Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (n-q)

February 28 2013 - 3:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF

PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT

INVESTMENT COMPANY

|

Investment Company Act file

number

|

811-8211

|

|

|

|

|

|

Dreyfus Institutional Preferred Money Market Funds

|

|

|

|

(Exact name of Registrant as specified in charter)

|

|

|

|

|

|

|

|

c/o The Dreyfus Corporation

200 Park Avenue

New York, New York 10166

|

|

|

|

(Address of principal executive offices) (Zip

code)

|

|

|

|

|

|

|

|

Janette E. Farragher, Esq.

200 Park Avenue

New York, New York 10166

|

|

|

|

(Name and address of agent for service)

|

|

|

|

|

Registrant's telephone

number, including area code:

|

(212) 922-6000

|

|

|

|

|

Date of fiscal year end:

|

3/31

|

|

|

Date of reporting period:

|

12/31/2012

|

|

|

|

|

|

|

|

|

|

FORM N-Q

Item 1. Schedule of Investments.

|

|

|

STATEMENT OF INVESTMENTS

|

|

Dreyfus Institutional Preferred Money Market Fund

|

|

December 31, 2012 (Unaudited)

|

|

|

|

|

|

|

Negotiable Bank Certificates of Deposit--33.5%

|

Principal Amount ($)

|

|

Value ($)

|

|

Bank of Montreal (Yankee)

|

|

|

|

|

0.21% - 0.36%, 2/15/13 - 3/21/13

|

285,000,000

|

a

|

285,000,000

|

|

Bank of Nova Scotia (Yankee)

|

|

|

|

|

0.33% - 0.59%, 1/2/13

|

330,000,000

|

a

|

330,000,000

|

|

Bank of Tokyo-Mitsubishi Ltd. (Yankee)

|

|

|

|

|

0.24%, 2/20/13

|

300,000,000

|

|

300,000,000

|

|

Canadian Imperial Bank of Commerce (Yankee)

|

|

|

|

|

0.37%, 1/2/13

|

150,000,000

|

a

|

150,000,000

|

|

Chase Bank USA

|

|

|

|

|

0.20%, 2/20/13

|

125,000,000

|

|

125,000,000

|

|

Mizuho Corporate Bank (Yankee)

|

|

|

|

|

0.26% - 0.27%, 3/8/13 - 3/12/13

|

300,000,000

|

|

300,000,000

|

|

Norinchukin Bank (Yankee)

|

|

|

|

|

0.27%, 3/18/13

|

150,000,000

|

|

150,000,000

|

|

Skandinaviska Enskilda Banken (Yankee)

|

|

|

|

|

0.25%, 3/4/13

|

100,000,000

|

b

|

100,000,000

|

|

Sumitomo Mitsui Trust Bank (Yankee)

|

|

|

|

|

0.27%, 1/17/13

|

200,000,000

|

b

|

199,976,000

|

|

Svenska Handelsbanken (Yankee)

|

|

|

|

|

0.29%, 4/4/13

|

140,000,000

|

b

|

140,000,000

|

|

Toronto Dominion Bank (Yankee)

|

|

|

|

|

0.25% - 0.28%, 4/15/13 - 6/20/13

|

201,350,000

|

|

201,353,361

|

|

Westpac Banking Corp.

|

|

|

|

|

0.57% - 0.61%, 1/2/13

|

350,000,000

|

a,b

|

350,000,000

|

|

Total Negotiable Bank Certificates of Deposit

|

|

|

|

|

(cost $2,631,329,361)

|

|

|

2,631,329,361

|

|

Commercial Paper--3.5%

|

|

|

|

|

ASB Finance Ltd.

|

|

|

|

|

0.47%, 1/11/13

|

75,000,000

|

a,b

|

75,000,000

|

|

Svenska Handelsbanken Inc.

|

|

|

|

|

0.24%, 1/17/13

|

200,000,000

|

b

|

199,978,667

|

|

Total Commercial Paper

|

|

|

|

|

(cost $274,978,667)

|

|

|

274,978,667

|

|

Asset

-Backed Commercial Paper--4.0%

|

|

|

|

|

Alpine Securitization Corp.

|

|

|

|

|

0.35%, 3/18/13

|

50,000,000

|

b

|

49,963,056

|

|

Atlantis One Funding Corp.

