false

0001754820

0001754820

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2024

Desktop Metal, Inc.

(Exact name of Registrant as Specified in

Its Charter)

| Delaware |

|

001-38835 |

|

83-2044042 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

63 3rd

Avenue

Burlington,

MA 01803

(Address of principal

executive offices) (Zip Code)

(978)

224-1244

(Registrant’s telephone number, include

area code)

N/A

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2

below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A Common stock, par value $0.0001 per share |

|

DM |

|

The New York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD

Disclosure.

In connection with the planned merger (the

“Merger”) of Desktop Metal, Inc., a Delaware corporation (the “Company”), and Nano U.S. I, Inc., a Delaware

corporation (“Merger Sub”), which is an indirect subsidiary of Nano Dimension Ltd., an Israeli company (“Nano”),

pursuant to the Agreement and Plan of Merger, dated as of July 2, 2024, by and among the Company,

Nano and Merger Sub, the Company made available on its investor relations website a letter to stockholders (the “Tax Guidelines”)

to provide information regarding documentation required in connection with the application of Israeli withholding tax in connection with

the anticipated closing of the Merger. A copy of the Tax Guidelines is attached as Exhibit 99.1 and is incorporated herein by reference.

The Merger is expected to close in the fourth

quarter of 2024, and is subject to customary closing conditions, including required regulatory approvals.

The information contained in this Current

Report on Form 8-K (including the exhibit) is being furnished and shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section.

The information contained in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement

or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in any such filing.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits.

Forward-looking Statements

This report contains forward-looking

statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995

and other Federal securities laws. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates,” and similar expressions or variations of

such words are intended to identify forward-looking statements. Specifically this report includes statements regarding the expected

timing of closing of the Merger. The forward-looking statements contained or implied in this report are subject to other risks and

uncertainties, including (i) the ultimate outcome of the proposed transaction between the Company and Nano, (ii) the

timing of the proposed transaction, (iii) the occurrence of any event, change or other circumstance that could give rise to the

termination of the proposed transaction; (iv) the ability to satisfy closing conditions to the completion of the proposed

transaction, (v) other risks related to the completion of the proposed transaction and actions related thereto, and

(vi) the risks and uncertainties discussed under the heading “Risk Factors” in the Company’s annual report on

Form 10-K filed with the SEC on March 15, 2024, and in any subsequent filings with the SEC, and under the heading

“Risk Factors” in Nano’s annual report on Form 20-F filed with the SEC on March 21, 2024, and in any

subsequent filings with the SEC. Except as otherwise required by law, the Company undertakes no obligation to publicly release any

revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence

of unanticipated events. References and links to websites have been provided as a convenience, and the information contained on such

websites is not incorporated by reference into this report.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

Desktop Metal, Inc. |

| |

|

|

| Date: |

November 8, 2024 |

By: |

/s/ Larry O’Connell |

| |

|

Name: |

Larry O’Connell |

| |

|

Title: |

General Counsel and Corporate Secretary |

Exhibit 99.1

Dear Desktop Metal Stockholder,

In connection with the planned merger of Desktop

Metal, Inc., a Delaware corporation (“Desktop Metal”), and Nano Dimension Ltd., an Israeli company (“Nano”),

Desktop Metal stockholders will be required to provide certain documents to Computershare (the “Exchange Agent”) or

to their broker to avoid the application of Israeli withholding tax (at a rate of approximately 25%) to the Merger Consideration, in

accordance with the terms of (a) the Agreement and Plan of Merger, dated as of July 2, 2024, by and among Desktop Metal and

Nano, among others (the “Agreement”), and (b) the tax ruling issued by the Israeli Tax Authority (the “ITA”)

on September 29, 2024 (the “ITA Tax Ruling”). Capitalized terms not defined herein shall have the meaning ascribed

to them in the Agreement.

At the closing of the merger, Nano will pay the

total Merger Consideration to the Exchange Agent for the merger, Computershare, for distribution to Desktop Metal’s stockholders,

and at the same time, all of Desktop Metal’s outstanding common stock immediately prior to the closing of the merger will be canceled

in exchange for the right to receive the Merger Consideration, in cash, without interest. The ITA Tax Ruling generally provides that the

Merger Consideration paid to a Desktop Metal stockholder who is not an Israeli resident will be exempt from Israeli tax withholding if

certain documents are provided to the Exchange Agent or to your broker.

