United States Securities and Exchange Commission

Washington, DC 20549

NOTICE OF EXEMPT SOLICITATION

NAME OF REGISTRANT: CNX Resources

Corporation (CNX)

NAME OF PERSONS RELYING ON EXEMPTION: Proxy

Impact

ADDRESS OF PERSON RELYING ON EXEMPTION: 5011

Esmond, Richmond, CA 94805

WRITTEN MATERIALS: The attached written

materials are submitted pursuant to Rule 14a-6(g)(1) (the “Rule”) promulgated under the Securities Exchange Act of 1934. Submission

is not required of this filer under the terms of the Rule, but is made voluntarily in the interest of public disclosure and consideration

of these important issues.

Dear CNX shareholders,

In 25 years of engaging with corporations I have never had to write

a letter like this.

I am writing because CNX Resources

Corporation (“CNX” or the “Company”) has provided false and misleading information and omitted crucial details

in at least 17 DEF 14a filings — regarding the climate lobbying shareholder proposal filed by Proxy Impact (the “Representative”)

on behalf of Handlery Hotels (the “Proponent”), and that this is a violation of the SEC’s anti-fraud rule (Rule 14a-9).

I realize that most of you have already voted, but this information

may make you reconsider your vote - especially if you followed Glass Lewis’ recommendation – or at least will make you aware

of egregious behavior by the Company.

Much of this relates to Mr. Deluliis repeated, false allegations that

the Proponent was unwilling to meet and engage with CNX. For example, on March 27, 2023, Mr. Deluliis claimed that the Proponent “submi[tted]

the proposal and then purposely evad[ed]” the Company in violation of “ethical and professional duties.”1

And on April 17, 2023, Mr. Deluliis claimed that “[d]espite numerous attempts at outreach . . . [the Proponent] refuse[s] to engage.”2

These statements came despite fact that the Representative provided

CNX with five potential call dates between December 14, 2022 and April 25, 2023 and an offer to speak “at a

mutually convenient time.” These dates were offered in the Proponent’s initial submission in November 2022 as well as in a

subsequent communication on April 7, 2023 (see Exhibit A). The Company did not respond to these offers to engage. Instead, Mr. Deluliis

resorted to vitriol including, notably, an often-used Twitter hashtag (#HandleryHeist) suggesting that the Proponent was engaged in improper

activity.

In addition to being false and misleading, and omitting material facts,

Mr. Deluliis, whose tone is often inflammatory, impugns the Proponent and its Representative’s character, personal reputation, and

integrity without factual foundation (a violation of Rule 14a-9). As demonstrated in multiple DEF 14A filings3 (also see examples

in Exhibit B): These include:

| · | Falsely accuse the Proponent of refusing to engage with the Company while omitting that the Proponent offered multiple meeting times

and days that were not accepted by the Company; |

| · | Claim, without any factual basis, that the Proposal is an abuse of the shareholder proposal process; and |

| · | Accuse, without any factual basis, the Proponent and the Representative of filing the resolution for financial gain and/or media attention. |

_____________________________

1 https://otp.tools.investis.com/clients/us/cnx-resources/SEC/sec-show.aspx?FilingId=16518155&Cik=0001070412&Type=PDF&hasPdf=1

2 https://otp.tools.investis.com/clients/us/cnx-resources/SEC/sec-show.aspx?FilingId=16566009&Cik=0001070412&Type=PDF&hasPdf=1

3 https://investors.cnx.com/sec-filings

(related tweets begin with 3/28/23)

These misstatements and omissions are not minor quibbles about wording

or interpretations as to which reasonable people might differ. Rather, the Company made false and misleading statements and omitted information

that has proven to be material. The Company’s extensive repetition of these claims in its

DEF 14a filings, on the Company website, on an earnings call and on the Company and Mr. Deluliis’ social media are likely to have

a significant impact on the upcoming resolution vote as evidenced by the fact that, in April, proxy advisory service Glass Lewis acted

on this information and released what we believe to be an unprecedented recommendation against the Proposal, citing the Company’s

misrepresentations about proponent’s actions— and not the substance of the proposal — as the main reason for its

recommendation:

Glass

Lewis recommendation on CNX climate lobbying proposal #5

“The

Company has provided some level of disclosure concerning how its lobbying is aligned with the Paris Agreement; and in this instance, it

is not clear that the proponent or its agent has worked in good faith to engage in a dialogue with the Company prior to this proposal

going to a vote, thus, we are not of the view that shareholders should support this resolution at this time.

“RECOMMENDATION

We recognize the Company has provided some level of disclosure concerning how its lobbying efforts are aligned with that of the Paris

Agreement. Although we believe that additional details concerning this assessment would better allow shareholders to understand how it

is lobbying on climate-related matters, we have significant concerns with the proponent of this proposal and believe that support for

this resolution is not warranted on that basis.”

(See

Exhibit C)

The Glass Lewis recommendation was sent to thousands of its subscribers.

