Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

March 01 2023 - 6:42AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of March, 2023

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its

charter)

Ciudad Grupo

Santander

28660 Boadilla

del Monte (Madrid) Spain

(Address of principal

executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Banco Santander,

S.A.

TABLE OF CONTENTS

Item |

|

| |

|

| 1

|

Press Release dated March 1, 2023 |

Item

1

|

Banco Santander, S.A., in compliance with

the Mexican and U.S. securities legislation, hereby communicates the following:

MATERIAL INFORMATION

|

|

Banco Santander, S.A. (“Banco Santander”),

following its announcement dated February 7, 2023, announces that the expiration date of the Tender Offers (as defined below) has been

extended until April 10, 2023, as further described below.

|

| On February 7, 2023, Banco Santander announced the commencement of concurrent cash tender offers in Mexico (the “Mexican Offer”) and the United States (the “U.S. Offer” and, together with the Mexican Offer, the “Tender Offers”) to acquire all of the issued and outstanding (i) Series B shares (the “Series B Shares”) of Banco Santander México, S.A., Institución de Banca Múltiple, Grupo Financiero Santander México (“Santander Mexico”) and (ii) American Depositary Shares (each of which represents five Series B Shares) of Santander Mexico (the “ADSs” and jointly with the Series B Shares, the “Shares”), in each case other than any Series B Shares or ADSs owned, directly or indirectly, by Banco Santander, and which collectively amount to approximately 3.76% of Santander Mexico’s outstanding share capital. In addition, Banco Santander announced that following the Tender Offers, Banco Santander intends to (a) deregister the Series B Shares from the Mexican National Securities Registry of the Mexican National Banking and Securities Commission and delist such Series B Shares from the Mexican Stock Exchange, and (b) remove the ADSs from listing on the New York Stock Exchange and the Series B Shares and ADSs from registration with the U.S. Securities and Exchange Commission. The U.S. Offer is subject to the terms and conditions set forth in the U.S. Offer to Purchase filed with the SEC and the Mexican Offer is subject to the terms and conditions set forth in the informative memorandum (folleto informativo), in each case, as amended from time to time. |

| |

| In connection with the foregoing, Banco Santander announces its decision to extend the expiration date of (i) the Mexican Offer until 2:00 p.m., Mexico City time, on April 10, 2023, and (ii) the U.S. Offer until 5:00 p.m., New York City time, on April 10, 2023; in each case, unless further extended or earlier terminated. Except for the foregoing, all the terms of the Tender Offers will remain unchanged. |

| |

| The Tender Offers commenced on February 7, 2023. The U.S. Offer was previously scheduled to expire at 5:00 p.m., New York City time, on March 8, 2023 and the Mexican Offer was previously scheduled to expire at 2:00 p.m., Mexico City time, on March 8, 2023. |

| |

| This extension gives holders of Shares additional time to complete and return the transmittal documentation and to give instructions to their brokers or other securities intermediaries to tender their Shares into the Tender Offers. |

| |

|

Casa de Bolsa Santander, S.A. de C.V., which is

acting as intermediary (intermediario) in connection with the Series B Shares, and Citibank, N.A., which is acting as tender agent

in the U.S. Offer, have advised us that, as of 5:00 p.m., New York City time, on February 28, 2023, approximately 143,720 Shares had been

validly tendered and not properly withdrawn pursuant to the Tender Offers (representing approximately 0.056% of the outstanding Series

B Shares, including Series B Shares represented by ADSs, that Banco Santander or its affiliates do not already own).

|

| Consummation of the Offers is subject to certain conditions, including the absence of any material adverse change in the financial condition, results of operations or prospects of Santander Mexico. |

| |

| Boadilla del Monte (Madrid), March 1, 2023 |

|

IMPORTANT INFORMATION FOR INVESTORS ABOUT THE

PROPOSED TRANSACTION

|

| INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE TENDER OFFER STATEMENT, U.S. OFFER TO PURCHASE, THE TRANSACTION STATEMENT ON SCHEDULE 13E-3, SOLICITATION /RECOMMENDATION STATEMENT AND ALL OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AND THE CNBV REGARDING THE TENDER OFFERS CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TENDER OFFERS AS THEY CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFERS. |

| |

| Such documents,

and other documents filed by Banco Santander and Santander Mexico, may be obtained without charge at the SEC’s website at www.sec.gov

and through the CNBV´s website at www.cnbv.gob.mx. The U.S. offer to purchase and related materials may also be

obtained for free by contacting the information agent for the Tender Offers. |

| |

| This communication shall not constitute a tender offer in any country or jurisdiction in which such offer would be considered unlawful or otherwise violate any applicable laws or regulations, or which would require Banco Santander or any of its affiliates to change or amend the terms or conditions of such offer in any manner, to make any additional filing with any governmental or regulatory authority or take any additional action in relation to such offer. |

