Belden Inc. (NYSE: BDC) (the “Company”), a leading global

supplier of network infrastructure solutions, today reported fiscal

fourth quarter and full year results for the period ended December

31, 2022.

“Belden delivered another strong quarter of continued growth

with expanding margins. For the full year 2022, we achieved both

record revenues and record EPS. I am proud of how our teams

navigated this challenging year by focusing on customer success and

business outcomes. Our strength in 2022 was broad-based,

demonstrating the strong secular growth trends benefiting our

strategically positioned portfolio. For the full year, revenues

grew 16% organically with improved profitability and expanded

margins. We continue to invest our capital strategically in new

product innovation, selective bolt-on acquisitions, and share

repurchases. Our balance sheet is strong, as we ended the year with

net leverage of 1.0x, down from 2.1x a year ago,” said Roel

Vestjens, President and CEO of Belden Inc.

Fourth Quarter 2022

GAAP revenues for the quarter totaled $659 million, increasing

$47 million, or 8%, compared to $612 million in the year-ago

period. Organic year-over-year growth for the quarter was 12%, with

Industrial Automation Solutions at 18% and Enterprise Solutions at

6%. Net income was $61 million, compared to $80 million in the

year-ago period. Net income as a percentage of revenue was 9.3%,

compared to 13.1% in the year-ago period. EPS totaled $1.40 for the

quarter, compared to $1.76 in the year-ago period.

Adjusted revenues for the quarter totaled $659 million,

increasing $48 million, or 8%, compared to $611 million in the

year-ago period. Adjusted EBITDA was $115 million, increasing $14

million, or 14%, compared to $101 million in the year-ago period.

Adjusted EBITDA margin was 17.4%, up 90 bps, compared to 16.5% in

the year-ago period. Adjusted EPS was $1.75, increasing 35%

compared to $1.30 in the year-ago period. Adjusted results are

non-GAAP measures, and a non-GAAP reconciliation table is provided

as an appendix to this release.

Full Year 2022

GAAP and Adjusted revenues for the year totaled a record $2.606

billion, increasing $305 million, or 13%, compared to $2.301

billion in the prior year. Organic growth for the year was 16%,

with Industrial Automation Solutions at 19% and Enterprise

Solutions at 13%. Net income was $268 million, compared to $199

million in the prior year. Net income as a percentage of revenue

was 10.3%, compared to 8.6% in the prior year. EPS totaled an

annual record $6.01, compared to $4.37 in the prior year, up

38%.

Adjusted EBITDA was $444 million, increasing $72 million, or

19%, compared to $372 million in the prior year. Adjusted EBITDA

margin was 17.0%, up 90 bps, compared to 16.1% in the year-ago

period. Adjusted EPS was an annual record $6.41, increasing 35%

compared to $4.75 in the prior year.

Outlook

“2022 was a record year for Belden with growth across the

business. While macro conditions remain uncertain as we enter 2023,

our portfolio is designed to deliver organic growth in excess of

GDP. We are confident in our ability to execute our strategy and

generate sustainable, long-term shareholder value. Our transformed

portfolio aligns Belden with key long-term secular trends that have

lengthy investment cycles. Investments in automation, reshoring,

increased connectivity, increasing bandwidth usage, and network

upgrades all bode well for Belden to produce sustainable earnings

growth. We ended 2022 with low leverage and significant liquidity,

which will allow us to invest in future organic and inorganic

growth opportunities. After record performance in 2022, we are

confident in our ability to deliver at least $8.00 of adjusted EPS

by 2025,” said Mr. Vestjens.

The table below provides guidance for both the full year 2023,

as well as the first quarter of 2023.

Full Year 2023:

- Revenues between $2.670 billion and $2.720 billion

- Organic growth between 3% and 5%

- GAAP EPS between $5.73 and $6.13

- Adjusted EPS between $6.60 and $7.00

First Quarter 2023:

- Revenues between $615 million and $630 million

- Organic growth between 3% and 6%

- GAAP EPS between $1.29 and $1.39

- Adjusted EPS between $1.50 and $1.60

Earnings Conference Call

Management will host a conference call today at 8:30 am ET to

discuss results. The listen-only audio of the conference call will

be broadcast live via the Internet at https://investor.belden.com. The dial-in number

for participants is 888-394-8218 with confirmation code 2705002. A

replay of this conference call will remain accessible in the

investor relations section of the Company’s website for a limited

time.