The purpose of this letter is to give notice to

Desktop Metal stockholders of the documents that will be required by the ITA to avoid Israeli withholding tax on the payment of the Merger

Consideration to you. You will be required to submit the documents described below to the Exchange Agent or to your broker after the closing

of the merger in order to receive payment for your Desktop Metal shares. Other documents not related to Israeli withholding tax may also

be required, and will be requested separately. Instructions on how to submit all required documents will be provided after the closing.

The closing of the merger has not yet occurred,

and Desktop Metal is not requesting any forms or submissions from stockholders at this time. Please do not submit any forms or other

materials to Desktop Metal or its representatives in connection with the merger until requested to do so.

This summary is not applicable to residents of

Israel. This summary is for information purposes only and is not tax or legal advice.

Because some of the documents described

below must be applied for and obtained from a governmental tax authority, Desktop Metal stockholders are urged to consult with their tax

advisors as soon as possible, in advance of the closing.

| I. | Documentary Requirements

Applicable to Desktop Metal Stockholders |

The specific documents you will be required to

provide to avoid Israeli withholding tax will depend on whether you hold your Desktop Metal stock as a stockholder of record on the books

of the Company’s transfer agent (in which case you are a “Registered Holder”) or through a broker in street name

(in which case you are a “Street Name Holder”), what percentage of Desktop Metal stock you own, the amount of Merger

Consideration you are entitled to receive, and whether you are an individual or an entity.

We have included checkboxes for your convenience

– please check the box that applies to you, then review the section below entitled “II. Information Regarding Documents Required

by the ITA” for more information on the specific documentary requirements applicable to you.

After the closing of the merger, you will receive

a Letter of Transmittal from the Exchange Agent, or a communication from your broker, with details on how to submit all required documents.

Registered Holders of Desktop Metal’s

Capital Stock:

| ¨ | Provide

either a Valid Tax Certificate or a Tax Residency Certificate. |

Street Name Holders Holding Less Than 5% of

Desktop Metal’s Capital Stock:

1. If you are

receiving less than $300,000:

| ¨ | Individuals:

Provide a copy of your passport1

and a Tax Declaration. |

| ¨ | Non-Individuals:

Provide a Tax Declaration. |

| 2. | If you are receiving between $300,000

and $500,000: |

| ¨ | Individuals:

Provide either (a) a Valid Tax Certificate or (b) a copy of your passport2,

a Tax Declaration, and a Tax Residency Certificate. |

| ¨ | Non-Individuals:

Provide either (a) a Valid Tax Certificate or (b) a Tax Declaration and

a Tax Residency Certificate. |

| 3. | If you are receiving more than $500,000: |

| ¨ | Provide

a Valid Tax Certificate. |

Street Name Holders Holding 5% or More of

Desktop Metal’s Capital Stock:

| ¨ | Provide

either a Valid Tax Certificate or a Tax Residency Certificate. |

| II. | Information Regarding

Documents Required by the ITA |

As explained in more detail above, you may be

required to provide one or more of the following to the Exchange Agent or to your broker to avoid Israeli withholding tax with respect

to the Merger Consideration.

A “Tax Declaration”

is a declaration for Israeli tax withholding purposes to the effect that you are not an Israeli resident, in the form attached hereto

as Exhibit A.

A “Tax Residency Certificate”

is a certificate issued by the relevant Tax authority in the country in which you reside (in the United States, the Internal Revenue

Service (“IRS”)), confirming that you are considered a tax resident of such country. According to the terms of the

Agreement, a Tax Residency Certificate must be valid in the tax year during which the Merger Consideration is paid to you. However, the

Exchange Agent has informed Desktop Metal that they intend to accept Tax Residency Certificates issued in and with respect to calendar

year 2024 for payment of the Merger Consideration without the application of Israeli withholding tax through June 30, 2025. If

you are a U.S. resident stockholder, please see additional information below regarding the process to obtain a Tax Residency Certificate

from the IRS.

1

If you do not have a passport, provide another certificate that proves residency outside of Israel to the reasonable satisfaction

of the Exchange Agent (e.g., for a United States person, an IRS Form W-9).

