As filed with the Securities and Exchange

Commission on March 20, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BERKSHIRE HILLS BANCORP, INC.

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

|

6036

(Primary Standard Industrial

Classification Code Number)

|

04-3510455

(I.R.S. Employer

Identification Number)

|

60 State Street

Boston, Massachusetts 02109

(800) 773-5601, ext. 133773

(Address, Including Zip Code, and Telephone

Number, Including

Area Code, of Registrant’s Principal

Executive Offices)

Richard M. Marotta

President and Chief Executive Officer

60 State Street

Boston, Massachusetts 02109

(800) 773-5601 ext. 133773

(Address, Including Zip Code, and Telephone

Number, Including Area Code, of Agent for Service)

|

Copies to:

|

|

Lawrence

M. F. Spaccasi, Esq.

Marc Levy, Esq.

Luse Gorman, PC

5335 Wisconsin Avenue, N.W., Suite 780

Washington, D.C. 20015

(202) 274-2000

|

Michael Krebs, Esq.

Nutter McClennen & Fish

LLP

155 Seaport Blvd.

Boston, MA 02210

(617) 439-2000

|

Approximate date of commencement of proposed

sale to the public:

From time to time after the effective

date of this Registration Statement.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection dividend or interest reinvestment plans, check the

following box: x

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If

this Form is a registration statement pursuant to General Instructions I.D. or a post-effective amendment thereto that shall become

effective upon the filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instructions I.D filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2

of the Exchange Act. (Check one):

|

Large accelerated filer x

|

Accelerated filer ¨

|

Non-accelerated filer ¨

|

Smaller reporting company ¨

|

|

|

|

|

Emerging

growth company ¨

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of Securities Act. ¨

CALCULATION OF REGISTRATION FEE

Title of each class of

securities to be registered

|

|

Amount

to be registered

|

|

|

Proposed

maximum offering price per share

|

|

|

Proposed

maximum aggregate offering price

|

|

|

Amount

of registration fee

|

|

|

Common Stock, $0.01 par value per share

|

|

|

4,404,022

|

|

|

$

|

16.25

|

(1)

|

|

$

|

71,565,358

|

(1)

|

|

$

|

9,290

|

(1)

|

|

|

(1)

|

Estimated pursuant to Rule 457(c) under the Securities Act, solely for the purpose of calculating the registration fee, based

upon the average of the high and low sales prices of the Registrant’s common stock on March 17, 2020 (a date within five

business days prior to the initial filing of this registration statement), as reported on the New York Stock Exchange.

|

PROSPECTUS

4,404,022 Shares of Common Stock

This prospectus relates

to an aggregate of up to 4,404,022 shares of common stock (the “Shares”) of Berkshire Hills Bancorp, Inc., a Delaware

corporation (“Berkshire” or the “Company”), that may be resold from time to time by the Selling Stockholders

(as defined below) for their own account. Each of the Selling Stockholders is listed in the table in the section titled “Selling

Stockholders” in this prospectus. We will not receive any proceeds from the sale of Shares offered by the Selling Stockholders.

We issued substantially

all of the Shares pursuant to the Agreement and Plan of Merger, dated as of May 22, 2017, between Berkshire and Commerce Bancshares

Corp. (the “Commerce Merger Agreement”). Concurrent with the execution of the Commerce Merger Agreement, we entered

into a Shareholder Agreement (the “Shareholder Agreement”) with David G. Massad, Sr., the Chairman and majority

owner of Commerce Bancshares Corp. (“Commerce”). When we completed the Commerce acquisition on October 13, 2017,

we issued 4,357,344 shares of our common stock and 521,607 shares of our preferred stock to Mr. Massad pursuant to the Commerce

Merger Agreement.

Mr. Massad died

on December 28, 2018. All of the common stock and preferred stock that we issued to Mr. Massad pursuant to the Commerce

Merger Agreement were transferred upon his death to Mr. Massad’s estate (the “Estate”).

In July 2019,

the Estate sold 600,000 shares of our common stock.

The Shareholder Agreement,

among other things, restricted the Estate’s ability to transfer, acquire or sell shares of our common stock, influence corporate

transactions and management of Berkshire and initiate and support actions or shareholder proposals not recommended by our board

of directors. On December 27, 2019, the Company entered into an Amended and Restated Shareholder Agreement (the “Amended

and Restated Shareholder Agreement”) with the Estate. The amendments to the Shareholder Agreement primarily included:

|

|

1.

|

Increasing the Estate’s ability to sell blocks of the Company’s common stock without

the Company’s prior written consent (from 1% to 2% of the Company’s outstanding shares of common stock per month);

|

|

|

2.

|

Excepting from the selling restrictions in the Amended and Restated Shareholder Agreement, any

Permitted Transferee (as defined in the Amended and Restated Shareholder Agreement) that beneficially owns less than 3.5% of the

Company’s outstanding shares of common stock;

|

|

|

3.

|

Increasing the Estate’s ability to sell Company common stock in a firm commitment offering

from 5% to 7.5% of the Company’s outstanding shares of common stock; and

|

|

|

4.

|

Requiring the Company to file a shelf registration statement permitting sales of Company common

stock by the Estate immediately following the filing of the Company’s Annual Report on Form 10-K for the year ending

December 31, 2019.

|

In January 2020,

the Estate converted 260,700 of our preferred stock into 521,400 shares of our common stock. Subsequently, the Estate transferred

1,000,000 shares of our common stock each of Mr. Massad’s three adult children for a total of 3,000,000 shares of our

common stock.

The Estate and Mr. Massad’s

three adult children are the selling stockholders under this prospectus (the “Selling Stockholders”). Subject to the

resale restrictions set forth in the Amended and Restated Shareholder Agreement, the Selling Stockholders may sell the Shares in

one or more transactions directly to purchasers or through underwriters, broker-dealers or agents, who may receive compensation

in the form of discounts, concessions or commissions. The Selling Stockholders may sell the Shares at any time at market prices

prevailing at the time of sale, at prices related to such market prices, at a fixed price or prices subject to change or at privately

negotiated prices. This prospectus describes the general manner in which the Shares may be offered and sold by the Selling Stockholders.