|

|

|

|

|

0.21%, 3/18/13

|

200,000,000

|

b

|

199,911,333

|

|

Gemini Securitization Corp., LLC

|

|

|

|

|

0.17%, 1/2/13

|

63,023,000

|

b

|

63,022,702

|

|

Total Asset-Backed Commercial Paper

|

|

|

|

|

(cost $312,897,091)

|

|

|

312,897,091

|

|

Time Deposits--21.1%

|

|

|

|

|

Bank of America N.A. (Grand Cayman)

|

|

|

|

|

0.01%, 1/2/13

|

235,000,000

|

|

235,000,000

|

|

Deutsche Bank AG (Grand Cayman)

|

|

|

|

|

0.03%, 1/2/13

|

175,000,000

|

|

175,000,000

|

|

|

|

|

|

|

|

Lloyds TSB Bank (London)

|

|

|

|

|

|

0.15%, 1/2/13

|

|

300,000,000

|

|

300,000,000

|

|

National Australia Bank (Grand Cayman)

|

|

|

|

|

|

0.01%, 1/2/13

|

|

375,000,000

|

|

375,000,000

|

|

Nordea Bank Finland (Grand Cayman)

|

|

|

|

|

|

0.05%, 1/2/13

|

|

325,000,000

|

|

325,000,000

|

|

Skandinaviska Enskilda Banken (Grand Cayman)

|

|

|

|

|

|

0.03%, 1/2/13

|

|

250,000,000

|

|

250,000,000

|

|

Total Time Deposits

|

|

|

|

|

|

(cost $1,660,000,000)

|

|

|

|

1,660,000,000

|

|

U.S. Government Agency--3.2%

|

|

|

|

|

|

Federal Home Loan Mortgage Corp.

|

|

|

|

|

|

0.39%, 1/2/13

|

|

|

|

|

|

(cost $249,998,138)

|

|

250,000,000

|

a,c

|

249,998,138

|

|

U.S. Treasury Bills--1.3%

|

|

|

|

|

|

0.09%, 5/23/13

|

|

|

|

|

|

(cost $99,964,500)

|

|

100,000,000

|

|

99,964,500

|

|

Repurchase Agreements--33.4%

|

|

|

|

|

|

ABN AMRO Bank N.V.

|

|

|

|

|

|

0.17%-0.19%, dated 12/31/12, due 1/2/13 in the amount

|

|

|

|

|

|

of $

650,006,472 (fully collateralized by

$404,395,402

|

|

|

|

|

|

Government National Mortgage Association, 4%-5%, due

|

|

|

|

|

|

10/20/39-10/20/41, value $306,000,000 and

|

|

|

|

|

|

$356,936,500 U.S. Treasury Notes, 0.13%-0.63%, due

|

|

|

|

|

|

9/30/13-8/31/17, value $357,000,096)

|

|

650,000,000

|

|

650,000,000

|

|

Citigroup Global Markets Holdings Inc.

|

|

|

|

|

|

0.17%, dated 12/31/12, due 1/2/13 in the amount of

|

|

|

|

|

|

$475,004,486 (fully collateralized by

$7,915,100 U.S.

|

|

|

|

|

|

Treasury Inflation Protected Securities, 2%, due

|

|

|

|

|

|

1/15/16, value

$10,314,656 and $445,210,300 U.S.

|

|

|

|

|

|

Treasury Notes, 2.13%-4.75%, due 5/15/14-8/15/21,

|

|

|

|

|

|

value $474,185,450)

|

|

475,000,000

|

|

475,000,000

|

|

HSBC USA Inc.

|

|

|

|

|

|

0.15%, dated 12/31/12, due 1/2/13 in the amount of

|

|

|

|

|

|

$

725,006,042 (fully collateralized by

$253,592,500

|

|

|

|

|

|

U.S. Treasury Bonds, 3.13%-4.38%, due

|

|

|

|

|

|

5/15/40-11/15/41, value $300,794,694 and $430,643,800

|

|

|

|

|

|

U.S. Treasury Notes, 0.75%-1.75%, due

|

|

|

|

|

|

3/31/13-2/28/17, value $438,712,342)