Net Income, Earnings per Share (EPS), Net Leverage, and

Organic Growth

All references to net income and EPS within this earnings

release refer to income from continuing operations and income from

continuing operations per diluted share attributable to Belden

stockholders, respectively. Net leverage is calculated as (A) total

debt less cash and cash equivalents divided by (B) the sum of

trailing twelve months Adjusted EBITDA plus trailing twelve months

stock-based compensation expense. Organic growth is calculated as

the change in revenues excluding the impacts of changes in currency

exchange rates and copper prices, as well as acquisitions and

divestitures.

BELDEN INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended

Twelve Months Ended

December 31, 2022

December 31, 2021

December 31, 2022

December 31, 2021

(In thousands, except per

share data)

Revenues

$

659,072

$

611,959

$

2,606,485

$

2,301,260

Cost of sales

(412,594

)

(404,030

)

(1,690,196

)

(1,529,417

)

Gross profit

246,478

207,929

916,289

771,843

Selling, general and administrative

expenses

(129,889

)

(108,485

)

(448,636

)

(378,027

)

Research and development expenses

(28,599

)

(22,117

)

(104,350

)

(90,227

)

Amortization of intangibles

(9,761

)

(7,685

)

(37,860

)

(30,630

)

Asset impairments

—

—

—

(9,283

)

Gain on sale of asset

—

—

37,891

—

Operating income

78,229

69,642

363,334

263,676

Interest expense, net

(7,984

)

(16,061

)

(43,554

)

(62,693

)

Loss on debt extinguishment

—

—

(6,392

)

(5,715

)

Non-operating pension benefit

1,709

1,355

4,005

4,476

Gain on sale of note receivable

—

27,036

—

27,036

Income from continuing operations before

taxes

71,954

81,972

317,393

226,780

Income tax expense

(10,631

)

(1,506

)

(49,645

)

(27,939

)

Income from continuing operations

61,323

80,466

267,748

198,841

Loss from discontinued operations, net of

tax

—

(132,039

)

(3,685

)

(136,384

)

Gain (loss) on disposal of discontinued

operations, net of tax

692

1,860

(9,241

)

1,860

Net income (loss)

62,015

(49,713

)

254,822

64,317

Less: Net income attributable to

noncontrolling interest

48

56

159

392

Net income (loss) attributable to Belden

stockholders

$

61,967

$

(49,769

)

$

254,663

$

63,925

Weighted average number of common shares

and equivalents:

Basic

42,819

44,927

43,845

44,802

Diluted

43,705

45,729

44,537

45,361

Basic income (loss) per share attributable

to Belden stockholders:

Continuing operations

$

1.43

$

1.79

$

6.10

$

4.43

Discontinued operations

—

(2.94

)

(0.08

)

(3.04

)

Disposal of discontinued operations

0.02

0.04

(0.21

)

0.04

Net income (loss)

$

1.45

$

(1.11

)

$

5.81

$

1.43

Diluted income (loss) per share

attributable to Belden stockholders:

Continuing operations

$

1.40

$

1.76

$

6.01

$

4.37

Discontinued operations

—

(2.94

)

(0.08

)

(3.04

)

Disposal of discontinued operations

0.02

0.04

(0.21

)

0.04

Net income (loss)

$

1.42

$

(1.11

)

$

5.72

$

1.41

Common stock dividends declared per

share

$

0.05

$

0.05

$

0.20

$

0.20

BELDEN INC.

OPERATING SEGMENT INFORMATION

(Unaudited)

Enterprise

Solutions

Industrial Automation

Solutions

Total

Segments

(In thousands, except

percentages)

