UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2014

BRADY CORPORATION

(Exact name of registrant as specified in its charter)

Commission File Number 1-14959

|

Wisconsin |

|

39-0971239 |

|

(State of Incorporation) |

|

(IRS Employer Identification No.) |

6555 West Good Hope Road

Milwaukee, Wisconsin 53223

(Address of Principal Executive Offices and Zip Code)

(414) 358-6600

(Registrant’s Telephone Number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

On August 1, 2014, the Board of Directors of Brady Corporation (the “Company”) appointed J. Michael Nauman as President and Chief Executive Officer of the Company, effective August 4, 2014. In addition, Mr. Nauman was appointed as a member of the Board of Directors, effective as of August 4, 2014, with a term expiring at the next annual meeting of shareholders in November 2014.

Michael Nauman, age 52, joins the Company after 20 years in a number of senior management positions at Molex Incorporated, a global electronic components company based in Lisle, Illinois. For the past five years, Mr. Nauman was Molex’s Executive Vice President and President of the Global Integrated Products Division, where he led six global business units in the automotive, datacom, industrial, medical, military/aerospace and mobile markets. Prior to joining Molex in 1994, Mr. Nauman was Controller and then President of Ohio Associated Enterprises, Inc., a manufacturer based in Painesville, Ohio, and prior to that was a tax accountant and auditor for Arthur Andersen and Company.

There are no arrangements or understandings between Mr. Nauman and any other persons pursuant to which he was selected as an officer of the Company, he has no family relationships with any of the Company’s directors or executive officers, and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

The Company entered into an employment offer letter dated August 1, 2014 with Mr. Nauman (the “Offer Letter”). The Offer Letter provides that Mr. Nauman will receive an annual base salary of $675,000, subject to periodic review and adjustment. The Offer Letter also provides that he will participate in the Company’s annual cash incentive plan in fiscal 2015, with a targeted annual incentive opportunity of 100% of base salary and a maximum annual incentive opportunity of 200% of base salary. The Offer Letter further provides the Mr. Nauman will receive awards under the Company’s 2012 Omnibus Incentive Stock Plan (the “Incentive Stock Plan”) in September 2014, subject to the discretion of the Management Development and Compensation Committee, with a grant date value of $1.8 million, divided equally between time-based options and restricted stock units. Under the terms of the Offer Letter, Mr. Nauman will be required to hold, directly or indirectly, shares of Brady common stock equal to five times his base salary within five years of his appointment.

The Offer Letter provides that Mr. Nauman will be able to participate in all employee benefit plans and programs generally available to the Company’s executive officers, including perquisites covering a car allowance, financial planning and executive physical program, and will be reimbursed for certain of his relocation expenses. The Offer Letter also contains 24-month non-competition and non-solicitation provisions, as well as standard confidentiality, waiver and non-disparagement provisions. Should Mr. Nauman’s employment be terminated by the Company without cause or should he resign for good reason (as such events are defined in the Offer Letter), the Company will pay Mr. Nauman a severance benefit equal to two times the sum of his base salary and target bonus.

Upon commencement of his employment on August 4, 2014, and pursuant to the terms of the Offer Letter, the Company entered into a Restricted Stock Unit Agreement with Mr. Nauman (the “RSU Agreement”) under which Mr. Nauman received 53,668 restricted stock units with an aggregate award value of $1.5 million, as calculated based on the 30-day average NYSE closing price of the Company’s Class A Non-Voting Common Stock. The restricted stock units will vest in equal annual increments on the third, fourth and fifth anniversaries of the grant date, with vesting accelerated in the event of death, disability, termination following a change of control, or termination by the Company without cause (as such events are defined in the RSU Agreement).

Effective August 4, 2014, the Company also entered into a Change of Control Agreement with Mr. Nauman (the “Change of Control Agreement”). Under the terms of the Change of Control Agreement, in the event of a qualifying termination within 24 months following a change of control (as such events are defined in the

2

Change of Control Agreement), Mr. Nauman will receive two times his annual base salary, two times his target bonus, and the amount of his target bonus prorated based on when the termination occurs.

Upon Mr. Nauman’s appointment as President and Chief Executive Officer, Thomas J. Felmer will step down as Interim President and Chief Executive Officer and will continue to serve as the Company’s Senior Vice President and Chief Financial Officer. The Management Development and Compensation Committee of the Board of Directors authorized an award of 5,000 restricted stock units to Mr. Felmer, effective August 4, 2014, which will vest upon the first anniversary of the grant date, with vesting accelerated in the event of death, disability, termination following a change of control, or termination by the Company without cause.

A copy of the Company’s press release announcing Mr. Nauman’s appointment is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The foregoing descriptions of the Offer Letter, RSU Agreement and Change of Control Agreement are qualified in their entirety by reference to the full text of such agreements, copies of which are attached hereto as Exhibits 10.1, 10.2 and 10.3, respectively, and are incorporated herein by reference.

Item 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

The following are filed as Exhibits to this Report.

|

Exhibit No. |

|

Description of Exhibit |

|

|

|

|

|

10.1 |

|

Employment Offer Letter between the Company and Mr. Nauman dated as of August 1, 2014. |

|

|

|

|

|

10.2 |

|

Restricted Stock Unit Agreement between the Company and Mr. Nauman dated as of August 4, 2014. |

|

|

|

|

|

10.3 |

|

Change of Control Agreement between the Company and Mr. Nauman dated as of August 4, 2014. |

|

|

|

|

|

99.1 |

|

Press Release of Brady Corporation, dated August 4, 2014. |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

BRADY CORPORATION |

|

Date: August 4, 2014 |

|

|

|

/s/ Thomas J. Felmer |

|

|

Thomas J. Felmer |

|

|

Senior Vice President & |

|

|

Chief Financial Officer |

4

EXHIBIT INDEX

|

EXHIBIT |

|

|

|

NUMBER |

|

DESCRIPTION |

|

|

|

|

|

10.1 |

|

Employment Offer Letter between the Company and Mr. Nauman dated as of August 1, 2014. |

|

|

|

|

|

10.2 |

|

Restricted Stock Unit Agreement between the Company and Mr. Nauman dated as of August 4, 2014. |

|

|

|

|

|

10.3 |

|

Change of Control Agreement between the Company and Mr. Nauman dated as of August 4, 2014. |

|

|

|

|

|

99.1 |

|

Press Release of Brady Corporation, dated August 4, 2014. |

5

Exhibit 10.1

BRADY CORPORATION

6555 West Good Hope Road

Milwaukee, WI 53211

August 1, 2014

Michael Nauman

3615 Doral Drive

Little Rock, AR 72212

Dear Michael:

On behalf of Brady Corporation (“Brady” or the “Company”), I am pleased to offer you the position of President and Chief Executive Officer (“CEO”), reporting to the Company’s Board of Directors (the “Board”), working at the Company’s headquarters at 6555 West Good Hope Road in Milwaukee, Wisconsin.

Outlined below are the terms and conditions of your position with Brady. In developing this offer, our goal has been to provide you with an attractive and competitive compensation package as you undertake your new position with Brady on or about August 4, 2014 (the “Employment Start Date”).

1. Board Appointment. You will be appointed to the Board upon your Employment Start Date.

2. Base Salary. Your starting annual base salary will be $675,000.00, less applicable taxes, deductions and withholdings, paid bi-weekly. Your annual base salary will be reviewed annually, commencing with the Company’s fiscal year beginning August 1, 2015, and may be changed in the discretion of the Board or Management Development and Compensation Committee (the “Committee”); however, such base salary shall not be lowered below $675,000.00.

