UNITEDSTATES

SECURITIESANDEXCHANGECOMMISSION

Washington,D.C.20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21972

Name of Fund: BlackRock Credit Allocation Income Trust IV (BTZ)

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: Anne F. Ackerley, Chief Executive Officer, BlackRock

Credit Allocation Income Trust IV, 55 East 52

nd

Street, New York, NY 10055.

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 10/31/2009

Date of reporting period: 10/31/2009

Item 1 – Report to Stockholders

EQUITIES FIXED INCOME REAL ESTATE LIQUIDITY ALTERNATIVES BLACKROCK SOLUTIONS

Annual Report

OCTOBER 31, 2009

BlackRock Credit Allocation Income Trust I, Inc. (PSW)

BlackRock Credit Allocation Income Trust II, Inc. (PSY)

BlackRock Credit Allocation Income Trust III (BPP)

BlackRock Credit Allocation Income Trust IV (BTZ)

BlackRock Enhanced Capital and Income Fund, Inc. (CII)

BlackRock Floating Rate Income Trust (BGT)

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

|

|

|

|

Table of Contents

|

|

|

|

Page

|

|

Section 19(b) Disclosure

|

2

|

|

Dear Shareholder

|

3

|

|

Annual Report:

|

|

|

Fund Summaries

|

4

|

|

The Benefits and Risks of Leveraging

|

10

|

|

Derivative Financial Instruments

|

10

|

|

Financial Statements:

|

|

|

Schedules of Investments

|

11

|

|

Statements of Assets and Liabilities

|

36

|

|

Statements of Operations

|

37

|

|

Statements of Changes in Net Assets

|

38

|

|

Statement of Cash Flows

|

40

|

|

Financial Highlights

|

41

|

|

Notes to Financial Statements

|

47

|

|

Report of Independent Registered Public Accounting Firm

|

58

|

|

Important Tax Information

|

59

|

|

Disclosure of Investment Advisory Agreements and Sub-Advisory Agreements

|

60

|

|

Automatic Dividend Reinvestment Plans

|

64

|

|

Officers and Directors

|

66

|

|

Additional Information

|

69

|

Section 19(b) Disclosure

BlackRock Credit Allocation Income Trust IV (BTZ) and BlackRock Enhanced Capital and Income Fund, Inc. (CII) (collectively, the “Funds”), acting pursuant to

a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Fund’s Board of Directors/Trustees (the “Board”), each

have

adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital

(“Plan”).

In accordance with the Plans, the Funds currently distribute the following fixed amounts per share on a monthly basis for BTZ and a quarterly basis for CII:

|

|

|

|

Exchange Symbol

|

Amount Per Common Share

|

|

BTZ

|

$ 0.100

|

|

CII

|

$ 0.485

|

The fixed amounts distributed per share are subject to change at the discretion of each Fund’s Board. Under its Plan, each Fund will distribute all available

investment income to its shareholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended

(the “Code”). If sufficient investment income is not available on a monthly/quarterly basis, the Funds will distribute long-term capital gains and/or return

of

capital to shareholders in order to maintain a level distribution. Each monthly/quarterly distribution to shareholders is expected to be at the fixed amount

established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Funds to comply with

the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about the Funds’ investment performance from the amount of these distributions or from the terms of the Plan.

Each Fund’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate a Fund’s Plan without prior notice if it deems such actions to be in the best interests of the Fund or its share-

holders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above net asset

value) or widening an existing trading discount. The Funds are subject to risks that could have an adverse impact on their ability to maintain level distri-

butions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, decreased market volatility, companies sus-

pending or decreasing corporate dividend distributions and changes in the Code. Please refer to each Fund’s prospectus for a more complete description

of its risks.

Please refer to Additional Information for a cumulative summary of the Section 19(a) notices for each Fund’s current fiscal period. Section 19(a) notices for

the Funds, as applicable, are available on the BlackRock website

www.blackrock.com

.

2 ANNUAL REPORT OCTOBER 31, 2009

Dear Shareholder

Over the past 12 months, we have witnessed a seismic shift in market sentiment — from fear and pessimism during the worst economic decline and crisis

of confidence in financial markets since The Great Depression to increasing optimism amid emerging signs of recovery. The period began in the midst of an

intense deterioration in global economic activity and financial markets in the final months of 2008 and the early months of 2009. The collapse of confi-

dence resulted in massive government policy intervention on a global scale in the financial system and the economy. The tide turned dramatically in March

2009, however, on the back of new US government initiatives, as well as better-than-expected economic data and upside surprises in corporate earnings.

Not surprisingly, global equity markets endured extreme volatility over the past 12 months, starting with steep declines and heightened risk aversion in the

early part of the reporting period, which eventually gave way to an impressive rally that began in March. Although there have been fits and starts along the

way and a few modest corrections, the new bull market has pushed all major US indices well into positive territory for 2009. The experience in international

markets was similar to that in the United States. In particular, emerging markets (which were less affected by the global credit crunch and are experiencing

faster economic growth rates when compared to the developed world) have posted impressive gains since the rally began.

In fixed income markets, the flight-to-safety premium in Treasury securities prevailed during the equity market downturn, which drove yields sharply lower,

but concerns about deficit spending, debt issuance, inflation and dollar weakness have kept Treasury yields range bound in recent months. As economic

and market conditions began to improve in early 2009, near-zero interest rates on risk-free assets prompted many investors to reallocate money from cash

investments into higher-yielding and riskier non-Treasury assets. The high yield sector was the greatest beneficiary of this move, having decisively outpaced

all other taxable asset classes since the start of 2009. Similarly, the municipal bond market is on pace for its best performance year ever in 2009, following

one of its worst years in 2008. Investor demand remains strong for munis, helping to create a highly favorable technical backdrop. Municipal bond mutual

funds are seeing record inflows, reflecting the renewed investor interest in the asset class.

As a result of the rebound in sentiment and global market conditions, most major benchmark indexes are now in positive territory for both the

6- and 12-month periods.

|

|

|

|

|

Total Returns as of October 31, 2009

|

6-month

|

12-month

|

|

US equities (S&P 500 Index)

|

20.04%

|

9.80%

|

|

Small cap US equities (Russell 2000 Index)

|

16.21

|

6.46

|

|

International equities (MSCI Europe, Australasia, Far East Index)

|

31.18

|

27.71

|

|

US Treasury securities (BofA Merrill Lynch 10-Year US Treasury Index*)

|

(0.79)

|

8.12

|

|

Taxable fixed income (Barclays Capital US Aggregate Bond Index)

|

5.61

|

13.79

|

|

Tax-exempt fixed income (Barclays Capital Municipal Bond Index)

|

4.99

|

13.60

|

|

High yield bonds (Barclays Capital US Corporate High Yield 2% Issuer Capped Index)

|

27.72

|

48.65

|

|

* Formerly a Merrill Lynch index.

|

|

|

|

Past performance is no guarantee of future results. Index performance shown for illustrative purposes only. You cannot invest directly in an

index.

|

|

The market environment has visibly improved since the beginning of the year, but a great deal of uncertainty and risk remain. Through periods of market

turbulence, as ever, BlackRock’s full resources are dedicated to the management of our clients’ assets. For additional market perspective and investment

insight, visit the most recent issue of our award-winning

Shareholder®

magazine at

www.blackrock.com/shareholdermagazine.

