— Cash Provided by Operating Activities of

$405 Million —

— Repurchased $150 Million of Common Stock

—

Arrow Electronics, Inc. (NYSE:ARW) today reported second-quarter

2019 sales of $7.34 billion, a decrease of 1 percent from sales of

$7.39 billion in the second quarter of 2018. Second-quarter sales,

as adjusted, increased 2 percent year over year. The company

reported a second-quarter net loss of $549 million, or $(6.48) per

share on a diluted basis, compared with net income of $170 million,

or $1.92 per share on a diluted basis, in the second quarter of

2018. Excluding certain items1, net income would have been $137

million, or $1.60 per share on a diluted basis, in the second

quarter of 2019, compared with net income of $194 million, or $2.19

per share on a diluted basis, in the second quarter of 2018. In the

second quarter of 2019, changes in foreign currencies negatively

impacted growth by approximately $148 million or 2 percent on sales

and $.06 or 2 percent on earnings per share on a diluted basis

compared to the second quarter of 2018.

Global components second-quarter sales of $5.27 billion were

flat year over year. Sales, as adjusted, increased 2 percent year

over year. Europe components sales decreased 2 percent year over

year. Sales in the region, as adjusted, increased 4 percent year

over year. Asia-Pacific components sales increased 4 percent year

over year. Americas components sales decreased 3 percent year over

year. Global components second-quarter operating loss was $562

million. Second-quarter operating income, excluding amortization of

intangibles expense, as adjusted, was $207 million.

“Despite facing challenging market conditions in the second

quarter, and an ongoing inventory correction, we are encouraged by

the significant progress we continue to make in executing our

long-term strategy,” said Michael J. Long, chairman, president, and

chief executive officer. “We are leveraging our integrated

solutions and expanded reach to drive innovation forward for our

customers, and remain committed to continuing to expand engineering

services and lead the convergence of information technology with

operational technology. We are confident that the steps we are

taking today to strengthen our focus on the key technology areas of

smart cities, smart homes, and smart connected vehicles, will not

only enhance shareholder value, but also improve people's

lives.”

Global enterprise computing solutions second-quarter sales of

$2.07 billion decreased 2 percent year over year. Sales, as

adjusted, increased 1 percent year over year. Europe enterprise

computing solutions sales decreased 3 percent year over year. Sales

in the region, as adjusted, increased 5 percent year over year.

Americas enterprise computing solutions sales decreased 1 percent

year over year. Sales in the region, as adjusted, were flat year

over year. Global enterprise computing solutions second-quarter

operating income was $98 million. Second-quarter operating income,

excluding amortization of intangibles expense, as adjusted, totaled

$101 million.

“Arrow is committed to capitalizing on opportunities available

to us, and to that end, we continue to align and evolve our

enterprise computing solutions business toward advanced,

higher-value software-led solutions,” said Mr. Long. “We are

pleased that our infrastructure software and security solutions

again produced healthy growth on a year-over-year basis in the

second quarter.”

“Second-quarter cash provided by operating activities was $405

million. As we advance our efforts to reduce working capital and

use our strong, countercyclical cash flow to position the company

for long-term profit acceleration when market conditions improve,

we also remain focused on preserving near-term profitability. We

have commenced our previously announced cost optimization program,

and are executing on our plan to drive efficiencies while

generating approximately $130 million in annualized cost savings,”

said Chris Stansbury, senior vice president and chief financial

officer. “We remain committed to returning excess cash to

shareholders. Consistent with this commitment, we returned

approximately $150 million to shareholders through our stock

repurchase program during the second quarter. At the end of the

quarter, we had approximately $539 million of remaining

authorization under our share repurchase program.”

1 A reconciliation of non-GAAP adjusted financial measures,

including sales, as adjusted, operating income, as adjusted, net

income attributable to shareholders, as adjusted, and net income

per share, as adjusted, to GAAP financial measures is presented in

the reconciliation tables included herein.

GUIDANCE

“Our third-quarter outlook excludes the financial results from

the PC and mobility asset disposition business. As we look to the

third quarter, we expect total sales to range between $6.850

billion and $7.250 billion, with global components sales between

$4.925 billion and $5.125 billion, and global enterprise computing

solutions sales between $1.925 billion and $2.125 billion. As a

result of this outlook, we expect earnings per share on a diluted

basis to range from $.97 to $1.09, and earnings per share on a

diluted basis, excluding certain items1, to range from $1.62 to

$1.74 per share. Our guidance assumes interest expense will total

approximately $54 million. Our guidance also assumes an average tax

rate at the high end of the long-term range of 23.5 percent to 25.5

percent, and average diluted shares outstanding of approximately 85

million. We are expecting the average USD-to-Euro exchange rate for

the third quarter to be approximately $1.12 to €1. We estimate

changes in foreign currencies will have a negative impact on growth

of approximately $90 million, or 1 percent on sales, and $.05, or 2

percent, on earnings per share on a diluted basis compared to the

third quarter of 2018,” said Mr. Stansbury.