If necessary, the specific manner in which the Shares may be offered and sold will be described in a supplement to this prospectus.

See “Plan of Distribution”. A portion of the Shares may be sold by one or more lenders to which the Estate may pledge

Shares as collateral for one or more loans. In the event of a planned sale of Shares by one or more of those lenders, we will identify

each lender in a supplement to this prospectus.

Our

common stock is listed on the New York Stock Exchange (“NYSE”) and trades under the symbol “BHLB”. On March 17,

2020, the closing price of our common stock, as reported on the NYSE, was $17.42

per share.

INVESTING IN OUR

COMMON STOCK INVOLVES RISKS. YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER “RISK FACTORS” ON PAGE 3 OF THIS

PROSPECTUS, AS WELL AS OTHER INFORMATION CONTAINED OR INCORPORATED BY REFERENCE IN THIS PROSPECTUS, INCLUDING OUR ANNUAL REPORT

ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2019, OR IN ANY PROSPECTUS SUPPLEMENT HERETO BEFORE MAKING A DECISION

TO INVEST IN OUR SECURITIES.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The securities are not savings or deposit accounts and are not insured by the Federal Deposit Insurance Corporation or any

other governmental agency.

The date of this prospectus is March 20,

2020.

table

of contents

ABOUT THIS PROSPECTUS

This prospectus is

part of a registration statement on Form S-3 under the Securities Act of 1933, as amended (the “Securities Act”),

that we filed with the Securities and Exchange Commission (“SEC”) as a “well-known seasoned issuer” as

defined in Rule 405 under the Securities Act, using a “shelf” registration, or continuous offering, process. Under

this shelf registration process, the Selling Stockholders may, from time to time, sell or otherwise dispose of some or all of the

Shares.

You should rely only

on the information we have provided or incorporated by reference in this prospectus. We have not authorized anyone to provide you

with additional or different information. No dealer, salesperson or other person is authorized to give any information or to represent

anything not contained in this prospectus. You must not rely on any unauthorized information or representation. You should not

assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this

prospectus, or that the information contained in any prospectus supplement or document incorporated by reference is accurate as

of any date other than the date set forth in those documents.

This prospectus

does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus in any

jurisdiction where such offer or sale is not permitted.

This prospectus incorporates

by reference business, financial and other information about us that is not included in or delivered with this document. You should

read the additional information described under the sections entitled “Incorporation of Documents by Reference” and

“Where You Can Find More Information” in this prospectus.

This prospectus may

be supplemented from time to time by one or more prospectus supplements. Any such prospectus supplements may include additional

information, such as additional risk factors or other special considerations applicable to us, our business or results of operations

or our common stock, and may also update, amend or supplement the information in this prospectus. If there is any inconsistency

between the information in this prospectus and any prospectus supplement, you should rely on the information in the applicable

prospectus supplement.

Unless otherwise mentioned

or unless the context requires otherwise, all references in this prospectus to the terms “Berkshire,” “we,”

“our,” and “us” or similar references refer to Berkshire Hills Bancorp, Inc., a Delaware corporation,

and its subsidiaries on a consolidated basis.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Certain statements

contained in this prospectus and the documents incorporated by reference herein that are not historical facts may constitute forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of

1934, as amended (referred to as the “Exchange Act”), and are intended to be covered by the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995. You can identify these statements from the use of the words “may,”

“will,” “should,” “could,” “would,” “plan,” “potential,”

“estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,”

“target” and similar expressions. These forward-looking statements are subject to significant risks, assumptions and

uncertainties, including among other things, changes in general economic and business conditions, increased competitive pressures,

changes in the interest rate environment, legislative and regulatory change, changes in the financial markets, and other risks

and uncertainties disclosed from time to time in documents that Berkshire files with the SEC. You should not place undue reliance

on forward-looking statements, which reflect our expectations only as of the date of this report. We do not assume any obligation

to revise forward-looking statements except as may be required by law.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to

“incorporate by reference” information filed with them, which means that we can disclose important information to you

by referring you to documents previously filed with the SEC. The information incorporated by reference is an important part of

this prospectus. Any statement made in a document incorporated by reference in this prospectus is deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement in this prospectus or in any other subsequently filed document,

which is also incorporated by reference, modifies or supersedes the statement.

We incorporate by reference

our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of

the Exchange Act, between the date of this prospectus and the termination of the offering of the securities described in this prospectus.

We are not, however, incorporating by reference any document or portion thereof, whether specifically listed below or filed in

the future, that is not deemed “filed” with the SEC. Unless expressly incorporated into this prospectus, a current

report (or portion thereof) furnished, but not filed, on Form 8-K shall not be incorporated by reference into this prospectus

(including, but not limited to, materials furnished under Items 2.02 or 7.01 of Form 8-K). The following documents filed with

the SEC pursuant to the Exchange Act are incorporated by reference herein:

We will provide to

each person, including any beneficial holder, to whom a prospectus is delivered, at no cost, upon written or oral request, a copy

of any or all of the information that has been incorporated by reference in the prospectus but not delivered with the prospectus.

Requests for documents should be directed to the attention of our Investor Relations Manager, Berkshire Hills Bancorp, Inc.,

60 State Street, Boston, Massachusetts 02109, telephone number (800) 773-5601, ext. 13373.

Exhibits to these filings

will not be sent unless those exhibits have been specifically incorporated by reference in such filings.

PROSPECTUS SUMMARY

This section contains

a general summary of information contained elsewhere in this prospectus. It may not include all of the information that is important

to you. Our business is subject to a number of risks, which we describe in the “Risk Factors” in our Annual Report

on Form 10-K for the annual period ended December 31, 2019, filed with the SEC on February 28, 2020, and subsequent

quarterly reports on Form 10-Q, which are incorporated by reference herein. See “Incorporation of Documents by Reference”.

You should read the entire prospectus and the documents incorporated by reference before making an investment decision.

