false000088524500008852452024-02-012024-02-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

February 1, 2024

Date of Report (date of earliest event reported)

THE BUCKLE, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Nebraska | 001-12951 | 47-0366193 |

| (State or other jurisdiction of | (Commission | (I.R.S. Employer |

| incorporation or organization) | File Number) | Identification No.) |

| | | | | | | | | | | | | | | | | |

| 2407 West 24th Street, | | | |

| Kearney, | Nebraska | | 68845-4915 | |

| (Address of principal executive offices) | | (Zip Code) | |

Registrant's telephone number, including area code: (308) 236-8491

__________________________________________________________

(Former name, former address and former fiscal year if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, $0.01 par value | BKE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

ITEM 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On February 1, 2024, the Compensation Committee of the Board of Directors of The Buckle, Inc. (the “Company”) approved the Company’s compensation program for executive officers for the upcoming 2024 fiscal year. Participants in this compensation program include the Company’s President and Chief Executive Officer, its Senior Vice President of Finance and Chief Financial Officer, and its other “named executive officers” as defined in Item 402(a)(3) of Regulation S-K and in Instruction 4 to Item 5.02 of Form 8-K.

The elements of the compensation program approved by the Compensation Committee for fiscal 2024 are consistent with the compensation program approved for the Company’s executive officers for fiscal 2023. Specifically, the elements for each executive officer include:

•A competitive base salary;

•An incentive cash bonus, based upon the actual performance of the Company;

•Benefits including a health and welfare plan, 401(k) plan, and supplemental non-qualified deferred compensation plan (to provide officers with a benefit comparable to that being currently provided to other employees under the 401(k) plan); and

•Shares of Restricted Stock (hereafter referred to as “Non-Vested Stock” in accordance with terminology used in Generally Accepted Accounting Principles).

Additional information regarding the compensation program is as follows:

Base Salaries for Fiscal 2024

The base salaries for fiscal 2024 for the Company’s President and Chief Executive Officer, its Senior Vice President of Finance and Chief Financial Officer, and its other named executive officers, as approved by the Compensation Committee, are as follows:

| | | | | | | | |

| Name and Title | | Base Salary

($) |

| | |

| Dennis H. Nelson, President and Chief Executive Officer | | 1,275,000 | |

| Thomas B. Heacock, Senior Vice President of Finance and Chief Financial Officer | | 595,000 | |

| Kari G. Smith, Executive Vice President of Stores | | 660,000 | |

| Brett P. Milkie, Senior Vice President of Leasing | | 640,000 | |

| Kelli D. Molczyk, Senior Vice President of Women's Merchandising | | 520,000 | |

Incentive Cash Bonuses and the 2024 Incentive Plan

As part of the compensation program for fiscal 2024, the Compensation Committee approved the Company’s 2024 Management Incentive Plan, which is included as Exhibit 10.1 to this Form 8-K (the “2024 Incentive Plan”). The 2024 Incentive Plan is modeled after the Company’s 2023 Management Incentive Plan (the “2023 Incentive Plan”), which was included as Exhibit 10.1 to the Company’s Form 8-K filed with the Securities and Exchange Commission on January 31, 2023.

The 2024 Incentive Plan is a one-year plan designed to motivate the Company’s key employees to improve stockholder value by linking a portion of their compensation to the Company’s financial performance. The 2023 Incentive Plan also was a one-year plan designed to motivate the Company’s key employees to improve stockholder value by linking a portion of their compensation to the Company’s financial performance.

Description of the 2024 Incentive Plan

The 2024 Incentive Plan will be administered by the Compensation Committee. The Compensation Committee’s powers include authority, within the limitations set forth in the 2024 Incentive Plan, to:

•Select the persons to be granted “cash awards,” as defined in the 2024 Incentive Plan;

•Determine the time when cash awards will be granted;

•Determine whether objectives and conditions for earning cash awards have been met; and

•Determine whether payment of cash awards will be made at the end of an award period or deferred.

Any employee of the Company whose performance the Compensation Committee determines can have a significant effect on the success of the Company – designated a “key employee” by the 2024 Incentive Plan – will be granted an annual incentive cash award under the 2024 Incentive Plan. Because the number of key employees may change over time and because the selection of participants is discretionary, it is impossible to determine the number of persons who will be eligible for awards under the 2024 Incentive Plan during its term. However, it is anticipated that seven persons will receive cash awards for fiscal 2024 under the 2024 Incentive Plan.