As always, we thank you

for entrusting BlackRock with your investments, and we look forward to continuing to serve you in the months and years ahead.

Announcement to Shareholders

On December 1, 2009, BlackRock, Inc. and Barclays Global Investors, N.A. combined to form one of the world's preeminent investment management firms.

The new company, operating under the BlackRock name, manages $3.19 trillion in assets** and offers clients worldwide a full complement of active man-

agement, enhanced and index investment strategies and products, including individual and institutional separate accounts, mutual funds and other pooled

investment vehicles, and the industry-leading iShares platform of exchange traded funds.

** Data is as of September 30, 2009, is subject to change, and is based on a pro forma estimate of assets under management and other data at BlackRock, Inc.

and Barclays Global Investors.

THIS PAGE NOT PART OF YOUR FUND REPORT

3

Fund Summary

as of October 31, 2009

BlackRock Credit Allocation Income Trust I, Inc.

Investment Objective

BlackRock Credit Allocation Income Trust I, Inc. (PSW) (formerly BlackRock Preferred and Corporate Income Strategies Fund, Inc.) (the “Fund”)

seeks to

provide shareholders with high current income and capital appreciation. The Fund seeks to achieve its objectives by investing primarily in credit-related securi-

ties, including, but not limited to, investment grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with

economic characteristics similar to these credit-related securities.

Effective November 13, 2009, BlackRock Preferred and Corporate Income Strategies Fund, Inc. was renamed BlackRock Credit Allocation Income Trust I, Inc.

The Board approved a change to the Fund’s non-fundamental investment policies during the period. Please refer to page 70 in the Additional Information

section.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the 12 months ended October 31, 2009, the Fund returned 37.59% based on market price and 46.46% based on net asset value (“NAV”). For the

same period, the closed-end Lipper Income & Preferred Stock Funds category posted an average return of 39.55% on a market price basis and 40.36% on

a NAV basis. All returns reflect reinvestment of dividends. The Fund’s discount to NAV, which widened during the period, accounts for the difference between

performance based on price and performance based on NAV. Strong annual performance has been driven by the Fund’s positioning to fully capture the

near-term strength anticipated in the preferred sector during 2009. The Fund benefited from an overweight allocation to institutional hybrids (preferred secu-

rities available only over-the-counter to institutional investors) as the sector continued its dramatic outperformance during 2009 relative to retail preferred

securities, which are exchange traded. This position also served as a performance detractor when the preferred sector deteriorated during the fourth quarter

of 2008. Performance benefited from participation in several additional issuer-related tenders in preferred equity exchanges, along with an overweight in

the insurance sector. A generally large position in short-term securities proved beneficial as well — most notably during 2008 and into the first quarter

of 2009 — as it preserved NAV better than had the Fund been fully invested. Finally, the Fund notably reduced leverage in response to rating agency

methodology changes for preferred securities requiring greater collateral due to increased volatility in the sector, which detracted from performance.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

|

|

|

|

|

|

Fund Information

|

|

|

|

|

|

|

|

|

|

|

Symbol on New York Stock Exchange (“NYSE”)

|

|

|

|

|

|

PSW

|

|

|

Initial Offering Date

|

|

|

|

|

|

August 1, 2003

|

|

|

Yield based on Closing Market Price as of October 31, 2009 ($8.24)

1

|

|

|

|

8.74%

|

|

|

Current Monthly Distribution per Common Share

2

|

|

|

|

|

|

$0.06

|

|

|

Current Annualized Distribution per Common Share

2

|

|

|

|

|

|

$0.72

|

|

|

Leverage as of October 31, 2009

3

|

|

|

|

|

|

|

32%

|

|

|

1

Yield on closing market price is calculated by dividing the current

annualized distribution per share by the closing market price.

|

|

|

|

Past performance does not guarantee future results.

|

|

|

|

|

|

|

|

|

2

The distribution is not constant and is subject to change. A portion of the

distribution may be deemed a tax return of capital or net realized gain.

|

|

|

3

Represents reverse repurchase agreements and Auction Market Preferred

Shares (“Preferred Shares”) as a percentage of total managed assets,

|

|

|

which is the total assets of the Fund (including any assets attributable to any borrowings and Preferred Shares) minus the sum of liabilities

(other

|

|

|

than borrowings representing financial leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks

of

|

|

|

Leveraging on page 10.

|

|

|

|

|

|

|

|

|

|

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

|

10/31/09

|

10/31/08

|

Change

|

High

|

Low

|

|

|

Market Price

|

|

|

$8.24

|

$7.00

|

17.71%

|

$8.52

|

$3.44

|

|

|

Net Asset Value

|

|

|

$9.31

|

$7.43

|

25.30%

|

$9.31

|

$4.55

|

|

|

The following unaudited charts show the portfolio composition and credit quality allocations of the Fund’s total investments:

|

|

|

Portfolio Composition

|

|

|

Credit Quality Allocations

4

|

|

|

|

|

|

10/31/09

|

10/31/08

|

|

|

|

10/31/09

|

10/31/08

|

|

|

Preferred Securities

|

58%

|

87%

|

AA/Aa

|

|

|

—

|

14%

|

|

|

Short-Term Securities

|

29

|

11

|

A/A

|

|

|

26%

|

36

|

|

|

Corporate Bonds

|

13

|

2

|

BBB/Baa

|

|

62

|

36

|

|

|

|

|

|

BB/Ba

|

|

|

8

|

4

|

|

|

|

|

|

B/B

|

|

|

2

|

—

|

|

|

|

|

|

Not Rated

|

|

2

|

10

|

|

|

|

|

|

4

Using the higher of Standard & Poor’s (“S&P’s”) or

Moody’s Investor

|

|

|

|

|

|

Service (“Moody’s”) ratings.

|

|

|

|

4

|

ANNUAL REPORT

|

|

|

|

OCTOBER 31, 2009

|

|

|

Fund Summary

as of October 31, 2009

BlackRock Credit Allocation Income Trust II, Inc.

Investment Objective

BlackRock Credit Allocation Income Trust II, Inc. (PSY) (formerly BlackRock Preferred Income Strategies Fund, Inc.) (the “Fund”)

seeks to provide share-

holders with current income and capital appreciation. The Fund seeks to achieve its objectives by investing primarily in credit-related securities, including,

but not limited to, investment grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with economic

characteristics similar to these credit-related securities.

Effective November 13, 2009, BlackRock Preferred Income Strategies Fund, Inc. was renamed BlackRock Credit Allocation Income Trust II, Inc.