Berkshire is a bank

holding company headquartered in Boston, Massachusetts that was incorporated and commenced operations in 2000. Our common stock

is listed on the New York Stock Exchange and trades under the symbol “BHLB”. We conduct our operations primarily through

Berkshire Bank, a Massachusetts trust company with 115 full service branch offices in Massachusetts, Connecticut, New York, Vermont,

New Jersey and Pennsylvania. Berkshire Bank, which we sometimes refer to in this prospectus as the “Bank”, provides

personal and business banking, insurance, and wealth management services. We also are the holding company for Berkshire Insurance

Group, an insurance agency in Western Massachusetts. As of December 31, 2019, Berkshire had total assets of $13.2 billion,

total deposits of $10.3 billion and total stockholders’ equity of $1.8 billion.

For additional information

concerning our business and our financial condition, results of operations and prospects, you should refer to the documents incorporated

in this document by reference, including our Annual Report on Form 10-K for the year ended December 31, 2019. See “Incorporation

of Documents by Reference” and “Where You Can Find More Information”.

2017 Acquisition of Commerce Bancshares

Corp.

On October 13,

2017, we completed our acquisition of Commerce Bancshares Corp. (“Commerce”), the holding company of Commerce Bank &

Trust Company and its subsidiaries headquartered in Worcester, Massachusetts. Pursuant to the Commerce Merger Agreement, Commerce

merged into Berkshire, with Berkshire as the surviving entity (the “Commerce Merger”), and each share of Commerce common

stock outstanding as of the effective time of the Commerce Merger was converted into the right to receive 0.93 shares of our common

stock, except that no Commerce shareholder was permitted to receive in the Commerce Merger, either individually or when aggregated

with such shareholder’s “acting in concert” group (as defined in 12 C.F.R. § 225.41 of Regulation Y), more

than 9.9% of the shares of our common stock outstanding as of the effective time of the Commerce Merger. Any Commerce shareholder

that would have otherwise received shares of Berkshire common stock in excess of such 9.9% limit instead received 0.465 shares

of our Series B Non-Voting Preferred Stock, par value $0.01 (the “preferred stock”), for each share of Commerce

common stock that was not convertible into our common stock.

In the Commerce Merger,

we issued 4,842,074 shares of common stock, subject to adjustment for fractional shares, and 521,607 shares of our preferred stock.

Each preferred share is convertible into two shares of our common stock under specified conditions. The shares are considered participating,

but do not maintain preferential treatment over common shares. Proportional dividends on the preferred shares are not payable unless

also declared for common shares.

Massad Estate and Shareholder Agreement

In the Commerce Merger,

we issued to David G. Massad, Sr., Commerce’s Chairman and majority shareholder, 4,357,344 shares of our common stock

and 521,607 shares of our preferred stock. Mr. Massad died on December 28, 2018. The shares of our common stock and our

preferred stock originally issued to Mr. Massad in the Commerce Merger now are held by the Estate. In July 2019, the

Estate sold 600,000 shares of our common stock. In January 2020, the Estate converted 260,700 of our preferred stock into

521,400 shares of our common stock. Subsequently, the Estate transferred 1,000,000 shares of our common stock each of Mr. Massad’s

three adult children for a total of 3,000,000 shares of our common stock. The sole beneficiaries of the Estate are Mr. Massad’s

three adult children: Christine A. Mandara, David G. Massad, II and Pamela A. Massad. Ms. Massad is a director of Berkshire

and the personal representative of the Estate. The Estate, Ms. Mandara, David G. Massad, II and Ms. Massad are sometimes

collectively referred to in this prospectus as the “Selling Stockholders”.

Concurrently with the

execution of the Commerce Merger Agreement, David G. Massad, Sr. entered into an agreement with Berkshire, which was amended

on December 27, 2019 (the “Amended and Restated Shareholder Agreement”), a copy of which is filed as Exhibit 10.1

to the registration statement of which this prospectus is a part. Since Mr. Massad’s death, the Estate has had the benefit

of, and been subject to, Mr. Massad’s rights and obligations under the Amended and Restated Shareholder Agreement. The

Amended and Restated Shareholder Agreement provides that until the Estate and its Acting in Concert Group (as defined in the Amended

and Restated Shareholder Agreement) have owned, in the aggregate, less than 5% of the then-outstanding shares of our common stock

for at least 120 consecutive days, the Estate generally may not sell or otherwise transfer shares of our common stock without our

prior approval, except for specified monthly amounts permissible under the terms of the Amended and Restated Shareholder Agreement.

We have agreed in the Amended and Restated Shareholder Agreement that we will not unreasonably withhold or delay our approval of

a sale or other transfer if requested by the Estate. The amendments in the Amended and Restated Shareholder Agreement primarily

include:

|

|

1.

|

Increasing the Estate’s ability to sell blocks of the Company’s common stock without

the Company’s prior written consent (from 1% to 2% of the Company’s outstanding shares of common stock per month);

|

|

|

2.

|

Excepting from the selling restrictions in the Amended and Restated Shareholder Agreement, any

Permitted Transferee (as defined in the Amended and Restated Shareholder Agreement) that beneficially owns less than 3.5% of the

Company’s outstanding shares of common stock;

|

|

|

3.

|

Increasing the Estate’s ability to sell Company common stock in a firm commitment offering

from 5% to 7.5% of the Company’s outstanding shares of common stock; and

|

|

|

4.

|

Requiring the Company to file a shelf registration statement permitting sales of Company common

stock by the Estate immediately following the filing of the Company’s Annual Report on Form 10-K for the year ending

December 31, 2019.

|

The Amended and Restated

Shareholder Agreement also provides, among other things, that the Estate will not acquire, offer or propose to acquire or agree

to acquire, whether by purchase, tender or exchange offer, or through the acquisition of control of another person or entity (including

by way of merger or consolidation) any shares of our common stock or any other class of our capital stock that has voting rights,

any right to vote or direct the voting of any additional shares of our common stock or our other voting stock, or any securities

convertible into our common stock or other voting stock, with certain exceptions, if the acquisition of such stock would cause

the Estate to beneficially own, in the aggregate with its Acting in Concert Group, more than 9.9% of the then-outstanding shares

of our common stock, as calculated pursuant to 12 C.F.R. § 225.41 of Regulation Y. We sometimes refer to this limit as the

“9.9% Beneficial Ownership Limitation”. The Amended and Restated Shareholder Agreement also restricts the Estate from

converting the preferred stock into our common stock if, after giving effect to such conversion, the Estate would, in the aggregate

with its Acting in Concert Group, exceed the 9.9% Beneficial Ownership Limitation.