The 2024 Incentive Plan includes the creation of a “bonus pool” as a cash incentive for executives. This bonus pool will be calculated utilizing the Company’s “pre-bonus net income,” as defined in the 2024 Incentive Plan, as the key performance metric. Dollars will be added to the bonus pool in two methods: (i) 1.2% of fiscal 2024’s pre-bonus net income will be included as a “base amount,” as defined in the 2024 Incentive Plan; and (ii) if fiscal 2024’s pre-bonus net income exceeds the Company’s “target pre-bonus net income amount,” as defined in the 2024 Incentive Plan, then a percentage of the amount above the target will be added to the base amount in calculating the total bonus pool, as outlined in the 2024 Incentive Plan. Bonus pool awards pursuant to the 2024 Incentive Plan will be in addition to base salaries.

Cash Awards

Each participant in the 2024 Incentive Plan will receive a cash award equal to 100% of their respective share of the bonus pool. The President and Chief Executive Officer’s share of the bonus pool for fiscal 2024, as approved by the Compensation Committee, is 37 points (approximately 37% of the allocated points). The share of each other participant in the bonus pool will be determined by the President and Chief Executive Officer under the terms of the 2024 Incentive Plan.

No cash award payment for the 2024 fiscal year may be made to an executive officer until the Company’s pre-bonus net income for the year is certified by the Compensation Committee. A participant shall not be entitled to receive payment of an award under the 2024 Incentive Plan unless such participant is still in the employ of the Company on the last day of the fiscal year for which the cash award is earned.

Non-Vested Stock

Non-Vested Stock was granted by the Compensation Committee on February 4, 2024 in accordance with the Company’s 2023 Employee Restricted Stock Plan. The 2023 Employee Restricted Stock Plan was approved by the Company’s stockholders at the Meeting held June 5, 2023. The 2023 Employee Restricted Stock Plan permits the Company, acting by the Compensation Committee, to grant awards of Non-Vested Stock, including performance awards. The 2023 Employee Restricted Stock Plan grants the Compensation Committee the authority to determine and select the performance criteria and the applicable performance period, and to establish performance goals, without further stockholder approval, so long as the performance criteria, performance period, and performance goals are consistent with the 2023 Employee Restricted Stock Plan as approved by the stockholders.

On February 4, 2024, the Compensation Committee granted shares of Non-Vested Stock pursuant to the 2023 Employee Restricted Stock Plan to the Company’s President and Chief Executive Officer, its Senior Vice President of Finance and Chief Financial Officer, and its other named executive officers as follows:

| | | | | | | | | | | | | | |

| Name | | Performance Based Shares

(#) | Non-Performance Based Shares

(#) | Total Number of Non-Vested Shares

(#) |

| | | | |

| Dennis H. Nelson | | 110,000 | | 10,000 | | 120,000 | |

| Thomas B. Heacock | | 16,000 | | 2,400 | | 18,400 | |

| Kari G. Smith | | 17,000 | | 2,800 | | 19,800 | |

| Brett P. Milkie | | 16,000 | | 2,400 | | 18,400 | |

| Kelli D. Molczyk | | 14,000 | | 2,000 | | 16,000 | |

For fiscal 2024, as shown in the above table, the Compensation Committee approved and awarded both performance based and non-performance based shares.

Performance based shares awarded under the 2023 Employee Restricted Stock Plan include a primary performance feature whereby 50% of the shares granted will vest over four years if the Company achieves the target (as established by the Compensation Committee) for fiscal 2024 pre-bonus net income, the next 25% of the shares granted will vest over four years if the Company’s fiscal 2024 pre-bonus net income increases at least 2.5% over the target, and the final 25% of the shares granted will vest over four years if the Company’s fiscal 2024 pre-bonus net income increases at least 5.0% over the target. Performance based shares also include a secondary performance feature enabling vesting for up to 100% of the shares granted as follows: 25% of the shares granted will vest over four years if the Company’s net income from operations (adjusted to exclude expenses recorded for equity compensation) exceeds 12.0% of net sales for the fiscal year, an additional 25% of the shares granted will vest over four years if the Company’s net income from operations (adjusted to exclude expenses recorded for equity compensation) exceeds 14.0% of net sales for the fiscal year, an additional 25% of the shares granted will vest over four years if the Company’s net income from operations (adjusted to exclude expenses recorded for equity compensation) exceeds 16.0% of net sales for the fiscal year, and the final 25% of the shares granted will vest over four years if the Company’s net income from operations (adjusted to exclude expenses recorded for equity compensation) exceeds 20% of net sales for the fiscal year. The primary and secondary performance features operate independently and the actual number of shares that vest will be the greater of the two amounts derived from the applicable calculation methods. Upon the Compensation Committee’s certification of the achievement of the performance results, 20% of the Non-Vested Stock shares would vest immediately, with 20% vesting on January 31, 2026, 30% on January 30, 2027, and 30% on January 29, 2028.