3. Incentive Compensation. You are eligible to participate in Brady’s annual incentive program. Bonus awards are based on attainment of specified Company operating and financial goals, including sales growth, operating profit and net income growth. Your targeted annual incentive opportunity is 100% of base annual salary, with upside potential to 200% of this target (200% of base salary). The first such payment for which you are eligible will be based upon results and performance in fiscal year 2015.

4. Sign-on Equity Award. You will be entitled to receive an initial equity award in the form of Restricted Stock Units under the Brady Corporation 2012 Omnibus Incentive Stock Plan (the “Incentive Stock Plan”) with an aggregate award value of $1.5 million (the “Initial RSUs”). The number of Initial RSUs shall be calculated based on the 30-day average NYSE closing price of Brady’s Class A Non-Voting Common Stock for the period ended on the last trading day prior to the Employment Start Date. The Initial RSUs will vest in equal annual increments on the third, fourth and fifth anniversaries of the grant date. The Initial RSUs will be granted upon hire and documented by separate agreement.

1

5. Subsequent Equity Awards. Commencing with the fiscal year beginning August 1, 2014, you will be eligible for annual equity awards under the Incentive Stock Plan. Fiscal year 2015 annual equity awards are scheduled to be made in September 2014, subject to the discretion of the Committee. Your fiscal year 2015 annual equity award will have a grant date fair value of $1.8 million (the “Initial Annual Grant”), with fifty percent (50%) of such Initial Annual Grant in the form of options and fifty percent (50%) in the form of restricted stock units, and will be documented by separate agreements. The terms and conditions of the Initial Annual Grant (including, without limitation, the form of award(s), vesting schedule, performance objectives, restrictive provisions, etc.) will be on terms and conditions similar to the annual long-term incentive awards granted to other senior executive officers of the Company at the time of such grants. The actual grant date value and form of any equity awards made thereafter during your employment with Brady shall be determined in the discretion of the Committee after taking into account the Company’s and your performance and other relevant factors. It is contemplated that the terms and conditions of annual grants (including, without limitation, the form of award(s), vesting schedule, performance objectives, restrictive provisions, etc.) will be on the same terms and conditions applicable to the annual long-term incentive awards granted to other senior executive officers of the Company at the time of such grants. All of such annual grants shall be subject to any applicable tax withholding or deductions. You will have the opportunity to evaluate the future structure of the long-term incentives to ensure alignment with strategic priorities and shareholder value (subject to committee participation and approval).

6. General Terms. All grants hereunder shall be made pursuant to the Incentive Stock Plan and shall be subject to the terms and conditions of the Incentive Stock Plan, including, without limitation, Section 3.01 thereof (which provides that the number of shares underlying awards granted to any one person during a calendar year shall not exceed 500,000) and will contain restrictions relating to confidentiality, non-solicitation and non-competition.

7. Clawbacks. All bonuses and equity grants are subject to Brady “clawback” policies as in effect from time to time, including any established under the Dodd-Frank Wall Street Reform.

8. Stock Ownership. You will be required to own and hold, directly or indirectly shares equal to five times your base salary within five years of your Employment Start Date. For this purpose, share ownership shall be determined in accordance with Brady’s corporate policies on share ownership. No selling of company stock is allowed (other than as withholding or sale for taxes at your highest state and federal marginal tax rate) until the guideline has been satisfied.

9. Benefits. Brady offers an excellent package of employee benefits, which includes, retirement, medical, dental, vision, life insurance, and other programs. In addition, you will be eligible to participate in the benefit plans available to Brady’s executive officers, including Brady’s Matched 401(k) Plan, Funded Retirement Plan, Restoration Plan and Executive Deferred Compensation Plan. Please refer to benefit plan documents for eligibility. You will also participate in the current executive perquisite program, which for you will initially include an annual car allowance of $18,000, financial and tax planning up to $6,000 the first year of your employment and $3,000 annually thereafter, and participation in the Mayo executive physical program. Of course, Brady may change its general benefits

2

at any time. However, the Company understands and agrees that your participation in the Mayo Clinic executive physical program is of utmost importance to you and shall not be eliminated or reduced during your employment.

The Company will reimburse you for reasonable legal fees incurred in connection with negotiating and reviewing this letter up to a maximum of ten thousand dollars ($10,000) (based on your attorney’s normal charges and upon providing Brady with documentation of the charges). This will be a taxable benefit to you.

You will be expected to travel in connection with your employment. Brady will reimburse you for reasonable business expenses incurred in connection with your employment, upon presentation of appropriate documentation in accordance with the Company’s expense reimbursement policies and you will be eligible to participate in the travel policy established by the Company generally for its senior management.

10. Vacation and Holidays. You are eligible for vacation and holidays in accordance with Brady’s policy in effect for executive officers; provided, however, that upon your hire you will receive on an annual basis throughout the term of your employment five (5) documented weeks of vacation and one (1) additional week to use in your discretion.

11. Relocation. This position shall be held in Milwaukee, Wisconsin and it is understood that you will be relocating to the Milwaukee area at or near the time of your start date although the relocation of other members of your family may not occur for an extended period of time. Brady will provide you with a temporary and interim housing expense/transportation allowance in accordance with the Brady Corporation Domestic Relocation Policy (the “Relocation Policy”) which will begin in August 2014, modified as follows:

(1) It is agreed that you may initially utilize hotel accommodations or an apartment or other rental accommodation and will move some possessions to that location. It is further agreed that you may subsequently move into a long-term apartment, with additional items moved from Little Rock, Arkansas. Brady will cover the cost of these accommodations (up to 60 days) and pay for the related moving expenses in accordance with the Relocation Policy.

(2) When your family is prepared to move to the Milwaukee area, Brady will reimburse you for your moving expenses in accordance with its then existing Relocation Policy, less moving expenses previously reimbursed pursuant to (1) above.

12. No Conflict with Prior Agreements. As a condition of Brady’s obligations under this agreement, you must provide a written waiver of the terms of any applicable restrictive covenants with your former employer or any entity affiliated with your former employer that may be triggered by your employment by Brady. The parties acknowledge that such waiver, in form agreeable to Brady, has been received. By signing this offer letter, you represent that your employment with Brady shall not breach any agreement you have with any third party.

3

13. Obligations. During your employment, you shall devote your full business efforts and time to Brady. This obligation, however, shall not preclude you from engaging in appropriate civic, charitable or religious activities or, with the consent of the Board, from serving on the boards of directors of companies that are not competitors to Brady, as long as the activities do not materially interfere or conflict with your responsibilities to or your ability to perform your duties of employment at Brady. Any outside activities must be in compliance with and approved if required by Brady’s Code of Ethics or Corporate Governance Principles. Your current non-profit activities are the Museum of Discovery, Arkansas Science and Technology Authority, and Arkansas Stem Coalition and the Company hereby agrees that such activities do not materially interfere or conflict with your responsibilities to the Company.