The Board approved a change to the Fund’s non-fundamental investment policies during the period. Please refer to page 70 in the Additional Information

section.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the 12 months ended October 31, 2009, the Fund returned 29.37% based on market price and 48.36% based on NAV. For the same period, the

closed-end Lipper Income & Preferred Stock Funds category posted an average return of 39.55% on a market price basis and 40.36% on a NAV basis.

All returns reflect reinvestment of dividends. The Fund moved from a premium to a discount to NAV by year-end, which accounts for the difference between

performance based on price and performance based on NAV. Strong annual performance has been driven by the Fund’s positioning to fully capture the

near-term strength anticipated in the preferred sector during 2009. The Fund benefited from an overweight allocation to institutional hybrids (preferred secu-

rities available only over-the-counter to institutional investors) as the sector continued its dramatic outperformance during 2009 relative to retail preferred

securities, which are exchange traded. This position also served as a performance detractor when the preferred sector deteriorated during the fourth quarter

of 2008. Performance benefited from participation in several additional issuer-related tenders in preferred equity exchanges, along with an overweight in

the insurance sector. A generally large position in short-term securities proved beneficial as well — most notably during 2008 and into the first quarter

of 2009 — as it preserved NAV better than had the Fund been fully invested. Finally, the Fund notably reduced leverage in response to rating agency

methodology changes for preferred securities requiring greater collateral due to increased volatility in the sector, which detracted from performance.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

|

|

|

|

|

|

Fund Information

|

|

|

|

|

|

|

|

|

|

|

Symbol on NYSE

|

|

|

|

|

|

|

PSY

|

|

|

Initial Offering Date

|

|

|

|

|

|

March 28, 2003

|

|

|

Yield on Closing Market Price as of October 31, 2009 ($8.90)

1

|

|

|

|

10.11%

|

|

|

Current Monthly Distribution per Common Share

2

|

|

|

|

|

$ 0.075

|

|

|

Current Annualized Distribution per Common Share

2

|

|

|

|

|

$ 0.900

|

|

|

Leverage as of October 31, 2009

3

|

|

|

|

|

|

|

30%

|

|

|

1

Yield on closing market price is calculated by dividing the current

annualized distribution per share by the closing market price.

|

|

|

|

Past performance does not guarantee future results.

|

|

|

|

|

|

|

|

|

2

The distribution is not constant and is subject to change. A portion of the

distribution may be deemed a tax return of capital or net realized gain.

|

|

|

3

Represents reverse repurchase agreements and Preferred Shares as a

percentage of total managed assets, which is the total assets of the Fund

|

|

|

(including any assets attributable to any borrowings and Preferred Shares) minus the sum of liabilities (other than borrowings representing

financial

|

|

|

leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page

10.

|

|

|

|

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

10/31/09

|

10/31/08

|

Change

|

High

|

Low

|

|

|

Market Price

|

|

$ 8.90

|

$8.10

|

9.88%

|

$ 9.20

|

$3.69

|

|

|

Net Asset Value

|

|

$10.03

|

$7.96

|

26.01%

|

$10.03

|

$4.60

|

|

|

The following unaudited charts show the portfolio composition and credit quality allocations of the Fund’s total investments:

|

|

|

Portfolio Composition

|

|

|

Credit Quality Allocations

4

|

|

|

|

|

|

10/31/09

|

10/31/08

|

|

|

|

10/31/09

|

10/31/08

|

|

|

Preferred Securities

|

88%

|

93%

|

AA/Aa

|

|

|

1%

|

15%

|

|

|

Short-Term Securities

|

9

|

4

|

A/A

|

|

|

26

|

34

|

|

|

Corporate Bonds

|

3

|

3

|

BBB/Baa

|

|

56

|

28

|

|

|

|

|

|

BB/Ba

|

|

|

14

|

6

|

|

|

|

|

|

B/B

|

|

|

3

|

—

|

|

|

|

|

|

Not Rated

|

|

—

|

17

|

|

|

|

|

|

4

Using the higher of S&P’s or Moody’s

ratings.

|

|

|

|

ANNUAL REPORT

|

|

|

|

OCTOBER 31, 2009

|

|

5

|

Fund Summary

as of October 31, 2009

BlackRock Credit Allocation Income Trust III

Investment Objective

BlackRock Credit Allocation Income Trust III (BPP) (formerly BlackRock Preferred Opportunity Trust) (the “Fund”)

seeks high current income consistent

with capital preservation. The Fund seeks to achieve its objectives by investing primarily in credit-related securities, including, but not limited to, investment

grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with economic characteristics similar to these

credit-related securities.

Effective November 13, 2009, BlackRock Preferred Opportunity Trust was renamed BlackRock Credit Allocation Income Trust III.

The Board approved a change to the Fund’s non-fundamental investment policies during the period. Please refer to page 70 in the Additional Information

section.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the 12 months ended October 31, 2009, the Fund returned 36.42% based on market price and 47.16% based on NAV. For the same period, the

closed-end Lipper Income & Preferred Stock Funds category posted an average return of 39.55% on a market price basis and 40.36% on a NAV basis. All

returns reflect reinvestment of dividends. The Fund’s discount to NAV, which widened during the period, accounts for the difference between performance

based on price and performance based on NAV. Strong annual performance has been driven by the Fund’s positioning to fully capture the near-term

strength anticipated in the preferred sector during 2009. The Fund benefited from an overweight allocation to institutional hybrids (preferred securities avail-

able only over-the-counter to institutional investors) as the sector continued its dramatic outperformance during 2009 relative to retail preferred securities,

which are exchange traded. This position also served as a performance detractor when the preferred sector deteriorated during the fourth quarter of 2008.

Performance benefited from participation in several additional issuer-related tenders in preferred equity exchanges, along with an overweight in the insur-

ance sector. A generally large position in short-term securities proved beneficial as well — most notably during 2008 and into the first quarter of 2009 —

as it preserved NAV better than had the Fund been fully invested. Finally, the Fund notably reduced leverage in response to rating agency methodology

changes for preferred securities requiring greater collateral due to increased volatility in the sector, which detracted from performance.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions.

