UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 27, 2015

BERKSHIRE HILLS BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

001-15781 |

|

04-3510455 |

|

(State or Other Jurisdiction)

of Incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

|

24 North Street, Pittsfield, Massachusetts |

|

01201 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (413) 443-5601

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On April 27, 2015, Berkshire Hills Bancorp, Inc. (the “Company”), the holding company for Berkshire Bank (the “Bank”), announced its financial results for the three month period ended March 31, 2015. The news release containing the financial results and the declaration of a quarterly dividend is included as Exhibit 99.1 and shall not be deemed “filed” for any purpose.

Item 8.01 Other Events

On April 27, 2015, the Company announced a cash dividend of $0.19 per share to shareholders of record at the close of business on May 14, 2015, payable on May 28, 2015.

Item 9.01 Financial Statements and Exhibits

(a) Financial Statements of Businesses Acquired. Not applicable.

(b) Pro Forma Financial Information. Not applicable.

(c) Shell Company Transactions. Not applicable.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

News Release dated April 27, 2015 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

Berkshire Hills Bancorp, Inc. |

|

|

|

|

|

|

|

|

|

DATE: April 28, 2015 |

By: |

/s/ Michael P. Daly |

|

|

|

Michael P. Daly

President and Chief Executive Officer |

3

Exhibit 99.1

Berkshire Hills Reports 19% Increase in First Quarter Core EPS; Dividend Declared

PITTSFIELD, MA, April 27, 2015 — Berkshire Hills Bancorp, Inc. (NYSE: BHLB) reported $0.50 in core earnings per share in the first quarter of 2015, which was a 19% increase over first quarter results in the prior year. Profit growth has been due to higher revenues from continued business momentum. First quarter core EPS increased by 4% from $0.48 in the fourth quarter of 2014. GAAP EPS totaled $0.35 per share in the most recent quarter compared to $0.46 in the linked quarter. Earnings in both periods were impacted by non-core charges related primarily to growth and restructuring, including charges related to the acquisition of Hampden Bancorp, which was completed on April 17, 2015.

FIRST QUARTER FINANCIAL HIGHLIGHTS (comparisons are to prior quarter unless otherwise stated):

· 4% increase in core earnings per share

· 14% annualized increase in commercial loans

· 6% annualized increase in deposits

· 11% annualized increase in demand deposits

· 9% increase in fee income (year-over-year)

· 0.36% non-performing assets/assets

· 0.28% net loan charge-offs/average loans

CEO Michael Daly stated, “We continued our momentum of sequential and year-over-year growth in core EPS in the most recent quarter. We also maintained double digit annualized expansion in our focus areas of commercial loans and demand deposits, where we continue to capitalize on the strength of our regional bank franchise. This contributed to an increase in our net interest margin before purchased loan accretion. Most categories of fee income also increased year over year as we further develop revenue synergies and deepen our market and wallet share.”

Mr. Daly continued, “Our acquisition of Springfield-based Hampden Bancorp was completed on April 17 on schedule. We look forward to expanding our share of that market through the additional services that we can deliver with our resources. In recent weeks, Berkshire also announced the recruitment of leadership talent for our Hartford commercial banking team and for our successful Albany private banking and wealth teams. We’ve delivered core earnings growth while also strengthening our market

1

presence and the financial solutions that we offer in our regions. Hockey legend Ray Bourque and left wing Milan Lucic joined us as spokespersons and we completed a second successful season in our partnership with NESN (New England Sports Network) as the Official Bank of Boston Bruins coverage on the network, garnering widespread brand recognition and significant business leads.”

Mr. Daly concluded, “The Hampden acquisition boosted our assets and outstanding shares by more than 10% and we continue to target accretive financial benefits after merger efficiencies are achieved during the year. We are maintaining our focus on expense disciplines and efficiency while improving our overall franchise positioning and talent redeployment to better serve our customers. Our goal is to continue to generate positive core operating leverage from revenue synergies and expense management to further improve core earnings and profitability.”

DIVIDEND DECLARED

The Board of Directors voted to declare a cash dividend of $0.19 per share to shareholders of record at the close of business on May 14, 2015, payable on May 28, 2015. This dividend equates to a 2.9% annualized yield based on the $26.18 average closing price of Berkshire’s common stock during the first quarter. In January 2015, the Board increased the dividend by $0.01, or 6%, from the $0.18 quarterly amount which was in effect throughout 2014.

FINANCIAL CONDITION

Total assets increased at a 4% annualized rate in the first quarter due primarily to a 4% annualized increase in total loans funded by a 6% annualized increase in total deposits. Capital and liquidity ratios remained solid and did not change significantly. Tangible book value per share increased at a 6% annualized rate to $17.46 and total book value per share increased at a 3% annualized rate to $28.36.

Berkshire continued to generate strong double digit commercial loan growth, which measured 14% annualized in the first quarter of 2015, including 11% annualized growth in commercial and industrial loan balances. Managed reductions in other loans resulted in 4% annualized growth in total loans during the quarter. Residential mortgage loans decreased as most first quarter mortgage originations were sold into the secondary market following a decrease in interest rates at the start of the year. The decrease in consumer loans was due to a change in the auto loan portfolio strategy initiated in the final quarter of 2014.

Asset quality metrics remained favorable and continued to improve. Annualized net loan charge-offs measured 0.28% of average loans for the quarter. Quarter-end non-performing assets decreased to 0.36% of total assets and accruing delinquent loans decreased to 0.43% of total loans. The loan loss allowance increased to 0.77% of total loans; approximately 15% of quarter-end loans were balances recorded at fair value in prior year bank acquisitions.

2

Annualized first quarter deposit growth of 6% included increases in most major categories. Growth was primarily in relationship oriented transaction accounts. The ratio of loans/deposits was 100% at quarter-end, compared to 101% at the start of the quarter.

RESULTS OF OPERATIONS

First quarter 2015 core EPS increased by $0.02, or 4%, over the linked quarter due to growth in loans and fee revenues. The first quarter core return on equity improved to 7.1% and the core return on tangible equity improved to 12.1%. Net non-core charges totaled $0.15 per share during the quarter, including $0.11 related to the Hampden merger and $0.04 in branch restructuring charges. The GAAP return on equity measured 5.0% during the quarter including the impact of these non-core charges.

Total net interest income decreased sequentially by $1.2 million, or 2%, including a $1.3 million decrease to $0.3 million in purchased loan accretion. The net interest margin increased to 3.15% from 3.12% before purchased loan accretion including the benefit of the shift in mix towards higher yielding loans from investment securities. Including purchased loan accretion, the net interest margin was 3.18% in the first quarter, compared to 3.23% in the prior quarter.