14. Employment At-Will. Please understand that this letter does not constitute a contract of employment for any specific period of time, but will create an employment at-will relationship that may be terminated at any time by you or Brady, with or without cause and with or without advance notice. The at-will nature of the employment relationship may not be modified or amended except by written agreement signed by Brady’s Lead Independent Director and you. Notwithstanding the foregoing, if your employment is terminated by Brady without Cause or you resign for Good Reason, Brady will pay you a severance benefit equal to two times the sum of your base salary and target bonus, payable in monthly installments over a two year period. For this purpose, “Cause” means (i) your willful and continued failure to substantially perform your duties with the Company (other than any such failure resulting from physical or mental incapacity) after written demand for performance is given to you by the Company which specifically identifies the manner in which the Company believes you have not substantially performed and a reasonable time to cure has transpired, (ii) your conviction of or plea of nolo contendere for the commission of a felony, or (iii) your commission of an act of dishonesty or of any willful act of misconduct which results in or could reasonably be expected to result in significant injury (monetarily or otherwise) to the Company, as determined in good faith by the Committee. “Good Reason” shall be deemed to exist only if the Company shall fail to correct within 60 days after receipt of written notice from you specifying in reasonable detail the reasons you believe one of the following events or conditions has occurred (provided such notice is delivered by you no later than 30 days after the initial existence of the occurrence): (1) a material diminution of your then current aggregate base salary and target bonus amount (other than pro rata reductions that also affect substantially all other similarly situated employees) without your prior written agreement; (2) the material diminution of your authority, duties or responsibilities as President and CEO of the Company without your prior written agreement; or (3) the relocation of your position with the Company to a location that is greater than 50 miles from Milwaukee, Wisconsin and that is also further from your principal place of residence, without your prior written agreement, provided that in all events the termination of your service with the Company shall not be treated as a termination for “Good Reason” unless such termination occurs not more than six (6) months following the initial existence of the occurrence of the event or condition claimed to constitute “Good Reason”. In addition, Brady will provide you with a separate change in control agreement upon your employment with Brady providing that in the event of a qualifying termination within 24 months following a change in control, you will receive two times your annual base salary, two times your target bonus, and a pro rata bonus for the year of termination based upon

4

your target bonus for such year. All severance benefits are conditioned on your signing a full release of any and all claims against Brady in a release form acceptable to Brady and commercially reasonable and standard within the community (within 60 days after your termination of employment or such shorter period as may be specified by the Company) after the termination of your employment and your not revoking such release pursuant to any revocation rights afforded by applicable law. Upon a termination of your employment, you hereby resign as of the date of such termination as a director and officer of Brady and its affiliates and subsidiaries and as a fiduciary of any of its or their benefit plans, and you agree to promptly execute and deliver upon such termination any document reasonably required by Brady to evidence the foregoing.

15. Code Section 280G. Notwithstanding any provision of this Agreement to the contrary, in the event that you become entitled to receive payments or benefits under this Agreement or under any other plan, agreement or arrangement with the Company (all such payments and benefits being referred to herein as the “Total Payments”) and it is determined that any of the Total Payments will be subject to any excise tax pursuant to Code Section 4999, or any similar or successor provision (the “Excise Tax”), the Company shall pay you either (i) the full amount of the Total Payments or (ii) an amount equal to the Total Payments, reduced by the minimum amount necessary to prevent any portion of the Total Payments from being an “excess parachute payment” (within the meaning of Code Section 280G) (the “Capped Payments”), whichever of the foregoing amounts results in the receipt by you, on an after-tax basis, of the greatest amount of Total Payments notwithstanding that all or some portion of the Total Payments may be subject to the Excise Tax. The determination as to whether and to what extent payments are required to be reduced in accordance with the preceding sentence shall be made at the Company’s expense.

16. Code of Ethics and Brady Policies. Brady is committed to creating a positive work environment and conducting business ethically. As an employee of Brady, you will be expected to abide by the Company’s policies and procedures including Brady’s Code of Ethics and Brady’s Corporate Governance Principles. Brady requests that you review, sign and bring with you on your Employment Start Date, the enclosed Code of Ethics Acknowledgment Form.

17. Confidentiality. During your employment with the Company, the Company will provide you with Confidential Information relating to the Company, its business and clients, the disclosure or misuse of which would cause severe and irreparable harm to the Company. You agree that all Confidential Information is and shall remain the sole and absolute property of the Company. Upon the termination of your employment with the Company for any reason, you agree to immediately return to the Company all documents and materials that contain or constitute Confidential Information, in any form whatsoever, including but not limited to, all copies, abstracts, electronic versions, and summaries thereof. You further agree that, without the written consent of the Board of Directors, you will not disclose, use, copy or duplicate, or otherwise permit the use, disclosure, copying or duplication of any Confidential Information of the Company, other than in connection with the authorized activities conducted in the course of your employment with the Company. You agree to take all reasonable steps and precautions to prevent any unauthorized disclosure, use, copying or duplication of Confidential Information. For purposes of this Agreement, Confidential Information means any and all financial, technical, commercial

5

or other information concerning the business and affairs of the Company that is confidential and proprietary to the Company.

18. Noncompetition; Nonsolicitation. You agree that during the time of your employment with Company, you will not, directly or indirectly, perform duties as or for a Competitor, or participate in the inducement of or otherwise encourage Company employees, clients, or vendors to currently and/or prospectively breach, modify, or terminate any agreement or relationship they have or had with Company. In addition, for a period of 24 months following the termination of your employment with Company, you will not: (A) perform duties as or for a Competitor that are the same as or similar to the duties performed by you for the Company at any time during any part of the 24 month period preceding the termination of your employment with Company; or (B) participate in the inducement of or otherwise encourage Company employees, clients, or vendors to currently and/or prospectively breach, modify, or terminate any agreement or relationship they have or had with Company during any part of the 24 month period preceding the termination of your employment with Company. For purposes of the foregoing, a Competitor shall mean any corporation, person, firm or organization (or division or part thereof) engaged in or about to become engaged in research and development work on, or the production and/or sale of, any product or service which is directly competitive with one with respect to which you acquired Confidential Information by reason of your work with the Company.

19. Non-Disparagement. You agree, other than with regard to employees in the good faith performance of your duties with the Company while employed by the Company, both during and for five (5) years after your employment with the Company terminates, not to knowingly disparage the Company or its officers, directors, employees or agents in any manner likely to be harmful to it or them or its or their business, business reputation or personal reputation. The Company will instruct its Chief Executive and the named executive officers of the Company, other than in the good faith performance of their duties to the Company or in connection with their fiduciary duties to the Company and applicable law, both during and for five (5) years after your employment with the Company terminates, not to knowingly disparage you in any manner likely to be harmful to you or your business reputation or personal reputation. This paragraph shall not be violated by statements from either party which are truthful, complete and made in good faith in required response to legal process or governmental inquiry. You also agree that any breach of this non-disparagement provision by you shall be deemed a material breach of this offer letter.

20. Entire Agreement. This offer letter and the referenced documents and agreements constitute the entire agreement between you and Brady with respect to the subject matter hereof and supersede any and all prior or contemporaneous oral or written representations, understandings, agreements or communications between you and Brady concerning those subject matters.

21. Eligibility to Work in the United States. In order for Brady to comply with United States law, we ask that on your Employment Start Date you bring to Brady appropriate documentation to verify your authorization to work in the United States. Brady may not employ anyone who cannot provide documentation showing that they are legally authorized to work in the United States.

