UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

| | | | | |

☒ | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to ________________

Commission File Number 001 – 32205

| | | | | |

A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

CBRE 401 (k) PLAN

| | | | | |

B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

CBRE Group, Inc.

2121 North Pearl Street, Suite 300

Dallas, Texas 75201

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | Note: All other supplemental schedules have been omitted because they are not applicable or are not required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974, as amended. | |

| | | |

| EXHIBITS: | |

| | | |

| | | |

Report of Independent Registered Public Accounting Firm

To the Plan Participants and Plan Administrator

CBRE 401(k) Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of CBRE 401(k) Plan (the Plan) as of December 31, 2023 and 2022, the related statements of changes in net assets available for benefits for the years ended December 31, 2023 and 2022, and the related notes (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the years ended December 31, 2023 and 2022, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Accompanying Supplemental Information

The Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2023 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ KPMG LLP

We have served as the Plan’s auditor since 2008.

Austin, Texas

June 20, 2024

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

AS OF DECEMBER 31, 2023 AND 2022

| | | | | | | | | | | |

| 2023 | | 2022 |

| ASSETS: | | | |

| Participant-directed investments - at fair value | $ | 3,651,161,798 | | $ | 2,994,027,588 |

| | | |

| | | |

| Notes receivable from participants | 41,097,568 | | 34,022,563 |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total Assets | 3,692,259,366 | | 3,028,050,151 |

| | | |

| LIABILITIES: | | | |

| Accrued liabilities | 47,683 | | 116,815 |

| Total Liabilities | 47,683 | | 116,815 |

| | | |

| NET ASSETS AVAILABLE FOR BENEFITS | $ | 3,692,211,683 | | $ | 3,027,933,336 |

See accompanying notes to the financial statements.

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

YEARS ENDED DECEMBER 31, 2023 AND 2022

| | | | | | | | | | | |

| | 2023 | | 2022 |

| ADDITIONS: | | | |

| Contributions: | | | |

| Employee deferral contributions | $ | 298,701,333 | | $ | 276,981,489 |

| Employer contributions | 108,347,536 | | 98,241,603 |

| Rollover contributions | 58,831,114 | | 50,871,971 |

| Total contributions | 465,879,983 | | 426,095,063 |

| | | |

| Investment income (loss): | | | |

| Net appreciation (depreciation) in fair value of investments | 499,926,276 | | (658,063,670) |

| Dividend and interest income | 62,598,521 | | 66,264,759 |

| Net investment income (loss) | 562,524,797 | | (591,798,911) |

| | | |

| Interest income on notes receivable from participants | 2,483,378 | | 1,835,028 |

| Total additions, net | 1,030,888,158 | | (163,868,820) |

| | | |

| DEDUCTIONS: | | | |

| Benefits paid to participants | 365,265,203 | | 262,583,172 |

| Administrative expenses | 1,344,608 | | 2,599,448 |

| Total deductions | 366,609,811 | | 265,182,620 |

| | | |

| NET INCREASE (DECREASE) IN NET ASSETS | 664,278,347 | | (429,051,440) |

| | | |

| NET ASSETS AVAILABLE FOR BENEFITS: | | | |

| Beginning of year | 3,027,933,336 | | 3,456,984,776 |

| | | |

| End of year | $ | 3,692,211,683 | | $ | 3,027,933,336 |

See accompanying notes to the financial statements.

CBRE 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2023 AND 2022

1. DESCRIPTION OF PLAN

The following description of the CBRE 401(k) Plan (the “Plan”) provides only general information. Participants should refer to the Plan document and related amendments for a more complete description of the Plan’s provisions. The Plan is sponsored by CBRE Services, Inc. (“CBRE Services” and “Plan Sponsor”), which is a subsidiary of CBRE Group, Inc. (“CBRE Group”). CBRE Services, CBRE Group, and other subsidiaries of CBRE Group are hereinafter referred to collectively as the “Company.”

General—The Plan is a defined contribution savings plan, which provides retirement benefits for eligible employees of the Company who elect to participate. Most of the Company’s non-union United States (“U.S.”) employees, other than qualified real estate agents having the status of independent contractors under section 3508 of the Internal Revenue Code of 1986, as amended (“IRC”), are eligible to participate in the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Plan Amendments—The Plan was amended during 2023 and 2022. These amendments conformed Plan language with operations, incorporated certain legally required updates, and made discretionary changes to Plan terms such as governance, distribution opportunities, and Plan compensation.