These

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

|

|

|

|

|

|

Fund Information

|

|

|

|

|

|

|

|

|

|

|

Symbol on NYSE

|

|

|

|

|

|

|

BPP

|

|

|

Initial Offering Date

|

|

|

|

|

|

February 28, 2003

|

|

|

Yield on Closing Market Price as of October 31, 2009 ($9.94)

1

|

|

|

|

|

8.75%

|

|

|

Current Monthly Distribution per Common Share

2

|

|

|

|

|

|

$0.0725

|

|

|

Current Annualized Distribution per Common Share

2

|

|

|

|

|

|

$0.8700

|

|

|

Leverage as of October 31, 2009

3

|

|

|

|

|

|

|

29%

|

|

|

1

Yield on closing market price is calculated by dividing the current

annualized distribution per share by the closing market price.

|

|

|

|

Past performance does not guarantee future results.

|

|

|

|

|

|

|

|

|

2

The distribution is not constant and is subject to change. A portion of the

distribution may be deemed a tax return of capital or net realized gain.

|

|

|

3

Represents reverse repurchase agreements and Preferred Shares as a

percentage of total managed assets, which is the total assets of the Fund

|

|

|

(including any assets attributable to any borrowings and Preferred Shares) minus the sum of liabilities (other than borrowings representing

financial

|

|

|

leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page

10.

|

|

|

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

10/31/09

|

10/31/08

|

Change

|

High

|

Low

|

|

|

Market Price

|

|

$ 9.94

|

$8.51

|

16.80%

|

$10.35

|

$4.00

|

|

|

Net Asset Value

|

|

$11.05

|

$8.77

|

26.00%

|

$11.13

|

$5.06

|

|

|

The following unaudited charts show the portfolio composition and credit quality allocations of the Fund’s total investments:

|

|

|

Portfolio Composition

|

|

|

Credit Quality Allocations

4

|

|

|

|

|

|

10/31/09

|

10/31/08

|

|

|

|

10/31/09

|

10/31/08

|

|

|

Preferred Securities

|

69%

|

90%

|

AA/Aa

|

|

|

4%

|

16%

|

|

|

Short-Term Securities

|

23

|

3

|

A/A

|

|

|

28

|

39

|

|

|

Corporate Bonds

|

8

|

7

|

BBB/Baa

|

|

45

|

24

|

|

|

|

|

|

BB/Ba

|

|

|

13

|

5

|

|

|

|

|

|

B

|

|

|

5

|

—

|

|

|

|

|

|

CCC/Caa

|

|

5

|

—

|

|

|

|

|

|

Not Rated

|

|

—

|

16

|

|

|

|

|

|

4

Using the higher of S&P’s or Moody’s

ratings.

|

|

|

6

|

ANNUAL REPORT

|

|

|

|

OCTOBER 31, 2009

|

|

|

Fund Summary

as of October 31, 2009

BlackRock Credit Allocation Income Trust IV

Investment Objective

BlackRock Credit Allocation Income Trust IV (BTZ) (formerly BlackRock Preferred and Equity Advantage Trust) (the “Fund”)

seeks to achieve high

current income, current gains and capital appreciation. The Fund seeks to achieve its objectives by investing primarily in credit-related securities, including,

but not limited to, investment grade corporate bonds, high yield bonds, bank loans, preferred securities or convertible bonds or derivatives with economic char-

acteristics similar to these credit-related securities.

Effective November 13, 2009, BlackRock Preferred and Equity Advantage Trust was renamed BlackRock Credit Allocation Income Trust IV.

The Board approved a change to the Fund’s non-fundamental investment policies during the period. Please refer to page 70 in the Additional Information

section.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the 12 months ended October 31, 2009, the Fund returned 38.38% based on market price and 41.06% based on NAV. For the same period, the

closed-end Lipper Income & Preferred Stock Funds category posted an average return of 39.55% on a market price basis and 40.36% on a NAV basis. All

returns reflect reinvestment of dividends. The Fund’s discount to NAV, which widened during the period, accounts for the difference between performance

based on price and performance based on NAV. Strong annual performance has been driven by the Fund’s positioning to fully capture the near-term

strength anticipated in the preferred sector during 2009. The Fund benefited from an overweight allocation to institutional hybrids (preferred securities avail-

able only over-the-counter to institutional investors) as the sector continued its dramatic outperformance during 2009 relative to retail preferred securities,

which are exchange traded. This position also served as a performance detractor when the preferred sector deteriorated during the fourth quarter of 2008.

Performance benefited from participation in several additional issuer-related tenders in preferred equity exchanges, along with an overweight in the insur-

ance sector. A generally large position in short-term securities proved beneficial as well — most notably during 2008 and into the first quarter of 2009 —

as it preserved NAV better than had the Fund been fully invested. Finally, the Fund notably reduced leverage in response to rating agency methodology

changes for preferred securities requiring greater collateral due to increased volatility in the sector, which detracted from performance.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

|

|

|

|

|

|

Fund Information

|

|

|

|

|

|

|

|

|

|

|

Symbol on NYSE

|

|

|

|

|

|

|

BTZ

|

|

|

Initial Offering Date

|

|

|

|

|

|

December 27, 2006

|

|

|

Yield on Closing Market Price as of October 31, 2009 ($10.96)

1

|

|

|

|

10.95%

|

|

|

Current Monthly Distribution per Common Share

2

|

|

|

|

|

$ 0.10

|

|

|

Current Annualized Distribution per Common Share

2

|

|

|

|

|

$ 1.20

|

|

|

Leverage as of October 31, 2009

3

|

|

|

|

|

|

|

31%

|

|

|

1

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price.

|

|

|

|

Past performance does not guarantee future results.

|

|

|

|

|

|

|

|

|

2

The distribution is not constant and is subject to change. A portion of the distribution may be deemed a tax return of capital or net realized gain.

|

|

|

3

Represents reverse repurchase agreements and Preferred Shares as a percentage of total managed assets, which is the total assets of the Fund

|

|

|

(including any assets attributable to any borrowings and Preferred Shares) minus the sum of liabilities (other than borrowings representing financial

|

|

|

leverage). For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 10.

|

|

|

|

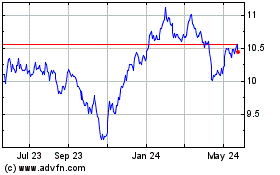

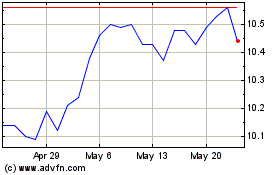

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

|

10/31/09

|

10/31/08

|

Change

|

High

|

Low

|

|

|

Market Price

|

|

|

$10.96

|

$ 9.36

|

17.09%

|

$11.49

|

$4.56

|

|

|

Net Asset Value

|

|

|

$12.64

|

$10.59

|

19.36%

|

$12.69

|

$6.89

|

|

|

The following unaudited charts show the portfolio composition of the Fund’s total investments and credit quality allocations of the

|

|

|

Fund’s total investments excluding Common Stocks:

|

|

|

|

|

|

|

|

|

Portfolio Composition

|

|

|

Credit Quality Allocations

4

|

|

|

|

|

|

10/31/09

|

10/31/08

|

|

|

|

10/31/09

|

10/31/08

|

|

|

Preferred Securities

|

57%

|

59%

|

AA/Aa

|

|

|

4%

|

15%

|

|

|

Short-Term Securities

|

33

|

21

|

A/A

|

|

|

33

|

37

|

|

|

Corporate Bonds

|

4

|

4

|

BBB/Baa

|

|

53

|

30

|

|

|

Common Stocks

|

6

|

16

|

BB/Ba

|

|

|

6

|

2

|

|

|

|

|

|

B/B

|

|

|

4

|

16

|

|

|

|

|

|

4

Using the higher of S&P’s or Moody’s ratings.