RISK FACTORS

In addition to

the other information contained in or incorporated by reference into this prospectus, including the matters addressed under the

section “Cautionary Statement Regarding Forward-Looking Statements” beginning on page ii, you should consider

carefully the risk factors associated with the business, financial condition or operating results of Berkshire. These risk factors

may be found in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

In addition to

the risks factors presented in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, there may

be additional risks and uncertainties that are not currently known to the Company or that the Company currently deems to be immaterial

that could materially and adversely affect the Company's business, financial condition or operating results. As a result, past

financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate

results or trends in future periods. Further, to the extent that any of the information contained in our Annual Report on Form 10-K

for the fiscal year ended December 31, 2019 constitutes forward-looking statements, the risk factors set forth in our annual

report also are cautionary statements identifying important factors that could cause actual results to differ materially from those

expressed in any forward-looking statements made by or on behalf of the Company.

USE OF PROCEEDS

The Selling Stockholders

will receive all of the net proceeds from the sales of the Shares covered by this prospectus, and Berkshire will not receive any

proceeds from the sales.

SELLING STOCKHOLDERS

The Selling Stockholders

under this prospectus may include one or more of the Estate, Ms. Mandara, David G. Massad, II, and Ms. Massad. This

prospectus covers the resale of up to 1,278,744 shares of our common stock now held by the Estate; 1,046,909 shares now held individually

by Ms. Mandara; 1,000,000 shares now held individually by David G. Massad, II; and 1,078,369 shares now held individually

by Ms. Massad.

The following tables

sets forth information regarding the Selling Stockholders and the Shares that may be offered and sold from time to time by them

pursuant to this prospectus. Other information about the Selling Stockholders may change over time.

The Selling Stockholders

from time to time may offer all or some or none of their Shares under this prospectus. Since the Selling Stockholders are not obligated

to sell, transfer or otherwise dispose of their Shares, and because the Selling Stockholders may acquire shares of our publicly-traded

common stock, we cannot estimate how many shares each Selling Stockholder will beneficially own upon the termination of any particular

offering by such Selling Stockholder. The table below assumes that the Selling Stockholders will sell all of the Shares.

To the best of our

knowledge, based in part on representations made to us by the Selling Stockholders, none of the Selling Stockholders has or within

the past three years has had, any position, office or other material relationship with us or any of our affiliates, except that

Ms. Massad has served as a director of Berkshire since December 8, 2017.

To the best of our

knowledge, none of the Selling Stockholders is a broker-dealer or an affiliate of a broker-dealer, nor as of the date of the registration

statement of which this prospectus is a part, did any Selling Stockholder have direct or indirect agreements or understandings

with any person to distribute their shares. See “Plan of Distribution”.

|

Owner

|

|

Shares of Common

Stock Owned Prior to

Offering

|

|

|

Maximum Number of

Shares of Common

Stock Being Offered

|

|

|

Shares of Common

Stock Owned After

Offering

|

|

Pamela A. Massad, as

personal representative of the Estate of David G. Massad, Sr. and not individually

|

|

|

1,278,744

|

|

|

|

1,278,744

|

|

|

|

0

|

(1)

|

|

Christine A. Mandara

|

|

|

1,046,909

|

|

|

|

1,473,157

|

(2)

|

|

|

0

|

(1)

|

|

David G. Massad, II

|

|

|

1,000,000

|

|

|

|

1,426,248

|

(3)

|

|

|

0

|

(1)

|

|

Pamela A. Massad, individually

|

|

|

1,081,473

|

(4)

|

|

|

1,504,617

|

(5)

|

|

|

3,104

|

(6)

|

|

|

(1)

|

Assumes the sale by each of the Estate, Ms. Mandara and David G. Massad, II of all of

the Shares covered by this prospectus for each of them.

|

|

|

(2)

|

Consists of 1,046,909 shares of our common stock owned individually as of the date of this prospectus

plus 426,248 shares of common stock, representing one-third of the number of Shares that are owned by the Estate and covered by

this prospectus.

|

|

|

(3)

|

Consists of 1,000,000 shares of our common stock owned individually as of the date of this prospectus

plus 426,248 shares of common stock, representing one-third of the number of Shares that are owned by the Estate and covered by

this prospectus.

|

|

|

(4)

|

Consists of 1,078,369 shares of our common stock owned individually as of the date of this prospectus,

and 3,104 unvested restricted shares of our common stock held in trust indirectly, but as to which Ms. Massad has the sole

right to vote.

|

|

|

(5)

|

Consists of 1,078,369 shares of common stock owned individually as of the date of this prospectus

plus 426,248 shares of common stock, representing one-third of the number of Shares that are owned by the Estate and covered by

this prospectus.

|

|

|

(6)

|

Consists of 3,104 unvested restricted shares of our common stock held in trust indirectly, but

as to which Ms. Massad has the sole right to vote, not covered by this prospectus.

|

PLAN OF DISTRIBUTION

The Shares listed in

the table appearing under “Selling Stockholders” are being registered to permit public secondary trading of these Shares

by the holders of such Shares from time to time on or after the date of this prospectus. Registration of the Shares covered by

this prospectus does not mean, however, that such Shares necessarily will be offered or sold pursuant to the prospectus. Berkshire

will not receive any of the proceeds from the sale of the Shares by the Selling Stockholders.