Administration—Prior to December 1, 2022, the Plan was administered by the Administrative Committee, which had the power to administer and interpret the Plan, monitor the performance of the Plan investment funds and make recommendations to the Chief Executive Officer for certain vendor changes. Effective December 1, 2022, the Company restructured Plan governance, delegating Plan investment authority to the Retirement Investment Committee (the “Committee”) and Plan administration responsibilities to the Plan Administrator, who is appointed by the Chief People Officer. Fidelity Workplace Services LLC (“Fidelity”) is the Plan’s recordkeeper.

Trustee—With the exception of life insurance policies, Fidelity Management Trust Company (“Fidelity Management Trust”) serves as trustee for all the Plan’s assets. CBRE Services serves as trustee for certain life insurance policies (see Note 5).

Eligibility—All salaried, hourly and W-2 commissioned employees on the domestic payroll of CBRE Services, or any other domestic subsidiary that participates in the Plan, are eligible to participate in the Plan as soon as administratively feasible following the date the employee is credited with one hour of service. However, the following employees, or classes of employees, are not eligible to participate: (1) employees that are non-resident aliens with no U.S. source income; (2) employees covered under a collective bargaining agreement that does not expressly provide for participation in the Plan; (3) employees classified as “leased employees” or independent contractors, even if subsequently determined to be common law employees; (4) employees covered by another Company tax-qualified plan; or (5) persons classified as qualified real estate agents having the status of independent contractors under the IRC.

Employee Contributions—Participants in the Plan may elect to contribute from 1% to 75% of their eligible compensation on a pre-tax or after-tax Roth basis through payroll deferrals, subject to certain IRC limitations. Participants who do not make an affirmative deferral election or opt out of participation within 45 days are automatically enrolled with pre-tax deferrals equal to three percent (3%) of the participant’s compensation. The Plan Administrator and the IRC may limit the percentage of eligible compensation that highly compensated employees may contribute. Participants are also allowed to roll over amounts distributed from other tax-qualified plans to the Plan.

Employer Contributions—The Plan allows the Company to make matching contributions to participants. The Company matches its employee’s contributions up to 66-2/3% of the first 6% of the employee’s annual compensation (up to a maximum annual matching contribution of $6,000). Aggregate matching contributions amounted to $108,347,536 and $98,241,603 for the years ended December 31, 2023 and 2022, respectively.

Additionally, the Plan provides for discretionary profit-sharing contributions by the Company for certain employees of CBRE Clarion Securities, LLC (“CBRE Clarion”). There were no discretionary profit-sharing contributions for the years ended December 31, 2023 and 2022.

Participant Accounts—Each participant’s account is credited with the participant’s contributions, an allocation of Company contributions and investment earnings (or losses) thereon and charged certain administrative expenses. Allocations of earnings are based on participant account balances in an investment. The overall benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account. Participants may invest up to 25% of their Plan accounts in

CBRE 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

DECEMBER 31, 2023 AND 2022

the CBRE Stock Fund, which is a unitized fund that includes shares of the Company’s common stock and interest-earning cash for pending transactions and includes accruals for income earned and benefits payable.

Vesting—Participants are immediately vested in all employee contributions, participant rollover contributions from other qualified plans and earnings (or losses) thereon. Generally, participants who were active on October 1, 2021 vest in all prior and future matching contributions at a rate of 33-1/3% each year of service with 100% vesting after three years of service. Participants who terminated employment on or before September 30, 2021 continue to have matching contributions vest under the Plan’s prior vesting schedule, which vested 20% for each year of service, with 100% vesting after five years of service. Upon rehire, these prior matching contributions continue to be subject to five-year vesting, and new matching contributions will be subject to three-year vesting as described above. Special vesting rules continue to apply to matching contributions made before January 1, 2007. Participants become immediately fully vested in Company matching contributions upon reaching age 65, becoming disabled (as defined in the Plan) or death, in each case if employed by the Company at that time. Service for the year is determined using the elapsed time method of crediting service.

Participants generally forfeit any portion of Company contributions that has not yet vested upon the earlier of: (i) the date of the participant’s final distribution; or (ii) the date on which the participant has no eligible service for five consecutive years.

