UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 3, 2014

BERKSHIRE HILLS BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

|

001-15781 |

|

04-3510455 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File No.) |

|

(I.R.S. Employer

Identification No.) |

|

24 North Street, Pittsfield, Massachusetts |

|

01201 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (413) 443-5601

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

x Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

On November 3, 2014, Berkshire Hills Bancorp, Inc. (the “Company” or “Berkshire Hills”), the parent company of Berkshire Bank, and Hampden Bancorp, Inc. (“Hampden”), the parent company of Hampden Bank, entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which Hampden will merge with and into Berkshire Hills. Concurrent with the merger, it is expected that Hampden Bank will merge with and into Berkshire Bank.

Under the terms of the Merger Agreement, each outstanding share of Hampden common stock will be converted into the right to receive 0.8100 shares of Company common stock.

The proposed merger is subject to customary closing conditions, including the receipt of regulatory approvals and approval by the stockholders of Hampden. The merger is currently expected to be completed in the second quarter of 2015. In connection with the proposed merger, it is expected that two Hampden directors will be appointed to the Berkshire Hills Board of Directors.

The directors and certain executive officers of Hampden have agreed to vote their shares in favor of the approval of the Merger Agreement at the Hampden stockholders meeting to be held to vote on the proposed transaction. If the merger is not consummated under specified circumstances, Hampden has agreed to pay the Company a termination fee which will be equal to $3.6 million if such fee shall become payable within 45 days from the date of the Agreement and $4.7 million if such fee shall become payable thereafter.

The Merger Agreement also contains usual and customary representations and warranties that the Company and Hampden made to each other as of specific dates. The assertions embodied in those representations and warranties were made solely for purposes of the contract between the Company and Hampden, and may be subject to important qualifications and limitations agreed to by the parties in connection with negotiating its terms. Moreover, the representations and warranties are subject to a contractual standard of materiality that may be different from what may be viewed as material to stockholders, and the representations and warranties may have been used to allocate risk between the Company and Hampden rather than establishing matters as facts.

The Company will file a copy of the Merger Agreement as an exhibit to a separate Current Report on Form 8-K. The Company’s press release announcing the merger is attached hereto as Exhibit 99.1 and incorporated by reference herein.

Additional Information and Where to Find It

In connection with the proposed merger, Berkshire Hills will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will include a Proxy Statement of Hampden and a Prospectus of Berkshire Hills, as well as other relevant documents concerning the proposed merger. Investors and stockholders are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the proposed merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. Copies of the Registration Statement and Proxy Statement/Prospectus and the filings that will be incorporated by reference therein, as well as other filings containing information about Berkshire Hills and

2

Hampden, when they become available, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Berkshire Hills at www.berkshirebank.com under the tab “Investor Relations” or from Hampden Bancorp by accessing Hampden Bancorp’s website at www.hampdenbank.com under the tab “Investor Relations.”

Hampden and Berkshire Hills and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Hampden Bancorp in connection with the proposed merger. Information about the directors and executive officers of Berkshire Hills is set forth in the proxy statement for the Berkshire Hills 2014 annual meeting of stockholders, as filed with the SEC on Schedule 14A on April 1, 2014. Information about the directors and executive officers of Hampden Bancorp is set forth in the proxy statement for Hampden Bancorp’s 2014 annual meeting of stockholders, as filed with the SEC on a Schedule 14A on September 26, 2014. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the Proxy Statement/Prospectus and other relevant documents regarding the proposed merger to be filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

Forward-Looking Statements

Certain statements contained in this Current Report on Form 8-K that are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”), notwithstanding that such statements are not specifically identified as such. In addition, certain statements may be contained in our future filings with the SEC, in press releases, and in oral and written statements made by us or with our approval that are not statements of historical fact and constitute forward-looking statements within the meaning of the Act. Examples of forward-looking statements include, but are not limited to: (i) projections of revenues, expenses, income or loss, earnings or loss per share, the payment or nonpayment of dividends, capital structure and other financial items; (ii) statements of our plans, objectives and expectations or those of our management or Board of Directors, including those relating to products or services; (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Words such as “believes,” “anticipates,” “expects,” “intends,” “targeted,” “continue,” “remain,” “will,” “should,” “may” and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements.

Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to: local, regional, national and international economic conditions and the impact they may have on us and our customers and our assessment of that impact, changes in the level of non-performing assets and charge-offs; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the effects of and changes in trade and monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve Board; inflation, interest rate, securities market and monetary fluctuations; political instability; acts of war or terrorism; the timely development and acceptance of new products and services and perceived overall value of these products and services by users;

3

changes in consumer spending, borrowings and savings habits; changes in the financial performance and/or condition of our borrowers; technological changes; acquisitions and integration of acquired businesses; the ability to increase market share and control expenses; changes in the competitive environment among financial holding companies and other financial service providers; the quality and composition of our loan or investment portfolio; the effect of changes in laws and regulations (including laws and regulations concerning taxes, banking, securities and insurance) with which we and our subsidiaries must comply; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters; changes in our organization, compensation and benefit plans; the costs and effects of legal and regulatory developments, including the resolution of legal proceedings or regulatory or other governmental inquiries and the results of regulatory examinations or reviews; greater than expected costs or difficulties related to the opening of new branch offices or the integration of new products and lines of business, or both; and/or our success at managing the risk involved in the foregoing items.

Item 7.01 Regulation FD Disclosure

An Investor Presentation containing additional information regarding the merger is included in this report as Exhibit 99.2 and is furnished herewith, and shall not be deemed “filed” for any purpose.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

Exhibit 99.1 Press Release dated November 4, 2014

Exhibit 99.2 Investor Presentation dated November 4, 2014

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

Berkshire Hills Bancorp, Inc. |

|

|

|

|

|

|

|

DATE: November 4, 2014 |

By: |

/s/Michael P. Daly |

|

|

|

Michael P. Daly |

|

|

|

President and Chief Executive Officer |

5

Exhibit 99.1

JOINT NEWS RELEASE

BERKSHIRE HILLS AND HAMPDEN ANNOUNCE IN-MARKET MERGER

PITTSFIELD, MA AND SPRINGFIELD, MA — November 4, 2014 — Berkshire Hills Bancorp, Inc. (NYSE: BHLB) and Hampden Bancorp, Inc. (Nasdaq: HBNK) today announced that they have signed a definitive merger agreement under which Berkshire will acquire Hampden and its subsidiary, Hampden Bank, in an all-stock transaction valued at approximately $109 million.

Berkshire’s total assets will increase to $7.1 billion including the $706 million in acquired Hampden assets. This in-market merger is expected to create efficiencies, strategic growth and market share benefits for the consolidated operations of the two banks in the Springfield area. Hampden operates 10 branches in the greater Springfield area and reported $508 million in net loans and $490 million in deposits as of September 30, 2014. Berkshire operates 11 branches with $627 million in deposits in this market. Berkshire will have a pro forma market cap of approximately $740 million and 100 branches serving customers and communities across New England and New York. Pro forma tangible equity to tangible assets is expected to improve to 7.4% when the merger is completed.

“We are pleased to welcome Hampden customers and employees to America’s Most Exciting Bank®,” said Michael P. Daly, President and CEO of Berkshire. “This in-market partnership will create a strong platform for serving our combined customers, while producing attractive returns for both our existing shareholders and the new shareholders from Hampden joining us in this transaction. We will move into the top 5 position in deposit market share and plan to use this opportunity to further capitalize on our strong product set and culture of customer engagement. This merger complements our expansion initiatives in Central Massachusetts and Hartford, a combined market area that is the second largest in New England.”

“We are delighted to be joining the Berkshire franchise,” commented Glenn S. Welch, President and CEO of Hampden. “Our two banks share rich histories, consistent core values and a strong commitment to customers and communities. I’m proud of our 162 years of serving customers in our markets and believe the combination created by our two companies will benefit our clients, communities and shareholders.”

