Brady Corporation Announces Exercise of Full 600,000 Share Over-Allotment Option

July 06 2006 - 5:30PM

PR Newswire (US)

MILWAUKEE, July 6 /PRNewswire-FirstCall/ -- Brady Corporation

(NYSE:BRC) today announced that the underwriters of its previously

announced public offering of Class A non-voting Common Stock have

purchased an additional 600,000 shares pursuant to their exercise

in full of their option to purchase additional shares to cover

over-allotments. After deducting underwriting discounts,

commissions and other estimated expenses of the offering, Brady

expects net proceeds from the sale of over-allotment shares to be

approximately $20.6 million. The offering, including the exercise

of the over-allotment option, resulted in the total sale of

4,600,000 shares of Brady's Class A Common Stock at a price to

public of $36.00 per share. The offering was marketed through a

group of underwriters, including sole bookrunning manager Robert W.

Baird & Co.; co-lead managers Credit Suisse and Wachovia

Securities; and co-manager BMO Capital Markets. This news release

does not constitute an offer to sell or the solicitation of an

offer to buy any securities. The offering was made only by means of

a prospectus supplement, a copy of which may be obtained from the

offices of Robert W. Baird & Co., 777 East Wisconsin Avenue,

28th Floor, Milwaukee, Wisconsin 53202-5391. An electronic copy of

the prospectus supplement and related prospectus is available on

the Securities and Exchange Commission's website at

http://www.sec.gov/ . Brady Corporation is a leading global

manufacturer and marketer of identification solutions and specialty

products that identify and protect premises, products and people.

Its products include high-performance labels and signs, safety

devices, printing systems and software, and precision die- cut

materials. Brady believes that certain statements in this news

release are "forward- looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. All statements

related to future, not past, events included in this news release,

including, without limitation, statements regarding Brady's future

financial position, business strategy, targets, projected sales,

costs, earnings, capital expenditures, debt levels and cash flows,

and plans and objectives of management for future operations are

forward-looking statements. When used in this news release, words

such as "may," "will," "expect," "intend," "estimate,"

"anticipate," "believe," "should," "project" or "plan" or similar

terminology are generally intended to identify forward-looking

statements. These forward-looking statements by their nature

address matters that are, to different degrees, uncertain and are

subject to risks, assumptions and other factors, some of which are

beyond Brady's control, that could cause actual results to differ

materially from those expressed or implied by such forward-looking

statements. For Brady, uncertainties arise from future financial

performance of major markets Brady serves, which include, without

limitation, telecommunications, manufacturing, electrical,

construction, laboratory, education, governmental, public utility,

computer, transportation; difficulties in making and integrating

acquisitions; risks associated with newly acquired businesses;

Brady's ability to retain significant contracts and customers;

future competition; Brady's ability to develop and successfully

market new products; changes in the supply of, or price for, parts

and components; increased price pressure from suppliers and

customers; interruptions to sources of supply; environmental,

health and safety compliance costs and liabilities; Brady's ability

to realize cost savings from operating initiatives; Brady's ability

to attract and retain key talent; difficulties associated with

exports; risks associated with international operations;

fluctuations in currency rates versus the US dollar; technology

changes; potential write-offs of Brady's substantial intangible

assets; risks associated with obtaining governmental approvals and

maintaining regulatory compliance for new and existing products;

business interruptions due to implementing business systems; and

numerous other matters of national, regional and global scale,

including those of a political, economic, business, competitive and

regulatory nature contained from time to time in Brady's U.S.

Securities and Exchange Commission filings, including, but not

limited to, those factors listed in the "Risk Factors" section

located in Item 1A of Part II of Brady's Quarterly Report on Form

10-Q for the period ended April 30, 2006. These uncertainties may

cause Brady's actual future results to be materially different than

those expressed in its forward-looking statements. Brady does not

undertake to update its forward-looking statements. DATASOURCE:

Brady Corporation CONTACT: Barbara Bolens of Brady Corporation,

+1-414-438-6940 Web site: http://www.bradycorp.com/ Company News

On-Call: http://www.prnewswire.com/comp/952350.html

Copyright

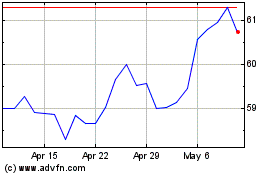

Brady (NYSE:BRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

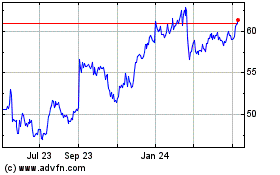

Brady (NYSE:BRC)

Historical Stock Chart

From Jul 2023 to Jul 2024