Forfeited Accounts—Forfeited accounts are invested in a money market fund and included in participant-directed investments in the accompanying Statements of Net Assets Available for Benefits. These accounts are used to pay expenses of the Plan or to reduce future Company contributions. During the year ended December 31, 2023, account forfeitures totaled $6,403,357. We used $7,281,211 to reduce Company contributions and $546,786 was used to pay expenses. The funds came from both current year and prior year forfeited balances. During the year ended December 31, 2022, account forfeitures totaled $6,233,649. We used $14,207,787 to reduce Company contributions and $1,367,570 was used to pay expenses. As a result, at December 31, 2023 and 2022, forfeited non-vested account balances totaled $947,516 and $2,372,156, respectively.

Payment of Benefits and Withdrawals—Participants are entitled to the balance of their vested accounts upon retirement, termination of employment, disability or death. The Plan also provides for withdrawals due to hardship, subject to certain limitations, from rollover accounts, from pre-2002 after-tax voluntary contribution accounts and after attaining age 59½. Distributions are primarily made in a single lump-sum cash payment equal to the balance of the participants’ accounts. As a result of the Consolidated Appropriations Act of 2023, which includes the Setting Every Community Up Retirement Enhancement (“SECURE”) 2.0 Act, the required minimum distribution age is 70½ for anyone born before July 1, 1949, and 72 for anyone born from July 1, 1949 through December 31, 1950, and effective January 1, 2023, increases up to age 73 for anyone born on or after January 1, 1950 through December 31, 1959, and age 75 for anyone born on or after January 1, 1960.

Notes Receivable from Participants—Participants may elect to borrow from their accounts up to a maximum of $50,000, not to exceed 50.00% of their vested account balance. Loan transactions are treated as transfers between the investment fund and the loan fund. Generally, participant loans are to be repaid through payroll deductions over a period generally not to exceed five years. The loans are secured by the balance in the participant’s account and bear interest at a rate as determined by the Plan Administrator. Interest rates on loans outstanding at December 31, 2023 and 2022 range from 4.25% to 10.50% and 4.25% to 8.25%, respectively, and mature on various dates through January 2029.

CBRE 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

DECEMBER 31, 2023 AND 2022

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting—The accompanying financial statements have been prepared under the accrual basis of accounting in accordance with accounting principles generally accepted in the U.S. (“GAAP”).

Investment Valuation and Income Recognition—The Plan’s investments are stated at fair value.

Shares of mutual funds are valued at quoted market prices.

Investments in the common/collective trusts are valued at net asset value (“NAV”).

A portion of the Plan is invested in shares of CBRE Group’s common stock, which is valued at its quoted market price on the New York Stock Exchange. The value of CBRE Group’s common stock was $93.09 and $76.96 per share as of December 31, 2023 and 2022, respectively, which represented the quoted market price of CBRE Group’s common stock as of those dates. The Plan held 1,023,276 and 1,080,476 shares of common stock of CBRE Group, with a cost basis of $37,164,147 and $37,906,483 as of December 31, 2023 and 2022, respectively. During the years ended December 31, 2023 and 2022, the Plan did not earn any dividend income from CBRE Group’s common stock.

Life insurance policies are valued at cash surrender value.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on an accrual basis. Dividends are recorded on the ex-dividend date.

Net appreciation (depreciation) in fair value of investments includes realized and unrealized gains and losses on investments sold or held during the year.

Management fees and operating expenses of the Plan’s investment funds are generally paid by the investment funds and are reflected as a reduction of investment return for such investments. A portion of the management fees for certain investment funds is returned to the Plan to pay administrative expenses or be allocated to participants, which practice is commonly referred to as “revenue sharing.”

Revenue Sharing—Revenue sharing is placed in an “ERISA Account” which is invested in a money market fund and included in participant-directed investments in the accompanying Statements of Net Assets Available for Benefits. Total revenue sharing, including interest, was $2,073,239 and $1,460,053 in 2023 and 2022, respectively. Revenue sharing was first used to pay the fees of Fidelity and its affiliates aggregating to $1,552,135 and $1,387,988 in 2023 and 2022, respectively. In addition, administrative expenses were paid out of the ERISA Account in the amount of $282,612 and $210,479 in 2023 and 2022, respectively. The balance in the ERISA Account was $239,225 and $733 as of December 31, 2023 and 2022, respectively.