Please refer to the CFO commentary, which can be found at

investor.arrow.com, as a supplement to the company’s earnings

release.

Arrow Electronics guides innovation forward for over 200,000

leading technology manufacturers and service providers. With 2018

sales of $30 billion, Arrow develops technology solutions that

improve business and daily life. Learn more at

fiveyearsout.com.

Information Relating to Forward-Looking

Statements

This press release includes forward-looking statements that are

subject to numerous assumptions, risks, and uncertainties, which

could cause actual results or facts to differ materially from such

statements for a variety of reasons, including, but not limited to:

industry conditions, the company's implementation of its new

enterprise resource planning system, changes in product supply,

pricing and customer demand, competition, other vagaries in the

global components and global enterprise computing solutions

markets, changes in relationships with key suppliers, increased

profit margin pressure, the effects of additional actions taken to

become more efficient or lower costs, risks related to the

integration of acquired businesses, changes in legal and regulatory

matters, and the company’s ability to generate additional cash

flow. Forward-looking statements are those statements which are not

statements of historical fact. These forward-looking statements can

be identified by forward-looking words such as "expects,"

"anticipates," "intends," "plans," "may," "will," "believes,"

"seeks," "estimates," and similar expressions. Shareholders and

other readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date on

which they are made. The company undertakes no obligation to update

publicly or revise any of the forward-looking statements.

For a further discussion of factors to consider in connection

with these forward-looking statements, investors should refer to

Item 1A Risk Factors of the company’s Annual Report on Form 10-K

for the year ended Dec. 31, 2018.

Certain Non-GAAP Financial

Information

In addition to disclosing financial results that are determined

in accordance with accounting principles generally accepted in the

United States (“GAAP”), the company also provides certain non-GAAP

financial information relating to sales, operating income, net

income attributable to shareholders, and net income per basic and

diluted share.

The company provides sales, gross profit, and operating expense

on a non-GAAP basis adjusted for the impact of changes in foreign

currencies (referred to as “impact of changes in foreign

currencies”) by re-translating prior period results at current

period foreign exchange rates, the impact of dispositions by

adjusting the company’s operating results for businesses disposed,

as if the dispositions had occurred at the beginning of the

earliest period presented (referred to as “impact of

dispositions”), the impact of the company's personal computer and

mobility asset disposition business (referred to as "impact of wind

down"), the impact of inventory reserves related to the digital

business (referred to as "impact of digital inventory reserve"),

and the impact of the notes receivable and inventory reserve

related to the AFS business (referred to as "AFS notes receivable

reserve" and "AFS inventory reserve," respectively). Operating

income is adjusted to exclude identifiable intangible asset

amortization, restructuring, integration, and other charges, and

loss on disposition of businesses, net, AFS notes receivable and

inventory reserve, digital inventory reserve, the impact of

non-cash charges related to goodwill, tradenames, and property,

plant and equipment, and the impact of wind down. Net income

attributable to shareholders, and net income per basic and diluted

share are adjusted to exclude identifiable intangible asset

amortization, restructuring, integration, and other charges, and

loss on disposition of businesses, net, AFS notes receivable and

inventory reserve, digital inventory reserve, the impact of

non-cash charges related to goodwill, tradenames, and property,

plant and equipment, the impact of wind down, and the impact of

U.S. tax reform. A reconciliation of the company’s non-GAAP

financial information to GAAP is set forth in the tables below.

The company believes that such non-GAAP financial information is

useful to investors to assist in assessing and understanding the

company’s operating performance and underlying trends in the

company’s business because management considers these items

referred to above to be outside the company’s core operating

results. This non-GAAP financial information is among the primary

indicators management uses as a basis for evaluating the company’s

financial and operating performance. In addition, the company’s

Board of Directors may use this non-GAAP financial information in

evaluating management performance and setting management

compensation.

The presentation of this additional non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for, or alternative to, sales, operating income, net

income and net income per basic and diluted share determined in

accordance with GAAP. Analysis of results and outlook on a non-GAAP

basis should be used as a complement to, and in conjunction with,

data presented in accordance with GAAP.

ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands except per share

data)

(Unaudited)

Quarter Ended

Six Months Ended

June 29, 2019

June 30, 2018

June 29, 2019

June 30, 2018

Sales

$

7,344,548

$

7,392,528

$

14,500,539

$

14,268,141

Cost of sales

6,529,639

6,459,708

12,823,942

12,466,377

Gross profit

814,909

932,820

1,676,597

1,801,764

Operating expenses:

Selling, general, and administrative

expenses

599,212

580,388

1,155,288

1,143,357

Depreciation and amortization

46,982

46,422

94,508

93,669

Loss on disposition of businesses, net

—

—

866

1,562

Impairments

697,993

—

697,993

—

Restructuring, integration, and other

charges

19,912

19,183

31,572

40,354

1,364,099

645,993

1,980,227

1,278,942

Operating income (loss)

(549,190

)

286,827

(303,630

)

522,822

Equity in earnings (losses) of affiliated

companies

382

517

(1,085

)

(156

)