1

Michael P. Daly concluded, “This is a solid business combination with efficiency benefits. Hampden is a well run company with an attractive core deposit base and a significant presence in the community. After integration, the transaction is expected to be accretive to Berkshire’s earnings per share, return on equity, and capital. We have a strong track record of execution and our collective teams are positioned to complete this integration flawlessly.”

Under the terms of the merger agreement, each outstanding share of Hampden common stock will be exchanged for 0.81 shares of Berkshire Hills common stock. The merger is valued at $20.53 per share of Hampden common stock based on the $25.35 average closing price of Berkshire’s stock for the five day period ending November 3, 2014. The $20.53 per share value represents 133% of Hampden’s $15.49 tangible book value per share and a 6.0% premium to core deposits based on financial information as of September 30, 2014.

The transaction is intended to qualify as a reorganization for federal income tax purposes, and as a result, the shares of Hampden common stock exchanged for shares of Berkshire common stock are expected to be transferred on a tax-free basis. The definitive agreement has been approved by the unanimous votes of the Boards of Directors of both companies. Consummation of the agreement is subject to the approval of Hampden’s shareholders, as well as state and federal regulatory agencies. The merger is targeted to be completed early in the second quarter of 2015. Two Hampden directors will be appointed to Berkshire’s board of directors and Glenn S. Welch will be joining Berkshire as Regional President for the Pioneer Valley and Connecticut. Berkshire and Hampden have created foundations for community charitable support which will continue to provide charitable contributions underscoring their mutual commitment to serving their local communities.

Sandler O’Neill & Partners, L.P. served as the financial advisor to Berkshire, and Sterne, Agee & Leach, Inc. served as the financial advisor to Hampden. Luse Gorman Pomerenk & Schick, P.C. served as outside counsel to Berkshire, while Goodwin Procter LLP served as outside counsel to Hampden.

INVESTOR PRESENTATION

An Investor Presentation will be posted on Berkshire’s website (ir.berkshirebank.com) and Hampden’s website (www.hampdenbank.com) containing additional information regarding this merger.

BACKGROUND

Berkshire Hills Bancorp is the parent of Berkshire Bank — America’s Most Exciting Bank®. The Company, recognized for its entrepreneurial approach and distinctive culture, has approximately $6.4 billion in assets and 91 full service branch offices in Massachusetts, New York, Connecticut, and Vermont providing personal and business banking, insurance, and wealth management services. For more information, visit www.berkshirebank.com.

Hampden Bancorp, Inc. (Nasdaq: HBNK) is the holding company of Hampden Bank. Established in 1852, Hampden Bank is a full service community bank serving the families and

2

businesses in and around Hampden County. The Bank has ten office locations in Springfield, Agawam, Longmeadow, West Springfield, Wilbraham, and Indian Orchard. Hampden Bank offers customers the latest in internet banking, including on-line banking and bill payment solutions. For more information, visit www.hampdenbank.com.

FORWARD LOOKING STATEMENTS

This document contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about the proposed merger of Berkshire and Hampden. These statements include statements regarding the anticipated closing date of the transaction and anticipated future results. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Certain factors that could cause actual results to differ materially from expected results include delays in completing the merger, difficulties in achieving cost savings from the merger or in achieving such cost savings within the expected time frame, difficulties in integrating Berkshire and Hampden, increased competitive pressures, changes in the interest rate environment, changes in general economic conditions, legislative and regulatory changes that adversely affect the business in which Berkshire and Hampden are engaged, changes in the securities markets and other risks and uncertainties disclosed from time to time in documents that Berkshire files with the Securities and Exchange Commission.

NON-GAAP FINANCIAL MEASURES

This document references non-GAAP financial measures incorporating tangible equity and related measures, as well as core deposits. These measures are commonly used by investors in evaluating business combinations and financial condition.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed merger, Berkshire will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will include a Proxy Statement of Hampden and a Prospectus of Berkshire, as well as other relevant documents concerning the proposed merger. Investors and stockholders are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the proposed merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Registration Statement and Proxy Statement/Prospectus, as well as other filings containing information about Berkshire and Hampden, when they become available, may be obtained at the SEC’s Internet site (www.sec.gov). Copies of the Registration Statement and Proxy Statement/Prospectus (when they become available) and the filings that will be incorporated by reference therein may also be obtained, free of charge, from Berkshire’s website at ir.berkshirebank.com or by contacting Berkshire Investor Relations at 413-236-3149 or from Hampden’s website at www.hampdenbank.com and selecting the “Investor Relations” link or by contacting Hampden Investor relations at 413-452-5150.

