Banks Report Record Quarterly Increase in Sour Credit-Card Debt -- 2nd Update

May 29 2019 - 5:11PM

Dow Jones News

By Lalita Clozel

WASHINGTON -- Banks reported an annual increase in sour loans

led by credit-card debt in the first quarter and a surge in

past-due commercial and industrial loans, a federal regulator said

Wednesday

The Federal Deposit Insurance Corp. in a quarterly report on

bank earnings reported a 22.8% bump in commercial and

industrial-loan balances that are 90 days or more past due. Banks

also wrote off $12.7 billion in uncollectible loans, a 5.5%

increase from the same time last year.

Net charge-offs for credit-card debt increased by $543.4 million

over the last year, the largest such dollar increase relative to

other loan categories.

The net charge-off rate has crept up in recent years, prompting

large lenders such as Capital One Financial Corp. and Discover

Financial Services to tighten credit limits. It has increased in

eight of the past 10 quarters, the FDIC said, reaching 3.97% in the

first quarter.

FDIC officials attributed the most recent sour credit card debt

increases to a few banks that have lowered their underwriting

standards. "There have been some banks that have relatively

recently pursued a little bit more of an aggressive [approach],"

said Pat Mitchell, a deputy director at the FDIC.

Banks have said they are wary of newer credit-score data that

excludes some borrowers' performance during the financial crisis.

Capital One's chief executive Richard Fairbank said during an

earnings call last month that the bank was on the lookout for

"degradation of performance of consumers for a given FICO score,"

referring to the widely used credit score.

Credit-card delinquencies are also becoming a growing issue for

older borrowers, according to research by the Federal Reserve Bank

of New York.

"Transitions into serious delinquency for credit card accounts

increased again," the Fed said in a February report on household

debt and credit. "It has risen sharply among older borrowers over

the last two years."

Still, analysts don't view credit-card delinquencies as a major

source of risk for banks.

Credit-card lenders are "relatively disciplined," said Warren

Kornfeld, a senior vice president at Moody's. "They know if you

drop standards, that could come back to haunt you."

FDIC Chairman Jelena McWilliams said "the competition to attract

deposit and loan customers is strong, and therefore, banks need to

maintain rigorous underwriting standards and prudent risk

management."

The noncurrent loan rate remained relatively steady, with less

than half of all banks reporting an increase in their balance of

loans that are 90 days or more past due or troubled.

Banks saw an increase in noncurrent commercial and industrial

loans, which increased by $3.3 billion in the first quarter -- the

largest quarterly dollar increase since 2016. In its April survey

of senior loan officers, the Fed found that banks had eased some

terms for these types of loans to large and midsize firms, while

keeping standards steady for smaller firms.

The figures on distressed debt came as bank profits in the first

quarter of the year grew 8.7% over the same period last year, to

$60.7 billion. The increase was driven by growing interest margins,

the FDIC said. Banks retained $22.1 billion in earnings in the

first quarter and boosted dividend payments by 25.9%, to $38.6

billion.

"In July, this economic expansion will be the longest on record

in the United States," said Ms. McWilliams. "As a result, the

nation's banks are strong."

To better weather credit risk, banks allocated $13.9 billion in

loan-loss provisions, a nearly 12% increase from a year earlier. A

large portion of the annual increase came from the largest banks,

the FDIC said.

Write to Lalita Clozel at lalita.clozel.@wsj.com

(END) Dow Jones Newswires

May 29, 2019 16:56 ET (20:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

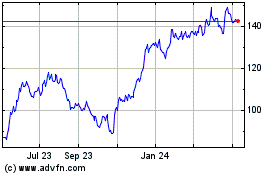

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

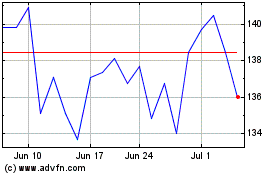

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024