Gain (loss) on investments, net

1,390

(2,563

)

6,738

(5,015

)

Employee benefit plan expense

1,139

1,257

2,278

2,488

Interest and other financing expense,

net

51,563

60,803

103,544

105,982

Income (loss) before income taxes

(600,120

)

222,721

(403,799

)

409,181

Provision (benefit) for income taxes

(52,369

)

51,681

1,538

98,271

Consolidated net income (loss)

(547,751

)

171,040

(405,337

)

310,910

Noncontrolling interests

1,215

1,125

2,894

1,901

Net income (loss) attributable to

shareholders

$

(548,966

)

$

169,915

$

(408,231

)

$

309,009

Net income (loss) per share:

Basic

$

(6.48

)

$

1.94

$

(4.80

)

$

3.52

Diluted

$

(6.48

)

$

1.92

$

(4.80

)

$

3.48

Weighted-average shares outstanding:

Basic

84,652

87,802

85,022

87,878

Diluted

84,652

88,652

85,022

88,841

ARROW ELECTRONICS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands except par

value)

(Unaudited)

June 29, 2019

December 31, 2018

ASSETS

Current assets:

Cash and cash equivalents

$

269,989

$

509,327

Accounts receivable, net

7,976,603

8,945,463

Inventories

3,596,613

3,878,678

Other current assets

267,151

274,832

Total current assets

12,110,356

13,608,300

Property, plant, and equipment, at

cost:

Land

7,873

7,882

Buildings and improvements

156,124

158,712

Machinery and equipment

1,443,901

1,425,933

1,607,898

1,592,527

Less: Accumulated depreciation and

amortization

(793,981

)

(767,827

)

Property, plant, and equipment, net

813,917

824,700

Investments in affiliated companies

86,157

83,693

Intangible assets, net

290,236

372,644

Goodwill

2,067,499

2,624,690

Other assets

656,204

270,418

Total assets

$

16,024,369

$

17,784,445

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

6,245,068

$

7,631,879

Accrued expenses

853,735

912,292

Short-term borrowings, including current

portion of long-term debt

279,158

246,257

Total current liabilities

7,377,961

8,790,428

Long-term debt

3,157,274

3,239,115

Other liabilities

666,419

378,536

Commitments and contingencies

Equity:

Shareholders’ equity:

Common stock, par value $1:

Authorized - 160,000 shares in both 2019

and 2018, respectively

Issued - 125,424 shares in both 2019 and

2018, respectively

125,424

125,424

Capital in excess of par value

1,136,649

1,135,934

Treasury stock (42,283 and 40,233 shares

in 2019 and 2018, respectively), at cost

(2,139,743

)

(1,972,254

)

Retained earnings

5,927,104

6,335,335

Accumulated other comprehensive loss

(280,709

)

(299,449

)

Total shareholders’ equity

4,768,725

5,324,990

Noncontrolling interests

53,990

51,376

Total equity

4,822,715

5,376,366

Total liabilities and equity

$

16,024,369

$

17,784,445

ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In thousands)

(Unaudited)

Quarter Ended

June 29, 2019

June 30, 2018

Cash flows from operating activities:

Consolidated net income (loss)

$

(547,751

)

$

171,040

Adjustments to reconcile consolidated net

income (loss) to net cash provided by (used for) operations:

Depreciation and amortization

46,982

46,422

Amortization of stock-based

compensation

8,539

12,619

Equity in losses of affiliated

companies

(382

)

(517

)

Deferred income taxes

(78,814

)

15,524

Impairments

697,993

—

(Gain) loss on investments, net

(1,390

)

2,563

Other

6,381

2,140

Change in assets and liabilities, net of

effects of acquired and disposed businesses:

Accounts receivable

(54,436

)

(863,490

)

Inventories

143,740

(239,297

)

Accounts payable

193,832

451,093

Accrued expenses

(21,102

)

21,571

Other assets and liabilities

11,826

(29,440

)

Net cash provided by (used for) operating

activities

405,418

(409,772

)

Cash flows from investing activities:

Cash consideration paid for acquired

businesses, net of cash acquired

—

(96

)

Proceeds from disposition of

businesses

9,460

—

Acquisition of property, plant, and

equipment

(47,821

)

(31,816

)

Other

—

(3,500

)

Net cash used for investing activities

(38,361

)

(35,412

)

Cash flows from financing activities:

Change in short-term and other

borrowings

(66,112

)

77,995

(Payments) proceeds from long-term bank

borrowings, net

(216,046

)

157,948

Proceeds from exercise of stock

options

2,691

993

Repurchases of common stock

(146,999

)

(20,038

)

Other

(147

)

(156

)

Net cash provided by (used for) financing

activities

(426,613

)

216,742

Effect of exchange rate changes on

cash

(22,354

)

10,317

Net decrease in cash and cash

equivalents

(81,910

)

(218,125

)

Cash and cash equivalents at beginning of

period

351,899

548,644

Cash and cash equivalents at end of

period

269,989

330,519

ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In thousands)

(Unaudited)