Total fee income increased by $1.1 million, or 9% year-over-year, with increases in most major categories. Fee income was up $0.8 million, or 6%, compared to the linked quarter. Seasonal increases in insurance and wealth management revenues mostly offset seasonal and weather related decreases in loan and deposit fees. Mortgage banking fees increased due to increased refinancing demand spurred by lower interest rates.

The loan loss provision totaled $3.9 million in each of the two most recent quarters and exceeded net charge-offs of $3.2 million in each of these quarters. Including seasonal and weather related factors, first quarter core non-interest expense increased to $40.7 million from $39.9 million in the linked quarter. Full-time equivalent staff was unchanged at 1,091 at quarter-end. The efficiency ratio increased to 63.3% due to seasonality and lower revenue from purchased loan accretion. This ratio is expected to improve due to planned revenue growth and efficiencies related to the Hampden acquisition and the branch restructuring.

Berkshire’s increased financing of tax-advantaged commercial development projects contributed $0.04 in additional EPS in the first quarter, compared to the prior quarter. This offset the $0.03 after-tax impact of the previously noted decrease in purchased loan accretion. Due to its regional reach and resources, the Company has expanded its tax-advantaged investments in redevelopment projects with commercial relationship partners in its communities. This financing resulted in a charge to non-interest income which is more than offset by the tax benefits which are a component of income tax expense. This activity is summarized and included with Supplementary Data reported on schedule F-9.

3

UNAUDITED FINANCIAL HIGHLIGHTS OF HAMPDEN BANCORP

Included in the financial exhibits to this news release are unaudited selected first quarter financial highlights for Hampden, which was acquired by Berkshire on April 17, 2015. This information does not include all items which may affect Hampden’s final financial statements as of March 31, 2015 and it does not include non-core charges related to the merger of Hampden into Berkshire. Additional financial information about Hampden will be provided in the notes to Berkshire’s midyear financial statements, which will include merger accounting adjustments as well as the results of the acquired Hampden operations from the effective date of the merger.

CONFERENCE CALL

Berkshire will conduct a conference call/webcast at 10:00 a.m. eastern time on Tuesday, April 28, 2015 to discuss the results for the quarter and provide guidance about expected future results. Participants should dial-in to the call 10-15 minutes before it begins. Information about the conference call follows:

Live Dial-in: 888-317-6003; access number: 5204709

Webcast: ir.berkshirebank.com

Replay: 877-344-7529; access number: 10062838

A telephone replay of the call will be available through Wednesday, May 6, 2015. The webcast will be available on Berkshire’s website for an extended period of time. A print friendly version of this news release will be available at the web link shown above.

BACKGROUND

Berkshire Hills Bancorp is the parent of Berkshire Bank — America’s Most Exciting Bank®. Including the operations of Hampden Bancorp acquired on April 17, 2015, Berkshire has $7.2 billion in assets and 96 full-service branch offices in Massachusetts, New York, Connecticut, and Vermont providing personal and business banking, insurance, and wealth management services. Including new shares issued for the Hampden acquisition, Berkshire now has 29.52 million shares outstanding.

FORWARD LOOKING STATEMENTS

This document contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. There are several factors that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see Berkshire’s most recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission and available on the SEC’s website at www.sec.gov. Berkshire does not undertake any obligation to update forward-looking statements.

4

NON-GAAP FINANCIAL MEASURES

This document contains certain non-GAAP financial measures in addition to results presented in accordance with Generally Accepted Accounting Principles (“GAAP”). These non-GAAP measures provide supplemental perspectives on operating results, performance trends, and financial condition. They are not a substitute for GAAP measures; they should be read and used in conjunction with the Company’s GAAP financial information. A reconciliation of non-GAAP financial measures to GAAP measures is included in the accompanying financial tables. In all cases, it should be understood that non-GAAP per share measures do not depict amounts that accrue directly to the benefit of shareholders. The Company utilizes the non-GAAP measure of core earnings in evaluating operating trends, including components for core revenue and expense. These measures exclude amounts which the Company views as unrelated to its normalized operations, including securities gains/losses, losses recorded for hedge terminations, merger costs, restructuring costs, systems conversion costs, and out-of-period adjustments. Non-core adjustments are presented net of an adjustment for income tax expense. This adjustment is determined as the difference between the GAAP tax rate and the effective tax rate applicable to core income. The efficiency ratio is adjusted for non-core revenue and expense items and for tax preference items. The Company also calculates measures related to tangible equity, which adjust equity (and assets where applicable) to exclude intangible assets due to the importance of these measures to the investment community. Charges related to merger and acquisition activity consist primarily of severance/benefit related expenses, contract termination costs, and professional fees. Systems conversion costs relate primarily to the Company’s core systems conversion and related systems conversions costs. Restructuring costs primarily consist of costs and losses associated with the disposition of assets.

CONTACTS

Investor Relations Contact

Allison O’Rourke; Senior Vice President, Investor Relations Officer; 413-236-3149

Media Contact

Ray Smith; Assistant Vice President, Marketing; 413-236-3756

5

BERKSHIRE HILLS BANCORP, INC.

CONSOLIDATED BALANCE SHEETS - UNAUDITED - (F-1)