3

PARTICIPANTS IN SOLICITATION

Berkshire and Hampden and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Hampden in connection with the proposed merger. Information about the directors and executive officers of Berkshire is set forth in the proxy statement for Berkshire’s 2014 annual meeting of stockholders, as filed with the SEC on a Schedule 14A on April 1, 2014. Information about the directors and executive officers of Hampden is set forth in the proxy statement for Hampden’s 2014 annual meeting of stockholders, as filed with the SEC on a Schedule 14A on September 26, 2014 and additional filings reporting results of the annual meeting on November 4, 2014. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the Proxy Statement/Prospectus and other relevant documents regarding the proposed merger to be filed with the SEC (when they become available). Free copies of these documents may be obtained as described in the preceding paragraph.

CONTACTS

Berkshire Hills Bancorp, Inc.: Michael P. Daly, President and Chief Executive Officer

Telephone: 413-236-3194

Hampden Bancorp, Inc.: Glenn S. Welch, President and Chief Executive Officer

Telephone: 413-452-5144

4

Exhibit

99.2

|

|

Berkshire

Announces In-Market Acquisition of Hampden Bancorp November 4, 2014

|

|

|

FORWARD LOOKING

STATEMENTS This document contains certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995 about the

proposed merger of Berkshire and Hampden. These statements include statements

regarding the anticipated closing date of the transaction and anticipated

future results. Forward-looking statements can be identified by the fact that

they do not relate strictly to historical or current facts. They often

include words like "believe," "expect,"

"anticipate," "estimate," and "intend" or

future or conditional verbs such as "will," "would,"

"should," "could" or "may." Certain factors

that could cause actual results to differ materially from expected results

include delays in completing the merger, difficulties in achieving cost

savings from the merger or in achieving such cost savings within the expected

time frame, difficulties in integrating Berkshire and Hampden, increased

competitive pressures, changes in the interest rate environment, changes in

general economic conditions, legislative and regulatory changes that

adversely affect the business in which Berkshire and Hampden are engaged,

changes in the securities markets and other risks and uncertainties disclosed

from time to time in documents that Berkshire files with the Securities and

Exchange Commission. NON-GAAP FINANCIAL MEASURES This presentation references

non-GAAP financial measures incorporating tangible equity and related

measures, as well as core deposits. These measures are commonly used by

investors in evaluating business combinations and financial condition. 1

|

|

|

2 ADDITIONAL

INFORMATION AND WHERE TO FIND IT In connection with the proposed merger,

Berkshire will file with the Securities and Exchange Commission (“SEC”) a

Registration Statement on Form S-4 that will include a Proxy Statement of

Hampden and a Prospectus of Berkshire, as well as other relevant documents

concerning the proposed merger. Investors and stockholders are urged to read

the Registration Statement and the Proxy Statement/Prospectus regarding the

proposed merger when it becomes available and any other relevant documents

filed with the SEC, as well as any amendments or supplements to those

documents, because they will contain important information. A free copy of

the Registration Statement and Proxy Statement/Prospectus, as well as other

filings containing information about Berkshire and Hampden, when they become

available, may be obtained at the SEC’s Internet site (www.sec.gov). Copies

of the Registration Statement and Proxy Statement/Prospectus (when they

become available) and the filings that will be incorporated by reference

therein may also be obtained, free of charge, from Berkshire’s website at

ir.berkshirebank.com or by contacting Berkshire Investor Relations at

413-236-3149 or from Hampden’s website at www.hampdenbank.com and selecting

the “Investor Relations” link or by contacting Hampden Investor relations at 413-452-5150.

