0001766478false00017664782023-08-222023-08-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): August 22, 2023

Angel Oak Mortgage REIT, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Maryland | 001-40495 | 37-1892154 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

3344 Peachtree Road Northeast, Suite 1725, Atlanta, Georgia 30326

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (404) 953-4900

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | AOMR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 7.01 Regulation FD Disclosure.

On August 22, 2023, Angel Oak Mortgage REIT, Inc. (the “Company”) issued a press release announcing that it had contributed loans with a scheduled principal balance of approximately $93.8 million to an approximately $260.6 million scheduled principal balance securitization transaction backed by a pool of residential mortgage loans along with other affiliates of Angel Oak Capital Advisors, LLC, an affiliate of the Company's Manager. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K.

The information contained in this Item 7.01 and the attached Exhibit 99.1 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Item 7.01 and the attached Exhibit 99.1 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, unless it is specifically incorporated by reference therein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Date: June 27, 2023 | | | ANGEL OAK MORTGAGE REIT, INC. |

| | | |

| | | By: /s/ Brandon Filson |

| | | Name: Brandon Filson |

| | | Title: Chief Financial Officer and Treasurer |

| | | |

| | | |

| | | |

| | | |

| | | |

Angel Oak Mortgage REIT, Inc. Reduces Funding Costs and Boosts Liquidity with Participation in $260.6 million Securitization

Third securitization of the year pays down most expensive warehouse facility, decreases financing costs, reduces recourse leverage, and frees up capital

ATLANTA—August 22, 2023—Angel Oak Mortgage REIT, Inc. (NYSE: AOMR), (the “Company,” “we,” and “our”), a leading real estate finance company focused on acquiring and investing in first-lien non-QM loans and other mortgage-related assets in the U.S. mortgage market, announces its participation in AOMT 2023-5, an approximately $260.6 million scheduled principal balance securitization backed by a pool of residential mortgage loans. Similar to this year’s AOMT 2023-1 securitization, AOMR participated in AOMT 2023-5 alongside other Angel Oak entities. The senior tranche received an AAA rating from Fitch Ratings.

“AOMT 2023-5 builds upon the positive momentum of June’s AOMT 2023-4 securitization, the earnings impact of which had not yet been demonstrated in our Q2 results. Between these two securitizations, we have released over $45 million in capital for new loan purchases and reduced over $260 million of debt on our highest-cost loan financing facility, which will drive a meaningful positive impact to earnings in the coming quarters,” said Sreeni Prabhu, Chief Executive Officer and President of Angel Oak Mortgage REIT, Inc. “Additionally, this transaction increases the weighted average coupon rate of our remaining residential whole loans portfolio, which should support future securitization execution.”

Key Highlights and Updates

•The securitization and committed loan purchases will increase the weighted average coupon rate of the Company’s residential whole loans portfolio to 5.53%, up 69 basis points from 4.84% as of June 30, 2023. This is expected to continue to increase as newly-originated loans are purchased with capital released from the securitization.

•AOMR contributed loans with a scheduled unpaid principal balance of $93.8 million, against which it carried $63.5 million of debt on its highest-cost loan financing facility.

•The execution of AOMT 2023-5 brings AOMR’s total liquidity1 to over $150 million.

•In total, AOMT 2023-5 consists of 530 loans. The securitization has an average original credit score of 735, an original average loan-to-value ratio of 71.9%, and a non-zero debt-to-income ratio of 32.9%.

•AOMR will retain its pro-rata share of the unsold bonds in the securitization.

1 Total liquidity consists of unrestricted cash and unencumbered assets

Forward Looking Statements

This press release contains certain forward-looking statements that are subject to various risks and uncertainties, including, without limitation, statements relating to the performance of the Company’s investments. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” or by the negative of these words and phrases or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe existing or future plans and strategies, contain projections of results of operations, liquidity and/or financial condition, or state other forward-looking information. The Company’s ability to predict future events or conditions or their impact or the actual effect of existing or future plans or strategies is inherently uncertain. Although the Company believes that such forward-looking statements are based on reasonable assumptions, actual results and performance in the future could differ materially from those set forth in or implied by such forward-

looking statements. You are cautioned not to place undue reliance on these forward‐looking statements, which reflect the Company’s views only as of the date of this press release. Additional information concerning factors that could cause actual results and performance to differ materially from these forward-looking statements is contained from time to time in the Company’s filings with the Securities and Exchange Commission. Except as required by applicable law, neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward‐looking statements. The Company does not undertake any obligation to update any forward-looking statements contained in this press release as a result of new information, future events or otherwise.

About Angel Oak Mortgage REIT, Inc.

Angel Oak Mortgage REIT, Inc. is a real estate finance company focused on acquiring and investing in first lien non-QM loans and other mortgage-related assets in the U.S. mortgage market. The Company’s objective is to generate attractive risk-adjusted returns for its stockholders through cash distributions and capital appreciation across interest rate and credit cycles. The Company is externally managed and advised by an affiliate of Angel Oak Capital Advisors, LLC, which, collectively with its affiliates, is a leading alternative credit manager with a vertically integrated mortgage origination platform. Angel Oak, Angel Oak Mortgage REIT, AOMR and the tree design are trademarks owned or registered by Angel Oak Companies, LP in the U.S.

Additional information about the Company is available at www.angeloakreit.com.

Contacts

Investors:

investorrelations@angeloakreit.com

855-502-3920

Company Contact:

KC Kelleher, Head of Corporate Finance & Investor Relations

404-528-2684

kc.kelleher@angeloakcapital.com

Media:

Bernardo Soriano, Gregory FCA for Angel Oak Mortgage, Inc.

914-656-3880

bernardo@gregoryfca.com

v3.23.2

Cover

|

Aug. 22, 2023 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001766478

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 22, 2023

|

| Entity Registrant Name |

Angel Oak Mortgage REIT, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-40495

|

| Entity Tax Identification Number |

37-1892154

|

| Entity Address, Address Line One |

3344 Peachtree Road Northeast

|

| Entity Address, Address Line Two |

Suite 1725

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30326

|

| City Area Code |

404

|

| Local Phone Number |

953-4900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.01 par value per share

|

| Trading Symbol |

AOMR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

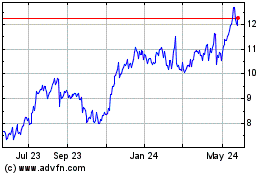

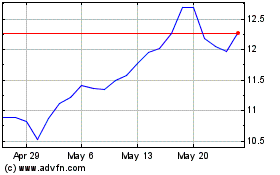

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

From Apr 2024 to May 2024

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

From May 2023 to May 2024