|

|

|

March 31 |

|

December 31 |

|

|

(In thousands) |

|

2015 |

|

2014 |

|

|

Assets |

|

|

|

|

|

|

Cash and due from banks |

|

$ |

43,089 |

|

$ |

54,179 |

|

|

Short-term investments |

|

19,125 |

|

17,575 |

|

|

Total cash and short-term investments |

|

62,214 |

|

71,754 |

|

|

|

|

|

|

|

|

|

Trading security |

|

14,970 |

|

14,909 |

|

|

Securities available for sale, at fair value |

|

1,099,656 |

|

1,091,818 |

|

|

Securities held to maturity, at amortized cost |

|

42,818 |

|

43,347 |

|

|

Federal Home Loan Bank stock and other restricted securities |

|

58,734 |

|

55,720 |

|

|

Total securities |

|

1,216,178 |

|

1,205,794 |

|

|

|

|

|

|

|

|

|

Loans held for sale, at fair value |

|

29,305 |

|

19,493 |

|

|

|

|

|

|

|

|

|

Residential mortgages |

|

1,473,239 |

|

1,496,204 |

|

|

Commercial real estate |

|

1,672,099 |

|

1,611,567 |

|

|

Commercial and industrial loans |

|

826,815 |

|

804,366 |

|

|

Consumer loans |

|

756,510 |

|

768,463 |

|

|

Total loans |

|

4,728,663 |

|

4,680,600 |

|

|

Less: Allowance for loan losses |

|

(36,286 |

) |

(35,662 |

) |

|

Net loans |

|

4,692,377 |

|

4,644,938 |

|

|

|

|

|

|

|

|

|

Premises and equipment, net |

|

85,053 |

|

87,279 |

|

|

Other real estate owned |

|

1,444 |

|

2,049 |

|

|

Goodwill |

|

264,742 |

|

264,742 |

|

|

Other intangible assets |

|

10,627 |

|

11,528 |

|

|

Cash surrender value of bank-owned life insurance |

|

105,302 |

|

104,588 |

|

|

Deferred tax asset, net |

|

26,828 |

|

28,776 |

|

|

Other assets |

|

77,169 |

|

61,090 |

|

|

Total assets |

|

$ |

6,571,239 |

|

$ |

6,502,031 |

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Demand deposits |

|

$ |

892,225 |

|

$ |

869,302 |

|

|

NOW deposits |

|

436,458 |

|

426,108 |

|

|

Money market deposits |

|

1,372,924 |

|

1,407,179 |

|

|

Savings deposits |

|

512,607 |

|

496,344 |

|

|

Time deposits |

|

1,505,469 |

|

1,455,746 |

|

|

Total deposits |

|

4,719,683 |

|

4,654,679 |

|

|

|

|

|

|

|

|

|

Senior borrowings |

|

956,118 |

|

962,576 |

|

|

Subordinated borrowings |

|

89,765 |

|

89,747 |

|

|

Total borrowings |

|

1,045,883 |

|

1,052,323 |

|

|

|

|

|

|

|

|

|

Other liabilities |

|

89,443 |

|

85,742 |

|

|

Total liabilities |

|

5,855,009 |

|

5,792,744 |

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

716,230 |

|

709,287 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

6,571,239 |

|

$ |

6,502,031 |

|

|

|

|

|

|

|

|

|

Net shares outstanding |

|

25,253 |

|

25,183 |

|

F-1

BERKSHIRE HILLS BANCORP, INC.

CONSOLIDATED LOAN & DEPOSIT ANALYSIS - UNAUDITED - (F-2)

LOAN ANALYSIS

|

|

|

|

|

|

|

Annualized growth % |

|

|

(in millions) |

|

March 31, 2015

Balance |

|

Dec. 31, 2014

Balance |

|

Quarter ended

March 31, 2015 |

|

|

|

|

|

|

|

|

|

|

|

Total residential mortgages |

|

$ |

1,473 |

|

$ |

1,496 |

|

(6 |

)% |

|

|

|

|

|

|

|

|

|

|

Commercial real estate |

|

1,672 |

|

1,612 |

|

15 |

|

|

Commercial and industrial loans |

|

827 |

|

804 |

|

11 |

|

|

Total commercial loans |

|

2,499 |

|

2,416 |

|

14 |

|

|

|

|

|

|

|

|

|

|

|

Home equity |

|

318 |

|

319 |

|

(1 |

) |

|

Auto and other |

|

439 |

|

450 |

|

(10 |

) |

|

Total consumer loans |

|

757 |

|

769 |

|

(6 |

) |

|

Total loans |

|

$ |

4,729 |

|

$ |

4,681 |

|

4 |

% |

DEPOSIT ANALYSIS

|

|

|

|

|

|

|

Annualized growth % |

|

|

(in millions) |

|

March 31, 2015

Balance |

|

Dec. 31, 2014

Balance |

|

Quarter ended

March 31, 2015 |

|

|

Demand |

|

$ |

892 |

|

$ |

869 |

|

11 |

% |

|

NOW |

|

436 |

|

426 |

|

9 |

|

|

Money market |

|

1,373 |

|

1,407 |

|

(10 |

) |

|

Savings |

|

513 |

|

497 |

|

13 |

|

|

Total non-maturity deposits |

|

3,214 |

|

3,199 |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

Total time deposits |

|

1,506 |

|

1,456 |

|

14 |

|

|

Total deposits |

|

$ |

4,720 |

|

$ |

4,655 |

|

6 |

% |

F-2

BERKSHIRE HILLS BANCORP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED - (F-3)

|

|

|

Three Months Ended |

|

|

|

|

March 31, |

|

|

(In thousands, except per share data) |

|

2015 |

|

2014 |

|

|

Interest and dividend income |

|

|

|

|

|

|

Loans |

|

$ |

44,445 |

|

$ |

42,494 |

|

|

Securities and other |

|

8,306 |

|

7,301 |

|

|

Total interest and dividend income |

|

52,751 |

|

49,795 |

|

|

Interest expense |

|

|

|

|

|

|

Deposits |

|

4,949 |

|

4,721 |

|

|

Borrowings |

|

2,309 |

|

2,308 |

|

|

Total interest expense |

|

7,258 |

|

7,029 |

|

|

Net interest income |

|

45,493 |

|

42,766 |

|

|

Non-interest income |

|

|

|

|

|

|

Loan related income |

|

1,283 |

|

1,248 |

|

|

Mortgage banking income |

|

1,253 |

|

372 |

|

|

Deposit related fees |

|

5,677 |

|

5,439 |

|

|

Insurance commissions and fees |

|

2,967 |

|

3,049 |

|

|

Wealth management fees |

|

2,603 |

|

2,549 |

|

|

Total fee income |

|

13,783 |

|

12,657 |

|

|

Other |

|

(1,255 |

) |

524 |

|

|

Gain on sale of securities, net |

|

34 |

|

34 |

|

|

Loss on termination of hedges |

|

— |

|

(8,792 |

) |

|

Total non-interest income |

|

12,562 |

|

4,423 |

|

|

Total net revenue |

|

58,055 |

|

47,189 |

|

|

Provision for loan losses |

|

3,851 |

|

3,396 |

|

|

Non-interest expense |

|

|

|

|

|

|

Compensation and benefits |

|

21,811 |

|

19,859 |

|

|

Occupancy and equipment |

|

7,108 |

|

6,814 |

|

|

Technology and communications |

|

3,593 |

|

3,778 |

|

|

Marketing and promotion |

|

713 |

|

521 |

|

|

Professional services |

|

1,272 |

|

1,152 |

|

|

FDIC premiums and assessments |

|

1,129 |

|

1,009 |

|

|

Other real estate owned and foreclosures |

|

251 |

|

523 |

|

|

Amortization of intangible assets |

|

901 |

|

1,306 |

|

|

Merger, restructuring and conversion expense (1) |

|

4,421 |

|

6,301 |

|

|

Other |

|

3,949 |

|

4,097 |

|

|

Total non-interest expense |

|

45,148 |

|

45,360 |

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

9,056 |

|

(1,567 |

) |

|

Income tax expense |

|

297 |

|

(461 |

) |

|

Net income |

|

$ |

8,759 |

|

$ |

(1,106 |

) |

|

|

|

|

|

|

|

|

Earnings per share: |

|

|

|

|

|

|

Basic |

|

$ |

0.35 |

|

$ |

(0.04 |

) |

|

Diluted |

|

$ |

0.35 |

|

$ |

(0.04 |

) |

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

Basic |

|

24,803 |

|

24,698 |

|

|

Diluted |

|

24,955 |

|

24,698 |

|

(1) Merger, restructuring and conversion expenses include Hampden acquisition and branch acquisition related expenses and restructuring expenses.