2

See prior footnote.

A “Valid Tax Certificate”

is a specific withholding tax certificate (at a zero rate) issued by the ITA. Please see additional information below regarding the process

to obtain a Valid Tax Certificate from the ITA.

Please note that both Tax Residency Certificates

and Valid Tax Certificates are issued by Tax authorities, both with separate application processes, requirements and anticipated response

times, which may significantly delay your ability to provide the applicable documentation to the Exchange Agent or to your broker, which

will be required to obtain the payment of Merger Consideration to you. You are urged to review the documentary requirements summarized

herein with your tax advisor as soon as possible.

Assistance with Obtaining a Valid Tax Certificate

from the ITA

Obtaining a Valid Tax Certificate from the ITA

is a routine procedure, typically requiring two to four weeks from the date of submission. To apply for a Valid Tax Certificate, the following

documents are generally required:

| · | A Tax Declaration; |

| · | A copy of your passport or, in the case of Desktop Metal stockholders who are not natural persons, a certificate

of incorporation; |

| · | A Tax Residency Certificate; and |

| · | Bank account details of the Desktop Metal stockholder. |

Please note that the list above reflects the documents

generally required by the ITA to establish residency outside of Israel. However, the ITA may in certain circumstances be satisfied as

to a stockholder’s residency outside of Israel without one or more of the foregoing (for example, the ITA may determine that a Tax

Residency Certificate is not required following receipt of the other documents). In addition, the ITA may require a stockholder to provide

additional documents to establish residency outside of Israel (for example, if the Desktop Metal stockholder is a legal entity, the ITA

may also request a declaration stating that there are no Israeli residents among the holders of rights in such entity or that Israeli

residents hold less than 25% of such rights, and a list of all such entity holders).

Desktop Metal stockholders considering applying

for a Valid Tax Certificate are urged to consult with their tax advisors. Shibolet & Co. (“Shibolet”), Desktop

Metal’s Israeli legal counsel, may be able to assist any Desktop Metal stockholder in the process of obtaining a Valid Tax Certificate

from the ITA (subject to specific engagement terms with the stockholder being responsible for Shibolet’s fees, and conflict of

interest clearance).

Procedure for Obtaining a Tax Residency Certificate

for United States Resident Stockholders

IRS Form 6166 (Certification of United States

Tax Residency) is a letter printed on U.S. Department of Treasury stationery certifying that the individuals or entities listed are residents

of the United States for purposes of the income tax laws of the United States. The IRS procedure for requesting an IRS Form 6166

is the submission of IRS Form 8802 (Application for United States Residency Certification).

The instructions to IRS Form 8802 recommend

that you mail your application, including full payment of the user fee (in general, fee is $85 per form for an individual and $185 per

form for entities), at least 45 days before the date you need to submit IRS Form 6166. The IRS will contact you after 30 days if

there will be a delay in processing your application. You can call the IRS at 267-941-1000 (not a toll-free number) and select the U.S.

residency option if you have questions regarding your application.

The certification period is generally one year.

You can request certification for both the current year and any number of prior years. The IRS generally will not accept an early submission

for an IRS Form 6166 for calendar year 2025 that has a postmark date before December 1, 2024.

This discussion is for information purposes only

and is not tax or legal advice. You may be subject to different rules in light of your particular circumstances. In completing IRS

Form 8802, Desktop Metal stockholders are urged to review the instructions to IRS Form 8802 and consult with their tax advisors.

Procedures for Delivering Tax Documents

If you are a Registered Holder, you will receive

a Letter of Transmittal from the Exchange Agent, which will set forth the procedures to submit the applicable tax documents described

above to the Exchange Agent, following the closing of the merger. If you are a Street Name Holder, you will receive instructions from

your broker following the closing of the merger.

| Contact Information |

| |

| IBI Capital (Israeli Exchange Agent): |

Mr. Tzvika Bernstein

Managing Partner

IBI Capital

Mobile +972 50 6209410

Tel: +972 3 5190365

Email: Tzvika@102trust.com

|

| Shibolet & Co. |

4 Yitzhak Sadeh St.

Tel Aviv 6777504

Israel

E-mail: l.aviram@shibolet.com,maya@shibolet.com, and i.atrash@shibolet.com

Attention: Lior Aviram, Maya Koubi Bara-nes, and Ibrahim Atrash |

The foregoing relates only to Israeli withholding

tax. Stockholders may be required to submit other documentation (including IRS Form W-8 or W-9) to avoid U.S. income tax withholding

that could apply to the Merger Consideration. Further information will be provided to Registered Holders by the Exchange Agent, and to

Street Name Holders by their brokers, as soon as possible after the closing of the merger.