6

22. IRC 409A. This letter agreement is intended to comply with the provisions of Section 409A of the Internal Revenue Code (the “Code”) and shall be interpreted and administered accordingly. If any provision or term of this Agreement would be prohibited by or inconsistent with the requirements of Section 409A of the Code, then such provision or term shall be deemed to be reformed to comply with Section 409A of the Code. Each severance payment shall be treated as a separate and distinct “payment” for purposes of Code Section 409A. Accordingly, any such payments that would otherwise be payable (i) within 2-½ months after the end of Brady’s taxable year in which the right to payment is no longer subject to a substantial risk of forfeiture, or (ii) within 2-½ months after your taxable year in which the right to payment is no longer subject to a substantial risk of forfeiture, whichever occurs later (the “Short Term Deferral Period”), are exempt from Code Section 409A. Furthermore, any such payments paid after the Short Term Deferral Period which meet the conditions for the severance pay exception under Section 409A shall also be exempt from Section 409A. A termination of employment shall not be deemed to have occurred for purposes of any provision of this letter agreement providing for the payment of any amounts or benefits upon or following a termination of employment that are considered “nonqualified deferred compensation” under Section 409A of the Code unless such termination is also a “separation from service” within the meaning of Section 409A of the Code and, for purposes of any such provision of this letter agreement, references to a “termination,” “termination of employment” or like terms shall mean “separation from service.” If you are deemed on the date of termination to be a “specified employee” within the meaning of that term under Section 409A(a)(2)(B) of the Code, then with regard to any payment that is considered non-qualified deferred compensation under Section 409A of the Code payable on account of a “separation from service,” such payment or benefit shall be made or provided at the date which is the earlier of (A) the date that is immediately following the expiration of the six (6)-month period measured from the date of such “separation from service” of you, and (B) the date of your death (the “Delay Period”). Upon the expiration of the Delay Period, all payments and benefits delayed pursuant to this paragraph (whether they would have otherwise been payable in a single sum or in installments in the absence of such delay) shall be paid or reimbursed to you in a lump sum, and any remaining payments and benefits due under this letter agreement shall be paid or provided in accordance with the normal payment dates specified for them herein.

23. Background Check. You represent that all information provided by you to Brady or its agents with regard to your background is true and correct.

24. Choice of Law, Jurisdiction, Venue. This letter and all disputes arising hereunder or relating hereto shall be governed by the internal laws of the state of Wisconsin, without regard to its conflict of laws principles. EACH OF THE PARTIES HERETO (A) SUBMITS TO THE JURISDICTION OF THE STATE COURTS LOCATED IN THE COUNTY OF MILWAUKEE, WISCONSIN, U.S.A., OR THE U.S. FEDERAL DISTRICT COURT FOR THE EASTERN DISTRICT OF WISCONSIN WITH RESPECT TO ANY LEGAL ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS LETTER; (B) AGREES THAT ANY CLAIMS WITH RESPECT TO SUCH ACTION OR PROCEEDING SHALL BE HEARD OR DETERMINED ONLY IN SUCH COURT; (C) AGREES NOT TO BRING ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS LETTER IN ANY OTHER COURT UNLESS OR UNTIL SUCH COURT HAS FINALLY REFUSED TO EXERCISE JURISDICTION; AND (D) WAIVES ANY DEFENSE OF INCONVENIENT FORUM TO THE MAINTENANCE OF ANY ACTION OR PROCEEDING SO BROUGHT.

7

25. Notices. All notices and other communications under this letter shall be in writing and shall be given by hand delivery to the other party or by registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

|

If to Nauman: |

Michael Nauman |

|

|

3615 Doral Drive |

|

|

Little Rock, AR 72212 |

|

|

|

|

If to Brady: |

Brady Corporation |

|

|

6555 West Good Hope Road |

|

|

Milwaukee, Wisconsin 53223 |

|

|

Attention: CFO |

We look forward to your joining Brady. Please indicate your acceptance of this offer by signing where indicated below and returning an executed copy of this offer to me at your earliest convenience.

Sincerely,

|

/s/ Conrad G. Goodkind |

|

|

|

|

|

Brady Corporation |

|

|

Conrad G. Goodkind |

|

|

Lead Independent Director |

|

I accept this offer of employment with Brady Corporation and agree to the terms and conditions outlined in this letter.

|

/s/ Michael Nauman |

|

August 1, 2014 |

|

Michael Nauman |

|

Date |

Enclosures

Cc: HR file

8

Exhibit 10.2

BRADY CORPORATION

RESTRICTED STOCK UNIT AGREEMENT

The Management Development and Compensation Committee (the “Committee”) of the Brady Corporation Board of Directors has awarded to J. Michael Nauman (“Employee”) a restricted stock unit award effective August 4, 2014 pursuant to the terms of the Brady Corporation 2012 Omnibus Incentive Stock Plan (the “Plan”). The Corporation’s records shall be the official record of the grant described herein and, in the event of any conflict between this description and the Corporation’s records, the Corporation’s records shall control.

1. Number of Units

This Restricted Stock Unit Award applies to 53,668 shares of the presently authorized Class A Nonvoting Common Stock of the Corporation, $.01 par value (the “Restricted Stock Units”). The Restricted Stock Units granted under this Agreement are units that will be reflected in a book account maintained by the Corporation until they become vested or have been forfeited.

2. Service Vesting Requirement

The vesting of this Award (other than pursuant to accelerated vesting in certain circumstances as provided in Section 3 below) shall be subject to the satisfaction of the condition set forth in Section 2(a) below:

(a) Vesting. The Award shall be subject to the following service vesting requirement. If the Employee continues in employment through the vesting dates listed below, the Restricted Stock Units shall be vested as listed in the following table:

|

Vesting Date |

|

Cumulative Percentage of

Vested Restricted Stock Units |

|

|

|

|

|

Third anniversary of grant date |

|

33-1/3% |

|

Fourth anniversary of grant date |

|

66-2/3% |

|

Fifth anniversary of grant date |

|

100% |

(b) Forfeiture of Restricted Stock Units. Except as provided in Section 3, if the Employee terminates employment prior to the satisfaction of the vesting requirements set forth in Section 2(a) above, any unvested Restricted Stock Units shall immediately be forfeited. The period of time during which the Restricted Stock Units covered by this Award are forfeitable is referred to as the “Restricted Period.”

3. Accelerated Vesting.

(a) Notwithstanding the terms and conditions of Section 2 hereof, in the event of the termination of the Employee’s employment with the Corporation (and any Affiliate) prior to the end of the Restricted Period due to death or Disability, or due to termination by the Corporation without Cause, the Restricted Stock Units shall become fully vested.

(b) In the event of the termination of the Employee’s employment with the Corporation (and any Affiliate) prior to the end of the Restricted Period due to a Change in Control, the Restricted Stock Units shall become unrestricted and fully vested.

For purposes of this Agreement, a “Change of Control” shall occur if any person or group of persons (as defined in Section 13(d)(3) of the Securities and Exchange Act of 1934) other than the members of the family of William H. Brady, Jr. and their descendants, or trusts for their benefit, and the W. H. Brady Foundation, Inc., collectively, directly or indirectly controls in excess of 50% of the voting common stock of the Corporation.

