UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-39511

BURFORD CAPITAL LIMITED

(Translation of registrant’s name into English)

Oak House

Hirzel Street

St. Peter Port

Guernsey GY1 2NP

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

This report includes materials as an exhibit that

have been made available in respect of Burford Capital Limited as of May 31, 2024.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BURFORD CAPITAL LIMITED |

| |

|

|

| |

|

|

| |

By: |

/s/ Mark N. Klein |

| |

|

Name: |

Mark N. Klein |

| |

|

Title: |

General Counsel and Chief Administrative Officer |

Date: May 31, 2024

Exhibit 99.1

May 31, 2024

Notification of Transaction by Person Discharging

Managerial Responsibilities

Burford Capital Limited, the leading global finance

and asset management firm focused on law, provides the following notification of a transaction by a person discharging managerial responsibilities.

On May 28, 2024, Chris Halmy, Vice Chair and Non-Executive Director, used his deferred cash compensation to purchase 712 ordinary shares

of nil par value of Burford Capital Limited (the "Shares") through the Burford employee deferred compensation plan.

Further details

about the Burford employee deferred compensation plan can be found in Burford's Annual Report on Form 20-F for the year ended December

31, 2023 filed with the US Securities and Exchange Commission on March 28, 2024. In essence, Burford employees and non-executive

directors are able to elect to defer cash compensation, without incurring current taxes, into the Burford employee deferred compensation

plan, which in turn permits the full amount of that deferred compensation to be allocated to the Shares (or for other investment options).

This is a tax-efficient way for employees and non-executive directors to continue to accumulate exposure to the Shares.

For further information, please contact:

| Burford Capital Limited |

|

| For investor and analyst inquiries: |

|

| Americas: Josh Wood, Head of Investor Relations - email |

+1 212 516 5824 |

| EMEA & Asia: Rob Bailhache, Head of EMEA & Asia Investor Relations - email |

+44 (0)20 3530 2023 |

| For press inquiries: |

|

| David Helfenbein, Vice President, Public Relations - email |

+1 (212) 516 5824 |

| |

|

| Deutsche Numis - NOMAD and Joint Broker |

+44 (0)20 7260 1000 |

| Giles Rolls |

|

| Charlie Farquhar |

|

| |

|

| Jefferies International Limited - Joint Broker |

+44 (0)20 7029 8000 |

| Graham Davidson |

|

| James Umbers |

|

| |

|

| Berenberg – Joint Broker |

+44 (0)20 3207 7800 |

| Toby Flaux |

|

| James Thompson |

|

| Yasmina Benchekroun |

|

About Burford Capital

Burford Capital

is the leading global finance and asset management firm focused on law. Its businesses include litigation finance and risk

management, asset recovery and a wide range of legal finance and advisory activities. Burford is publicly traded on the New York Stock

Exchange (NYSE: BUR) and the London Stock Exchange (LSE: BUR), and it works with companies and law firms around the world from its offices

in New York, London, Chicago, Washington, DC, Singapore, Dubai, Sydney and Hong Kong.

For more information,

please visit www.burfordcapital.com.

This announcement does not constitute an offer

to sell or the solicitation of an offer to buy any ordinary shares or other securities of Burford.

This announcement does not constitute an offer

of any Burford private fund. Burford Capital Investment Management LLC, which acts as the fund manager of all Burford private funds,

is registered as an investment adviser with the US Securities and Exchange Commission. The information provided in this announcement

is for informational purposes only. Past performance is not indicative of future results. The information contained in this announcement

is not, and should not be construed as, an offer to sell or the solicitation of an offer to buy any securities (including, without limitation,

interests or shares in any of Burford private funds). Any such offer or solicitation may be made only by means of a final confidential

private placement memorandum and other offering documents.

Forward-looking statements

This announcement

contains “forward-looking statements” within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended,

regarding assumptions, expectations, projections, intentions and beliefs about future events. These statements are intended as “forward-looking

statements”. In some cases, predictive, future-tense or forward-looking words such as “aim”, “anticipate”,

“believe”, “continue”, “could”, “estimate”, “expect”, “forecast”,

“guidance”, “intend”, “may”, “plan”, “potential”, “predict”, “projected”,

“should” or “will” or the negative of such terms or other comparable terminology are intended to identify forward-looking

statements, but are not the exclusive means of identifying such statements. In addition, Burford and its representatives may from time

to time make other oral or written statements that are forward-looking, including in its periodic reports that Burford files with, or

furnishes to, the US Securities and Exchange Commission, other information made available to Burford’s security holders

and other written materials. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors

because they relate to events and depend on circumstances that may or may not occur in the future. Burford cautions that forward-looking

statements are not guarantees of future performance and are based on numerous assumptions, expectations, projections, intentions and beliefs

and that Burford’s actual results of operations, including its financial position and liquidity, and the development of the industry

in which it operates, may differ materially from (and be more negative than) those made in, or suggested by, the forward-looking statements

contained in this announcement. Significant factors that may cause actual results to differ from those Burford expects include, among

others, those discussed under “Risk Factors” in Burford’s annual report on Form 20-F for the year ended December 31,

2023 filed with the US Securities and Exchange Commission on March 28, 2024 and other reports or documents that Burford files with,

or furnishes to, the US Securities and Exchange Commission from time to time. In addition, even if Burford’s results of operations,

including its financial position and liquidity, and the development of the industry in which it operates are consistent with the forward-looking

statements contained in this announcement, those results of operations or developments may not be indicative of results of operations

or developments in subsequent periods.

Except as required by law, Burford undertakes

no obligation to update or revise the forward-looking statements contained in this announcement, whether as a result of new information,

future events or otherwise.

| 1 |

Details

of the person discharging managerial responsibilities/person closely associated |

| |

(a) Name |

Christopher Halmy |

| 2 |

Reason

for the notification |

|

| |

(a) Position/status |

A PDMR occupying the position of Non-Executive Director |

| |

(b) Initial

notification /Amendment |

Initial |

| 3 |

Details

of the issuer, emission allowance market participant, auction platform, auctioneer or auction monitor |

| |

(a) Name

|

Burford

Capital Limited |

| |

(b) LEI |

549300FUKUWFYJMT2277 |

| 4 |

Details

of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and

(iv) each place where transactions have been conducted |

| |

(a) Description

of the financial instrument, type of instrument |

Ordinary Shares |

| |

Identification

code |

GG00BMGYLN96 |

| |

(b) Nature

of the transaction |

Allocation of fully vested notional Ordinary Shares equivalent to a

deferred amount of cash compensation under Burford's deferred compensation plan |

| |

(c) Price(s)and

volume(s) |

Price(s) |

|

Volume(s) |

$14.04 |

|

712 |

| |

|

|

| |

(d) Aggregated

information

·

Aggregated

volume

·

Price

|

N/A |

| |

(e) Date

of the transaction |

28 May 2024

|

| |

(f) Place

of the transaction |

Outside a trading venue |

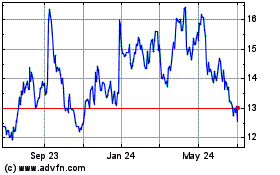

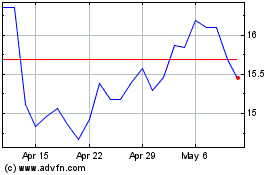

Burford Capital (NYSE:BUR)

Historical Stock Chart

From May 2024 to Jun 2024

Burford Capital (NYSE:BUR)

Historical Stock Chart

From Jun 2023 to Jun 2024