Although the Plan allows for the calculated excess in the ERISA Account, as determined by the Plan Administrator, to be allocated to participant accounts pro rata in proportion to their account balances, no amounts were taken out of the ERISA Account and allocated to participant accounts during the years ended December 31, 2023 and 2022.

Notes Receivable from Participants—Participant loans are valued at their amortized cost, which represents the unpaid principal balance plus accrued interest. Interest income is recorded on an accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2023 and 2022. If a participant ceases to make loan repayments and the Plan Administrator deems the participant loan to be in default, the participant loan balance is reduced, and a benefit payment is recorded.

Payment of Benefits—Benefits are recorded when paid.

Use of Estimates—The preparation of financial statements in conformity with GAAP requires the Plan’s management to make estimates and assumptions that affect the reported amounts of net assets available for benefits and changes therein and disclosure of contingent assets and liabilities. Actual results may differ from those estimates.

Risks and Uncertainties—The Plan invests in various securities as directed by the participants among the investment options offered under the Plan, including mutual funds, common/collective trusts and CBRE Group’s common stock. Investment securities, in general, are exposed to various risks, such as interest rate risk, credit risk and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of the

CBRE 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

DECEMBER 31, 2023 AND 2022

investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the accompanying financial statements and notes.

The Plan invests through mutual funds in the securities of foreign companies, which involve special risks and considerations not typically associated with investing in U.S. companies. These risks include devaluation of currencies, potentially less reliable information about issuers, different securities transaction clearance and settlement practices, and possible adverse political and economic developments. Moreover, securities of many foreign companies and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies.

3. FAIR VALUE MEASUREMENTS

The “Fair Value Measurements and Disclosures” Topic of the Financial Accounting Standards Board Accounting Standards Codification (“Topic 820”) defines fair value as the price that would be received to sell an asset or paid to transfer a liability in in an orderly transaction between market participants at the measurement date. Topic 820 also establishes a three-level fair value hierarchy that prioritizes the inputs used to measure fair value. This hierarchy requires entities to maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair value are as follows:

•Level 1 – Quoted prices in active markets for identical assets and liabilities that the Plan has the ability to access.

•Level 2 – Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

•Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. This includes certain pricing models, discounted cash flow methodologies and similar techniques that use significant unobservable inputs.

The classification of fair value measurements within the hierarchy is based upon the lowest level of input that is significant to the measurement.

The following tables set forth a summary of the Plan’s investments measured at fair value on a recurring basis as of December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 |

| Fair Value Measured and Recorded Using | | |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Mutual funds | $ | 1,598,725,199 | | $ | — | | $ | — | | $ | 1,598,725,199 |

| CBRE Group, Inc. common stock fund | 96,195,554 | | — | | — | | 96,195,554 |

| Common/collective trusts | — | | 1,956,241,045 | | — | | 1,956,241,045 |

| | | | | | | |

| Total investments at fair value | $ | 1,694,920,753 | | $ | 1,956,241,045 | | $ | — | | $ | 3,651,161,798 |

| | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2022 |

| | Fair Value Measured and Recorded Using | | |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Mutual funds | $ | 1,312,968,651 | | $ | — | | $ | — | | $ | 1,312,968,651 |

| CBRE Group, Inc. common stock fund | 83,796,732 | | — | | — | | 83,796,732 |

| Common/collective trusts | — | | 1,597,117,563 | | — | | 1,597,117,563 |

| Life insurance policies | — | | 144,642 | | — | | 144,642 |

| Total investments at fair value | $ | 1,396,765,383 | | $ | 1,597,262,205 | | $ | — | | $ | 2,994,027,588 |

CBRE 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

DECEMBER 31, 2023 AND 2022

4. COMMON/COLLECTIVE TRUSTS

The following table summarizes the Plan’s investments in common/collective trusts:

| | | | | | | | | | | |

| Fair Value |

| | as of December 31, |

| | 2023 | | 2022 |

| Vanguard Target Retirement Funds | $ | 1,590,385,372 | | $ | 1,250,338,665 |

| Fidelity Managed Income Portfolio | 168,420,584 | | 195,636,758 |

| Putnam Large Cap Value Trust | 155,716,594 | | 106,156,823 |

| Allspring Emerging Growth CIT | 41,718,495 | | 44,985,317 |

| Total common/collective trusts | $ | 1,956,241,045 | | $ | 1,597,117,563 |

| | | |

The Plan’s investments in common/collective trusts are stated at NAV and are considered to have a readily determinable fair value. The NAV, as provided by the trustees, is based on the fair value of the underlying investments held by each fund, less its liabilities.