|

|

|

|

ANNUAL REPORT

|

|

|

|

OCTOBER 31, 2009

|

|

7

|

|

|

|

|

Fund Summary

as of October 31, 2009

|

BlackRock Enhanced Capital and Income Fund, Inc.

|

|

Investment Objective

|

|

|

BlackRock Enhanced Capital and Income Fund, Inc. (CII) (the “Fund”)

seeks to provide investors with a combination of current income and capital

|

|

appreciation. The Fund seeks to achieve its investment objective by investing primarily in a diversified portfolio of common stocks in an attempt to

|

|

generate current income and by employing a strategy of writing (selling) call options on equity indexes in an attempt to generate gains from option

|

|

premiums primarily on the S&P 500 Index.

|

|

|

The Board approved a change to the Fund’s option writing policy during the period. Please refer to page 70 in the Additional Information section.

|

|

No assurance can be given that the Fund’s investment objective will be achieved.

|

|

|

Performance

|

|

|

For the 12 months ended October 31, 2009, the Fund returned 29.88% based on market price and 22.01% based on NAV. For the same period, the

|

|

benchmark S&P 500 Citigroup Value Index returned 2.98% based on NAV. All returns reflect reinvestment of dividends. The Fund's discount to NAV, which

|

|

narrowed significantly during the period, accounts for the difference between performance based on price and performance based on NAV. The main con-

|

|

tributor to Fund performance relative to the S&P 500 Citigroup Value Index was the Option strategy that was implemented by the Fund. The option strategy

|

|

contributed almost 75% of the outperformance over the index. From an equity holdings standpoint, the main contributors were an underweight and stock

|

|

selection in financials, stock selection in health care and industrials, and overweights in the information technology and energy sectors. The main detractors

|

|

from performance for the one-year period included stock selection in materials and consumer staples, as well as an underweight in the consumer

|

|

discretionary sector.

|

|

|

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

|

|

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

|

|

|

|

|

|

|

Fund Information

|

|

|

|

|

|

|

|

|

|

Symbol on NYSE

|

|

|

|

|

|

CII

|

|

|

Initial Offering Date

|

|

|

|

|

April 30, 2004

|

|

|

Yield on Closing Market Price as of October 31, 2009 ($13.76)

1

|

|

|

|

14.10%

|

|

|

Current Quarterly Distribution per share

2

|

|

|

|

|

$ 0.485

|

|

|

Current Annualized Distribution per share

2

|

|

|

|

|

$ 1.940

|

|

|

1

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price.

|

|

|

|

Past performance does not guarantee future results.

|

|

|

|

|

|

|

|

|

2

The distribution is not constant and is subject to change. A portion of the distribution may be deemed a tax return of capital or net realized gain.

|

|

|

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

10/31/09

|

10/31/08

|

Change

|

High

|

Low

|

|

|

Market Price

|

|

$13.76

|

$12.37

|

11.24%

|

$15.70

|

$ 7.92

|

|

|

Net Asset Value

|

|

$14.40

|

$13.78

|

4.50%

|

$14.99

|

$10.62

|

|

|

The following unaudited charts show the ten largest holdings and sector allocations of the Fund’s long-term investments:

|

|

|

|

Ten Largest Holdings

|

|

Sector Allocations

|

|

|

|

|

|

|

10/31/09

|

|

|

|

10/31/09

|

10/31/08

|

|

|

The Travelers Cos., Inc.

|

4%

|

Financials

|

|

19%

|

16%

|

|

|

JPMorgan Chase & Co.

|

3

|

Information Technology

|

|

17

|

15

|

|

|

LSI Corp.

|

3

|

Health Care

|

|

13

|

4

|

|

|

Chevron Corp.

|

3

|

Consumer Staples

|

|

12

|

23

|

|

|

Schering-Plough Corp.

|

3

|

Energy

|

|

|

11

|

15

|

|

|

Bristol-Myers Squibb Co.

|

3

|

Industrials

|

|

9

|

7

|

|

|

Exxon Mobil Corp.

|

3

|

Telecommunication Services

|

7

|

6

|

|

|

Kimberly-Clark Corp.

|

3

|

Consumer Discretionary

|

6

|

6

|

|

|

Kraft Foods, Inc.

|

3

|

Materials

|

|

3

|

3

|

|

|

Time Warner, Inc.

|

3

|

Utilities

|

|

|

3

|

5

|

|

|

|

|

For Fund compliance purposes, the Fund’s sector classifications refer

|

|

|

|

|

to any one or more of the sector sub-classifications used by one or

|

|

|

|

|

more widely recognized market indexes or ratings group indexes,

|

|

|

|

|

and/or as defined by Fund management. This definition may not

|

|

|

|

|

apply for purposes of this report, which may combine sector sub-

|

|

|

|

|

classifications for reporting ease.

|

|

|

|

8

|

ANNUAL REPORT

|

|

|

OCTOBER 31, 2009

|

|

|

Fund Summary

as of October 31, 2009

BlackRock Floating Rate Income Trust

Investment Objective

BlackRock Floating Rate Income Trust (BGT) (formerly BlackRock Global Floating Rate Income Trust) (the “Fund”)

seeks to provide a high level of current

income and to seek the preservation of capital. The Fund seeks to achieve its objective by investing in a global portfolio of primarily floating and variable

rate securities.

No assurance can be given that the Fund’s investment objective will be achieved.

Performance

For the 12 months ended October 31, 2009, the Fund returned 54.14% based on market price and 39.51% based on NAV. For the same period, the

closed-end Lipper Loan Participation Funds category posted an average return of 39.76% on a market price basis and 25.60% on a NAV basis. All returns

reflect reinvestment of dividends. (The performance of the Lipper category does not necessarily correlate to that of the Fund, as the Lipper group comprises

both closed-end funds that employ leverage and continuously offered closed-end funds that do not. For this reporting period, those Lipper peers that do not

employ leverage were at a disadvantage given the market rally.) The Fund's discount to NAV, which narrowed during the period, accounts for the difference

between performance based on price and performance based on NAV. For the first two months of the reporting period, the high yield loan market was under

extreme pressure and lost 10.9%, as measured by the Credit Suisse Leveraged Loan Index. However, this brief period of underperformance was followed by the

market’s strongest results ever, as the sector gained more than 40% for the period January 1, 2009 to October 31, 2009. On average, market performance was

positive and the Fund’s reduction of leverage in response to higher collateral requirements imposed by the major rating agencies had a negative effect on

absolute performance. Relative to its Lipper peers, the Fund gained from both maintaining leverage and focusing on higher-quality sectors and structures, which

benefited most during the sharp rally in 2009. Conversely, the Fund’s cash position hurt performance during the period.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These

views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

|

|

|

|

|

|

|

|

|

Fund Information

|

|

|

|

|

|

|

|

|

|

|

Symbol on NYSE

|

|

|

|

|

|

|

BGT

|

|

|

Initial Offering Date

|

|

|

|

|

|

August 30, 2004

|

|

|

Yield on Closing Market Price as of October 31, 2009 ($12.58)

