Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 12 2013 - 4:28PM

Edgar (US Regulatory)

|

Filed pursuant to Rule 433

Registration Statement No. 333-180300-03

June

12, 2013

|

Credit Suisse Commodity Rotation ETN

The Credit Suisse Commodity Rotation Exchange Traded Notes (the “ETNs”) are senior, unsecured debt securities issued by Credit Suisse AG (“Credit Suisse”), acting through its Nassau Branch, that are

linked to the Credit Suisse Commodity Backwardation Total Return Index. The Index is a long-only commodity index that follows a rules-based strategy to select eight components based on the price of the commodity futures contracts of various terms. The

ETNs are listed on NYSE Arca under the ticker symbol “CSCR.”

1

The ETNs should be purchased only by knowledgeable investors who understand the potential consequences of investing in them.

|

ETN Details

|

|

|

ETN Ticker

|

CSCR

|

|

Indicative value ticker

|

CSCR.IV

|

|

Bloomberg Index ticker

|

CSCUBKTR

|

|

CUSIP/ISIN

|

22542D456/US22542D4566

|

|

Primary exchange

|

NYSE Arca

1

|

|

ETN annual investor fee

|

0.85%*

|

|

ETN inception date

|

June 11, 2013

|

|

Underlying index

|

Credit Suisse Commodity

|

|

Backwardation Total Return Index

|

|

*Because of daily compounding,

the actual investor fee realized may exceed 0.85% per annum.

|

|

|

|

Index Returns

(as of 06/06/13)

|

|

1 month

|

0.92%

|

|

3 month

|

-1.07%

|

|

1 year

|

12.93%

|

|

Since Inception Annualized*

|

-0.85%

|

|

*Index Inception Date was

February 21, 2012.

|

|

|

Index

Portfolio Statistics

(06/06/12 - 06/06/13)

|

|

Correlation to S&P 500 TR Index

|

0.44

|

|

Correlation to Barclays

|

|

|

US Aggregate TR Index

|

-0.33

|

|

Correlation to DJ-UBS

|

|

|

Commodity TR Index

|

0.84

|

|

Correlation to S&P GSCI TR Index

|

0.89

|

|

Annualized volatility

|

12.58%

|

|

1 year Sharpe Ratio*

|

1.02

|

|

*Sharpe ratio calculated using

the Federal Funds Effective Rate as of 06/06/13.

|

1

Credit Suisse has no obligation to maintain any listing on

NYSE Arca or any other exchange and we may delist the ETNs at any time.

Strategy Focus

|

n

|

|

The prices of futures contracts for any given commodity often vary depending on the

time to expiration of those futures contracts.

|

|

n

|

|

The Index is a long-only commodity index that selects component sub-indices whose

underlying commodities exhibit the highest amount of backwardation or the lowest amount of contango.

|

|

n

|

|

“Backwardation” describes situations where, for any given commodity, the

prices of futures contracts that are nearer to expiration are higher than the prices of futures contracts with longer to expiration.

“Contango” describes situations where the prices of futures contracts nearer to expiration are lower than the prices

of futures contracts with longer to expiration.

|

|

n

|

|

Backwardated term structures have historically occurred at times of scarcity, where

near-term demand for a commodity increases the price of the nearer-term futures contracts more than the prices of longer-term

futures contracts.

|

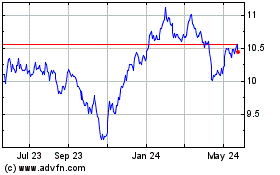

Index Performance

(February 21, 2012-June 06, 2013)

The above graph sets forth the historical performance of the Index and

the DJ-UBS TR Index from the index inception date of February 21, 2012 through June 06, 2013. Historical performance is not indicative

of future performance. The above graph does not include the investor fee associated with the ETNs, which will reduce the amount

of the return on the ETNs at maturity or upon repurchase by Credit Suisse.

|

|

|

|

|

For More Information

|

|

|

|

ETN Desk

: 212 538 7333

|

Email

: ETN.Desk@credit-suisse.com

|

Website

: www.credit-suisse.com/etn

|

Index Overview

|

n

|

|

The Index is a long-only index of single commodity indices that are dynamically selected

each month by using a proprietary allocation method.

|

|

n

|

|

The level of backwardation/contango is measured between two observation points on

the curve (month 1 and, generally, month 6).

|

|

n

|

|

Each month, the Index identifies 8 of the 24 eligible commodities with the highest

level of backwardation or the lowest level of contango, subject to maximum allocations for particular commodity sectors.

|

|

n

|

|

The Index allocates a 12.50% weight to each of the commodities selected, and takes

long positions in the selected commodities through single commodity indices that track futures contracts spread over the 4, 5

and 6 month tenors.

|

|

n

|

|

Each month, the Index reviews the 24 commodities in its universe and reallocates to

the 8 with the highest level of backwardation (or least contango) at that time.