Six Months Ended

June 29, 2019

June 30, 2018

Cash flows from operating activities:

Consolidated net income (loss)

$

(405,337

)

$

310,910

Adjustments to reconcile consolidated net

income (loss) to net cash provided by (used for) operations:

Depreciation and amortization

94,508

93,669

Amortization of stock-based

compensation

27,629

25,662

Equity in losses of affiliated

companies

1,085

156

Deferred income taxes

(71,846

)

12,706

Impairments

697,993

—

(Gain) loss on investments, net

(6,738

)

5,015

Other

11,956

5,605

Change in assets and liabilities, net of

effects of acquired and disposed businesses:

Accounts receivable

895,553

(73,647

)

Inventories

278,142

(499,917

)

Accounts payable

(1,346,176

)

(240,725

)

Accrued expenses

(71,394

)

(516

)

Other assets and liabilities

(28,956

)

(123,767

)

Net cash provided by (used for) operating

activities

76,419

(484,849

)

Cash flows from investing activities:

Cash consideration paid for acquired

businesses, net of cash acquired

—

(331,563

)

Proceeds from disposition of

businesses

9,460

34,291

Acquisition of property, plant, and

equipment

(81,636

)

(66,551

)

Other

2,940

(8,000

)

Net cash used for investing activities

(69,236

)

(371,823

)

Cash flows from financing activities:

Change in short-term and other

borrowings

(173,356

)

59,613

Proceeds from long-term bank borrowings,

net

118,977

759,334

Redemption of notes

—

(300,000

)

Proceeds from exercise of stock

options

9,622

5,985

Repurchases of common stock

(200,924

)

(72,551

)

Other

(147

)

(156

)

Net cash provided by (used for) financing

activities

(245,828

)

452,225

Effect of exchange rate changes on

cash

(693

)

4,883

Net decrease in cash and cash

equivalents

(239,338

)

(399,564

)

Cash and cash equivalents at beginning of

period

509,327

730,083

Cash and cash equivalents at end of

period

$

269,989

$

330,519

ARROW ELECTRONICS, INC.

NON-GAAP SALES RECONCILIATION

(In thousands)

(Unaudited)

Quarter Ended

June 29, 2019

June 30, 2018

% Change

Consolidated sales, as reported

$

7,344,548

$

7,392,528

(0.6

)%

Impact of changes in foreign

currencies

—

(147,506

)

Impact of dispositions and wind down

(77,914

)

(113,445

)

Consolidated sales, as adjusted

$

7,266,634

$

7,131,577

1.9

%

Global components sales, as reported

$

5,270,935

$

5,284,364

(0.3

)%

Impact of changes in foreign

currencies

—

(99,842

)

Impact of dispositions and wind down

(77,914

)

(100,372

)

Global components sales, as adjusted

$

5,193,021

$

5,084,150

2.1

%

Americas Components sales, as reported

$

1,876,799

$

1,937,882

(3.2

)%

Impact of changes in foreign

currencies

—

(1,611

)

Impact of dispositions and wind down

(60,860

)

(73,962

)

Americas Components sales, as adjusted

$

1,815,939

$

1,862,309

(2.5

)%

Europe components sales, as reported

$

1,415,888

$

1,447,972

(2.2

)%

Impact of changes in foreign

currencies

—

(81,728

)

Impact of dispositions and wind down

(17,054

)

(26,410

)

Europe components sales, as adjusted

$

1,398,834

$

1,339,834

4.4

%

Asia components sales, as reported

$

1,978,248

$

1,898,510

4.2

%

Impact of changes in foreign

currencies

—

(16,503

)

Asia components sales, as adjusted

$

1,978,248

$

1,882,007

5.1

%

Global ECS sales, as reported

$

2,073,613

$

2,108,164

(1.6

)%

Impact of changes in foreign

currencies

—

(47,664

)

Impact of dispositions

—

(13,073

)

Global ECS sales, as adjusted

$

2,073,613

$

2,047,427

1.3

%

Europe ECS sales, as reported

$

701,157

$

721,130

(2.8

)%

Impact of changes in foreign

currencies

—

(38,339

)

Impact of dispositions

—

(13,073

)

Europe ECS sales, as adjusted

$

701,157

$

669,718

4.7

%

Americas ECS sales, as reported

$

1,372,456

$

1,387,034

(1.1

)%

Impact of changes in foreign

currencies

—

(9,325

)

Americas ECS sales, as adjusted

$

1,372,456

$

1,377,709

(0.4

)%

ARROW ELECTRONICS, INC.

