Filed by Amcor plc

Pursuant to Rule 425 of the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Berry Global Group, Inc.

Commission File No.: 001-35672

Explanatory Note: The following is a script for a pre-recorded video

message from Peter Konieczny to employees of Amcor plc that was released on November 19, 2024.

November 19, 2024

PK Pre-Recorded

Message Script to Amcor Employees

Introduction

| · | Hi everyone, thank you for tuning in. |

| · | I didn’t want to miss sharing with all of you the great news we announced

today – we are combining with Berry Global to create a global leader in consumer and healthcare packaging solutions. |

| · | It is a very exciting combination with the potential to transform both companies

and – truly – the way the world thinks about packaging. Together, the combined companies we will be able to accelerate the

possible -- elevating brands, shaping lives and protecting Earth in a way neither company could do on its own. |

| · | This will build on the great work all of us have been doing to help Amcor

grow by putting the customer first, elevating sustainability and smartly selecting higher growth, higher margin categories. |

| · | So let me spend some time discussing why this is the right next step for

Amcor and what this means for all of us. |

Why Berry Global is the Right Partner

| · | Let me first get some of the drier, more factual information out of the way.

Berry Global is well known in our industry for their flexibles, containers and dispensing closures for customers in food and beverage,

home and personal care, food service and healthcare. |

| · | And similar to us, they do so with great knowledge and capabilities in sustainability,

innovation, specialized tooling, design and multi-component assembly. We are talking about two highly complementary organizations. |

| · | And you know how much we value culture at Amcor, so I am glad to tell you

their culture is closely aligned to ours. Safety is also a core value for them and we share a clear focus on customers, sustainability

and innovation. Like us, they operate at scale, with about 30,000 colleagues and 200 locations globally. |

| · | That means that, together, we will provide customers across the globe a broader

product offering, even stronger capabilities in materials science and a lot of supply certainty in a dynamic world. We’re all going

to be part of the most impactful and beloved packaging brand in the world! |

| · | Frankly, there are areas where Berry is more advanced than Amcor, and vice

versa. Combined, we will be able to do more, faster than we otherwise would apart. |

| · | We will help global customer get access to local markets and local customers

gain global capabilities. What’s great is that as one team we will be the partner of choice for customers. |

What this Means for Us

| · | While there are still details to be worked out, I believe this will

bring incredible possibilities for our team. First because it really illustrates how we are playing to win, not just participate –

with all the energy and pride that comes along. And second, because being part of a broader, more diverse global team there will be important

new opportunities for many team members. |

| · | I’m happy to say the combined company will be named Amcor plc. and

I will continue to have the honor of working alongside all of you as Chief Executive Officer. |

| · | Our global head office will remain in Zurich, and we intend to have multiple

business group offices in the U.S. – Evansville, Indiana where Berry is based – in addition to our offices in Ann Arbor,

Deerfield, and Miramar. We will also maintain a business group office in Singapore and maintain our presence in Melbourne. |

What’s Next?

| · | While we look forward to our future with Berry, today’s announcement

is only the first step in this process. |

| · | We all need to be very clear that it’s business as usual for our two

separate and independent companies while we go through the regulatory clearance and closing process – which we expect to take through

the first half of calendar 2025. |

| · | We are lucky to have a very experienced team that knows how to go through

these processes, and now is the time to stay focused and disciplined. I’m counting on everyone at Amcor to stay safe and focused

on serving customers so we can maintain positive momentum. There are no immediate changes to roles, responsibilities or reporting structures.

I’ll make sure you receive more information as the process advances. |

| · | I’m sure you have questions about what this announcement means for

you. Please be sure to review the FAQ that was distributed and talk to your manager. |

Thank You

| · | Let me close by thanking you for continuing to make Amcor such a special

place. |

| · | I am convinced we will be even stronger in this next chapter, and I am honored

to continue leading Amcor forward, working my heart out together with all of you. |

Important Information for Investors

and Shareholders

This communication does not constitute

an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction,

nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It does not constitute a prospectus

or prospectus equivalent document. No offering or sale of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the US Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

In connection with the proposed

transaction between Amcor plc (“Amcor”) and Berry Global Group, Inc. (“Berry”), Amcor and Berry

intend to file relevant materials with the Securities and Exchange Commission (the “SEC”), including, among other filings,

an Amcor registration statement on Form S-4 that will include a joint proxy statement of Amcor and Berry that also constitutes a

prospectus of Amcor with respect to Amcor’s ordinary shares to be issued in the proposed transaction, and a definitive joint proxy

statement/prospectus, which will be mailed to shareholders of Amcor and Berry (the “Joint Proxy Statement/Prospectus”). Amcor

and Berry may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the Joint

Proxy Statement/Prospectus or any other document which Amcor or Berry may file with the SEC. INVESTORS AND SECURITY HOLDERS OF AMCOR AND

BERRY ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the registration

statement and the Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Amcor or Berry through the

website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Amcor will be available free of charge

on Amcor’s website at amcor.com under the tab “Investors” and under the heading “Financial Information”

and subheading “SEC Filings.” Copies of the documents filed with the SEC by Berry will be available free of charge on Berry’s

website at berryglobal.com under the tab “Investors” and under the heading “Financials” and subheading “SEC

Filings.”

