UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

SKY HARBOUR GROUP CORPORATION

(Name of Issuer)

Class A common stock, par value $0.0001 per share

(Title of Class of Securities)

83085C107

(CUSIP Number)

Joshua P. Weisenburger

Boston Omaha Corporation

1601 Dodge Street, Suite 3300

Omaha, Nebraska 68102

(402) 201-2073

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

May 17, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

NOTE: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

SCHEDULE 13D

|

1

|

NAMES OF REPORTING PERSONS

|

| |

Boston Omaha Corporation

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

(a) ☐

(b) ☐

|

|

3

|

SEC USE ONLY

|

| |

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

| |

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

| |

☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

| |

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

| |

20,406,810 (1)

|

|

8

|

SHARED VOTING POWER

|

| |

|

|

9

|

SOLE DISPOSITIVE POWER

|

| |

20,406,810 (1)

|

|

10

|

SHARED DISPOSITIVE POWER

|

| |

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

| |

20,406,810 (1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

| |

☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

| |

63.1% of Class A Stock (2); representing 27.4% beneficial ownership of the combined voting Common Stock (3)

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

| |

CO

|

|

(1)

|

Comprised of 12,687,031 shares of the Issuer’s (as defined below) Class A common stock, par value $0.0001 (the “Class A Stock”), and warrants exercisable for 7,719,779 shares of Class A Stock (“Warrant Shares”) held by the Reporting Person.

|

|

(2)

|

Calculated based on the shares of Class A Stock, including Warrant Shares, beneficially owned by the Reporting Person relative to the Issuer’s 24,638,948 outstanding shares of Class A Stock, as of May 6, 2024, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on May 14, 2024, plus the 7,719,779 Warrant Shares.

|

|

(3)

|

Calculated based on the shares of Class A Stock, including Warrant Shares, beneficially owned by the Reporting Person relative to the Issuer’s 24,638,948 outstanding shares of Class A Stock and 42,192,250 outstanding shares of Class B common stock, par value $0.0001 per share (“Class B Stock” and together with the Class A Stock, the “Common Stock”), as of May 6, 2024, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on May 14, 2024, plus the 7,719,779 Warrant Shares.

|

Item 1. Security and Issuer.

This Amendment No. 1 (“Amendment No. 1”) amends and supplements the Schedule 13D filed with the U.S. Securities and Exchange Commission on February 4, 2022 (together with the Amendment No. 1, the “Schedule 13D”). As further described in Item 6, this Amendment No. 1 is being filed in connection with the transfer of certain shares of Class A Stock pursuant to the Separation Agreement (as defined below). Each capitalized term used but not defined herein has the meaning ascribed to such term in the Schedule 13D.

This Schedule 13D relates to shares of the Class A Stock of Sky Harbour Group Corporation, a Delaware corporation (the “Issuer”), whose principal executive office is located at 136 Tower Road, Hangar M, Suite 205, White Plains, NY 10604.

Item 2. Identity and Background.

|

(a)

|

This Schedule 13D is being filed by Boston Omaha Corporation, a Delaware corporation (the “Reporting Person”). All investment and voting decisions for the Class A Stock held by the Reporting Person are made by the Reporting Person based on a majority consent of its investment committee, comprised of Mr. Adam K. Peterson and Mr. Joshua P. Weisenburger, each of whom expressly disclaims any beneficial ownership of the reported securities other than to the extent of any pecuniary indirect interest he may have therein as a stockholder of the Reporting Person. Current information concerning the identity and background of the directors and officers of the Reporting Person is set forth in Schedule I attached hereto, which is incorporated by reference to this Item 2.

|

|

(b)

|

The principal business address of the Reporting Person is 1601 Dodge Street, Suite 3300, Omaha, NE 68102.

|

|

(c)

|

The principal business of the Reporting Person is outdoor advertising, surety insurance and broadband telecommunications services.

|

|

(d)

|

(e) During the last five years, neither the Reporting Person nor, to the best of the Reporting Person’s knowledge, any other person identified in Schedule I has been (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

Item 4. Purpose of Transaction.

The information in Item 6 of this Schedule 13D is incorporated by reference into this Item 4.

Item 5. Interest in Securities of the Issuer.

(a) – (b)

The following sets forth, as of the date of this Schedule 13D, the aggregate number of shares of Issuer’s Class A Stock and percentage of Class A Stock (including Warrant Shares) beneficially owned by the Reporting Person, and which the Reporting Person has the sole or shared power to vote or to direct the vote, sole or shared power to dispose or to direct the disposition of, as of the date hereof, based on 24,638,948 outstanding shares of Class A Stock of the Issuer as of May 6, 2024, as reported by the Issuer in its Quarterly Report on Form 10-Q filed with the SEC on May 14, 2024, plus the Warrant Shares.

