(0.8)

(0.2)

(7.1)

15.3

10.1%

Acquisition related expenses

0.3

(0.3)

-

-

-

Amortization of intangibles

20.1

-

(20.1)

-

-

Total operating expenses

$89.5

($2.0)

($25.1)

($10.6)

$51.8

34.3%

(1) Primarily includes other non-recurring

expenses such as non-acquisition related severance, foreign

currency transaction gains and losses, systems integrations, legal

entity rationalization, expenses related to retention of key

employees from acquisitions and non-recurring consulting and

advisory fees.

E2OPEN PARENT HOLDINGS, INC.

RECONCILIATION OF ADJUSTED

EARNINGS PER SHARE

TABLE III

(in millions, except per share

amounts)

Q1 25

GAAP Net loss

(42.8)

Interest expense, net

24.7

Income taxes benefit

(1.9)

Depreciation & amortization

53.6

EBITDA

$33.6

Share-based compensation

11.8

Non-recurring/non-operating costs

2.6

Acquisition-related adjustments

0.3

Change in tax receivable agreement

liability

4.0

Change in fair value of warrant

liability

(3.8)

Change in fair value of contingent

consideration

2.3

Adjusted EBITDA

$50.7

Depreciation

(8.9)

Interest and other expense, net

(24.7)

Normalized income taxes (1)

(4.1)

Adjusted Net Income

$13.0

Adjusted basic shares outstanding

344.4

Adjusted earnings per share

$0.04

(1) Income taxes calculated using 24%

effective rate.

E2OPEN PARENT HOLDINGS,

INC.

ADJUSTED FREE CASH

FLOW

TABLE IV

(in millions)

Q1 25

GAAP operating cash flow

35.9

Add: Non recurring cash payments (1)

4.3

Add: Change in channel client deposits

payable (2)

(1.2)

Adjusted operating cash flow

$39.1

Capital expenditures

(6.1)

Adjusted free cash flow

$33.0

(1) Primarily includes other non-recurring

expenses such as non-acquisition related severance, foreign

currency transaction gains and losses, systems integrations, legal

entity rationalization, expenses related to retention of key

employees from acquisitions and non-recurring consulting and

advisory fees.

(2) Channel Client Deposits Payable

represents client deposits for the incentive payment program

associated with the Company's channel shaping application. The

Company offers services to administer incentive payments to

partners on behalf of the Company’s clients. The Company’s clients

deposit these funds into a restricted cash account with an offset

included as a liability in incentive program payable in the

Consolidated Balance Sheets.

E2OPEN PARENT HOLDINGS,

INC.

CONSOLIDATED CAPITAL

TABLE V

Description

Shares (000's)

Notes

Shares outstanding as of May 31, 2024

307,516

Shares outstanding

Common Units

30,919

Units issued in the Business Combination

that have not been converted from common units to Class A common

stock (Common units are represented by Class V shares).

Series B-2 Shares (unvested)

3,372

Represents the right to acquire shares of

Class A common stock when the 20-day VWAP reaches $15.00 per

share.

Restricted Common Units Series 2

(unvested)

2,628

Represents the right in E2open Holdings,

LLC that converts into common units when the 20-day VWAP reaches

$15.00. Upon conversion to common units, the holders can elect to

convert the common units to Class A common stock.

Adjusted Basic Shares

344,435

Warrants

29,080

Outstanding warrants with an exercise

price of $11.50.

Options (vested/unreleased and

unvested)

6,322

Options issued to management under the

long-term incentive plan.

Restricted Shares (vested/unreleased and

unvested)

16,779

Restricted shares issued to employees,

management and directors under the long-term incentive plan.

Fully Converted Shares

396,616

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240710240699/en/

Investor Contact Dusty Buell

dusty.buell@e2open.com investor.relations@e2open.com

Media Contact 5W PR for

e2open e2open@5wpr.com 718-757-6144

Corporate Contact Kristin

Seigworth VP Communications, e2open kristin.seigworth@e2open.com

pr@e2open.com

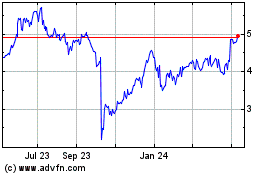

E2open Parent (NYSE:ETWO)

Historical Stock Chart

From Oct 2024 to Nov 2024

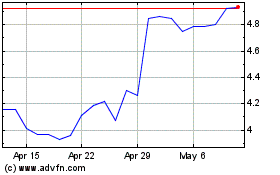

E2open Parent (NYSE:ETWO)

Historical Stock Chart

From Nov 2023 to Nov 2024