For the three

months ended December 31, 2022

Segment Revenues

$

303,403

$

355,669

$

659,072

Segment EBITDA

42,699

70,436

113,135

Segment EBITDA margin

14.1

%

19.8

%

17.2

%

Depreciation expense

6,173

6,053

12,226

Amortization of intangibles

4,544

5,217

9,761

Amortization of software development

intangible assets

2

1,017

1,019

Severance, restructuring, and acquisition

integration costs

1,595

950

2,545

Adjustments related to acquisitions and

divestitures

8,684

596

9,280

For the three

months ended December 31, 2021

Segment Revenues

$

294,312

$

316,295

$

610,607

Segment EBITDA

39,806

59,662

99,468

Segment EBITDA margin

13.5

%

18.9

%

16.3

%

Depreciation expense

5,613

5,489

11,102

Amortization of intangibles

4,393

3,292

7,685

Amortization of software development

intangible assets

22

392

414

Severance, restructuring, and acquisition

integration costs

6,044

5,284

11,328

Adjustments related to acquisitions and

divestitures

—

(750

)

(750

)

For the twelve

months ended December 31, 2022

Segment Revenues

$

1,198,478

$

1,408,007

$

2,606,485

Segment EBITDA

161,517

277,079

438,596

Segment EBITDA margin

13.5

%

19.7

%

16.8

%

Depreciation expense

23,387

23,282

46,669

Amortization of intangibles

17,595

20,265

37,860

Amortization of software development

intangible assets

54

3,821

3,875

Severance, restructuring, and acquisition

integration costs

9,200

7,485

16,685

Adjustments related to acquisitions and

divestitures

5,589

2,244

7,833

For the twelve

months ended December 31, 2021

Segment Revenues

$

1,074,426

$

1,226,834

$

2,301,260

Segment EBITDA

144,509

222,684

367,193

Segment EBITDA margin

13.4

%

18.2

%

16.0

%

Depreciation expense

21,627

21,446

43,073

Amortization of intangibles

17,595

13,035

30,630

Amortization of software development

intangible assets

94

1,485

1,579

Severance, restructuring, and acquisition

integration costs

13,800

10,067

23,867

Adjustments related to acquisitions and

divestitures

(7,052

)

2,017

(5,035

)

Asset impairments

—

9,283

9,283

BELDEN INC.

OPERATING SEGMENT RECONCILIATION TO

CONSOLIDATED RESULTS

(Unaudited)

Three Months Ended

Twelve Months Ended

December 31, 2022

December 31, 2021

December 31, 2022

December 31, 2021

(In thousands)

Total Segment Revenues

$

659,072

$

610,607

$

2,606,485

$

2,301,260

Adjustments related to acquisitions

—

1,352

—

—

Consolidated Revenues

$

659,072

$

611,959

$

2,606,485

$

2,301,260

Total Segment EBITDA

$

113,135

$

99,468

$

438,596

$

367,193

Total non-operating pension benefit

1,709

1,355

4,005

4,476

Non-operating pension settlement loss

235

—

1,189

—

Eliminations

(75

)

(47

)

(231

)

(120

)

Consolidated Adjusted EBITDA (1)

115,004

100,776

443,559

371,549

Depreciation expense

(12,226

)

(11,102

)

(46,669

)

(43,073

)

Amortization of intangibles

(9,761

)

(7,685

)

(37,860

)

(30,630

)

Adjustments related to acquisitions and

divestitures

(9,280

)

750

(7,833

)

5,035

Interest expense, net

(7,984

)

(16,061

)

(43,554

)

(62,693

)

Severance, restructuring, and acquisition

integration costs

(2,545

)

(11,328

)

(16,685

)

(23,867

)

Amortization of software development

intangible assets

(1,019

)

(414

)

(3,875

)

(1,579

)

Non-operating pension settlement loss

(235

)

—

(1,189

)

—

Loss on debt extinguishment

—

—

(6,392

)

(5,715

)

Asset impairments

—

—

—

(9,283

)

Gain on sale of asset

—

—

37,891

—

Gain on sale of note receivable

—

27,036

—

27,036

Income from continuing operations before

taxes

$

71,954

$

81,972

$

317,393

$

226,780

(1)

Consolidated Adjusted EBITDA is a non-GAAP

measure. See Reconciliation of Non-GAAP Measures for additional

information.