Subject to the sales

volume restrictions set forth in the Amended and Restated Shareholder Agreement, the Selling Stockholders may sell the Shares from

time to time directly to purchasers or through underwriters, broker-dealers or agents, at market prices prevailing at the time

of sale, at prices related to such market prices, at a fixed price or prices subject to change or at negotiated prices, by a variety

of methods including one or more of the following:

|

|

·

|

through the NYSE or on any national securities

exchange or quotation service on which the shares of common stock may be listed or quoted at the time of sale;

|

|

|

·

|

in the over-the-counter market;

|

|

|

·

|

in transactions other than on such exchanges

or services or in the over-the-counter market;

|

|

|

·

|

through the exercise of purchased or written

options;

|

|

|

·

|

through a combination of any such methods;

or

|

|

|

·

|

through any other method permitted under

applicable law and in accordance with our “policy prohibiting insider trading” if applicable to a Selling Stockholder.

|

In effecting sales,

brokers or dealers engaged by one or more of the Selling Stockholders may arrange for brokers or dealers to participate. Broker-dealers

may receive commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of

shares, from the purchaser) in amounts to be negotiated. Broker-dealer transactions may include:

|

|

·

|

a block trade in which a broker-dealer

may resell all or part of the block, as principal or agent, in order to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer, as principal,

and a subsequent resale by the broker-dealer for its account;

|

|

|

·

|

pledges of shares to a broker-dealer,

who may, in the event of default, purchase or sell the pledged shares; or

|

|

|

·

|

ordinary brokerage transactions and transactions

in which a broker solicits purchasers on behalf of the Selling Stockholders.

|

In addition, Selling

Stockholders who are not subject to our insider trading policy (or who have received a waiver thereunder) may enter into option,

derivative or hedging transactions with respect to the Shares, and any related offers or sales of Shares may be made pursuant to

this prospectus. For example, such Selling Stockholders may:

|

|

·

|

enter into transactions involving short

sales of the shares by broker-dealers in the course of hedging the positions they assume with Selling Stockholders;

|

|

|

·

|

sell shares short themselves and deliver

the shares registered hereby to settle such short sales or to close out stock loans incurred in connection with their short positions;

|

|

|

·

|

write call options, put options or other

derivative instruments (including exchange-traded options or privately negotiated options) with respect to the shares, or which

they settle through delivery of the shares;

|

|

|

·

|

enter into option transactions or other

types of transactions that require the Selling Stockholder to deliver shares to a broker, dealer or other financial institution,

who may then resell or transfer the shares under this prospectus; or

|

|

|

·

|

lend the shares to a broker, dealer or

other financial institution, which may sell the lent shares.

|

These option, derivative

and hedging transactions may require the delivery to a broker, dealer or other financial institution of shares offered hereby,

and such broker, dealer or other financial institution may resell such shares pursuant to this prospectus.

Brokers, dealers, agents

or underwriters participating in transactions as agent may receive compensation in the form of discounts, concessions or commissions

from the Selling Stockholders (and, if they act as agent for the purchaser of the shares, from such purchaser). The discounts,

concessions or commissions as to a particular broker, dealer, agent or underwriter might be in excess of those customary in the

type of transaction involved.

The Selling Stockholders

and any underwriter, broker, dealer or agent that participates in such distribution may be deemed to be an “underwriter”

within the meaning of the Securities Act, and any discount, commission or concessions received by any underwriters, brokers, dealers

or agents might be deemed to be underwriting discounts and commissions under the Securities Act. Neither we nor the Selling Stockholders

can presently estimate the amount of such compensation. Any Selling Stockholder who is an “underwriter” within the

meaning of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act and the provisions

of the Exchange Act and the rules thereunder relating to stock manipulation. The Selling Stockholders may agree to indemnify

underwriters, brokers, dealers or agents that participate in transactions involving sales of the Shares against specific liabilities,

including liabilities arising under the Securities Act.

The Estate will pay

substantially all of the expenses incident to the preparation of the registration statement, of which this prospectus forms a part.

We will pay the expenses incident to the filing with the SEC of the registration statement, of which this prospectus forms a part.

Each Selling Stockholder will be responsible for that Selling Stockholder’s respective expenses incident to any sale of Shares

by that Selling Stockholder, including commissions and discounts of underwriters, brokers, dealers or agents.

In order to comply

with certain states’ securities laws, if applicable, the Shares sold in those jurisdictions may only be sold through registered

or licensed brokers or dealers. In addition, in certain states, the Shares may not be sold unless the Shares have been registered

or qualified for sale in that state or an exemption from registration or qualification is available and is complied with.

We cannot assure you

that any of the Selling Stockholders will sell all or any portion of the Shares offered by them pursuant to this prospectus. In

addition, we cannot assure you that the Selling Stockholders will not transfer, devise or gift the shares by other means not described

in this prospectus. Moreover, any Shares of common stock covered by this prospectus that meet the requirements for sale in accordance

with Rule 144 may be sold under Rule 144 rather than under this prospectus.

We may suspend the

use of this prospectus if we learn of any event that causes this prospectus to include, directly or through incorporation by reference,

an untrue statement of a material fact or omit to state a material fact required to be stated in this prospectus or necessary to

make the statements in this prospectus not misleading in light of the circumstances then existing. If this type of event occurs,

a prospectus supplement or post-effective amendment, if required, will be distributed to each Selling Stockholder.

DESCRIPTION OF

COMMON STOCK

The following summary contains a description

of the general terms of the common stock. You should

refer to our Certificate of Incorporation and filings with the SEC with respect to the offering of such common stock.

General

Berkshire Hills Bancorp, which is incorporated

under the General Corporation Law of the State of Delaware, is authorized to issue 100,000,000 shares of its common stock, $0.01

par value, of which 50,201,987 shares were issued and outstanding as of March 20, 2020. Berkshire Hills Bancorp’s board of

directors may at any time, without additional approval of the holders of preferred stock or common stock, issue additional authorized

shares of common stock.

Voting Rights

The holders of common stock are entitled

to one vote per share on all matters presented to stockholders. Holders of common stock are not entitled to cumulate their votes

in the election of directors. However, Berkshire Hills Bancorp’s Certificate of Incorporation provides that a record owner

of Berkshire Hills Bancorp’s common stock who beneficially owns, either directly or indirectly, in excess of 10% of Berkshire

Hills Bancorp’s outstanding shares, is not entitled to any vote in respect of the shares held in excess of the 10% limit.

No Preemptive or Conversion Rights

The holders of common stock do not have

preemptive rights to subscribe for a proportionate share of any additional securities issued by Berkshire Hills Bancorp before

such securities are offered to others. The absence of preemptive rights increases Berkshire Hills Bancorp’s flexibility to

issue additional shares of common stock in connection with Berkshire Hills Bancorp’s acquisitions, employee benefit plans

and for other purposes, without affording the holders of common stock a right to subscribe for their proportionate share of those

additional securities. The holders of common stock are not entitled to any redemption privileges, sinking fund privileges or conversion

rights.