Exhibit A

Tax Declaration

'א חפסנ

DECLARATION OF STATUS FOR ISRAELI INCOME TAX PURPOSES

You are receiving this form of “Declaration

of Status For Israeli Income Tax Purposes” as a holder of shares of common stock of Desktop Metal Inc (the “Shares”),

a company organized under the laws of the State of Delaware (the “Company”), in connection with the merger between

the Company and Nano US I, Inc. a company organized under the laws of the State of Delaware (“NANO US”) and an

indirect wholly-owned subsidiary of Nano Dimension LTD , a company organized under the laws of the State of Israel (the “Parent”),

pursuant to the terms and conditions of that certain Agreement and Plan of Merger, dated as of July 2nd

2024, by and between the Company, NANO US and the Parent (the “Merger”).

By completing this form in a manner that would

substantiate your eligibility for an exemption from Israeli withholding tax, you will allow Parent, Parent’s paying agents, your

broker or any other withholding agent, or their authorized representatives to exempt you from Israeli withholding tax.

This form is relevant only if you certify that

(A) you are NOT a “resident of Israel” (as defined under Section 1 of the Israeli Income Tax Ordinance [New Version],

5721-1961 (the “Ordinance”) for purposes of the Ordinance, (B) you acquired your Shares on or after the Company’s

initial public offering/listing on Nasdaq (i.e., on or after 10.12.2020 ), (C) you are the beneficial owner (directly or indirectly)

of less than 5% of the Company’s issued and outstanding Shares,

For clarity, this form is NOT relevant if you

are a registered shareholder (i.e., you hold Shares as a record holder in the Company’s share register), if your Shares are subject

to tax under Section 102 of the Ordinance, or if your consideration exceeds US$500,000.

Please note that

in addition to completing this declaration, you are required to provide (i) if you are an individual, a copy of your valid non-Israeli

passport (or, if you do not have a non-Israeli passport, an IRS Form W-9 or a valid government-issued identification card); and

(ii) if your consideration exceeds US$300,000 (but does not exceed US$ 500,000) or if you are a citizen of Israel, also a tax residency

certificate from the applicable tax authority in your country of residence.

| PART I |

|

Identification and details of Shareholder (including Eligible Israeli Brokers) (see instructions) |

|

|

| |

|

|

|

|

| 1. Name: |

|

2. Type of Shareholder (more than one box may be

applicable): |

|

| |

|

|

|

|

|

| |

|

(please print full name) |

¨ |

Corporation (or Limited |

¨ |

Bank |

|

| |

|

|

Liability Company) |

¨ |

Broker |

|

| |

|

¨ |

Individual |

¨ |

Other Financial |

|

| |

|

¨ |

Trust |

|

Institution |

|

| |

|

¨ |

Partnership |

|

|

|

| |

|

¨ |

Other: |

|

|

|

| |

|

|

|

|

| 3. For individuals only: |

4. For all other Shareholders: |

|

|

|

| |

|

|

|

| Date of birth: |

______/_____/______ |

Country of incorporation or organization: |

|

| month / day / year |

|

|

|

|

|

| |

|

|

| Country of residence: |

Registration number of entity (if applicable): |

|

| |

|

|

|

|

|

| Countries of citizenship (name all citizenships): |

|

|

|

|

|

| |

|

|

|

|

| Taxpayer Identification or |

Country of residence: |

|

|

|

| Social Security No. (if applicable): |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| 5. Permanent Address (house number, street, apartment number, city, state, zip or postal code, country): |

|

| 6.

Mailing Address (if different from above): |

7.