F-3

BERKSHIRE HILLS BANCORP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED - (F-4)

|

|

|

Quarters Ended |

|

|

|

|

Mar. 31, |

|

Dec. 31, |

|

Sept. 30, |

|

June 30, |

|

Mar. 31, |

|

|

(In thousands, except per share data) |

|

2015 |

|

2014 |

|

2014 |

|

2014 |

|

2014 |

|

|

Interest and dividend income |

|

|

|

|

|

|

|

|

|

|

|

|

Loans |

|

$ |

44,445 |

|

$ |

45,706 |

|

$ |

43,958 |

|

$ |

42,309 |

|

$ |

42,494 |

|

|

Securities and other |

|

8,306 |

|

8,310 |

|

8,098 |

|

8,866 |

|

7,301 |

|

|

Total interest and dividend income |

|

52,751 |

|

54,016 |

|

52,056 |

|

51,175 |

|

49,795 |

|

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

4,949 |

|

5,109 |

|

4,877 |

|

4,478 |

|

4,721 |

|

|

Borrowings |

|

2,309 |

|

2,260 |

|

2,230 |

|

2,368 |

|

2,308 |

|

|

Total interest expense |

|

7,258 |

|

7,369 |

|

7,107 |

|

6,846 |

|

7,029 |

|

|

Net interest income |

|

45,493 |

|

46,647 |

|

44,949 |

|

44,329 |

|

42,766 |

|

|

Non-interest income |

|

|

|

|

|

|

|

|

|

|

|

|

Loan related income |

|

1,283 |

|

1,763 |

|

1,471 |

|

1,846 |

|

1,248 |

|

|

Mortgage banking income |

|

1,253 |

|

504 |

|

994 |

|

691 |

|

372 |

|

|

Deposit related fees |

|

5,677 |

|

6,137 |

|

6,449 |

|

6,610 |

|

5,439 |

|

|

Insurance commissions and fees |

|

2,967 |

|

2,223 |

|

2,632 |

|

2,460 |

|

3,049 |

|

|

Wealth management fees |

|

2,603 |

|

2,373 |

|

2,330 |

|

2,294 |

|

2,549 |

|

|

Total fee income |

|

13,783 |

|

13,000 |

|

13,876 |

|

13,901 |

|

12,657 |

|

|

Other |

|

(1,255 |

) |

1,200 |

|

520 |

|

402 |

|

524 |

|

|

Gain on sale of securities, net |

|

34 |

|

— |

|

245 |

|

203 |

|

34 |

|

|

Loss on termination of hedges |

|

— |

|

— |

|

— |

|

— |

|

(8,792 |

) |

|

Total non-interest income |

|

12,562 |

|

14,200 |

|

14,641 |

|

14,506 |

|

4,423 |

|

|

Total net revenue |

|

58,055 |

|

60,847 |

|

59,590 |

|

58,835 |

|

47,189 |

|

|

Provision for loan losses |

|

3,851 |

|

3,898 |

|

3,685 |

|

3,989 |

|

3,396 |

|

|

Non-interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

21,811 |

|

20,965 |

|

20,665 |

|

20,279 |

|

19,859 |

|

|

Occupancy and equipment |

|

7,108 |

|

6,655 |

|

6,780 |

|

6,656 |

|

6,814 |

|

|

Technology and communications |

|

3,593 |

|

3,702 |

|

3,484 |

|

3,800 |

|

3,778 |

|

|

Marketing and promotion |

|

713 |

|

771 |

|

659 |

|

621 |

|

521 |

|

|

Professional services |

|

1,272 |

|

1,205 |

|

830 |

|

1,024 |

|

1,152 |

|

|

FDIC premiums and assessments |

|

1,129 |

|

1,083 |

|

1,163 |

|

1,029 |

|

1,009 |

|

|

Other real estate owned and foreclosures |

|

251 |

|

232 |

|

13 |

|

33 |

|

523 |

|

|

Amortization of intangible assets |

|

901 |

|

996 |

|

1,236 |

|

1,274 |

|

1,306 |

|

|

Merger, restructuring and conversion expense |

|

4,421 |

|

1,762 |

|

238 |

|

190 |

|

6,301 |

|

|

Other |

|

3,949 |

|

4,305 |

|

4,619 |

|

4,357 |

|

4,097 |

|

|

Total non-interest expense |

|

45,148 |

|

41,676 |

|

39,687 |

|

39,263 |

|

45,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

9,056 |

|

15,273 |

|

16,218 |

|

15,583 |

|

(1,567 |

) |

|

Income tax expense (benefit) |

|

297 |

|

3,875 |

|

4,230 |

|

4,119 |

|

(461 |

) |

|

Net income (loss) |

|

$ |

8,759 |

|

$ |

11,398 |

|

$ |

11,988 |

|

$ |

11,464 |

|

$ |

(1,106 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.35 |

|

$ |

0.46 |

|

$ |

0.48 |

|

$ |

0.46 |

|

$ |

(0.04 |

) |

|

Diluted |

|

$ |

0.35 |

|

$ |

0.46 |

|

$ |

0.48 |

|

$ |

0.46 |

|

$ |

(0.04 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

24,803 |

|

24,758 |

|

24,747 |

|

24,715 |

|

24,698 |

|

|

Diluted |

|

24,955 |

|

24,912 |

|

24,861 |

|

24,809 |

|

24,698 |

|

(1) See note on Page F-3

F-4

BERKSHIRE HILLS BANCORP, INC.

ASSET QUALITY ANALYSIS - UNAUDITED - (F-5)

|

|

|

At or for the Quarters Ended |

|

|

|

|

Mar. 31, |

|

Dec. 31, |

|

Sept. 30, |

|

June 30, |

|

Mar. 31, |

|

|

(in thousands) |

|

2015 |

|

2014 |

|

2014 |

|

2014 |

|

2014 |

|

|

NON-PERFORMING ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

Non-accruing loans: |

|

|

|

|

|

|

|

|

|

|

|

|

Residential mortgages |

|

$ |

4,153 |

|

$ |

3,908 |

|

$ |

4,810 |

|

$ |

5,295 |

|

$ |

6,071 |

|

|

Commercial real estate |

|

13,516 |

|

12,878 |

|

12,192 |

|

12,583 |

|

13,036 |

|

|

Commercial and industrial loans |

|

1,308 |

|

1,705 |

|

2,225 |

|

4,821 |

|

2,411 |

|

|

Consumer loans |

|

3,032 |

|

3,214 |

|

3,660 |

|

3,359 |

|

3,846 |

|

|

Total non-accruing loans |

|

22,009 |

|

21,705 |

|

22,887 |

|

26,058 |

|

25,364 |

|

|

Other real estate owned |

|

1,444 |

|

2,049 |

|

4,854 |

|

2,445 |

|

2,418 |

|

|

Total non-performing assets |

|

$ |

23,453 |

|

$ |

23,754 |

|

$ |

27,741 |

|

$ |

28,503 |

|

$ |

27,782 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-accruing loans/total loans |