BELDEN INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

December 31, 2022

December 31, 2021

(In thousands)

ASSETS

Current assets:

Cash and cash equivalents

$

687,676

$

641,563

Receivables, net

440,102

383,444

Inventories, net

341,563

345,203

Other current assets

66,866

58,283

Assets of discontinued operations

—

449,152

Total current assets

1,536,207

1,877,645

Property, plant and equipment, less

accumulated depreciation

381,864

343,564

Operating lease right-of-use assets

73,376

75,571

Goodwill

862,253

821,448

Intangible assets, less accumulated

amortization

246,830

238,155

Deferred income taxes

14,642

31,736

Other long-lived assets

46,503

29,558

$

3,161,675

$

3,417,677

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

350,058

$

377,765

Accrued liabilities

289,861

278,108

Liabilities of discontinued operations

—

96,993

Total current liabilities

639,919

752,866

Long-term debt

1,161,176

1,459,991

Postretirement benefits

67,828

120,997

Deferred income taxes

58,582

51,113

Long-term operating lease liabilities

59,250

61,967

Other long-term liabilities

30,970

14,661

Stockholders’ equity:

Common stock

503

503

Additional paid-in capital

825,669

833,627

Retained earnings

751,522

505,717

Accumulated other comprehensive loss

(5,871

)

(70,566

)

Treasury stock

(428,812

)

(313,994

)

Total Belden stockholders’ equity

1,143,011

955,287

Noncontrolling interests

939

795

Total stockholders’ equity

1,143,950

956,082

$

3,161,675

$

3,417,677

BELDEN INC.

CONDENSED CONSOLIDATED CASH FLOW

STATEMENTS

(Unaudited)

Twelve Months Ended

December 31, 2022

December 31, 2021

(In thousands)

Cash flows from operating activities:

Net income

$

254,822

$

64,316

Adjustments to reconcile net income to net

cash from operating activities:

Depreciation and amortization

88,738

87,988

Share-based compensation

23,676

24,871

Loss on debt extinguishment

6,392

5,715

Goodwill and other asset impairment

—

140,461

Deferred income tax expense (benefit)

(627

)

3,575

Gain on sale of asset

(37,891

)

—

Changes in operating assets and

liabilities, net of the effects of currency exchange rate changes,

acquired businesses and disposals:

Receivables

(33,605

)

(119,012

)

Inventories

5,558

(92,984

)

Accounts payable

(20,595

)

135,666

Accrued liabilities

(5,416

)

61,241

Income taxes

2,335

(6,448

)

Other assets

2,881

(12,692

)

Other liabilities

(4,972

)

(20,642

)

Net cash provided by operating

activities

281,296

272,055

Cash flows from investing activities:

Proceeds from disposal of businesses, net

of cash sold

334,574

45,735

Proceeds from disposal of tangible

assets

43,534

30,234

Purchase of intangible assets

—

(3,650

)

Cash used for acquisitions and

investments, net of cash acquired

(104,603

)

(73,340

)

Capital expenditures

(105,094

)

(90,982

)

Net cash provided by (used for)

investing activities

168,411

(92,003

)

Cash flows from financing activities:

Payments under borrowing arrangements

(230,639

)

(360,304

)

Payments under share repurchase

program

(150,000

)

—

Cash dividends paid

(8,949

)

(9,056

)

Withholding tax payments for share-based

payment awards

(7,186

)

(5,570

)

Payments under financing lease

obligations

(157

)

(3,151

)

Debt issuance costs paid

—

(8,173

)

Payments to noncontrolling interest

holders

—

(2,682

)

Proceeds from issuance of common stock

3,717

—

Borrowings under credit arrangements

—

356,010

Net cash used for financing activities

(393,214

)

(32,926

)

Effect of foreign currency exchange rate

changes on cash and cash equivalents

(12,574

)

(5,363

)

Increase in cash and cash equivalents

43,919

141,763

Cash and cash equivalents, beginning of

period

643,757

501,994

Cash and cash equivalents, end of

period

$

687,676

$

643,757

The Condensed Consolidated Cash Flow Statement includes the

results of discontinued operations up to the disposal date,

February 22, 2022.

BELDEN INC.

RECONCILIATION OF NON-GAAP

MEASURES

(Unaudited)

In addition to reporting financial results in accordance with

accounting principles generally accepted in the United States, we

provide non-GAAP operating results adjusted for certain items,

including: asset impairments; accelerated depreciation expense due

to plant consolidation activities; purchase accounting effects

related to acquisitions, such as the adjustment of acquired

inventory and deferred revenue to fair value and transaction costs;

severance, restructuring, and acquisition integration costs; gains

(losses) recognized on the disposal of businesses and tangible

assets; amortization of intangible assets; gains (losses) on debt

extinguishment; certain revenues and gains (losses) from patent

settlements; discontinued operations; and other costs. We adjust

for the items listed above in all periods presented, unless the

impact is clearly immaterial to our financial statements. When we

calculate the tax effect of the adjustments, we include all current

and deferred income tax expense commensurate with the adjusted

measure of pre-tax profitability.

