UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 3, 2015 (January 28, 2015)

AAC HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Nevada |

|

001-36643 |

|

35-2496142 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 115 East Park Drive, Second Floor

Brentwood, Tennessee |

|

|

|

37027 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

(615) 732-1231

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On January 28, 2015, AAC Holdings,

Inc., a Nevada corporation (the “Company”), through Behavioral Healthcare Realty, LLC, a Delaware limited liability company and subsidiary of the Company (the “Buyer”), entered into a Purchase and Sale Agreement (the

“Agreement”) with FiftyNine Palms, Inc., a California corporation (“Seller”), pursuant to which Buyer agrees to acquire certain real property of Seller. The purchase price for the property is $12,500,000 in addition to a

$1,000,000 lease termination fee.

The Agreement contains customary representations, warranties and covenants by the parties to such

agreement as well as customary indemnification provisions and termination rights for the parties. The closing is expected to occur during the first quarter of 2015 and is subject to certain closing conditions, including the amendment or removal of

certain use restrictions on the property to allow the Buyer to use the property for its intended use.

| Item 7.01 |

Regulation FD Disclosure. |

On February 3, 2015, the Company issued a press release

announcing the execution of the Agreement. A copy of the press release is furnished as Exhibit 99.1 hereto.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

|

|

| 99.1 |

|

Press Release dated February 3, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AAC HOLDINGS, INC. |

|

|

|

|

| Date: February 3, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Michael T. Cartwright |

|

|

|

|

|

|

Michael T. Cartwright |

|

|

|

|

|

|

Chief Executive Officer and Chairman |

EXHIBIT INDEX

|

|

|

| No. |

|

Exhibit |

|

|

| 99.1 |

|

Press Release dated February 3, 2015 |

Exhibit 99.1

|

|

|

| Contact: |

|

Tripp Sullivan |

|

|

SCR Partners |

|

|

(615) 760-1104 |

|

|

IR@contactAAC.com |

AAC Holdings, Inc. Expands De Novo Pipeline with Hospital Entry in Southern California

BRENTWOOD, Tenn. – (February 3, 2015) AAC Holdings, Inc. (NYSE: AAC), added to its pipeline of de novo growth opportunities with the entry into a

definitive agreement for the acquisition, through its subsidiary, Behavioral Healthcare Realty, LLC, of an 84-licensed-bed hospital in Aliso Viejo, California for an aggregate of $13.5 million in cash. The closing is expected to occur during the

first quarter of 2015 and is subject to certain closing conditions, including the amendment or removal of certain use restrictions on the property.

The

hospital is currently occupied by Arcadian at Aliso, a memory care living operator that will relocate to another facility in the area during 2015. AAC will begin renovation and rehabilitation of the facility in the first half of 2015 and expects to

apply for a license to operate as a Chemical Dependency Recovery Hospital (“CDRH”). The Company expects to invest an additional $5 million for renovations and construction, which will include an additional 40 beds and has targeted a

completion date for the first half of 2016.

Michael Cartwright, Chairman and Chief Executive Officer of AAC Holdings, noted, “Our de novo pipeline

is a strong growth driver for us, and we have a demonstrated track record of creating growth and returns from these projects. With the addition of the Aliso Viejo facility in the Laguna Beach area to the 164-bed facility in Riverview, Florida and

the 150-bed facility in Ringwood, New Jersey, we now have 438 beds in our pipeline that will increase our bed count by over 80% the next two years. The ability to operate this new facility as a Chemical Dependency Recovery Hospital will enable us to

provide the highest levels of care in our industry and further solidify the footprint we have in the Southern California market with our 107-bed Forterus facility in Temecula and the 36-bed San Diego Addiction Treatment Center.”

About American Addiction Centers

American Addiction Centers is a leading provider of inpatient substance abuse treatment services. We treat adults as well as adolescents who are struggling

with drug addiction, alcohol addiction, and co-occurring mental/behavioral health issues. We operate seven substance abuse treatment facilities and one mental health facility specializing in overeating disorders. Located throughout the United

States, these facilities are focused on delivering effective clinical care and treatment solutions.

Forward Looking Statements

This release contains forward looking statements within the meaning of the federal securities laws. These forward looking statements are made only as of the

date of this release. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “may,” “potential,”

“predicts,” “projects,” “should,” “will,” “would,” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these words.

Forward-looking statements may include information concerning AAC Holdings’ possible or assumed future results of operations, including descriptions of AAC Holdings’ revenues, profitability, outlook and overall business strategy. These

statements involve known and unknown risks, uncertainties and other factors that may cause our actual results and performance to be materially different from the information contained in the forward looking statements. These risks, uncertainties and

other factors include, without limitation: (i) our inability to operate our facilities; (ii) our reliance on our sales and marketing program to continuously attract and enroll clients; (iii) a reduction in reimbursement rates by

certain third-party payors; (iv) our failure to successfully achieve growth through acquisitions and de novo expansions; (v) uncertainties regarding the timing of the closing of the transaction; (vi) the possibility that a

governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transaction; and (vii) general economic conditions, as well as other risks discussed in the “Risk Factors” section of the Company’s

registration statement on Form S-1, as amended, and other filings with the Securities and Exchange Commission. As a result of these factors, we cannot assure you that the forward looking statements in this release will prove to be accurate.

Investors should not place undue reliance upon forward looking statements.

###

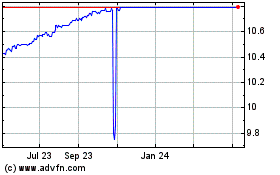

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Sep 2023 to Sep 2024