|

0.47 |

% |

0.46 |

% |

0.50 |

% |

0.59 |

% |

0.60 |

% |

|

Total non-performing assets/total assets |

|

0.36 |

% |

0.37 |

% |

0.44 |

% |

0.45 |

% |

0.46 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVISION AND ALLOWANCE FOR LOAN LOSSES |

|

|

|

|

|

|

|

|

|

|

|

|

Balance at beginning of period |

|

$ |

35,662 |

|

$ |

34,966 |

|

$ |

34,353 |

|

$ |

33,602 |

|

$ |

33,323 |

|

|

Charged-off loans |

|

(3,432 |

) |

(3,660 |

) |

(3,360 |

) |

(3,516 |

) |

(3,317 |

) |

|

Recoveries on charged-off loans |

|

205 |

|

458 |

|

288 |

|

278 |

|

200 |

|

|

Net loans charged-off |

|

(3,227 |

) |

(3,202 |

) |

(3,072 |

) |

(3,238 |

) |

(3,117 |

) |

|

Provision for loan losses |

|

3,851 |

|

3,898 |

|

3,685 |

|

3,989 |

|

3,396 |

|

|

Balance at end of period |

|

$ |

36,286 |

|

$ |

35,662 |

|

$ |

34,966 |

|

$ |

34,353 |

|

$ |

33,602 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses/total loans |

|

0.77 |

% |

0.76 |

% |

0.77 |

% |

0.77 |

% |

0.79 |

% |

|

Allowance for loan losses/non-accruing loans |

|

165 |

% |

164 |

% |

153 |

% |

132 |

% |

132 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOAN CHARGE-OFFS |

|

|

|

|

|

|

|

|

|

|

|

|

Residential mortgages |

|

$ |

(299 |

) |

$ |

(181 |

) |

$ |

(394 |

) |

$ |

(602 |

) |

$ |

(1,055 |

) |

|

Commercial real estate |

|

(2,007 |

) |

(1,810 |

) |

(1,470 |

) |

(1,028 |

) |

(1,105 |

) |

|

Commercial and industrial loans |

|

(375 |

) |

(540 |

) |

(687 |

) |

(1,341 |

) |

(215 |

) |

|

Home equity |

|

(202 |

) |

(240 |

) |

(193 |

) |

(51 |

) |

(458 |

) |

|

Auto and other consumer |

|

(344 |

) |

(431 |

) |

(328 |

) |

(216 |

) |

(284 |

) |

|

Total, net |

|

$ |

(3,227 |

) |

$ |

(3,202 |

) |

$ |

(3,072 |

) |

$ |

(3,238 |

) |

$ |

(3,117 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net charge-offs (QTD annualized)/average loans |

|

0.28 |

% |

0.29 |

% |

0.28 |

% |

0.31 |

% |

0.30 |

% |

|

Net charge-offs (YTD annualized)/average loans |

|

0.28 |

% |

0.29 |

% |

0.29 |

% |

0.30 |

% |

0.30 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DELINQUENT AND NON-ACCRUING LOANS/TOTAL LOANS |

|

|

|

|

|

|

|

|

|

|

|

|

30-89 Days delinquent |

|

0.28 |

% |

0.42 |

% |

0.32 |

% |

0.34 |

% |

0.37 |

% |

|

90+ Days delinquent and still accruing |

|

0.15 |

% |

0.10 |

% |

0.12 |

% |

0.21 |

% |

0.22 |

% |

|

Total accruing delinquent loans |

|

0.43 |

% |

0.52 |

% |

0.44 |

% |

0.55 |

% |

0.59 |

% |

|

Non-accruing loans |

|

0.47 |

% |

0.46 |

% |

0.50 |

% |

0.59 |

% |

0.60 |

% |

|

Total delinquent and non-accruing loans |

|

0.90 |

% |

0.98 |

% |

0.94 |

% |

1.14 |

% |

1.19 |

% |

F-5

BERKSHIRE HILLS BANCORP, INC.

SELECTED FINANCIAL HIGHLIGHTS - UNAUDITED - (F-6)

|

|

|

At or for the Quarters Ended |

|

|

|

|

Mar. 31, |

|

Dec. 31, |

|

Sept. 30, |

|

June 30, |

|

Mar. 31, |

|

|

|

|

2015 |

|

2014 |

|

2014 |

|

2014 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PER SHARE DATA |

|

|

|

|

|

|

|

|

|

|

|

|

Core earnings, diluted |

|

$ |

0.50 |

|

$ |

0.48 |

|

$ |

0.46 |

|

$ |

0.44 |

|

$ |

0.42 |

|

|

Net earnings, diluted |

|

0.35 |

|

0.46 |

|

0.48 |

|

0.46 |

|

(0.04 |

) |

|

Tangible book value |

|

17.46 |

|

17.19 |

|

16.67 |

|

16.40 |

|

15.84 |

|

|

Total book value |

|

28.36 |

|

28.17 |

|

27.69 |

|

27.49 |

|

26.99 |

|

|

Market price at period end |

|

27.70 |

|

26.66 |

|

23.49 |

|

23.22 |

|

25.88 |

|

|

Dividends |

|

0.19 |

|

0.18 |

|

0.18 |

|

0.18 |

|

0.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERFORMANCE RATIOS (2) |

|

|

|

|

|

|

|

|

|

|

|

|

Core return on assets |

|

0.76 |

% |

0.75 |

% |

0.73 |

% |

0.71 |

% |

0.71 |

% |

|

Return on assets |

|

0.54 |

|

0.71 |

|

0.77 |

|

0.75 |

|

(0.08 |

) |

|

Core return on equity |

|

7.06 |

|

6.89 |

|

6.59 |

|

6.32 |

|

6.02 |

|

|

Core return on tangible equity |

|

12.14 |

|

11.96 |

|

11.76 |

|

11.34 |

|

10.84 |

|

|

Return on equity |

|

5.00 |

|

6.52 |

|

6.95 |

|

6.64 |

|

(0.64 |

) |

|

Net interest margin, fully taxable equivalent |

|

3.18 |

|

3.23 |

|

3.20 |

|

3.26 |

|

3.35 |

|

|

Fee income/Net interest and fee income |

|

23.25 |

|

21.79 |

|

23.59 |

|

23.87 |

|

22.84 |

|

|

Efficiency ratio |

|

63.27 |

|

62.46 |

|

62.89 |

|

62.96 |

|

64.42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROWTH |

|

|

|

|

|

|

|

|

|

|

|

|

Total commercial loans, year-to-date (annualized) |

|

14 |

% |

15 |

% |

14 |

% |

19 |

% |

9 |

% |

|

Total loans, year-to-date (annualized) |

|

4 |

|

12 |

|

12 |

|

13 |

|

6 |

|

|

Total net revenues, year-to-date, compared to prior year |

|

23 |

|

— |

|

(3 |

) |

(7 |

) |

(17 |

) |

|

Core earnings per share, year-to-date, compared to prior year |

|

19 |

|

(4 |

) |

(10 |

) |

(15 |

) |

(22 |

) |

|

Earnings per share, year-to-date, compared to prior year |

|

N/A |

|

(18 |

) |

(27 |

) |

(54 |

) |

(110 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCIAL DATA (In millions) |