Vanguard Target Retirement Funds are a series of 11 fund options as of both December 31, 2023 and 2022, designed for investors expecting to retire around the year indicated in each option’s name. The funds, which are the Plan’s default investment options, are managed to gradually become more conservative over time. The funds invest in a diversified portfolio of stock and bond mutual funds.

The Fidelity Managed Income Portfolio is a common/collective trust that is a commingled pool of the Fidelity Group Trust for Employee Benefit Plans. It is managed by Fidelity Management Trust, which is also the trustee of the Plan. The Fidelity Managed Income Portfolio invests in investment contracts issued by insurance companies, other financial institutions, and fixed income securities. A portion of the portfolio is invested in a money market fund to provide daily liquidity. Investment contracts provide for the payment of a specified rate of interest to the portfolio and for the repayment of principal when contracts mature. The portfolio seeks to maintain a stable NAV. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at NAV.

The Putnam Large Cap Value Trust is a common/collective trust which invests in equity securities of companies consistent with their investment objectives. Investments are stated at the NAV of shares held by the Plan as of December 31, 2023 and 2022.

The Allspring Emerging Growth CIT is a common/collective trust which invests in equity securities of companies consistent with their investment objectives. Investments are stated at the NAV of shares held by the Plan as of December 31, 2023 and 2022.

5. LIFE INSURANCE POLICIES

When the Trammell Crow Company Retirement Savings Plan merged into the Plan, some of the transferred assets consisted of life insurance policies issued by Great-West Life & Annuity Insurance Company (“Great-West”). These policies are owned by CBRE Services, which is the trustee of the CBRE 401(k) Life Insurance Trust, for the benefit of the participants insured and generally may be distributed or surrendered at the participant’s direction. Premiums are paid out of dividends and the cash surrender value of the specific insured’s insurance policy. Upon distribution of a participant’s total vested account balance, the policy must also be distributed to the participant or surrendered. These policies are fully allocated to the insured participant’s rollover account. These policies are included at cash surrender value within Plan assets in the accompanying financial statements and had a face value $2,100,000 as of December 31, 2022. The remaining life insurance policies under the Plan were surrendered in 2023, such that the Plan did not maintain any life insurance policies as of December 31, 2023.

CBRE 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

DECEMBER 31, 2023 AND 2022

6. NON-DISCRIMINATION TESTING

The Plan Sponsor determined that the Plan passed the IRC non-discrimination testing with respect to the years ended December 31, 2023 and 2022.

7. EXEMPT PARTY-IN-INTEREST TRANSACTIONS

Certain of the Plan’s investments are funds managed by the Plan’s trustees or its affiliates. As a result, these transactions qualify as exempt party-in-interest transactions. In addition, the Plan invests in shares of common stock in CBRE Group, of which the Plan Sponsor is a subsidiary. As a result, these transactions also qualify as exempt party-in-interest transactions.

8. ADMINISTRATIVE EXPENSES

The Plan provides that administrative expenses shall be paid by the Plan unless the Company, in its discretion, pays the expenses. Many of the Plan’s administrative expenses, including the fees of the recordkeepers and trustees, are paid by the Plan via revenue sharing (see Note 2). A few expenses, such as review and processing of qualified domestic relations orders, are paid by the Plan and charged to participant accounts.

9. TAX STATUS

The Internal Revenue Service (“IRS”) determined and informed the Company by letter dated October 16, 2017 that the Plan and related trust, including amendments made through January 2017, were designed in compliance with the IRC.

The Puerto Rico Hacienda determined and informed the Company by letters dated December 5, 2016 that the Plan, as amended and restated as of January 1, 2014, its amendments #1 and #2, and related trust were designed in compliance with the Puerto Rico Internal Revenue Code. The Plan as restated effective as of September 4, 2017, its amendments #1 through #5, and the restatement as of January 1, 2022, were filed for qualification under the Puerto Rico Internal Revenue Code with Hacienda on December 26, 2022. The request for qualification of the restatements and the amendments are currently under evaluation by Hacienda. Although the Plan has been amended since receiving the determination letters, the Plan administrator believes that the Plan is designed, and is currently being operated, in compliance with the applicable requirements of the IRC and Puerto Rico Internal Revenue Code and, therefore, believe that the Plan is qualified, and the related trust is tax-exempt. As such, no provision for income taxes has been included in the Plan’s financial statements.