We utilize the adjusted results to review our ongoing operations

without the effect of these adjustments and for comparison to

budgeted operating results. We believe the adjusted results are

useful to investors because they help them compare our results to

previous periods and provide important insights into underlying

trends in the business and how management oversees our business

operations on a day-to-day basis. As an example, we adjust for the

purchase accounting effect of recording deferred revenue at fair

value in order to reflect the revenues that would have otherwise

been recorded by acquired businesses had they remained as

independent entities. We believe this presentation is useful in

evaluating the underlying performance of acquired companies.

Similarly, we adjust for other acquisition-related expenses, such

as amortization of intangibles and other impacts of fair value

adjustments because they generally are not related to the acquired

business' core business performance. As an additional example, we

exclude the costs of restructuring programs, which can occur from

time to time for our current businesses and/or recently acquired

businesses. We exclude the costs in calculating adjusted results to

allow us and investors to evaluate the performance of the business

based upon its expected ongoing operating structure. We believe the

adjusted measures, accompanied by the disclosure of the costs of

these programs, provides valuable insight.

Adjusted results should be considered only in conjunction with

results reported according to accounting principles generally

accepted in the United States.

Three Months Ended

Twelve Months Ended

December 31, 2022

December 31, 2021

December 31, 2022

December 31, 2021

(In thousands, except

percentages and per share amounts)

GAAP revenues

$

659,072

$

611,959

$

2,606,485

$

2,301,260

Adjustments related to acquisitions

—

(1,352

)

—

—

Adjusted revenues

$

659,072

$

610,607

$

2,606,485

$

2,301,260

GAAP gross profit

$

246,478

$

207,929

$

916,289

$

771,843

Severance, restructuring, and acquisition

integration costs

1,317

7,002

10,088

11,308

Amortization of software development

intangible assets

1,019

414

3,875

1,579

Adjustments related to acquisitions and

divestitures

—

(1,352

)

1,648

2,349

Adjusted gross profit

$

248,814

$

213,993

$

931,900

$

787,079

GAAP gross profit margin

37.4

%

34.0

%

35.2

%

33.5

%

Adjusted gross profit margin

37.8

%

35.0

%

35.8

%

34.2

%

GAAP selling, general and administrative

expenses

$

(129,890

)

$

(108,485

)

$

(448,637

)

$

(378,027

)

Severance, restructuring, and acquisition

integration costs

1,228

4,326

6,597

12,559

Adjustments related to acquisitions and

divestitures

9,280

602

7,833

(7,384

)

Adjusted selling, general and

administrative expenses

$

(119,382

)

$

(103,557

)

$

(434,207

)

$

(372,852

)

GAAP and adjusted research and development

expenses

$

(28,599

)

$

(22,117

)

$

(104,350

)

$

(90,227

)

GAAP income from continuing operations

$

61,323

$

80,466

$

267,748

$

198,841

Interest expense, net

7,984

16,061

43,554

62,693

Income tax expense

10,631

1,506

49,645

27,939

Loss on debt extinguishment

—

—

6,392

5,715

Non-operating pension settlement loss

235

—

1,189

—

Gain on sale of note receivable

—

(27,036

)

—

(27,036

)

Total non-operating adjustments

18,850

(9,469

)

100,780

69,311

Asset impairments

—

—

—

9,283

Severance, restructuring, and acquisition

integration costs

2,545

11,328

16,685

23,867

Amortization of intangible assets

9,761

7,685

37,860

30,630

Amortization of software development

intangible assets

1,019

414

3,875

1,579

Adjustments related to acquisitions and

divestitures

9,280

(750

)

7,833

(5,035

)

Gain on sale of asset

—

—

(37,891

)