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

6,571 |

|

$ |

6,502 |

|

$ |

6,352 |

|

$ |

6,311 |

|

$ |

6,010 |

|

|

Total earning assets |

|

5,993 |

|

5,923 |

|

5,765 |

|

5,700 |

|

5,408 |

|

|

Total investments |

|

1,216 |

|

1,206 |

|

1,171 |

|

1,198 |

|

1,145 |

|

|

Total loans |

|

4,729 |

|

4,681 |

|

4,553 |

|

4,450 |

|

4,243 |

|

|

Allowance for loan losses |

|

36 |

|

36 |

|

35 |

|

34 |

|

34 |

|

|

Total intangible assets |

|

275 |

|

276 |

|

277 |

|

279 |

|

280 |

|

|

Total deposits |

|

4,720 |

|

4,655 |

|

4,563 |

|

4,479 |

|

4,219 |

|

|

Total stockholders’ equity |

|

716 |

|

709 |

|

697 |

|

690 |

|

678 |

|

|

Total core income |

|

12.4 |

|

12.0 |

|

11.4 |

|

10.9 |

|

10.4 |

|

|

Total net income |

|

8.8 |

|

11.4 |

|

12.0 |

|

11.5 |

|

(1.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSET QUALITY RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

Net charge-offs (current quarter annualized)/average loans |

|

0.28 |

% |

0.29 |

% |

0.28 |

% |

0.31 |

% |

0.30 |

% |

|

Allowance for loan losses/total loans |

|

0.77 |

|

0.78 |

|

0.77 |

|

0.77 |

|

0.79 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDITION RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity to total assets |

|

10.90 |

% |

10.91 |

% |

10.97 |

% |

10.94 |

% |

11.27 |

% |

|

Tangible stockholders’ equity to tangible assets (3) |

|

7.00 |

|

6.95 |

|

6.91 |

|

6.81 |

|

6.94 |

|

|

Investments to total assets |

|

18.51 |

|

18.54 |

|

18.43 |

|

18.99 |

|

19.05 |

|

|

Loans/deposits |

|

100 |

|

101 |

|

100 |

|

99 |

|

101 |

|

(1) Reconciliation of Non-GAAP financial measures, including all references to core and tangible amounts, appear on pages F-9.

(2) All performance ratios are annualized and are based on average balance sheet amounts, where applicable.

(3) Tangible assets are total assets less total intangible assets.

F-6

BERKSHIRE HILLS BANCORP, INC.

AVERAGE BALANCES - UNAUDITED - (F-7)