| |

|

Forward-Looking Statements

This communication contains forward-looking statements

which reflect management’s current views and estimates regarding the abilities of the parties to complete the Tender Offers and

the expected timing of completion of the Tender Offers, among other matters. All statements other than statements of historical fact are

statements that could be deemed forward-looking statements, including all statements regarding the intent, belief or current expectation

of the parties and members of their senior management team. Forward-looking statements include, without limitation, statements regarding

the Tender Offers and related matters; prospective performance and opportunities; post-closing operations; the outlook for the business;

filings and approvals relating to the Tender Offers; the expected timing of the completion of the Tender Offers; the ability to complete

the Tender Offers considering the various conditions; and any assumptions underlying any of the foregoing. Investors are cautioned that

any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and are cautioned not

to place undue reliance on these forward-looking statements.

A number of risks, uncertainties and other

important factors may cause actual developments and results to differ materially from Banco Santander’s or Santander Mexico’s

expectations. Risks and uncertainties include, among other things, risks related to the Tender Offers, including uncertainties as

to the timing of the Tender Offer; the possibility of business disruptions due to transaction-related uncertainty; uncertainties

as to the availability of certain statutory relief under the U.S. securities laws; how many of Santander Mexico shareholders will

tender their shares in the Tender Offers; general economic or industry conditions of areas where Banco Santander or Santander Mexico

have significant operations or investments (such as a worse economic environment, higher volatility in the capital markets, inflation

or deflation, changes in demographics, consumer spending, investment or saving habits, and the effects of the war in Ukraine or the

COVID-19 pandemic in the global economy); exposure to various market risks (particularly interest rate risk, foreign exchange rate

risk, equity price risk and risks associated with the replacement of benchmark indices); potential losses from early repayments on

loan and investment portfolios, declines in value of collateral securing loan portfolios, and counterparty risk; political stability

in Spain, the United Kingdom, other European countries, Latin America and the US; changes in legislation, regulations, taxes, including

regulatory capital and liquidity requirements, especially in view of the UK exit of the European Union and increased regulation in

response to financial crises; the ability to integrate successfully acquisitions and related challenges that result from the inherent

diversion of management’s focus and resources from other strategic opportunities and operational matters; and changes in access

to liquidity and funding on acceptable terms, in particular if resulting from credit spreads shifts or downgrade in credit ratings;

and other risks and uncertainties discussed in (i) Santander Mexico’s filings with the SEC, including the “Risk Factors”

and “Special Note Regarding Forward-Looking Statements” sections of Santander Mexico’s most recent annual report

on Form 20-F and subsequent 6-Ks filed with, or furnished to, the SEC and (ii) Banco Santander’s filings with the SEC,

including the “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” sections of

Banco Santander’s most recent annual report on Form 20-F and subsequent 6-Ks filed with, or furnished to, the SEC. You

can obtain copies of Banco Santander’s and Santander Mexico’s filings with the SEC for free at the SEC’s website

(www.sec.gov). Other factors that may cause actual results to differ materially include those set forth in the Tender Offer

Statement on Schedule TO, the Transaction Statement on Schedule 13E-3, the Solicitation/Recommendation Statement on Schedule 14D-9 and

other documents related to the Tender Offers filed with the SEC by Banco Santander and/or Santander Mexico from time to time. All

forward-looking statements are based on information currently available and the parties assume no obligation and disclaim any intent

to update any such forward-looking statements.

|

| Numerous factors could affect our future results and could cause those results deviating from those anticipated in the forward-looking statements. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. Our forward-looking statements speak only as at date of this communication and are informed by the knowledge, information and views available as at the date of this communication. Banco Santander is not required to update or revise any forward-looking statements, regardless of new information, future events or otherwise. |

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

Banco Santander, S.A. |

| |

|

|

| |

|

|

| Date: |

March 1, 2023 |

|

By: |

/s/ Javier Illescas |

| |

|

|

|

Name: |

Javier Illescas |

| |

|

|

|

Title: |

Group Executive Vice President |

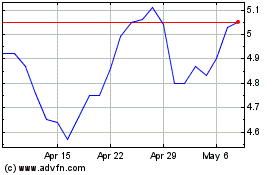

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

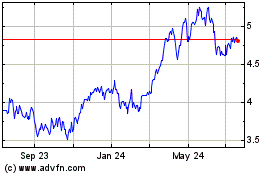

Banco Santander (NYSE:SAN)

Historical Stock Chart

From Jul 2023 to Jul 2024