Current Report Filing (8-k)

May 31 2022 - 9:21AM

Edgar (US Regulatory)

6.244% Fixed-to-Floating Rate Normal Preferred Capital Securities of Mellon Capital IV (fully and unconditionally guaranteed by The Bank of New York false 0001390777 0001390777 2022-05-31 2022-05-31 0001390777 us-gaap:CommonStockMember 2022-05-31 2022-05-31 0001390777 us-gaap:PreferredStockMember 2022-05-31 2022-05-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 31, 2022

THE BANK OF NEW YORK MELLON CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35651 |

|

13-2614959 |

(State or other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 240 Greenwich Street New York, New York |

|

10286 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 495-1784

Not Applicable

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

BK |

|

New York Stock Exchange |

| 6.244% Fixed-to-Floating Rate Normal Preferred Capital Securities of Mellon Capital IV (fully and unconditionally guaranteed by The Bank of New York Mellon Corporation) |

|

BK/P |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On May 31, 2022, The Bank of New York Mellon Corporation (the “Company”) and Franklin Resources, Inc. (“Franklin Templeton”) announced that they have entered into a definitive agreement, pursuant to which Franklin Templeton will acquire BNY Alcentra Group Holdings, Inc. (together with its subsidiaries, “Alcentra”) from the Company. The transaction is expected to be completed early in the first calendar quarter of 2023, subject to customary closing conditions, including certain regulatory approvals. Franklin Templeton will pay $350 million in cash at close and up to a further $350 million in contingent consideration dependent on the achievement of certain performance thresholds over the next four years. In addition, Franklin Templeton has committed to purchase all seed capital investments from the Company related to Alcentra which, as of March 31, 2022, were valued at approximately $305 million. The seed capital investments will be valued at the time of close to determine the final seed capital purchase amount. At close, the Company expects the transaction to increase its Common Equity Tier 1 capital by approximately $0.5 billion.

The information presented in this Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, which may be expressed in a variety of ways, including the use of future or present tense language, relate to Franklin Templeton’s acquisition of Alcentra from the Company, including the expected timing of the closing of such acquisition and the expected increase to the Company’s Common Equity Tier 1 capital. These statements are based upon current beliefs and expectations and are subject to significant risks and uncertainties (some of which are beyond the Company’s control). Actual outcomes may differ materially from those expressed or implied as a result of risks and uncertainties, including, but not limited to: (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the acquisition agreement, (ii) the risks related to the satisfaction of the conditions to closing the transaction (including the failure to obtain necessary regulatory and client approvals) and (iii) not satisfying, in whole or in part, the performance thresholds for the contingent consideration. In addition, actual results are subject to other risks and uncertainties set forth in the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2021, the Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 and the Company’s other filings with the Securities and Exchange Commission. All statements in this Current Report on Form 8-K speak only as of the date of this filing and the Company undertakes no obligation to update the information to reflect events or circumstances that arise after that date or to reflect the occurrence of unanticipated events, except as required by federal securities laws.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

The Bank of New York Mellon Corporation (Registrant) |

|

|

|

|

| Date: May 31, 2022 |

|

|

|

By: |

|

/s/ James J. Killerlane III |

|

|

|

|

Name: James J. Killerlane III |

|

|

|

|

Title: Secretary |

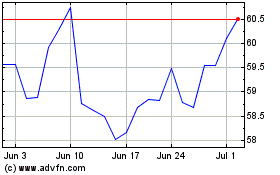

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Aug 2024 to Sep 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Sep 2023 to Sep 2024