NON-GAAP SALES RECONCILIATION

(In thousands)

(Unaudited)

Six Months Ended

June 29, 2019

June 30, 2018

% Change

Consolidated sales, as reported

$

14,500,539

$

14,268,141

1.6

%

Impact of changes in foreign

currencies

—

(344,336

)

Impact of dispositions and wind down

(172,109

)

(261,608

)

Consolidated sales, as adjusted

$

14,328,430

$

13,662,197

4.9

%

Global components sales, as reported

$

10,462,862

$

10,214,296

2.4

%

Impact of changes in foreign

currencies

—

(229,563

)

Impact of dispositions and wind down

(160,968

)

(207,784

)

Global components sales, as adjusted

$

10,301,894

$

9,776,949

5.4

%

Americas Components sales, as reported

$

3,783,828

$

3,734,580

1.3

%

Impact of changes in foreign

currencies

—

(4,138

)

Impact of dispositions and wind down

(123,726

)

(152,354

)

Americas Components sales, as adjusted

$

3,660,102

$

3,578,088

2.3

%

Europe components sales, as reported

$

2,919,254

$

2,926,358

(0.2

)%

Impact of changes in foreign

currencies

—

(196,117

)

Impact of dispositions and wind down

(37,242

)

(55,430

)

Europe components sales, as adjusted

$

2,882,012

$

2,674,811

7.7

%

Asia components sales, as reported

$

3,759,780

$

3,553,358

5.8

%

Impact of changes in foreign

currencies

—

(29,308

)

Asia components sales, as adjusted

$

3,759,780

$

3,524,050

6.7

%

Global ECS sales, as reported

$

4,037,677

$

4,053,845

(0.4

)%

Impact of changes in foreign

currencies

—

(114,773

)

Impact of dispositions

(11,141

)

(53,824

)

Global ECS sales, as adjusted

$

4,026,536

$

3,885,248

3.6

%

Europe ECS sales, as reported

$

1,464,314

$

1,471,400

(0.5

)%

Impact of changes in foreign

currencies

—

(94,054

)

Impact of dispositions

(11,141

)

(26,331

)

Europe ECS sales, as adjusted

$

1,453,173

$

1,351,015

7.6

%

Americas ECS sales, as reported

$

2,573,363

$

2,582,445

(0.4

)%

Impact of changes in foreign

currencies

—

(20,719

)

Impact of dispositions

—

(27,493

)

Americas ECS sales, as adjusted

$

2,573,363

$

2,534,233

1.5

%

ARROW ELECTRONICS, INC.

NON-GAAP EARNINGS

RECONCILIATION

(In thousands except per share

data)

(Unaudited)

Three months ended June 29,

2019

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

AFS Write Downs

Digital Write Downs

Impairments(1)

Impact of Wind Down(6)

Other(2)

Non-GAAP measure

Sales

$

7,344,548

$

—

$

—

$

—

$

—

$

—

$

(77,914

)

$

—

$

7,266,634

Gross Profit

814,909

—

—

1,868

20,114

—

4,305

—

841,196

Operating income

(549,190

)

8,665

19,906

15,851

20,114

623,085

104,219

—

242,650

Income before income taxes

(600,120

)

8,665

19,906

15,851

20,114

623,085

104,229

(1,390

)

190,340

Provision for income taxes

(52,369

)

2,463

4,865

3,910

4,962

64,246

24,730

(382

)

52,425

Consolidated net income

(547,751

)

6,202

15,041

11,941

15,152

558,839

79,499

(1,008

)

137,915

Noncontrolling interests

1,215

140

—

—

—

—

—

—

1,355

Net income attributable to

shareholders

$

(548,966

)

$

6,062

$

15,041

$

11,941

$

15,152

$

558,839

$

79,499

$

(1,008

)

$

136,560

Net income per diluted share(5)

$

(6.48

)

$

0.07

$

0.18

$

0.14

$

0.18

$

6.60

$

0.94

$

(0.01

)

$

1.60

Effective tax rate

8.7

%

27.5

%

Three months ended June 30,

2018

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

AFS Write Downs

Digital Write Downs

Impairments

Impact of Wind Down(6)

Other(2)

Non-GAAP measure

Sales

$

7,392,528

$

—

$

—

$

—

$

—

$

—

$

(100,372

)

$

—

$

7,292,156

Gross Profit

932,820

—

—

—

—

—

(17,079

)

—

915,741

Operating income

286,827

9,161

11,654

—

—

—

9,482

—

317,124

Income before income taxes

222,721

9,161

11,654

—

—

—

9,536

2,563

255,635

Provision for income taxes

51,681

2,540

2,893

—

—

—

2,545

631

60,290

Consolidated net income

171,040

6,621

8,761

—

—

—

6,991

1,932

195,345

Noncontrolling interests

1,125

149

—

—

—

—

—

—

1,274

Net income attributable to

shareholders

$

169,915

$

6,472

$

8,761

$

—

$

—

$

—

$

6,991

$

1,932

$

194,071

Net income per diluted share

$

1.92

$

0.07

$

0.10

$

—

$

—

$

—

$

0.08

$

0.02

$

2.19

Effective tax rate

23.2

%

23.6

%

ARROW ELECTRONICS, INC.