GAAP requires plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan and concluded that as of December 31, 2023, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to 2020.

10. PLAN TERMINATION

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions to or terminate the Plan at any time, subject to the provisions of ERISA and the IRC. In the event of Plan termination, participants would become 100% vested in their employer contributions.

11. SUBSEQUENT EVENTS

The Plan has evaluated subsequent events from December 31, 2023 through June 20, 2024, the date the financial statements were issued. There have been no material events that would require recognition disclosure in the accompanying financial statements.

CBRE 401(k) PLAN

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

DECEMBER 31, 2023 AND 2022

12. RECONCILIATION OF FINANCIAL STATEMENTS TO FORM 5500

The following is a reconciliation of net assets available for benefits as of December 31, 2023 and 2022, as reported in the accompanying financial statements, to Schedule H on the Plan’s Form 5500:

| | | | | | | | | | | |

| | 2023 | | 2022 |

| Net assets available for benefits per the financial statements | $ | 3,692,211,683 | | $ | 3,027,933,336 |

| Participant loans in default - deemed distributions | (830,686) | | (751,292) |

| Net assets available for benefits per Form 5500 | $ | 3,691,380,997 | | $ | 3,027,182,044 |

The following is a reconciliation of the net increase (decrease) in net assets available for benefits for the years ended December 31, 2023 and 2022, as reported in the accompanying financial statements, to Schedule H on the Plan’s Form 5500:

| | | | | | | | | | | |

| | 2023 | | 2022 |

| Net increase (decrease) in net assets per the financial statements | $ | 664,278,347 | | $ | (429,051,440) |

| Increase in participant loans in default - deemed distributions | (79,394) | | (89,334) |

| Net increase (decrease) in net assets per Form 5500 | $ | 664,198,953 | | $ | (429,140,774) |

SUPPLEMENTAL SCHEDULE

CBRE 401(k) PLAN

EIN: 52-1616016 – PLAN NUMBER 001

SCHEDULE H, LINE 4i – SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | (c) Description of Investment, Including | | | | |

| | | | Maturity Date, Rate of Interest, | | | | |

(a) | | (b) Identity of Issue, Borrower, Lessor, or Similar Party | | Collateral, Par, or Maturity Value | | (d) Cost | | (e) Current Value |

| | American Century Mid Cap Value Fund | | Mutual Fund | | (2) | | $ | 104,551,515 |

| | American Europacific Growth Fund | | Mutual Fund | | (2) | | 89,152,152 |

| | American Funds New Perspective Fund | | Mutual Fund | | (2) | | 65,856,757 |

| | Blackrock Strategic Income Opportunities Fund | | Mutual Fund | | (2) | | 19,968,877 |

| | Carillon Eagle Mid Cap Growth Fund | | Mutual Fund | | (2) | | 103,133,623 |

| (1) | | Fidelity 500 Index Fund | | Mutual Fund | | (2) | | 508,889,193 |

| (1) | | Fidelity Balanced Fund | | Mutual Fund | | (2) | | 61,051,783 |

| (1) | | Fidelity Extended Market Index Fund | | Mutual Fund | | (2) | | 52,023,399 |

| (1) | | Fidelity Global Ex U.S. Index Fund | | Mutual Fund | | (2) | | 41,519,349 |

| (1) | | Fidelity Real Estate Index Fund | | Mutual Fund | | (2) | | 6,644,116 |

| (1) | | Fidelity U.S. Bond Index Fund | | Mutual Fund | | (2) | | 120,719,269 |

| | Franklin Small Cap Value Fund | | Mutual Fund | | (2) | | 41,575,672 |

| | Invesco Developing Markets Fund | | Mutual Fund | | (2) | | 43,590,653 |

| | Loomis Sayles Growth Fund | | Mutual Fund | | (2) | | 229,888,091 |

| (1) | | MainStay CBRE Real Estate Fund | | Mutual Fund | | (2) | | 20,361,276 |

| | Metropolitan West Total Return Bond Fund | | Mutual Fund | | (2) | | 48,005,051 |

