0000021175falseCommon Stock, Par value $2.50"CNA"00000211752024-06-052024-06-050000021175exch:XNYS2024-06-052024-06-050000021175exch:XCHI2024-06-052024-06-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 5, 2024

CNA FINANCIAL CORPORATION

| | |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 1-5823 | | 36-6169860 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

151 N. Franklin

Chicago, IL 60606

(Address of principal executive offices) (Zip Code)

(312) 822-5000

(Registrant's telephone number, including area code)

| | |

| NOT APPLICABLE |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, Par value $2.50 | | "CNA" | | New York Stock Exchange |

| | | | Chicago Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02(b) Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 5, 2024, the Registrant issued a press release announcing that, following the end of his current term in the role of Chief Executive Officer and Chairman of the Board of Directors of the Registrant on December 31, 2024, Dino E. Robusto will transition to a new role with the Registrant. Mr. Robusto was appointed Executive Chairman of the Board of Directors of the Registrant effective January 1, 2025 and will remain employed by the Registrant in such role, serving as Executive Chairman of the Board and a strategic advisor to the Chief Executive Officer for a term of one year, ending on December 31, 2025. The press release is filed as Exhibit 99.1 to this Form 8-K.

ITEM 5.02(c) Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 5, 2024, the Registrant issued a press release announcing that Douglas M. Worman, Executive Vice President and Global Head of Underwriting of the Registrant, was appointed President and Chief Executive Officer of the Registrant, effective January 1, 2025. The press release is filed as Exhibit 99.1 to this Form 8-K. The terms of Mr. Worman’s employment agreement are included in Item 5.02(e) and incorporated herein by reference. In addition, Mr. Worman is expected to become a member of the Board of Directors of the Registrant in connection with his appointment as President and Chief Executive Officer.

ITEM 5.02(e) Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 5, 2024, the Registrant entered into a new Employment Agreement with Dino E. Robusto (the “Robusto Employment Agreement”) with respect to his appointment as Executive Chairman of the Registrant, which Agreement provides for a term beginning on January 1, 2025 and ending on December 31, 2025. The Robusto Employment Agreement provides for an annual salary of $6 million and a bonus for 2025, based upon Mr. Robusto’s performance as Executive Chairman, as determined by the Compensation Committee of Registrant’s Board of Directors, of up to a maximum of $2 million, payable in cash.

The Robusto Employment Agreement also provides for standard executive health and welfare benefits and continued vesting of equity awards, as well as potential termination payments upon separation from Registrant. The potential termination payments include full 2025 salary, pro-rated 2025 maximum bonus and continued vesting of equity awards upon termination without cause by the Registrant or termination for good reason by Mr. Robusto. For a period of 24 months following termination under the Robusto Employment Agreement, Mr. Robusto is subject to non-competition, non-solicitation and non-interference restrictive covenants. In the event that Mr. Robusto’s employment is terminated on or prior to December 31, 2024, the terms of his current employment agreement shall apply.

On June 5, 2024, the Registrant entered into an Employment Agreement with Douglas M. Worman (the “Worman Employment Agreement”), with respect to his appointment as President and Chief Executive Officer of the Registrant, which Agreement provides for a term beginning on January 1, 2025 and ending on December 31, 2028. The Worman Employment Agreement provides for an annual salary of $1.1 million and an annual cash incentive award, as determined by the Compensation Committee of Registrant’s Board of Directors, with an annual target award of $4 million and an annual maximum payout of $6 million. Mr. Worman will also be eligible for long-term incentive equity awards, in accordance with Registrant’s Amended and Restated Incentive Compensation Plan effective January 1, 2020, with an annual target value of $5 million.

The Worman Employment Agreement also provides for standard executive health and welfare benefits, as well as potential termination payments upon separation from Registrant under certain circumstances. The potential termination payments include a pro-rated annual cash incentive award and continued vesting of equity awards upon termination without cause by the Registrant or termination for good reason by Mr. Worman, plus termination payments at an annual rate equal to annual salary and target annual cash incentive award, payable in at least monthly installments for the remainder of the employment term, but in any event not less than one year post-termination. For a period of 24 months following termination under the Worman Employment Agreement, Mr. Worman is subject to non-competition, non-solicitation and non-interference restrictive covenants. In the event that Mr. Worman’s employment is terminated on or prior to December 31, 2024, the Worman Employment Agreement shall be null and void, except that certain restrictive covenants in the agreement, including those that are summarized above, shall apply in the event his employment is terminated for cause by the Registrant or without good reason by Mr. Worman.