|

|

725,000,000

|

|

725,000,000

|

|

Royal Bank of Scotland

|

|

|

|

|

|

0.20%, dated 12/31/12, due 1/2/13 in the amount of

|

|

|

|

|

|

$

350,003,889 (fully collateralized by

$102,000,000

|

|

|

|

|

|

U.S. Treasury Bonds, 3.75%-6%, due 2/15/26-8/15/41,

|

|

|

|

|

|

value $136,804,123, $52,590,000 U.S. Treasury

|

|

|

|

|

|

Inflation Protected Securities, 1.25%, due 7/15/20,

|

|

|

|

|

|

value $66,596,107 and $146,041,600 U.S. Treasury

|

|

|

|

|

|

Notes, 1.25%-3.13%, due 12/13/14-8/15/21, value

|

|

|

|

|

|

$

153,600,173

)

|

|

350,000,000

|

|

350,000,000

|

|

TD Securities (USA) LLC

|

|

|

|

|

|

0.17%, dated 12/31/12, due 1/2/13 in the amount of

|

|

|

|

|

|

$

425,004,014 (fully collateralized by

$258,564,600

|

|

|

|

|

|

U.S. Treasury Inflation Protected Securities, 2.38%,

|

|

|

|

|

|

|

|

|

|

|

due 1/15/25, value $433,500,158)

|

425,000,000

|

|

425,000,000

|

|

Total Repurchase Agreements

|

|

|

|

|

(cost $2,625,000,000)

|

|

|

2,625,000,000

|

|

Total Investments

(cost $7,854,167,757)

|

100.0

|

%

|

7,854,167,757

|

|

Cash and Receivables (Net)

|

.0

|

%

|

234,945

|

|

Net Assets

|

100.0

|

%

|

7,854,402,702

|

|

|

|

a Variable rate security--interest rate subject to periodic change.

|

|

b Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold

|

|

in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2012, these

|

|

securities amounted to $1,377,851,758 or 17.5% of net assets.

|

|

c The Federal Housing Finance Agency ("FHFA") placed Federal Home Loan Mortgage Corporation and Federal National Mortgage

|

|

Association into conservatorship with FHFA as the conservator. As such, the FHFA oversees the continuing affairs of these

|

|

companies.

|

At December 31, 2012, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes.

The following is a summary of the inputs used as of December 31, 2012 in valuing the fund's investments:

|

|

|

|

Valuation Inputs

|

Short-Term Investments ($)+

|

|

Level 1 - Unadjusted Quoted Prices

|

-

|

|

Level 2 - Other Significant Observable Inputs

|

7,854,167,757

|

|

Level 3 - Significant Unobservable Inputs

|

-

|

|

Total

|

7,854,167,757

|

|

|

|

+ See Statement of Investments for additional detailed categorizations.

|

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”)

recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange

Commission (“SEC”) under authority of federal laws are also sources

of authoritative GAAP for SEC registrants. The fund's financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

Portfolio valuation: Investments in securities are valued at amortized cost in accordance with Rule 2a-7 under the Act. If amortized cost is determined not to approximate market value, the fair value of the portfolio securities will be determined by procedures established by and under the general supervision of the Board of Trustees.

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments

relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for

identical investments.

Level 2—other significant observable inputs (including quoted

prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s

own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, money market securities are valued using amortized cost, in accordance with rules under the Act. Generally, amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

The fund may enter into repurchase agreements with financial institutions, deemed to be creditworthy by the Manager, subject to

the seller’s agreement to repurchase and the fund’s agreement to resell such securities at a mutually agreed upon price. Pursuant to

the terms of the repurchase agreement, such securities must have an aggregate market value greater than or equal to the terms of the repurchase price plus accrued interest at all times. If the value of the underlying securities falls below the value of the repurchase price plus accrued interest, the fund will require the seller to deposit additional collateral by the next business day. If the request for additional collateral is not met, or the seller defaults on its repurchase obligation, the fund maintains its right to sell the underlying securities at market value and may claim any resulting loss against the seller.

Additional investment related disclosures are hereby incorporated by reference to the annual and semi-annual reports previously filed with the Securities and Exchange Commission on Form N-CSR.

|

|

|

STATEMENT OF INVESTMENTS

|

|

Dreyfus Institutional Preferred Plus Money Market Fund

|

|

December 31, 2012 (Unaudited)

|

|

|

|

|

|

|

|

Negotiable Bank Certificates of Deposit--6.8%

|

|

Principal Amount ($)

|

|

Value ($)

|

|

Bank of Montreal (Yankee)

|

|

|

|

|

|

0.19%, 1/10/13

|

|

35,000,000

|

|

35,000,000

|

|

Sumitomo Mitsui Banking Corporation (Yankee)

|

|

|

|

|

|

0.18%, 1/10/13

|

|

20,000,000

|

a

|

20,000,000

|

|

Toronto Dominion Bank (Yankee)

|

|

|

|

|

|

0.18%, 1/11/13

|

|

35,000,000

|

|

35,000,000

|

|

Total Negotiable Bank Certificates of Deposit

|

|

|

|

|

|

(cost $90,000,000)

|

|

|

|

90,000,000

|

|

Asset

-Backed Commercial Paper--5.3%

|

|

|

|

|

|

Alpine Securitization Corp.

