Current Report Filing (8-k)

February 19 2020 - 4:20PM

Edgar (US Regulatory)

false0000703351

0000703351

2020-02-12

2020-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 12, 2020

BRINKER INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

DE

|

|

1-10275

|

|

75-1914582

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

3000 Olympus Blvd

|

|

|

|

|

|

|

Dallas

|

TX

|

|

|

|

|

75019

|

|

(Address of principal executive offices)

|

|

|

|

|

(Zip Code)

|

|

|

|

|

(972)

|

980-9917

|

|

|

|

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of exchange on which registered

|

|

Common Stock, $0.10 par value

|

|

EAT

|

|

NYSE

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425).

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12).

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5 - Corporate Governance and Management

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers

On February 12, 2020, the Compensation Committee (the “Committee”) of the Board of Directors of Brinker International, Inc. (the “Company”) and the Board of Directors approved the Maggiano’s Little Italy Change in Control and Long Term Incentive Plan (the “Maggiano’s Plan”). Kelly Baltes, Executive Vice President and President of Maggiano’s Little Italy ("Maggiano's"), participates in the Maggiano’s Plan with the potential to be paid 70% of the total dollar amount available for awards under the Maggiano's Plan, if any.

Under the Maggiano’s Plan, a cash bonus pool will be available for awards to participants at the end of the Company’s 2024 fiscal year in the event that Maggiano’s earnings before interest, taxes, depreciation and amortization (“EBITDA”) has a five-year compound annual growth rate (“CAGR”) that meets or exceeds target levels designated by the Committee. No awards will be made if the EBITDA CAGR does not meet the minimum threshold. The Committee set the target EBITDA CAGR at levels difficult to achieve that require significant growth in EBITDA that exceed target growth levels under the existing Maggiano’s Performance Share Plan and that require the elevated performance to be sustained for a longer period of time.

In the event a change of control of Maggiano’s (excluding a change in control of the entire Company) occurs before the end of the Company’s 2024 fiscal year, a cash bonus pool may be available for awards to participants in an amount equal to a percentage multiplied by the incremental value generated from the change in control of Maggiano’s over a Committee-approved base value. No cash bonus pool will be available if a minimum EBITDA multiple set by the Committee is not realized in the change of control. Furthermore, no cash bonus pool will be available if the value of consideration received from a change in control of Maggiano’s does not exceed the Committee-approved base value. The Maggiano’s Plan requires significant value creation in order for participants to achieve any payment in the event of a change of control of Maggiano’s.

The foregoing is only a summary and it is qualified in its entirety by the specific terms of the Maggiano’s Plan attached as Exhibit 10.1 to this Form 8-K and incorporated herein by reference.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

10.1 Maggiano’s Little Italy Change in Control and Long Term Incentive Plan*

* Certain confidential information in this exhibit has been omitted and replaced with [***] because it is not material and its disclosure would likely be competitively harmful.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BRINKER INTERNATIONAL, INC.

|

|

|

|

|

|

Dated: February 19, 2020

|

By:

|

|

/s/ Wyman T. Roberts

|

|

|

|

|

Wyman T. Roberts,

|

|

|

|

|

President and Chief Executive Officer

|

|

|

|

|

and President of Chili's Grill & Bar

|

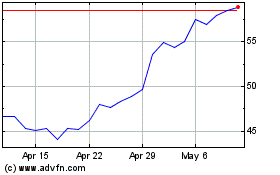

Brinker (NYSE:EAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

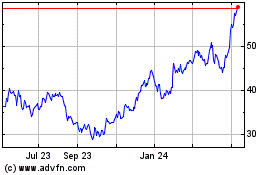

Brinker (NYSE:EAT)

Historical Stock Chart

From Apr 2023 to Apr 2024