Dividends

Holders of common stock are entitled to

receive dividends ratably when, as and if declared by Berkshire Hills Bancorp’s board of directors from assets legally available

therefor, after payment of all dividends on preferred stock, if any is outstanding. Under Delaware law, Berkshire Hills Bancorp

may pay dividends out of surplus or net profits for the fiscal year in which declared and/or for the preceding fiscal year, even

if our surplus accounts are in a deficit position. Dividends paid by our subsidiary bank have historically been a significant source

of funds available to Berkshire Hills Bancorp. Berkshire Hills Bancorp expects to use these sources of funds in the future, as

well as proceeds it may obtain from the offering of common stock, preferred stock and/or debt securities for payment of dividends

to our stockholders, the repurchase of our common stock and for other needs. Berkshire Hills Bancorp’s board of directors

intends to maintain its present policy of paying regular quarterly cash dividends. The declaration and amount of future dividends

will depend on circumstances existing at the time, including Berkshire Hills Bancorp’s earnings, financial condition and

capital requirements, as well as regulatory limitations and such other factors as Berkshire Hills Bancorp’s board of directors

deems relevant.

Berkshire Hills Bancorp’s principal

assets and sources of income consist of investments in our operating subsidiaries, which are separate and distinct legal entities.

Certain Certificate of Incorporation and Bylaw Provisions

Affecting Stock

Berkshire Hills Bancorp’s Certificate

of Incorporation and Bylaws contain several provisions that may make Berkshire Hills Bancorp a less attractive target for an acquisition

of control by anyone who does not have the support of Berkshire Hills Bancorp’s board of directors. Such provisions include,

among other things, the requirement of a supermajority vote of stockholders or directors to approve certain business combinations

and other corporate actions, a minimum price provision, several special procedural rules, a vote limitation provision and the limitation

that stockholder actions may only be taken at a meeting and may not be taken by unanimous written stockholder consent. The foregoing

is qualified in its entirely by reference to Berkshire Hills Bancorp’s Certificate of Incorporation and Bylaws, both of which

are on file with the SEC.

Restrictions on Ownership

Under the federal Change in Bank Control

Act, a notice must be submitted to the Federal Reserve if any person (including a company), or group acting in concert, seeks

to acquire “control” of a bank holding company or bank. An acquisition of “control” can occur upon the

acquisition of 10.0% or more of a class of voting securities of a bank holding company or savings institution or as otherwise

defined by the Federal Reserve. Under the Change in Bank Control Act, the Federal Reserve has 60 days from the filing of a complete

notice to act, taking into consideration certain factors, including the financial and managerial resources of the acquirer and

the anti-trust effects of the acquisition.

EXPERTS

The consolidated financial statements of Berkshire Hills Bancorp,

Inc. as of December 31, 2019 and 2018 and for each of the three years in the period ended December 31, 2019 have been audited by

Crowe LLP, an independent registered public accounting firm, as set forth in their report appearing in our Annual Report on Form

10-K for the year ended December 31, 2019 and incorporated in this registration statement by reference. Such consolidated financial

statements have been so incorporated in reliance upon their authority as experts in accounting and auditing.

LEGAL MATTERS

The validity of the

Shares of our common stock that may be sold pursuant to this prospectus has been passed upon by Luse Gorman, PC, Washington, D.C.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the

information requirements of the Exchange Act and file annual, quarterly and current reports, proxy statements and other information

with the SEC. We are required to file electronic versions of these documents with the SEC. Our reports, proxy statements and other

information can be inspected and copied at prescribed rates at the Public Reference Room of the SEC located at 100 F Street, N.E.,

Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

The SEC also maintains a website that contains reports, proxy and information statements and other information, including electronic

versions of our filings. The website address is http://www.sec.gov. Our SEC filings are also available free of charge at our website

at http://ir.berkshirebank.com/, as soon as reasonably practicable after we electronically file them with or furnish them to

the SEC. Information contained on our web site is not part of this prospectus or our other filings with the SEC.

We have filed with

the SEC a registration statement on Form S-3 under the Securities Act with respect to the Shares. This prospectus does not

contain all of the information in the registration statement, parts of which we have omitted, as allowed under the rules and

regulations of the SEC. You should refer to the registration statement for further information with respect to us and the Shares.

Copies of the registration statement, including exhibits, may be inspected without charge at the SEC’s Public Reference Room

and on the SEC’s website at the addresses set forth above.

You should note that

where we summarize in this prospectus the material terms of any contract, agreement or other document filed as an exhibit to the

registration statement, the summary information provided in this prospectus is less complete than the actual contract, agreement

or document. You should refer to the exhibits to the registration statement for copies of the actual contract, agreement or document.

4,404,022 Shares of Common Stock

PROSPECTUS

March 20,

2020

No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely

on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only

under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only

as of its date.

PART II: INFORMATION

NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance

and Distribution.

The following table

sets forth the estimated costs and expenses, other than any underwriting discounts and commissions, payable by us in connection

with the offering of the securities being registered. All amounts shown are estimates, except for the registration fee.

|

SEC Registration Fee

|

|

$

|

10,084

|

|

|

Accounting fees and expenses

|

|

$

|

15,000

|

|

|

Legal fees and expenses

|

|

$

|

25,000

|

|

|

Miscellaneous

|

|

$

|

7,516

|

|

|

Total

|

|

$

|

57,600

|

|

Item 15. Indemnification of Directors

and Officers.

In accordance with the General Corporation

Law of the State of Delaware (being Chapter 1 of Title 8 of the Delaware Code), Articles 10 and 11 of Berkshire Hills Bancorp’s

Certificate of Incorporation provide as follows:

TENTH:

A. Each person who was or is made a party

or is threatened to be made a party to or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative

or investigative (hereinafter a “proceeding”), by reason of the fact that he or she is or was a Director or an Officer

of the Corporation or is or was serving at the request of the Corporation as a Director, Officer, employee or agent of another

corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to an employee benefit

plan (hereinafter an “indemnitee”), whether the basis of such proceeding is alleged action in an official capacity

as a Director, Officer, employee or agent, or in any other capacity while serving as a Director, Officer, employee or agent, shall

be indemnified and held harmless by the Corporation to the fullest extent authorized by the Delaware General Corporation Law, as

the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits

the Corporation to provide broader indemnification rights than such law permitted the Corporation to provide prior to such amendment),

against all expense, liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and

amounts paid in settlement) reasonably incurred or suffered by such indemnitee in connection therewith; provided, however, that,

except as provided in Section C hereof with respect to proceedings to enforce rights to indemnification, the Corporation shall

indemnify any such indemnitee in connection with a proceeding (or part thereof) initiated by such indemnitee only if such proceeding

(or part thereof) was authorized by the Board of Directors of the Corporation.