|

|

|

|

|

|

0.18%, 1/23/13

|

|

35,000,000

|

a

|

34,996,150

|

|

Gotham Funding Corp.

|

|

|

|

|

|

0.20%, 1/24/13

|

|

35,000,000

|

a

|

34,995,528

|

|

Total Asset-Backed Commercial Paper

|

|

|

|

|

|

(cost $69,991,678)

|

|

|

|

69,991,678

|

|

Time Deposits--7.5%

|

|

|

|

|

|

National Australia Bank (Grand Cayman)

|

|

|

|

|

|

0.01%, 1/2/13

|

|

50,000,000

|

|

50,000,000

|

|

Nordea Bank Finland (Grand Cayman)

|

|

|

|

|

|

0.05%, 1/2/13

|

|

50,000,000

|

|

50,000,000

|

|

Total Time Deposits

|

|

|

|

|

|

(cost $100,000,000)

|

|

|

|

100,000,000

|

|

U.S. Government Agency--7.9%

|

|

|

|

|

|

Federal Home Loan Bank

|

|

|

|

|

|

0.00%, 1/2/13

|

|

|

|

|

|

(cost $105,000,000)

|

|

105,000,000

|

|

105,000,000

|

|

U.S. Treasury Bills--49.7%

|

|

|

|

|

|

0.01% - 0.09%, 1/3/13 - 2/28/13

|

|

|

|

|

|

(cost $662,976,412)

|

|

663,000,000

|

|

662,976,412

|

|

Repurchase Agreements--22.5%

|

|

|

|

|

|

ABN AMRO Bank N.V.

|

|

|

|

|

|

0.17%, dated 12/31/12, due 1/2/13 in the amount of

|

|

|

|

|

|

$

100,000,944 (fully collateralized by

$96,660,100

|

|

|

|

|

|

U.S. Treasury Notes, 2%, due 4/30/16, value

|

|

|

|

|

|

$

102,000,103

)

|

|

100,000,000

|

|

100,000,000

|

|

Goldman, Sachs & Co.

|

|

|

|

|

|

0.25%, dated 12/31/12, due 1/2/13 in the amount of

|

|

|

|

|

|

$

50,000,694 (fully collateralized by

$100,085,185

|

|

|

|

|

|

Government National Mortgage Association,

|

|

|

|

|

|

2.50%-6.50%, due 9/20/27-11/20/42, value $51,000,000)

|

|

50,000,000

|

|

50,000,000

|

|

HSBC USA Inc.

|

|

|

|

|

|

0.15%, dated 12/31/12, due 1/2/13 in the amount of

|

|

|

|

|

|

$

100,000,833 (fully collateralized by

$101,690,000

|

|

|

|

|

|

U.S. Treasury Notes, 0.38%, due 3/15/15, value

|

|

|

|

|

|

$

102,001,012

)

|

|

100,000,000

|

|

100,000,000

|

|

RBC Capital Markets

|

|

|

|

|

|

|

|

|

|

|

0.15%, dated 12/31/12, due 1/2/13 in the amount of

|

|

|

|

|

$50,000,417 (fully collateralized by $50,280,900 U.S.

|

|

|

|

|

Treasury Notes, 0.25%-4.25%, due 11/15/14-1/15/15,

|

|

|

|

|

value $51,000,061)

|

50,000,000

|

|

50,000,000

|

|

Total Repurchase Agreements

|

|

|

|

|

(cost $300,000,000)

|

|

|

300,000,000

|

|

Total Investments

(cost $1,327,968,090)

|

99.7

|

%

|

1,327,968,090

|

|

Cash and Receivables (Net)

|

.3

|

%

|

4,018,355

|

|

Net Assets

|

100.0

|

%

|

1,331,986,445

|

|

|

|

a Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold

|

|

in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2012, these

|

|

securities amounted to $89,991,678 or 6.8% of net assets.

|

At December 31, 2012, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes.

