Brandywine Realty Trust Announces Common Quarterly Dividend, and Confirms Fourth Quarter 2024 Earnings Release and Conference Call

December 10 2024 - 1:44PM

Brandywine Realty Trust (NYSE:BDN) announced today that its Board

of Trustees has declared a quarterly cash dividend of $0.15 per

common share and OP Unit payable on January 23, 2025 to holders of

record on January 8, 2025. The quarterly dividend is equivalent to

an annual rate of $0.60 per share.

Conference

Call and Audio

Webcast

We will release our fourth quarter earnings

after the market close on Tuesday February 4, 2025 and will hold

our fourth quarter conference call on Wednesday February 5, 2025 at

9:00 a.m. Eastern Time. To access the conference call by phone,

please visit link here, and you will be provided with dial in

details. A live webcast of the conference call will also be

available on the Investor Relations page of our website at

www.brandywinerealty.com.

About

Brandywine Realty

Trust

Brandywine Realty Trust (NYSE: BDN) is one of

the largest, publicly traded, full-service, integrated real estate

companies in the United States with a core focus in the

Philadelphia and Austin markets. Organized as a real estate

investment trust (REIT), we own, develop, lease and manage an

urban, town center and transit-oriented portfolio comprising 147

properties and 21.1 million square feet as of September 30, 2024.

Our purpose is to shape, connect and inspire the world around us

through our expertise, the relationships we foster, the communities

in which we live and work, and the history we build together. For

more information, please visit www.brandywinerealty.com.

Forward-Looking

Statements

This press release contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Such forward- looking

statements can generally be identified by our use of

forward-looking terminology such as “will,” “strategy,” “expects,”

“seeks,” “believes,” “potential,” or other similar words. Because

such statements involve known and unknown risks, uncertainties and

contingencies, actual results may differ materially from the

expectations, intentions, beliefs, plans or predictions of the

future expressed or implied by such forward-looking statements.

These forward- looking statements, including our 2024 guidance, are

based upon the current beliefs and expectations of our management

and are inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are

difficult to predict and not within our control. Such risks,

uncertainties and contingencies include, among others: risks

related to the impact of other potential future outbreaks of

infectious diseases on our financial condition, results of

operations and cash flows and those of our tenants as well as on

the economy and real estate and financial markets; reduced demand

for office space and pricing pressures, including from competitors,

that could limit our ability to lease space or set rents at

expected levels or that could lead to declines in rent; uncertainty

and volatility in capital and credit markets, including changes

that reduce availability, and increase costs, of capital or that

delay receipt of future debt financings and refinancings; the

effect of inflation and interest rate fluctuations, including on

the costs of our planned debt financings and refinancings; the

potential loss or bankruptcy of tenants or the inability of tenants

to meet their rent and other lease obligations; risks of

acquisitions and dispositions, including unexpected liabilities and

integration costs; delays in completing, and cost overruns incurred

in connection with, our developments and redevelopments;

disagreements with joint venture partners; unanticipated operating

and capital costs; uninsured casualty losses and our ability to

obtain adequate insurance, including coverage for terrorist acts;

additional asset impairments; our dependence upon certain

geographic markets; changes in governmental regulations, tax laws

and rates and similar matters; unexpected costs of REIT

qualification compliance; costs and disruptions as the result of a

cybersecurity incident or other technology disruption; reliance on

key personnel; and failure to maintain an effective system of

internal control, including internal control over financial

reporting. The declaration and payment of future dividends (both

timing and amount) is subject to the determination of our Board of

Trustees, in its sole discretion, after considering various

factors, including our financial condition, historical and forecast

operating results, and available cash flow, as well as any

applicable laws and contractual covenants and any other relevant

factors. Our Board’s practice regarding declaration of dividends

may be modified at any time and from time to time. Additional

information on factors which could impact us and the

forward-looking statements contained herein are included in our

filings with the Securities and Exchange Commission, including our

Form 10-K for the year ended December 31, 2023. We assume no

obligation to update or supplement forward-looking statements that

become untrue because of subsequent events except as required by

law.

Company/Investor Contact:

Tom WirthEVP & CFO

610-832-7434tom.wirth@bdnreit.com

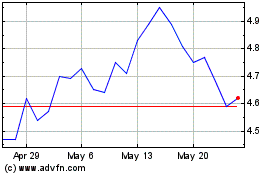

Brandywine Realty (NYSE:BDN)

Historical Stock Chart

From Nov 2024 to Dec 2024

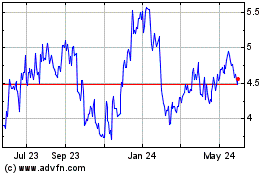

Brandywine Realty (NYSE:BDN)

Historical Stock Chart

From Dec 2023 to Dec 2024