Mr. Worman, 57, has served as Executive Vice President and Global Head of Underwriting of the Registrant since 2022 and joined the Registrant in March 2017 as Executive Vice President & Chief Underwriting Officer. Prior to joining the Registrant, Mr. Worman served as CEO of Endurance U.S. Insurance; Executive Vice President of Alterra Capital Holdings, a Stone Point Capital company; CEO of Alterra US Insurance; and President & CEO of AIG Excess Casualty Group, formerly known as American Home. Mr. Worman is a graduate of The Pennsylvania State University.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits:

See Exhibit Index.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Press Release, dated June 5, 2024 |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | CNA Financial Corporation |

| | (Registrant) |

| | |

| Date: June 5, 2024 | By | /s/ Susan A. Stone |

| | (Signature) |

| | Susan A. Stone

Executive Vice President and General Counsel |

FOR IMMEDIATE RELEASE

CNA Financial Corporation Announces Executive Leadership Transition

CHICAGO, June 5, 2024 -- CNA Financial Corporation (NYSE: CNA) announced today that Executive Vice President & Global Head of Underwriting Doug Worman will become President and Chief Executive Officer of the company as of January 1, 2025. At that time, Dino E. Robusto, the current Chairman and CEO, will transition to the role of Executive Chairman of CNA’s Board of Directors. In this role, Robusto will lead the board as well as serve as a strategic advisor to Worman in pursuit of the company’s objectives.

“We are extremely thankful to Dino who over the past 8 years has worked tirelessly to lead the company to record levels of profitability and top quartile underwriting performance. We are delighted that he will continue to advise CNA as Executive Chairman. As we look to the future, we know that Doug is a dynamic and proven leader with a clear vision for the company,” said James S. Tisch, a member of CNA's board of directors and the CEO of Loews Corporation, CNA's largest shareholder.

“Doug is an exceptional underwriting executive and has strengthened and solidified CNA’s underwriting culture and profitability,” said Robusto. “Along with the board, I am confident in Doug’s ability to lead CNA forward. He builds excellent organizational talent, skillfully cultivates broker relationships, and drives innovation to deliver industry-leading products and services for business customers.”

“I am honored to take on the CEO role, building upon Dino’s success in optimizing CNA’s strategic underwriting direction,” added Worman. “My goal is to continue elevating CNA as a preeminent P&C insurer.”

Worman joined CNA in March 2017 as Executive Vice President & Chief Underwriting Officer. He was instrumental in building CNA product organizations and business units as well as spearheading the company’s Global Underwriting Committee, leading to his current position of Global Head of Underwriting in 2022. He is currently responsible for the oversight, strategy and underwriting direction of CNA's Property & Casualty operations worldwide.

Prior to joining CNA, Worman served as CEO of Endurance U.S. Insurance; Executive Vice President of Alterra Capital Holdings, a Stone Point Capital company; and CEO of Alterra US Insurance. He began his insurance career as an underwriter at AIG, where he worked his way up through various underwriting and management positions, eventually serving as President & CEO of AIG Excess Casualty Group, formerly known as American Home. Worman is a graduate of The Pennsylvania State University.

About CNA

CNA is one of the largest U.S. commercial property and casualty insurance companies. Backed by more than 125 years of experience, CNA provides a broad range of standard and specialized insurance products and services for businesses and professionals in the U.S., Canada and Europe. For more information, please visit CNA at www.cna.com.

Follow CNA (NYSE: CNA) on: X | LinkedIn | YouTube

# # #

Press Contacts

CNA Newsroom

newsroom@cna.com

312-822-5167

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

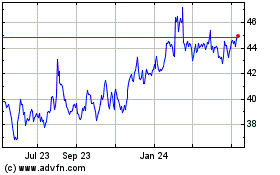

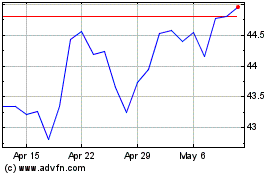

CNA Financial (NYSE:CNA)

Historical Stock Chart

From Dec 2024 to Jan 2025

CNA Financial (NYSE:CNA)

Historical Stock Chart

From Jan 2024 to Jan 2025