For purposes of this Agreement, a termination due to Change of Control shall occur if within the 24 month period beginning with the date a Change of Control occurs (i) the Employee’s employment with the Corporation (and any Affiliate) is involuntarily terminated (other than by reason of death, disability or Cause) or (ii) the Employee’s employment with the Corporation (and any Affiliate) is voluntarily terminated by the Employee subsequent to (A) a 10% or more diminution in the total of the Employee’s annual base salary (exclusive of fringe benefits) and the Employee’s target bonus in comparison with the Employee’s total of annual base salary and target bonus immediately prior to the date the Change of Control occurs, (B) a significant diminution in the responsibilities or authority of the Employee in comparison with the Employee’s responsibility and authority immediately prior to the date the Change of Control occurs or (C) the imposition of a requirement by the Corporation that the Employee relocate to a principal work location more than 50 miles from the Employee’s principal work location immediately prior to the date the Change of Control occurs.

For purposes of this Agreement, Cause means (i) the Employee’s willful and continued failure to substantially perform the Employee’s duties with the Corporation (other than any such failure resulting from physical or mental incapacity) after written demand for performance is given to the Employee by the Corporation which specifically identifies the manner in which the Corporation believes the Employee has not substantially performed and a reasonable time to cure has transpired, (ii) the Employee’s conviction of or plea of nolo contendere for the commission of a felony, or (iii) the Employee’s commission of an act of dishonesty or of any willful act of misconduct which results in or could reasonably be expected to result in significant injury (monetarily or otherwise) to the Corporation, as determined in good faith by the Committee.

2

(c) In the event of (i) the merger or consolidation of the Corporation with or into another corporation or corporations in which the Corporation is not the surviving corporation, (ii) the adoption of any plan for the dissolution of the Corporation, or (iii) the sale or exchange of all or substantially all the assets of the Corporation for cash or for shares of stock or other securities of another corporation, the Restricted Stock Units shall become fully vested.

4. No Dividends

No dividends will be paid or accrued on any Restricted Stock Units during the Restricted Period.

5. Settlement of Restricted Stock Units.

As soon as practicable after Restricted Stock Units become vested, the Company shall deliver to the Employee one share of the Corporation’s Class A Nonvoting Common Stock, $.01 par value (“Corporation Stock”) for each Restricted Stock Unit which becomes vested.

6. Transfer Restrictions

This Award is non-transferable and may not be assigned, pledged or hypothecated and shall not be subject to execution, attachment or similar process. Upon any attempt to effect any such disposition, or upon the levy of any such process, the Award shall immediately become null and void and the Restricted Stock Units shall be forfeited.

7. Withholding Taxes

The Corporation may require payment of or withhold any tax which it believes is payable as a result of the Restricted Stock Units becoming vested, and the Corporation may defer making delivery of the Corporation Stock until arrangements satisfactory to the Corporation have been made with regard to any such withholding obligations. In lieu of part or all of any such payment, the Employee, in satisfaction of all withholding taxes (including, without limitation, Federal income, FICA (Social Security and Medicare) and any state and local income taxes) payable as a result of such vesting, may elect, subject to such rules and regulations as the Committee may adopt from time to time, to have the Corporation withhold that number of shares of Corporation Stock (valued at Fair Market Value on the date of vesting and rounded upward) required to settle such withholding taxes.

8. Death of Employee

If the Restricted Stock Units shall vest upon the death of the Employee, the shares of Corporation Stock and any amounts in the Employee’s Dividend Account shall be issued and paid to the estate of the Employee unless the Corporation shall have theretofore received in writing a beneficiary designation, in which event they shall be issued and paid to the designated beneficiary.

3

9. Confidentiality, Non-Solicitation and Non-Compete

As consideration for the grant of this Award, Employee agrees to, understands and acknowledges the following:

(a) During Employee’s employment with the Corporation and its Affiliates (the “Company”), the Company will provide Employee with Confidential Information relating to the Company, its business and clients, the disclosure or misuse of which would cause severe and irreparable harm to the Company. Employee agrees that all Confidential Information is and shall remain the sole and absolute property of the Company. Upon the termination of Employee’s employment with the Company for any reason, Employee shall immediately return to the Company all documents and materials that contain or constitute Confidential Information, in any form whatsoever, including but not limited to, all copies, abstracts, electronic versions, and summaries thereof. Executive further agrees that, without the written consent of the Chief Executive Officer of the Corporation or, in the case of the Chief Executive Officer of the Corporation, without the written approval of the Board of Directors of the Corporation, Employee will not disclose, use, copy or duplicate, or otherwise permit the use, disclosure, copying or duplication of any Confidential Information of the Company, other than in connection with the authorized activities conducted in the course of Employee’s employment with the Company. Employee agrees to take all reasonable steps and precautions to prevent any unauthorized disclosure, use, copying or duplication of Confidential Information. For purposes of this Agreement, Confidential Information means any and all financial, technical, commercial or other information concerning the business and affairs of the Company that is confidential and proprietary to the Company, including without limitation,

(i) information relating to the Company’s past and existing customers and vendors and development of prospective customers and vendors, including specific customer product requirements, pricing arrangements, payments terms, customer lists and other similar information;

(ii) inventions, designs, methods, discoveries, works of authorship, creations, improvements or ideas developed or otherwise produced, acquired or used by the Company;

(iii) the Company’s proprietary programs, processes or software, consisting of but not limited to, computer programs in source or object code and all related documentation and training materials, including all upgrades, updates, improvements, derivatives and modifications thereof and including programs and documentation in incomplete stages of design or research and development;

(iv) the subject matter of the Company’s patents, design patents, copyrights, trade secrets, trademarks, service marks, trade names, trade dress, manuals, operating instructions, training materials, and other industrial

4

property, including such information in incomplete stages of design or research and development; and

(v) other confidential and proprietary information or documents relating to the Company’s products, business and marketing plans and techniques, sales and distribution networks and any other information or documents which the Company reasonably regards as being confidential.

(b) Employee agrees that, without the written consent of the Chief Executive Officer of the Corporation, in the case of the Chief Executive Officer of the Corporation, without the written approval of the Board of Directors of the Corporation, Employee shall not engage in any of the conduct described in subsections (i) or (ii), below, either directly or indirectly, or as an employee, contractor, consultant, partner, officer, director or stockholder, other than a stockholder of less than 5% of the equities of a publicly traded corporation, or in any other capacity for any person, firm, partnership or corporation:

(i) During the time of Employee’s employment with Company, Employee will not: (A) perform duties as or for a Competitor; or (B) participate in the inducement of or otherwise encourage Company employees, clients, or vendors to currently and/or prospectively breach, modify, or terminate any agreement or relationship they have or had with Company.

(ii) For a period of 24 months following the termination of Employee’s employment with Company, Employee will not: (A) perform duties as or for a Competitor that are the same as or similar to the duties performed by Employee for the Company at any time during any part of the 24 month period preceding the termination of Employee’s employment with Company; or (B) participate in the inducement of or otherwise encourage Company employees, clients, or vendors to currently and/or prospectively breach, modify, or terminate any agreement or relationship they have or had with Company during any part of the 24 month period preceding the termination of Employee’s employment with Company.

For purposes of this Agreement, a Competitor shall mean any corporation, person, firm or organization (or division or part thereof) engaged in or about to become engaged in research and development work on, or the production and/or sale of, any product or service which is directly competitive with one with respect to which Employee acquired Confidential Information by reason of Employee’s work with the Company.

