Current Report Filing (8-k)

May 07 2015 - 11:29AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 7, 2015

BERKSHIRE HILLS BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

001-15781 |

|

04-3510455 |

|

(State or Other Jurisdiction) |

|

(Commission File No.) |

|

(I.R.S. Employer |

|

of Incorporation) |

|

|

|

Identification No.) |

|

24 North Street, Pittsfield, Massachusetts |

|

01201 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (413) 443-5601

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure

On May 7, 2015, Berkshire Hills Bancorp, Inc. (the “Company”) made a presentation at its 2015 Annual Meeting of Stockholders. A copy of the presentation as presented at the 2015 Annual Meeting of Stockholders is attached as Exhibit 99.1 to this report and is being furnished to the SEC and shall not be deemed “filed” for any purpose.

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements of Businesses Acquired. Not applicable.

(b) Pro Forma Financial Information. Not applicable.

(c) Shell Company Transactions. Not applicable.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Slide Presentation made at the Company’s 2015 Annual Meeting of Stockholders |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

BERKSHIRE HILLS BANCORP, INC. |

|

|

|

|

|

|

|

Date: May 7, 2015 |

By: |

/s/ Michael P. Daly |

|

|

|

Michael P. Daly |

|

|

|

President and Chief Executive Officer |

3

Exhibit 99.1

|

|

Annual Shareholder Meeting May 7, 2015 |

|

|

Forward Looking Statements. This document contains certain forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These statements include statements about anticipated financial results. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like "believe," "expect," "anticipate," "estimate," and "intend" or future or conditional verbs such as "will," "would," "should," "could" or "may.“ There are several factors that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see Berkshire’s most recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission and available on the SEC's website at www.sec.gov. Berkshire does not undertake any obligation to update forward-looking statements made in this document. NON-GAAP FINANCIAL MEASURES. This presentation references non-GAAP financial measures incorporating tangible equity and related measures, and core earnings excluding merger and non-recurring costs. These measures are commonly used by investors in evaluating business combinations and financial condition. GAAP earnings are lower than core earnings primarily due to merger and non-recurring expenses. Reconciliations are in earnings releases at www.berkshirebank.com. |

|

|

Who We Are Assets: $7.3 billion Loans: $5.2 billion Deposits: $5.2 billion AUM: $1.4 billion Annualized Revenue: $255 million Branches: 96 plus lending offices Footprint: New England and New York Market Capitalization: $825 million NYSE: BHLB Note: all data pro-forma with Hampden |

|

|

2014 Accomplishments Integrated 20 branch acquisition in Central and Eastern NY Agreed to acquire Hampden Bancorp In-market merger - closed on April 17, 2015 Top 5 deposit market share in Springfield area Expanded commercial banking and wealth management business lines through team recruitment Active balance sheet management supported margin Former Chairman of TD Banknorth, Bill Ryan, named Chairman of our Board of Directors |

|

|

2014 Financial Highlights Core EPS - $1.80; GAAP EPS - $1.36 Core revenue growth: 17% (4Q14/4Q13) Core EPS growth: 20% (4Q14/4Q13) Total loan growth: 12% (FY14) 15% Commercial Loan Growth 11% Consumer Loan Growth Total deposit growth: 21% (FY14) Fee income growth: 6% (FY14) Note: GAAP EPS net of merger, restructuring and conversion related items, securities gains and out of period adjustment – all net of taxes. |

|

|

Shareholder Results 3 year total shareholder return: 30% Dividend yield: 2.9% Quarterly dividend increased by 6% in 1Q15 Stock price at 12/31/14: $26.66 Recent 52 week high: $29.30 TBV/share: $17.19 BV/share: $28.17 |

|

|

Our Financial Goals and Objectives Return on assets > 1.00% Return on equity > 10% Return on tangible equity >15% Efficiency ratio < 60% Positive Operating Leverage Loan growth Expense management Process improvement Competitive dividend Drive Profitability |

|

|

The Power of the Franchise Culture Vision Footprint |

|

|

Q&A |

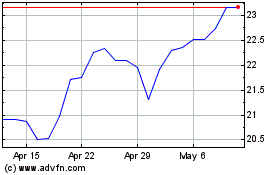

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

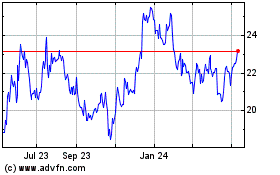

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jul 2023 to Jul 2024