|

|

|

Quarters Ended |

|

|

|

|

Mar. 31, |

|

Dec. 31, |

|

Sept. 30, |

|

June 30, |

|

Mar. 31, |

|

|

(In thousands) |

|

2015 |

|

2014 |

|

2014 |

|

2014 |

|

2014 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

Residential mortgages |

|

$ |

1,469,910 |

|

$ |

1,468,271 |

|

$ |

1,412,720 |

|

$ |

1,379,625 |

|

$ |

1,379,266 |

|

|

Commercial real estate |

|

1,646,638 |

|

1,611,343 |

|

1,579,258 |

|

1,488,462 |

|

1,420,382 |

|

|

Commercial and industrial loans |

|

806,710 |

|

733,750 |

|

716,787 |

|

703,798 |

|

684,776 |

|

|

Consumer loans |

|

765,938 |

|

782,584 |

|

763,296 |

|

729,654 |

|

699,598 |

|

|

Total loans (1) |

|

4,689,196 |

|

4,595,948 |

|

4,472,061 |

|

4,301,539 |

|

4,184,022 |

|

|

Securities (2) |

|

1,176,559 |

|

1,190,182 |

|

1,169,765 |

|

1,225,646 |

|

1,047,658 |

|

|

Short-term investments and loans held for sale |

|

55,652 |

|

54,843 |

|

39,496 |

|

28,426 |

|

28,631 |

|

|

Total earning assets |

|

5,921,407 |

|

5,840,973 |

|

5,681,322 |

|

5,555,611 |

|

5,260,311 |

|

|

Goodwill and other intangible assets |

|

275,732 |

|

276,645 |

|

277,775 |

|

279,024 |

|

278,386 |

|

|

Other assets |

|

300,264 |

|

304,909 |

|

305,698 |

|

311,176 |

|

312,145 |

|

|

Total assets |

|

$ |

6,497,403 |

|

$ |

6,422,527 |

|

$ |

6,264,795 |

|

$ |

6,145,811 |

|

$ |

5,850,842 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

NOW |

|

$ |

423,474 |

|

$ |

415,806 |

|

$ |

417,802 |

|

$ |

425,824 |

|

$ |

409,631 |

|

|

Money market |

|

1,408,777 |

|

1,426,722 |

|

1,405,454 |

|

1,448,624 |

|

1,490,408 |

|

|

Savings |

|

502,412 |

|

479,988 |

|

480,036 |

|

481,790 |

|

463,615 |

|

|

Time |

|

1,419,706 |

|

1,425,865 |

|

1,406,914 |

|

1,152,651 |

|

1,069,987 |

|

|

Total interest-bearing deposits |

|

3,754,369 |

|

3,748,381 |

|

3,710,206 |

|

3,508,889 |

|

3,433,641 |

|

|

Borrowings |

|

1,106,541 |

|

1,053,884 |

|

980,135 |

|

1,113,431 |

|

899,458 |

|

|

Total interest-bearing liabilities |

|

4,860,910 |

|

4,802,265 |

|

4,690,341 |

|

4,622,320 |

|

4,333,099 |

|

|

Non-interest-bearing demand deposits |

|

869,780 |

|

863,795 |

|

824,489 |

|

779,775 |

|

749,982 |

|

|

Other liabilities |

|

65,453 |

|

56,805 |

|

60,088 |

|

52,712 |

|

76,258 |

|

|

Total liabilities |

|

5,796,143 |

|

5,722,865 |

|

5,574,918 |

|

5,454,807 |

|

5,159,339 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

701,260 |

|

699,662 |

|

689,877 |

|

691,004 |

|

691,503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

6,497,403 |

|

$ |

6,422,527 |

|

$ |

6,264,795 |

|

$ |

6,145,811 |

|

$ |

5,850,842 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplementary data |

|

|

|

|

|

|

|

|

|

|

|

|

Total non-maturity deposits |

|

$ |

3,204,443 |

|

$ |

3,186,311 |

|

$ |

3,127,781 |

|

$ |

3,136,013 |

|

$ |

3,113,636 |

|

|

Total deposits |

|

4,624,149 |

|

4,612,176 |

|

4,534,695 |

|

4,288,664 |

|

4,183,623 |

|

|

Fully taxable equivalent income adjustment |

|

889 |

|

887 |

|

859 |

|

852 |

|

718 |

|

|

Total average tangible equity (3) |

|

425,528 |

|

423,017 |

|

412,102 |

|

411,980 |

|

413,117 |

|

(1) Total loans include non-accruing loans.

(2) Average balances for securities available-for-sale are based on amortized cost.

(3) Total average tangible equity results from the subtraction of average goodwill and other intangible assets from total average stockholders’ equity.

F-7

BERKSHIRE HILLS BANCORP, INC.

AVERAGE YIELDS (Fully Taxable Equivalent - Annualized) - UNAUDITED - (F-8)

|

|

|

Quarters Ended |

|

|

|

|

Mar. 31, |

|

Dec. 31, |

|

Sept. 30, |

|

June 30, |

|

Mar. 31, |

|

|

|

|

2015 |

|

2014 |

|

2014 |

|

2014 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

Residential mortgages |

|

3.94 |

% |

3.88 |

% |

3.86 |

% |

3.99 |

% |

4.12 |

% |

|

Commercial real estate |

|

4.12 |

|

4.18 |

|

4.26 |

|

4.20 |

|

4.49 |

|

|

Commercial and industrial loans |

|

3.70 |

|

4.22 |

|

3.79 |

|

3.82 |

|

3.97 |

|

|

Consumer loans |

|

3.23 |

|

3.35 |

|

3.34 |

|

3.49 |

|

3.56 |

|

|

Total loans |

|

3.86 |

|

3.96 |

|

3.91 |

|

3.96 |

|

4.13 |

|

|

Securities |

|

3.10 |

|

3.00 |

|

2.98 |

|

3.13 |

|

3.04 |

|

|

Short-term investments and loans held for sale |

|

1.40 |

|

1.37 |

|

1.65 |

|

1.40 |

|

1.51 |

|

|

Total earning assets |

|

3.67 |

|

3.73 |

|

3.70 |

|

3.76 |

|

3.89 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Funding liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

NOW |

|

0.14 |

|

0.15 |

|

0.17 |

|

0.15 |

|

0.15 |

|

|

Money market |

|

0.40 |

|

0.42 |

|

0.37 |

|

0.36 |

|

0.37 |

|

|

Savings |

|

0.15 |

|

0.14 |

|

0.14 |

|

0.16 |

|

0.16 |

|

|

Time |

|

0.92 |

|

0.91 |

|

0.91 |

|

0.98 |

|

1.15 |

|

|

Total interest-bearing deposits |

|

0.53 |

|

0.54 |

|

0.52 |

|

0.51 |

|

0.56 |

|

|

Borrowings |

|

0.85 |

|

0.85 |

|

0.90 |

|

0.85 |

|

1.04 |

|

|

Total interest-bearing liabilities |

|

0.61 |

|

0.61 |

|

0.60 |

|

0.59 |

|

0.66 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest spread |

|

3.06 |

|

3.12 |

|

3.10 |

|

3.17 |

|

3.23 |

|

|

Net interest margin |

|

3.18 |

|

3.23 |

|

3.20 |

|

3.26 |

|

3.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of funds (1) |

|

0.51 |

|

0.52 |

|

0.51 |

|

0.51 |

|

0.56 |

|

|

Cost of deposits (2) |

|

0.43 |

|

0.44 |

|

0.43 |

|

0.42 |

|

0.46 |

|

(1) Cost of funds includes all deposits and borrowings.

(2) The average cost of deposits include the deposits held for sale.

F-8

BERKSHIRE HILLS BANCORP, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES - UNAUDITED - (F-9)

|

|

|

|

|

At or for the Quarters Ended |

|

|

|

|

|

|

Mar. 31, |

|

Dec. 31, |

|

Sept. 30, |

|

June 30, |

|

Mar. 31, |

|

|

(in thousands) |

|

|

|

2015 |

|

2014 |

|

2014 |

|

2014 |

|

2014 |

|

|

Net income (loss) |

|

|

|

$ |

8,759 |

|

$ |

11,398 |

|

$ |

11,988 |

|

$ |

11,464 |

|

$ |

(1,106 |

) |

|

Adj: Gain on sale of securities, net |

|

|

|

(34 |

) |

— |

|

(245 |

) |

(203 |

) |

(34 |

) |

|

Adj: Loss on termination of hedges |

|

|

|

— |

|

— |

|

— |

|

— |

|

8,792 |

|

|

Adj: Merger and acquisition expense |

|

|

|

3,275 |

|

1,708 |

|

— |

|

52 |

|

3,637 |

|

|

Adj: Restructuring and conversion expense |

|

|

|

1,146 |

|

54 |

|

238 |

|

138 |

|

2,665 |

|

|

Adj: Out-of-period adjustment (1) |

|

|

|

— |

|

— |

|

— |

|

— |

|

1,381 |

|

|

Adj: Income taxes |

|

|

|

(772 |

) |

(1,114 |

) |

(612 |

) |

(536 |

) |

(4,923 |

) |

|

Total core income |

|

(A) |

|

$ |

12,374 |

|

$ |

12,046 |

|

$ |

11,369 |

|

$ |

10,915 |

|

$ |

10,412 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

|

|

$ |

58,055 |

|

$ |

60,847 |

|

$ |

59,590 |

|

$ |

58,835 |

|

$ |

47,189 |

|

|

Adj: Gain on sale of securities, net |

|

|

|

(34 |

) |

— |

|

(245 |

) |

(203 |

) |

(34 |

) |

|

Adj: Loss on termination of hedges |

|

|

|

— |

|

— |

|

— |

|

— |

|

8,792 |

|

|

Adj: Out-of-period adjustment (1) |

|

|

|

— |

|

— |

|

— |

|

— |

|

1,381 |

|

|

Total core revenue |

|

(B) |

|

$ |

58,021 |

|

$ |

60,847 |

|

$ |

59,345 |

|

$ |

58,632 |

|

$ |

57,328 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-interest expense |

|

|

|

$ |

45,148 |

|

$ |

41,676 |

|

$ |

39,687 |

|

$ |

39,263 |

|

$ |

45,360 |

|

|

Less: Total non-core expense (see above) |

|

|

|

(4,421 |

) |

(1,762 |

) |

(238 |

) |

(190 |

) |

(6,302 |

) |

|

Core non-interest expense |

|

(C) |

|

$ |

40,727 |

|

$ |

39,914 |

|

$ |

39,449 |

|

$ |

39,073 |

|

$ |

39,058 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total average assets |