|

Selected Investment Considerations

|

—

|

|

The ETNs do not have a minimum payment at maturity or

daily repurchase value and are fully exposed to any decline in the Index. Furthermore, the return at maturity or upon repurchase

will be reduced by the fees and charges associated with the ETNs. Therefore, the level of the Index must increase by an

amount sufficient to offset the applicable fees and charges.

|

|

—

|

|

You will not receive any periodic interest payments on

the ETNs.

|

|

—

|

|

Although the return on the ETNs will be based on the

performance of the Index, the payment of any amount due on the ETNs, including any payment at maturity or upon early redemption

or acceleration, is subject to the credit risk of Credit Suisse. Investors are dependent on Credit Suisse’s ability to pay

all amounts due on the ETNs, and therefore investors are subject to our credit risk. In addition, any decline in our credit ratings,

any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely

affect the market value of the ETNs prior to maturity.

|

|

—

|

|

The performance of the Index will not be representative

of the performance of the commodities market generally and there is no assurance that the strategy on which the Index is based

will be successful.

|

|

—

|

|

We have listed the ETNs on NYSE Arca under the symbol

“CSCR”. We expect that investors will purchase and sell the ETNs primarily in this secondary market. We have no obligation

to maintain this listing on NYSE Arca or any listing on any other exchange, and may delist the ETNs at any time.

|

|

—

|

|

The indicative value is not the same as the closing price

or any other trading price of the ETNs in the secondary market. The trading price of the ETNs at any time is the price at which

you may be able to sell your ETNs in the secondary market at such time, if one exists. The trading price of the ETNs at any time

may vary significantly from the indicative value of such ETNs at such time. Before trading in the secondary market, you should

compare the indicative value with the then-prevailing trading price of the ETNs.

|

|

—

|

|

Commodity prices are characterized by high and unpredictable

volatility, which could lead to high and unpredictable volatility in the Index. Market prices of the commodity futures contracts

that underlie the single-commodity indices which comprise the Index tend to be highly volatile. Commodity market prices are not

related to the value of a future income or earnings stream, as tends to be the case with fixed-income and equity investments,

but are subject to rapid fluctuations based on numerous factors, including changes in supply and demand relationships, governmental

programs and policies, national and international monetary, trade, political and economic events, changes in interest and exchange

rates, speculation and trading activities in commodities and related contracts, weather, and agricultural, trade, fiscal and exchange

control policies.

|

|

—

|

|

The ETNs will reflect the return on the Index, which

provides notional exposure to single commodity indices that track futures contracts and not physical commodities or their spot

prices. Price movements in futures contracts on commodities may not correlate with changes in the spot prices of commodities.

|

|

—

|

|

As an owner of the ETNs, you will not have rights that

holders of the commodity futures contracts included in the single-commodity indices which comprise the Index may have. Investment

in the ETNs is not a pass-through investment in futures contracts.

|

|

—

|

|

We have the right to accelerate your ETNs in whole or

in part at any time. The amount you may receive upon an acceleration by Credit Suisse may be less than the amount you would receive

on your investment at maturity or if you had elected to have us repurchase your ETNs at a time of your choosing.

|

|

—

|

|

Tax consequences of the ETNs are uncertain and potential

investors should consult their tax advisors regarding the U.S. federal income tax consequences of an investment in the ETNs.

|

|

—

|

|

An investment in the ETNs involves significant risks.

The selected investment considerations herein are not intended as a complete description of all risks associated with the ETNs.

For further information regarding risks, please see the section entitled “Risk Factors” in the applicable pricing

supplement.

|

Credit Suisse AG (“Credit Suisse”) has filed a registration

statement (including prospectus supplement and prospectus) with the Securities and Exchange Commission, or SEC, for the offering

of securities. Before you invest, you should read the applicable pricing supplement, the Prospectus Supplement dated March 23,

2012, and Prospectus dated March 23, 2012, to understand fully the terms of the ETNs and other considerations that are important

in making a decision about investing in the ETNs. You may get these documents without cost by visiting EDGAR on the SEC website

at www.sec.gov. Alternatively, Credit Suisse, or any agent or dealer participating in an offering will arrange to send you the

pricing supplement, prospectus supplement and prospectus if you so request by calling toll-free 1 (800) 221-1037.

You may access the applicable pricing supplement related to the ETNs

discussed herein on the SEC website at:

http://www.sec.gov/Archives/edgar/data/1053092/000089109213005273/e54087_424b2.htm

You may access the prospectus supplement and prospectus on the SEC website

at www.sec.gov or by clicking on the hyperlinks to each of the respective documents incorporated by reference in the pricing supplement.

Copyright ©2013. Credit Suisse Group and/or its affiliates. All rights reserved.

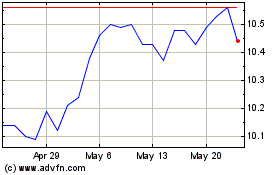

BlackRock Credit Allocat... (NYSE:BTZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

BlackRock Credit Allocat... (NYSE:BTZ)

Historical Stock Chart

From Jul 2023 to Jul 2024