Current Report Filing (8-k)

December 02 2020 - 4:52PM

Edgar (US Regulatory)

0001108134

false

0001108134

2020-12-02

2020-12-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(D) OF

THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): December 2, 2020

BERKSHIRE

HILLS BANCORP, INC.

(Exact Name of Registrant

as Specified in its Charter)

|

Delaware

|

|

001-15781

|

|

04-3510455

|

|

(State or Other Jurisdiction)

of Incorporation)

|

|

(Commission File No.)

|

|

(I.R.S. Employer

Identification No.)

|

|

60 State Street, Boston, Massachusetts

|

|

02109

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s

telephone number, including area code: (800)

773-5601

Not Applicable

(Former Name or Former

Address, if Changed Since Last Report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common stock, par value $0.01 per share

|

|

BHLB

|

|

New York Stock Exchange

|

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth

company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On December 2,

2020, Berkshire Bank (the “Bank”), a wholly-owned subsidiary of Berkshire Hills Bancorp, Inc. (the

“Company”), entered into a Purchase and Assumption Agreement with Investors Bank, Short Hills, New Jersey,

pursuant to which the Bank agreed to sell its eight Mid-Atlantic branches, including six branches in New Jersey and two

branches in Pennsylvania (the “Branches”), to Investors Bank. The sale involves the assignment of approximately

$639 million of deposits and approximately $308 million of loans at par value. Investors Bank has agreed to pay a premium of

3.0% of the final deposit balance transferred. The sale includes all branch premises and equipment, and the agreement

provides that the buyer intends to offer employment to all associated staff. The Purchase and Assumption Agreement contains

customary representations, warranties and covenants of the Bank and Investors Bank. Subject to regulatory approval and

customary closing conditions, the transaction is expected to close in the first half of 2021.

The foregoing description of the branch

sale and the Purchase and Assumption Agreement does not purport to be complete and is qualified in its entirety by reference to

the Purchase and Assumption Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein

by reference.

On December 2, 2020, the Company announced

that the Bank had entered into an agreement to sell its eight Mid-Atlantic branches, including six branches in New Jersey and two

branches in Pennsylvania, to Investors Bank. The Company also announced that the Bank intends to consolidate 16 of its branches

in New England and New York in the first half of 2021, subject to customary regulatory approvals. A copy of the news release announcing

the branch sale and consolidation is included as Exhibit 99.1 and is incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

|

|

(a)

|

Financial Statements of Businesses Acquired. Not applicable.

|

|

|

(b)

|

Pro Forma Financial Information. Not applicable.

|

|

|

(c)

|

Shell Company Transactions. Not applicable.

|

|

|

104.1

|

Cover Page for this Current Report on Form 8-K, formatted

in Inline XBRL

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

Berkshire Hills Bancorp, Inc.

|

|

|

|

|

|

DATE: December 2, 2020

|

By:

|

|

|

|

|

Sean A. Gray

Acting President and CEO

|

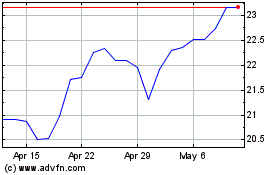

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jul 2024 to Aug 2024

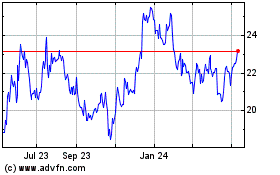

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Aug 2023 to Aug 2024