|

(D) |

|

$ |

6,497 |

|

$ |

6,423 |

|

$ |

6,265 |

|

$ |

6,146 |

|

$ |

5,851 |

|

|

Total average stockholders’ equity |

|

(E) |

|

701 |

|

700 |

|

690 |

|

691 |

|

692 |

|

|

Total average tangible stockholders’ equity |

|

(F) |

|

426 |

|

423 |

|

412 |

|

412 |

|

413 |

|

|

Total tangible stockholders’ equity, period-end (2) |

|

(G) |

|

441 |

|

433 |

|

420 |

|

411 |

|

398 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total common shares outstanding, period-end (thousands) |

|

(H) |

|

25,253 |

|

25,183 |

|

25,173 |

|

25,115 |

|

25,105 |

|

|

Average diluted shares outstanding (thousands) (3) |

|

(I) |

|

24,955 |

|

24,912 |

|

24,861 |

|

24,809 |

|

24,833 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core earnings per share, diluted |

|

(A/I) |

|

$ |

0.50 |

|

$ |

0.48 |

|

$ |

0.46 |

|

$ |

0.44 |

|

$ |

0.42 |

|

|

Tangible book value per share, period-end |

|

(G/H) |

|

$ |

17.46 |

|

$ |

17.19 |

|

$ |

16.67 |

|

$ |

16.40 |

|

$ |

15.84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance ratios (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core return on assets |

|

(A/D) |

|

0.76 |

% |

0.75 |

% |

0.73 |

% |

0.71 |

% |

0.71 |

% |

|

Core return on equity |

|

(A/E) |

|

7.06 |

|

6.89 |

|

6.59 |

|

6.32 |

|

6.02 |

|

|

Core return on tangible equity (5) |

|

(A/F) |

|

12.14 |

|

11.96 |

|

11.76 |

|

11.34 |

|

10.84 |

|

|

Efficiency ratio |

|

(C-L)/(B+J+M) |

|

63.27 |

|

62.46 |

|

62.89 |

|

62.96 |

|

64.42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplementary data (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax benefit - tax-advantaged commercial project investments (6) |

|

(J) |

|

$ |

4,034 |

|

$ |

570 |

|

$ |

555 |

|

$ |

555 |

|

$ |

555 |

|

|

Non-interest income charge - tax-advantaged commercial project investments (7) |

|

(K) |

|

(2,851 |

) |

(417 |

) |

(417 |

) |

(417 |

) |

(417 |

) |

|

Net income on tax-advantaged commercial project investments |

|

(J+K) |

|

1,183 |

|

153 |

|

138 |

|

138 |

|

138 |

|

|

Intangible amortization |

|

(L) |

|

901 |

|

996 |

|

1,236 |

|

1,274 |

|

1,306 |

|

|

Fully taxable equivalent income adjustment |

|

(M) |

|

889 |

|

887 |

|

859 |

|

852 |

|

718 |

|

(1) The out of period adjustment shown above relates to interest income earned on loans acquired in bank acquisitions.

(2) Total tangible stockholders’ equity is computed by taking total stockholders’ equity less the intangible assets at period-end.

(3) Average diluted shares computed for core earnings per share differ from GAAP average diluted shares, in the first quarter of 2014, due to the GAAP net loss compared to core net income for the period.

(4) Ratios are annualized and based on average balance sheet amounts, where applicable. Quarterly data may not sum to year-to-date data due to rounding.

(5) Core return on tangible equity is computed by dividing the total core income adjusted for the tax-affected amortization of intangible assets, assuming a 40% marginal rate, by tangible equity.

(6) The tax benefit is the direct reduction to the income tax provision due to tax credits and deductions generated from investments in historic rehabilitation, low-income housing, new market projects, and renewable energy projects.

(7) The non-interest income charge is the reduction to the tax-advantaged commercial project investments, which are incurred as the tax credits are generated.

F-9

HAMPDEN BANCORP

UNAUDITED SELECTED FINANCIAL HIGHLIGHTS - F-10

|

|

|

March 31, |

|

December 31, |

|

|

(In thousands) |

|

2015 |

|

2014 |

|

|

Selected Financial Condition Data: |

|

|

|

|

|

|

Loans: |

|

|

|

|

|

|

Residential mortgages |

|

$ |

106,367 |

|

$ |

109,427 |

|

|

Commercial real estate |

|

209,491 |

|

207,393 |

|

|

Commercial and industrial loans |

|

85,646 |

|

87,867 |

|

|

Consumer loans |

|

106,015 |

|

108,346 |

|

|

Total loans |

|

$ |

507,519 |

|

$ |

513,033 |

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

Demand deposits |

|

$ |

104,638 |

|

$ |

82,630 |

|

|

NOW deposits |

|

53,755 |

|

50,989 |

|

|

Money market deposits |

|

87,083 |

|

99,229 |

|

|

Savings deposits |

|

100,415 |

|

98,794 |

|

|

Time deposits |

|

154,621 |

|

157,250 |

|

|

Total deposits |

|

$ |

500,512 |

|

$ |

488,892 |

|

|

|

|

Three Months Ended |

|

Three Months Ended |

|

|

|

|

March 31, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

Selected Operating Data: |

|

|

|

|

|

|

Net Interest income |

|

$ |

5,273 |

|

$ |

5,205 |

|

|

Non-interest income |

|

799 |

|

856 |

|

|

Core non-interest expense (1) |

|

4,169 |

|

4,497 |

|

|

|

|

|

|

|

|

|

Average Yields: (2) |

|

|

|

|

|

|

Total loans |

|

4.54 |

% |

4.51 |

% |

|

Total deposits |

|

0.71 |

|

0.72 |

|

|

|

|

|

|

|

|

|

(1) Core non-interest expense information excludes non-core merger and shareholder relations associated items.

(2) Average yields are annualized.

F-10

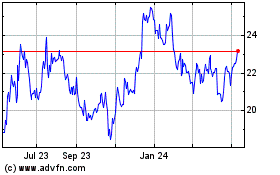

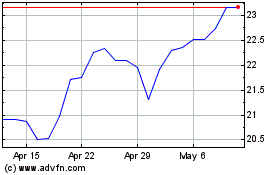

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jul 2023 to Jul 2024