NON-GAAP EARNINGS

RECONCILIATION

(In thousands except per share

data)

(Unaudited)

Six months ended June 29,

2019

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

AFS Write Downs

Digital Write Downs

Impairments(1)

Impact of Wind Down(6)

Other(3)

Non-GAAP measure

Sales

$

14,500,539

$

—

$

—

$

—

$

—

$

—

$

(160,968

)

$

—

$

14,339,571

Gross Profit

1,676,597

—

—

1,868

20,114

—

(3,822

)

—

1,694,757

Operating income

(303,630

)

17,807

30,992

15,851

20,114

623,085

114,415

866

519,500

Income before income taxes

(403,799

)

17,807

30,992

15,851

20,114

623,085

114,572

(5,872

)

412,750

Provision for income taxes

1,538

5,003

7,576

3,910

4,962

64,246

27,258

(5,203

)

109,290

Consolidated net income

(405,337

)

12,804

23,416

11,941

15,152

558,839

87,314

(669

)

303,460

Noncontrolling interests

2,894

282

—

—

—

—

—

—

3,176

Net income attributable to

shareholders

$

(408,231

)

$

12,522

$

23,416

$

11,941

$

15,152

$

558,839

$

87,314

$

(669

)

$

300,284

Net income per diluted share(5)

$

(4.80

)

$

0.15

$

0.28

$

0.14

$

0.18

$

6.57

$

1.03

$

(0.01

)

$

3.50

Effective tax rate

(0.4

)%

26.5

%

Six months ended June 30,

2018

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

AFS Write Downs

Digital Write Downs

Impairments

Impact of Wind Down(6)

Other(4)

Non-GAAP measure

Sales

$

14,268,141

$

—

$

—

$

—

$

—

$

—

$

(207,784

)

$

—

$

14,060,357

Gross Profit

1,801,764

—

—

—

—

—

(36,747

)

—

1,765,017

Operating income

522,822

19,877

28,560

—

—

—

14,828

1,562

587,649

Income before income taxes

409,181

19,877

28,560

—

—

—

14,928

6,577

479,123

Provision for income taxes

98,271

5,471

7,575

—

—

—

4,092

1,413

116,822

Consolidated net income

310,910

14,406

20,985

—

—

—

10,836

5,164

362,301

Noncontrolling interests

1,901

302

—

—

—

—

—

—

2,203

Net income attributable to

shareholders

$

309,009

$

14,104

$

20,985

$

—

$

—

$

—

$

10,836

$

5,164

$

360,098

Net income per diluted share(5)

$

3.48

$

0.16

$

0.24

$

—

$

—

$

—

$

0.12

$

0.06

$

4.05

Effective tax rate

24.0

%

24.4

%

(1) Impairments include goodwill

impairments of $570,175, tradename impairments of $46,000, and

$6,910 in impairment charges related to various other fixed

assets.

(2) Other includes gain (loss) on

investments, net

(3) Other includes loss on disposition of

businesses, net and gain (loss) on investments, net and impact of

Tax Act.

(4) Other includes loss on disposition of

businesses, net and gain (loss) on investments, net.

(5) For the three months and six months

ended June 29, 2019, the non-GAAP net income per diluted share

calculation includes 649 thousand shares and 758 thousand shares,

respectively, that were excluded from the GAAP net income per

diluted share calculation. Additionally, in all periods presented

the sum of the components for diluted EPS, as adjusted may not

agree to totals, as presented, due to rounding.

(6) Amounts for restructuring,

integration, and other charges, and identifiable intangible asset

amortization related to the personal computer and mobility asset

disposition business are included in “impact of wind down”

above.

ARROW ELECTRONICS, INC.

SEGMENT INFORMATION

(In thousands)

(Unaudited)

Quarter Ended

Six Months Ended

June 29, 2019

June 30, 2018

June 29, 2019

June 30, 2018

Sales:

Global components

$

5,270,935

$

5,284,364

$

10,462,862

$

10,214,296

Global ECS

2,073,613

2,108,164

4,037,677

4,053,845

Consolidated

$

7,344,548

$

7,392,528

$

14,500,539

$

14,268,141

Operating income (loss):

Global components

$

(561,878

)

$

253,840

$

(327,346

)

$

483,386

Global ECS

98,388

109,417

185,106

193,223

Corporate (a)

(85,700

)

(76,430

)

(161,390

)

(153,787

)

Consolidated

$

(549,190

)

$

286,827

$

(303,630

)

$

522,822

(a)

Includes restructuring, integration, and

other charges of $19.9 million and $31.6 million for the second

quarter and first six months of 2019, and $19.2 million and $40.4

million for the second quarter and first six months of 2018,

respectively.

NON-GAAP SEGMENT

RECONCILIATION

Quarter Ended

Six Months Ended

June 29, 2019

June 30, 2018

June 29, 2019

June 30, 2018

Global components operating income, as

reported

$

(561,878

)

$

253,840

$

(327,346

)

$

483,386

Intangible assets amortization expense

(b)

5,807

5,900

12,060

11,695

Impairments

623,085

—

623,085

—

Impact of wind-down (b)

104,213

1,953

113,835

3,034

AFS notes receivable reserve

15,851

—

15,851

—

Digital inventory reserve

20,114

—

20,114

—

Global components operating income, as

adjusted

$

207,192

$

261,693

$

457,599

$

498,115

Global ECS operating income, as

reported

$

98,388

$

109,417

$

185,106

$

193,223

Intangible assets amortization expense

2,858

3,261

5,747

8,182

Global ECS operating income, as

adjusted

$

101,246

$

112,678

$

190,853

$

201,405

(b)

Impact of wind down includes intangible

asset amortization expense related to the personal computer and

mobility asset disposition business. Impact of wind down excludes

restructuring, integration, and other charges as they are reported

on the corporate entity.