| | Parnassus Core Equity Fund | | Mutual Fund | | (2) | | 41,794,423 |

| | Total Mutual Funds | | | | | | 1,598,725,199 |

| | | | | | | | |

| | Allspring Emerging Growth CIT | | Common/Collective Trust | | (2) | | 41,718,495 |

| (1) | | Fidelity Managed Income Portfolio | | Common/Collective Trust | | (2) | | 168,420,584 |

| | Putnam Large Cap Value Trust | | Common/Collective Trust | | (2) | | 155,716,594 |

| | Vanguard Target Retirement 2020 Fund | | Common/Collective Trust | | (2) | | 50,335,941 |

| | Vanguard Target Retirement 2025 Fund | | Common/Collective Trust | | (2) | | 191,771,384 |

| | Vanguard Target Retirement 2030 Fund | | Common/Collective Trust | | (2) | | 209,704,836 |

| | Vanguard Target Retirement 2035 Fund | | Common/Collective Trust | | (2) | | 246,175,991 |

| | Vanguard Target Retirement 2040 Fund | | Common/Collective Trust | | (2) | | 170,906,395 |

| | Vanguard Target Retirement 2045 Fund | | Common/Collective Trust | | (2) | | 236,190,722 |

| | Vanguard Target Retirement 2050 Fund | | Common/Collective Trust | | (2) | | 179,725,019 |

| | Vanguard Target Retirement 2055 Fund | | Common/Collective Trust | | (2) | | 166,987,450 |

| | Vanguard Target Retirement 2060 Fund | | Common/Collective Trust | | (2) | | 77,365,200 |

| | Vanguard Target Retirement 2065 Fund | | Common/Collective Trust | | (2) | | 26,506,668 |

| | Vanguard Target Retirement Income Trust | | Common/Collective Trust | | (2) | | 34,715,766 |

| | Total Common/Collective Trusts | | | | | | 1,956,241,045 |

| | | | | | | | |

| (1) | | CBRE Group, Inc. Stock Fund | | Common Stock | | (2) | | 96,195,554 |

| | | | | | | | |

| (1) | | Notes Receivable From Participants | | Interest rates of 4.25% to 10.50%; | | | | |

| | | | Maturity dates from | | | | |

| | | | January 2024 to January 2029 | | (2) | | 40,266,882 |

| | Total Investments | | | | | | $ | 3,691,428,680 |

______________________________(1)Exempt party-in-interest transactions.

(2)Cost information is not required for participant-directed investments and therefore is not included.

See accompanying report of independent registered public accounting firm.

REQUIRED INFORMATION

The Statements of Net Assets Available for Benefits as of December 31, 2023 and 2022, the Statements of Changes in Net Assets Available for Benefits for the years ended December 31, 2023 and 2022 and the related notes to these financial statements and supplemental schedule, together with the Report of Independent Registered Public Accounting Firm and the Consent of Independent Registered Public Accounting Firm, are attached and filed herewith.

SIGNATURES

The Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| CBRE 401(k) PLAN |

| |

Date: June 20, 2024 | /s/ Emma E. Giamartino |

| Emma E. Giamartino |

| Chief Financial Officer (Principal Financial Officer) |

| |

Date: June 20, 2024 | /s/ Lindsey S. Caplan |

| Lindsey S. Caplan |

| Chief Accounting Officer (Principal Accounting Officer) |

| |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the registration statement (No. 333-116398) on Form S-8 of CBRE Group, Inc. of our report dated June 20, 2024, with respect to the financial statements and the supplemental Schedule H, Line 4i Schedule of Assets (Held at End of Year) as of December 31, 2023 of the CBRE 401(k) Plan.

/s/ KPMG LLP

Austin, Texas

June 20, 2024

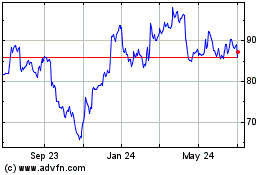

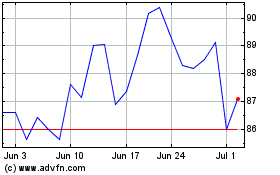

CBRE (NYSE:CBRE)

Historical Stock Chart

From May 2024 to Jun 2024

CBRE (NYSE:CBRE)

Historical Stock Chart

From Jun 2023 to Jun 2024