Non-performance based shares awarded under the 2023 Employee Restricted Stock Plan are not subject to performance objectives and will vest over a period of four years as follows: 20% on February 1, 2025, 20% on January 31, 2026, 30% on January 30, 2027, and 30% on January 29, 2028.

The employee must remain in the employ of the Company on the vesting date in order to become vested in both the performance based and the non-performance based shares.

Full Text of 2024 Incentive Plan and 2023 Employee Restricted Stock Plan

The foregoing descriptions of the Company’s 2024 Incentive Plan and its 2023 Employee Restricted Stock Plan do not purport to be complete and are qualified by reference to the full text of those plans. A copy of the 2024 Incentive Plan is included as Exhibit 10.1 to this Form 8-K. A copy of the 2023 Employee Restricted Stock Plan was included as Exhibit A to the Company’s Proxy Statement for the Annual Meeting held on June 5, 2023.

ITEM 9.01(d). Exhibits

Exhibit 10.1 The Buckle, Inc. 2024 Management Incentive Plan

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| The Buckle, Inc. |

| |

| Date: February 5, 2024 | By: /s/ THOMAS B. HEACOCK |

| | Name: Thomas B. Heacock |

| | Title: Senior Vice President of Finance, |

| | Treasurer and Chief Financial Officer |

EXHIBIT INDEX

| | | | | |

| The Buckle, Inc. 2024 Management Incentive Plan |

| |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| |

| |

| |

| |

| |

| |

| |

EXHIBIT 10.1

THE BUCKLE, INC.

2024 MANAGEMENT INCENTIVE PLAN

1.PURPOSES

The purpose of The Buckle, Inc. 2024 Management Incentive Plan is to reward the Company’s Executive Officers for increasing stockholder value by creating a bonus program that assures (on average) that increases in executive compensation will mirror increases in stockholder value.

2.DEFINITIONS

A.“Applicable Percentage Amount” means 1.20% of the current fiscal year Pre-Bonus Net Income.

B.“Bonus Pool” means the amount calculated each Plan Year equal to: (i) the Applicable Percentage Amount plus (ii) the amount determined by multiplying the Increase in Pre-Bonus Net Income over the Target Amount by the current Plan Year Pre-Bonus Net Income Factor (based on the Increase in Pre-Bonus Net Income over the Target Amount).

C.“Cash Award” or "Award" means any cash incentive payment made under the Plan.

D.“Committee” means the Compensation Committee of The Buckle, Inc.’s Board of Directors, or such other committee designated by that Board of Directors.

E.“Company” means The Buckle, Inc. and its subsidiary.

F.“Executive Officers” means the officers of the Company designated as executive officers in the Company’s annual report on Form 10-K as filed with the Securities and Exchange Commission.

G.“GAAP” means generally accepted accounting principles consistently applied.

H.“Increase” means the amount by which the Company’s Pre-Bonus Net Income in the current Plan Year exceeds the Target Amount.

I.“Participant” means any individual to whom an Award is granted under the Plan.

J.“Plan” means this Plan, which shall be known as The Buckle, Inc. 2024 Management Incentive Plan.

K.“Plan Year” means a fiscal year of the Company.

