Annaly Capital Management, Inc. Announces Increased Management Stock Ownership Commitments & Additions to Management Team & I...

July 10 2017 - 4:20PM

Business Wire

Annaly Capital Management, Inc. (NYSE:NLY) (“Annaly” or the

“Company”) today announced increased management stock ownership

commitments as well as senior hires across its investment groups

and within its corporate infrastructure.

Increased Stock Ownership Commitment by CEO

and Senior Management

Kevin Keyes, the Company’s Chief Executive Officer and

President, has volunteered an increased commitment to own an

aggregate $15 million of common stock of the Company within the

next three years. Mr. Keyes’ current stock ownership position has

been acquired entirely through purchases on the open market and he

has pledged to meet his enhanced $15 million commitment solely

through additional open market purchases within the next three

years. This $15 million commitment exceeds Mr. Keyes’ $10 million

stock ownership requirement, which was implemented pursuant to the

expanded stock ownership guidelines previously announced in

2016.

In addition to Mr. Keyes, other members of senior management,

including Chief Investment Officer David Finkelstein, Chief Credit

Officer Timothy Coffey, Chief Financial Officer Glenn Votek and

Chief Legal Officer Anthony Green, have also committed to

voluntarily increase their stock ownership positions beyond the

amounts required under the 2016 stock ownership guidelines. Like

Mr. Keyes, these officers have agreed to achieve their increased

stock ownership commitments solely through open market purchases of

the Company’s common stock within the next three years. These

increased stock ownership commitments by management, together with

the 2016 stock ownership guidelines, which apply to more than 40%

of employees, serve to enhance the alignment of interests between

the Company’s officers and employees and Annaly’s other

stockholders. As of June 30, 2017, all individuals subject to the

Company’s stock ownership guidelines either met or, within the

applicable period, are expected to meet such guidelines.

Additions to Management Team and Investment

Groups

Annaly today announced the additions to the management and

investment groups profiled below. Mr. Keyes commented: “We view

these experienced professionals as a continued sign of our ongoing

commitment to expand the breadth and depth of our diversified

platform. These additions further enable us to drive the growth and

performance of each of our four investment groups and continue to

build our prominence as the most competitive diversified capital

manager in the industry. In this challenging investment environment

our people, coupled with the strength of our liquidity and

investment optionality, are unique strategic advantages that have

contributed to our leadership position in the industry.”

Souren Ouzounian has joined Annaly as Deputy Chief Financial

Officer and Treasurer and a Managing Director, Finance Group.

Souren joins the Company from Bank of America Merrill Lynch and

Merrill Lynch & Co., where he was the Head of Americas

Corporate Finance. Souren has a Master of Business Administration

from the Sloan School of Management at MIT and a Bachelor of Arts

from Columbia College.

V.S. Srinivasan (Srini) has joined Annaly as a Managing

Director, Agency and Residential Credit Group. Srini joins the

Company from KLS Diversified Asset Management (“KLS”), where he was

a Portfolio Manager of Agency MBS and Derivatives. Prior to KLS,

Srini held the position of Managing Director and Head of Structured

Products Modeling at Barclays PLC with previous experience at J.P.

Morgan/Bear Stearns and Co. as a mortgage/prepayment strategist.

Srini has a Master of Science from Rutgers University and a

Bachelor of Technology from the Indian Institute of Technology.

Thomas (Tom) Hobbis has joined Annaly as a Managing Director,

Originations, Middle Market Lending Group. Tom joins the Company

from CIT Group, Inc., where he was a Managing Director in the

Sponsor Finance Group. Prior to CIT, Tom held similar positions at

SunTrust Robinson Humphrey, ING Capital and ABN AMRO. Tom has a

Master of Business Administration from Fordham University and a

Bachelor of Arts from Gettysburg College.

Donald (Don) Choe has joined Annaly as Chief Technology Officer

and a Managing Director, Information Technology Group. Don joins

the Company from ZAIS Group, LLC, where he was Chief Technology

Officer and Head of Analytics and a Managing Director. Don has also

served in application development and systems positions at Barclays

Capital PLC, Lehman Brothers, Inc., Merrill Lynch & Co., Morgan

Stanley and Prudential Securities. Don has a Bachelor of Science

from the University of Pennsylvania.

Jillian Detmer has joined Annaly as a Director, Middle Market

Lending Group. Jillian joins the Company from GoldenTree Asset

Management, where she was responsible for leading the Firm’s

Consultant Relations effort in addition to holding various other

positions within the Business Development group. Jillian has a

Bachelor of Arts from Lafayette College.

James (Jim) D’Amore has joined Annaly as a Director, Head of

Tax, Finance Group. Jim joins the Company from

PricewaterhouseCoopers, where he was a Manager in the Metro Real

Estate – Tax department. Jim has a Master of Business

Administration, a Master of Science and a Bachelor of Science each

from Fordham University.

About Annaly

Annaly is a leading diversified capital manager that invests in

and finances residential and commercial assets. Annaly’s principal

business objective is to generate net income for distribution to

its stockholders and to preserve capital through the prudent

selection of investments and continued management of its portfolio.

Annaly has elected to be taxed as a real estate investment trust,

or REIT, for federal income tax purposes. Annaly is externally

managed by Annaly Management Company LLC. Each of the individuals

named in this release is employed by Annaly Management Company LLC

and provides services to Annaly pursuant to the management

agreement between Annaly and Annaly Management Company LLC.

Additional information is available at www.annaly.com.

Forward-Looking Statements

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as "may," "will," "believe," "expect,"

"anticipate," "continue," or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financings; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow our commercial business; our ability

to grow our residential mortgage credit business; credit risks

related to our investments in credit risk transfer securities,

residential mortgage-backed securities and related residential

mortgage credit assets, commercial real estate assets and corporate

debt; risks related to investments in mortgage servicing rights and

ownership of a servicer; our ability to consummate any contemplated

investment opportunities; changes in government regulations

affecting our business; our ability to maintain our qualification

as a REIT for U.S. federal income tax purposes; and our ability to

maintain our exemption from registration under the Investment

Company Act of 1940, as amended. For a discussion of the risks and

uncertainties which could cause actual results to differ from those

contained in the forward-looking statements, see "Risk Factors" in

our most recent Annual Report on Form 10-K and any subsequent

Quarterly Reports on Form 10-Q. We do not undertake, and

specifically disclaim any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements, except as required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170710006045/en/

Annaly Capital Management, Inc.Investor

Relations1-888-8Annalywww.annaly.com

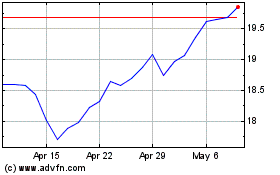

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

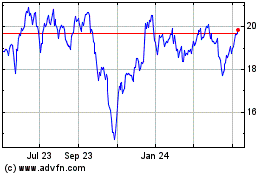

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024