Certain Information Regarding

Participants

Amcor, Berry, and their respective

directors and executive officers may be considered participants in the solicitation of proxies from the shareholders of Amcor and Berry

in connection with the proposed transaction. Information about the directors and executive officers of Amcor is set forth in its Annual

Report on Form 10-K for the year ended June 30, 2024, which was filed with the SEC on August 16, 2024 and its proxy statement

for its 2024 annual meeting, which was filed with the SEC on September 24, 2024. Information about the directors and executive officers

of Berry is set forth in its Annual Report on Form 10-K for the year ended September 30, 2023, which was filed with the SEC

on November 17, 2023, its proxy statement for its 2024 annual meeting, which was filed with the SEC on January 4, 2024, and

its Current Reports on Form 8-K, which were filed with the SEC on February 12, 2024, April 11, 2024, September 6,

2024 and November 4, 2024. To the extent holdings of Amcor’s or Berry’s securities by its directors or executive officers

have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial

Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and

executive officers of Amcor and Berry, including a description of their direct or indirect interests, by security holdings or otherwise,

and other information regarding the potential participants in the proxy solicitations, which may be different than those of Amcor’s

shareholders and Berry’s stockholders generally, will be contained in the Joint Proxy Statement/Prospectus and other relevant materials

to be filed with the SEC regarding the proposed transaction. You may obtain these documents (when they become available) free of charge

through the website maintained by the SEC at http://www.sec.gov and from Amcor’s or Berry’s website as described above.

Cautionary Statement Regarding

Forward-Looking Statements

This communication contains certain

statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E

of the Exchange Act. Some of these forward-looking statements can be identified by words like “anticipate,” “approximately,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “outlook,” “plan,” “potential,” “possible,” “predict,”

“project,” “target,” “seek,” “should,” “will,” or “would,” the

negative of these words, other terms of similar meaning or the use of future dates. Such statements, including projections as to the anticipated

benefits of the proposed transaction, the impact of the proposed transaction on Amcor’s and Berry’s business and future financial

and operating results and prospects, the amount and timing of synergies from the proposed transaction, the terms and scope of the expected

financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company following the closing

of the proposed transaction and the closing date for the proposed transaction, are based on the current estimates, assumptions and projections

of the management of Amcor and Berry, and are qualified by the inherent risks and uncertainties surrounding future expectations generally,

all of which are subject to change. Actual results could differ materially from those currently anticipated due to a number of risks and

uncertainties, many of which are beyond Amcor’s and Berry’s control. None of Amcor, Berry or any of their respective directors,

executive officers, or advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied

in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results

of operations or financial condition of Amcor or Berry. Should any risks and uncertainties develop into actual events, these developments

could have a material adverse effect on Amcor’s and Berry’s businesses, the proposed transaction and the ability to successfully

complete the proposed transaction and realize its expected benefits. Risks and uncertainties that could cause results to differ from expectations

include, but are not limited to, the occurrence of any event, change or other circumstance that could give rise to the termination of

the merger agreement; the risk that the conditions to the completion of the proposed transaction (including shareholder and regulatory

approvals) are not satisfied in a timely manner or at all; the risks arising from the integration of the Amcor and Berry businesses; the

risk that the anticipated benefits of the proposed transaction may not be realized when expected or at all; the risk of unexpected costs

or expenses resulting from the proposed transaction; the risk of litigation related to the proposed transaction; the risks related to

disruption of management’s time from ongoing business operations as a result of the proposed transaction; the risk that the proposed

transaction may have an adverse effect on the ability of Amcor and Berry to retain key personnel and customers; general economic, market

and social developments and conditions; the evolving legal, regulatory and tax regimes under which Amcor and Berry operate; potential

business uncertainty, including changes to existing business relationships, during the pendency of the proposed transaction that could

affect Amcor’s and/or Berry’s financial performance; and other risks and uncertainties identified from time to time in Amcor’s

and Berry’s respective filings with the SEC, including the Joint Proxy Statement/Prospectus to be filed with the SEC in connection

with the proposed transaction. While the list of risks presented here is, and the list of risks presented in the Joint Proxy Statement/Prospectus

will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties,

and other risks may present significant additional obstacles to the realization of forward-looking statements. Forward-looking statements

included herein are made only as of the date hereof and neither Amcor nor Berry undertakes any obligation to update any forward-looking

statements, or any other information in this communication, as a result of new information, future developments or otherwise, or to correct

any inaccuracies or omissions in them which become apparent. All forward-looking statements in this communication are qualified in their

entirety by this cautionary statement.

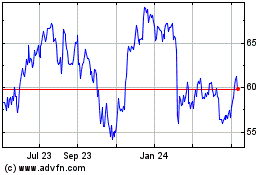

Berry Global (NYSE:BERY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Berry Global (NYSE:BERY)

Historical Stock Chart

From Nov 2023 to Nov 2024