PARTICIPANTS IN SOLICITATION Berkshire and Hampden and certain of their

respective directors and executive officers may be deemed to be participants

in the solicitation of proxies from the stockholders of Hampden in connection

with the proposed merger. Information about the directors and executive

officers of Berkshire is set forth in the proxy statement for Berkshire’s

2014 annual meeting of stockholders, as filed with the SEC on a Schedule 14A

on April 1, 2014. Information about the directors and executive officers of

Hampden is set forth in the proxy statement for Hampden’s 2014 annual meeting

of stockholders, as filed with the SEC on a Schedule 14A on September 26,

2014 and additional filings reporting results of the annual meeting on November

4, 2014. Additional information regarding the interests of those participants

and other persons who may be deemed participants in the transaction and a

description of their direct and indirect interests, by security holdings or

otherwise, may be obtained by reading the Proxy Statement/Prospectus and

other relevant documents regarding the proposed merger to be filed with the

SEC (when they become available). Free copies of these documents may be

obtained as described in the preceding paragraph.

|

|

|

Merger Benefits

3

|

|

|

Pro Forma

Franchise Full service regional bank with a distinctive brand and culture,

strong middle market opportunities and a solid foundation for growth BHLB

HBNK Source: BHLB and HBNK company financials and pro forma analysis 4 Assets:

$7.1 billion Loans: $5.1billion Deposits: $5.1 billion Wealth AUM: $1.3

billion Annualized revenue: $265 million Branches: 100 plus lending offices

Footprint: New England and Central New York Market capitalization:

approximately $750 million NYSE: BHLB

|

|

|

Note: Map does

not show Berkshire’s Haydenville, MA branch which is also in the Springfield

MSA Source: SNL Financial; position data as of June 30, 2014 Top 5 Market

Share Position

|

|

|

Hampden

Bancorp, Inc. Overview Greater Springfield’s local community bank . . . the

bank where brighter days begin. Founded: 1852 Headquarters: Springfield, MA

Branches: 10 Footprint: Springfield, Massachusetts MSA Nasdaq: HBNK Assets:

$706 million Net loans: $508million Deposits: $490 million Annualized

revenue: $25 million Performance ratios: 0.66% ROAA; 5.4% ROE; 3.17% NIM; 69%

Efficiency ratio Source: Company Financials as of 9/30/14 For more

information on Hampden Bank please visit “www.hampdenbank.com” 6

|

|

|

Merger Summary

Merger Partner Hampden Bancorp, Inc. (Nasdaq: HBNK) Deal Price per Share

$20.53 Consideration Structure 0.81 shares of BHLB for each outstanding HBNK

share Aggregate Deal Value $109 million (see note regarding shares owned by

BHLB and other adjustments) Consideration Mix 100% stock Termination Fee $3.6

million within the first 45 days and $4.7 million thereafter Required

Approvals Customary regulatory approval; Hampden shareholder approval

Anticipated Closing Targeted for early in the second quarter of 2015 NOTE:

Based on $25.35 average closing price of BHLB common stock for the last five

trading days ended 11/3/14. As of 10/31/14, HBNK had 5,498,111 shares

outstanding. Pro forma HBNK shares at closing are 5,103,883, including

adjustments for 208,558 HBNK shares currently owned by BHLB (3.8%) and

185,670 shares to extinguish HBNK ESOP debt. Deal value includes $3.9 million

estimated cost to repurchase 423,783 HBNK outstanding options. Merger

agreement dated 11/3/14. 7

|

|

|

Comparative

Transaction Multiples HBNK Transaction Regional Transactions Price/LTM

Earnings 25x 29x Price/Tangible Book Value 133% 160% Core Deposit Premium

6.0% 7.9% Source: SNL Financial, HBNK company financials, and pro forma

analysis HBNK’s financials are as of and for the twelve months ended 9/30/14;