B. The right to indemnification conferred

in Section A of this Article TENTH shall include the right to be paid by the Corporation the expenses incurred in defending any

such proceeding in advance of its final disposition (hereinafter an “advancement of expenses”); provided, however,

that, if the Delaware General Corporation Law requires, an advancement of expenses incurred by an indemnitee in his or her capacity

as a Director or Officer (and not in any other capacity in which service was or is rendered by such indemnitee, including, without

limitation, services to an employee benefit plan) shall be made only upon delivery to the Corporation of an undertaking (hereinafter

an “undertaking”), by or on behalf of such indemnitee, to repay all amounts so advanced if it shall ultimately be determined

by final judicial decision from which there is no further right to appeal (hereinafter a “final adjudication”) that

such indemnitee is not entitled to be indemnified for such expenses under this Section or otherwise. The rights to indemnification

and to the advancement of expenses conferred in Sections A and B of this Article TENTH shall be contract rights and such rights

shall continue as to an indemnitee who has ceased to be a Director, Officer, employee or agent and shall inure to the benefit of

the indemnitee’s heirs, executors and administrators.

C. If a claim under Section A or B of this

Article TENTH is not paid in full by the Corporation within sixty days after a written claim has been received by the Corporation,

except in the case of a claim for an advancement of expenses, in which case the applicable period shall be twenty days, the indemnitee

may at any time thereafter bring suit against the Corporation to recover the unpaid amount of the claim. If successful in whole

or in part in any such suit, or in a suit brought by the Corporation to recover an advancement of expenses pursuant to the terms

of an undertaking, the indemnitee shall be entitled to be paid also the expenses of prosecuting or defending such suit. In (i) any

suit brought by the indemnitee to enforce a right to indemnification hereunder (but not in a suit brought by the indemnitee to

enforce a right to an advancement of expenses) it shall be a defense that, and (ii) in any suit by the Corporation to recover

an advancement of expenses pursuant to the terms of an undertaking the Corporation shall be entitled to recover such expenses upon

a final adjudication that, the indemnitee has not met any applicable standard for indemnification set forth in the Delaware General

Corporation Law. Neither the failure of the Corporation (including its Board of Directors, independent legal counsel, or its stockholders)

to have made a determination prior to the commencement of such suit that indemnification of the indemnitee is proper in the circumstances

because the indemnitee has met the applicable standard of conduct set forth in the Delaware General Corporation Law, nor an actual

determination by the Corporation (including its Board of Directors, independent legal counsel, or its stockholders) that the indemnitee

has not met such applicable standard of conduct, shall create a presumption that the indemnitee has not met the applicable standard

of conduct or, in the case of such a suit brought by the indemnitee, be a defense to such suit. In any suit brought by the indemnitee

to enforce a right to indemnification or to an advancement of expenses hereunder, or by the Corporation to recover an advancement

of expenses pursuant to the terms of an undertaking, the burden of proving that the indemnitee is not entitled to be indemnified,

or to such advancement of expenses, under this Article TENTH or otherwise shall be on the Corporation.

D. The rights to indemnification and to

the advancement of expenses conferred in this Article TENTH shall not be exclusive of any other right which any person may have

or hereafter acquire under any statute, the Corporation’s Certificate of Incorporation, Bylaws, agreement, vote of stockholders

or Disinterested Directors or otherwise.

E. The Corporation may maintain insurance,

at its expense, to protect itself and any Director, Officer, employee or agent of the Corporation or subsidiary or Affiliate or

another corporation, partnership, joint venture, trust or other enterprise against any expense, liability or loss, whether or not

the Corporation would have the power to indemnify such person against such expense, liability or loss under the Delaware General

Corporation Law.

F. The Corporation may, to the extent authorized

from time to time by the Board of Directors, grant rights to indemnification and to the advancement of expenses to any employee

or agent of the Corporation to the fullest extent of the provisions of this Article TENTH with respect to the indemnification and

advancement of expenses of Directors and Officers of the Corporation.

ELEVENTH:

A Director of this Corporation shall not

be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a Director, except

for liability: (i) for any breach of the Director’s duty of loyalty to the Corporation or its stockholders; (ii) for

acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) under Section 174

of the Delaware General Corporation Law; or (iv) for any transaction from which the Director derived an improper personal

benefit. If the Delaware General Corporation Law is amended to authorize corporate action further eliminating or limiting the personal

liability of Directors, then the liability of a Director of the Corporation shall be eliminated or limited to the fullest extent

permitted by the Delaware General Corporation Law, as so amended.

Any repeal or modification of the foregoing

paragraph by the stockholders of the Corporation shall not adversely affect any right or protection of a Director of the Corporation

existing at the time of such repeal or modification.

With respect to possible indemnification

of directors, officers and controlling persons of Berkshire Hills Bancorp for liabilities arising under the Securities Act of

1933 (the “Act”) pursuant to such provisions, Berkshire Hills Bancorp is aware that the Securities and Exchange Commission

has publicly taken the position that such indemnification is against public policy as expressed in the Act and is, therefore,

unenforceable.

Item 16. Exhibits.