The following also sets forth the combined voting power of the 20,406,810 shares of Class A Stock (including Warrant Shares) beneficially owned by the Reporting Person relative to the Issuer’s total outstanding Common Stock, as to which the Reporting Person has the sole or shared power to vote or to direct the vote, and sole or shared power to dispose or to direct the disposition of, as of the date hereof, based on 24,638,948 shares of Class A Stock and 42,192,250 shares of the Issuer’s Class B Stock issued and outstanding as of as of May 6, 2024, as reported by the Issuer in its Quarterly Report on Form 10-Q filed with the SEC on May 14, 2024, plus the Warrant Shares. The Reporting Person disposed of 281,250 shares of Class A Stock, as reported in the Form 4 filed with the Securities and Exchange Commission on February 24, 2023.

| |

|

Class A

Common Stock

|

|

|

Class B

Common Stock

|

|

|

Combined

Voting

Power

|

|

|

Reporting Person

|

|

Number(1)

|

|

|

%(2)

|

|

|

Number

|

|

|

%

|

|

|

(%)(3)

|

|

|

Boston Omaha Corporation

|

|

|

20,406,810 |

|

|

|

63.1 |

% |

|

|

- |

|

|

|

- |

|

|

|

27.4 |

% |

|

(1)

|

Consists of 12,687,031 shares of Class A Stock and 7,719,779 Warrant Shares held by the Reporting Person.

|

|

(2)

|

Calculated based on the shares of Class A Stock, including Warrant Shares, beneficially owned by the Reporting Person relative to the Issuer’s 24,638,948 outstanding shares of Class A Stock, as of May 6, 2024, as reported by the Issuer in its Quarterly Report on Form 10-Q filed with the SEC on May 14, 2024, plus the 7,719,779 Warrant Shares.

|

|

(3)

|

Calculated based on the shares of Class A Stock, including Warrant Shares, beneficially owned by the Reporting Person relative to the Issuer’s 24,638,948 outstanding shares of Class A Stock and 42,192,250 outstanding shares of Class B Stock, as of May 6, 2024, as reported by the Issuer in its Quarterly Report on Form 10-Q filed with the SEC on May 14, 2024, plus the 7,719,779 Warrant Shares. Holders of Class A Stock and Class B Stock are entitled to one vote per share on all matters submitted to the stockholders for their vote or approval.

|

|

(c)

|

Except as described elsewhere in this Schedule 13D, including in Items 3 and 6 incorporated herein by reference, during the past 60 days, neither the Reporting Person nor, to the knowledge of the Reporting Person, any person named in Item 2 hereof, have effected any transactions with respect to the Issuer’s Class A Stock.

|

|

(d)

|

No person other than the Reporting Person is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, the shares of the Issuer’s Class A Stock.

|

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is hereby supplemented as follows:

The responses to Item 5 are incorporated by reference into this Item 6.

Separation Agreement

On May 9, 2024, the Reporting Person, Alex B. Rozek, and certain other parties set forth therein, entered into a Separation and Stock Repurchase Agreement (the “Separation Agreement”) in connection with Mr. Rozek’s separation from the Reporting Person. The Separation Agreement provided for the transfer of the shares described below upon Mr. Rozek’s agreeing to allow his right to revoke the Separation Agreement, which waiver of these revocation rights became effective on May 17, 2024.

Pursuant to the Separation Agreement, among other things, the Reporting Person agreed to repurchase from Mr. Rozek and Boulderado Partners, LLC, an entity controlled by Mr. Rozek, shares and warrants of the Reporting Person in exchange for cash and 36,705 shares of Class A Stock, payable to Mr. Rozek, as well as cash and 194,738 shares of Class A Stock, payable to Boulderado Partners, LLC.

In addition, pursuant to the Separation Agreement, Mr. Rozek received from the Reporting Person 200,000 shares of Class A Stock as part of his separation payments and benefits.

Item 7. Material to Be Filed as Exhibits.

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: May 21, 2024

| |

BOSTON OMAHA CORPORATION

|

| |

|

|

| |

By:

|

/s/ Joshua P. Weisenburger

|

| |

Name:

|

Joshua P. Weisenburger

|

Schedule I

The name, present principal occupation or employment and citizenship of each of the executive officers and directors of the Reporting Person are set forth below. The business address of each individual associated with the Reporting Person is c/o 1601 Dodge Street, Suite 3300, Omaha, NE 68102.

Boston Omaha Corporation

|

Name

|

|

Present Principal Occupation or Employment

|

|

Citizenship

|

| |

|

|

|

|

|

Adam K. Peterson

|

|

Chairperson, President and Chief Executive Officer

|

|

USA

|

| |

|

|

|

|

|

Joshua P. Weisenburger

|

|

Chief Financial Officer

|

|

USA

|

| |

|

|

|

|

|

Joseph M. Meisinger

|

|

Chief Accounting Officer

|

|

USA

|

| |

|

|

|

|

|

Bradford B. Briner

|

|

Candidate for State Treasurer of the State of North Carolina (Director)

|

|

USA

|

| |

|

|

|

|

|

Brendan J. Keating

|

|

Manager of Boston Omaha Asset Management, LLC (Director)

|

|

USA

|

| |

|

|

|

|

|

Frank H. Kenan II

|

|

Co-Founder and Principal of KD Capital Management, LLC (Director)

|

|

USA

|

| |

|

|

|

|

|

Jeffrey C. Royal

|

|

President of Dundee Bank (Director)

|

|

USA

|

| |

|

|

|

|

|

Vishnu Srinivasan

|

|

Chief Investment Officer of The Ohio State University (Director)

|

|

USA

|

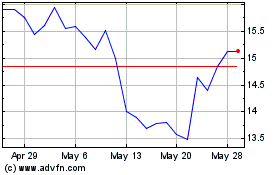

Boston Omaha (NYSE:BOC)

Historical Stock Chart

From May 2024 to Jun 2024

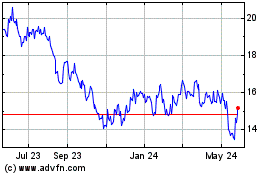

Boston Omaha (NYSE:BOC)

Historical Stock Chart

From Jun 2023 to Jun 2024