L.“Pre-Bonus Net Income” means Pre-Bonus, Pre-Tax Net Income, which means the Company’s net income from operations after the deduction of all expenses, excluding (i) administrative and store manager percentage bonuses; (ii) book accruals for all Restricted Stock Compensation expense; and (iii) income taxes. In addition, “Pre-Bonus, Pre-Tax Net Income” shall exclude the full effect of any unusual, non-recurring, or infrequent item of expense, including, but not limited to, an impairment charge, a restructuring charge, a change to generally accepted accounting principles, a regulatory change, a fine, a judgment, or related litigation costs, if any such unusual, non-recurring, and infrequent item exceeds $1,000,000.

M.“Pre-Bonus Net Income Factor” means the factor set forth below with respect to the Increase in Pre-Bonus Net Income over the Target Amount, with each percentage being applied incrementally to dollars of growth in Pre-Bonus Net Income over the Target Amount in the current Plan year.

| | | | | | | | |

| Increase in Pre-Bonus Net Income | | Pre-Bonus Net Income Factor |

| | |

| > 0% to 10.0% | | 10.0% |

| > 10.0% to 15.0% | | 9.0% |

| > 15.0% to 20.0% | | 8.0% |

| > 20.0% to 25.0% | | 7.0% |

| > 25.0% to 30.0% | | 6.0% |

| > 30.0% to 45.0% | | 5.0% |

| > 45% | | 4.0% |

N.“Target Amount” means the amount established each fiscal year by the Compensation Committee with regard to Pre-Bonus Net Income. For the 2024 Management Incentive Plan, the Target was set at $260,000,000.

3.ADMINISTRATION

The Plan shall be administered by the Committee. The Committee shall have the authority to:

(i)interpret and determine all questions of policy and expediency pertaining to the Plan;

(ii)adopt such rules, regulations, agreements, and instruments as it deems necessary for its proper administration;

(iii)grant waivers of Plan or Award conditions;

(iv)accelerate the payment of Awards;

(v)correct any defect, supply any omission, or reconcile any inconsistency in the Plan, any Award, or any Award notice;

(vi)take any and all actions it deems necessary or advisable for the proper administration of the Plan; and

(vii)adopt such Plan procedures, regulations, sub-plans, and the like as it deems are necessary to enable Executive Officers to receive Awards.

4.ELIGIBILITY

All Executive Officers are eligible to become a Participant in the Plan.

5.CASH AWARDS

A.Each Participant in the Plan shall receive a Cash Award calculated to be equal to 100% of the Participant’s share of the Bonus Pool. The President and Chief Executive Officer’s share of the Bonus Pool shall be 37 points (approximately 37% of the allocated points) and the share of each other Participant in the Bonus Pool shall be determined by the President and Chief Executive Officer prior to the first day of each Plan Year (or immediately upon adoption of the Plan).

B.No payment of a Cash Award for the year may be made to an Executive Officer until the Company’s Pre-Bonus Net Income for the year is certified by the Committee. A Participant shall not be entitled to receive payment of an Award unless such Participant is still in the employ of the Company on the last day of the fiscal year for which the Cash Award is earned.

C.The Company shall withhold all applicable federal, state, local, and foreign taxes required by law to be paid or withheld relating to the receipt or payment of any Cash Award.

6.GENERAL

A.Any rights of a Participant under the Plan shall not be assignable by such Participant, by operation of law or otherwise, except by will or the laws of descent and distribution. No Participant may create a lien on any funds or rights to which he or she may have an interest under the Plan, or which is held by the Company for the account of the Participant under the Plan.

B.Participation in the Plan shall not give any Executive Officer any right to remain in the employ of the Company. Further, the adoption of the Plan shall not be deemed to give any Executive Officer or other individual the right to be selected as a Participant or to be granted an Award.

C.To the extent any person acquires a right to receive payments from the Company under this Plan, such rights shall be no greater that the rights of an unsecured creditor of the Company.

D.The Plan shall be governed by and construed in accordance with the laws of the State of Nebraska.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

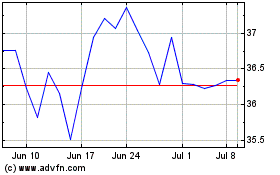

Buckle (NYSE:BKE)

Historical Stock Chart

From Apr 2024 to May 2024

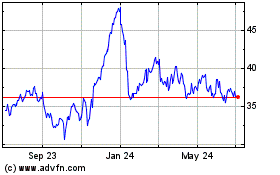

Buckle (NYSE:BKE)

Historical Stock Chart

From May 2023 to May 2024