ARROW ELECTRONICS, INC.

NON-GAAP EARNINGS RECONCILIATIONS

ADJUSTED FOR WIND DOWN

(In thousands except per share

data)

(Unaudited)

Below are previously reported non-GAAP

earnings reconciliations for the years 2017, 2018 and 2019 adjusted

to exclude the personal computer and mobility asset disposition

business (referred to as "impact of wind down").

Three months ended March 30,

2019

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

AFS Write Downs

Digital Write Downs

Impairments(1)

Impact of Wind Down(8)

Other(2)

Non-GAAP measure

Sales

$

7,155,991

$

—

$

—

$

—

$

—

$

—

$

(83,054

)

$

—

7,072,937

Gross Profit

861,688

—

—

—

—

—

(8,127

)

—

853,561

Operating income

245,560

9,142

11,086

—

—

—

10,196

866

276,850

Income before income taxes

196,321

9,142

11,086

—

—

—

10,343

(4,482

)

222,410

Provision for income taxes

53,907

2,540

2,711

—

—

—

2,528

(4,821

)

56,865

Consolidated net income

142,414

6,602

8,375

—

—

—

7,815

339

165,545

Noncontrolling interests

1,679

142

—

—

—

—

—

—

1,821

Net income attributable to

shareholders

$

140,735

$

6,460

$

8,375

$

—

$

—

$

—

$

7,815

$

339

$

163,724

Net income per diluted share(4)

$

1.63

$

0.07

$

0.10

$

—

$

—

$

—

$

0.09

$

—

$

1.90

Effective tax rate

27.5

%

25.6

%

ARROW ELECTRONICS, INC.

NON-GAAP EARNINGS

RECONCILIATION

(In thousands except per share

data)

(Unaudited)

Three months ended March 31,

2018

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

Impact of Tax Reform

Impact of Wind Down(8)

Other(5)

Non-GAAP measure

Sales

$

6,875,613

$

—

$

—

$

—

$

(107,412

)

$

—

$

6,768,201

Gross profit

868,944

—

—

—

(19,668

)

—

849,276

Operating income

235,995

10,716

16,906

—

5,346

1,562

270,525

Income before income taxes

186,460

10,716

16,906

—

5,392

4,014

223,488

Provision for income taxes

46,590

2,931

4,682

—

1,547

782

56,532

Consolidated net income

139,870

7,785

12,224

—

3,845

3,232

166,956

Noncontrolling interests

776

153

—

—

—

—

929

Net income attributable to

shareholders

$

139,094

$

7,632

$

12,224

$

—

$

3,845

$

3,232

$

166,027

Net income per diluted share(4)

$

1.56

$

0.09

$

0.14

$

—

$

0.04

$

0.04

$

1.86

Effective tax rate

25.0

%

25.3

%

Three months ended June 30,

2018

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

Impact of Tax Reform

Impact of Wind Down(8)

Other(3)

Non-GAAP measure

Sales

$

7,392,528

$

—

$

—

$

—

$

(100,372

)

$

—

$

7,292,156

Gross profit

932,820

—

—

—

(17,079

)

—

915,741

Operating income

286,827

9,161

11,654

—

9,482

—

317,124

Income before income taxes

222,721

9,161

11,654

—

9,536

2,563

255,635

Provision for income taxes

51,681

2,540

2,893

—

2,545

631

60,290

Consolidated net income

171,040

6,621

8,761

—

6,991

1,932

195,345

Noncontrolling interests

1,125

149

—

—

—

—

1,274

Net income attributable to

shareholders

$

169,915

$

6,472

$

8,761

$

—

$

6,991

$

1,932

$

194,071

Net income per diluted share

$

1.92

$

0.07

$

0.10

$

—

$

0.08

$

0.02

$

2.19

Effective tax rate

23.2

%

23.6

%

Three months ended September 30,

2018

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

Impact of Tax Reform

Impact of Wind Down(8)

Other(5)

Non-GAAP measure

Sales

$

7,490,445

$

—

$

—

$

—

$

(104,958

)

$

—

$

7,385,487

Gross profit

923,778

—

—

—

(17,397

)

—

906,381

Operating income

290,310

8,845

9,611

—

611

2,042

311,419

Income before income taxes

235,227

8,845

9,611

—

633

972

255,288

Provision for income taxes

57,054

2,539

2,454

—

304

240

62,591

Consolidated net income

178,173

6,306

7,157

—

329

732

192,697

Noncontrolling interests

1,640

145

—

—

—

—

1,785

Net income attributable to

shareholders

$

176,533

$

6,161

$

7,157

$

—

$

329

$

732

$

190,912

Net income per diluted share

$

1.99

$

0.07

$

0.08

$

—

$

—

$

0.01

$

2.15

Effective tax rate

24.3

%

24.5

%

Three months ended December 31,

2018

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

Impact of Tax Reform

Impact of Wind Down(8)