—

Total operating income adjustments

22,605

18,677

28,362

60,324

Depreciation expense

12,226

11,102

46,669

43,073

Adjusted EBITDA

$

115,004

$

100,776

$

443,559

$

371,549

GAAP income from continuing operations

margin

9.3

%

13.1

%

10.3

%

8.6

%

Adjusted EBITDA margin

17.4

%

16.5

%

17.0

%

16.1

%

GAAP income from continuing operations

$

61,323

$

80,466

$

267,748

$

198,841

Less: Net income attributable to

noncontrolling interest

48

56

159

392

GAAP net income from continuing operations

attributable to Belden

stockholders

$

61,275

$

80,410

$

267,589

$

198,449

GAAP income from continuing operations

$

61,323

$

80,466

$

267,748

$

198,841

Plus: Operating income adjustments from

above

22,605

18,677

28,362

60,324

Plus: Loss on debt extinguishment

—

—

6,392

5,715

Plus: Non-operating pension settlement

loss

235

—

1,189

—

Less: Gain on sale of note receivable

—

27,036

—

27,036

Less: Net income attributable to

noncontrolling interest

48

56

159

392

Less: Tax effect of adjustments above

7,809

12,595

18,169

21,957

Adjusted net income from continuing

operations attributable to Belden

stockholders

$

76,306

$

59,456

$

285,363

$

215,495

GAAP income from continuing operations per

diluted share attributable to

Belden stockholders (EPS)

$

1.40

$

1.76

$

6.01

$

4.37

Adjusted income from continuing operations

per diluted share attributable to Belden stockholders (Adjusted

EPS)

$

1.75

$

1.30

$

6.41

$

4.75

GAAP and adjusted diluted weighted average

shares

43,705

45,729

44,537

45,361

BELDEN INC.

RECONCILIATION OF NON-GAAP

MEASURES

(Unaudited)

We define free cash flow, which is a non-GAAP financial measure,

as net cash from operating activities adjusted for capital

expenditures net of the proceeds from the disposal of tangible

assets. We believe free cash flow provides useful information to

investors regarding our ability to generate cash from business

operations that is available for acquisitions and other

investments, service of debt principal, dividends and share

repurchases. We use free cash flow, as defined, as one financial

measure to monitor and evaluate performance and liquidity. Non-GAAP

financial measures should be considered only in conjunction with

financial measures reported according to accounting principles

generally accepted in the United States. Our definition of free

cash flow may differ from definitions used by other companies.

Three Months Ended

Twelve Months Ended

December 31, 2022

December 31, 2021

December 31, 2022

December 31, 2021

(In thousands)

GAAP net cash provided by operating

activities

$

202,496

$

170,136

$

281,296

$

272,055

Capital expenditures

(54,844

)

(35,413

)

(105,094

)

(90,982

)

Proceeds from disposal of assets

—

26,985

43,534

30,234

Non-GAAP free cash flow

$

147,652

$

161,708

$

219,736

$

211,307

BELDEN INC.

RECONCILIATION OF NON-GAAP

MEASURES

2023 Guidance

Year Ended

Three Months Ended

December 31, 2023

April 2, 2023

(In thousands)

GAAP income from continuing operations per

diluted share attributable to Belden common stockholders

$5.73 - $6.13

$1.29 - $1.39

Amortization of intangible assets

0.69

0.18

Severance, restructuring, and acquisition

integration costs

0.16

0.02

Adjustments related to acquisitions and

divestitures

0.02

0.01

Adjusted income from continuing operations

per diluted share attributable to Belden common stockholders

$6.60 - $7.00

$1.50 - $1.60

Our guidance is based upon information currently available

regarding events and conditions that will impact our future

operating results. In particular, our results are subject to the

factors listed under "Forward-Looking Statements" in this release.

In addition, our actual results are likely to be impacted by other

additional events for which information is not available, such as

asset impairments, adjustments related to acquisitions and

divestitures, severance, restructuring, and acquisition integration

costs, gains (losses) recognized on the disposal of assets, gains

(losses) on debt extinguishment, discontinued operations, and other

gains (losses) related to events or conditions that are not yet

known. Such information is not available for our 2025 fiscal year,

and therefore we are unable to estimate 2025 GAAP income from

continuing operations per diluted share attributable to Belden

common stockholders.