While Glass Lewis’ lack of due diligence in researching this recommendation is shocking (neither the Proponent or Representative

were contacted for comment before making such an accusatory recommendation based on their alleged behavior) – it was based on misleading

and omitted information and spurious accusations that have been aggressively promoted by Mr. Deluliis in extensive outreach to investors.

We agree with Glass Lewis that

egregious acts of bad faith should be a factor in recommendations, but there is enough public information available to show that Glass

Lewis targeted the wrong bad actor.

To date:

The Proponent has filed a climate

lobbying resolution, successfully defended itself against a frivolous No Action letter,4 filed an exempt solicitation focused

strictly on the merits of the resolution,5 and has not made public posts or remarks and has even refused media inquires.

The Company, by contrast, has

refused five proposed call dates for dialogue, filed a frivolous No Action letter (based on Charles Schwab’s use of a digital signature

in a proof of ownership letter), made public several letters from the CEO to Proponent that uses inflammatory language and makes false

allegations (to which Mr. Deluliis seems surprised – and enraged - when the Proponent does not respond to these), and extensively

repeats these false claims and publicly trolls the Proponent and Representative’s business operations, motives and integrity on

social media, the Company’s website, on an earnings call, and in filing an extraordinary number of exempt solicitations (because

apparently Mr. Deluliis’ tweets are considered important material information for shareholders).

_____________________________

4

https://www.sec.gov/divisions/corpfin/cf-noaction/14a-8/2023/handlerycnx031623-14a8.pdf

5 https://otp.tools.investis.com/clients/us/cnx-resources/SEC/sec-show.aspx?FilingId=16561974&Cik=0001070412&Type=PDF&hasPdf=1

What Mr. Deluliis has not done

is to provide the information requested in the resolution.

The Company’s report6

– consisting of a graphic with two columns asking a Yes or No question lags far behind the standards expected by investors7

and that provided by other companies.

Mr. Deluliis’ statements on behalf of CNX go far beyond the normal

vigorous arguments companies make against shareholder proposals. They blatantly misrepresent the Proponent’s willingness to engage

and provide inaccurate information to shareholders about the Proponent and the Representative’s actions, character, and motivations.

In both substance and tone, these spurious accusations are unworthy of inclusion in a public company’s proxy solicitation statements.

Nor are they worthy of a Company’s shareholders who expect a CEO to act in a professional manner and provide accurate information.

Michael Passoff

Proxy Impact

_____________________________

6 https://www.cnx.com/cnx/media/Pdf/CNX-Lobbying_Trade-Assoc.pdf

7

https://climate-lobbying.com/wp-content/uploads/2022/03/2022_global-standard-responsible-climate-lobbying_APPENDIX.pdf

EXHIBIT

A

Proponent’s offers to speak with CNX:

November 2022 – April 2023

Handlery Hotels offered to speak with the company in a letter on November

16, 2022

“The Shareholder is available for a meeting with the

Company regarding this shareholder proposal. The dates/times will be provided by Proxy Impact.”

Proxy Impact, Handlery Hotels authorized representative, forwarded

that letter to the Company on November 22, 2022, along with proposed call dates.

“Handlery Hotels and/or Proxy Impact will be available

to speak with the Company via teleconference between 1:00 p.m. - 2:00 p.m. Eastern time on either Wednesday, December 14, or Wednesday,

December 21, 2022. Alternatively, we would be happy to arrange for a call to discuss our proposal at a mutually convenient time.”

The Company did not respond.

The Representative responded affirmatively to a request from CNX to

have a call and he provided three dates for a call.

The Company did not respond.

EXHIBIT B

Examples of CNX CEO Deluliis’ misrepresentations,

false claims and spurious accusations to Proxy Service Advisors, Investors and the Public

March 29, 2023, Excerpt from letters from CEO Deluliis to Glass Lewis

and ISS

April 21, 2023, Excerpt from letter from CEO Deluliis to ISS

April 27, 2023, CEO Deluliis’ Comments on CNX Earnings Call

March 28, 2023, Social Media Post by CEO Deluliis

EXHIBIT C

Excerpts from Glass Lewis recommendation Against CNX Climate Lobbying

Shareholder Proposal #5

Based on the misleading information provided by CNX Resources, Glass

Lewis made the following recommendation:

8

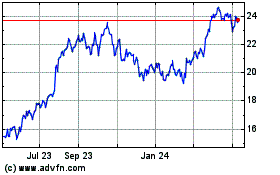

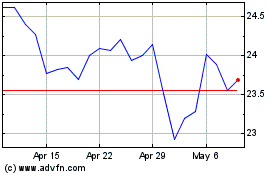

CNX Resources (NYSE:CNX)

Historical Stock Chart

From Jun 2024 to Jul 2024

CNX Resources (NYSE:CNX)

Historical Stock Chart

From Jul 2023 to Jul 2024