core deposit premium is based on total deal consideration Regional

transactions: median of deals announced since January 1, 2011 with aggregate

deal values greater than $50mm, target total assets greater than $400mm and

target headquartered in New England. 8

|

|

|

Transaction Assumptions

9 Key Assumptions Cost saves 35% 1x after tax restructuring charges $9.5

million Loan credit mark $14 million; 2.8% of loans (50% accretable, 50%

non-accretable) Loan interest rate premium mark $8 million Core deposit

intangibles $5.0 million (1.50%) Note: Existing $6mm HBNK loan loss allowance

reversed

|

|

|

Appendix 10

|

|

|

Similar profile

indicates smooth integration Combined: 55% commercial – strategic focus

Pro-Forma Combined $5.06B Loan Composition BHLB $4.56B Avg yield: 3.91% HBNK

$0.51B Avg yield: 4.59% Source: Company financials; data as of 9.30.14;

yields are averages based on Q3 2014 data 11

|

|

|

Similar

concentrations - facilitates integration Combined: 27% transaction accounts –

focused for growth Source: Company financials; data as of 9.30.14; costs are

averages based on Q3 2014 data BHLB $4.56B Avg cost: 0.43% Pro-Forma Combined

$5.05B Deposit Composition HBNK $0.49B Avg cost: 0.71% 12

|

|

|

Hampden

Financial Highlights Source: SNL Financial ; June 30 FYE 13 Dollar Values in

Thousands, Except Per Share Amounts For the Fiscal Year Ended, 2011Y 2012Y

2013Y 2014Y Balance Sheet Total Assets $573,326 $615,957 $652,962 $701,497

Cash and Securities 148,299 176,733 169,440 162,553 Gross Loans Held for

Investment 403,181 411,492 455,761 513,286 Loan Loss Allowance 5,473 5,148

5,414 5,651 Total Deposits 417,255 434,832 474,798 491,732 Total Borrowings

54,711 86,976 86,992 116,446 Total Equity $93,516 $87,160 $83,659 $87,159

Profitability (%) Operating Revenue $20,929.0 $22,290.0 $22,951.0 $23,980.0

Net Income $1,314.0 $3,016.0 $2,974.0 $4,515.0 ROAA 0.23% 0.52% 0.46% 0.65%

ROAE 1.40% 3.37% 3.41% 5.30% Net Interest Margin 3.38% 3.50% 3.14% 3.10%

Efficiency Ratio 81.6% 76.5% 77.0% 66.6% Asset Quality and Capital Ratios (%)

NPAs / Assets 2.99% 2.38% 1.32% 1.44% NCOs / Average Loans 0.68% 0.19% 0.09%

0.06% Total Equity / Total Assets 16.31% 14.15% 12.81% 12.42% Risk-based

Capital Ratio 23.90% 21.20% 19.10% 18.30% Per Share Information ($) Common

Shares Outstanding (actual) 6,799,499 5,968,395 5,629,099 5,651,130 EPS after

Extra 0.21 0.51 0.54 0.83 Reported: Book Value 13.75 14.60 14.86 15.43

|

|

|

Hartford/Springfield

Metro Area The merger between Berkshire Hills and Hampden Bancorp will create

the 10th ranked depository institution in the attractive Hartford/Springfield

area, also known as the “knowledge corridor” Reflects the area’s high

concentration of schools with 29 universities and over 155,000 students There

are over 50,000 businesses in the area with a labor force of nearly 1 million

Median household income of $67,457 and $51,430 for the Hartford and

Springfield MSAs respectively versus the national median of $51,579 For more

information please visit www.hartfordspringfield.com 14 (1) Green shading

denotes Hartford GDP, gold shading denotes Springfield GDP Source: SNL

Financial, U.S. Bureau of Economic Analysis

|

|

|

If you have any

questions, please contact: Allison O’Rourke 99 North Street Pittsfield, MA

01202 Investor Relations Officer (413) 236-3149 aorourke@berkshirebank.com 15

|

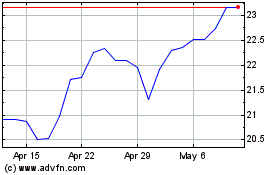

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

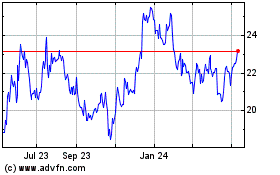

Berkshire Hills Bancorp (NYSE:BHLB)

Historical Stock Chart

From Jul 2023 to Jul 2024