Forward-Looking Statements

This release contains, and any statements made by us concerning

the subject matter of this release contain, forward-looking

statements, including our expectations for the first quarter and

full year 2023 and adjusted EPS for 2025. Forward-looking

statements also include any statements regarding future financial

performance (including revenues, growth, expenses, earnings,

margins, cash flows, dividends, capital expenditures and financial

condition), plans and objectives, and related assumptions. In some

cases these statements are identifiable through the use of words

such as “anticipate,” “believe,” “estimate,” “forecast,” “guide,”

“expect,” “intend,” “plan,” “project,” “target,” “can,” “could,”

“may,” “should,” “will,” “would” and similar expressions.

Forward-looking statements reflect management’s current beliefs and

expectations and are not guarantees of future performance. Actual

results may differ materially from those suggested by any

forward-looking statements for a number of reasons, including,

without limitation: the impact of disruptions in the global supply

chain, including the inability to obtain raw materials and

components in sufficient quantities on commercially reasonable

terms; the lack of certainty as to the duration and magnitude of

the impact of COVID-19 and the economic recovery from that impact;

foreign and domestic political, economic and other uncertainties,

including changes in currency exchange rates; the impact of a

challenging global economy or a downturn in served markets; the

inability to successfully complete and integrate acquisitions in

furtherance of the Company’s strategic plan; difficulty in

forecasting revenue due to the unpredictable timing of orders

related to customer projects as well as the impacts of channel

inventory; inflation and changes in the price and availability of

raw materials leading to higher input and labor costs; the

inability to execute and realize the expected benefits from

strategic initiatives (including revenue growth, cost control, and

productivity improvement programs); the inability to retain key

employees; the increased influence of chief information officers on

purchasing decisions; disruptions in the Company’s information

systems including due to cyber-attacks leading to exposures of

personally identifiable information; changes in tax laws and

variability in the Company’s quarterly and annual effective tax

rates; the competitiveness of the global markets in which we

operate; the presence of substitute products in the marketplace;

the increased prevalence of cloud computing; the inability of the

Company to develop and introduce new products and competitive

responses to our products; the inability to achieve our strategic

priorities in emerging markets; the impact of changes in global

tariffs and trade agreements; volatility in credit and foreign

exchange markets; the presence of activists proposing certain

actions by the Company; perceived or actual product failures; risks

related to the use of open source software; disruption of, or

changes in, the Company’s key distribution channels; assertions

that the Company violates the intellectual property of others and

the ownership of intellectual property by competitors and others

that prevents the use of that intellectual property by the Company;

the impact of regulatory requirements and other legal compliance

issues; the impairment of goodwill and other intangible assets and

the resulting impact on financial performance; disruptions and

increased costs attendant to collective bargaining groups and other

labor matters; and other factors.

For a more complete discussion of risk factors, please see our

Annual Report on Form 10-K for the period ended December 31, 2021,

filed with the SEC on February 15, 2022. Although the content of

this release represents our best judgment as of the date of this

report based on information currently available and reasonable

assumptions, we give no assurances that the expectations will prove

to be accurate. Deviations from the expectations may be material.

For these reasons, Belden cautions readers to not place undue

reliance on these forward-looking statements, which speak only as

of the date made. Belden disclaims any duty to update any

forward-looking statements as a result of new information, future

developments, or otherwise, except as required by law.

About Belden

Belden Inc. delivers the infrastructure that makes the digital

journey simpler, smarter and secure. We’re moving beyond

connectivity, from what we make to what we make possible through a

performance-driven portfolio, forward-thinking expertise and

purpose-built solutions. With a legacy of quality and reliability

spanning 120-plus years, we have a strong foundation to continue

building the future. We are headquartered in St. Louis and have

manufacturing capabilities in North America, Europe, Asia, and

Africa. For more information, visit us at www.belden.com; follow us

on Facebook, LinkedIn and Twitter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230208005174/en/

Belden Investor Relations Aaron Reddington, CFA

(317) 219-9359 Investor.Relations@Belden.com

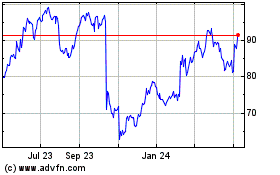

Belden (NYSE:BDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Belden (NYSE:BDC)

Historical Stock Chart

From Apr 2023 to Apr 2024