(c) Employee acknowledges and agrees that compliance with this Section 9 is necessary to protect the Company, and that a breach of any of this Section 9 will result in irreparable and continuing damage to the Company for which there will be no adequate remedy at law. In the event of a breach of this Section 9, or any part thereof, the Company, and its successors and assigns, shall be entitled to injunctive relief and to such other and further relief as is proper under the

5

circumstances. The Company shall institute and prosecute proceedings in any Court of competent jurisdiction either in law or in equity to obtain damages for any such breach of this Section 9, or to enjoin Employee from performing services in breach of Section 9(b) during the term of employment and for a period of 24 months following the termination of employment. Employee hereby agrees to submit to the jurisdiction of any Court of competent jurisdiction in any disputes that arise under this Agreement.

(d) Employee further agrees that, in the event of a breach of this Section 9, the Corporation shall also be entitled to recover the value of any amounts previously paid or payable or any shares (or the value of any shares) delivered or deliverable to Employee pursuant to any Company bonus program, this Agreement, and any other Company plan or arrangement.

(e) Employee agrees that the terms of this Section 9 shall survive the termination of Employee’s employment with the Company.

(f) EMPLOYEE HAS READ THIS SECTION 9 AND AGREES THAT THE CONSIDERATION PROVIDED BY THE CORPORATION IS FAIR AND REASONABLE AND FURTHER AGREES THAT GIVEN THE IMPORTANCE TO THE COMPANY OF ITS CONFIDENTIAL AND PROPRIETARY INFORMATION, THE POST-EMPLOYMENT RESTRICTIONS ON EMPLOYEE’S ACTIVITIES ARE LIKEWISE FAIR AND REASONABLE.

10. Clawback

This Award is subject to the terms of the Corporation’s recoupment, clawback or similar policy as it may be in effect from time to time, as well as any similar provisions of applicable law, any of which could in certain circumstances require repayment or forfeiture of awards or any shares of Corporation Stock or other cash or property received with respect to the awards (including any value received from a disposition of the shares acquired upon payment of the awards).

11. Adjustment of Shares

The terms and provisions of this Award (including, without limitation, the terms and provisions relating to the number and class of shares subject to this Award) shall be subject to appropriate adjustment in the event of any recapitalization, merger, consolidation, disposition of property or stock, separation, reorganization, stock dividend, issuance of rights, combination or split-up or exchange of shares, or the like.

12. Provisions of Plan Controlling

This Award is subject in all respects to the provisions of the Plan. In the event of any conflict between any provisions of this Award and the provisions of the Plan, the provisions of the Plan shall control, except to the extent the Plan permits the Committee to modify the terms of an Award grant and has done so herein. Terms defined in the Plan

6

where used herein shall have the meanings as so defined. Employee acknowledges receipt of a copy of the Plan.

13. Wisconsin Contract

This Award has been granted in Wisconsin and shall be construed under the laws of that state.

14. Severability

Wherever possible, each provision of this Award will be interpreted in such manner as to be effective and valid under applicable law, but if any provision hereof is held to be prohibited by or invalid under applicable law, such provision will be ineffective only to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions hereof.

IN WITNESS WHEREOF, the Corporation has granted this Award as of the day and year first above written.

|

|

BRADY CORPORATION |

|

|

|

|

|

By: |

/s/ Conrad G. Goodkind |

|

|

Name: |

Conrad G. Goodkind |

|

|

Its: |

Lead Independent Director |

|

|

|

|

EMPLOYEE’S ACCEPTANCE

I, Michael Nauman, hereby accept the foregoing Award and agree to the terms and conditions thereof, including the restrictions contained in Section 9 of this Agreement.

|

|

EMPLOYEE: MICHAEL NAUMAN |

|

|

|

|

|

|

|

|

Signature: |

/s/ Michael Nauman |

|

|

Print Name: |

Michael Nauman |

|

|

|

|

7

Exhibit 10.3

BRADY CORPORATION

CHANGE OF CONTROL AGREEMENT

AGREEMENT, made as of August 4, 2014, between Brady Corporation, a Wisconsin corporation, (“Corporation”) and J. Michael Nauman (“Executive”).

WHEREAS, the Executive has been appointed President and Chief Executive Officer of the Corporation; and

WHEREAS, in connection with Executive’s position, the Executive will possess intimate knowledge of the business and affairs of the Corporation and its policies, markets and financial and human resources, and the Executive will acquire certain confidential information and data with respect to the Corporation; and

WHEREAS, the Corporation wishes to receive the benefit of the Executive’s knowledge and experience and, as an inducement for service, is willing to offer the Executive certain payments due to severance as a result of change of control as set forth herein.

NOW, THEREFORE, in consideration of the mutual promises and covenants set forth herein, the Executive and Corporation agree as follows:

SECTION 1. DEFINITIONS.

(a) Change of Control. For purposes of this Agreement, a “Change of Control” shall occur if and when any person or group of persons (as defined in Section 13(d)(3) of the Securities and Exchange Act of 1934) other than the members of the family of William H. Brady, Jr. and their descendants, or trusts for their benefit, and the William H. Brady, Jr. Family Trust, collectively, directly or indirectly controls in excess of 50% of the voting common stock of the Corporation.

(b) Termination Due to Change of Control. A “Termination Due to Change of Control” shall occur if within the 24 month period beginning with the date a Change of Control occurs (i) the Executive’s employment with the Corporation is involuntarily terminated (other than by reason of death, disability or Cause) or (ii) the Executive’s employment with the Corporation is voluntarily terminated by the Executive subsequent to (A) any reduction in the total of the Executive’s annual base salary (exclusive of fringe benefits other than Executive’s participation in the Mayo Clinic executive physical program) and the Executive’s target bonus in comparison with the Executive’s annual base salary and target bonus immediately prior to the date the Change of Control occurs, (B) a significant diminution in the responsibilities or authority of the Executive in comparison with the Executive’s responsibility and authority immediately prior to the date the Change of Control occurs or (C) the imposition of a requirement by the Corporation that the Executive relocate to a principal work location more than 50 miles from the Executive’s principal work location immediately prior to the date the Change of Control occurs.

(c) “Cause” means (i) the Executive’s willful and continued failure to substantially perform the Executive’s duties with the Corporation (other than any such failure resulting from physical or mental incapacity) after written demand for performance is given to the Executive by the Corporation which specifically identifies the manner in which the Corporation believes the Executive has not substantially performed and a reasonable time to cure has transpired, (ii) the Executive’s conviction of (or plea of nolo contendere for the commission of) a felony, or (iii) the Executive’s commission of an act of dishonesty or of any willful act of misconduct which results in or could reasonably be expected to result in significant injury (monetarily or otherwise) to the Corporation, as determined in good faith by the Board of Directors of the Corporation.

(d) “Beneficiary” means any one or more primary or secondary beneficiaries designated in writing by the Executive on a form provided by the Corporation to receive any benefits which may become payable under this Agreement on or after the Executive’s death. The Executive shall have the right to name, change or revoke the Executive’s designation of a Beneficiary on a form provided by the Corporation. The designation on file with the Corporation at the time of the Executive’s death shall be controlling. Should the Executive fail to make a valid Beneficiary designation or leave no named Beneficiary surviving, any benefits due shall be paid to the Executive’s spouse, if living; or if not living, then to the Executive’s estate.

(e) “Code” means the Internal Revenue Code of 1986, as amended.

SECTION 2. PAYMENTS UPON TERMINATION DUE TO CHANGE OF CONTROL.