Contact Details: |

| |

Name: |

| |

Capacity: |

| |

Telephone Number (country

code, area code and number): |

| |

|

| 8. | I

hold the Shares of the Company (mark X in the appropriate place): |

| ¨ | directly,

as a registered holder |

| ¨ | through

a Broker. If you marked this box, please state the name of your Broker: _____________________ |

| ¨ | I

am a bank, broker or financial institution that is a “resident of Israel” |

| 9. | I

am the beneficial owner (directly or indirectly) of less than 5% of the Company’s issued

shares. |

Yes ¨ No ¨

| PART II |

Declaration

by Non-Israeli Residents (see instructions) ▶ |

| Eligible

Israeli Brokers should not complete this Part II |

A. To be completed only by Individuals.

I hereby declare that: (if the statement is correct, mark X in the following box)

| A.1 ¨ |

I am NOT, and since the date of purchase / receipt of my Shares

and until the date of the Merger was not, a “resident of Israel” for tax purposes, as defined under the Ordinance (regardless

of the application of any double tax treaty), which means, among other things, that: |

| · | The

State of Israel is not my permanent place of residence; |

| · | The

State of Israel is neither my place of residence nor that of my family; |

| · | The

ordinary or permanent place of my business and financial activity is NOT in the State of

Israel, and I do NOT have a permanent establishment in the State of Israel; |

| · | I

do NOT engage in an occupation in the State of Israel; |

| · | I

do NOT own business or part of a business in the State of Israel; |

| · | I

am NOT covered by the Israeli National Insurance Institution; |

| · | I

was NOT present (nor am I planning to be present) in Israel for 183 days or more during this

tax year; and |

| · | I

was NOT present (nor am I planning to be present) in Israel for 30 days or more during this

tax year, and the total period of my presence in Israel during this tax year and the two

previous tax years is less than 425 days in total. |

| · | I

was NOT present in Israel more than 75 days in any year since the date of the purchase of

the Shares and until the date of the Merger. |

| A.2 ¨ |

I acquired the Shares on or after the initial public offering/listing

of the Company on NASDAQ on 10.12.2020, and while the Shares were listed for trade and was not an Israeli resident when I acquired the

Shares. |

| A.3 ¨

|

My consideration does not exceed US$300,000. |

| A.4 ¨

|

My consideration exceeds US$300,000 but does not exceed US$500,000. |

| A.5 ¨

|

I did not purchase/ receive my Shares from a Relative nor were

they subject to Part E2 of the Ordinance (Israeli tax-free reorganization). |

B. To be completed by corporations

(except partnerships and trusts). I hereby declare that: (if correct, mark X in the following box)

| B.1 ¨

|

The corporation is NOT and since the date of purchase / receipt

of its Shares and until the date of the Merger was not, a “resident of Israel”

for tax purposes, as defined under the Ordinance, which means, among other things, that: |

| · | The

corporation is NOT registered with the Registrar of Companies in Israel; |

| · | The

corporation is NOT registered with the Registrar of “Amutot” (non-profit organizations)

in Israel; |

| · | The

control of the corporation is NOT situated in Israel; |

| · | The

management of the corporation is NOT located in Israel; |

| · | The

corporation does NOT have a permanent establishment in Israel; and |

| · | NO

Israeli resident holds, directly or indirectly via shares or through a trust or in any other

manner or "with another" or with others that are Israeli residents, 25.0% or more

of any “means of control” in the corporation as specified below: |

| o | The right to participate in

profits; |

| o | The right to appoint a director; |

| o | The right to share in the assets

of the corporation at the time of its liquidation; and |

| o | The right to direct the manner

of exercising one of the rights specified above. |

| B.2 ¨

|

The corporation acquired the Shares on or after the initial

public offering/listing of the Company on NASDAQ on 10.12.2020 on, and while the Shares were listed for trade and was not an Israeli

resident when it acquired the Shares. |

| B.3 ¨

|

The corporation’s consideration does not exceed US$300,000. |

| B.4 ¨

|

The corporation’s consideration exceeds US$300,000 but

does not exceed US$500,000. |

| B.5 ¨

|

The corporation's Shares were not subject to Part E2 of

the Ordinance (Israeli tax-free reorganization). |

C. To be completed by Partnerships.

I hereby declare that: (if correct, mark X in the following box)

| C.1 ¨

|

The partnership is NOT, and since the date of purchase / receipt

of its Shares and until the date of the Merger was not, a “resident of Israel”