1

|

|

|

|

|

6.44%

|

|

|

Current Monthly Distribution per Common Share

2

|

|

|

|

|

|

$0.0675

|

|

|

Current Annualized Distribution per Common Share

2

|

|

|

|

|

|

$0.8100

|

|

|

Leverage as of October 31, 2009

3

|

|

|

|

|

|

|

19%

|

|

|

1

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price.

|

|

|

|

Past performance does not guarantee future results.

|

|

|

|

|

|

|

|

|

2

The distribution is not constant and is subject to change. A portion of the distribution may be deemed a tax return of capital or net realized gain.

|

|

|

3

Represents loan outstanding and Preferred Shares as a percentage of total managed assets, which is the total assets of the Fund (including any

|

|

|

assets attributable to any borrowings and Preferred Shares) minus the sum of liabilities (other than borrowings representing financial leverage).

|

|

|

For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging on page 10.

|

|

|

|

The table below summarizes the changes in the Fund’s market price and NAV per share:

|

|

|

|

|

|

|

|

|

10/31/09

|

10/31/08

|

Change

|

High

|

Low

|

|

|

Market Price

|

|

|

$12.58

|

$ 9.63

|

30.63%

|

$12.98

|

$6.88

|

|

|

Net Asset Value

|

|

|

$13.29

|

$11.24

|

18.24%

|

$13.35

|

$8.86

|

|

|

The following unaudited charts show the portfolio composition of the Fund’s long-term investments and credit quality allocations

|

|

|

of the Fund’s long-term investments excluding floating rate loan interests:

|

|

|

|

|

|

|

Portfolio Composition

|

|

|

Credit Quality Allocations

4

|

|

|

|

|

|

10/31/09

|

10/31/08

|

|

|

|

10/31/09

|

10/31/08

|

|

|

Floating Rate Loan Interests

|

76%

|

79%

|

AAA/Aaa

|

|

|

16%

|

—

|

|

|

Corporate Bonds

|

20

|

14

|

A/A

|

|

|

4

|

20%

|

|

|

Foreign Government Obligations

|

3

|

7

|

BBB/Baa

|

|

27

|

30

|

|

|

Other Interests

|

1

|

—

|

BB/Ba

|

|

|

17

|

16

|

|

|

|

|

|

B/B

|

|

|

22

|

23

|

|

|

|

|

|

CCC/Caa

|

|

6

|

10

|

|

|

|

|

|

C/C

|

|

|

5

|

—

|

|

|

|

|

|

D

|

|

|

1

|

—

|

|

|

|

|

|

Not Rated

|

|

2

|

1

|

|

|

|

|

|

4

Using the higher of S&P’s or Moody’s ratings.

|

|

|

|

ANNUAL REPORT

|

|

|

|

OCTOBER 31, 2009

|

|

9

|

The Benefits and Risks of Leveraging

The Funds may utilize leverage to seek to enhance the yield and NAV of their

Common Shares. However, these objectives cannot be achieved in all interest

rate environments.

The Funds may utilize leverage through borrowings, the issuance of

Preferred Shares or by entering into reverse repurchase agreements. In

general, the concept of leveraging is based on the premise that the cost of

assets to be obtained from leverage will be based on short-term interest

rates, which normally will be lower than the income earned by each Fund

on its longer-term portfolio investments. To the extent that the total assets

of each Fund (including the assets obtained from leverage) are invested in

higher-yielding portfolio investments, each Fund’s Common Shareholders

will benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from lever-

age is paid to Common Shareholders in the form of dividends, and the

value of these portfolio holdings is reflected in the per share NAV of each

Fund’s Common Shares. However, in order to benefit Common Shareholders,

the yield curve must be positively sloped; that is, short-term interest rates

must be lower than long-term interest rates. If the yield curve becomes

negatively sloped, meaning short-term interest rates exceed long-term

interest rates, income to Common Shareholders will be lower than if the

Funds had not used leverage.

To illustrate these concepts, assume a Fund’s Common Shares capitalization

is $100 million and it borrows and/or issues Preferred Shares for an addi-

tional $50 million, creating a total value of $150 million available for invest-

ment in long-term securities. If prevailing short-term interest rates are 3%

and long-term interest rates are 6%, the yield curve has a strongly positive

slope. In this case, the Fund pays interest expense and/or dividends on

the $50 million of Preferred Shares based on the lower short-term interest

rates. At the same time, the securities purchased by the Fund with assets

received from the borrowings and/or issuance of Preferred Shares can earn

income based on long-term interest rates. In this case, the interest expense

and/or dividends paid to Preferred Shareholders are significantly lower

than the income earned on the Fund’s long-term investments, and there-

fore the Common Shareholders are the beneficiaries of the incremental

net income.

If short-term interest rates rise, narrowing the differential between short-

term and long-term interest rates, the incremental net income pickup on

the Common Shares will be reduced or eliminated completely. Furthermore,

if prevailing short-term interest rates rise above long-term interest rates of

6%, the yield curve has a negative slope. In this case, the Fund pays divi-

dends on the higher short-term interest rates whereas the Fund’s total port-

folio earns income based on lower long-term interest rates.

Furthermore, the value of a Fund’s portfolio investments generally varies

inversely with the direction of long-term interest rates, although other factors

can influence the value of portfolio investments. In contrast, the redemption

value of the Funds’ borrowings and/or Preferred Shares does not fluctuate

in relation to interest rates. As a result, changes in interest rates can influ-

ence the Funds’ NAV positively or negatively in addition to the impact on

Fund performance from leverage from borrowings.

The use of leverage may enhance opportunities for increased income to the

Funds and Common Shareholders, but as described above, it also creates

risks as short- or long-term interest rates fluctuate. Leverage also will gener-

ally cause greater changes to each Fund’s NAV, market price and dividend

rates than a comparable portfolio without leverage. If the income derived

from securities purchased with assets received from leverage exceeds the

cost of leverage, each Fund’s net income will be greater than if leverage had

not been used. Conversely, if the income from the securities purchased is

not sufficient to cover the cost of leverage, each Fund’s net income will be

less than if leverage had not been used, and therefore the amount available

for distribution to shareholders will be reduced. Each Fund may be required

to sell portfolio securities at inopportune times or at distressed values in

order to comply with regulatory requirements applicable to the use of lever-

age or as required by the terms of leverage instruments which may cause

a Fund to incur losses. The use of leverage may limit each Fund’s ability to

invest in certain types of securities or use certain types of hedging strate-

gies, such as in the case of certain restrictions imposed by ratings agencies

that rate Preferred Shares issued by each Fund. Each Fund will incur

expenses in connection with the use of leverage, all of which are borne by

the Common Shareholders and may reduce income on the Common Shares.