(a) The

following exhibits are filed as part of this Registration Statement on Form S-3:

Exhibit

Number

|

|

Description of Exhibit

|

|

|

|

|

|

4.1

|

|

Form of Common Stock Certificate of Berkshire Hills Bancorp, Inc. (Incorporated herein by reference to Exhibit 4.0 on Form S-1 filed March 10, 2000 (File No. 333-32146)).

|

|

|

|

|

|

4.2

|

|

Certificate of Designations of Series B Non-Voting Preferred Stock of Berkshire Hills Bancorp, Inc. (Incorporated herein by reference to Exhibit 3.1 on Form 8-K filed October 16, 2017 (File No. 001-15781)).

|

|

|

|

|

|

5.1

|

|

Opinion of Luse Gorman, PC as to the legality of the securities being issued (Incorporated herein by reference to Exhibit 5.1 on Form S-4 filed July 20, 2017 (File No. 333-219372)).

|

|

|

|

|

|

10.1

|

|

Amended and Restated Shareholder Agreement by and between the Estate of David G. Massad, Sr. and Berkshire Hills Bancorp, Inc., dated December 27, 2019 (Incorporated herein by reference to the Exhibits on Form 8-K filed on January 3, 2020 (File No. 001-15781)).

|

|

|

|

|

|

23.1

|

|

Consent of Crowe LLP*

|

|

|

|

|

|

23.2

|

|

Consent of Luse Gorman, PC*

|

|

|

|

|

|

24

|

|

Power of attorney (set forth on the signature pages to this Registration Statement).

|

*Filed herewith.

Item 17. Undertakings

The undersigned Registrant hereby undertakes:

(1) To file, during any period

in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus

required by Section 10(a)(3) to the Securities Act of 1933, as amended (the “Securities Act”);

(ii) To reflect in the prospectus

any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment

thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of

securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum

offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate,

the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in

the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material

information with respect to the plan of distribution not previously disclosed in the registration statement or any material change

to such information in the registration statement;

Provided, however, that the undertakings set

forth in paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the registrant pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are incorporated

by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part

of the registration statement;

(2) That, for purposes of

determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the

initial bona fide offering thereof;

(3) To remove from registration

by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering;

(4) That, for purposes of

determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by

the registrant pursuant to Rule 424(b)(3) and (h) shall be deemed to be part of the registration statement as of the date the filed

prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required

to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430D relating

to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by

section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the

earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities

in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that

is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to

the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration

statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with

a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement

or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose

of determining liability of the Registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the

securities:

The undersigned undertakes that

in a primary offering of securities of undersigned pursuant to this registration statement, regardless of the underwriting method

used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following

communications, undersigned will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus

or prospectus of the undersigned relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus

relating to the offering prepared by or on behalf of the undersigned or used or referred to by the undersigned;

(iii) The portion of any other

free writing prospectus relating to the offering containing material information about the undersigned or its securities provided

by or on behalf of the undersigned; and

(iv) Any other communication that

is an offer in the offering made by the undersigned to the purchaser.

(6) The undersigned registrant

hereby undertakes that, for the purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s

annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing

of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated

by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7) Insofar as indemnification

for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the

registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant

of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action,

suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered,

the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court

of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities

Act of 1933 and will be governed by the final adjudication of such issue.

(8) (i) For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus

filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant

pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement

as of the time it was declared effective.

(ii) For the purpose of determining

any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the City of Boston, Massachusetts on March 20, 2020.

|

|

BERKSHIRE HILLS BANCORP, INC.

|

|

|

|

|

|

By:

|

/s/ Richard M. Marotta

|

|

|

Name: Richard M. Marotta

|

|

|

Title: President & Chief Executive Officer

|

|

|

(Duly Authorized Representative)

|

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each

person whose signature appears below constitutes and appoints each of Richard M. Marotta and James M. Moses, severally, acting

alone and without the other, his true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution,

for him and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments)

to this Registration Statement on Form S-3 and to file the same, with all exhibits thereto, and other documents in connection

therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power and authority

to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents

and purposes as he might or could do in person, hereby ratifying and confirming that said attorney-in-fact, agent or his substitutes

may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, the Registration Statement has been signed by the following persons in the capacities and on the

date indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Richard M. Marotta

|

|

Director, President & Chief Executive Officer

|

|

March 20, 2020

|

|

Richard M. Marotta

|

|

(principal executive officer)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ James M. Moses

|

|

Senior Executive Vice President, Chief Financial Officer

|

|

March 20, 2020

|

|

James M. Moses

|

|

(principal financial and accounting officer)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ J. Williar Dunlaevy

|

|

Non-Executive Chairman

|

|

March 20, 2020

|

|

J. Williar Dunlaevy

|

|

|

|

|

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Baye Adofo-Wilson

|

|

Director

|

|

March 20, 2020

|

|

Baye Adofo-Wilson

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Rheo A. Brouillard

|

|

Director

|

|

March 20, 2020

|

|

Rheo A. Brouillard

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ David M. Brunelle

|

|

Director

|

|

March 20, 2020

|

|

David M. Brunelle

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Robert M. Curley

|

|

Director

|

|

March 20, 2020

|

|

Robert M. Curley

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John B. Davies

|

|

Director

|

|

March 20, 2020

|

|

John B. Davies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ William H. Hughes III

|

|

Director

|

|

March 20, 2020

|

|

William H. Hughes III

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

March 20, 2020

|

|

Cornelius D. Mahoney

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

March 20, 2020

|

|

Pamela A. Massad

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Dr. Sylvia Maxfield

|

|

Director

|

|

March 20, 2020

|

|

Dr. Sylvia Maxfield

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Laurie Norton Moffatt

|

|

Director

|

|

March 20, 2020

|

|

Laurie Norton Moffatt

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ William J. Ryan

|

|

Director

|

|

March 20, 2020

|

|

William J. Ryan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Jonathan I. Shulman

|

|

Director

|

|

March 20, 2020

|

|

Jonathan I. Shulman

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ D. Jeffrey Templeton

|

|

Director

|

|

March 20, 2020

|

|

D. Jeffrey Templeton

|

|

|

|

|

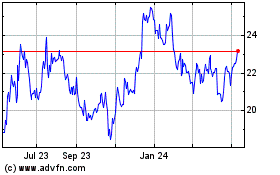

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jul 2024 to Aug 2024

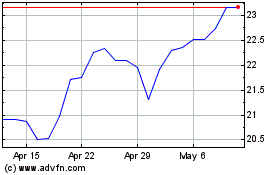

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Aug 2023 to Aug 2024