Lower-than-Expected Loss at Allegheny - Analyst Blog

January 22 2014 - 10:50AM

Zacks

Allegheny Technologies Inc. (ATI) posted loss

from continuing operations of $83.8 million or 79 cents per share

for fourth-quarter 2013 compared with a profit of $16 million or 15

cents per share recorded a year ago.

On a consolidated basis, the Pennsylvania-based specialty steel

company raked in net income of $173.4 million or $1.62 per share in

the quarter, up manifold from a profit of $10.5 million or 10 cents

per share registered in the year-ago quarter.

Consolidated net income includes gain (of $261.4 million, post tax)

on sale of the company’s tungsten materials business to Latrobe,

PA-based wear-resistant products company Kennametal

Inc. (KMT).

Barring charges associated with restructuring measures and

inventory valuation adjustments of $75.1 million (post-tax), loss

from continuing operations was 8 cents per share, narrower than the

Zacks Consensus Estimate of a loss of 19 cents.

For 2013, loss from continuing operations was $98.8 million, or 93

cents per share compared with an income of $150.5 million or $1.36

per share recorded a year ago. Excluding one-time items, loss from

continuing operations was 22 cents, also lower than the Zacks

Consensus Estimate of a loss of 33 cents.

Revenues for the fourth quarter slipped 10% year over year to

$915.3 million, missing the Zacks Consensus Estimate of $1,031

million. Revenues were hurt by soft demand across several end

markets. Allegheny also witnessed lower pricing for many of its

products and a decline in raw materials surcharges in the

quarter.

For the full year, revenues fell roughly 13% year over year to

$4,043.5 million, also falling short of the Zacks Consensus

Estimate of $4,324 million.

Operating profit slid roughly 51% year over year to $44.6 million

in the quarter with operating margin contracting to 4.9% from 8.9%

a year ago. Lower shipments of high value and standard products

coupled with lower base prices led to the decline in operating

profit. The impact of higher raw material costs for products with

longer manufacturing cycle times not aligned with lower raw

material surcharges also contributed to the decline.

Segment Review

Revenues from the High Performance Metals segment fell 17% year

over year to $436.7 million in the quarter due to lower mill

product shipments and a decline in sales of precision forged and

cast components, hurt by weaker demand from the jet engine,

construction and mining, nuclear energy, and oil and gas markets.

Lower pricing also affected sales.

Flat-Rolled Products segment sales went down 4% to $478.6 million

on account of reduced raw material surcharges and lower

base-selling pricing. The company saw lower demand on a sequential

basis across oil and gas/chemical process industry and electrical

energy markets.

Shipments of high-value products rose 10% on higher shipments of

Precision Rolled Strip products, nickel-based alloys and titanium.

Shipments of standard stainless products rose 6%. Average selling

prices for high-value and standard stainless products fell 8% and

13%, respectively.

Financial Position

Allegheny ended 2013 with cash and cash equivalents of $1,026.8

million, a more than three-fold year over year rise. Long-term debt

increased roughly 4% year over year to $1,527.4 million. Total

debt-to-total capital ratio was 40.2% as of Dec 31, 2013, up from

37.4% as of Dec 31, 2012. Operating cash flow for the full year was

$368.4 million, including $141 million for the fourth quarter.

Outlook

Allegheny, which is among the prominent players in the U.S.

specialty steel industry along with Carpenter

Technology (CRS), and Precision Castparts

(PCP), expects business conditions to gradually improve through

2014. However, it sees modest recovery in global economic

conditions.

Allegheny anticipates market conditions to remain favorable across

many of its major markets over the next 2-5 years. It expects

continued increase in aerospace build rates. The company also sees

modest growth in demand for jet engine spare parts through

2014.

Allegheny expects capital spending on global oil and gas

exploration and production forecasts project to remain strong and

sees modest growth in demand for its high performance specialty

materials from the medical market. Moreover, demand from the

electrical energy market is expected to remain flat for both power

generation and power distribution in the short-term.

Allegheny expects its High Performance Metals unit to benefit from

growing demand from many of its major global markets and higher

demand for its new products, notably from the aerospace market.

This will be partly offset by sustained weakness in demand from the

nuclear energy market.

For the Flat-Rolled Products division, the company expects

improving demand in 2014 for its high-value products, in

particular, nickel-based alloys and specialty alloys and Precision

Rolled Strip products. The new Hot-Rolling and Processing Facility

(HRPF) is expected to cut costs, lower cycle time and incite

revenue gains staring in 2015. The commissioning of the facility

will take most of this year and is expected to result in start-up

costs of roughly $30 million to $35 million (pre-tax) in 2014.

Allegheny anticipates capital expenditures for 2014 to be roughly

$300 million, down $313 million from 2013. The company remains

focused on cost optimization and is accelerating its cost reduction

efforts. Allegheny, through this move, was successful in gross cost

reductions of $141.2 million in 2013. The company is targeting $100

million in new gross cost reductions this year.

Allegheny currently retains a Zacks Rank #5 (Strong Sell).

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CARPENTER TECH (CRS): Free Stock Analysis Report

KENNAMETAL INC (KMT): Free Stock Analysis Report

PRECISION CASTP (PCP): Free Stock Analysis Report

To read this article on Zacks.com click here.

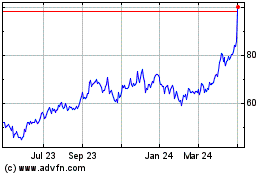

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

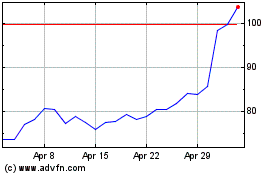

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024