Under the Investment Company Act of 1940, BGT is permitted to borrow

through a credit facility up to 33

1

/

3

% of its total managed assets and the

Funds are permitted to issue Preferred Shares in an amount of up to 50%

of their total managed assets at the time of issuance. Under normal cir-

cumstances, each Fund anticipates that the total economic leverage from

Preferred Shares, reverse repurchase agreements and credit facility borrow-

ings will not exceed 50% of its total managed assets at the time such lever-

age is incurred. As of October 31, 2009, the Funds had economic leverage

from Preferred Shares, reverse repurchase agreements and/or credit facility

borrowings as a percentage of their total managed assets as follows:

|

|

|

|

|

Percent of

|

|

|

Leverage

|

|

PSW

|

32%

|

|

PSY

|

30%

|

|

BPP

|

29%

|

|

BTZ

|

31%

|

|

BGT

|

19%

|

Derivative Financial Instruments

The Funds may invest in various derivative instruments, including financial

futures contracts, swaps, foreign currency exchange contracts and options,

as specified in Note 2 of the Notes to Financial Statements, which consti-

tute forms of economic leverage. Such instruments are used to obtain

exposure to a market without owning or taking physical custody of securi-

ties or to hedge market, equity, credit, interest rate and/or foreign currency

exchange rate risks. Such derivative instruments involve risks, including the

imperfect correlation between the value of a derivative instrument and the

underlying asset, possible default of the counterparty to the transaction

and illiquidity of the derivative instrument. Each Fund’s ability to success-

fully use a derivative instrument depends on the investment advisor’s

ability to accurately predict pertinent market movements, which cannot be

assured. The use of derivative instruments may result in losses greater than

if they had not been used, may require the Funds to sell or purchase port-

folio securities at inopportune times or at distressed values, may limit the

amount of appreciation the Funds can realize on an investment or may

cause the Funds to hold a security that they might otherwise sell. The

Funds’ investments in these instruments are discussed in detail in the

Notes to Financial Statements.

10 ANNUAL REPORT OCTOBER 31, 2009

|

|

|

|

|

|

|

|

|

|

|

|

Schedule of Investments

October 31, 2009

|

|

BlackRock Credit Allocation Income Trust I, Inc. (PSW)

|

|

|

|

|

|

|

|

(Percentages shown are based on Net Assets)

|

|

|

|

Par

|

|

|

|

|

|

Par

|

|

|

Corporate Bonds

|

|

(000)

|

Value

|

Capital Trusts

|

|

|

(000)

|

Value

|

|

Insurance — 2.5%

|

|

|

|

|

Multi-Utilities — 2.8%

|

|

|

|

|

|

Oil Insurance Ltd., 7.56% (a)(b)(c)

|

$ 1,000

|

$ 706,200

|

Dominion Resources Capital Trust I,

|

|

|

|

|

QBE Insurance Group Ltd., 9.75%, 3/14/14 (a)

|

|

1,484

|

1,695,246

|

7.83%, 12/01/27 (f)

|

|

$ 1,200 $

|

1,202,650

|

|

|

|

|

2,401,446

|

Dominion Resources, Inc., 7.50% (c)

|

|

1,051

|

1,029,980

|

|

|

|

|

|

|

Puget Sound Energy, Inc. Series A, 6.97%, 6/01/67 (c)

|

475

|

415,587

|

|

Media — 12.5%

|

|

|

|

|

|

|

|

|

|

|

COX Communications, Inc., 8.38%, 3/01/39 (a)

|

|

10,000

|

11,988,640

|

|

|

|

|

2,648,217

|

|

Total Corporate Bonds — 15.0%

|

|

|

14,390,086

|

Oil, Gas & Consumable Fuels — 1.3%

|

|

|

|

|

|

|

|

|

|

Enterprise Products Operating LLC, 8.38%, 8/01/66 (c)

|

825

|

808,500

|

|

|

|

|

|

|

TransCanada PipeLines Ltd., 6.35%, 5/15/67 (c)

|

|

500

|

465,397

|

|

Preferred Securities

|

|

|

|

|

|

|

|

|

1,273,897

|

|

|

|

|

|

|

Total Capital Trusts — 33.5%

|

|

|

|

32,110,050

|

|

Capital Trusts

|

|

|

|

|

|

|

|

|

|

|

Building Products — 0.7%

|

|

|

|

|

|

|

|

|

|

|

C8 Capital SPV Ltd., 6.64% (a)(b)(c)

|

|

980

|

691,018

|

Preferred Stocks

|

|

|

Shares

|

|

|

Capital Markets — 5.8%

|

|

|

|

|

Commercial Banks — 8.1%

|

|

|

|

|

|

Ameriprise Financial, Inc., 7.52%, 6/01/66 (c)

|

|

1,900

|

1,615,000

|

First Tennessee Bank NA, 3.90% (a)(c)

|

|

1,176

|

589,838

|

|

Lehman Brothers Holdings Capital Trust V,

|

|

|

|

|

HSBC USA, Inc.:

|

|

|

|

|

|

3.64% (b)(c)(d)(e)

|

|

1,600

|

|

160

|

Series D, 4.50% (c)

|

|

|

35,000

|

734,300

|

|

State Street Capital Trust III, 8.25% (b)(c)

|

|

725

|

731,257

|

Series H, 6.50%

|

|

|

168,000

|

3,410,400

|

|

State Street Capital Trust IV, 1.30%, 6/01/67 (c)

|

|

4,740

|

3,180,090

|

Provident Financial Group, Inc., 7.75%

|

|

42,000

|

1,013,250

|

|

|

|

|

5,526,507

|

Royal Bank of Scotland Group Plc, Series M, 6.40%

|

5,000

|

51,700

|

|

Commercial Banks — 3.3%

|

|

|

|

|

Santander Finance Preferred SA Unipersonal, 6.80%

|

72,807

|

1,992,000

|

|

Bank of Ireland Capital Funding II, LP, 5.57% (a)(b)(c)

|

429

|

188,760

|

|

|

|

|

7,791,488

|

|

Bank of Ireland Capital Funding III, LP, 6.11% (a)(b)(c)

|

740

|

325,600

|

Diversified Financial Services — 2.0%

|

|

|

|

|

Barclays Bank Plc, 5.93% (a)(b)(c)

|

|

500

|

390,000

|

Cobank ACB, 7.00% (a)

|

|

|

38,000

|

1,326,439

|

|

First Empire Capital Trust II, 8.28%, 6/01/27

|

|

910

|

691,337

|

ING Groep NV, 7.20%

|

|

|

35

|

612,942

|

|

National City Preferred Capital Trust I, 12.00% (b)(c)

|

|

300

|

343,359

|

|

|

|

|

|

|

SMFG Preferred Capital USD 3 Ltd., 9.50% (a)(b)(c)

|

|

875

|

948,675

|

|

|

|

|

1,939,381

|

|

Santander Perpetual SA Unipersonal, 6.67% (a)(b)(c)

|

250

|

228,123

|

Electric Utilities — 3.6%

|

|

|

|

|

|

SunTrust Preferred Capital I, 5.85% (b)(c)

