Brady Corp - Aggressive Growth

April 07 2011 - 8:00PM

Zacks

Brady Corp (BRC) analysts are increasingly bullish thanks to

the most recent earnings release. Estimates are on the rise and are

pointing to a great long-term trend that should carry shares of

this Zacks #1 Rank (Strong Buy) much higher.

Company Description

Brady Corp makes solutions that identify and protect premises,

products and people. Some of the products and services included

labels, signs, safety devices and printing systems. The company has

customers in the electronics, manufacturing, education and medical

fields, as well as others.

Another Surprise

Since beings featured as a Zacks Rank Buy back in December,

Brady Corp has reported another earnings surprise. On Feb 18 the

company said sales were up 11% for its fiscal second quarter, to

$329 million. The bulk of the increase was driven by 9.8% organic

sales growth.

Net income jumped 61% to $24.2 million. Earnings per share was

$0.48, which was 9 cents better than expected and was the third

surprise in the past 4 quarters.

Estimates Up

After the earnings surprise Brady Corp analysts raised full-year

estimates for both fiscal 2011 and 2012. This year's Zacks

Consensus Estimate is up 12 cents, to $2.29. Next year's

projections are averaging $2.57, also up 12 cents.

In fiscal 2010 Brady Corp brought in $1.74 per share, putting

projected growth rates at 32% for fiscal 2011 and another 12% in

2012.

The Chart

Shares of BRC have been climbing over the past few weeks,

breaking out to new highs. While this recent move may keep some on

the sidelines, the long-term earnings trend shows that the move is

warranted and could continue for a while.

Read the December 16th Feature Here

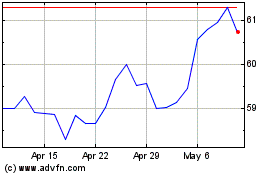

Brady (NYSE:BRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

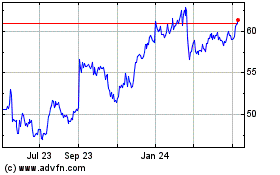

Brady (NYSE:BRC)

Historical Stock Chart

From Jul 2023 to Jul 2024