By Heather Haddon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 30, 2020).

The drive-through, a nearly 90-year-old American invention, may

be fast-food restaurants' best shot at surviving the coronavirus

lockdown.

Even those companies that have the drive-through option say they

will still likely endure hundreds of millions of dollars in sales

losses in the coming months after officials across the country have

banned dine-in eating to try to curb the spread of the new

coronavirus.

Yet drive-through is one of the few ways to reach customers in

nearly every U.S. state, along with carryout and delivery. Big

chains such as McDonald's Corp., Restaurant Brands International

Inc.'s Burger King and Yum Brands Inc.'s KFC that already make up

to 70% of sales at the drive-through are better positioned to

weather the crisis.

Customers can order food in a drive-through without coming into

close contact with a server or entering a dining room, minimizing

exposure to the virus.

Matt Harris, a 33-year-old assistant professor from Kansas City,

Mo., said drive-through seems like one of the safest options to get

food right now. He has noticed the lines of cars pulling up to

drive-through chains in his area has lightened, but they are far

busier than the local Olive Garden and Red Lobster.

"The lack of traffic feels almost post-apocalyptic," Mr. Harris

said.

Some companies with drive-throughs are retooling their

operations as they shift nearly all of their business there.

Drive-throughs now account for around 90% of U.S. sales at

Wendy's Co., compared with about two-thirds before the pandemic.

The Dublin, Ohio-based chain is redirecting the cash it had planned

to use for a new national breakfast offering to franchisees and

promotions for drive-through and delivery instead.

Some franchisees of restaurant chains with drive-throughs are

slapping up signs, and companies are sending out tweets to let

skittish customers know they are open for business and safe to

patronize. They are trying to maintain drive-through-service times

while having crews practice social distancing. Yum's Taco Bell is

featuring its drive-through workers in promotional campaigns.

The basics of the drive-through are largely unchanged from their

early 20th-century origins in the U.S. But some of the bigger

chains, including McDonald's and Burger King, have each spent tens

of millions of dollars in recent years to equip their

drive-throughs with digital menu boards because many consumers

still prefer ordering from their cars to dining in or the newer

phenomenon of delivery.

McDonald's, in a television ad that made its debut last week,

said: "We'll be taking your order in the drive-through.... Just

like we have for the last 65 years, we can still be here to take

your order."

Fast-food-delivery sales are growing but are still small

compared with the amount customers spend on carryout and

drive-through, which are more familiar to many diners and don't

come with added fees. Consumers spent $83 billion in drive-throughs

in the year through February, compared to less than $20 billion for

restaurant delivery, according to industry firm the NPD Group.

McDonald's, which introduced its first drive-through in Arizona

in 1975, was already making around 70% of its sales in the U.S. to

customers ordering from their cars before the coronavirus crisis

erupted. In the past year it has tried to cut drive-through times

via investments such as speed-of-service timers and by paring down

its menu. Now, the company is temporarily removing items from its

menus and suspending all-day breakfast to further simplify

operations.

Even at the drive-through, business is weaker as consumers stay

home. Franchisees for McDonald's, Burger King, KFC, Taco Bell and

Restaurant Brands International's Popeyes Louisiana Kitchen, said

their customer traffic was 10% to 30% lower in the past week. Many

owners said they were closing stores early and reducing staff hours

because of sales declines.

McDonald's increased its cash balance to $4.5 billion after

borrowing another $1 billion earlier this week, and Yum, also the

parent company of Pizza Hut, drew down $525 million from its credit

line. Yum said it expects the virus to depress its same-store sales

by the mid- toGo high-single digits in its current quarter, and

more so in the next period.

"No one is going to make money at this time," said David Barr,

owner of 30 KFC and Taco Bell locations across three southeastern

states.

Restaurants without drive-throughs, particularly casual-dining

chains, face the most serious threat to their existence.

Some dine-in chains, such as Texas Roadhouse Inc., are setting

up improvised drive-throughs to try to keep up some business.

Others, including Olive Garden-owner Darden Restaurants Inc. and

Applebee's parent-company Dine Brands Global Inc., are drawing down

on credit lines, while casual-dining chains Cheesecake Factory Inc.

and J. Alexander's Holdings Inc. have furloughed thousands of

workers because of plunging dine-in traffic since the virus

hit.

Ed Doherty, owner of 150 restaurants that include Applebee's and

Panera locations, said his total sales plummeted at his New Jersey

and New York restaurants by around 85% after the dine-in bans

rolled out. Little of his sales before the coronavirus came from

takeout.

"There was absolutely no sales," said Mr. Doherty, who said he

has laid off 7,000 of his 8,000 employees.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

March 30, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

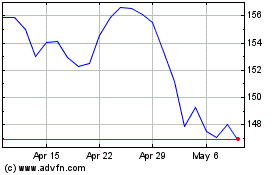

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Feb 2025 to Mar 2025

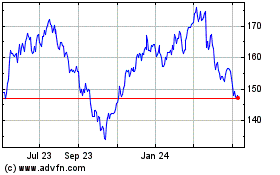

Darden Restaurants (NYSE:DRI)

Historical Stock Chart

From Mar 2024 to Mar 2025