for tax purposes, as defined under the Ordinance, which means, among other things, that: |

| · | The

partnership is NOT registered with the Registrar of Partnerships in Israel; |

| · | The

control of the partnership is NOT situated in Israel; |

| · | The

management of the partnership is NOT located in Israel; |

| · | The

partnership does NOT have a permanent establishment in Israel; |

| · | NO

Israeli resident holds, directly or indirectly via shares or through a trust or in any other

manner or "with another" or with others that are Israeli residents, 25.0% or more

of any right in the partnership or, of the right to direct the manner of exercising any of

the rights in the partnership; and |

| · | NO

partner in the partnership is an Israeli resident; |

| C.2 ¨

|

The partnership acquired the Shares on or after the initial

public offering/listing of the Company on NASDAQ on 10.12.2020, and while the Shares were listed for trade and was not an Israeli resident

when it acquired the Shares. |

| C.3 ¨

|

The partnership’s consideration does not exceed US$300,000. |

| C.4 ¨ |

The partnership’s consideration exceeds US$300,000 but does not

exceed US$500,000 |

| C.5 ¨

|

The partnership's Shares were not subject to Part E2 of

the Ordinance (Israeli tax-free reorganization). |

D. To be completed by Trusts. I

hereby declare that: (if correct, mark X in the following box)

| D.1 ¨

|

The trust is NOT, and since the date of purchase / receipt

of its Shares and until the dated of the Merger was not , a “resident of Israel” for tax purposes, as defined under the Ordinance,

which means, among other things, that: |

| · | The

trust is NOT registered in Israel; |

| · | NONE

of the settlors of the trust are Israeli residents; |

| · | The

trust does NOT have a permanent establishment in Israel; |

| · | NONE

of the beneficiaries of the trust are Israeli residents; and |

| · | The

trustee of the trust is NOT an Israeli resident. |

| D.2 ¨

|

The trust acquired the Shares on or after the initial public

offering/listing of the Company on NASDAQ on 10.12.2020, and while the Shares were listed for trade and was not an Israeli resident when

it acquired the Shares. |

| D.3 ¨

|

The trust’s consideration does not exceed US$300,000. |

| D.4 ¨

|

The trust’s consideration exceeds US$300,000 but does

not exceed US$500,000. |

| D.5 ¨

|

The Shares were not subject to Part E2 of the Ordinance

(Israeli tax-free reorganization). |

| PART III |

Declaration

by Israeli Bank, Broker or Financial Institution (see instructions) ► |

| |

Non-Israeli

Residents should not complete this Part III |

| |

|

I hereby declare that: (if correct,

mark X in the following box)

| ¨ | I

am a bank, broker or financial institution that is a “resident of Israel” within

the meaning of that term in Section 1 of the Ordinance, I am holding the Shares

solely on behalf of beneficial holder(s) and I am subject to the provisions of the Ordinance

and the regulations promulgated thereunder relating to the withholding of Israeli tax, including

with respect to the cash payment (if any) made by me to such beneficial holder(s) with

respect to Shares in connection with the Merger. |

| PART IV |

Certification.

By signing this form, I also declare that: |

|

| | | |

| · | I

understood this form and completed it correctly and pursuant to the instructions. |

| · | I

provided accurate, full and complete details in this form. |

| · | I

am aware that providing false details constitutes a criminal offense. |

| · | I

am aware that this form may be provided to the Israel Tax Authority, in case the Israel Tax

Authority so requests, for purposes of an audit or otherwise. |

| SIGN

HERE ► |

______________________________ |

_____________________ |

_________________________________ |

|

| |

|

|

|

| |

Signature

of Shareholder |

Date |

Capacity

in which acting |

|

| |

|

|

(or individual

authorized to sign on your behalf) |

|

Number of Shares: ______________

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

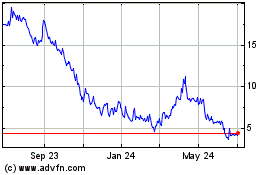

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Nov 2024 to Dec 2024

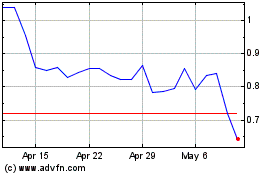

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Dec 2023 to Dec 2024