|

|

135

|

|

88,087

|

Alabama Power Co., 6.50%

|

|

|

25,000

|

750,000

|

|

|

|

|

3,203,941

|

Entergy Arkansas, Inc., 6.45%

|

|

|

28,800

|

609,301

|

|

|

|

|

|

|

Entergy Louisiana LLC, 6.95%

|

|

|

22,650

|

2,119,747

|

|

Diversified Financial Services — 3.0%

|

|

|

|

|

|

|

|

|

|

|

Farm Credit Bank of Texas Series 1, 7.56% (b)(c)

|

|

1,000

|

701,550

|

|

|

|

|

3,479,048

|

|

JPMorgan Chase Capital XXIII, 1.44%, 5/15/77 (c)

|

|

3,085

|

2,172,873

|

Insurance — 5.8%

|

|

|

|

|

|

|

|

|

2,874,423

|

Aspen Insurance Holdings Ltd., 7.40% (c)

|

|

55,000

|

1,116,500

|

|

|

|

|

|

|

Axis Capital Holdings Ltd.:

|

|

|

|

|

|

Electric Utilities — 0.5%

|

|

|

|

|

Series A, 7.25%

|

|

|

35,000

|

789,250

|

|

PPL Capital Funding, 6.70%, 3/30/67 (c)

|

|

500

|

430,000

|

Series B, 7.50% (c)

|

|

|

9,000

|

673,875

|

|

Insurance — 16.1%

|

|

|

|

|

Endurance Specialty Holdings Ltd. Series A, 7.75%

|

35,200

|

770,880

|

|

AXA SA, 6.38% (a)(b)(c)

|

|

3,585

|

3,038,287

|

RenaissanceRe Holding Ltd. Series D, 6.60%

|

|

110,000

|

2,267,100

|

|

Ace Capital Trust II, 9.70%, 4/01/30

|

|

500

|

552,614

|

|

|

|

|

5,617,605

|

|

The Allstate Corp., 6.50%, 5/15/57 (c)(f)

|

|

3,200

|

2,736,000

|

|

|

|

|

|

|

Chubb Corp., 6.38%, 3/29/67 (c)(g)

|

|

500

|

453,750

|

Real Estate Investment Trusts (REITs) — 7.4%

|

|

|

|

|

Farmers Exchange Capital, 7.05%, 7/15/28 (a)

|

|

500

|

428,271

|

BRE Properties, Inc. Series D, 6.75%

|

|

10,000

|

205,200

|

|

Genworth Financial, Inc., 6.15%, 11/15/66 (c)

|

|

750

|

502,500

|

First Industrial Realty Trust, Inc., 6.24% (c)

|

|

610

|

270,116

|

|

Great West Life & Annuity Insurance Co.,

|

|

|

|

|

HRPT Properties Trust:

|

|

|

|

|

|

7.15%, 5/16/46 (a)(c)

|

|

500

|

415,000

|

Series B, 8.75%

|

|

|

97,917

|

2,257,966

|

|

Liberty Mutual Group, Inc., 10.75%, 6/15/88 (a)(c)

|

|

500

|

525,000

|

Series C, 7.13%

|

|

|

125,000

|

2,332,500

|

|

Lincoln National Corp., 7.00%, 5/17/66 (c)

|

|

500

|

410,000

|

iStar Financial, Inc. Series I, 7.50%

|

|

59,500

|

416,500

|

|

MetLife, Inc., 6.40%, 12/15/66 (f)

|

|

500

|

433,125

|

Public Storage:

|

|

|

|

|

|

Nationwide Life Global Funding I, 6.75%, 5/15/67

|

|

500

|

378,967

|

Series F, 6.45%

|

|

|

10,000

|

212,500

|

|

Oil Casualty Insurance Ltd., 8.00%, 9/15/34 (a)

|

|

915

|

576,450

|

Series I, 7.25%

|

|

|

40,000

|

954,000

|

|

Progressive Corp., 6.70%, 6/15/67 (c)

|

|

500

|

437,973

|

Series M, 6.63%

|

|

|

20,000

|

429,000

|

|

Reinsurance Group of America, 6.75%, 12/15/65 (c)

|

700

|

542,500

|

|

|

|

|

7,077,782

|

|

The Travelers Cos., Inc., 6.25%, 3/15/67 (c)

|

|

500

|

450,000

|

Wireless Telecommunication Services — 2.8%

|

|

|

|

|

ZFS Finance (USA) Trust II, 6.45%, 12/15/65 (a)(c)(h)

|

1,800

|

1,620,000

|

Centaur Funding Corp., 9.08% (a)

|

|

|

2,720

|

2,729,350

|

|

ZFS Finance (USA) Trust IV, 5.88%, 5/09/32 (a)(c)

|

|

146

|

118,040

|

|

|

|

|

|

|

ZFS Finance (USA) Trust V, 6.50%, 5/09/67 (a)(c)

|

|

1,097

|

888,570

|

Total Preferred Stocks — 29.7%

|

|

|

|

28,634,654

|

|

Zenith National Insurance Capital Trust I,

|

|

|

|

|

|

|

|

|

|

|

8.55%, 8/01/28 (a)

|

|

1,000

|

955,000

|

|

|

|

|

|

|

|

|

|

15,462,047

|

|

|

|

|

|

|

Portfolio Abbreviations

|

|

|

|

|

|

|

|

|

|

|

To simplify the listings of portfolio holdings in the Schedules of

|

ADR

|

American Depositary Receipts

|

MXN

|

Mexican New Peso

|

|

|

Investments, the names of many of the securities have been

|

|

EUR

|

Euro

|

|

USD

|

US Dollar

|

|

|

|

abbreviated according to the following list:

|

|

|

GBP

|

British Pound

|

|

|

|

|

|

See Notes to Financial Statements.

|

|

|

|

|

|

|

|

|

|

|

ANNUAL REPORT

|

|

|

|

OCTOBER 31, 2009

|

|

11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule of Investments (continued)

|

|

|

|

BlackRock Credit Allocation Income Trust I, Inc. (PSW)

|

|

|

|

|

|

|

|

|

|

(Percentages shown are based on Net Assets)

|

|

|

|

Shares

|

|

|

|

|

|

|

|

|

|

|

|

Trust Preferreds

|

(000)

|

|

Value

|

|

|

|

|

|

|

|

|

|

Consumer Finance — 2.2%

|

|

|

|

•

|

For Fund compliance purposes, the Fund’s industry classifications refer to any one

|

|

Capital One Capital II, 7.50%, 6/15/66

|

93

|

$ 2,060,649

|

|

or more of the industry sub-classifications used by one or more widely recognized

|

|

Electric Utilities — 1.3%

|

|

|

|

|

market indexes or ratings group indexes, and/or as defined by Fund management.

|

|

PPL Energy Supply LLC, 7.00%, 7/15/46

|

49

|

|

1,263,610

|

|

This definition may not apply for purposes of this report, which may combine indus-

|

|

Insurance — 2.0%

|

|

|

|

|

try sub-classifications for reporting ease.

|

|

|

|

|

|

ABN AMRO North America Capital Funding Trust II,

|

|

|

|

•

|