Other(6)

Non-GAAP measure

Sales

$

7,918,182

$

—

$

—

$

—

$

(102,965

)

$

—

$

7,815,217

Gross profit

975,370

—

—

—

(16,947

)

—

958,423

Operating income

334,380

9,493

11,126

—

4,471

—

359,470

Income before income taxes

264,965

9,493

11,126

—

4,114

11,886

301,584

Provision for income taxes

32,474

2,772

4,786

28,323

1,635

3,025

73,015

Consolidated net income

232,491

6,721

6,340

(28,323

)

2,479

8,861

228,569

Noncontrolling interests

1,838

142

—

—

—

—

1,980

Net income attributable to

shareholders

$

230,653

$

6,579

$

6,340

$

(28,323

)

$

2,479

$

8,861

$

226,589

Net income per diluted share

$

2.63

$

0.08

$

0.07

$

(0.32

)

$

0.03

$

0.10

$

2.59

Effective tax rate

12.3

%

24.2

%

ARROW ELECTRONICS, INC.

NON-GAAP EARNINGS

RECONCILIATION

(In thousands except per share

data)

(Unaudited)

Twelve months ended December 31,

2018

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

Impact of Tax Reform

Impact of Wind Down(8)

Other(7)

Non-GAAP measure

Sales

$

29,676,768

$

—

$

—

$

—

$

(415,707

)

$

—

$

29,261,061

Gross profit

3,700,912

—

—

—

(71,091

)

—

3,629,821

Operating income

1,147,512

38,215

49,297

—

19,910

3,604

1,258,538

Income before income taxes

909,373

38,215

49,297

—

19,675

19,435

1,035,995

Provision for income taxes

187,799

10,782

14,815

28,323

6,031

4,678

252,428

Consolidated net income

721,574

27,433

34,482

(28,323

)

13,644

14,757

783,567

Noncontrolling interests

5,379

589

—

—

—

—

5,968

Net income attributable to

shareholders

$

716,195

$

26,844

$

34,482

$

(28,323

)

$

13,644

$

14,757

$

777,599

Net income per diluted share

$

8.10

$

0.30

$

0.39

$

(0.32

)

$

0.15

$

0.17

$

8.79

Effective tax rate

20.7

%

24.4

%

Twelve months ended December 31,

2017 (Adjusted)

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

Impact of Tax Reform

Impact of Wind Down(8)

Other(7)

Non-GAAP measure

Sales

$

26,554,563

$

—

$

—

$

—

$

(387,953

)

$

—

$

26,166,610

Gross profit

3,356,968

—

—

—

(80,834

)

—

3,276,134

Operating income

945,736

38,684

71,707

—

10,045

21,000

1,087,172

Income before income taxes

693,917

38,684

71,707

—

10,254

103,828

918,390

Provision for income taxes

286,541

13,790

21,753

(124,748

)

6,597

40,070

244,003

Consolidated net income

407,376

24,894

49,954

124,748

3,657

63,758

674,387

Noncontrolling interests

5,200

701

—

—

—

—

5,901

Net income attributable to

shareholders

$

402,176

$

24,193

$

49,954

$

124,748

$

3,657

$

63,758

$

668,486

Net income per diluted share

$

4.48

$

0.27

$

0.56

$

1.39

$

0.04

$

0.71

$

7.45

Effective tax rate

41.3

%

26.6

%

(1) Impairments for the three months ended

June 29, 2019 include goodwill impairments of $570,175, tradename

impairments of $46,000, and $6,910 in impairment charges related to

various other fixed assets.

(2) Other includes loss on disposition of

businesses, net and gain (loss) on investments, net and impact of

Tax Act.

(3) Other includes gain (loss) on

investments, net

(4) The sum of the components for diluted

EPS, as adjusted may not agree to totals, as presented, due to

rounding.

(5) Other includes gain (loss) on

investments, net and loss on disposition of businesses, net.

(6) Other includes gain (loss) on

investments, net and pension settlement.

(7) Other includes loss on disposition of

businesses, net and gain (loss) on investments, net and pension

settlement.

(8) Amounts for restructuring,

integration, and other charges, and identifiable intangible asset

amortization related to the personal computer and mobility asset

disposition business are included in “impact of wind down”

above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190801005300/en/

Steven O’Brien Vice President, Investor Relations

303-824-4544

Media Contact: John Hourigan, Vice President, Global

Communications 303-824-4586

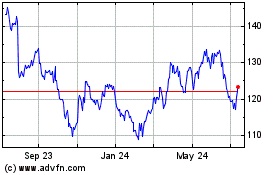

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Dec 2024 to Jan 2025

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Jan 2024 to Jan 2025