(a) Following Termination Due to Change of Control, the Executive shall be paid: (i) an amount equal to two times the annual base salary paid the Executive by the Corporation in effect immediately prior to the date the Change of Control occurs, and two times the Executive’s target bonus amount in effect immediately prior to the date the Change of Control occurs; and (ii) an amount equal to the pro rated portion of the Executive’s target bonus for the fiscal year, pro rated based on the number of days served in the fiscal year in which the Executive’s employment with the Corporation terminates. Such amount shall be paid in 24 equal monthly installments beginning on the 15th day of the month following the month in which the Executive’s employment with the Corporation terminates.

(b) If the scheduled payments under paragraph (a) above would result in disallowance of any portion of the Corporation’s deduction therefore under Section 162(m) of the Code, the payments called for under paragraph (a) shall be limited to the amount which is deductible, with the balance to be paid during the first taxable year in which the Corporation reasonably anticipates that the deduction of such payment is not barred by Section 162(m). However, in such event, the Corporation shall pay the Executive on a quarterly basis an amount of interest based on the prime rate recomputed each quarter on the unpaid scheduled payments.

(c) It is intended that (A) each payment or installment of payments provided under this Section 2 is a separate “payment” for purposes of Code Section 409A and (B) that the payments satisfy, to the greatest extent possible, the exemptions from the application of Code Section 409A, including those provided under Treasury Regulations 1.409A-1(b)(4) (regarding

2

short-term deferrals), 1.409A-1(b)(9)(iii) (regarding the two-times, two year exception), and 1.409A-1(b)(9)(v) (regarding reimbursements and other separation pay). Notwithstanding anything to the contrary in this Agreement, if the Corporation determines that on the Termination Due to Change of Control the Executive is a “specified employee” (as such term is defined under Treasury Regulation 1.409A-1(i)(1)) of the Corporation and that any payments to be provided to Executive are or may become subject to the additional tax under Code Section 409A(a)(1)(B) or any other taxes or penalties imposed under Code Section 409A (“Section 409A Taxes”), then such payments shall be delayed until the date that is six (6) months after the Termination Due to Change of Control. Any delayed payments shall be made in a lump sum on the first day of the seventh month following the Termination Due to Change of Control, or such earlier date that, as determined by the Corporation, is sufficient to avoid the imposition of any Section 409A Taxes on Executive.

SECTION 3. EXCISE TAX, ATTORNEY FEES.

(a) If the payments under Section 2 in combination with any other payments which the Executive has the right to receive from the Corporation (the “Total Payments”) would result in the Executive incurring an excise tax as a result of Section 280(G) of the Code, the Executive will be solely responsible for such excise tax.

(b) If the Executive is required to file a lawsuit to enforce the Executive’s rights under this Agreement and the Executive prevails in such lawsuit, the Corporation will reimburse the Executive for attorney fees incurred up to a maximum of $25,000.00.

SECTION 4. DEATH AFTER THE EXECUTIVE HAS BEGUN RECEIVING PAYMENTS.

Should the Executive die after Termination Due to Change of Control, but before receiving all payments due the Executive hereunder, any remaining payments due shall be made to the Executive’s Beneficiary.

SECTION 5. CONFIDENTIAL INFORMATION AGREEMENT.

The Executive has obligations under the separate Confidential Information Agreement between the Executive and the Corporation which continue beyond the Executive’s termination of employment. The payments to be made hereunder are conditioned upon the Executive’s compliance with the terms of the Confidential Information Agreement. The payments made hereunder shall be reduced by any payments the Corporation makes to the Executive under Section 3 of the Confidential Information Agreement. In the event the Executive violates the provisions of the Confidential Information Agreement, no further payments shall be due hereunder and the Executive shall be obligated to repay all previous payments received hereunder in the same manner as provided in Section 4 of the Confidential Information Agreement.

SECTION 6. MISCELLANEOUS.

(a) Non-Assignability. This Agreement is personal to the Executive and, without the prior written consent of the Corporation, shall not be assignable by the Executive

3

otherwise than by will or the laws of descent and distribution. This Agreement shall inure to the benefit of and be binding upon the Corporation and its successors and assigns and shall also be enforceable by the Executive’s legal representatives.

(b) Successors. The Corporation shall require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of the Corporation expressly to assume and agree to perform this Agreement in the same manner and to the same extent that the Corporation would have been required to perform it if no such succession had taken place. As used in this Agreement, “Corporation” shall mean both the Corporation as defined above and any such successor that assumes and agrees to perform this Agreement, by operation of law or otherwise.

(c) Governing Law. This Agreement shall be governed by, and construed in accordance with, the laws of the State of Wisconsin, without reference to principles of conflict of laws, to the extent not preempted by federal law. The captions of this Agreement are not part of the provisions hereof and shall have no force or effect.

(d) Notices. All notices and other communications under this Agreement shall be in writing and shall be given by hand delivery to the other party or by registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

|

If to the Executive: |

J. Michael Nauman |

|

|

3615 Doral Drive |

|

|

Little Rock, AR 72212 |

|

|

|

|

If to the Corporation: |

Brady Corporation |

|

|

6555 West Good Hope Road |

|

|

Milwaukee, Wisconsin 53223 |

|

|

Attention: CFO |

or to such other address as either party furnishes to the other in writing in accordance with this paragraph. Notices and communications shall be effective when actually received by the addressee.

(e) Construction. The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement. If any provision of this Agreement shall be held invalid or unenforceable in part, the remaining portion of such provision, together with all other provisions of this Agreement, shall remain valid and enforceable and continue in full force and effect to the fullest extent consistent with law.

(f) No Guarantee of Employment. Nothing contained in this Agreement shall give the Executive the right to be retained in the employment of the Corporation or affect the right of the Corporation to dismiss the Executive.

(g) Amendment; Entire Agreement. This Agreement may not be amended or modified except by a written agreement executed by the parties hereto or their respective successors and legal representatives. This Agreement contains the entire agreement between the

4

parties on the subjects covered and replaces all prior writings, proposals, specifications or other oral or written materials relating thereto.

(h) Impact on Other Plans. No amounts paid to the Executive under this Agreement will be taken into account as “wages”, “salary”, “base pay” or any other type of compensation when determining the amount of any payment or allocation, or for any other purpose, under any other qualified or nonqualified plan or agreement of the Corporation, except as otherwise may be specifically provided by such plan or agreement.

(i) Other Agreements. Except for the letter agreement outlining the terms of Executive’s employment with the Corporation, this Agreement supersedes any other severance arrangement or Change of Control Agreement between the Corporation and the Executive. This Agreement does not confer any payments or benefits other than the payments described in Sections 2 and 3 hereof.

(j) Withholding. To the extent required by law, the Corporation shall withhold any taxes required to be withheld with respect to this Agreement by the federal, state or local government from payments made hereunder or from other amounts paid to the Executive by the Corporation.

(k) Facility of Payment. If the Executive or, if applicable, the Executive’s Beneficiary, is under legal disability, the Corporation may direct that payments be made to a relative of such person for the benefit of such person, without the intervention of any legal guardian or conservator, or to any legal guardian or conservator of such person. Any such distribution shall constitute a full discharge with respect to the Corporation and the Corporation shall not be required to see to the application of any distribution so made.

SECTION 7. CLAIMS PROCEDURE.