The following is a summary of the inputs used as of December 31, 2012 in valuing the fund's investments:

|

|

|

|

Valuation Inputs

|

Short-Term Investments ($)+

|

|

Level 1 - Unadjusted Quoted Prices

|

-

|

|

Level 2 - Other Significant Observable Inputs

|

1,327,968,090

|

|

Level 3 - Significant Unobservable Inputs

|

-

|

|

Total

|

1,327,968,090

|

|

|

|

+ See Statement of Investments for additional detailed categorizations.

|

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”)

recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange

Commission (“SEC”) under authority of federal laws are also sources

of authoritative GAAP for SEC registrants. The fund's financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

Portfolio valuation: Investments in securities are valued at amortized cost in accordance with Rule 2a-7 under the Act. If amortized cost is determined not to approximate market value, the fair value of the portfolio securities will be determined by procedures established by and under the general supervision of the Board of Trustees.

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments

relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for

identical investments.

Level 2—other significant observable inputs (including quoted

prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s

own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, money market securities are valued using amortized cost, in accordance with rules under the Act. Generally, amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

The fund may enter into repurchase agreements with financial institutions, deemed to be creditworthy by the Manager, subject to

the seller’s agreement to repurchase and the fund’s agreement to resell such securities at a mutually agreed upon price. Pursuant to

the terms of the repurchase agreement, such securities must have an aggregate market value greater than or equal to the terms of the repurchase price plus accrued interest at all times. If the value of the underlying securities falls below the value of the repurchase price plus accrued interest, the fund will require the seller to deposit additional collateral by the next business day. If the request for additional collateral is not met, or the seller defaults on its repurchase obligation, the fund maintains its right to sell the underlying securities at market value and may claim any resulting loss against the seller.

Additional investment related disclosures are hereby incorporated by reference to the annual and semi-annual reports previously filed with the Securities and Exchange Commission on Form N-CSR.

Item 2. Controls

and Procedures.

(a) The

Registrant's principal executive and principal financial officers have

concluded, based on their evaluation of the Registrant's disclosure controls

and procedures as of a date within 90 days of the filing date of this report,

that the Registrant's disclosure controls and procedures are reasonably

designed to ensure that information required to be disclosed by the Registrant

on Form N-Q is recorded, processed, summarized and reported within the required

time periods and that information required to be disclosed by the Registrant in

the reports that it files or submits on Form N-Q is accumulated and

communicated to the Registrant's management, including its principal executive

and principal financial officers, as appropriate to allow timely decisions

regarding required disclosure.

(b) There

were no changes to the Registrant's internal control over financial reporting

that occurred during the Registrant's most recently ended fiscal quarter that

have materially affected, or are reasonably likely to materially affect, the

Registrant's internal control over financial reporting.

Item 3. Exhibits.

(a) Certifications of principal executive and

principal financial officers as required by Rule 30a-2(a) under the Investment

Company Act of 1940.

FORM N-Q

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934 and the Investment

Company Act of 1940, the Registrant has duly caused this Report to be signed on

its behalf by the undersigned, thereunto duly authorized.

Dreyfus Institutional

Preferred Money Market Funds

|

By:

/s/ Bradley J.

Skapyak

|

|

Bradley J.

Skapyak

President

|

|

Date:

|

February 26, 2013

|

|

|

|

Pursuant

to the requirements of the Securities Exchange Act of 1934 and the Investment

Company Act of 1940, this Report has been signed below by the following

persons on behalf of the Registrant and in the capacities and on the dates

indicated.

|

|

|

|

By

/s/ Bradley J.

Skapyak

|

|

Bradley J.

Skapyak

President

|

|

Date:

|

February 26, 2013

|

|

|

|

By:

/s/ James

Windels

|

|

James Windels

Treasurer

|

|

Date:

|

February 26, 2013

|

|

|

EXHIBIT INDEX

(a) Certifications of principal executive and principal

financial officers as required by Rule 30a-2(a) under the Investment Company

Act of 1940. (EX-99.CERT)

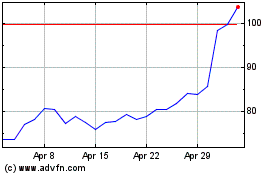

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

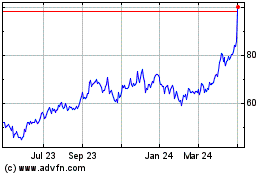

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024