(a) Claim Review. If the Executive or the Executive’s Beneficiary (a “Claimant”) believes that he or she has been denied all or a portion of a benefit under this Agreement, he or she may file a written claim for benefits with the Corporation. The Corporation shall review the claim and notify the Claimant of the Corporation’s decision within 60 days of receipt of such claim, unless the Claimant receives written notice prior to the end of the 60 day period stating that special circumstances require an extension of the time for decision. The Corporation’s decision shall be in writing, sent by mail to the Claimant’s last known address, and if a denial of the claim, must contain the specific reasons for the denial, reference to pertinent provisions of this Agreement on which the denial is based, a designation of any additional material necessary to perfect the claim, and an explanation of the claim review procedure.

(b) Appeal Procedure to the Board. A Claimant is entitled to request a review of any denial by the full Board by written request to the Chair of the Board within 60 days of receipt of the denial. Absent a request for review within the 60-day period, the claim will be deemed to be conclusively denied. The Board shall afford the Claimant the opportunity to review all pertinent documents and submit issues and comments in writing and shall render a review decision in writing, all within 60 days after receipt of a request for review (provided that,

5

in special circumstances the Board may extend the time for decision by not more than 60 days upon written notice to the Claimant.) The Board’s review decision shall contain specific reasons for the decision and reference to the pertinent provisions of this Agreement.

6

IN WITNESS WHEREOF, the Executive has signed this Agreement and, pursuant to the authorization of the Board, the Corporation has caused this Agreement to be signed, all as of the date first set forth above.

|

|

/s/ Michael Nauman |

|

|

Executive – J. Michael Nauman |

|

|

President and Chief Executive Officer |

|

|

|

|

|

|

|

|

Brady Corporation |

|

|

|

|

|

|

|

|

By: |

/s/ Conrad G. Goodkind |

|

|

|

Conrad G. Goodkind |

|

|

|

Lead Independent Director |

7

Exhibit 99.1

|

FOR IMMEDIATE RELEASE |

FOR MORE INFORMATION |

|

August 4, 2014 |

Carole Herbstreit |

|

|

414-438-6882 |

|

|

carole_herbstreit@bradycorp.com |

J. Michael Nauman Named Brady Corporation CEO

MILWAUKEE — Brady Corporation (NYSE: BRC), a world leader in identification solutions, today announced the appointment of J. Michael Nauman as President, Chief Executive Officer and Director, effective immediately.

“Michael Nauman is known and respected as a hands-on leader who thrives on attacking challenges, building customer relationships and driving product innovation,” said Conrad Goodkind, the Lead Independent Director of Brady’s Board. “His strong operational and financial background and experience in managing and growing diverse products and businesses throughout the world make him the ideal person to lead our business into the future.”

Goodkind noted that Thomas J. Felmer, who has served as Interim President and CEO since last October, will return to his previous position as Senior Vice President and Chief Financial Officer.

“On behalf of the Board, I want to thank Tom for his leadership as Interim CEO. Under his watch, Brady has seen an upturn in sales from continuing operations and organic sales growth, he managed the divestiture of our European and Asian die-cut businesses, and we were chosen by Airbus to provide flexible print-on-demand RFID integrated nameplates,” said Goodkind. “We are appreciative of Tom’s leadership and the Board looks forward to working with Michael, Tom and others in growing shareholder value.”

Nauman joins Brady after 20 years in a number of senior management positions at Lisle, Illinois-based Molex Incorporated. For the past five years, he was Molex’s Executive Vice President and President of the Global Integrated Products Division, where he led six global business units in the automotive, datacom, industrial, medical, military/aerospace and mobile markets. Under Nauman’s leadership, the Global Integrated Products Division grew to 12,000 employees at 26 locations in 13 countries with $1.2 billion in annual sales.

– more –

“I have been a Brady customer for many years and have always been impressed with the quality of Brady’s products and services, as well as its history of innovation. I was excited to learn about the opportunity at Brady,” said Nauman. “I’ve spent the past 20 years at a family controlled public company with Midwestern roots and values similar to Brady. Both companies share a global perspective and footprint and take great pride in their histories. I am both motivated and energized to be a part of the Brady family,” he added.

“Brady has a 100-year legacy of high quality, reliability and innovation. I will work to reinforce that culture and build on it to drive profitable growth and differentiate Brady from its competition. My goal is to make Brady even stronger and increase its industry leadership for the next hundred years,” said Nauman.

Nauman began his career as a tax accountant and auditor for Arthur Andersen and Company before serving as Controller and then President of Ohio Associated Enterprises, Inc. before joining Molex in 1994.

Nauman earned a Bachelor of Science in Management from Case Western Reserve University, is a Certified Public Accountant (CPA), a Chartered Global Management Accountant (CGMA) and holds three U.S. patents. He is a board member of the Arkansas Science & Technology Authority; Arkansas Science, Technology, Engineering and Math (STEM) Coalition; and Museum of Discovery.

About Brady Corporation

Brady Corporation is an international manufacturer and marketer of complete solutions that identify and protect people, products and places. Brady’s products help customers increase safety, security, productivity and performance and include high-performance labels, signs, safety devices, printing systems and software. Founded in 1914, the company has a diverse customer base in electronics, telecommunications, manufacturing, electrical, construction, medical and a variety of other industries. Brady is headquartered in Milwaukee, Wisconsin, and as of July 31, 2013, employed approximately 7,400 people in its worldwide businesses. Brady’s fiscal 2013 sales were approximately $1.15 billion. Brady stock trades on the New York Stock Exchange under the symbol BRC. More information is available at www.bradycorp.com.

Forward Looking Statements

Certain information in this news release constitutes “forward-looking statements.” These forward-looking statements relate to, among other things, statements concerning the consummation of the sale of the Die-Cut business and the Company’s future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations, all of which are based on current expectations and assumptions that are subject to risks and uncertainties.

– more –

The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady’s control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: Implementation of the Workplace Safety strategy; the length or severity of the current worldwide economic downturn or timing or strength of a subsequent recovery; future financial performance of major markets Brady serves, which include, without limitation, telecommunications, hard disk drive, manufacturing, electrical, construction, laboratory, education, governmental, public utility, computer, healthcare and transportation; future competition; changes in the supply of, or price for, parts and components; increased price pressure from suppliers and customers; Brady’s ability to retain significant contracts and customers; fluctuations in currency rates versus the U.S. dollar; risks associated with international operations; difficulties associated with exports; risks associated with obtaining governmental approvals and maintaining regulatory compliance; Brady’s ability to develop and successfully market new products; risks associated with identifying, completing, and integrating acquisitions; risks associated with divestitures and businesses held for sale; risks associated with restructuring plans; environmental, health and safety compliance costs and liabilities; risk associated with loss of key talent; risk associated with product liability claims; technology changes and potential security violations to the Company’s information technology systems; Brady’s ability to maintain compliance with its debt covenants; increase in our level of debt; potential write-offs of Brady’s substantial intangible assets; unforeseen tax consequences; risk, associated with our ownership structure; and numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady’s U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2013.

These uncertainties may cause Brady’s actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

# # #

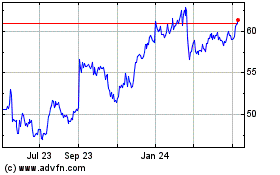

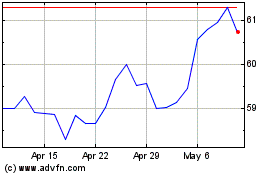

Brady (NYSE:BRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Brady (NYSE:BRC)

Historical Stock Chart

From Jul 2023 to Jul 2024